Information about a citizen’s income for a specific period of time and taxes paid in accordance with this is compiled into a single reporting form 2NDFL, which was first approved in 2010 and underwent changes in 2015 (Order of the Federal Tax Service of Russia No. ММВ-7-3 / [email protected] 2010 /17/11 edition 2015/10/09, registration with the Ministry of Justice No. 19368 2010/24/10; Order of the Federal Tax Service No. ММВ-7-11/ [email protected] 2015/30/10 “On approval of the form...” registration with the Ministry of Justice No. 39848 2015/25/11).

Previously, there was no standard form; the information was simply stored in the accounting and tax departments. Now the certificate is proof that you are “sleeping peacefully.” Where can I get a personal income tax certificate 2, if it allows access to certain services?

Personal income tax form 2, being essentially a tax certificate, almost immediately turned into the main document on a citizen’s income. The certificate is in demand in all situations where it is necessary to prove the financial stability of a citizen and the material basis of his confidence in the future.

Why you may need Form 2 Personal Income Tax

This type of certificate is usually provided under the following conditions:

- at a new place of work;

- when filing tax deductions;

- when calculating pensions;

- to participate in any litigation;

- during the procedure of adoption of a child;

- when calculating the amount of alimony or other payments;

- before applying for a visa (not always);

- to draw up a 3-NDFL declaration, which is filled out on the basis of a 2-NDFL;

- to provide a certificate to the tax office;

- when taking out a large amount on credit to purchase, for example, a car or an apartment. This helps the bank determine whether the borrower will be able to repay the borrowed amount later.

Many nuances for specific cases when taking form 2 personal income tax

Important! If an individual entrepreneur wants to take out a loan as an individual. person, Form 2 of personal income tax can be replaced by an extract from the Book of Income and Expenses.

A person is not obliged to talk about why he needed a certificate. It must be issued within 3 working days after writing an application for its receipt. If the tax agent is unable to provide this certificate for any reason, an administrative penalty will be imposed on him.

Form 2 personal income tax is not needed if:

- during the last reporting period the individual did not receive income;

- upon taking office at the first place of work;

- if the individual does not claim any deductions;

- employment took place on the first working day of the year;

- An individual does not have the right to reduce the tax base. In this case, the accounting department will not even ask for a certificate.

Error while filling

The most common design errors when filling out a form are:

- the date format is not followed;

- incorrect placement of the seal (its place is on the left);

- there is no decoding of the signature (name and position);

- the blue seal and the signature in blue ink merge - take care that the former does not hide the latter.

Marks or corrections on the form are not acceptable. If any inaccuracy is detected in the information, the accounting department must take immediate action. The adjustment is sent to the tax office, and the corrected personal income tax is issued to the applicant.

If the inspection discovers an inaccuracy before the accounting department notices the mistake, then a fine for inaccuracy cannot be avoided (TC Art. 126.1). If you independently identify an error/typo and correct the document, sanctions will not apply.

Where to get certificate 2 personal income tax

You can obtain this document from your tax agent. This could be the employer or the educational institution where the student is studying. In more unusual cases, you may need to contact the tax service directly, the employment center, or it will be impossible to obtain a certificate at all.

Certificates are issued by the organization's accounting department

However, there are a number of deductions that reduce the amount of deductions from income. This is relevant for some groups of citizens who are provided with government benefits.

Important! Deductions can be applied until the amount of annual income exceeds 350 thousand rubles. As soon as income passes this mark, the benefits will not apply.

In order for a new employer to understand what deductions were made at the previous place of work, the organization’s accountant needs a certificate 2 of personal income tax for the last reporting period.

Since the person had not officially worked anywhere before, this means that no tax deductions were made. Therefore, personal income tax certificate 2 cannot exist in this case.

A new employer needs this certificate to receive standard tax deductions, which take into account all the income of an individual for the last year, including income from the previous place of work.

In most cases, the employer will automatically issue this form along with other documents when terminating an employee. If he has not done this, you can write an application to receive it yourself.

Note! A certificate issued upon dismissal is valid for a month from the date of its issue. If during this time the person did not have time to give it to the accountant of the new company, he will have to register it again.

If for some reason the certificate was not issued immediately and the taxpayer needed it after some time, he can request it from the accounting department or from the head of that company, or come in person and ask for it to be issued. Often a simple request in words or in an email is enough to get it. However, no more than 4 years must pass after dismissal, otherwise the data in the certificate will be irrelevant.

Since there is no one to turn to for help, you will have to write an application to the tax service. Information about taxes paid by the employer is stored in the Federal Tax Service for the last year of the company’s activity. If the former employee has the details and TIN of the liquidated enterprise, the search process in the Federal Tax Service database will be significantly simplified.

When liquidating a company, you need to contact the tax service

Legally, it is impossible to obtain a personal income tax certificate 2 for unofficial employment. Proof of income can be a bank certificate of a deposit with an amount of more than 12 subsistence minimums. Moreover, a relatively new contribution may not be accepted.

Note! Such cases are quite complex and will most likely require the assistance of a lawyer.

Large companies with branches in several cities practice issuing documents only at the head office. For example, an employee lives and works (or worked) in Nizhny Novgorod, and the organization’s head office is in Moscow.

If in the same city where the need for a certificate arose, there is a branch of that organization, you need to go with a request to the director of this branch. In other cases, you can ask about this by phone or email, or by registered mail, send an application where the former employee wants to take 2 personal income tax certificate in writing. In this case, you need to indicate that the employer sends a scanned copy of the document by email and sends the original by regular mail. He must do this for free.

In this case, the certificate must be issued with current, up-to-date company data. In addition to Form 2 of personal income tax, an official certificate of renaming of the company can be issued, as well as documents evidencing reorganization and succession, if this took place in each specific case.

Responsibility for a forged certificate

Quite often, if it is impossible to obtain a Form 2 - Personal Income Tax certificate, citizens falsify this document. Such actions are a criminal offense for which you can get a real prison sentence. Moreover, this offense may fall immediately under two articles of the Criminal Code of the Russian Federation: 292 (official forgery) and 327 (forgery of forms and seals).

Article 292 of the Criminal Code of the Russian Federation when falsifying 2-NDFL will be applied if you want to carry out some kind of operation with the help of a certificate, as well as in some other similar cases. This article is quite short, it only has 2 points:

- Point one. Introduction by officials and civil servants of false information or corrections into documents for personal gain. Punishable by a fine of up to 80,000 rubles, compulsory labor for up to 480 hours, correctional labor for up to 2 years, forced labor for up to 2 years, arrest for 6 months, or imprisonment for 2 years;

- Point two. The same acts as described in paragraph one, but committed with the aim of violating the rights of individuals or legal entities, as well as the state. Punishable by a fine of up to 500,000 rubles, forced labor for up to 4 years, or imprisonment for 4 years.

Article 327 of the Criminal Code of the Russian Federation will be applied for the falsification of the certificate itself, and there is no way to avoid it when considering the case. It consists of three parts:

- Part one. Forgery of documents and stamps that give any rights or remove restrictions, as well as the sale of counterfeit documents. Punishable by imprisonment for 2 years, restriction of freedom for up to 3 years, arrest for 6 months;

- Part two. The same acts as in the first part, but committed in order to hide the crime. Punishable by forced labor for 4 years or imprisonment for up to 4 years;

- Part three. Using a fake document for personal gain. Punishable by a fine of up to 80,000 rubles, compulsory labor for up to 480 hours, correctional labor for up to 2 years, and arrest for 6 months.

When an employer is not required to issue 2 personal income taxes

If an individual entrepreneur or the organization where the taxpayer works does not withhold personal income tax from his income, then the employer, by definition, is not a tax agent and is not required to provide a certificate. This may happen if:

- the employee transfers taxes independently;

- remuneration was paid, on which the taxpayer is obliged to remit the tax himself, or income was paid that was not subject to taxation.

If there is no taxable income, the certificate will not be issued.

If the employer refuses to issue a certificate, the employee can complain to the state labor inspectorate.

Unemployed people, those who are registered with the employment service, receive this certificate there.

For individual entrepreneurs, it is impossible to obtain a personal income tax certificate 2. Where and how you can obtain a free-form income certificate, you need to find out from those who need this certificate. This could be a financial organization or a human resources department that accepts one or another application format. Therefore, to avoid disputes and disagreements, it is better to clarify in advance what format needs to be provided.

Maternity benefits are not taxed. On maternity leave, 2nd personal income tax can only be received if, in addition to payments, there is other income that is taxed. Therefore, a woman can obtain form 2 personal income tax from her employer, where she can only get it before the end of the reporting year:

- if she officially continues to work part-time;

- the husband or guardian is on maternity leave instead of the woman;

- a bonus or other source of taxable income was received.

If a person does not study, does not work (or works unofficially) and is not registered with the employment center, it is impossible to obtain this certificate.

Here you need to contact the Unified Settlement Center of the RF Ministry of Defense or one of the Financial Support Directorates of the RF Ministry of Defense. There is also the opportunity to request a certificate through the website of the Russian Ministry of Defense and clarify how to receive 2 personal income taxes.

Thus, it turns out that obtaining a certificate in Form 2 of personal income tax in each specific case is a rather specific matter. And for each person there may be a different form of receiving it.

This document is necessary to record the amounts of accrued income to an individual, as well as to control the collection of tax on the income of this person. The functions of control over accounting data lie with the tax authority where the organization is registered or located. For an individual (employee), the document is an official reflection of the source of his income.

Documents issued upon dismissal

The dismissal procedure is strictly regulated by law. When carrying out this, the main thing is to make a full settlement with the employee and hand over to him all the documents due. In fact, the parties must close mutual claims against each other so as not to subsequently raise documentation to resolve additional issues. Receiving all the required forms in hand allows the dismissed person to save time in the future on additional trips to the former employer to obtain documents that were not previously collected.

When terminating an employment contract with an employee, the employer is obliged to hand over to him:

- A work book with a record of work in this organization.

- Medical record, if available.

- Education documents, provided that their originals were kept by the employer. We are not talking about diplomas, but about certificates of advanced training, certificates of skills acquired in the process of work, and so on.

- A certificate that will allow you to make accruals for sick leave in future work in the event of an employee’s illness.

- When an employee is laid off, he is issued a certificate for the employment center.

At the request of the person being dismissed, he is given:

- Copies of orders for admission and dismissal.

- Certified copies of incentive and transfer forms.

- Certificate of income for the last 12 months in form 2-NDFL.

All papers require proper completion and certification; the employer must adhere to established registration standards.

Where can I get a personal income tax certificate 2 if I work?

To answer the question of where to get personal income tax certificate 2, let’s get acquainted with the scope of application of this document. Citizens usually need a certificate of this form for:

- confirmation of work experience during a certain period, as well as the amount of income received during this period;

- filing with the tax authority in order to obtain a deduction for taxes and property;

- a report on the payment of income tax to government authorities in case of belonging (location) in different countries;

- submitting documents for a loan to the bank, which will allow you to get a more convenient interest rate on the loan by minimizing the bank’s risks and confirming the client’s solvency;

- travel abroad - to a visa center to confirm solvency;

- change of place of work - the employer can request this certificate in the package of documents, which is necessary for timely and accurate reflection of data in accounting;

- other cases.

The contents of the certificate reflect information about the employer, employee, controlling tax authority, amounts of employee income received and tax and other deductions from income.

It should be noted that this certificate is drawn up in any case for each employee to submit reports to the tax authorities, regardless of whether the employee needs it in hand or not.

If you receive an official salary, you should contact the employer in the accounting department to obtain a certificate of this form. The certificate is generally generated for a calendar year and is issued an unlimited number of times. To obtain it, you must write a statement or verbally request this document. In the application, indicate the purpose for which you need this certificate, as well as the time period for which it is needed. The certificate is prepared within 3 calendar days. You do not have the right to refuse to issue this certificate if you are officially employed. When changing jobs, you should request a certificate from your previous employer in advance.

Over what period is it done?

The document is created for submission to the tax service for the past entire calendar year.

At the request of the dismissed person, income certificates can be issued even for several previous years. It is also not prohibited to draw up a document for short periods.

An employee has the right to request a certificate for a period of about several months or for a quarter of the current year.

Expert opinion

Irina Vasilyeva

Civil law expert

You can make a declaration of income both for the previous year and for the current period, but this must be clarified when contacting management.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

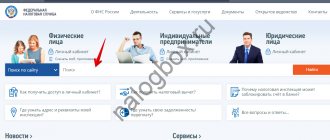

Where can I get personal income tax certificate 2 online?

To eliminate the need to visit the tax authorities, the document can be obtained via the Internet in the taxpayer’s personal account. The service belongs to the Federal Tax Service, and all data provided is reliable and ready for use. Obtaining a certificate via the Internet will significantly save time for both you and the employer.

If you need to obtain a certificate, but the previous employer does not carry out activities, check the availability of data for the corresponding tax period through the user’s personal account - data is stored there, regardless of the employer’s status.

If this is not possible, or if there is no information for the required period, notify the accounting department in writing that it is impossible to obtain a certificate due to the closure of the organization. Then the new employer will contact the tax and pension authorities to request information about the individual’s income, tax arrears and other information.

If you are not currently working, please contact the accounting department of your last employer to obtain a certificate of this form. According to current legislation, if you worked at your previous place officially, you must be given a certificate upon written request.

If you did not work, that is, did not receive official income, then income tax was not paid for you. In this case, it is not possible to draw up a certificate.

Citizens are trying to resort to the help of special organizations where they buy a certificate. Keep in mind the illegal nature of this action, as well as your responsibility for submitting such documents to the authorities. Penalties for the issuance and use of such a document are established by the Criminal Code, up to and including restriction of freedom.

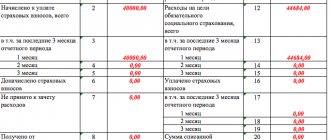

Help structure

The form approved by the Federal Tax Service includes a header, information part and certification.

The 4-digit code number of the regional inspectorate (IFNS) must be entered in the header.

The certification part includes the signature of the person who issued the document stating the full name and position and a seal imprint.

The information part of the help contains:

- comprehensive information about the organization and the employer;

- detailed information about the citizen at whose request the document was drawn up;

- list of income for the past time period (year) with deductions;

- provided deductions, or partial tax refund (TC Art. 218-221);

- final breakdown of income and taxes.

When filling out the document, code filling of individual items is used. A person with limited access to accounting documentation cannot be held responsible for completing the document and, therefore, should not be allowed to participate in the procedure.

12096-2-ndfl.jpg

Certificate 2-NDFL is a certificate about the income of an individual and taxes withheld from this income. The certificate is filled out in accordance with the procedure approved by Order of the Federal Tax Service of Russia No. ММВ-7-11/485 dated October 30, 2015. This form has been used since December 8, 2015.

Why might a certificate be needed? For the employer - to report withheld taxes on the employee’s income to the tax office. Individuals usually need a certificate to confirm their income for a bank or tax office in order to receive a tax deduction, when applying for a job, to obtain a visa, etc. Why do they ask you for a certificate from your previous places of employment? It will be needed to calculate vacation pay and sick pay. For banks and when obtaining a visa at a foreign consulate, an official certificate of your income is proof of your solvency.

How to make a certificate? A certificate in form 2-NDFL must be filled out by a tax agent in relation to each individual receiving income from it during the tax period (calendar year). Thus, the answer to the question of where to get a 2-NDFL certificate is simple - this certificate is issued by your employer (or the company where you performed some work or provided services under a contract), which, according to Art. 226 of the Tax Code of the Russian Federation, acts as a tax agent. The employee will be required to apply for a certificate.

Some organizations ask you to fill out an application based on a sample developed by the employer. The following information is usually indicated in the header of the application: name of the organization, full name of the general director, full name of the applicant.

Next comes the text of the application, where you must indicate the years for which you need a certificate. The application must contain the date of preparation and a personal signature. Is it possible to make a certificate without filling out an application? Yes, often a verbal request is enough for an employer. The maximum period for preparing a certificate is 3 days. The employer cannot refuse to issue you a certificate of income - this is a violation of current legislation.

Who fills it out?

The accounting department is responsible for preparing a certificate based on current reporting documentation.

[email protected] ), has the right and must sign the NFDL (form 2) chief accountant.

In the new form 2015. The code of the person signing the document is entered:

- code =1= signed by the employer himself;

- code =2= signed by the chief accountant (authorized).

If the certificate is obtained not at work, but directly from the tax office, then the function of signing will be taken over by an authorized representative of the agency, endowed with this right.

Where to get a 2-NDFL certificate if you don’t work

Many people are interested in the question of where to get a 2-NDFL certificate if you are not working at the moment? The answer depends on whether you have worked officially before. If you currently do not have a job, but you were officially employed at your previous places of work, you can request 2-NDFL there. This option, of course, is not suitable if you need to confirm your solvency now, for example, to apply for a loan. If the organization in which you worked was liquidated, you can make a request for income to the Pension Fund or the tax office, and this can be done by mail.

If you have never worked officially, you will not be able to get a 2-NDFL certificate. There is simply no one to give it to.

Issuance procedure and deadlines

The dismissal itself is not the basis for issuance and the certificate is not included in the list with other documents. It is compiled and issued only at the request of the recipient. He does not have to be on the company's staff, i.e. in fact, the agreement of the parties may already be terminated. It is enough for a former (current) employee to notify an employee of the accounting department or human resources department about the need to extradite. Sometimes management is approached with a similar request. The deadlines for preparing 2 personal income taxes after dismissal do not differ from the situation when the citizen is still working in the organization. In all cases they are 3 days.

How to obtain a 2-NDFL certificate for an individual entrepreneur?

Often, an individual entrepreneur needs to confirm his income, for example, to travel abroad. As a standard, everyone is asked to provide a 2-NDFL certificate, but the individual entrepreneur does not hire himself, and therefore cannot provide it. Individual entrepreneurs maintain reporting in a different form. An individual entrepreneur can confirm his income using a tax return, and it does not matter what taxation system he uses. Of course, if an individual entrepreneur also works part-time as a hired specialist, he can ask for 2-NDFL at his usual place of work.

Receipt using the State Services portal

If a person does not have registration with the Federal Tax Service, but is registered with State Services, he will also be able to obtain a certificate.

Algorithm:

1. On the login page to your personal account, select the login method “Login through government services (USIA)” and enter the login and password of the registration record on the portal. If you are already authorized in the ESIA, you will log in immediately.

2. Following the algorithm described above, receive the document in the taxpayer’s personal account.