An invoice is a document that serves as the basis for issuing a payment order to pay for goods or services to a supplier. The invoice can be issued in rubles or in foreign currency. An invoice in foreign currency is paid at the rate of the Central Bank of the Russian Federation in effect on the day of payment, unless otherwise provided by the agreement.

Any enterprise in the course of its business activities is faced with invoices for payment. How to issue invoices, whether it is possible to accept invoices with errors from suppliers, what invoicing programs exist - you will learn from the article.

Many experts mistakenly consider an invoice to be a primary document. If we turn to the Law of December 6, 2011 No. 402-FZ, it becomes clear that this is not so. The primary document reflects the fact of economic life - receipt of goods, write-off of money, payment of wages, etc. (Article 9 402-FZ). The account itself does not indicate the completion of a business transaction.

What is an invoice for payment in accounting?

An invoice for payment is a document that indicates the grounds and details for payment for goods or services. As a rule, it is used to formalize transactions under contracts between organizations and entrepreneurs, but can also be used for individuals. This document is optional; the parties can settle accounts with each other without it. But, on the other hand, it clarifies the requirements and deadlines, reminds payment details, and also encourages the buyer (customer) to pay faster. To issue an invoice for payment is to remind the counterparty of your payment details and encourage them to deposit money faster.

An invoice for payment is a document whose uniform form is not prescribed by law. That is, any organization has the right to develop its own form, provided that it includes the required details. Nowadays, traditional paper receipts are gradually giving way to digital ones. Electronic invoice for payment - what is it? This is an alternative to a paper document, containing similar information, the same mandatory details, but issued in digital form. Most often, they are prepared as a scanned image in pdf format (to transmit a copy of the signature of the director or manager) and sent to the payer by email.

Is an invoice a primary document or not? No, not primary and not even mandatory. It falls under the category of secondary or derivative acts.

The document is a table with the supplier’s payment details, a brief description of the goods supplied and services provided, and the final payment amount.

The invoice contains payment details to the supplier and a brief description of the goods supplied

Cases of drawing up an invoice by a VAT tax agent

Tax agents, when issuing an invoice for their counterparties, adhere to a period of 5 calendar days, counted from the date of advance payments or final payment for an asset accepted for accounting (Letter of the Federal Tax Service, dated 08/12/2009, No. ШС-22-3/634) . When an invoice for services and goods is issued by a tax agent:

- When rent is paid for state and municipal property, subject to the conclusion of an agreement with the government (but not represented by a municipal unitary enterprise or state unitary enterprise).

- When purchasing assets from municipal and state bodies, if the counterparty is not a municipal unitary enterprise or state unitary enterprise (clause 3 of article 161 of the Tax Code of the Russian Federation).

In the above situations, the invoice is issued in 1 copy and kept by the tax agent.

When purchasing goods from foreign entities that have not completed the registration procedure with the Federal Tax Service of the Russian Federation, it is necessary to prepare 2 copies of invoices and transfer one of them to your counterparty. A prerequisite is that the shipment of commodity items is carried out within the Russian Federation. A similar algorithm of actions applies when receiving services from foreign persons in Russia.

Read also

29.09.2016

Necessary details for non-cash payment of an invoice

There is no single form for such a document, but for the convenience of the parties, the following details are included in it:

- The name is "account".

- Document number in accordance with the supplier's internal documentation.

- Date of document preparation.

- Information about the customer - his name or name, if we are talking about an individual entrepreneur, TIN, address.

- Bank details of the supplier - corr. account, personal and current account, name and BIC of the bank.

- Information about the supplier - name, tax identification number, address.

- Information about goods and services - name, units of measurement, quantity, cost.

- Amount of payment.

- Taxes. For example, VAT or excise taxes. To avoid errors in calculations, when there is no value added tax, they do not skip it, but do so.

- Signatures, seals.

Why do we need mandatory details if the document itself is optional? Theoretically, it would not be a mistake not to indicate any of the details mentioned above, but such an approach will complicate the mutual understanding of the parties and their work. For example, if payment details are not specified, the counterparty will have to look for them in the contract. If the goods are not listed, the payer may not understand what exactly he is paying for under this act. Therefore, the clearer and more detailed the information is presented, the better. Such a document is easier to use for proceedings in the event of a conflict or trial.

When preparing an electronic document, facsimiles are sometimes used. In practice, it looks like this: an accountant prepares a paper invoice, the manager signs it, the secretary scans it and sends it by email to the payer. A facsimile is not equivalent to a “live” signature, but in this case such confirmation is sufficient.

Example of an invoice for payment with all required details

Key design features and cashless payments

Drawing up an invoice is optional, but it helps the parties agree on the amount and terms of payment, clarify details and streamline their own paperwork. The form of payment - cash or non-cash - is usually specified in the contract. Most modern organizations prefer non-cash transfers - they are faster, easier to process and confirm.

Numbering is important because it allows the organization to control the receipt of funds from issued invoices.

Cashless payment on an invoice - how is it used in practice? The parties have several options. Remember that the document is not mandatory; you can pay for services without it. For example, the payer has received the goods and asks the supplier to clarify payment details. The supplier decides that it would be more correct to prepare the document and forms it in paper form. Then it sends the scan to the other party. The payer opens the mobile application of his bank (for example, if payment is required through a business current account) and transfers the required amount using the payment details. The application will generate a digital receipt for him, which can also be easily sent by email to the supplier with the message “Receipt for invoice No...”.

Deadlines for issuance: general rule

The importance of an invoice is due to the need to have its original when deducting VAT. The rules for drawing up and issuing invoices are regulated by the Tax Code. In the provisions of paragraph 3 of Art. 168 of the Tax Code of the Russian Federation indicates when an invoice is issued - 5 calendar days are allotted for the procedure. One of the events is taken as the starting point:

- the day of actual shipment of goods according to the invoice;

- date of acceptance of services under the act;

- advance payment has been made.

From October 1, 2021, a new form of invoice and adjustment invoice will be used. For more information, see “VAT changes from October 1, 2021.”

Are the processing times for electronic and paper invoices different? The printed document is drawn up in 2 copies:

- the first is intended for the buyer;

- the second must remain with the seller (clause 6 of the Rules for filling out an invoice).

According to the Rules for maintaining the sales book, the company issuing the invoice is charged with the obligation to pre-register the document in the sales book (clause 3 p. 2). When an invoice is issued:

- or after confirmed shipment of material assets;

- or after the customer accepts the services/works;

- or after receiving an advance payment within the framework of a signed agreement.

Confirmation in the first case is an invoice, in the second - acts signed by both parties, in the third - a bank statement. Within 5 days (calendar), the supplier company must issue and send an invoice to its counterparty.

For ease of accounting, it is recommended to issue an invoice on the same date as the act or invoice. This is especially true for operations on border dates - at the junction of quarters. The rules for issuing a single invoice allow you to combine in one document operations for the shipment of several consignments of goods on different days. The main condition is compliance with the 5-day period. The period for issuing a document is counted according to the date of the invoice of the first delivery of materials or the first of the signed acts (Letter of the Ministry of Finance, dated January 12, 2016, No. 03-07-09/140).

To provide the counterparty with an electronic invoice, the written consent of the buyer is required. With electronic document management, when is an invoice issued - before or after payment? After payment, if an advance payment has been made, before payment in the case of shipment of goods.

The nuances of using electronic invoices:

- The document must comply with the format that is current on the day of registration and approved at the legislative level (Order of the Federal Tax Service dated March 24, 2016 No. ММВ-7-15/).

- It is necessary to use an electronic enhanced signature of the director of the company.

- The invoice will be recognized as issued after receiving electronic confirmation (clause 1.10 of the Procedure approved by Order of the Ministry of Finance dated November 10, 2015 No. 174n).

Document form

If, due to the nature of the company’s activity, it is necessary to constantly accept payments from counterparties, the logical solution would be to prepare a template in which to enter all the unchanged data, and before issuing, change only the names of payers, lists of goods and the payment amount. The most convenient option is to download a ready-made form and adapt it to suit your purposes. Filling out a ready-made form will only take a few minutes, and preparing a new one from scratch will take at least 20-30 minutes.

Download: Invoice form for payment

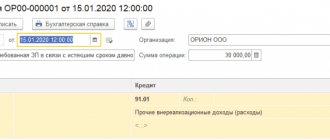

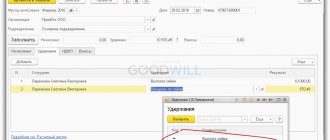

If the organization uses 1C software, registration will be even simpler. How to prepare an invoice for payment in 1C: Accounting:

- Open the “Sales” tab and find “Invoices for payment to customers” in the list.

- Clicking on this link will open a list of all previously created documents.

- Next, you need to click the “Create” button or the Ins button. A blank form will open.

- In the new document, fill in the payer’s information and all other fields (some will be filled in automatically).

- When the document is ready and verified, click “Burn.” The file will be saved. The document is ready. It can be printed or sent by email.

How to display

You can issue an invoice online electronically. The seller must keep one paper version. The second copy is sent to the buyer by regular mail. Some sellers send a receipt to the buyer via the Internet, i.e. letter by email. But most often, the accountant sends the check to the buyer by regular mail, and prints out a second copy and puts it in a folder called “Accounts.”

In addition, a check for payment can be sent to the client through the “My Business” application. The seller only needs to create it and send the client a link to it. There is no need to print the document. The client simply needs to follow the received link and click on the “Pay” button.

And if the seller issues the same checks every month, then he does not need to create a new form each time. A businessman can save the old form in the templates, and later click on the “Copy” button and open an account on a new page.

You can even issue several checks from the My Business application. To do this, the client only needs to log into the application and check the boxes next to the payment documents he needs. Next, he only needs to click on the “Create” tab. The system will independently issue the necessary acts and invoices. Ready-made documents are very easy to download. Moreover, papers are downloaded in the required format.

It is very easy to issue a check for payment.

At the top of the paper the details of the person receiving the funds are indicated.

This fits in:

- company name;

- TIN;

- checkpoint;

- information about the financial institution servicing the seller;

- account details.

In the middle of the paper the name of the document, its number, and the date of creation are recorded.

Below you should indicate the person who will send the finances. The name of the company that received the product or service is indicated here.

Next, indicate the name of the goods or services and their cost. Typically, products are entered in a list or table.

The table consists of the following sections:

- column: Serial number of the purchased product or service provided.

- column: Name of product or service. The name cannot be shortened.

- Columns 3, 4: Quantity and units of measurement are indicated. It can be pieces, kilograms, liters.

- Column 5: indicates the price per unit of measurement. The last paragraph indicates the total cost of the goods that the client paid.

Important! If a company operates under VAT, then this must be recorded in payment documents.

If the seller does not pay VAT, then the word “Without VAT” must be entered in the column. Additionally, you must enter the reason why the seller does not pay VAT. Usually, VAT is not paid by citizens who work under the simplified tax system, UTII, or PSN.

But there are situations when the client works under a simplified system, and the seller issues him a check with VAT. The client is obliged to pay the entire amount indicated on the check, but in the column should be entered: “Including VAT of 18%.”

The bottom line of the table indicates the cost of all goods in their entirety, and below the table this cost is written in letters.

The document must be signed by the chief accountant and the head of the company.

Paper replacing a regular invoice for payment

Some entrepreneurs issue an invoice instead of a regular check. This is a financial document that is drawn up not in advance, but upon completion of work, services provided, and goods shipped. The paper shows that the buyer has paid VAT on all fees and excise taxes.

The invoice is filled out in a form strictly established by law. The form records information about the origin of the goods. Moreover, if the goods were imported, then even the customs declaration number is entered into the form.

Important! The invoice is filled out in two copies.

The following information must be included in it:

- Details of the entrepreneur, individual, LLC. The details of the buyer and seller are entered here.

This part of the document contains the name of the company, the legal form of the company;

legal address of registration;

Checkpoint. Only legal entities can enter it.

- Information about the financial institution responsible for the transaction.

The name of the institution, BIC, current and correspondent account numbers are entered here.

- Payment codes.

OKPO, OKONH fit into this category.

- Invoice number and date of issue.

- VAT. In this section you should indicate its amount.

- Seller's full name and signature.

When drawing up a check, special attention should be paid to the “Purpose of payment” column. If this column contains the phrase “To pay for goods,” then it records all types of goods and the units in which they are measured.

The quantity of the product and the amount for it are also entered. The cost including VAT and the full cost are indicated.

If the column contains the phrase “Payment for services,” then the type of service or work performed is entered here. The quantity and amount with and without VAT are also entered.

Important! The entrepreneur may not record the types of supplies. In the check, a businessman can indicate the number of the agreement under which the transaction is being carried out. But the types of deliveries must be recorded in the delivery note or estimate.

But do not forget that some customers pay for their goods by bank transfer.

This check contains the following:

- Document header. The full name of the company, legal address, and contact information are indicated here.

- Table with registration data. TIN, checkpoint, and bank details are entered here. Where the column called “Recipient” is located, you need to enter the recipient’s name and current account number. Information about the bank is entered in the bottom lines of the table: its name, address, BIC. The BIC is contained in the paper received by the client when signing an agreement with a financial institution. The BIC is also located on the bank’s official website. Additionally, you need to indicate a correspondent account here. The correspondent account starts from 3010, and the settlement account from 4070-4080.

- Check number, date of issue.

- Information about the payer and consignee. The name of the company, individual entrepreneur, and details are entered here. The details require you to indicate TIN, KPP, legal address, and bank details.

- Total amount excluding VAT. It is usually indicated in the “Total” column.

- The name of the goods or services for which the check is written. Their price is included, cost excluding VAT.

- The interest rate for VAT. Usually it is 18%, but some products have an interest rate of 10%.

- Amount to be paid including VAT.

The completed document must be printed, signed and sealed. Next, it must be handed over to the client and wait for the money to arrive.

It happens that an entrepreneur has issued a check, but Tax Service employees do not accept it.

There may be several reasons for this.

Entrepreneur:

- I didn't decipher my signature. You don't just need to sign the check. The online version of the check must include an electronic signature from the seller. Without it, the document will not be sent to the buyer;

- missed the deadline for submitting payment documents. An invoice is issued on the day a regular check is issued to the client;

- delayed the process of receiving a check, did not file a tax deduction for VAT. A request for payment of a tax deduction is issued at the moment when the seller receives an invoice. But a businessman can easily miss this deadline. To prevent this from happening, experts recommend keeping a certificate of the date of receipt of the payment document;

- I mixed up the dates on the invoice. The seller and buyer must have identical payment documents. Otherwise, their transaction is considered invalid;

- I filled out the paper incorrectly and made mistakes. Errors may be in the name of the company, TIN, address, or personal information of the payer.

Note ! If the seller notices errors in his report, then he needs to act like this: he needs to cross out the problem area and enter the correct value. All changes must be recorded with the signature of the head of the company. Third party companies do not have the right to make changes to the form.

How to get rid of calendar confusion

In order not to make mistakes with the dates in the act and invoice, you can optimize the procedure for preparing these two documents, namely, combine them in one universal transfer document (UDD). Accordingly, such a document will have only one date. The reason for discrepancies in dates will disappear, and the risks of claims from controllers will be minimized.

The transition to using UPD requires preliminary preparation:

- It is necessary, based on the UPD form recommended by tax authorities, to develop a form that allows you to combine information from the invoice and the work completion certificate. It is important that this form contains all the details required for the primary document and invoice.

- Approve the UPD form and the possibility of its use in the accounting policy.

- Agree with counterparties on the terms of application of the UPD.

General recommendations for preparing UPD are given in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. MMB-20-3/ [email protected]

We tell you more about the algorithm for switching to UPD here.

What mistakes do you encounter when drafting a document?

It is enough to analyze the problems that are most often encountered in practice:

- Authorized persons do not decipher their signatures. This error is excluded only for documents in electronic form. In the electronic signature, the required amount of data is initially present.

- The five-day period for which the invoice must be issued is violated. This usually happens when the compilation time is confused with the posting time. This is due to the fact that the legislation itself does not have a clear definition of terms.

- Failure to receive a document during the tax period for which VAT is claimed for deduction. To get rid of this error, you need to store envelopes and receipts. Keeping a log of general mail helps.

- Different dates are placed on copies for the seller and the buyer. Usually the reason lies in the corrections. If invoices have different data, they cannot serve as evidence of a transaction.

- Signatures of the chief accountant, manager. The deduction will be denied due to the frequent use of facsimile signatures.

- Incorrectly designed header on the invoice. For example, errors are made in the details of the parties.

If errors are detected, they must be corrected in a timely manner using the established procedure. Incorrect indicators should be crossed out. And enter the correct ones in their place. Be sure to indicate the date the changes were made.

The manager's signature will confirm that the changes are true. For this purpose, a company seal is affixed. Making changes is available only to the organization that issued the invoice.

Why do you need a TIN and how to get it? Detailed instructions are in this material.

Invoice format

Current legislation does not regulate the formal type of account, that is, there is no unified form for paper or online forms. The invoice form can be developed by the organization independently. The institution also has the right to issue an invoice using numerous templates. The main thing that an accountant should know in this case is what details are needed to issue an invoice online.

In order to issue a paper or online invoice, you must fill in the following information:

- serial number and date of invoice generation;

- name of the seller and buyer, their legal and actual addresses;

- organizational (TIN, KPP, OGRN) and bank details from both parties;

- information about the purchased goods, works or services - their name, quantitative, qualitative (unit of measurement) and cost characteristics;

- presence (absence) of VAT;

- if necessary, the deadline for payment;

- responsible persons of the parties, their initials and signatures: for individual entrepreneurs - one signature, for commercial and non-profit organizations - two signatures (manager and chief accountant);

- for a paper document (if available) - print.

Rules for LLC

In this case, the account contains information on:

- The total amount payable in words, indicating VAT.

- Goods with services. Together with units of measurement of their quantity, total cost.

- Payment details from the seller, including correspondent and current accounts, bank name, INN with checkpoint, BIC.

- Number, date of issue of the document.

- Name of the organization.

The document is signed by the manager and the chief accountant. It is desirable to have a company seal.

It is acceptable to include advertising and other information, contact details, payment and delivery terms.

We issue invoices in English

In English, an invoice is referred to as invoice. In Russia, documents often lack translation.

The word invoice is a mandatory element of the papers.

In any invoice in English they write:

- Payment terms.

- The total amount.

- Delivery number, other combinations of numbers to make order tracking easier.

- Date of dispatch or purchase of services with goods.

- A company with a tax regime.

- Date of issue of the document.

- Contact details of both parties.

- Name and contact details of the specific seller.

- Own number, outgoing and incoming.

How to correctly submit an application for parental leave - see the link.

All information is described in as much detail as possible. This is important for foreign partners. Invoices contain the same data as in delivery notes.

When does it become necessary to issue an invoice?

There is no rule in the law that would prohibit conducting transactions without an account at all. There is no obligation to execute the document unless there is a strict requirement in the contract between the seller and the buyer.

The buyer transfers money based on the agreement. But there are other situations where an account becomes a requirement.

For example, when transferring an initially uncertain amount from one party to the other. When paying for communication services, an invoice is required. After all, such agreements refer to documents where there is no predetermined amount.

Read about what an offer is and why it is needed by following the link.

An invoice is issued in case of transactions subject to VAT. There are other situations prescribed by law.

The responsibility for invoicing buyers or customers is transferred to:

- Organizations that have received partial payment or advance payment from customers for the sale of goods and provision of services.

- Companies that sell goods on the basis of an agency agreement. When registering it in your own name. It is important to use a common taxation system.

- Firms exempt from VAT.

Example of an invoice for an LLC.

About the purpose of the document

The main function performed by this document is the ability to speed up settlements for counterparties. We can say that an invoice is a preliminary form of agreement, documented.

The text of the agreement specifies the specific price for the goods. Then they proceed to payment from buyers. The invoice is usually issued in a single copy.

A variety of documents related to economic activities include accounts in the financial sector. They are used by enterprises and legal entities that must pay VAT.

The invoice is issued after services have been rendered and goods have been provided. Without a document, it is often impossible to confirm payment of taxes and excise duties.

The invoice sometimes informs buyers where exactly the product was produced. They write about what number was assigned to the customs declaration and other similar data.

A memo on the absence of an employee from the workplace is easy to draw up. To avoid mistakes, look at the example in this article.

Creating two copies and extracting using a strictly established form is a mandatory requirement, otherwise VAT cannot be deducted from the buyer only on the basis of this document.

Is the invoice issued by an individual?

Since individuals are not VAT payers, they cannot issue an invoice. If an individual making a transaction has an urgent need to issue an invoice, the problem can be solved in two ways:

- register /CJSC/LLC;

- draw up an agreement with the organization for the provision of services, on the basis of which the individual will receive payment.

But an invoice issued directly from an individual will have absolutely no legal force.