12/24/201509/06/2018 17:16 Labor consultant

By law, the amount of additional payment for night work is set at no less than 20% of the salary or tariff rate, but in practice they usually pay an additional 40%. The fact is that until 2008, some Soviet-era regulations continued to be in force, and this payment figure appeared there. But let's look at the question in more detail.

From time immemorial, the rhythm of human life is such that the greatest activity occurs during the daytime. At night, there comes a period of recuperation, time for sleep and rest. Over many thousands of years of evolution, the body has adapted to this regime, determined by the change of day and night.

However, the current level of development of means of production does not allow us to abandon the use of human labor at night. Continuous production processes or long material processing cycles require constant human presence at any time of the day.

At the same time, night work requires increased effort from a person in order to maintain the intensity of work similar to daytime work. Therefore, labor legislation provides a number of guarantees and compensations for night workers. And you need to be able to use these compensations.

Additional payment for evening hours according to the Labor Code

Evening shifts offer a number of benefits for workers

Article 154 of the Labor Code of the Russian Federation guarantees the right to additional payment for every 60 minutes of work to any citizens. The minimum amount of such compensation is 20% of the hourly rate or rates calculated for the same time.

The specified limit is a lower one; employers have no right to pay below.

The following documents are the basis for adjusting the upper limit:

- Employment contract.

- Local act of a specific enterprise.

- Collective agreement.

That is, management has the right to increase the amount of additional payment for everyone. Accounting is based on the number of hours, not the volume of work. The indicator does not depend on how many products are produced by the employee.

Business Innovation Agency

Contents August 28, 2015 Having considered the issue, we came to the following conclusion: Current legislation does not oblige the employer to make additional payments to employees for working on the evening shift. Rationale for the conclusion: Article 149 of the Labor Code of the Russian Federation stipulates that when performing work in conditions deviating from normal (when performing work of various qualifications, combining professions (positions), overtime work, working at night, weekends and non-working holidays and when performing work in other conditions deviating from normal), the employee is made appropriate payments provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract.

The amounts of payments established by a collective agreement, agreements, local regulations, employment contract cannot be lower than those established by labor legislation and other regulations containing labor law norms. At the same time, the Labor Code of the Russian Federation does not mention such a thing as the evening shift, and does not establishes the employer’s obligation to pay at an increased rate for work on the evening shift. Previously, an additional payment for work on the evening shift in the amount of 20% was provided for in clause 9 of Resolution of the CPSU Central Committee, the Council of Ministers of the USSR and the All-Russian Central Council of Trade Unions dated February 12, 1987 N 194 (hereinafter referred to as Resolution N 194) .

The procedure for her appointment was determined by the Explanation “On the procedure for applying additional payments and providing additional leave for work in the evening and night shifts, provided for by the resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions of February 12, 1987 N 194”, approved by the resolution of the State Labor Committee of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated 05/07/1987 N 294/14-38. However, the said resolution was not actually subject to application from the date of entry into force of the RF Government Decree of 07/22/2008 N 554, which established the minimum amount of increase in wages for work at night (see also the ruling of the Supreme Court of the Russian Federation dated November 12, 2008

N GKPI08-2113, letter from the Ministry of Health and Social Development of Russia and Rostrud dated October 28, 2009 N 3201-6-1)

Additional pay for working night and evening shifts

The evening shift is the one immediately preceding night time. If work is underway during this period, it is considered that conditions deviate from normal. This refers to compensation payments. Due to this, the size of transfers is larger.

For tax purposes, such money is classified as the organization’s profit.

Compensation increased to 35% is due to the following employees:

- Security, paramilitary and fire protection personnel.

- In trucking companies where there is no shift schedule.

- In the field of trade, public catering.

- In the direction of housing and communal services.

- Workers on river boats.

- By rail, metro.

Evening time: additional tips

Almost all enterprises provide additional pay for working on the evening shift.

The legislation strictly regulates only night time, and regarding evening time there are no additional regulations for work.

But the General and Industry Rules contain additional descriptions regarding such arrangements.

This is especially true for multi-shift work. This is a mode when the enterprise supports 2 or more shifts throughout the day.

The main thing is that the duration of each of them should not exceed the limits established by current laws.

With a shift schedule, workers go to work at certain periods of time during the day. The internal labor regulations establish the procedure for such processes.

Typically, the transition from one shift to another occurs according to a standard schedule. A break between shifts is required. Its minimum period is double the working time for the previous shift.

One practical example:

An enterprise with a 4-brigade schedule. After 4 days of working 8 hours from 15:00 to 23:00, the team gets a day off before moving on to night shifts.

If the trade union and representatives of the owner did not take part in concluding the General Agreement, the rules and regulations in force at the national level apply to employees. This also applies to evening shifts. But the ban on the application of the norms of general agreements is not completely imposed.

From what time are they counted?

The Labor Code establishes that the amount of bonus for night shifts should be 20% of the salary.

Night hours start at 10 pm, the exact amount of the increase is indicated in the organization’s internal documentation. The Tax Service has collected statistics according to which the average salary increase is 40%.

There are several categories of employees who can count on increased rates:

| 35% | if the organization provides guard or security services |

| 35% | for employees of penitentiary organizations |

| 50% | employees of healthcare institutions |

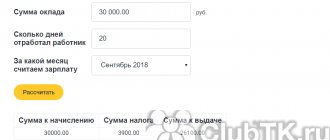

In all other cases, each hour of night work is paid at the discretion of the organization’s management, but the amount cannot be less than that established by the Labor Code. To correctly calculate working hours, you need to take the monthly salary and divide it by the number of working days according to the staffing schedule.

The resulting number is divided by the number of hours in a standard work shift. This figure shows how much a person earns on a day shift.

To calculate the correct hourly earnings for the night, you need to multiply the resulting figure by the percentage established in the company; this can be clarified in the accounting department.

To find out the salary per day, you need to multiply the number by the number of hours in one shift. Accordingly, if a citizen works 8 shifts at night, daily earnings must be multiplied by 8 to find out the monthly salary for this time.

Hourly rate for night/evening shifts

Salary is divided by standard working hours

If an hourly rate is set, there should be no problems with calculating compensation. After all, the most important indicator is known from the beginning.

Another thing is when employees fulfill their salary obligations. But experts give an answer on how to get out of these situations.

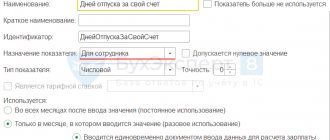

The salary or monthly tariff rate is divided by the standard working hours. Usually the latter is established in shift schedules.

Based on the results of each month, an additional payment is determined in connection with going out at night or in the evening. The number of hours is divided individually according to the length of working time for each.

Night and evening work: how are they different?

Shift change occurs from 22-45 to 23-00

Articles 154 and 96 of the Labor Code of the Russian Federation indicate exactly the time when night shifts begin: from 22:00 to 6:00. The night shift is reduced by 1 hour with the established 40-hour work week.

That is, in fact, citizens perform their duties until 5 am. But the shortened hour is not counted and is not worked out.

In the case of evening hours, there is no clear concept in the Codes. Article 152 regulates processing. Article 99 of the same Code deals with overtime.

These are any periods after the end of the normal working day. Any additional workload can be assigned only with the written consent of the subordinate.

Sometimes the procedure is not carried out if the assignment is related to current production needs. Here are some grounds that will not violate workers' rights:

- Lack of replacements.

- The need to repair equipment.

- Increased likelihood of breakdowns in case of work stoppage.

- Delays due to unforeseen circumstances.

Additional restrictions are introduced on overtime work. No more than 4 hours for two consecutive days, 120 hours per year maximum.

Night and evening time must be paid, no exceptions.

Who can be involved in processing?

There are restrictions for certain groups of citizens on access to recycling

A complete ban on such work is imposed in the following cases:

- For medical reasons.

- Persons under 18 years of age.

- Pregnant employees.

With written consent, this regime can be introduced for:

Those who care for disabled people and close relatives.

- Disabled people.

- Single mothers with children under 5 years old.

- Mothers with children under 3 years old.

There are several exceptions to the rules:

- Participation in video filming, theater and circus performances.

- Creative workers.

- Media staff.

Who is not allowed

There are several situations that prohibit night shifts:

- according to the employment contract, the employee works during the day;

- a person works under the condition of reduced working hours;

- employees cannot work at night, since such a ban is established in internal legal acts.

Regardless of working conditions, the following groups of citizens cannot work at night:

- pregnant employees;

- imperfect employees, except those involved in work of an artistic nature.

Regarding documentation

If such an operating mode is not described in internal documents, then it is the rule, not the exception. Before hiring such an employee, it is important to take several steps.

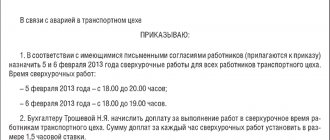

The number of actions depends on which category a particular citizen belongs to. It is enough to issue an order and provide the document for signature by the employee, if there are no contraindications.

All employee referrals must be accompanied by an order from the director with the mandatory signatures of each employee

The consent of the employees must be in writing as an appendix to the director’s order. Some categories will definitely require a signature from a second party.

It is recommended to develop unified types of notifications if you have to be involved in evening work quite often. The same applies to confirmations from employees. Sometimes one version is developed that contains two documents at once.

Employee consent

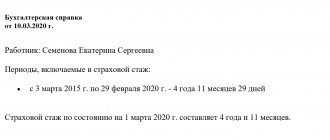

Some employees must provide written consent to switch to night work. This category includes disabled people and workers in enterprises if this work involves risks to life or health.

Consent is issued by the citizen personally and confirmed with a date and signature. The document states that the person is ready to work from 10 pm to 6 am. In addition to consent, a disabled person is required to undergo a medical examination and provide an opinion on the ability to carry out activities at night.

The document must indicate the following information:

- employee information;

- employer information;

- the body of the document, which specifies working hours and consent;

- date and signature of the employee.

When consent is given to the manager, he issues an order to change the schedule and switch to night work. The order is accompanied by the consent of the employee and, if any, the conclusion of a medical expert.

Consent is drawn up in free form; no requirements are provided for by law. It is checked by the HR department and then forwarded to the director. The result is that the employee is assigned to night shifts and the salary calculation is changed.

The form can be downloaded from the link.

About exit compensation

Many employers agree to include compensation for evening hours in monthly bonuses. The same goes for night shifts.

But because of such actions, the content of Article 130 of the Labor Code becomes meaningless. Article 150 describes in detail incentive payments for going to work under conditions that differ from normal ones. Indeed, under such circumstances, certain efforts are required.

But evening hours are regulated separately by each company; no additional rules are provided in this direction.

Advantages and disadvantages of using the system

According to statistics, many employees prefer working on the evening shift to the day shift.

Employees receive the following benefits from overtime:

- Usually, at night and in the evening, managers themselves leave their workplaces. Therefore, it is easier for many people mentally, they manage to complete more things.

- High salary level. Night and evening shifts are compensated at a higher rate than day shifts. At the same time, competition decreases, because others do not agree to such schedules.

- Free daytime. It can be devoted to any activity. You can start reading a book, or you can just lie down and relax. It is acceptable to devote time to other things.

There were some drawbacks:

- Problems with family members due to different lifestyles.

- Other family difficulties. One of the family members may not like the arrangement in which they see each other too rarely due to such differences.

- Negative impact on health. Working in the evening and at night is rarely beneficial for anyone.

- These options are not suitable for pregnant women.

Weekends and non-working holidays: calculation features

The minimum payment in such circumstances is double. But it depends on what schemes are used at the enterprise:

- In the case of piece workers, at least double piece rates are used.

- With daily and hourly tariff rates - regular rewards are also multiplied by two.

- Single or daily hourly rate is combined with salary.

You can use any internal regulations to establish the exact amount of compensation for a particular enterprise.

Employees receive increased compensation for hours during which they actually performed their duties. If part of a weekend and a holiday is transferred from a working day, then this part of the time is counted separately.

Remuneration of employees at any enterprise includes several components:

- Additional payments and allowances, bonuses, other incentive payments.

- Compensation transfers. This includes additional payment for work in difficult climatic conditions. Increased premiums are applied for work in areas prone to radioactive contamination.

- Additional payment for labor depending on the level of training of employees. The quality and conditions of the work performed also determine the result.

When calculating wages for holidays and weekends, in the evening, the employer must take into account the following factors:

- Tariff salary.

- Regional coefficients.

- Percentage allowances.

- Bonuses and compensation.

This law applies to all employers, regardless of their sector of employment.

Bonuses for working on weekends and holidays

Bonuses for work are calculated taking into account additional payments for shift schedules

Article 153 of the Labor Code states that wages are set only in accordance with a valid agreement between the interested parties.

It is necessary to take into account the system in force at a particular employer. When paying for work on a day off, almost all types of bonuses are taken into account.

If the contract specifies monthly bonuses, you cannot do without them.

Annual bonuses usually do not meet such criteria. Therefore, no accounting is carried out for this indicator.

The employer may provide other types of compensation:

- Financial assistance in connection with vacation.

- Compensation for the price of gasoline, car.

- Payment for food and travel.

advocatus54.ru

Accordingly, the administration must ensure separate accounting of night hours worked by each employee. This will be required both for the ease of calculating surcharges and for providing the necessary information at the request of regulatory authorities. For example, during an inspection by the labor inspectorate (scheduled or at the request of an employee).

The employer must take into account that there are a number of categories of workers who cannot be involved in night work. All of them are listed in Article 96 of the Labor Code of the Russian Federation.

There is also a category of workers who can be involved in night work only with their written consent (also see Article 96 of the Labor Code of the Russian Federation). In this case, these employees must be informed in writing of the possibility of their refusal to work at night. When calculating additional payment for night work to piece workers, the procedure for applying it remains the same as for time workers.

However, the current level of development of means of production does not allow us to abandon the use of human labor at night. Continuous production processes or long material processing cycles require constant human presence at any time of the day. At the same time, night work requires increased effort from a person in order to maintain the intensity of work similar to daytime work.

Therefore, labor legislation provides a number of guarantees and compensations for night workers.

And you need to be able to use these compensations. When does the night start? Article 96 of the Labor Code of the Russian Federation defines night time. They consider the time from 22 o'clock to 6 o'clock.

Labor consultant Legislatively, the amount of additional payment for night work is set at no less than 20% of the salary or tariff rate, but in practice the additional payment is usually 40%. The fact is that until 2008, some Soviet-era regulations continued to be in force, and this payment figure appeared there.