Should last year's personal income tax be withheld from the new year's income?

You must inform the Federal Tax Service about the impossibility of withholding personal income tax - submit a 2-NDFL certificate with sign “2” - no later than March 1 of the year following the one in which this personal income tax was calculated.

5 tbsp. 226 Tax Code of the Russian Federation. But in January - February, that is, from the beginning of the year before the message is submitted, an individual may have time to receive some kind of monetary income from you (for example, a salary). Is it necessary to withhold from them the balance of personal income tax calculated in 2016, but for some reason not withheld until the end of the year? Previously it was necessary, but now it’s not: don’t make the mistake of acting by inertia 11/15/2017 N.A. Martynyuk, tax expert

Like before

Of any money paid from the end of the reporting year until the submission of 2-NDFL certificates with sign “2” for it or before the deadline for their submission, last year’s tax should have been withheld and transferred to the budget. And in the 2-NDFL certificate for the reporting year, submitted with sign “1”, it was necessary to show such tax as withheld and paid. This followed from the explanations of the Ministry of Finance. But they were relevant only until 2021.

As it is now

Now it won't be possible to do that.

Firstly, the Tax Code norm, on which the Ministry of Finance relied in its explanations, has been formulated in a new way since 01/01/2016.

Now it says that the impossibility of withholding tax should be reported if the amount could not be withheld “during the tax period,” that is, a year.

It turns out that from the income paid to individuals in the new year, we no longer withhold personal income tax from last year’s income.

Secondly, if you do it as before, then the data on this tax in the calculation of tax amounts in Form 6-NDFL and in the income certificates of individuals in Form 2-NDFL for 2021 will not agree.

In Form 2-NDFL, the tax will be shown as withheld. And in form 6-NDFL - as calculated, but not withheld, since this form includes deductions made before the end of the reporting period.

It will not be possible to enter such a tax into Form 6-NDFL for 2021, since only taxes calculated in 2017 should be included in it. And the moment the tax is calculated coincides with the moment the income is received, that is, in our case, it falls on 2016.

The Federal Tax Service specialist agrees that the personal income tax calculated in 2021 does not need to be withheld from other income of the beginning of 2021, paid before the submission of the 2-NDFL certificate with sign “2”.

FROM AUTHENTIC SOURCES

KUDYAROVA Elena Nikolaevna

Advisor to the State Civil Service of the Russian Federation, 3rd class

“The tax agent has no obligation to additionally withhold personal income tax calculated from non-cash income received in 2021 (from financial benefits, income in kind), from cash income paid to an individual in 2021 before the deadline for submitting a message about the impossibility of withholding tax for the previous year (or before the message is submitted, if it is submitted earlier).

If a tax agent, before the end of the 2016 tax period, did not withhold from an individual the personal income tax calculated from his income due to the lack of such an opportunity, he is obliged to send both to the tax authority and to the individual himself a message about the impossibility of withholding personal income tax for the tax period of 2021 no later than March 1 2021.”

Obviously, this is true for personal income tax not only on non-cash income, but also on any other income paid to an individual in 2021, the tax on which you will not be able to withhold until 01/01/2017.

***

So, the Federal Tax Service must be notified of the amount of tax remaining unwithheld as of January 1 of the year following the year in which non-cash income was paid to the individual. That is, include the tax in the 2-NDFL certificate with attribute “2” and submit it no later than March 1 of the year following the one in which the personal income tax was not withheld.

An individual will have to pay this amount independently no later than December 1 on the basis of a tax notice sent to him by the inspectorate, that is, without filing a declaration.

Main book

Subscribe Post:

Updated calculation

The updated calculation must be submitted (clause 6 of Article 81 of the Tax Code of the Russian Federation):

- if the fact of non-reflection or incomplete reflection of information is revealed;

- if errors are identified that lead to an underestimation or overestimation of the amount of tax to be transferred.

On the title page the tax agent must indicate:

- when submitting the primary calculation – the value “000”;

- when submitting an updated calculation - the adjustment number (value “001”, “002”, etc.)

Thus, a “clarification” is submitted if the tax agent discovers that he did not reflect any information in the initial calculation or made an error that led to an understatement or overstatement of the tax amount (this is indicated, for example, in a letter from the Federal Tax Service of the Russian Federation dated 12/15/2016 No. BS-4-11/ [email protected] ).

For example, if you recalculated vacation pay paid to an employee in the previous reporting period, this does not mean that for the previous period you will have to submit an updated calculation in Form 6-NDFL. It all depends on the direction in which the amount of vacation income has changed.

If, as a result of recalculation of vacation pay, an additional payment is required, then you will not need to submit an amendment. The amount of the additional payment will be included in the 6-NDFL report for the period in which it was made. And since section 1 of the calculation is filled in with a cumulative total, it will reflect the full amount of vacation pay, taking into account recalculation.

If, after recalculation, the amount of vacation pay has decreased, then you will have to submit an updated calculation for the period in which the original vacation pay was accrued. In section 1 of the updated 6-NDFL, you will need to indicate a new, reduced amount.

Moscow tax authorities wrote about this in a letter dated March 12, 2018 No. 20-15/049940.

Types of errors in the 2-NDFL certificate

The first option is being late.

If the first of April has passed and you have not submitted certificates to the tax office (they are accepted by the Federal Tax Service according to the attached register), prepare to pay a fine.

If your certificates do not pass the entrance control for any reason (whether in paper or electronic form you report to the tax office) and there is no time left to correct the documents on time, then these 2-NDFL certificates will also be considered not provided.

During incoming control, the completion of all required fields of the document is checked.

Example: a street is missing from the address - the certificate will definitely not be accepted, however, if the employee’s TIN is missing, then this will not be a violation during entry control.

Based on the results of the inspection, a protocol is issued or sent through the electronic document management operator, indicating the not accepted certificates and errors found in them.

You can calculate the total amount of the fine for the first version of violations as follows: (“Number of certificates not submitted” + “Number of not accepted”) * 200 rubles for each form.

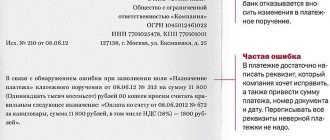

The second option is, in fact, errors.

For example:

- There is a TIN, but for another person;

- A letter is missing from the surname;

- The street was renamed last year;

- Errors in rounding of income received, etc.

The 2-NDFL certificates accepted from you (entrepreneurs) are then subjected to a second (office) inspection. Tax inspectors check documents against databases to identify all inaccuracies and violations. Previously, it was enough to simply submit corrected documents. Since 2021, an accountant’s mistake began to cost 500 rubles for each certificate.

Example: The program has incorrect rounding configured. You have twenty-five employees. The fine will be twelve thousand five hundred rubles (25*500).

All comments (6)

Hello! That is, it turns out that in 2015 this financial assistance to the employee was accrued and paid, but in the 2-NDFL report for 2015 you did not show this income at all, since you registered it as not subject to personal income tax. Did I understand correctly?

And please also clarify how you reflected in ZUP 3 so that the employee receives 520 rubles. less? Did you just reduce the amount in the document in the Sheet? You just need to understand what you have already reflected in the program in connection with this situation.

Good afternoon In 2015, financial assistance was paid and reflected in the reporting, but personal income tax was calculated incorrectly (the amount of deductions for financial assistance for the year exceeded 4,000 rubles), in the 2-personal income tax certificate there were two financial assistance and two deductions. In ZUP 3.1, I have not yet reflected in any way that the employee received 520 rubles. less. I uploaded the statement to the BP and adjusted the amount there.

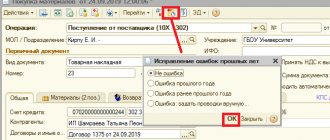

I understood the situation. I think it's easiest to do it this way. In 2021 (i.e. in the period when records were not yet kept in ZUP 3), enter the “Financial Assistance” document for this employee so that he can be paid as he should be, i.e. with personal income tax in the amount of 520 rubles. Next, using the “Vedomost” document, also from 2021, enter the payment to this employee, but at the same time remove 520 rubles in the personal income tax column for transfer and correct the payment amount, indicating exactly 4,000 rubles. those. In this way, you will essentially model the data that you have on this situation in 2021, but which was not transferred to ZUP 3.

As a result, it turns out that the program at the beginning of 2021 will contain information about unwithheld tax in the amount of 520 rubles, which the program will try to withhold the next time something is paid to the employee. It will only be necessary to refill the current statement to reflect the fact of withholding this personal income tax.

You will also need to submit a corrective form 2-NDFL for 2017, but you will have to prepare the form manually, since ZUP 3 does not contain information about the employee’s earnings for 2021. If accounting was previously kept in ZUP 2.5, then it is easier to prepare it there.

Good afternoon Thanks for the help. And after the personal income tax for previous years is withheld from the next payment, the documents “Material Assistance” and the Statement for the previous year do not need to be deleted?

No, don't. Otherwise, this calculated personal income tax will be lost and the program, when filling out the next statement, will distort the completion of this statement.

You can ask more questions

Access to the “Ask a Question” form is only possible if you have fully subscribed to BukhExpert8. Submit an application on behalf of Legal Entity. or Phys. faces you can here >>

By clicking the “Ask a Question” button, I agree with the BukhExpert8.ru regulations >>

Corrective clarifying certificates

To correct the information submitted in the initial certificate, you need to submit a corrective one. In the “adjustment number” field, in this case, the numbers from “01” to “98” are entered, depending on what kind of correction is being made on the account.

The number of the corrective certificate corresponds to the primary one, but the date will be new. Any inaccuracy in the provided certificate leads to a whole chain of violations, and as a result, correctional documents.

Let's look at some of them:

Example 1. Field “taxpayer status”.

It would seem like such a small thing, because the amounts are written down, the tax is withheld, why bother? The “status” sign in the certificate is indicated as “1”, i.e. resident and employee tax is withheld at a rate of 13%.

After submitting the initial 2-NDFL, HR staff found out that the employee had become a non-resident before the end of the reporting year. And we remember that a non-resident must pay tax at a rate of 30%. Therefore, we recalculate the tax for the reporting year.

We submit a corrective certificate 2-NDFL with attribute 1 and “non-resident taxpayer status (2).” But not only. The accountant cannot withhold the remaining 17% of personal income tax from the employee, since the reporting period has ended. Therefore, a certificate with attribute “2” is submitted. In which fields 1 and 2 are filled in similarly.

Field 3 indicates income that was not previously included in the tax base. In field five - the amount of calculated and not withheld tax.

Example 2. After submitting 2-NDFL reports, the accounting department discovered its mistake.

In honor of his fiftieth birthday, the employee was presented with a valuable gift in the amount of 5,000 rubles (exceeding the limit of 4,000 rubles). But the amount is 1000 rubles. was not taken into account as income and no tax was assessed. This means we submit a corrective certificate 2-NDFL with attribute “1”, where in the “income…” field we add the amount of this gift.

We recalculate the amount of the taxable base and calculated tax. We indicate the amount of personal income tax not withheld. Since you did not withhold tax for the gift, you need to fill out a certificate with attribute “2”, which also indicates the amount of personal income tax not withheld.

In both cases, you need to report the amount of unwithheld tax to the employee (taxpayer). And don’t forget to pay the penalties accrued on the amount of unpaid personal income tax.

Example 3: Your company issued an interest-free loan (or simply forgave an unpaid statement) to an individual who is not an employee (maybe a contractor).

In this case, you must submit a 2-NDFL certificate with sign “2” for the amount of income received by this individual. And also inform the taxpayer in writing about his debt to the budget. However, it is necessary to clarify that there are no penalties for failure to report.

Example 4. It turns out that the accountant did not indicate the benefits available to the employee (deduction for minor children).

Thus, he withheld excess personal income tax from the employee. In this situation, you need to submit a corrective certificate, from which the amount of tax overpaid to the budget will be visible.

And also, based on the employee’s written application, return this money to him through the bank. At the same time, the calculation with the budget will be adjusted in the current period due to personal income tax accruals for this employee.

Example 5. An employee applied to his Federal Tax Service for a personal income tax refund. After conducting a desk check, he was refused. The reason for the refusal is a discrepancy in the address. As a result, the employee did not receive his money on time. And you will have to pay a fine and submit a corrective certificate.

So, let's summarize. Submitting 2-NDFL reports requires attention and responsibility from the accountant so that your company can avoid any shortcomings (do not use corrective and canceling certificates); you only need to submit primary 2-NDFL certificates.

Salary recalculation

If an employee’s illness was not taken into account when filling out a time sheet, then the accountant could not correctly calculate his salary. Therefore, it needs to be recalculated, and the recalculation reflected in the 6-NDFL form.

How to reflect salary recalculation

Section 1 of form 6-NDFL is filled out with an accrual total for the first quarter, half a year, nine months and a year. Section 2 for the reporting period reflects transactions that were carried out over the last three months of this reporting period.

If errors were made in the calculations that lead to an underestimation or overestimation of personal income tax, you must provide a “clarification.”

If an employee brought sick leave, for example, for March 2021 in April 2021, the salary for March 2019 will have to be recalculated.

The total amounts, taking into account recalculation, are reflected in section 1 “clarifications” for 6-NDFL for the first quarter of 2021 by lines:

- 020 “Amount of accrued income”;

- 040 “Amount of calculated tax”;

- 070 “Amount of tax withheld.”

And the salary for March and personal income tax, taking into account recalculation, must be shown on lines 100 - 140 of section 2 for the first half of 2021.

If an employee brought sick leave for December 2021 in January 2020, then the accountant will have to recalculate the salary for December 2019.

The total amounts, taking into account the recalculation, must be reflected in section 1 “clarification” for 6-NDFL for 2021 in the lines:

- 020 “Amount of accrued income”;

- 040 “Amount of calculated tax”;

- 070 “Amount of tax withheld.”

Salaries for December 2021 and the amount of personal income tax, taking into account recalculation, are reflected in lines 100 - 140 of section 2 for the first quarter of 2021.

We return the overpayment of personal income tax to the employee

The overpayment is returned at the expense of upcoming personal income tax payments, subject to withholding and transfer to the budget from employee income. In August 2015, an employee of Torgovaya LLC A.S. Kondratiev was on a business trip. Upon his return, he submitted an advance report in which he reflected the costs of travel to the place of business trip and back in the amount of 10,000 rubles. He did not have tickets confirming travel expenses. Despite this, travel expenses were compensated to Kondratiev based on his application and the order of the manager. The accountant included the reimbursable expenses in the personal income tax base in August. The amount of personal income tax on compensation for travel expenses was 1,300 rubles.

Important: Kondratiev’s monthly income is 8,000 rubles. Kondratiev has no children. For the period January–August, standard deductions were not provided to the employee. Data on accrued income and withheld tax are given in the table.

The results of the adjustment are presented in the table. Period Amount of taxable income Amount of personal income tax to be withheld Excessive amount of personal income tax withheld January–August RUB 64,000. (74,000 rub. – 10,000 rub.) 8,320 rub. (64,000 rubles × 13%) 1,300 rubles (9,620 rubles –8,320 rubles) The total amount of personal income tax withheld from the salaries of all Hermes employees for September was 130,000 rubles. Of this amount, the Hermes accountant transferred only 128,700 rubles to the budget. The difference is 1300 rubles. was transferred to the bank account specified by Kondratiev in the return application. Operations related to the withholding, recalculation and payment of personal income tax to the budget are reflected in the accounting records of Hermes in the following entries. In August: Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1300 rubles. – personal income tax was withheld from compensation for travel expenses not documented by Kondratiev; Debit 68 subaccount “Personal Income Tax Payments” Credit 51–1300 rub.

What to consider when filling out form 6-NDFL

Tax officials reminded that the 6-NDFL calculation form and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (hereinafter referred to as the Procedure).

The calculation of 6-NDFL is made on an accrual basis for the first quarter, for six months, for nine months and for the year. The data is taken from tax registers (clause 1, article 230 of the Tax Code of the Russian Federation, clause 1.1 of the Procedure).

The calculation consists of sections, each of which is required to be completed:

- title page;

- section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

Section 1 indicates the amounts of accrued income, calculated and withheld tax at the appropriate tax rate.

Section 2 indicates the dates of actual receipt of income by individuals and withholding of tax, deadlines for transferring tax and generalized indicators of the amounts of actually received income and withheld tax for all individuals.

To do this, fill in the lines in section 2:

- 100, where they put the date of actual receipt of income reflected on line 130.

- 110 - the date of tax withholding from the amount of income actually received reflected on line 130.

- 120 - the date no later than which the tax amount must be transferred.

- 130, where they show the generalized amount of income actually received (without deduction of personal income tax) on the date indicated in line 100. This amount includes the advance paid in the middle of the month;

- 140 to indicate the generalized amount of personal income tax withheld on the date indicated in line 110.

The date of actual receipt of income is indicated on line 100 of section 2 of the calculation.

Let us remind you that if in relation to different types of income that have the same date of their actual receipt, there are different deadlines for tax transfer, then lines 100 - 140 are filled in for each tax transfer deadline separately.