Distinguish between taxes, penalties and fines

Value added tax (VAT) is the collection of part of the cost of goods, works, services produced in Russia or imported into the Russian Federation.

It is paid to the treasury upon the sale of various goods, works and services (GWS) for a certain reporting period. VAT is a fee for which there is no uniform rate. In the current year, 2021, goods, works and services are taxed at rates of 20%, 10% (food, children's goods) and 0%. Important! From 01/01/2019, the general rate for this tax increased from 18 to 20% (Federal Law No. 303-FZ of 08/03/2018). Therefore, this year, value added tax must be calculated at rates of 20% (clause 3 of Article 164 of the Tax Code of the Russian Federation), 10% (clause 2 of Article 164 of the Tax Code of the Russian Federation, nothing changes for these categories of goods) and 0% ( Clause 1 of Article 164 of the Tax Code of the Russian Federation). To correctly determine rates in 2021, specialists can use the recommendations set out in Letter of the Federal Tax Service No. SD-4-3 / [email protected] dated 10/23/2018.

BCC VAT (we'll look at penalties later) is used to group different types of income coming to the budget. BCCs are a twenty-digit identifier that includes information about one or another type of budget income or expense (Order No. 65n dated July 1, 2013).

To issue a payment order for a 2021 KBK VAT penalty, it is necessary to clarify the current regulations in order to avoid the procedure for clarification or return of payment or further penalties for late payment of tax or penalties. If the taxpayer is late in payment, then, in accordance with Art. 75 of the Tax Code of the Russian Federation, the tax inspectorate will charge him a penalty. The payment slip will need to indicate the KBK VAT penalty in 2021. A penalty is charged for each day of late payment. The institution has the opportunity to independently calculate penalties according to a given algorithm or contact the territorial Federal Tax Service for the corresponding requirement. A fine is a one-time penalty for violating tax rules. Based on Art. 122 of the Tax Code of the Russian Federation, a fine is assessed if unpaid or incompletely paid tax is discovered during a desk or other audit. The amount of the fine is determined in accordance with Art. 15.11 Code of Administrative Offenses of the Russian Federation.

Code structure

Each budget systematization code, in order to carry out the procedure for paying both the contribution and any penalties, is based on several parts:

- "administrator";

- “type of income”;

- "subgroups";

- "article";

- "element";

- "program";

- "economic classification".

The combination of numbers located under the name “administrator” includes additional 3 parts. They determine the work of the administrator, who is necessary to redirect funds to the government agency. The Federal Tax Service (FTS) is used to pay transport fees. The category for these tasks looks like 182. The subsequent digital set, called the “type of income,” consists of all digital combinations starting from 4 to 13 digits.

KBK table for VAT, penalties and fines

Let us present in the form of a table the main BCCs used when transferring value added tax, as well as penalties and BCC VAT fines 2021 for legal entities.

| Payment Description | KBK for VAT | KBK for transferring VAT penalties | KBC for transferring the fine |

| Goods, works, services sold on the territory of the Russian Federation | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Goods, works, services imported into the Russian Federation from the EAEU countries - the Republics of Belarus and Kazakhstan | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Goods, works, services imported into the territory of the Russian Federation (payment administrator - FCS) | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Value added tax, fines and penalties for VAT - BCC for 2020 have not changed compared to the previous period. To pay fees and penalties for value added tax in 2020, a specialist must also apply the above BCCs.

If you carefully examine the structure of the twenty-digit BCC, the specialist will notice that the identifier for paying penalties and tax penalties is identical to the code for paying the main tax, only the values in the penultimate block differ.

3-NDFL: what is the form for?

Form 3-NDFL is a special case of confirmation of receipt of taxable income.

In the general case, when an individual receives income in the form of wages from an employer-legal entity, the funds are received minus the 13% tax rate, and the responsibility for declaring the employee’s income rests with the employer.

Special cases of self-transfer of income information include receipt of income:

- when working for an individual employer;

- from property (sale or rental);

- by taking ownership of valuable property donated by a person who is not a relative of the recipient;

- from winning the lottery;

- Abroad.

Important! 3-NDFL is the basis for receiving tax compensation by individuals for types of expenses specified by law.

KBK for VAT for tax agents

In order to be considered a tax agent when paying taxes, an organization must meet a number of criteria. The institution must:

- Rent property from government agencies and local governments.

- Purchase GWS from foreign companies that sell products on the Russian market, but are not taxpayers to the budget system of the Russian Federation.

- Purchase government-owned property within the territory of the Russian Federation. An exception is objects leased from the Northern Sea Route starting from 04/01/2011.

- Realize Russian property assets in accordance with a court decision. The owner of such property must be the taxpayer. The exception is the property assets of the bankrupt.

- Intermediate in trade with foreign companies that are not tax residents of the Russian Federation.

Value added tax is withheld by the tax agent from the counterparty. After this, the tax is sent to the budget.

The tax rate is determined depending on the types of industrial and industrial goods acquired or sold on the territory of the Russian Federation. The tax can be included directly in the price of the product or calculated by the tax agent independently and then added to the price of the goods.

Accrual is made on the day of payment for purchased goods, works or services. The tax is transferred at the end of the quarter - equal shares of the calculated amount are paid monthly until the 25th day inclusive.

If the counterparty is a foreign company not registered in the Russian Federation, then the tax agent must pay the calculated tax to the budget immediately at the time of transfer of funds. The organization must draw up two payment orders at once and send them to the bank.

When drawing up a payment order to pay VAT to the budget, the tax agent must indicate the special status in field 101 - “02”. The BCC will be similar to the BCC for payment by a legal entity - 182 1 0300 110.

What do the codes classify?

The numerical number of budget systematization makes it possible to realize the comparability of characteristics of various types. The BCC is applied in cases where one of the parties to financial transactions belongs to the state. These figures classify the following indicators:

- profit;

- expenses;

- operations;

- ways to finance budget deficits.

The structure of sections and subsections is holistic in nature and is used during the preparation, approval and payment of budgets at various levels. The classification of points is arranged in such an order as to achieve the most complete and detailed specification of each process.

Further specification of costs is carried out at the level of targeted items and standard costs in the process of drawing up the corresponding budgets.

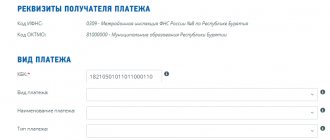

How to draw up a payment order

Payment orders are filled out strictly according to the regulations determined by the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012 and Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013, as amended on April 5, 2017.

When filling out a tax payment form, a specialist is recommended to follow these instructions:

- in field 101 “Payer status” the following values are indicated: 01 - for a legal entity, 02 - for tax agents, 06 - for payments upon import of products, 09 - for individual entrepreneurs;

- the tax amount must always be an integer;

- line 18 “Operation type” has the value “01”;

- in field 21 “Payment order” code 5 is indicated;

- in the UIN line the value 0 is entered, the “Payment Type” cell is not filled in;

- BCC, in accordance with the data in the table for legal entities, is entered in field “104”;

- for field 106 “Basis of payment” the TP code is set to “current period”;

- in line 107 you must indicate the quarter for which the tax is paid;

- the document number in field 108 will be 0, the document date in line 109 is the date of signing the VAT return;

- in cell 105 OKTMO is indicated in accordance with the value from the all-Russian classifier (data can also be found on the official website of the Federal Tax Service);

- in field 24 “Purpose of payment” the name of the payment is entered, as well as the period for which the payment is made. For example, “VAT transfer for the 3rd quarter of 2021.”

Error while filling

If significant errors that could affect the amount of taxes are discovered in the declaration form already submitted to the tax authority, changes should be made to it officially.

Important! The clarifying form is similar to the qualifying one. That is, if an error is discovered in 2021 for the 2016 reporting period, you should fill out a 2021 sample form to correct it.

Documents justifying the legality of such clarification should be attached to the updated form. Additionally, the package of documents allows for the presence of a cover letter explaining the reason for the clarification.

This detailed article provided comprehensive information on the issues of indicating the KBK personal income tax in 3-NDFL, as well as on the procedure for filing and possible adjustment of the declaration form. This is a simple process if you approach it responsibly and carefully, as required by any official financial document.

Import from EAEU countries - BCC for import VAT

Since May 29, 2014, the EAEU has existed - the Eurasian Economic Union. The unification of the Russian Federation, the Republic of Belarus and the Republic of Kazakhstan into a single economic zone has simplified the procedure for trade policy and commodity exchange between countries. The main idea of creating the EAEU is to ease the tax burden in the process of trade between participants. Also, a Customs Union has been created for the EAEU member countries, establishing uniform rules for regulating foreign trade with third parties. Currently, Armenia and Kyrgyzstan have also joined the EAEU. Thus, a special regime for paying value added tax for taxpayers from the Russian Federation has been established when trading with Belarus, Kazakhstan, Armenia and Kyrgyzstan.

VAT when purchasing goods from EAEU countries is paid by taxpayers both with a general tax regime and with special regimes.

It is important to remember that VAT when importing from EAEU countries is paid not upon import at customs, but to the territorial Federal Tax Service through a payment order. VAT must be transferred even if the counterparty is not from the countries of the Customs Union, but imports goods from the territory of the EAEU countries.

You will also have to pay VAT if the purchased products were previously imported into the EAEU countries.

This VAT can be calculated using a special formula:

Import VAT = (product price + excise tax amount (if any)) × tax rate (10%, 20%).

From 01/01/2019, the tax rate has been increased from 18 to 20%.

If a product is purchased in a foreign currency, its price must be converted into rubles at the current exchange rate at the time the product is accepted for accounting.

After registering goods from the EAEU countries, it is necessary to transfer VAT (KBK - 182 1 0400 110) to the tax office by the 20th day of the month following the period in which imported products were accepted for accounting.

During this period, the taxpayer is also required to submit a declaration on indirect taxes (import VAT - indirect tax) along with an application for the import of products and the transfer of value added tax. The territorial Federal Tax Service must provide all settlement and payment documents for imported goods (invoice, delivery note, etc.) and a certified copy of a bank statement reflecting the VAT payment transaction.

Changes in legislation

The legislation of the Russian Federation is flexible and requires constant monitoring. It is better to check the relevance of the document each time before contacting the authorized body.

Important! The latest changes to the reporting form were made by order dated October 25, 2017 and came into effect from the beginning of 2021.

In addition, the innovation of the 3-NDFL form from 2021 is the appearance of an application in which you should provide a calculation of your income from the sale of each property that was registered as a property after 01/01/2016.

Basic values

Further in the table we present those budget classification codes that may be needed when filling out form 3-NDFL for 2016.

Who pays personal income tax[/td]

BCC in 3-NDFL1 Articles 218 – 221 of the Tax Code of the Russian Federation:An ordinary individual claims a tax deduction at the expense of personal income tax, which was withheld and transferred earlier to the treasury by a tax agent182 1 0100 1102 Article 227 of the Tax Code:

• businessmen registered as individual entrepreneurs under the general tax regime; • notaries, lawyers with law offices, as well as other private practitioners182 1 0100 1103 Article 228 of the Tax Code:

Ordinary individuals who are required to declare income if it is taxable182 1 0100 110

Let's analyze: as can be seen from the table, for individual entrepreneurs KBK in 3-NDFL for 2016 has a separate value than for ordinary individuals. And the first position includes the BCC for 3-NDFL 2021 with a property deduction (or other deduction to which the applicant is entitled).