Rules for filling out the form

On the inspection websites and at the stands in the department there are samples of filling out an individual’s application for registration with the tax authority, the basic requirements for filling out the form:

- the text is entered in your own hand in block letters in blue or black ink or printed on a computer;

- if filled out with one’s own hand, put dashes in empty cells;

- corrections are not allowed.

We offer instructions on how to fill out an application for a TIN step by step.

Step 1. Fill out page 1:

- At the top of the page, indicate your Taxpayer Identification Number (if available).

- Next is the tax authority code. Find out by calling the inspectorate or on the Federal Tax Service website.

- Enter your details in the nominative case, as in an identity document.

- Please note your citizenship information and country code. For a stateless person, enter code 999.

- Indicate information about the submitter and telephone number for contact using “8” and without brackets.

Step 2. Fill out page 2.

- Fill out the line at the top by hand - enter your full name.

- Enter the details of your identity document (fill in the four digits of the series separated by a space after the first two).

- Next, fill out the data from the document exactly as indicated in the document (with all punctuation marks, in the same case).

- Place the date and signature at the bottom of the page.

Step 3. Fill out page 3:

- Fill out your full name at the top of the page by hand.

- Indicate information about your place of residence or stay (the type and name of the settlement, elements of the planning structure, road network, buildings and premises within the building are entered by hand).

- Sign and date at the bottom of the page.

Previously, there was a special sample for filling out an application for a TIN when changing a surname; from 10/01/2020 it is no longer necessary to submit it; the Federal Tax Service independently receives information through the Unified State Register of Civil Registry Office.

ConsultantPlus experts discussed how a foreign citizen can obtain a TIN. Use these instructions for free.

Purpose of the document

The current fiscal legislation determines that all citizens, entrepreneurs and organizations are registered with the Federal Tax Service as taxpayers.

Moreover, it does not matter whether a particular entity pays taxes to the budget or not. Even if a given person has no obligation to transfer fiscal payments, he is required to register with the Federal Tax Service. Registering an individual with the Federal Tax Service, or simply obtaining a Taxpayer Identification Number (TIN), is a mandatory procedure. Without a taxpayer identification number, a citizen will not be able to apply for tax deductions, register an individual business, or create a legal entity (organization). In addition, the TIN is a mandatory requirement for almost all tax and reporting forms. Therefore, in order to receive the code, you will have to contact the tax office with an application 2-2-Accounting.

Where and how to apply

There is no need to staple or otherwise secure the document. It is sent by mail with a list of the contents and with a notification, taken personally to the inspectorate or sent electronically.

The recipient is the Federal Tax Service inspection at the citizen’s place of residence (place of stay).

We recommend that you include a cover letter when sending by mail.

| In the Federal Tax Service No. __________ to _____________ Address: ______________________________ From _________________________________ Address: ______________________________ Telephone: ___________________________ Covering letter I am sending documents for tax registration and assignment of a TIN. Please notify me about the readiness of documents by phone __________________________. Additional telephone number _______________________. ___________________ (date, signature). |

Unified form

In order for a citizen to receive an identification number, it is necessary to prepare a special written application with a request to register it in the state register of taxpayers. The identification code shows who you are on the list in this state register.

To prepare your appeal, use the unified form, which was approved by Order of the Federal Tax Service No. ED-7-14 / [email protected] dated 05/08/2020. The unified form KND 1112015 is presented in Appendix No. 1 to the regulatory order.

The full name of the document is an individual’s application for registration with the tax authority KND 1112015, form 2-2-Accounting.

IMPORTANT!

Until October 1, the old forms from Order No. YAK-7-6/ [email protected] . As of October 1, 2020, new application forms for registration, notices of registration, and deregistration are in effect. Now a sample of filling out form 2-2-Accounting when changing a surname is not required - this option has been excluded from the form. The Federal Tax Service receives information through the Unified State Register of Civil Registry Offices.

Sample filling 2-2-Accounting

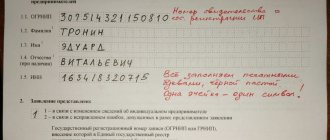

The application must be completed on 3 pages. At the top of the first page, the TIN is indicated in accordance with the document confirming registration with the tax authority. In the “tax authority code” field, you must indicate the code of the tax office to which the application is being submitted.

Next, in the main part of the form, you must enter the surname of the individual in the first line, fill in the first name and then the patronymic in the next line. The data in the application in form 2-2-Accounting must be entered as indicated in the identification documents.

Form 2-2-Accounting must be filled out by hand, in blue or black ink, or can be filled out using special software. Symbols must be entered into the cells in large block letters, legible handwriting, one character per cell.

Next, the page is divided into 2 parts, the right part is filled out by the tax inspector, the left part is filled out either by the individual submitting the 2-2-Accounting application, or by his representative, depending on this, the corresponding figure is entered (5 - if the accuracy of the information is confirmed by the individual himself, 6 – if his representative). If this part of the application is filled out by the individual himself, then all the cells (full name, tax identification number) do not need to be filled out - you only need to put down a date and signature.

The lower part of the first page of the form “Application 2-2-Accounting” (a sample of the filling is presented at the end of the article) is filled out by an employee of the tax authority, and contains information about who carried out the registration (employee position, full name, signature), TIN, date of registration for registration, data of the person who issued the certificate. Next, indicate the details of the certificate, date of issue, full name and signature of the person who received the certificate.

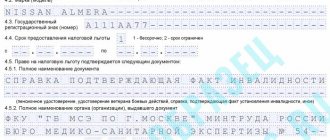

If in the period after 01.09.96 the applicant’s last name, first name, patronymic name changed, then on sheet 2 of the application it is necessary to indicate the data and year when they were changed. Next, you must indicate your gender (number 1 if male and 2 if female) and date of birth. Information about the place of birth must be specified exactly as indicated in the identity document.

Then you need to indicate the type of identification document (code 10 - if it is a passport) and the details of the document (series and number, name of the authority that issued the document, the date it was issued, etc.). Next, the presence of citizenship, the country code according to OKSM and the address of residence or stay in Russia are indicated. The address is indicated in accordance with the entry in the passport. The region code is filled in according to the directory “Subjects of the Russian Federation”.

On page 3 of application 2-2-Accounting, you must indicate information about the document confirming registration at the place of residence or place of stay in the Russian Federation (for foreign citizens or stateless citizens). It is necessary to indicate the type of document, its series and number, indicate the authority that issued the document and the date on which it was received. Next, indicate the date of registration at the place of residence or stay and a detailed address in Russia (zip code, district, city, etc.). After the registration address, you must indicate the address for actual communication with the taxpayer and confirm with your signature the accuracy of the information specified on the page.

A sample of filling out the application “Form 2-2-Accounting” is presented below. Carefully and accurately fill out the form, enter all data in full accordance with the supporting documents in legible handwriting in large block letters.

Application on form 2-2-Accounting

Completing an application for a TIN via the Internet

- Go to the Federal Tax Service website to the service “Registration of an individual with a tax authority on the territory of the Russian Federation”

Using this service, you can fill out an application for issuing a TIN, select any tax authority where the certificate will be received, monitor information about the status of the application, and also work with a previously drawn up application or its draft.

- Enter your login (email address) and password.

If you have not registered on the Federal Tax Service website before, you must do so by filling out a special form:

Note: registration on the Federal Tax Service website has no relation to the taxpayer’s Personal Account, which a citizen gains access to by personally visiting the tax authority.

- After entering the login and password, the user will be redirected to the page for filling out the application form

Note: it is better to enter data in order, following the system prompts.

From the stage of preparing a document to sending it, you need to go through 5 steps:

Note: if you plan to receive a certificate from a tax authority other than your place of residence, then in the last block you must select “Other tax authority”:

Nuances of filling out the form for foreigners

Forms for assigning a TIN for Russians and foreigners have the same format, however, foreign residents should take into account some features of filling out the application. On the second page of the form, in the citizenship column, you should indicate the number “2” and the code of the country of which the foreign migrant is a national. The code data is contained in the country classifier (OCSM).

Stateless migrants must fill in the details of the country where the identity card was issued. If there is no registered place of residence, the official details of the place of temporary stay are indicated.

Sources

- https://online-buhuchet.ru/poluchenie-inn-fizicheskogo-lica-obrazec-zayavleniya-2-2-uchet/

- https://BiznesZakon.ru/nalogooblozhenie/obrazec-zayavleniya-na-poluchenie-inn

- https://kontursverka.ru/news/blank-zayavleniya-postanovka-fizlica-na-uchyot

- https://buhland.ru/zayavlenie-na-poluchenie-inn-forma-2-2/

- https://MigrantVisa.ru/dokumenty/zajavlenie-inn/

What to do if your TIN is lost or stolen

To restore a previously lost TIN certificate, a citizen will need to provide a package of documents to the tax authority, as well as pay a state fee of 300 rubles.

To obtain a duplicate TIN, you must submit to the Federal Tax Service:

- Application for the issuance of a duplicate certificate, drawn up in any form;

- Russian passport or other identification document;

- Receipt for payment of state duty.

Note: replacement of a certificate in connection with a change of surname, first name or patronymic, gender, place or date of birth is carried out by the tax authorities completely free of charge. At the same time, the legislator specifically points out that replacing a document confirming registration in connection with changes in personal data is not the responsibility of a citizen, but only his right.

Features of drawing up different types of statements

Different types of applications can be sent to the tax office. They are divided into types depending on the purpose of the direction and content.

About obtaining a TIN

Any tax payer is registered with the Federal Tax Service. Registration is carried out within 5 days after sending the application. The latter is compiled according to form No. 2-2-Accounting, established by order of the Federal Tax Service No. YAK-7-6 / [email protected] dated August 11, 2011.

About the deduction

A deduction is an amount that reduces the calculation base when determining tax. There are these types of deductions:

- Regular.

- Child deduction.

- For investment.

Tax refunds are made based on the application. Its form is established by order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated February 14, 2021.

On issuing a certificate stating that the payer has no debts

The payer may request information about the presence/absence of tax debts. To do this you need to request a certificate. It may be needed, for example, when obtaining a mortgage.

The application form has not been approved. That is, the document can be drawn up in free form. However, it is recommended to adhere to the standard structure: “header”, title, text with a formulated request, signature and date.

For a refund or offset of tax that was overpaid

A company may mistakenly pay too much in taxes. To get a refund, you need to send an application to the tax office. You need to formulate your request in the “body” of the document. It could be:

- refund;

- offset of funds against future payments.

The application must be submitted within 3 years from the date of overpayment. Funds must be returned within a month from the date of receipt of the tax paper. The application can be submitted in electronic format. To do this, you need to go to your personal account of the Federal Tax Service.

About deferment of payment

Sometimes individuals or legal entities cannot pay taxes on time. In this case, they can request an installment plan. The amounts for which the installment plan is issued cannot exceed the value of the debtor's property on which the tax is paid. To receive the benefit, you must fill out an application in the form specified in Appendix No. 1, approved by Order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated September 28, 2010.

ATTENTION! If an installment plan is issued, interest accrues.

How to fill out: general recommendations

The main recommendations for filling out are enshrined in the Federal Tax Service order No. ED-7-14/ [email protected] Here's how to fill out an application for a TIN for an individual:

- Enter information into the form by hand or fill out the document using a computer or any printing technology. For handwriting, use only black or blue ink.

- If you made mistakes in filling out 2-2-Accounting, you will have to fill it out again. Errors, corrections or the use of corrective means when drawing up documents of this kind are unacceptable.

- If you fill out the form by hand, put dashes in the empty fields. When preparing KND 1112015 on the computer, do not put dashes.

Enter the information in block letters and make sure the text is easy to read.

Submit a completed example of filling out an application for TIN to the Federal Tax Service in person, by mail or through an authorized representative.