- What does the 3-NDFL form include?

- Where is the taxpayer category code filled in in the 3-NDFL declaration?

- Types of taxpayer codes

For the most part, we rarely have to deal with filling out and submitting tax returns, because this responsibility is assigned to the employer - it is he who withholds income tax from employee salaries. However, certain categories of citizens still have to fill out a 3-NDFL declaration and submit it to the tax authority, for example, taxpayer category code 760. Difficulties may arise already at the stage of filling out the title page, where encodings must be entered into empty forms: IFSN code, taxpayer country code and its category code. We will try to understand the meaning of the latter in this article.

Tax authority code in the declaration

Declaration 3-NDFL is submitted to the Federal Tax Service at the place of residence. The four-digit inspection code can be:

- Check on the Federal Tax Service website by finding your inspectorate at your place of residence.

- Ask the inspection itself.

- Determine yourself, knowing that:

- the first two digits are the region code;

- the second two digits are the number of the inspection itself.

EXAMPLE

If you live in Moscow and your place of residence belongs to Federal Tax Service Inspectorate No. 16 for Moscow, then the Federal Tax Service code in the 3-NDFL declaration will be 7716.

Using this code, specialists at your Federal Tax Service will immediately determine that the declaration is intended specifically for them.

Changes for 2021

The changes made to the declaration are in the Instructions from the Federal Tax Service (.doc (WORD) file).

The changes are minor, the instructions in the pictures on the Site remain relevant.

You only need to fill out the Title, R.1, R.2, Sheet A, Sheet E1.

If during the tax period standard tax deductions were not provided to the taxpayer or were provided in a smaller amount than provided for in this article, then at the end of the tax period, on the basis of the tax return and documents confirming the right to such deductions, the Federal Tax Service recalculates the tax base.

If the taxpayer had no income in certain months, then standard tax deductions are also provided for each month of the tax period, including those months in which there were no income payments.

New form for 2021 (for 2021, 2021 and 2018 reporting). Declaration 3-NDFL.XLS (all sheets)

Taxpayer category code

Declaration 3-NDFL is a multifunctional document. It is taken not only by citizens who decide to return the tax, but also by:

- Individual entrepreneur on the general taxation system;

- heads of peasant farms;

- persons engaged in private practice without registration as individual entrepreneurs (lawyers, notaries, etc.).

Tax officers who receive all returns need to understand who exactly is reporting to them and on what basis. Therefore, for speed and convenience, a special coding of the category of the person submitting the declaration is placed on the title.

| INDIVIDUALS CATEGORY CODE FOR 3-NDFL | DECODING |

| 720 | Individuals with individual entrepreneur status |

| 730 | Notaries and other persons engaged in private practice |

| 740 | Lawyers |

| 750 | Arbitration managers |

| 760 | Other individuals filing declarations in connection with:

|

| 770 | Individuals heading peasant (farm) households |

Thus, “ordinary” individuals submitting 3-NDFL enter the code 760.

Adjustment number for individuals

Also, on the title page of the declaration, the applicant for personal income tax return is required to indicate the adjustment number.

This is the first cell, which consists of three cells, comes after the name of the document, which is written in bold.

The adjustment number was created so that tax employees can see what type of reporting it is, filed by the same person during the specified tax period.

This number usually consists of one digit. First, the required number is indicated, then two dashes are added.

You need to fill out the cell in which you need to enter the correction number as follows:

| 0 | If taxpayers submit their returns for verification for the first time in a year |

| 1 | If an individual sends a document for analysis a second time. Most often this happens if errors were made when filling out the previous form, and the tax officer asked to correct them |

| 2 | If the applicant for income tax compensation re-issues or simply submits the declaration for verification for the third time in a year. This happens when one individual can receive several deductions at the same time and decides to receive them during one tax period. For example, this could be processing reimbursement for education, medical services and the purchase of property. |

It is not easy to allocate several cells for the provided number. In certain situations, individuals submit a declaration more than ten times, and then they need to enter a two-digit code.

Document type code in the 3-NDFL declaration

Since there are several types of identity documents, it also turned out to be more convenient to encode them in the declaration.

The main codes are:

| CODE | DOCUMENT | EXPLANATION |

| 03 | Birth certificate | For persons under 16 years of age (from 01.10.97 – 14 years of age) |

| 07 | Military ID of a soldier (sailor, sergeant, sergeant major) | Military ID for soldiers, sailors, sergeants and foremen doing military service under conscription or contract |

| 08 | Temporary certificate issued in lieu of a military ID | Temporary certificate |

| 10 | Foreign passport | Foreign citizen's passport |

| 11 | Certificate of registration of an immigrant's application for recognition as a refugee | For refugees who do not have refugee status |

| 12 | Resident card | Residence permit in the Russian Federation |

| 13 | Refugee certificate in the Russian Federation | For refugees |

| 14 | Temporary identity card of a citizen of the Russian Federation | Temporary identity card of a citizen of the Russian Federation in form 2P |

| 15 | Temporary residence permit in the Russian Federation | Temporary residence permit (stamp in the document of a foreign citizen) |

| 18 | Certificate of temporary asylum in the Russian Federation | For those who have received temporary asylum in the Russian Federation |

| 21 | Passport of a citizen of the Russian Federation | Passport of a citizen of the Russian Federation, valid on the territory of the Russian Federation since October 1, 1997 |

| 23 | Birth certificate issued by an authorized body of a foreign state | For persons under 16 years of age (from 01.10.97 – 14 years of age) |

| 27 | Reserve officer's military ID | Reserve officer's military ID |

| 91 | Other documents | Other documents issued by the internal affairs bodies of the Russian Federation certifying the identity of a citizen |

The vast majority of those reading this material will need code 21 - a passport of a citizen of the Russian Federation.

How to fill?

TIN: you need to enter it only on the main page, on the rest it will be added automatically.

Taxpayer category codes: Code 720 - individual entrepreneur; Code 730 - notary; Code 740 - lawyer; Code 760 - other individual; Code 770 - individual entrepreneur head of a peasant (farm) enterprise

Country code: Code 643 - Russia.

Document type code: Code 21 - passport.

Tax period (code): 34 (year).

Sample of filling out the declaration 3-NDFL Title

Sample of filling out the declaration 3-NDFL R.1

Sample of filling out the declaration 3-NDFL R.2

Initial data

The employee worked at Romashka LLC throughout 2011 and received 6,000 per month. Also 6 months. He did not receive the standard tax deduction of 400 rubles, but now he decided to file a clarifying return and return the tax.

You only need to fill out the Title, R.1, R.2, Sheet A, Sheet E1.

New form from 2021 (approved in October 2021). 3-NDFL.XLS sample of filling out for social tax deduction.. Correct the data in the form to your own, taking into account the amendments (see the first sentence).

Step-by-step instruction:

STEP 1 Fill out the Title Sheet (Tax return for personal income tax (form 3-NDFL)).

We indicate the tax period (code) - if the declaration is submitted for the year, then indicate the number 34.

Tax period is the year for which the declaration is filed.

The country code is 643 (Russian Federation).

We indicate your data.

Document type code - 21 (passport).

Sample of filling out the declaration 3-NDFL Title.

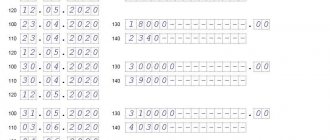

STEP 2 Fill out P1 (Section 1. Information on the amounts of tax subject to payment (addition) to the budget/refund from the budget).

Sample of filling out the declaration 3-NDFL R.1

KBK 1821 0100 110. Personal income tax on income taxed at the tax rate established by paragraph 1 of Article 224 of the Tax Code of the Russian Federation, with the exception of income received by individuals registered as individual entrepreneurs, private notaries and other persons engaged in private practice

STEP 3 Fill out P2 (Section 2. Calculation of the tax base and amount).

Sample of filling out the declaration 3-NDFL R.2

Fill in the information about the employee.

STEP 4 Fill out Sheet A (Income from sources in the Russian Federation).

Sample of filling out the 3-NDFL declaration Sheet A

In lines 10-70 we indicate the organization and the income that was received. There can be many such organizations

line 60 indicate the organization from which the income was received

line 70 6000 * 12 = 72,000

line 80 72 000 - 6*400 = 69 600

line 90 69 600 * 13% = 9048

line 100 equals 90 if income tax has been paid

Sample of filling out the 3-NDFL declaration Sheet A

Note: if there are more than three organizations from which you received income (which fit on one page), then the organizations that do not fit on the sheet are listed on the second sheet of Form A.

STEP 5 Fill out Sheet E1 (Calculation of standard and social tax deductions).

Sample of filling out the 3-NDFL declaration Sheet E1

New form for 2021 (for 2021 and 2021 reporting). Declaration 3-NDFL.XLS (all sheets)

To receive social deductions, an individual (including individual entrepreneurs) must have income subject to personal income tax at a rate of 13%

06/04/2018Russian tax portal

expert of the Legal Consulting Service GARANT auditor Ovchinnikova Svetlana.

Quality control of the response: reviewer of the Legal Consulting Service GARANT auditor, member of the RSA Elena Melnikova.

The citizen is registered in the prescribed manner as an individual entrepreneur. During 2021, individual entrepreneurs used a taxation system in the form of UTII (for the activity “retail trade”). When registering as an individual entrepreneur, an application to apply the simplified tax system (for other types of activities) was not submitted to the tax authority.

In the fourth quarter of 2021, activities subject to UTII were suspended. No other income was received as part of business activities.

At the same time, the individual entrepreneur receives a salary from the organization as an employee (that is, he has income subject to personal income tax at a rate of 13%). A citizen had his teeth treated at the dentist for a fee.

Dental expenses actually incurred in December 2021.

A citizen wants to receive a tax deduction for treatment.

How many tax returns does a citizen need to submit to the tax authority to receive a tax deduction for treatment?

On this issue we take the following position:

If, when registering as an individual entrepreneur, only types of activities for which UTII is applied were declared, then in the absence of income from business activities subject to personal income tax in 2017, the entrepreneur has the right to submit one Declaration as “another individual declaring income for the purpose of obtaining tax deductions” indicating code 760 on the title page.

If, during registration, types of activities that are not subject to UTII were also declared, from our point of view, you can additionally submit a “zero” Declaration as “an individual registered as an individual entrepreneur” indicating code 720 on the title page. However, such actions may prompt The tax authority will hold the individual entrepreneur accountable for failure to file returns (personal income tax and VAT) for previous periods (if they were not previously filed). Therefore, we believe that filing a second declaration with code 720 is only advisable if the individual entrepreneur, in addition to UTII declarations, submits zero declarations for other taxes (even if he does not carry out other types of activities).

Justification for the position:

Taxpayers of personal income tax are (clause 1 of article 207 of the Tax Code of the Russian Federation):

– individuals - tax residents of the Russian Federation;

– individuals who are not tax residents of the Russian Federation and receive income from sources in the Russian Federation. Since individual entrepreneurs are individuals registered in the prescribed manner and carrying out entrepreneurial activities without forming a legal entity, they are also generally recognized as personal income tax payers.

According to paragraph 1 of Art. 210 of the Tax Code of the Russian Federation, when determining the tax base, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation. At the same time, the tax base is determined separately for each type of income for which different tax rates are established (clause 2 of Article 210 of the Tax Code of the Russian Federation).

In accordance with paragraph 3 of Art. 210 of the Tax Code of the Russian Federation for income for which a tax rate of 13% is provided (clause 1 of Article 224 of the Tax Code of the Russian Federation), the tax base is defined as the monetary expression of such income subject to taxation, reduced by the amount of tax deductions provided for in Art. 218-221 of the Tax Code of the Russian Federation, taking into account the features established by Chapter 23 of the Tax Code of the Russian Federation.

So, by virtue of paragraphs. 3 p. 1 art. 219 of the Tax Code of the Russian Federation, personal income tax payers are provided with a social tax deduction for expenses on medical services incurred during the tax period, in particular, in the amount paid by the taxpayer for medical services (in accordance with the list of medical services approved by Decree of the Government of the Russian Federation of March 19, 2001 N 201) , provided to him by medical organizations, individual entrepreneurs engaged in medical activities.

Thus, in order to receive social deductions for any tax period, an individual (including individual entrepreneurs) must have income in this tax period that is subject to personal income tax at a rate of 13%.

Based on clause 4 of Art. 346.26 of the Tax Code of the Russian Federation, payment of UTII by individual entrepreneurs provides for their exemption from the obligation to pay personal income tax (in relation to income received from business activities subject to UTII).

As we understand from the question, in 2021 you incurred expenses for medical services (you paid for your own treatment in a dental clinic). At the same time, in the same year, income was received that was taxed with personal income tax at a rate of 13% (in the form of wages). Therefore, under such circumstances, you have the right to receive a social tax deduction in 2021 (despite the fact that as an individual entrepreneur you are a UTII payer).

In order to receive a social tax deduction “for treatment,” an individual must submit a personal income tax return to the tax office at the place of residence (clause 2 of Article 219 of the Tax Code of the Russian Federation). In addition to the declaration, it is also necessary to submit documents confirming the taxpayer’s actual expenses for medical services provided (clause 3, clause 1, article 219 of the Tax Code of the Russian Federation).

In general, in tax returns, individuals indicate all income received by them during the tax period, sources of their payment, tax deductions, tax amounts withheld by tax agents, amounts of advance payments actually paid during the tax period, tax amounts subject to payment (surcharge) or refund based on the results of the tax period. At the same time, taxpayers have the right not to indicate in the tax return income that is not subject to taxation (exempt from taxation) in accordance with Art. 217 of the Tax Code of the Russian Federation (with the exception of income specified in clauses 60 and 66 of Article 217 of the Tax Code of the Russian Federation), as well as income upon receipt of which the tax is fully withheld by tax agents, if this does not prevent the taxpayer from receiving tax deductions provided for in Art. . 218-221 of the Tax Code of the Russian Federation (clause 4 of Article 229 of the Tax Code of the Russian Federation).

For 2021, individuals (including individual entrepreneurs who are on the general tax system) submit a tax return to the tax authority in form 3-NDFL (approved by order of the Federal Tax Service of Russia dated December 24, 2014 N ММВ-7-11 / [email protected] ) , hereinafter referred to as the Declaration. For this tax period, the declaration should be submitted no later than 05/03/2018 (clause 7 of article 6.1, clause 1 of article 229 of the Tax Code of the Russian Federation, Decree of the Government of the Russian Federation of October 14, 2017 N 1250 “On the transfer of days off in 2018”).

According to clause 2.1 of the Procedure for filling out the personal income tax return form (Appendix No. 2 to the order of the Federal Tax Service of Russia dated December 24, 2014 N MMV-7-11 / [email protected] ), hereinafter - the Procedure, the Declaration form consists of a title page, sections 1, 2, sheets A, B, C, D, D1, D2, E1, E2, G, Z, I. The title page, sections 1, 2 are subject to mandatory completion by all taxpayers submitting the Declaration. The remaining sheets are filled out as needed.

In accordance with paragraphs. 5 clause 3.2 of the Procedure, when filling out page 001 of the title page of the Declaration, the code of the taxpayer category is indicated - the code of the category to which the taxpayer belongs, in respect of whose income the Declaration is being submitted, in accordance with Appendix No. 1 to the Procedure. In turn, Appendix 1 provides, in particular, the following codes:

— 720 “individual registered as an individual entrepreneur”;

— 760 “another individual declaring income in accordance with Art. 227.1 and 228 of the Tax Code of the Russian Federation, as well as for the purpose of obtaining tax deductions in accordance with Art. Art. 218-221 of the Tax Code of the Russian Federation or for another purpose.”

That is, the Declaration can be submitted by the taxpayer both as an individual entrepreneur and as an individual.

However, in the letters of the Federal Tax Service of Russia dated 04/26/2011 N AS-4-3/6753, the Federal Tax Service of Russia for Moscow dated 03/03/2010 N 20-14/ [email protected] a different opinion was presented: if the individual entrepreneur declared during registration as eligible , and activities that do not fall under UTII, then the individual entrepreneur must submit declarations under the general taxation regime, even if he is engaged exclusively in activities that fall under UTII. The same conclusion was made by the regional tax authorities (material Question: Is a taxpayer who, when registering with the tax authorities, required, in addition to the types of activities subject to UTII, types of activities falling under taxation under the general system, to submit tax returns for VAT? (response of the Federal Tax Service of the Russian Federation on Perm region, April 2012)).

Here we would like to draw your attention to the fact that, according to the legal position of the Constitutional Court of the Russian Federation, set out in the definition of July 11, 2006 N 265-O, the responsibilities of an individual entrepreneur arising from his status include the obligation to submit a personal income tax return, which is not made dependent on the results of business activities, that is, from the fact of receiving income in the corresponding tax period (see also letter of the Ministry of Finance of Russia dated October 30, 2015 N 03-04-07/62684).

Taking into account the above, we believe that if, when registering as an individual entrepreneur, you declared only the types of activities for which UTII is applied to them, then if there is no income from business activities subject to personal income tax in 2021, you have the right to submit one Declaration as “another individual, declaring income for the purpose of obtaining tax deductions” indicating code 760 on the title page.

Then you will need to fill out the title page, sections 1 and 2, Sheet A, Sheet E1 of the Declaration.

If, when registering as an individual entrepreneur, you also declared types of activities that do not fall under UTII, from our point of view, it is safer to submit an additional “zero” Declaration as “an individual registered as an individual entrepreneur” indicating code 720 on the title page. The declaration, in addition to the title page, will include sections 1, 2, Sheet B.

At the same time, we note that the legislation does not directly provide for the submission of 2 separate Declarations to the tax authority by individuals who are individual entrepreneurs in a case similar to the one described in the question.

In relation to previous tax periods, we found the following clarifications (see Information from the Federal Tax Service for the Perm Territory dated March 31, 2008, “Methodological materials for taxpayers “Filling out form 3-NDFL according to the new rules” (official website of the Federal Tax Service of the Russian Federation for the Perm Territory, section “Our consultation”, March 2008)):

Example. I.P. Serov is registered as an individual entrepreneur and is required to submit a declaration in form 3-NDFL in accordance with Article 227 of the Tax Code of the Russian Federation. In addition, I.P. Serov has the right to submit a declaration in order to receive a social tax deduction in connection with payment for his education at an educational institution. In this case, when filling out the corresponding field on the title page of the I.P. declaration. Serov needs to indicate the category “individual registered as an individual entrepreneur.”

As you can see, the individual entrepreneur was asked to submit one return to the tax authority. But, firstly, the conditions of the example are unknown (perhaps the income taxed at a rate of 13% was received as part of entrepreneurial activity (and not under an employment contract as in our case)). And secondly, this procedure was provided for by Order of the Ministry of Finance of Russia dated December 29, 2007 N 162n “On approval of the tax return form for personal income tax (Form 3-NDFL) and the Procedure for filling it out.”

Thus, paragraph 2 of section II The procedure for filling out the title page of the Declaration form provided that the category to which the taxpayer belongs is reflected by placing the sign “V” in the appropriate field... If the taxpayer can be classified into several categories, the category is indicated which corresponds to the corresponding field closest to the left edge of the title page.

At the same time, the status on the leftmost edge of the sheet was “an individual registered as an individual entrepreneur.” At present, the Procedure for filling out a declaration does not contain such a norm.

Unfortunately, we were unable to find official explanations from the authorized bodies that fully correspond to the situation being analyzed. The position expressed in the response is our expert opinion.

In this regard, we recommend that the entrepreneur, based on paragraphs. 1 clause 1 art. 21, pp. 4 paragraphs 1 art. 32 of the Tax Code of the Russian Federation, contact the tax authority (at the place of registration of the individual entrepreneur) for written explanations on the procedure for filling out the Declaration in the case under consideration. It is possible that in such a situation the tax authority will consider filing two returns redundant.

In this regard, we present material from which it is clear that filing a personal income tax return with zero indicators can provoke the tax authority to hold the individual entrepreneur accountable for the entrepreneur’s failure to submit VAT returns (which, we recall, are currently submitted in electronic form): Question: Individual the entrepreneur is on a special regime in the form of UTII. The tax authority saw the obligation to apply OSNO and, accordingly, to submit a personal income tax return, from the decisions made based on the results of desk audits of the entrepreneur’s VAT returns (submitted by him with zero indicators), according to which the taxpayer was charged VAT, fines and penalties. As a result, due to the failure to submit a personal income tax return, the Federal Tax Service decided to suspend operations on the merchant’s account in the bank in the manner prescribed by Art. 76 Tax Code of the Russian Federation. Are the actions of the tax authorities legal? (“Single tax on imputed income: accounting and taxation”, N 2, March-April 2015).

Therefore, in our opinion, the issue of filing a second declaration in form 3-NDFL with code 720 should be decided by an entrepreneur depending on whether he, in principle, submits zero declarations for taxes other than UTII.

Subscribe Post:

Fresh materials

- Policyholder category code in the Pension Fund of the Russian Federation The policyholder category code is a detail about which questions arise quite often. In this article we will try...

- Tax period 3 quarter 6 personal income tax code Add to “Necessary” Current as of: January 10, 2021 Calculation of 6-personal income tax – reporting submitted quarterly by organizations...

- Funiculocele code according to ICD 10 Description Causes Symptoms (signs) Diagnosis Treatment Brief description Hydrocele (hydrocele) is an accumulation of serous fluid…

- Taxpayer status in certificate 2 of personal income tax 2021 Taxpayer statusIn the field “Taxpayer status” the taxpayer status code is indicated.Digit 1 - if the taxpayer is a tax…

Taxpayer status code

This code determines whether the person submitting the declaration is a tax resident of the Russian Federation or not.

A citizen of the Russian Federation and a tax resident of the Russian Federation are different concepts! A foreign citizen can obtain the status of a tax resident of the Russian Federation, and a citizen of the Russian Federation can become a tax non-resident.

To be a tax resident, you must be in Russia for at least 183 calendar days a year on the date of receipt of income . In this case, citizenship does not matter:

- for someone who crossed the border of the Russian Federation in the status of a non-resident, the right to be a tax resident arises after he spends 183 days or more in the territory of the Russian Federation during the year;

- The opposite rule is also true - if a citizen of the Russian Federation, who is initially a tax resident, stays outside the Russian Federation for more than 183 days during the year, he becomes a non-resident for the purposes of calculating and paying personal income tax in Russia.

Another important rule: resident status is determined not after the end of a calendar year, but on each date of receipt of income.

The declaration must indicate the status to which the declared income relates.

EXAMPLE

The citizen of the Russian Federation was on a long business trip from 07/01/2018 to 09/30/2019. I came to the Russian Federation on vacation from 06/01/2019 to 06/30/2019. On November 10, 2019, a citizen sold an apartment in the Russian Federation. Let’s say that he needs to pay tax on the sold apartment. A citizen forms 3-NDFL for 2021.

As of the date of sale of the apartment (11/10/2019), the citizen spent 292 days outside the territory of the Russian Federation for the year from 11/10/2018 to 11/09/2019 (excluding vacations, and days of entry and exit from Russia are considered days in the Russian Federation). This means that on the date of receipt of income from the sale of an apartment, the citizen is a tax non-resident. He is obliged to calculate and pay tax at a non-resident rate of 30%. And indicate status “2” (not a tax resident) in the 3-NDFL declaration.

Results

The taxpayer category in 3-NDFL is indicated in the form of a code that must be selected from Appendix 1 to the Procedure for filling out the declaration. There are six categories in total, each of which shows who exactly the taxpayer is, reporting to the controllers.

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service dated October 7, 2019 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What rights can taxpayers expect to be respected?

Tax legislation provides for a number of rights for payers, which they can use regardless of whether they belong to large or small entrepreneurs. The following is a list of fundamental rights:

- The right to receive oral explanations about the procedure for applying tax accounting and reporting standards, the rules for filling out individual document forms and calculating the amounts of tax deductions.

- The right to written explanations on issues of interest to the taxpayer, to receive free reference and information support, and to conduct consultations.

- The taxpayer has the right to demand that tax return forms be provided to him for review and completion.

- Application in practice of benefits in the form of tax deductions or by switching to simplified taxation regimes.

- Draw up reconciliation reports with the tax office for individual taxes and for the organization as a whole.

- Offset the amounts of overpaid taxes, process the return of funds excessively transferred to the budget in the form of advance payments, current tax deductions, penalties, and penalties.

- Provide explanations regarding the calculations made for tax payments and payments made.

- Participate in audits to control their financial activities.

- Defend your point of view within the legal framework if you disagree with the results of an audit by the tax authorities, give additional explanations on the audit reports.

Composition of taxpayers and fee payers

Art. 57 of the Russian Constitution provides for the fulfillment of the obligation to pay taxes by everyone. These provisions are specified by the norms of the Tax Code.

Taxpayers and payers of fees are divided into 2 main categories: individuals and organizations. Each specified type of subject has its own characteristics, provided for by the norms of the Civil Code and Tax Code.

An additional basis for dividing these individuals is their belonging to Russia. A distinction is made between national and foreign taxpayers. This applies to both citizens and organizations.

Also, taxpayers can be divided into residents of Russia (staying on its territory for at least 183 days throughout the year) and non-residents. The latter may be provided with benefits, including the right to receive exemption from paying certain taxes. This is explained by the fact that their place of residence is located abroad.

The concept of taxpayer and fee payer

No obligatory payment can be levied if the circle of persons obliged to pay it is not stipulated. For this reason, each section of the Tax Code that establishes a particular tax and fee contains relevant provisions.

The general rules defining the status of taxpayers, which occupy a central place in industry legislation, are established in Chapter 3 of the Tax Code of the Russian Federation.

The definition is contained in Art. 19 Tax Code of the Russian Federation. According to it, taxpayers and payers of fees are individuals, as well as organizations on which this document imposes obligations for their payment.

From 2021, new rules will be introduced. Administration and control of payment of contributions to extra-budgetary funds are transferred to the tax authorities, so this definition will acquire the corresponding elements.

In some cases, foreign structures operating in Russia without forming a legal entity are recognized as taxpayers.

Taking into account the concept set out in Art. 19 of the Tax Code of the Russian Federation, the legislator separates the concepts of a taxpayer and a payer of fees. Starting from 2017, a mandatory contribution payer will appear. Judicial practice has come to the conclusion that the status of these entities is not uniform.

The rights and obligations of taxpayers that concern them exclusively do not apply to fee payers and vice versa.

Taxpayers who are organizations

Art. 11 of the Tax Code defines them as legal entities formed in accordance with Russian law, or foreign legal entities with legal capacity, as well as international organizations and their Russian branches or representative offices.

The legal status of branches and representative offices of organizations does not imply recognition of them as taxpayers. However, they are important in situations where tax control is carried out (on-site inspection of the branch’s activities) and are subject to registration with the issuance of a corresponding notification.

The Tax Code interprets the concept of branches and representative offices more broadly than the Civil Code. Tax regulations introduce the concept of a separate division, which means the presence of at least one stationary workplace. Each of them requires registration.

Protection during tax control

If tax control is carried out against a taxpayer, he is provided with protection. As part of it, he can provide explanations, documents and other evidence and information to substantiate his position.

In addition, the following features are provided:

- obtaining copies of requirements and acts of the inspection structure;

- requirement to comply with legal procedures;

- failure to comply with obviously illegal requirements and instructions of inspectors;

- participation in meetings at which tax documents are studied and statements are made on the merits of the issues under consideration;

- appealing all acts, demands and decisions of tax authorities, as well as demanding compensation for losses caused as a result of violations. Both judicial protection is possible (the procedure and features are provided for by procedural rules), in which a statement of claim is filed, and an appeal to a higher inspection (the procedure is contained in the Tax Code).

Also, the taxpayer has the right to maintain tax secrets. The inspection must ensure its protection, preventing this information from leaking.