At the end of the tax period, individual entrepreneurs, as a rule, submit declarations to the tax office. In particular, individual entrepreneurs using the simplified tax system fill out a declaration regardless of whether income was received or not. This service can significantly simplify the maintenance of the simplified tax system. We recommend trying it to minimize risks and save your time.

If there is no income, entrepreneurs using the simplified tax regime submit a so-called zero declaration.

In our publication today, we will look at who can submit a zero declaration under the simplified tax system in 2021 for 2021, the rules and procedure for filling it out.

Do I need to submit a zero assessment according to the simplified tax system for 2021?

The simplified declaration is submitted to individual entrepreneurs and organizations applying this regime, regardless of:

- Availability of income during the tax period.

You need to report even if you suffered a loss. In this case, it will not be zero, but with indicators, since those who use the “income” object calculate the tax on the income received (without taking into account expenses), and those who use the “income minus expenses” object take into account the resulting loss when calculating the tax.

- Availability of hired workers.

The fact of having employees affects only the procedure for reducing the tax on insurance premiums. It does not affect the obligation to submit reports.

- The fact of conducting business in general.

Even if no activity was carried out during the tax period, there was no income, and nothing was received into the current account, the declaration will still have to be submitted. In this situation, the legislator gives the simplifier a choice: to submit a zero according to the simplified tax system or a single simplified declaration (USD).

Thus, if there is no activity during the tax period, the simplifier must submit a zero declaration, and if there is no income or employees, he must submit a regular one, with indicators.

Zero report on UTII

If we talk about passing the “zero” level for UTII, then everything is not simple. MIFTS will not accept a blank tax report. In this case, the calculation of the tax amount will not depend on profits and costs. Even if no activity was carried out and the taxpayer was not deregistered, he must pay the tax and prepare a report . The deadline for submission is the 20th day after the end of the quarter. Reporting to funds, as well as accounting, will be zero. In accounting, balance sheet lines cannot be empty. The institution has an authorized capital, funds, and property. In the absence of households. transactions during the reporting period, these figures must be reflected in the report.

Zero declaration form under the simplified tax system for 2021

A zero declaration under the simplified tax system is drawn up in the form approved by Order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3 / [email protected] It is the same for simplifiers of both types: those who calculate income tax and those who pay it from the difference between income and expenses.

The composition of zero reporting depends on the object used:

| simplified tax system 6% (income) | STS 15% (income minus expenses) |

| Title page | |

| Section 1.1 Section 2.1.1 | Section 1.2 Section 2.2 |

Deadline for submitting a zero declaration under the simplified tax system for 2021

Zero statements according to the simplified tax system are submitted within the same time frame as reporting with the following indicators:

- until March 31 - organizations;

- until April 30 - individual entrepreneur.

If the deadline for submitting the report falls on a weekend or holiday, it is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). The deadline for submitting reports under the simplified tax system for 2021 does not fall on a weekend and therefore will not be postponed.

Thus, organizations must submit a zero declaration under the simplified tax system for 2021 by 03/31/2020, and individual entrepreneurs by 04/30/2020.

Reporting methods

The legislation provides for the following options for submitting zero reporting:

- in electronic form;

- on paper.

The institution must submit reports electronically:

- if the average number of employees is more than 100 people. (in an existing company - for the last year, in a newly created company - in the month of formation);

- regardless of the number, if this obligation is provided for in Part 2 of the Tax Code for a specific tax.

- if the institution is a large taxpayer.

In other cases, the institution may submit the report either on paper or electronically, as desired. This procedure is enshrined in Article 80 of the Tax Code of the Russian Federation.

The legislation does not provide for the simultaneous provision of tax reporting on paper and electronically via a telecommunication channel.

Requirements for filling out the zero simplified tax system for 2021

Requirements for completing the simplified taxation system declaration are given in the Procedure for filling it out, approved. By Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] :

- The declaration can be filled out by hand, on a computer, using special programs.

- When filling out a declaration on paper, use only black, purple or blue ink. If you enter information, for example, in red, the machine will not be able to recognize it, and the declaration will be returned.

- You cannot correct errors in a printed zero using putty or other similar means. If you made a typo, it is better to redo the sheet again, this will save you in the future from possible disputes with the inspection inspector.

- Enter the information in the declaration in capital block letters, regardless of whether you fill it out by hand or on the computer. The machine only recognizes printed letters.

- If you fill out the zero on the computer, use the Courier New font with a height of 16-18.

- Double-sided printing is prohibited; each page of the declaration must be printed on a separate sheet.

- Do not staple the report sheet, as this may damage the barcode in the upper corner of the page. The machine will not be able to read reports with a damaged barcode. It is advisable not to fasten the sheets of the document with anything at all and submit them to the inspection inspector in a file.

- Enter the indicators in the declaration from left to right, starting from the first acquaintance.

- Include in the zero sheet only those sheets that we wrote about above. The rest do not need to be attached to the declaration.

- Page numbering is continuous, starting from the title page. A zero declaration (for any object) will have only 3 sheets.

- In all empty lines you need to put dashes: we will tell you which ones specifically below.

Sample of filling out the zero form according to the simplified tax system 6% for 2021

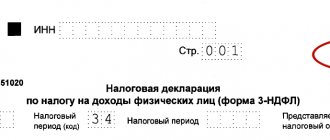

Title page

Information is entered into it in the same order as in reporting with indicators. The title page is filled out equally by those who use the “income” object and by those who work on the “income minus expenses” object. You can familiarize yourself with the procedure for filling out the Title Page for the simplified tax system of 6% in this article.

Section 1.1

In this section you only need to fill out a few lines:

- INN/KPP.

Transfer them from the title page; when filled out on the computer, they will be reflected on all remaining sheets.

- page 010 (030, 060, 090).

Indicate OKTMO at your location. Organizations indicate it by their legal address, and individual entrepreneurs by the address of their place of registration. You can find it out on this site.

If you did not change OKTMO during the year, fill out only line 010, and put dashes in all the rest. If a code change occurred in a certain quarter, enter it in line 030 (if the OKTMO was changed in the 2nd quarter), 060 (if the change occurred in the 3rd quarter) and 090 (if the change occurred in the 4th quarter).

- Reliability and completeness…..

Sign and date the declaration.

In all other lines of section 1.1, put dashes.

Section 2.1.1

In addition to the INN/KPP and page number in this section, fill in:

- page 102.

If there are no employees, enter the value “2”, if there are any, “1”.

- pp. 120-123.

Specify the rate according to the simplified tax system. If you are not using a discounted rate, enter "6.0" in these lines.

Place dashes in all other lines in the section.

Sample zero declaration of simplified tax system 6% 2019

Submission of zero reporting to the Pension Fund of Russia

First you need to download the form. If the organization has an appropriate accounting program installed, it should have this form. If not, then a blank form and a completed sample can be taken from our website.

filling out a zero report to the Pension Fund (form RSV-1 Pension Fund)

zero report to the Pension Fund (form RSV-1 Pension Fund)

Which sheets should I fill out?

Information that needs to be filled out is highlighted in red. Form RSV-1 includes 3 pages, but if zero reporting is submitted, the 2nd page is not filled out.

Where can I get the data to fill out a zero report to the Pension Fund?

The checkpoint and identification number can be found in the document on registration with the MIFTS.

The registration code for the Pension Fund is in the policyholder’s notice. OKPO, OKVED, OKATO codes can be obtained in a letter from the statistics agency.

The peculiarity of compiling the “zero” is to fill in the line “average number”. If the institution did not carry out activities during the reporting period, it means that there is only one employee - the manager. Enter the number 1 in the required line.

It is also necessary to fill in basic information about the organization: name, address, tax system used.

How to prove the submission of the report?

When submitting reports to the Pension Fund, you must ask the receiving employee to put an acceptance mark on the 2nd copy of the report, and if sent by mail, you must save the notice.

When transmitting a report via a telecommunications channel from the Pension Fund of Russia, you must receive a receipt message. This message can prove the submission of the report.

If you require assistance in preparing and submitting a zero report to the Pension Fund of the Russian Federation, then leave a request in the pop-up form at the bottom of the window, and our lawyer will promptly provide you with qualified assistance in this matter.

Sample of filling out the zero simplified tax system 15% for 2021

Title page

The data on the title page is entered regardless of which declaration is submitted: with indicators or zero. You can familiarize yourself with the procedure for filling out the Title Page for the simplified tax system of 15% in this article.

Section 1.2

In this section you only need to fill in the INN/KPP, page number and OKTMO code. If the code has not changed during the year, indicate it in line 010, and put a dash in the rest. If the code has changed, enter it in one of the lines corresponding to the period in which it changed: 030, 060 or 090. In the remaining lines, put dashes.

What else do you need to know as an individual entrepreneur with employees?

If your employee works under an employment contract or a GPC agreement, you should also pass:

- SZV-M, SZV-stazh, SZV-TD;

- 6-NDFL and 2-NDFL.

The 6-NDFL form may have zero indicators, but the 2-NDFL form cannot. If there were no employees during the reporting period, it is not necessary to submit reports. You can send a letter to the Federal Tax Service in any form stating that the salary was not accrued or paid.

If you transferred payment to an employee at least once a year, you must submit 2-NDFL for the full year and 6-NDFL for the quarter in which the earnings were accrued. Then 6-NDFL will be submitted until the end of the year.

A single simplified declaration instead of a zero according to the simplified tax system

Instead of a zero declaration under the simplified tax system, you can submit a single simplified tax return (SUD). But for this the following conditions must be met:

- Absence of an object of taxation in the tax period.

The object of taxation under the simplified system is income (for the simplified tax system 6%) or the difference between income and expenses (for the simplified tax system 15%).

- No transactions on the current account.

There should be no transactions at all - not even payment of utilities.

The EUD consists of only one sheet and is submitted to the Federal Tax Service no later than January 20 of the year following the reporting year. That is, the EUD according to the simplified tax system for 2021 must be submitted by 01/20/2020.

The most optimal solution in the absence of activity in the tax period would be to submit a zero declaration under the simplified tax system. Filling it out is no more difficult than filling out a EUD, but the deadline for submitting information is longer and the risk of controversial issues arising is less.