From the beginning of 2021, the minimum wage (minimum wage) in Russia is 11,280 rubles (Law No. 82-FZ of June 19, 2000, Art. 1). Hired employees cannot be paid less than this level if they have worked the standard working hours for a month, properly performing their job duties. Employees need to know what is included in the minimum wage, since some managers strive to include in the minimum wage all possible monetary payments, including those that should be accrued above the “minimum wage”. Employers should also clarify what the minimum wage is made up of in order to avoid administrative fines and litigation with subordinates.

Minimum wage size in 2021

A project to change the methodology for calculating the minimum wage has been submitted to the State Duma.

The current version provides that from January 1 of the corresponding year the minimum wage is set no lower than the subsistence level of the working population in the country as a whole for the second quarter of the previous year. This system has existed for the last two years - since January 1, 2021. Based on this calculation logic, then for 2021 the minimum wage should be 12,392 rubles . And this is confirmed by Order of the Ministry of Labor dated August 28, 2020 No. 542n.

However, the draft law, which is currently being considered in the first reading, proposes a higher minimum wage in 2021 - 12,792 rubles. Apparently, the initiative is related to the consequences of the prolonged pandemic.

New methodology for calculating the minimum wage

The proposal is that the minimum wage should now depend on the median salary for the previous year.

The bill clarifies that starting from 2021, the ratio of the minimum wage to the median salary will be set at 42%. This ratio will be reviewed at least once every 5 years, taking into account socio-economic circumstances.

At the same time, the minimum wage cannot be lower than the subsistence level of the working population as a whole for the next year.

What is median per capita income

By this concept we should mean the amount of money income, relative to which half of the population has an average per capita income below this value, the other half - above this value.

The median per capita income is calculated taking into account the collected statistical information.

Salary below the minimum wage: responsibility and fines

Why is the minimum wage important? For many reasons. First of all, wages depend on it. The employer does not have the right to pay full-time employees a salary below the minimum wage, as stated in Art. 133 of the Labor Code of the Russian Federation: “The monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage.”

Rostrud on its official website clarifies that wages may be less than the minimum wage if the employee works part-time or part-time. “The salary may be less than the minimum wage. In addition to salary, wages include compensation payments, various bonuses and incentive payments (Article 129 of the Labor Code of the Russian Federation). Thus, taking into account all salary increases or incentives, the employee receives an amount greater than or equal to the minimum wage. If the employee’s salary is still less than the established minimum wage, the employer must make an additional payment up to the minimum wage.”

Conducting business according to the law. Services for individual entrepreneurs and LLCs less than 3 months old

Details

The employer must understand that he is at great risk if his employees receive wages below the minimum wage. The labor inspectorate may fine him. According to Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, such a violation entails a warning or the imposition of an administrative fine on officials in the amount of 10,000 to 20,000 rubles; for legal entities - from 30,000 to 50,000 rubles.

For repeated violations, the fine for officials ranges from 20,000 to 30,000 rubles. or disqualification for a period of one to three years; for legal entities - from 50,000 to 100,000 rubles.

Salary is less than the minimum wage for a part-time worker

Rostrud experts draw attention to the fact that in case of part-time work, remuneration should not be lower than the minimum wage, calculated in proportion to the time worked - depending on output or on other conditions determined by the employment contract (Article 285 of the Labor Code of the Russian Federation).

Thus, the wages of a part-time worker should not be lower than the minimum wage, calculated in proportion to the time worked.

What are incentive payments?

Types of additional payments for professional qualifications:

- bonus. Its accrual may be a certain percentage of the salary, or it may be paid to the employee once;

- various rewards;

- additional payments specified in the collective agreement or internal regulations.

Such bonuses are paid from the salary fund and are assigned:

- for quality work performed;

- for good performance and intensity;

- for the period worked;

- for experience

Allowances are set by the management of the institution, the amounts are prescribed in the collective and individual agreement. A provision on incentive payments with criteria for the effectiveness of services provided should be developed.

Additional information: Occupational safety and health at school.

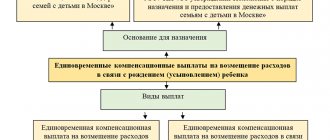

Compensation payments and incentive payments from the public sector

The advantage of modern remuneration is that the manager is given more independence in the distribution of funds for material incentives for employees. An employee’s salary can be influenced by factors such as the volume and quality of work performed, the education and qualifications of the employee, the scope of professional qualities and job responsibilities. In the qualification group, a basic salary is introduced. Allowances regulate increasing coefficients. The salary of a public sector employee does not become less if the employee performs the same amount of work. Funds from paid activities also go towards incentive payments.

Incentive criteria and payments to teachers and educators in 2018

The criteria for bonus payments are established by each general education institution separately, focusing on legislation when drawing up a document. The following criteria have been developed for secondary school teachers:

- participation in classroom and extracurricular activities: excursions, social and educational projects;

- monitoring student progress;

- implementation of intermediate knowledge tests;

- holding events with parents;

- the effectiveness of children’s participation in various Olympiads and competitions;

- organization of sports leisure;

- carrying out work with families at risk;

- working with children with disabilities and gifted children;

- work to improve academic performance;

- advanced training, teacher certification and various forms of training.

For educators and teaching staff of the State Budgetary Educational Institution, additional allowances are calculated in the amount of sixty percent of the institution’s bonus fund. The remaining forty percent is provided for other employees.

Incentive payments to healthcare workers in 2021

In 2021, bonuses for employees of medical institutions are calculated on a point system, their amounts depend on the results achieved, and are paid only to those who have a certificate to perform a particular activity. The size depends on the following factors:

- number of diseases detected in time;

- number of incorrect diagnoses;

- cases of untimely hospitalization;

- complications after operations;

- complaints from patients;

- improper documentation.

Minutes of the meeting of the commission on the distribution of incentive payments

Bonuses are accrued based on the employee’s performance, for example, for a year. A portion of the salary fund goes to motivating employees.

Each organization adopts a regulation on the distribution of allowances. Then a commission is elected to distribute these bonuses, which includes several members of the team. The commission draws up a protocol on the decision made. Based on this protocol, the manager issues an order on additional payments. The order is sent to the accounting department.

Score sheet for preschool teacher for incentive payments 2021 - sample

Criteria have been developed for calculating additional payments to teachers; they are used to judge their professional competence. These criteria are stated in the evaluation sheet, which helps to evaluate the work of the teacher in order to calculate subsequent additional payments to the salary.

Regional minimum wage

According to Art. 133.1 of the Labor Code of the Russian Federation, in addition to the federal minimum wage, which is valid throughout Russia, regions can set their own minimum wage. It is determined taking into account socio-economic conditions and the cost of living of the working population in the corresponding subject of the Russian Federation.

By law, the minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage established by federal law. At the same time, regional authorities have the right to equate the minimum wage to the federal standard or increase it.

Employers have a period of 30 days during which they can send to the labor body a written refusal to join the regional agreement on the minimum minimum wage in a specific subject. Silence automatically means consent, that is, if they do not refuse, they join the agreement.

The minimum wage in the constituent entities of the Russian Federation: table

Minimum wage in Moscow for 2021

The minimum wage in Moscow is 20,195 rubles. established by Decree of the Moscow Government dated September 10, 2019 No. 1177-PP and is already in force from October 1, 2021.

Minimum wage in the Leningrad region from January 1, 2021

On November 28, 2021, a Regional Agreement on the minimum wage was concluded in the Leningrad Region for 2021, according to which the minimum wage here is set at 12,800 rubles.

It follows from this that the monthly salary of a person working in the Leningrad region and in an employment relationship with an employer subject to a regional agreement cannot be lower than the minimum wage in the Leningrad region if this person has fully worked the standard working hours during this period and fulfilled labor standards.

In connection with the increase in the minimum wage, the question often arises about salary indexation - is it mandatory? We previously wrote about this in the article “Wage Indexation: An Employer’s Right or Obligation?”

Minimum wage when setting wages for LLC branch employees

There are often situations when an LLC is registered in one subject of the Russian Federation, and its employees work in a branch of the LLC in another subject. In this case, what minimum wage should we be guided by when setting salaries for branch employees?

In this case, it is legal to set the salary taking into account the minimum wage established in the subject where the LLC branch is located.

Calculate your salary and benefits taking into account the increase in the minimum wage from 2021

As stated above, in the regions the minimum wage can be established by regional agreement. In accordance with Part 2 of Art. 133.1. The Labor Code of the Russian Federation, the minimum wage in a constituent entity of the Russian Federation can be established for employees operating in the territory of the corresponding constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

With a shift work schedule

A shift work schedule itself implies a cumulative accounting of hours, since fluctuations in the use of working time established by the schedule must be taken into account.

Hence the rules for calculating additional payments up to the minimum wage:

- If the tariff rate is not established, it is calculated by salary and hours of the working week (40-hour, 36-hour, 24-hour).

- The use of rates and salaries without taking into account the minimum wage during a shift work schedule, as in other cases, is prohibited.

- If a full-time employee has worked a full month according to the schedule, he will receive full payment according to the hours or salary established taking into account the minimum wage. No additional payment up to the minimum wage is required.

- If a part-time employee has worked a full month according to the schedule, he will receive proportional payment according to the hours or salary established taking into account the minimum wage. The minimum wage is taken in proportion to its rate (as in the example above).

- If there is a delay in the schedule through no fault of the employee, he is paid additionally according to the rules of Art. 155 Labor Code of the Russian Federation.

- All additional payments to the minimum wage must be taken into account within the working week established for the employee, regardless of his actual schedule. The length of the working week cannot be more than 40 hours (Labor Code of the Russian Federation, Article 91). All calculations of tariffs and salaries, including for shift work schedules, must not violate these provisions. If at the end of the billing period there is overtime, it is paid to the employee additionally. This paid processing is not included in the additional payment up to the minimum wage.