When a pensioner purchases real estate as a property, it is necessary, first of all, to determine whether he has the right to apply for a tax deduction (hereinafter referred to as NV, preference, benefit) for the costs of this purchase. Of key importance, in this case, is the fact of having income, that is is the pensioner working?. If at the time of purchasing an apartment, and in the future, a pensioner has a source of income, he has no restrictions on claiming benefits and reimburses the funds on an equal basis with other categories of citizens. If a citizen purchases real estate and subsequently retires, he can transfer the balance of the income tax to the previous 3 years, but only on the condition that during these years he had income subject to personal income tax.

It should be noted that pensioners have the right to transfer the balance of their income tax only since 2014, and if the apartment was purchased earlier than the specified period, they will not be able to take advantage of this preference.

The process of filling out 3-NDFL for 2021 when purchasing an apartment

There are many different nuances that depend on the social status of the buyer and seller.

For example, it matters who buys housing and from whom. After all, a property-type deduction will not be available if you purchase a home from a close relative. It is quite natural that not everyone will be able to receive a deduction. After all, the state cannot give dividends to just anyone. Therefore, there are certain conditions to determine whether a person can receive a deduction.

Filling out the 3-NDFL declaration when selling an apartment for 2021 - a sample of the new form, instructions

Regardless of the right to a benefit, the seller of an apartment who has owned it for less than a minimum number of years must declare his income to the Federal Tax Service and claim the right to a property benefit. For these purposes, an individual fills out a tax return 3-NDFL, to which a package of documents is attached.

- Title;

- Section 1 – total amount of personal income tax payable;

- Section 2 – calculation of the tax base and tax;

- Appendix 1 and calculations thereto – income from the sale of housing is shown;

- Appendix 6 – calculation of property deduction from the sale.

The procedure for filling out an application for a tax deduction and a 3NFDL declaration

- donations to charitable organizations;

- payment for medical services received personally or by relatives, under a contract;

- additional payments for the funded part of the taxpayer’s pension;

- contributions to non-state pension provision for oneself, or family members, or close relatives.

payment for your own education or full-time education for a family member under a contract with an educational institution;

Russian legislation provides for the refund to an individual of part of the income tax paid. To get your money back, you must correctly fill out an application to the tax authority and a 3-NDFL declaration for a tax deduction for 2021, filled out according to the sample.

Sample of filling out 3NDFL for a pensioner for 3 years

Property tax deductions Amounts of personal income tax tax rates Examples of calculating personal income tax when receiving a tax deduction in case of purchase of an apartment by pensioners To correctly fill out the tax return in form 3-NDFL, I suggest you familiarize yourself with the most common cases of calculating personal income tax (income tax) when receiving a property tax deduction in the case purchasing housing (apartments, rooms, houses, etc.). It should be borne in mind that each case is individual and it is better for you to seek the advice of a specialist both to calculate the amount of personal income tax and to correctly fill out the 3-NDFL tax return. Example: A taxpayer in 2021, having taken a loan, purchased a residential building and based on income for 2021, based on the 3-NDFL declaration submitted to the tax office, he has the right to receive a property tax deduction. In December 2021 You can find out the OKTMO on the Federal Tax Service website 040 Not filled out when applying for NV 050 Indicate the amount of NV to be returned for this D Section 2 Lines What is indicated Comment 010 Amount of income received for the year, excluding personal income tax (!) In our case , Stepanov received 504,000 rubles for 2021. 020 To be filled in if there were incomes that are not subject to taxation In our case, there were no such incomes 030 This line indicates the amount of income subject to income tax. In our example, all of Stepanov’s income is subject to personal income tax 040 The amount of tax NVs that a citizen is entitled to claim The value of this lines = line 2.8 of Sheet D1 050-051 Not to be filled in 051-052 When applying for personal income tax by an individual, not to be filled out 060-070 Since there is no tax payable, the value “0” is indicated or a dash is placed 080 The amount of personal income tax paid to the budget B is indicated In our case, Stepanov’s employer paid 65,520 rubles to the budget. It is possible to establish a number of important aspects that pensioners should take into account when completing and submitting the 3-NDFL declaration, including:

We recommend reading: Transport Card blocked

Special rights of pensioners The tenth paragraph of article number 220 of the tax legislation states that 3-NDFL deductions for the purchase of real estate can be calculated taking into account past tax periods for people of retirement age. This also applies to the remainder of the deduction. This previous period is limited to the three years that preceded the year in which the deduction balance began to form. Let's look at the situation using examples.

Conditions for filling out the declaration

Pensioners who, within the reporting period (12 calendar months) received income other than pension payments, will have to worry about this. Based on the Tax Code, in this case the citizen will be charged 13% personal income tax. Such a person has the right to later claim compensation - a tax deduction. Working pensioners must adhere to the same algorithm as other individuals.

They will have to meet a number of conditions:

- Be a resident of the Russian Federation. This means living within the country for at least 183 days in the reporting year;

- During the reporting period, have additional income, for example, dividends or rent;

- Submit the completed declaration personally or through a representative, as well as prepare other documents if the person has the right to a property deduction.

If a person needs to declare additional income, i.e. pay tax on him or he wants to exercise his right to receive a property deduction, the algorithm for filling out the declaration may change slightly.

How to fill out a 3-NDFL tax return for several years

Good afternoon. Please tell me how to return %% from the mortgage. The apartment was purchased in 2021 on a shared basis. The property was registered in 2021. The main return of 13% was received in 2021 for 2021 and in 2021 for 2021. Now I want to return 13% on mortgage interest. As I understand it, you can return it starting from the moment the mortgage agreement is concluded and the payment of interest on the mortgage loan begins, i.e. from 2021. But since you can only file a return for the previous 3 years, and for 2 years (2021 and 2021) I received the main refund (in 2021, the balance of the refund was less than the tax paid), can I file a return? in 2021 for 2021 and immediately include in it all paid %% on the mortgage starting from 2021 (i.e. fill out only one declaration on the 2021 form)?

Arthur, hello. First, you will receive a deduction for the cost of the apartment. Therefore, you don’t have to indicate interest until you receive a deduction for the cost of the apartment. If for 2021 your income exceeds the cost of the apartment, then yes, then indicate in the declaration the amount of interest according to a certificate from the bank. In 2021, also according to a certificate from the bank. Etc.

Nuances when applying tax benefits

When there are no benefits. There are a couple of situations in which a tax deduction cannot be applied to pensioners when purchasing an apartment:

- if the transaction is concluded with a related party. The law includes such persons as close relatives - spouses, children, parents, brothers or sisters, or guardians;

- when payment for the construction of a house or the purchase of an apartment is made at the expense of other persons or organizations (employer, budget), as well as when using maternity capital.

If there are several owners. When purchasing a home in shared ownership, the amount of the property deduction must be distributed between them:

- in proportion to the acquired shares, if the property was registered before 01/01/2014;

- according to actual expenses incurred by each owner (but not more than the maximum statutory maximum of 2 million rubles), if the apartment was purchased after 01/01/2014.

Exchange deal with additional payment. When making a transaction that involves the exchange of existing living space with a monetary surcharge, the party that incurred financial expenses also has the right to apply to the Federal Tax Service for a property deduction.

Joint ownership. When purchasing an apartment, plot, house by persons who are officially married, the property will be considered joint. In this case, both spouses have the right to a property deduction, but if they wish, they can redistribute it in favor of one of them.

Refund amount. The Federal Tax Service has the right to transfer not the entire amount calculated in the declaration as a personal income tax refund. Such situations arise when the applicant has overdue debts on other budget payments, which the tax authorities compensate from the tax accrued for reimbursement.

How to fill out the 3-NDFL declaration for 3 years

- obligated to send it to the Federal Tax Service for the past year, even if they do not have data to fill out (Article 227 of the Tax Code of the Russian Federation);

- submitting it only when circumstances arose in the past year that create an obligation (Articles 227.1, 228 of the Tax Code of the Russian Federation) or interest (Articles 218–221 of the Tax Code of the Russian Federation) in filing a report.

- filing an updated report, which is associated with the discovery of errors, either obliging or allowing amendments to be made - this is usually used by persons obliged to submit reports;

- submission of the primary report later than the date established for filing the declaration - this is done by persons interested in submitting it, but: who forgot to submit the declaration on time;

- those who did not have all the necessary documents on hand to complete it on time;

- those who decide to take advantage of the tax refund opportunity that applies to the past 3 years (pensioners).

How can a pensioner fill out the 3-NDFL declaration in 2021?

To begin with, the pensioner needs to enter his TIN in the identification number field, and then enter the adjustment number. If the declaration is submitted for the first time in this reporting year, you must indicate code 0. The year in which the housing loan was received is noted in the “Tax period” line. Then, in the Federal Tax Service code line, enter the 4-digit code of the authority to which the documents are being sent. Next, it’s time to move on to the fields for data about the tax payer: indicate the passport details of the person who is submitting the declaration and his status. In the “Status” line, enter the number 1 if the person is a resident of the country and the number 2 if he is not. Next, in the line “Reliability and completeness of information,” you must enter the number 1 if the person acts on his own behalf and does not use the services of a trusted person.

We recommend reading: Conversion of preferential pensions

As for other situations when a pensioner needs to declare income received from, for example, the sale of a plot of land or a car, the filling algorithm does not change significantly. In 3-NDFL, you will also need to indicate personal data, the amount of profit received as a result of the transaction, and independently, in section 6, calculate the total amount of tax that needs to be paid to the budget.

Step-by-step instructions for filling out

After receiving the form, you must carefully fill out the first page. Here you need to enter your personal data in block letters, rewrite information from your passport and indicate contact information for communication.

Then the algorithm is as follows:

- On page 4 of sheet A you need to describe all available sources of income and the total amount of income;

- On page 8 of sheet D, note what amount of deduction the citizen is entitled to (if the goal of all manipulations is to receive compensation);

- On page 9 of sheet D, indicate the amount of tax that is returned after the sale of the property;

- On page 10 of sheet E, calculate the required amount of property or social deduction;

- On pages 13-19, describe the available sources of income in the form of securities, investments and other income, which are also subject to 13% personal income tax;

- Then go to page 2-3, where you add summary information regarding all deductions and income that will be taxed.

Important point! There are no significant differences in the process of filling out a declaration between a pensioner and a working young person. The forms are filled out almost identically, with one exception - the pensioner must enter the index “1” in field 040 on sheet D1.

How to fill out 3-NDFL correctly

In 2021, the personal income tax return in Form 3-NDFL is submitted by April 30. If the taxpayer completed and submitted the report before the amendments to the form came into force, he does not need to submit the information again using the new form. If you need to claim a deduction, you can submit your return at any time during the year.

- Passport of a citizen of the Russian Federation - 21;

- Birth certificate - 03;

- Military ID - 07;

- Temporary certificate issued instead of a military ID - 08;

- Passport of a foreign citizen - 10;

- Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on the merits - 11;

- Residence permit in the Russian Federation - 12;

- Refugee certificate - 13;

- Temporary identity card of a citizen of the Russian Federation - 14;

- Temporary residence permit in the Russian Federation - 15;

- Certificate of temporary asylum in the Russian Federation - 18;

- Birth certificate issued by an authorized body of a foreign state - 23;

- Identity card of a Russian military personnel/Military ID of a reserve officer - 24;

- Other documents - 91.

Is there a statute of limitations for returning a tax deduction?

After receiving the documentation, the tax authority checks the acts. The deadline in this situation is three months. When the deadline has expired, the citizen must be notified of the decision made.

If the answer is negative, then the reason must be stated in the document. For example, when not all documents have been collected. Once corrected, you will be able to submit your application again. When the application is approved, funds are transferred within a month. For this reason, you must first visit the bank and open an account.

Statutes of limitation are established for citizens who have received pension status and do not work. It is equal to the three years preceding retirement.

How to fill out the new form 3-NDFL

Count and indicate the number of completed pages of your tax return, then sign the cover page and enter the date. If filling out is carried out in electronic format, you will need an electronic key - a digital signature.

The deadline for filing a personal income tax return for 2021 is 04/30/2021. Transfers are not provided in this case. Let us remind you that in 2021 the filing deadline fell on a weekend, and the declaration for last year had to be submitted no later than 05/03/2021.

Submitting 3-NDFL when selling real estate

Calculation example No. 2: Kanadaev A.I. purchased an apartment in 2021 for 3 million rubles. At the same time, the purchase and sale agreement remained in his hands along with the seller’s receipt for receipt of funds. At the end of 2021, he decided to sell the property for 3,150,000 rubles.

- The adjustment number is 0, if such a report is being processed for the first time (clarified version, then 1,2, etc.).

- TIN (if not available, the field remains blank).

- Reporting period – 34 (code).

- Code of the Tax Service to which the appeal was sent.

- Tax payer code from the list (for individuals – 760).

- OKTMO - can be found out from a tax inspector.

- Personal data, payer addresses.

- Citizenship column (RF – 1, if another country – 2).

- RF code.

- Resident of the Russian Federation – 1, no – 2.

If the pensioner continues to work

Even if a pensioner receives income from which he pays personal income tax, he can still transfer the deduction to the previous three years. In this case, the remainder of the deduction can be used in future periods. For pensioner status, it is important to receive a pension, and not quit work and live only on payments from the state.

For example, a pensioner bought an apartment in 2021 and continues to work. He can return the tax for 2017-2019, and if part of the deduction remains, he can use it at the employer and not pay tax for several more years while there is a balance.

3-NDFL when selling an apartment

If the apartment is sold and there are no grounds for paying personal income tax, then the declaration indicates only information about income from the purchased housing, and the tax deduction is accordingly calculated only from this amount. There is no need to submit a declaration within the period established by law solely for the purpose of obtaining a property deduction. If it displays information about acquired income and expenses for two transactions, then submission must be carried out in the general manner, no later than April 30 following the reporting year.

If the purchase and sale of real estate were made during one tax period, i.e., during one calendar year, then the citizen has the right to offset property deductions . In this case, the 3-NDFL declaration is filled out in the general manner, as when receiving income from the sale of real estate. An annex is also added to it, which provides information about property deductions associated with receiving income from the sale of an apartment. Thus, in one declaration you can display two transactions at once and calculate the cost of tax.

We recommend reading: Personal Income Tax Reimbursement for Treatment of Fillings in the Clinic

Pensioners as a category of citizens

Pensioners, like any other categories of individuals, remain citizens of Russia and count on similar rights and freedoms, regardless of whether they have stopped working or not.

Despite this, there are certain specific features inherent in older people as a category of citizens:

- The main income of most pensioners is state pension payments;

- Taxes are not paid to the treasury from this source of income, which is why the right of citizens to receive a tax deduction is called into question;

- They incur certain expenses for treatment, training, purchase of real estate and its sale.

Separately, it is worth noting that all pensioners are divided into two large categories - non-working persons and persons engaged in full-time work.

The lack of pension funds to cover current expenses forces retirees to look for work and find third-party sources of income. Many of them buy securities, rent out real estate, and place funds in time deposits in commercial banks. Receiving additional income forces pensioners to fill out a 3-NDFL declaration.

3-NDFL for pensioners when buying an apartment

Another feature: in addition to the standard set of documents as an annex to 3-NDFL, when purchasing an apartment in 2021, a pensioner must add a copy of his pension certificate.

The fact is that, on the basis of paragraph 10 of Article 220 of the Tax Code, pensioners are allowed to transfer the deduction in 3-NDFL for the purchase of an apartment to previous tax periods. Of course, this also applies to the rest of it. But there is a limit: no more than 3 years ago. That is, before the year in which the carryover balance of the personal income tax deduction is formed.

Don't forget about your spouse

If a pensioner is officially married and his spouse has income subject to income tax (NDFL), then in some cases a deduction can be obtained through him.

Features of the distribution of property tax deductions between spouses in marriage are discussed in detail in our article “Features of tax deductions when spouses purchase an apartment/house”

If you have not yet purchased a home, we recommend our partner’s site-guide, APARTMENT-Bez-AGENTA.ru. This is an educational site for those who want to understand the rules for buying and selling apartments.

New form 3-NDFL in 2021

- Mandatory tax returns must be submitted between January 1 and April 30, 2021, if income was received in 2021.

- To obtain a tax refund when receiving social and property deductions, the declaration can be submitted throughout the entire calendar year.

- if the declaration is mixed, then it is submitted according to the mandatory deadline: no later than the last day of April 2021.

Voluntary options for filling out a tax return form 3-NDFL include cases where the taxpayer wants to receive deductions for education, paid medical care or a property deduction for the purchase of housing.

Tax deduction for pensioners

→ → Current as of: June 10, 2021

depends on exactly what expenses he wants to reimburse.

If, for example, a pensioner wants to return part of the money spent on his treatment, then he needs to contact the tax authority to receive a social tax deduction ().

If a pensioner wants to return part of the money spent on purchasing real estate, then the tax authority must declare a property tax deduction (). A tax deduction allows citizens to return part of their personal income tax, the amounts of which were previously withheld from their salaries by their employer and transferred to the budget.

In addition, the use of a deduction allows you to reduce the amount of tax payable. That is, citizens who receive income taxed at a rate of 13% (for example, wages under an employment contract) can claim tax deductions. The property tax deduction when purchasing an apartment is limited to 2,000,000 rubles.

In this case, the maximum personal income tax refundable is 13% of this amount, i.e. 260,000 rubles (2,000,000 x 13%) (). This tax deduction is presented once ().

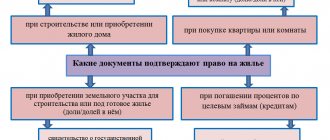

To return income tax, a pensioner will need to submit to the tax office a package of documents confirming the right to a property tax deduction, as well as a declaration in form 3-NDFL (,).

If the buyer of an apartment during the year did not exercise the right to receive a property tax deduction in full, then the balance of this deduction can be transferred to the next calendar years until it is fully used ().

An example of filling out the 3rd personal income tax declaration for 2021 when purchasing an apartment in year 3

To receive standard deductions, you do not need to fill out Form 3 of Personal Income Tax 2021, since deductions are provided by the employer upon the personal application of the employee. In exceptional cases, when the employer was unable to provide standard deductions, a tax return is prepared to receive the excess tax withheld.

It is almost impossible for an unprepared person to fill out the declaration. Therefore, in our article we provide a sample of filling out the 3-NDFL declaration for 2021 when purchasing an apartment. Some aspects of obtaining a deduction and filling out the form are also discussed. In addition, links to download the necessary papers are provided.

Examples of receiving NV by pensioners

Situation #1

Stepanov bought a one-room apartment in 2021. He retired in June 2021. Thus, in 2021, he can declare an IR for 2021 (the year the apartment was purchased) and 3 years preceding this period: 2021, 2021 and 2015.

Situation No. 2

Stepanov bought a one-room apartment in 2015, but retired a year earlier. Since he did not work in the year he purchased the property, he will not be able to claim benefits during this period. But he has the right to declare NV for the 3 years preceding the year of purchase of the apartment, namely for 2014, 2013, 2012.

Situation No. 3

Stepanov bought the property in 2015, but he retired in 2010 and at the time of purchasing the property had not worked for 5 years. Since Stepanov did not work 3 years before purchasing the home and did not pay personal income tax to the budget, he will not be able to receive a deduction.

Having dealt with the peculiarities of receiving a deduction for pensioners, we will consider how to correctly fill out the 3-NDFL declaration (hereinafter referred to as D, reporting) for a tax refund.

Filling out and documents for 3-NDFL when selling a car

Art. 229 of the Tax Code of the Russian Federation obliges citizens to submit documentation no later than April 30 of the year following the reporting period. That is, if the car was sold in 2021, then reports should be submitted by April 30, 2021. The tax amount must be paid by July 15 of the year in which the declaration was submitted.

In accordance with the provisions of clause 17.1 of Art. 217 of the Tax Code of the Russian Federation and clause 4 of Article 229 of the Tax Code of the Russian Federation, only those citizens who have owned a car for less than 3 years are required to pay tax. A person who owns a vehicle for more than 3 years is completely exempt from paying tax and preparing reports.

Z-NDFL for working pensioners

In addition, working pensioners may need 3-NDFL to receive tax deductions. Why only working people? Because the deduction is provided only in case of payment of income tax by a citizen who applies for a benefit in the amount of tax paid.

Pensions are not taxed, so, relatively speaking, there is nothing to deduct. As a result, in accordance with Art. 218, 219, 220, 221 of the Tax Code of the Russian Federation, Z-NDFL declarations for pensioners who work officially and pay personal income tax through an employer may need to be filled out and submitted to the Federal Tax Service in two cases: when the pensioner receives additional income; to receive a tax deduction for acquired real estate, purchase of land, treatment, training, insurance, when selling real estate or a car.

Working pensioners who pay tax on their income have the right to receive a tax deduction.

In order to return income tax to a pensioner, it is necessary to submit a personal income tax declaration to the tax office at the place of registration (Article 229 of the Tax Code of the Russian Federation).