Documentation

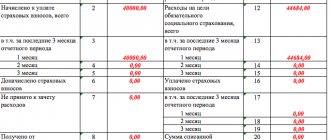

The principle of reimbursement of funds from the Social Insurance Fund in 2020 Insured under compulsory social insurance for

Information about a citizen’s income for a specific period of time and paid in accordance with this

It is not always possible to put purchased equipment into operation immediately. As a rule, it needs

In what cases is a zero VAT return submitted? Is it necessary to submit a zero VAT return?

Control ratios 6-NDFL and 2-NDFL for 2021 - this is a separate way to check

An invoice is the most important document that is required for both parties to trade transactions. Entrepreneurs who constantly exhibit

On November 25, 2021, Federal Tax Service Order No. ED-7-14/ [email protected] “On

A citizen who purchased real estate in 2021 with money from which income tax was previously paid

Accounting entries for insurance premiums: DT 20 CT 69.1 - accruals for mandatory social benefits

To whom and where to submit reports on contributions The functions of policyholders for compulsory social insurance are assigned