VAT declaration 2021 – form

From the first quarter of 2021, a new VAT declaration form will be used. The form was approved by order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/558, as amended on December 20, 2016.

For VAT, reporting “on paper” has not been submitted since 2014 - you need to report to the Federal Tax Service electronically via TKS through a special operator. The paper form can only be used by non-paying tax agents and taxpayer agents exempt from calculating and paying VAT (clause 5 of Article 174 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated January 30, 2015 No. OA-4-17/1350).

The VAT return is submitted no later than the 25th day after the end of the quarter. For the 4th quarter of 2021, you must report by January 25, 2018, regardless of the form of submission of the report.

Duty

Let us say right away that submitting a zero VAT return in 2021 is precisely an obligation, and not a right of the organization. It occurs when two conditions are present:

- the company operates on a common tax system;

- There was no activity for the quarter.

you will still have to submit a zero VAT return, including for the 3rd quarter of 2021 . The current form can be downloaded from our website.

Composition of the VAT return

The procedure for filling out the declaration was developed by the Federal Tax Service of the Russian Federation in Appendix No. 2 to the same order No. MMV-7-3/558, which approved the form.

The VAT form consists of a title page and 12 sections, of which only section 1 is mandatory for everyone, and the rest are filled out only if the relevant data is available.

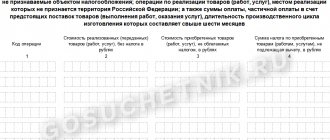

Thus, for taxpayers who carried out only non-VAT-taxable transactions in the reporting quarter, section 7 of the VAT declaration is required to be completed. “Special regime officers” who allocated VAT in invoices, and persons exempted from taxpayer obligations under Articles 145 and 145.1 of the Tax Code of the Russian Federation, but those who have issued VAT invoices submit Section 12 as part of the declaration. VAT agents fill out Section 3 if they have had no other tax transactions other than agency ones. Sections 8 and 9 are intended for taxpayers keeping books of purchases/sales, and sections 10 and 11 are intended for intermediaries filling out a declaration according to the invoice journal.

Presentation on paper

The VAT return can be submitted on paper:

- tax agents who do not pay VAT, working under a special regime, or exempt from paying tax;

- organizations and organizations that are not VAT payers, or have received an exemption from payment, if they: are not large taxpayers;

- did not issue invoices with the indicated amount of VAT;

- acted on the basis of agency agreements in the interests of other persons, but used invoices;

- their number of employees does not exceed hundreds.

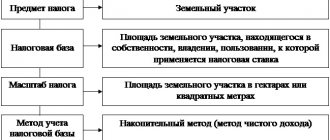

Any plot can be encumbered with an easement - both intended for individual housing construction and agricultural land. How to correctly draw up an application for the provision of a land plot? You will find a sample here.

To privatize a land plot, you need to collect a package of certain documents. You will find the list in our article.

VAT declaration 2017: filling out the required sections

The VAT declaration is filled out based on the following documents:

- Purchase books and sales books,

- Invoices from VAT evaders,

- Invoice journal (intermediaries),

- Accounting registers and tax registers.

The title page of the declaration is quite standard. It contains information about the organization/individual entrepreneur:

- TIN and checkpoint,

- Adjustment number – “0” for the primary declaration, “1”, “2”, etc. for subsequent clarifications,

- Tax period code, according to Appendix No. 3 to the Filling Out Procedure, and year,

- Code of the Federal Tax Service where reports are submitted,

- Name/full name VAT payer, as indicated in the company’s charter, or in the individual’s passport,

- OKVED code, as in the extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs,

- Number of pages of the declaration and attached documents,

- Contact details, signature of the manager/individual entrepreneur.

Section 1 of the VAT return, which is mandatory for everyone, reflects the amount of tax to be paid or reimbursed from the budget. The data is entered into it after calculating the results in other necessary sections of the declaration, and includes:

- Territory code according to OKTMO - it can be found in the territory classifier, or on the websites of Rosstat and the Federal Tax Service;

- KBK, relevant for this period,

- Lines 030-040 reflect the total amount of tax payable, and line 050 - the amount to be reimbursed,

- Lines 060-080 are filled in if the code “227” is indicated in the “At location” line of the title page.

The title page with section 1 is submitted to the Federal Tax Service and in the case where there are no indicators to be reflected in sections 2-12 of the declaration, such VAT reporting will be “zero”.

What data is included in the first section?

The initial section of the return is intended to calculate the total tax amount.

- OKTMO is entered in the line with code 010.

- Under number 020 is placed the KBK for VAT (by analogy with the KBK for the simplified tax system) for that part of services and goods that are sold on the territory of the Russian Federation.

- Under number 030, the amount of the VAT contribution is entered; it does not appear in the third section of the report, and is not shown in subsequent lines of the current section.

- Under numbers 040 and 050, the results for sections 3 to 6 are entered. If there is no tax base, dashes are placed in these lines.

Next there are numbers 060-080. They are issued if the code “227” appears on the title page in the line with the location of the accounting. Otherwise, leave a dash.

How to check the declaration

Before sending the completed declaration to the Federal Tax Service, you need to check that it is filled out correctly. This can be done using the “Control ratios of declaration indicators”, published in the letter of the Federal Tax Service of the Russian Federation dated 04/06/2017 No. SD-4-3/6467. The ratios are checked not only within the VAT return, but are compared with indicators of other reporting forms and financial statements.

If any control ratio for VAT is violated, the declaration will not pass a desk audit, the tax authorities will consider this an error and send a request for appropriate explanations within 5 days. Taxpayers are required to submit explanations, as well as the declaration, in electronic form according to the TKS (clause 3 of Article 88 of the Tax Code of the Russian Federation). Electronic formats for such explanations were approved by order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15/682.

EUD as an alternative

Payers, instead of a zero VAT return in 2017, can submit a single simplified declaration (SUD). It was approved back in 2007 by Order of the Ministry of Finance No. 62n. The conditions are the same: in the past quarter the company did not show any activity in general mode. Moreover, the right to report on this form is directly provided for by the Tax Code - paragraph 2 of Article 80.

The main advantage of the EUD is that you can surrender on a paper form and not have to bother contacting a special operator. This is usually what newly formed firms and startups do.

As for any paper tax reporting, a VAT return (zero, etc.) can be submitted personally by the head of the company or its representative by proxy. If by registered mail, then with a description of the attachment. And, of course, no one prohibits the most advanced method - via TKS through a data operator.

The main disadvantage of the EUD is the shortened deadline for submitting such a report: the 20th day after the end of the quarter. And this is five days shorter than submitting standard VAT reporting in accordance with its general rules.

The EUD form looks like this:

You can download the EUD form on our website here.

Also see “Who must pay VAT”.

Read also

12.05.2017

Sample of filling out a VAT return

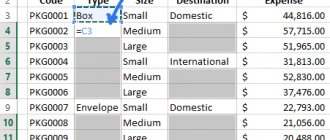

Astra LLC uses OSNO and is engaged in wholesale trade of products. Let's say that in the 4th quarter of 2021 Astra had only three operations:

- Goods were sold to one buyer in the amount of 1 million rubles. excluding VAT. Goods sold are subject to VAT at a rate of 18%.

- Goods were purchased for the amount of 1416 thousand rubles. including VAT 18% (RUB 216 thousand). This tax, according to the documents, can be deducted.

- An advance payment was received from the buyer for future deliveries in the amount of 531 thousand rubles. including VAT 18% (RUB 81 thousand).

In this case, you need to fill out the following sections of the declaration:

- title page,

- Section 1 – the amount of VAT to be transferred to the budget;

- Section 3 – tax calculation for the reporting quarter;

- section 8 – indicators from the purchase book on the received invoice in order to deduct the submitted VAT from the total tax amount;

- section 9 - data from the sales book on issued invoices. In our case, this section needs to be filled out twice, because... There were two sales transactions, and we will fill in the total lines 230-280 only once.

Information on the third section

In the third section of the declaration, the tax contribution is calculated at rates of 10% and 18%, and tax deductions are indicated.

Lines numbered 010 to 040, columns 3 and 5, describe transactions for the sale of services and the supply of goods subject to VAT.

Line 050 contains information about operations related to the functioning of the object as a property complex.

Line 060 is intended for entering data on construction and installation work carried out, provided for the enterprise itself.

This information is entered only if this type of work was performed in a specific tax period.

Under number 070, information is entered about the tax base and the amount of tax on the amount received as an advance payment or advance for goods or services.

The VAT return shows both the prepayment and subsequent transactions for this payment.

The amount of tax that is taken from this advance is entered in the appropriate field.

Line 080 contains information about the amounts that make up the tax base and on which VAT is calculated.

These are transactions that accompany settlements for payment for services or goods provided.

This includes payments such as fines, late fees and similar charges.

Lines 090-110 contain detailed information about VAT charges that should be restored in the current tax period.

- Under number 090, enter the amount to be restored.

- Number 100 shows the contribution in the case where the amount for deduction was accepted for products or services that are subsequently exported.

- Number 110 shows transactions when a tax deduction was calculated for fixed assets, intangible assets or rights that become a contribution to the authorized capital of a third-party organization.

Line 120 contains the total tax amount, which includes the contribution for transactions for the sale of products and services and the amount of the restored tax.

Title page

The title page is filled out by everyone without exception.

- The first thing you need to fill out is your Taxpayer Identification Number (TIN) and checkpoint; there shouldn’t be any problems here.

- Next comes the correction number. Here, too, everything is logical: 00 when filing the declaration for the first time, and so on.

- Codes defining the tax period. From is indicated 01-12 in accordance with the month. From 21-24 in accordance with the filing quarter. Or the year for which reporting is being submitted is indicated.

- Then you should indicate the code of the tax authority to which the document is submitted. This information can be obtained both at the Federal Tax Service office itself and on the website.

- Code at the place of registration. In the case where the declaration is submitted at the place of registration of the taxpayer’s organization, code No. “400” is indicated.

- This is followed by the name of the taxpayer.

- The code of the type of economic activity according to the OKVED classifier is indicated in accordance with the certifying documents.

- The telephone number is either the number of the accountant or the owner of the company.

- 1 or 2 must be entered in accordance with who is filing the declaration. The taxpayer, that is, the owner of the organization or his representative - for example, an accountant.

- Full name of the taxpayer or representative.

It is best to indicate the taxpayer's full name in capital letters to avoid misunderstandings on the part of the inspector.

A power of attorney can be used as a document confirming the authority of the representative. Such a document can be issued either by the organization itself or by a notary.