What is settlement reconciliation?

Clause 9 of Article 18 of Federal Law No. 212 “On Insurance Contributions” states that the Social Insurance Fund can initiate reconciliation of settlements with the payer. This procedure is carried out on the basis of the rules established by the same law - Federal Law No. 212. It is carried out on the initiative of both the body itself and the payer. The frequency of the event can be any. Reconciliation can be initiated on any date. However, the procedure is usually carried out every quarter. In particular, it is planned after sending the report in Form 4-FSS.

NOTE! In connection with current changes in legislation, from January 1, 2021, control over the timeliness and completeness of payment of insurance contributions and fees to the Social Insurance Fund is transferred to the Federal Tax Service.

Since the payment of insurance premiums is now the responsibility of the fiscal service, they should be paid to the accounts of the Federal Tax Service (for reporting periods after January 1, 2021). Until this date, payments were made to the FSS accounts. To avoid confusion, until the end of 2021 you could continue to pay on your usual accounts, but in 2021 you will have to pay according to the new requirements.

Features of the reconciliation report

The reconciliation report is the primary documentation. On its basis, you can verify the quality of the accounting department’s activities. It allows you to timely detect and eliminate financial offenses. The act indicates not only the obligations, but also the items for which debts arose. For example, these could be debts due to penalties.

What is the content of the document?

The required application details are:

- Name and details of the organization sending the request (TIN, address, telephone numbers).

- Purpose of payments and period of their making, which are subject to reconciliation.

- It is a desirable option to receive a prepared report (the applicant can receive a paper version of the report in person or by mail).

- Date of the application.

- Full name and contact details of the official responsible for the request and reconciliation.

The procedure for submitting a request to the FSS is regulated by Federal Law No. 243 of July 3, 2016. The request form can be arbitrary, or it can be focused on the application form to the Federal Tax Service (Appendix No. 8 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n).

Reconciliation goals

Reconciliation allows you to track outgoing deductions and control the formation of debts. It is usually initiated by the payer when there is a likelihood of a conflict with the fund regarding the volume of transferred contributions. It is also needed to detect overpayments as part of liquidation or reorganization. Reconciliation is usually carried out in the presence of these circumstances:

- Reorganization.

- Liquidation.

- The need to track the presence of debt.

- Establishing the amount of overpayments.

- Systematization of information.

- The company plans to participate in government competitions and tenders.

At the end of the event, a reconciliation report is issued. It is an essential document within the financial activities of the enterprise.

Every month the legal entity must make contributions to the fund. If they don't exist, debt will form. Its presence can negatively affect a variety of aspects of activity. These consequences are possible:

- Negative reputation in the market.

- Failure of transactions with counterparties.

- Loss of public investment.

- Negative payment history.

- Judicial debt collection.

- Seizure.

Reconciliation allows you to monitor the status of your payments. It is recommended to carry it out at least once a quarter. This frequency ensures timely tracking of all debts.

FOR YOUR INFORMATION! Regular control allows you to reduce the fiscal burden on the entity in the form of fines and penalties for debts.

IMPORTANT! It is on the basis of the reconciliation report that an application for the refund of tax overpayments is drawn up.

Control of insurance premiums is the responsibility of the Federal Tax Service

To properly control your activities regarding the deductions made, you should arrange reconciliations at least once every 3 months. This will allow you to always be aware of debts and overpayments.

The tariff is used to connect companies specializing in providing reporting services to other organizations and individual entrepreneurs. The tariff does not limit the number of organizations for which reports are submitted and assumes a per-report tariff.

The state has officially established the amount of tariffs for injury insurance. The list of all rates is indicated in the order dated 2006. From that moment on, the percentages did not change.

The tariff is used to connect companies specializing in providing reporting services to other organizations and individual entrepreneurs. The tariff does not limit the number of organizations for which reports are submitted and assumes a per-report tariff.

The tax base includes all types of wages and allowances that are paid directly by the employer. But state and some incentive types of accruals are not included in it. When calculating the amount of insurance payments, you do not need to take into account:

- benefits that are provided for the period of training and internship in the company;

- state benefits for benefit groups;

- various types of material support;

- compensation payments received as a result of the emergency closure of the employing organization;

- bonuses provided to workers in the northern regions, as well as those employed in activities hazardous to health.

There is no specific deadline for the transfer of information in the legislation. But if a debt is discovered from a company, the FSS is obliged to notify the payer about it within ten days.

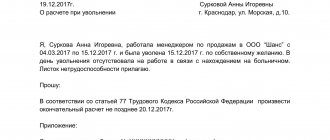

How to get a reconciliation report before 2021

The specifics of the procedure depend on the specific reporting period for which the report is required. First, let's consider the option when a reconciliation report is required for the period up to December 31, 2021 inclusive. In this case, it must be requested from the Federal Tax Service.

There are two ways to obtain a certificate. Let's look at them.

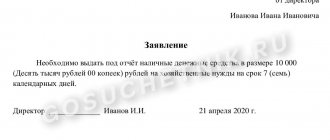

Drawing up an application

To receive the certificate, you need to fill out an application. Its form is not regulated by regulations. However, you need to provide essential information: details of the legal entity, date of application. The response to the application should arrive within five days.

Let's look at the requirements for the application:

- You need to specify the enumerations that you want to check and the codes for them.

- The application must contain essential information about the payer: name, TIN and KPP, registration number.

- You must indicate whose name the document is being sent to. This is the name of the FSS, its address, contact information.

- Title of the application.

- The body of the text contains a request to the FSS. In particular, this is a request for reconciliation.

The application is signed by the chief accountant and the general director with a transcript. The document may not indicate a list of verified contributions. It is allowed to indicate all the necessary information in the appendix to the application. This application speeds up the event. The paper must either be taken to the fund in person or sent by email.

IMPORTANT! The application form can be downloaded from the FSS website.

FOR YOUR INFORMATION! Only the general director of the entity can submit an application. If he does not have the appropriate ability, then the function is performed by a trusted person. In this case, you need to draw up a power of attorney. Without it, the application simply will not be accepted.

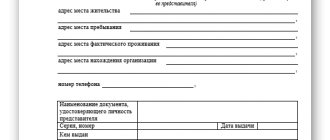

Using Internet services

Using the Internet allows you to speed up the reconciliation process. To apply, you need to register on the official website of the FSS. First, the payer enters his details in the appropriate fields. After this, you can use all the resources of the service. The FSS website is a tool that will allow you to track the movement of money in your account and check the presence of balances/debts. You can order a statement for the desired period. It can be obtained in both electronic and paper format. In the second case, the document is sent to the payer's address.

ATTENTION! Requesting a certificate via the Internet is the most preferable option. This is due to the speed of the process and simplicity. If the fund must respond to a paper application within five days, then to an electronic application a response will be received within the next day.

Receiving a reconciliation report from the Social Insurance Fund

The act sent to the payer includes final information. The document includes this information:

- Date of preparation.

- Fund and payer details.

- Payment status of the payer.

The subject may be found to be in debt. In this case, the arrears must be paid immediately. The act also states the overpayment, if any. Under the circumstances under consideration, the legal entity can either return the overpayment to its account, or leave the funds that will be accepted as payment next month. The amount can be withdrawn partially. In this case, you must indicate in the refund application the amount that needs to be transferred to the payer’s accounts.

FOR YOUR INFORMATION! The act can be sent to the payer by mail or delivered directly to the payer. If the second option is preferred, you must indicate this in the application.

General procedure

Reconciliation of calculations is a procedure that involves the following procedure:

- Creating a statement. You can create a document in either paper or electronic form. You can attach an application to your application indicating the payments that need to be verified.

- Submitting an application to the FSS. You can send it by mail or deliver it in person.

- Receiving a reconciliation report. The document can be obtained within 5 days from the date of receipt of the fund’s application.

- Reconciliation of the received data with the information that the company has. In the process, discrepancies are discovered.

- Correction of all errors. All discrepancies must be removed. This is necessary for the company to have all reliable information about the status of settlements. This will prevent the occurrence of debts and overpayments. If debts are discovered, they must be repaid.

The last step is signing the act.

How to copy electronic VLSI reporting to another computer

To transfer data to another computer, you will need to perform a number of steps:

- Copy the cryptographic information security serial number for yourself and create a backup copy of the database.

- On your new computer, download the latest version of the VLSI program from the website.

- Install the program, and then delete the db folder in the directory and instead copy the folder with the same name from the backup.

- Install a new version of the program and enter its serial number.

- Launch the program and wait until automatic system monitoring takes place.

- Check whether the reporting was transferred correctly.

- The next time you send reports to the inspectorate, write a letter there asking them to check whether they received the reports. This will ensure that everything is working properly.

There is also another option - simply copy the VLSI folder from one computer to another, but this method may lead to errors.

How to obtain a reconciliation report in 2021 and beyond

There are few fundamental differences from the usual procedure. The most important change is that payments will now have to be made to other current accounts - no longer the Social Insurance Fund, but the Federal Tax Service. To apply for reconciliation, you will have to contact the tax office at the place of registration of the legal entity. Further, the algorithm is in many ways similar to what was used for the FSS.

- Submitting an application (the requirements for it remain unchanged).

- Formation of a reconciliation report (this is done by the Federal Tax Service based on the application received). The act is drawn up in two copies and sent to the applicant - the payer.

- Having received the act, the applicant enters his information into it and forwards (hands over in person or electronically) one of the copies to the tax authorities.

- If discrepancies are found, reconciliation continues with the study of supporting documentation. If necessary, adjustments are made to the original act.

- If there were no discrepancies or they were successfully eliminated, the act is signed by both parties (the payer and the representative of the Federal Tax Service). In other words, the parties sign that they agree with the information contained in the act.

- Signatures certify the completion of the reconciliation and approval of the calculations contained in it.

Receiving notifications

When the territorial fund office sends a notice for your registration number, an orange circle will appear next to the heading of the “Notices” section.

To receive a notification: • go to the “Notifications” section • on the yellow background, click on the link “Download... new notifications” • select a certificate and click “Sign”

After signing, new notices will be downloaded from the FSS and will appear in the list below. If an error occurs, the circle color will change to red. To read the error text, click on the “Error Information” link.

To try receiving notifications again: • Click on the “Try again” link • Select the certificate and click “Sign”