It is not always possible to put purchased equipment into operation immediately. As a rule, it needs installation. Such equipment is recorded on account 07. Separately, it is necessary to take into account equipment that cannot be put into operation immediately after receipt. Such fixed assets also require modification and installation, and equipping with auxiliary parts. Both units of equipment and complexes are considered similar operating systems. Let's consider all the nuances of accounting for objects that need installation.

Question: How to reflect in the accounting of a Russian organization the acquisition and import into the territory of the Russian Federation of equipment that requires installation for the purpose of use in production, as well as the installation of this equipment, if the equipment was purchased from a Kazakh seller, is imported from the territory of the Republic of Kazakhstan, the installation of the equipment is carried out a Kazakh contractor on the territory of the Russian Federation? The contractual cost of the equipment is 2,000,000 rubles, the cost of installation work is 200,000 rubles. (excluding VAT). Settlements with the seller and contractor are made after receipt of the equipment and completion of installation work, respectively. The Kazakh contractor is not registered with the tax authorities of the Russian Federation as a VAT payer and does not have a representative office in the Russian Federation. View answer

The concept of materials and raw materials in accounting

These nomenclature groups include assets that can be used as semi-finished products, raw materials, components and other types of inventory assets for the production of products and services, or used for the own needs of an organization or enterprise.

- Control of their safety

- Reflection in accounting of all business transactions involving the movement of inventory items (for cost planning and management and financial accounting)

- Formation of cost (materials, services, products).

- Control of standard stocks (to ensure a continuous cycle of work)

- Identification of shortages, losses, damage to materials

- Analysis of the effectiveness of the use of mineral reserves.

Results

Accepting the supplier's invoice means in most cases the buyer's agreement to pay. In accounting, such an action is not considered as a separate business transaction. All entries in accounting accounts can be made only on the basis of primary documents. An invoice for payment (even with a permit visa from the head of the company) is not a primary document.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

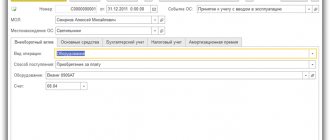

Purchase of equipment

When purchasing equipment, you should take into account not only its cost, but also the costs associated with purchasing the OS (transportation, installation, etc.). It is the sum of these expenses that will constitute the initial cost of the object to be reflected in accounting.

| Dt | CT | Description | Sum | Document |

| 08 | 60 | Accounting for the cost of purchased machines | RUB 6,345,763 | Sales Invoice |

| 08 | 60 | Accounting for transport company services | RUB 520,763 | Certificate of completion |

| 19 | 60 | VAT accounting (17) | RUB 1,235,974 | Invoice |

| 01 | 08 | Commissioning of machines (6 345 763 520 763) | RUB 6,866,826 | Act OS-1 |

Relations between the parties

Unless otherwise provided by the contract, the work is performed at the expense of the contractor - from his materials, with his forces and means. This norm is enshrined in paragraph 1 of Article 704 of the Civil Code of the Russian Federation. The price of the contract, according to paragraph 2 of Article 709 of the Civil Code of the Russian Federation, includes compensation for the contractor’s costs and the remuneration due to him. It can be determined by drawing up an estimate.

Thus, the contract may stipulate that the equipment, the cost of which will subsequently be compensated by the customer, is purchased by the contractor.

Taking into account equipment requiring installation

Some of the equipment that goes into production usually requires installation. This can be production or technical equipment that functions only after its assembly, as well as measuring instruments that are mounted to the main equipment.

| Dt | CT | Description | Sum | Document |

| 07 | 60 | Reflection of the cost of equipment requiring installation | RUB 5,714,729 | Sales Invoice |

| 07 | 60 | Reflection of the cost of transport company services | RUB 34,746 | Certificate of completion |

| 19 | 60 | Reflection of input VAT on the cost of equipment | RUB 1,030,271 | Sales Invoice |

| 19 | 60 | Reflection of input VAT on the cost of transport company services | RUR 6,254 | Certificate of completion |

| 08_3 | 07 | Reflection of the cost of equipment transferred for installation of the conveyor line (56) | RUB 5,749,475 | Equipment acceptance certificate |

| 68 VAT | 19 | Acceptance for deduction of input VAT on costs of purchasing equipment (1,030,271 6,254) | RUB 1,036,525 | Invoice |

| 08_3 | 60 | Reflection of value | RUB 198,305 | Certificate of completion |

| 19 | 60 | Reflection of input VAT on cost | RUB 35,695 | Certificate of completion |

| 01 OS in operation | 08_3 | Acceptance for registration and commissioning of the conveyor line (5,749,475,198,305) | RUB 5,947,780 | OS commissioning certificate |

| 68 VAT | 19 | Acceptance of input VAT deduction from the cost | RUB 35,695 | Invoice |

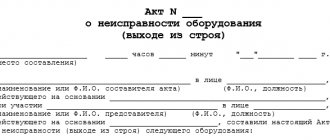

Repair of equipment

Equipment repair refers to work that eliminates its malfunction and restores its functionality. The technical properties of the equipment do not change.

| Dt | CT | Description | Sum | Document |

| 10_5 | 50 | Purchasing a compressor | RUB 3,496 | Packing list |

| 19 | 60 | Accounting for VAT on the cost of the compressor | 629 rub. | Packing list |

| 68 VAT | 19 | Acceptance of VAT deduction | 629 rub. | Invoice |

| 60 | 51 | Payment to the supplier for the compressor | 4,125 rub. | Payment order |

| 44 | 10_5 | Compressor cost write-off | RUB 3,496 | Act OS-3 |

| 44 | 70 | Accounting for the costs of repairing refrigeration equipment on your own | RUB 3,115 | Act OS-3 |

Accounting for inventory items in accounting: postings and documents

Accounting for inventory items in accounting is reflected on the basis of primary documentation and can be as follows:

- The purchase of materials is made in cash or by bank transfer, confirmed by a purchase agreement, payment and settlement documents or the transfer of a power of attorney to receive goods and materials with subsequent settlement with the supplier. It is received at the warehouse on the basis of a bill of lading or a receipt order. When purchasing materials, additional transportation and procurement costs (for example, delivery) may be reflected.

- Sale of materials - transfer of raw materials to third parties.

- Transfer - from the founders, contractors or sponsors, is accounted for at the estimated value or on the basis of available documents: contracts, payment documents, appraisal reports, etc.

- Write-off of materials - reflects the expenditure of inventory and materials into production. It may imply both the write-off of materials for actual production and the write-off for general business needs. Depends on corr. accounts (20, 23, 25, 26). Disposal may be reflected due to damage or loss of inventory items.

- Shortage of materials or surplus of materials are recorded as a result of inventory. They may be reflected within the normal limits or as a result of loss/damage.

- Operations with customer-supplied raw materials - features of accounting for materials received from another organization.

For production and for own needs, materials are released from the warehouse upon request - invoice or other documents (based on accounting policies); are written off to the production site, which then includes them in the cost of products or services.

Every year, according to PBU, owners are required to conduct scheduled inventories on the basis of an issued order with designated responsible persons. In addition to them, there may be unscheduled (sudden) audits and inventories. Their goal: control over the safety and correct use and write-off of inventory items.

Invoice accepted for payment: errors and consequences

An incorrect interpretation of the concept of “acceptance” in accounting can lead to distortion of accounting data and, as a result, the reflection of unreliable information in the financial statements. Let's look at this situation using an example.

A first-year financial college student, P. L. Samokhvalov worked part-time in his free time at Zimny Les LLC as an assistant in the accounting department. During the period of illness of the chief accountant, a stack of documents was transferred from the directorate to the accounting department, and the student was instructed to enter the documents into the 1C program.

The bundle contained a variety of papers: contracts, invoices, invoices, invoices. The student knew how to enter invoices into the program - he had already been taught this. But he didn’t have to work with bills to pay. But the student showed ingenuity. He did not ask advice from his more experienced colleagues, opened his training manual with test tasks in the discipline “Accounting”, found a test that was suitable in meaning with the wording “an invoice for payment for the supplied materials was accepted” and made entries, as was written in the answer to test:

- Dt 10 Kt 60 - for the cost of materials;

- Dt 19 Kt 60 - for the amount of VAT allocated from the cost of materials.

However, he missed two points:

- the materials were not actually received from the supplier;

- there was no primary document on the basis of which entries could be made in accounting (an invoice for payment, even with a director’s visa, is not a primary document).

As a result, materials that do not exist and non-existent VAT appeared on the company’s balance sheet. In addition, Zimniy Les LLC incurred a debt to the supplier who issued the invoice for payment. And in the company’s balance sheet, the data in two sections at once was distorted: “Current assets” and “Short-term liabilities”.

The chief accountant, who had returned from sick leave, spent a long time checking the primary data with the data in the program until the error was discovered. The student got away with a verbal reprimand the first time.

Find out what fines are provided for distortion of accounting data.

Thus, if an invoice received from a supplier is accepted for payment, an accounting entry to reflect this fact (as a separate operation) is not needed.

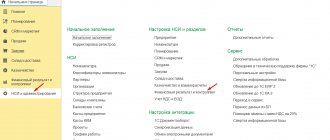

Modernization of equipment and its depreciation

Equipment modernization refers to work related to improving its technological and service properties.

Depreciation on modernized equipment is accrued provided that the modernization will take no more than 12 months. If the improvement process has been carried out for more than a year, then depreciation must be stopped.

- initial cost of equipment - 418,000 rubles;

- useful life - 3 years;

- annual depreciation rate 1/3*100% = 33.33%;

- monthly depreciation amount 418,000 * 33.33% / 12 months. = 11,610 rub.

| Dt | CT | Description | Sum | Document |

| 26 | 02 | Depreciation on modernized equipment | RUB 11,610 | Depreciation statement |

| 08 OS upgrade costs | 60 | Cost of contractor's work | RUB 52,966 | Certificate of completion |

| 19 | 60 | VAT on the cost of the contractor's work | RUB 9,534 | Certificate of completion |

| 68 VAT | 19 | VAT deductible | RUB 9,534 | Invoice |

| 60 | 51 | Payment to the contractor | 62,500 rub. | Payment order |

| 26 | 02 | Depreciation on modernized equipment | RUB 11,610 | Depreciation statement |

| 01 | 08 OS upgrade costs | Increase in the book value of equipment by the amount of modernization | RUB 52,966 | Act of modernization |

Fixed assets - what are they?

Fixed assets – cars, machinery and equipment, buildings, computer equipment.

There are two criteria that determine whether inventories belong to the category of fixed assets:

- Service life/useful life (must be more than one year);

- Cost expression (40,000 rubles for operating systems that were put into operation before 2021, and 100,000 rubles - from 01/01/2016).

The unit of accounting for these funds is an inventory object, which can be a separate item or a single complex of several items, but having a common control, for example a computer.

Fixed assets are subject to wear and tear, so depreciation must be charged on them.

Example of postings on account 10

Average cost = ((Cost of remaining materials at the beginning of the month Cost of materials received for the month) / (Number of materials at the beginning of the month Number of materials received)) x number of units released into production

Average cost in our example = (216686/270) x 125 = 100318

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.01 | 51 | Paid for materials | 255 690 | Bank statement |

| 10.01 | 60.01 | Receipt of materials to the warehouse from the supplier | 216 686 | Request-invoice |

| 19.03 | 60.01 | VAT included | 39 004 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 39 004 | Invoice |

| 20.01 | 10.01 | Posting: materials released from warehouse to production | 100 318 | Request-invoice |

| 94 | 10.01 | Writing off the cost of damaged sheets | 2408 | Write-off act |

| 20.01 | 94 | The cost of damaged sheets is written off as production costs | 2408 | Accounting information |

Retirement of equipment

There are several ways for materials to enter an organization: acquisition for a fee, acceptance as a contribution from the founders, production of materials, free receipt, etc.

Depending on the method of receipt, the following postings for materials appear in accounting.

| Debit | Credit | Contents of operation |

| 10 | 60, 76 | Receipt of the invoice from the supplier; Wholesale supply of goods is carried out under a sales contract |

| 10 | 71 | Acquisition of inventories by an accountable person |

| 10 | 75 | Founder's contribution; the estimated value of the property must be agreed upon with the person contributing the property |

| 10 | 91 | Reflected gratuitous receipt; In this case, the market value of the material is taken as the amount. A similar posting is made when taking into account materials received during the dismantling of fixed assets |

If upon receipt the cost of the material includes VAT, then its amount is reflected in a separate line.

Example 3

| Debit | Credit | Amount, rub. | Contents of operation |

| 10.6 | 60 | 15 000 | A batch of paper has arrived |

| 19.3 | 60 | 3 000 | The amount of input VAT is reflected |

| 68.2 | 19.3 | 3 000 | VAT amount accepted for refund |

| 60 | 51 | 18 800 | Payment was made to the supplier through a bank account |

For more information on the formation of VAT when purchasing inventories, see the material “How is VAT recorded on purchased assets?”

If an organization applies a taxation regime that excludes the use of VAT (STS, UTII), then the entire cost of materials should be credited to account 10. In this case, VAT does not apply to refundable taxes, but is taken into account when determining the cost price.

| Debit | Credit | Contents of operation |

| 20, 23, 25, 26, 29, 44 | 10 | Issue from a warehouse for production or general business needs of the organization; transfer is carried out using limit-fence cards or requirements-invoices |

| 94 | 10 | The gratuitous write-off of materials as a result of damage or theft is reflected. As a rule, a lack of food supplies is identified as a result of an inventory; an act of write-off of materials is drawn up |

| 99 | 10 | The materials were lost due to a natural disaster; the transaction is reflected using a write-off statement |

| 91 | 10 | Reflection of the transfer (sale) of materials to the third party; actual cost is used |

Disposal of equipment can be carried out either through liquidation or through sale.

| Dt | CT | Description | Sum | Document |

| 01 Disposal of fixed assets | 01 | Write-off of original cost | 112,000 rub. | Act OS-3 |

| 02 | 01 Disposal of fixed assets | Write-off of accrued depreciation | 34,000 rub. | Act OS-3 |

| 91_2 | 01 Disposal of fixed assets | Write-off of residual value | 78,000 rub. | Act OS-3 |

| 62 | 91_1 | Revenue accrued | 84,000 rub. | Transfer and Acceptance Certificate |

| 91_2 | 68 VAT | VAT charged on sales | RUB 12,814 | Invoice |

| Dt | CT | Description | Sum | Document |

| 02 | 01 Disposal of fixed assets | Reflection of the amount of depreciation | 74,000 rub. | OS write-off act |

| 01 Disposal of fixed assets | 01 | Reflection of original cost | 81,000 rub. | OS write-off act |

| 91_2 | 01 Disposal of fixed assets | Write-off of residual value | 7,000 rub. | OS write-off act |

Methods

There may be several options for supplying materials. Let's consider cooperation with suppliers (you can also receive invoices from the founders as a contribution to the authorized capital or create them on the organization's own).

Supply contract

Here you can also distinguish between delivery with payment after receipt of materials and delivery with prepayment. In the case of postpaid delivery, the following standard postings are made:

- D10 K60 – MPZ arrived at the warehouse;

- D19.3 K60 - reflected the amount of VAT in the price paid for received goods and materials;

- D68.2 K19.3 - attributed the amount of VAT paid to reimbursement from the budget;

- D60 K51 – repaid the accounts payable to the counterparty.

Important: the amount reflected in 1 entry does not include VAT.

If the inventories were paid earlier, then D60.02 K51 - reflected the prepayment to the supplier for the inventories;

Next, the same transactions for the receipt of materials at the warehouse and the reflection and reimbursement of VAT from the budget. And finally, the last posting D60.01 K60.02 - the prepayment made earlier is taken into account.

Advance report

An advance report is used in an organization to confirm that an accountable person has spent the amounts issued to him. Supporting documents (cash receipts, etc.) must also be attached to the report.

Thus, in this case, the inventory for the company is acquired by an accountable person. The wiring in this situation will be as follows (standard diagram):

- D71 K50 – funds were issued from the cash register to an accountable person;

- D10 K71 – inventories were received from the accountable entity;

- D19.3 K71 – reflected VAT;

- D68.2 K19.3 – included VAT as a refund.

There is another option for how you can reflect the receipt of materials from an accountable person, showing the actions of the supplier. This accounting method will allow you to analyze supplies by supplier.

- D71 K50 – issuance of funds to an accountable person for the needs of the company;

- D10 K60.1 – materials were received from the supplier to the warehouse (based on the primary documents attached to the expense report);

- D19.3 K60.1 – reflected VAT;

- D68.2 K19.3 – attributed VAT to reimbursement;

- D60.01 K71 – reflected the payment to the supplier by the accountable person.

Barter agreement

There are cases when goods arrive at an organization under an exchange agreement. Then you need to register them as follows (in this case, the usual procedure for transferring ownership of inventories is provided):

- D10 K60.01 – goods received from the counterparty under an exchange agreement;

- D19.3 K60.01 – the amount of VAT is reflected;

- D68.2 To 19.3 – value added tax was included in the reimbursement;

- D62.01 K91.1 – reflected the exchange of inventories under the concluded agreement;

- D91.2 K10 – the transferred MPZ was written off;

- D91.2 K68.2 – reflected VAT accrued on transferred materials;

- D60.01 K62.01 - offset the debt of the counterparty under the agreement concluded with him.

As a valuation of materials transferred under an exchange agreement, they take the price that, under similar conditions, the company uses to determine the cost of similar materials.

Transfer of equipment for rent

| Dt | CT | Description | Sum | Document |

| 03 Own property | 08 | Acceptance of equipment for registration | RUR 433,898 | Act OS-1 |

| 68 VAT | 19 | Acceptance of VAT deduction | RUB 78,102 | Act OS-1 |

| 03 Leased property | 03 Own property | Transfer of equipment to the tenant | RUR 433,898 | Transfer and Acceptance Certificate |