Statistical reporting in 2021

In addition to tax and accounting reporting, organizations must submit statistical reporting. The obligation to submit statistical reporting is established by Federal Law No. 282 of November 29, 2007. It is accepted by Rosstat.

Why are statistics needed?

The main task of Rosstat is to generate official statistical information about the country’s situation in the social, economic, demographic and environmental spheres.

Analysis of statistical data allows you to determine:

- How high is the tax burden on entrepreneurs and organizations?

- What is the state of this or that industry?

- How the state is developing

- To what extent is the situation improving or worsening in specific areas of life?

Based on the processed data, Rosstat assigns each individual entrepreneur and enterprise codes from all-Russian classifiers - statistics codes. Obtaining codes by an entrepreneur or organization is an optional procedure. However, they are necessary in some cases, for example:

reporting preparation

preparation of payment orders, as well as receipts for payment of taxes and insurance premiums

Opening a bank account

opening a branch of the enterprise

change of place of registration of individual entrepreneurs or address of the location of the enterprise

change of full name of individual entrepreneur or name of the enterprise and other cases

Who submits reports to Rosstat

Individual entrepreneurs and organizations submit statistical reporting. The list of forms used by large companies to submit statistical reports is quite extensive. Representatives of SMEs report in a simplified manner.

Small enterprises are required to submit statistical reports if they are included in the Rosstat sample. Selective surveillance is carried out constantly, and any organization can be included in it. With such monitoring, the submission of forms can be monthly, quarterly and annual. The forms that the respondent must submit may vary.

In addition to selective observation, there is continuous observation. It is held once every five years. The next continuous observation is planned for the end of 2021. Organizations included in the sample receive a corresponding notification from Rosstat, as well as a paper form. An enterprise or individual entrepreneur can clarify information about which forms to submit to Rosstat by contacting the territorial office of the statistical authorities.

The format in which the reporting will be submitted—in paper or electronic form—is chosen by the respondent himself. The exception is when the form provides only one specific format.

Statistical reporting forms

There are quite a few forms of statistical reporting, and their list changes regularly. A list of all forms of statistical observation is available on the Rosstat website. It includes all the necessary information about the forms, including due dates.

Here are examples of the most commonly mentioned statistical forms. They differ in their frequency.

Statistical forms that must be submitted annually include:

- MP (micro) - information about the main performance indicators of a micro-enterprise;

- 1-Enterprise - data on the company’s activities;

- 1-T - information on the number and wages of employees;

- 7-injuries - contains information about injuries at work and occupational diseases;

- 12-F - information on the use of funds;

- 57-T - on wages of workers by profession and position

- 23-N - contains data relating to the production, transmission, distribution and consumption of electrical energy,

- 4-TER - information on the use of fuel and energy resources.

Statistical reports are submitted quarterly using the following forms:

- P-4 (NZ) - information on underemployment and movement of workers;

- P-4 - data on the number of employees and their wages;

- P-2 - on investments in non-financial assets;

- PM - data on the main performance indicators of a small enterprise;

- P-5 (M) - basic information about the activities of the organization;

- 5-Z - data on the costs of production and sale of goods, works, services.

Other forms and some of the above are due monthly, for example:

- P-1 - information on the production and shipment of goods and services;

- P-3 - about the financial condition of the enterprise.

For some statistical reports, the deadlines must be clarified with Rosstat. These include:

- 1-З - labor force sample survey questionnaire;

- 1-KSR - information about the activities of a collective accommodation facility;

- 1-IP (vehicle cargo) - survey questionnaire for individual entrepreneurs transporting goods on a commercial basis;

- PM-1 (truck) - a sample survey of the activities of a small enterprise in the field of road transport.

How to get statistics codes

The list of reporting forms that must be submitted depends on various criteria. Among them:

Statistical reporting forms and deadlines for their submission

Statistical forms can be grouped depending on the type of business entity: for example, statistical reporting of individual entrepreneurs, micro-enterprises, medium and small firms, large organizations; there are also forms on which all of the listed entities can report.

Some 2021 statistical reporting may only be intended for certain sectors of activity: agriculture, retail trade, construction, etc. You can also highlight statistical reports presented by the number and composition of personnel, volume of revenue, products produced, etc.

Each statistical form has its own deadlines for submission, violation of which can result in significant fines (Article 13.19 of the Code of Administrative Offenses of the Russian Federation): 10 – 20 thousand rubles. for officials, and 20-70 thousand rubles. For the company. Responsibility for repeated violation of deadlines for submitting statistical reports will increase to 30-50 thousand rubles. for responsible officials, and up to 100-150 thousand rubles. for the organization. The same penalties apply when submitting false statistical data.

If there are no indicators for filling out reporting, Rosstat must be notified about this in a letter, and it should be written every time the next reporting date occurs (clause 1 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

Along with statistical reports, legal entities are required to submit a copy of their annual accounting reports to Rosstat. Accounting “statistical” reports (including those in simplified forms) are submitted no later than 3 months after the end of the reporting year (for 2017, the deadline is 04/02/2018). For violating the deadline, officials can be fined 300-500 rubles, and the company 3-5 thousand rubles. (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Statistical reporting of enterprises in 2021: deadlines

To protect yourself from missing Rosstat deadlines, we recommend that you entrust this concern to specialized software - VLSI Electronic Reporting. This service allows you to automate the preparation of not only standard accounting and tax reporting, but also reporting for other departments, including Rosstat.

The program contains and constantly updates Rosstat's requirements for filling out forms, all forms are updated, and when the deadline for submitting any report approaches, the system will definitely inform you and, thereby, remind you of this.

Filling out reports in VLSI is easy and simple. The program will fill in the general data on its own, so you will spend a minimum of time on this. In order to also send documents to the department through the system, you need to purchase an electronic signature (for example, at the official EDS Center on our website).

One should not lose sight of the important responsibility of all organizations registered and operating on the territory of the Russian Federation: all firms are required to submit their annual financial statements to the department. This must be done before the end of the first quarter of the year following the reporting year. The sanctions for violating this deadline are very impressive - up to half a million rubles per legal entity.

Who is responsible for submitting reports to Rosstat?

In general, Rosstat regulations contain the obligation for all enterprises to submit specialized reports. It doesn’t matter what industry the company belongs to, how many employees it employs or what the specifics of its activities are, sooner or later it will have to report to the department. True, there are certain patterns, for example:

- The larger the organization's staff, the more often it will have to prepare and submit statistical reports. Moreover, it is often necessary to send several different completed forms at the same time;

- Small businesses, on the other hand, do not have this obligation but still must report. As a rule, small and medium-sized businesses are required to send reports to Rosstat every few years when they are included in statistical observations or in any departmental sample. Research can be conducted based on various criteria - type of activity, number of employees, amount of revenue, etc.

In accordance with PP No. 79 and 209-FZ:

- When participating in a Rosstat sample study, a company must submit reports once a quarter or once a month, depending on the sample conditions;

- Rosstat may oblige microenterprises to prepare statistical reports no more than once a year.

Responsibility

If you do not submit statistical reports on time, you will have to pay a fine. Its size is indicated in Article 13.19 of the Code of Administrative Offenses of the Russian Federation:

- the organization will pay an amount of 20,000 rubles. up to 70,000 rubles, and for repeated violation from 100,000 rubles. up to 150,000 rubles;

- a manager or entrepreneur will pay from 10,000 rubles. up to 20,000 rubles, and for repeated violation from 30,000 rubles. up to 50,000 rub.

The head of the organization, by order, can appoint an employee who will be responsible for the presentation of statistical reporting (clause 5 of the regulation approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620). If there is no such order, then the manager himself pays the fine.

Another type of punishment is provided for in Article 3 of the Law of May 13, 1992 No. 2761-1. An organization or entrepreneur must compensate Rosstat for damages that arose due to the need to correct distorted data in consolidated reporting.

Cases related to the violations in question are considered directly by the territorial bodies of Rosstat (Article 23.53 of the Code of Administrative Offenses of the Russian Federation, Resolution of the State Statistics Committee of Russia dated February 7, 2003 No. 36).

Continuous and selective observation

Statistical observation can be continuous or selective.

In the first case, all respondents in the study group must submit statistical reporting. For example, if continuous statistical monitoring of activities in the field of trade in motor vehicles is carried out, the established forms of statistical reporting must be submitted by all organizations and entrepreneurs that were assigned the OKVED2 code 45.11 when registering with the territorial division of Rosstat.

If a sample observation is carried out, not all organizations and entrepreneurs that trade in vehicles must submit statistical reports, but only those that, by decision of Rosstat, were included in the sample.

This follows from the provisions of Part 1 of Article 6 of the Law of November 29, 2007 No. 282-FZ.

Situation: how to find out whether an organization (entrepreneur) is included in the list of respondents subject to random statistical observation?

Information about inclusion in the list of sample statistical observations, as well as statistical reporting forms and instructions for filling them out, should be communicated to organizations and entrepreneurs by the territorial divisions of Rosstat. This follows from paragraph 4 of the regulation approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620, and paragraph 4 of the Rules approved by Decree of the Government of the Russian Federation of February 16, 2008 No. 79.

However, the procedure for communicating such information to statistical respondents is not regulated by law. In practice, the territorial divisions of Rosstat solve this issue in different ways. Some of them publish on their websites lists of organizations and entrepreneurs included in the sample for compiling certain forms of statistical reporting. You can find the website of the territorial body of Rosstat (TOGS) using the interactive map on the portal https://www.gks.ru.

Many Rosstat divisions use targeted mailings to deliver the necessary information to respondents.

If for some reason an organization or entrepreneur does not know whether they are included in the list of sample statistical observations, you must contact the territorial division of Rosstat to obtain the necessary information.

Good to remember

- Micro and small businesses report to Rosstat only upon request.

- The types and timing of reporting depend on what you do.

- This does not apply to financial statements, which all LLCs must submit to Rosstat, regardless of whether they received the requirement or not.

- Check on the Rosstat website to see if statistical reporting is expected from you this year.

- Download the report form and instructions for filling it out on the Rosstat website.

- Do not ignore the requirements of Rosstat. Failure to submit reports may result in hefty fines.

Who should submit reports to statistics?

Legal norms establish the obligation to submit statistical reports to Rosstat. Moreover, what kind of reports need to be submitted depends on the status of the business entity, the type of activity performed, size, etc.

If a company does not operate, its reporting obligation does not disappear. She still has to fill out the forms and send them to statistics. If she does not have indicators, then she must prepare a letter with explanations and submit it to Rosstat.

Submission of reports to statistics in 2021 is also provided for organizations classified as small businesses and subject to preferential tax treatment. For these entities, the list of forms that need to be sent to statistics has been significantly reduced.

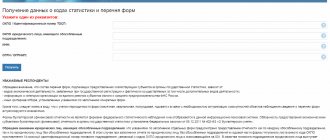

Attention! To find out which reports need to be sent to statistical authorities, you need to go to the website of this authority (https://statreg.gks.ru/), enter your TIN, OGRN, or OKPO code.

After this, the “Reporting to statistics by TIN” service will display a list of forms required for submission, as well as the deadlines by which subjects must send them to the statistical authorities.

Also, organizations should not forget that they must all submit financial statements to Rosstat at the end of the year. It is submitted to statistics after it is accepted by the tax authorities, that is, with a mark of acceptance by them.

Attention! Also, statistics periodically conducts sample studies, as a result of which subjects included in the sample must submit the prescribed forms. Rosstat officially notifies the business entity about this.

What do small businesses rent?

To determine what kind of statistical reporting should be prepared at an enterprise in 2018, you need to find out whether it belongs to the category of small. This determines the list of what will have to be compiled.

The criteria for classifying companies in terms of statistical reporting 2021 for LLCs and other forms of activity are as follows:

- participation in the authorized capital of other legal entities (no more than 25% for Russian companies and no more than 49% for foreign ones);

- SCH for employees for the previous year (microenterprises - up to 15 people, small - up to 100 people, medium - up to 250 people);

- size of income (microenterprises - up to 120 million rubles, small - up to 800 million rubles, medium enterprises - up to 2 billion rubles).

Continuous annual statistical reporting for 2021 for small and micro enterprises is not submitted.

In order to determine the list of companies that are included in the sample, a special algorithm is used. Those who are included in it fill out the following forms:

- forms of small business – for microenterprises and individual entrepreneurs;

- IP forms – for individual entrepreneurs;

- specialized forms such as statistical reports for 2021 trading and others.

How to determine if you are a micro and small business

- The share of participation of other large enterprises in your LLC does not exceed 25% of the authorized capital.

- For micro-enterprises: the number of employees is no more than 15 people and the annual revenue is a maximum of 120 million rubles.

- For small enterprises: the average number of employees is no more than 100 people and annual revenue is a maximum of 800 million rubles.

Micro or small enterprises report to Rosstat only upon its request.

If in doubt, find yourself using your TIN in the register on the tax website. Your details should say "micro enterprise" or "small enterprise".

Mortality in Russia by year

The definitely recorded improvement in the situation in 2017-2018 is the result of a long process and the joint work of the entire population together with the government of the country. In the decade between 1995 and 2005, deaths reached 3.6 million each year, and have only shown a steady downward trend since 2006. If you look at information over the past years, you can see that while 2,303,935 people died in 2005, in 2006 this number decreased to 2,166,703 citizens. The number of deaths fell below two million in 2011 and has remained no higher than this level since then, and in 2013 and 2014 the number of births on average in the country turned out to be higher than the number of deaths, which gave a positive population growth, even despite the increase in the absolute value of the number of deaths in these years, which rose from 1,871,809 to 1,912,347 people. As you can see from the graph below, after the surge in mortality in 2014, the downward trend returned and is still relevant today.

The instability in the trend of decreasing mortality is a consequence of many factors, but first of all, unfortunately, the high mortality rate of older people who undermined their health in previous years. People of retirement and pre-retirement age make up the largest social group among all deaths in the Russian Federation.