Accounting entries for insurance premiums:

- DT 20 CT 69.1 - accruals for compulsory social insurance (OSS).

- DT 20 CT 69.2 - at OPS.

- DT 20 CT 69.3 - for compulsory medical insurance.

- DT 20 CT 69.1.1 - for temporary disability and maternity (VNiM).

- DT 20 CT 69.11 (or 69.1.2) - for accidents and occupational diseases (injuries).

The calculation and payment of insurance contributions to the budget is a direct obligation of all Russian employers. Reflection of these transactions is an integral part of payroll accounting and its taxation. Before creating transactions for the transfer of insurance premiums, we will understand the key aspects regarding insurance coverage for employed citizens.

Features of taxation

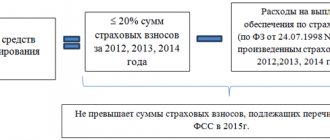

Back in 2021, the insurance coverage of citizens has undergone significant reforms. Thus, the Federal Tax Service became the single administrator of revenues. Let us recall that previously payments for insurance coverage were credited directly to extra-budgetary funds (PF of the Russian Federation, FFOMS, Social Insurance Fund).

Now the main regulatory act regulating the taxation procedure and tariffs for insurance premiums (IC) is Chapter 34 of the Tax Code of the Russian Federation. Generally established tariffs are the same for all economic entities:

- Mandatory pension insurance - 22%.

- Compulsory health insurance - 5.1%.

- Temporary disability and maternity insurance - 2.9%.

IMPORTANT!

In 2021, small businesses have reduced rates of insurance premiums for payments to employees above the minimum wage (102-FZ dated 04/01/2020). The preferential rates are as follows:

- OPS - 10%;

- Compulsory medical insurance - 5%;

- VNiM - 0%.

Read more: “Who is eligible for reduced SV tariffs”

To reflect preferential accruals, the same accounting accounts are used for insurance premiums at regular rates.

Please note that insurance against industrial accidents and occupational diseases (injuries) should be transferred to the Social Insurance Fund. That is, contributions for injuries were not transferred to the jurisdiction of the Federal Tax Service. The amount of payments varies from 0.2 to 8.5% depending on the hazard class of the company’s main activity.

According to the SV, a limit has been set for OPS: in 2021 - 1,465,000 rubles. If the amount of taxable income for an employee exceeds the specified limit, then the tariff is reduced to 10%. For VNiM, an acceptable limit of 966,000 rubles has been approved for 2021. If this limit is exceeded, the rate is reduced to 0%, that is, SV for VNIM does not pay if the limit is exceeded.

ConsultantPlus experts discussed how to correctly fill out a payment form to pay insurance premiums. Use these instructions for free.

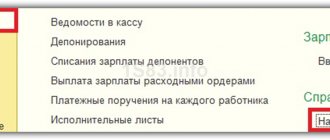

Salary deductions

Deductions from salary reduce the amount of accruals and go through the debit of account 70. As a rule, all employees have one deduction - personal income tax. Here account 70 corresponds with account 68 “Calculations for taxes and fees”, posting:

D70 K68

In postings for other deductions, the credit account changes depending on where it goes. For example, when withholding under a writ of execution in favor of a third party, account 76 “Settlements with various debtors and creditors” is used, posting:

D70 K76

Calculation rules

Insurance coverage is accrued on almost all types of income of workers that they receive as remuneration for their work. For example, contributions for compulsory pension insurance for employees of a budgetary institution are listed (similarly for commerce and non-profit organizations) from the following types of payments:

- salary (official salary or tariff rate);

- incentive and compensation payments (bonuses, additional payments for overtime, night and holiday payments);

- regional and territorial surcharges and coefficients;

- payment for regular labor holidays, educational and other holidays;

- other types of payments (for example, travel allowances, additional payments for part-time work, and others);

- payments under GPC agreements, author's orders, contracts.

But all types of state benefits (sickness, pregnancy and childbirth, one-time payments), financial assistance, unemployment benefits, preferential payments, pensions and similar types of income are completely exempt from SV taxation.

Accounts

All accounting entries for the calculation of insurance premiums are generated in a special accounting account 69 “Calculations for social insurance and security” (Order of the Ministry of Finance No. 94n).

To detail the data for each type of insurance coverage, the chart of accounts provides subaccounts:

- 69.1 - to reflect transactions on social security of citizens (VNiM and NS and PZ);

IMPORTANT!

It is necessary to provide additional analytics for subaccount 69.1, for example:

- 69.1/1 - accruals in favor of VNiM;

- 69.1/2 - data on payments to the Social Insurance Fund in favor of insurance against accidents and occupational diseases.

- 69.2 - for calculating insurance premiums in terms of mandatory insurance;

- 69.3 - information on accrued insurance premiums for compulsory medical insurance.

The credit of these accounting accounts reflects the accrual of SV, and the debit reflects their payment. Thus, the posting, if insurance premiums are accrued to extra-budgetary funds, is DT 20 CT 69.1.

It is worth noting that the employer charges insurance premiums only to the payroll, that is, from the amount of taxable payments and remuneration for labor. No deductions are made from citizens' earnings when calculating SV.

Let us remind you that when creating a reserve for vacations in the budget, it is necessary to provide for similar deductions to the reserve fund: the details of the calculation are in the article “How to calculate the vacation reserve.”

Payroll

Wage expenses are written off against the cost of production or goods, therefore the following accounts correspond to account 70:

- for a manufacturing enterprise - 20 account “Main production” or 23 account “Auxiliary production”, 25 “General production expenses”, 26 “General (administrative) expenses”, 29 “Servicing production and facilities”;

- for a trading enterprise - account 44 “Sales expenses”.

The wiring looks like this:

D20 (44.26,…) K70

This posting is made for the total amount of accrued salary for the month, or for each employee, if accounting on account 70 is organized with analytics for employees.

Typical wiring

Let's consider the key algorithm for calculating CBs and reflecting them in accounting using a specific example.

VESNA LLC is an OSNO company that applies generally established tariffs for insurance coverage for citizens. The contribution rate for injuries is 0.2%. In January 2021, salaries of key personnel were accrued in the amount of 1,000,000 rubles. The accountant recorded the following actions:

| Operation | Debit | Credit | Amount, in rubles | Note |

| Salaries of key personnel accrued | 20 | 70 | 1 000 000,00 | Basis document: salary slips for January |

| Accounting entry if insurance premiums from wages are calculated for temporary disability and maternity | 20 | 69.1/1 | 29 000,00 (1 000 000 × 2,9%) | |

| Accrual of SV on OPS | 20 | 69.2 | 220 000,00 (1 000 000 × 22%) | |

| SV reflected on compulsory medical insurance | 20 | 69.3 | 51 000,00 (1 000 000 × 5,1%) | |

| Accounting entry if contributions are accrued to extra-budgetary funds for injuries (in the Social Insurance Fund) | 20 | 69.1/2 | 2000,00 (1 000 000 × 0,2%) | |

| The money was transferred to the Federal Tax Service and funds: | ||||

| VNiM | 69.1/1 | 51 | 29 000,00 | Basis document: payment orders, extract from a banking organization on the status of the current account |

| OPS | 69.2 | 220 000,00 | ||

| Compulsory medical insurance | 69.3 | 51 000,00 | ||

| NS and PZ | 69.1/2 | 2000,00 | ||

In February 2021, VESNA LLC received from the Federal Tax Service a requirement to pay arrears in the amount of 5,000 rubles and a penalty in the amount of 135.55 rubles. The accountant made the following entries:

| Operation | Debit | Credit | Amount, rub. | A document base |

| Penalty accrued | 99 or 91 (depending on the method specified in the accounting policy) | 69 (according to the corresponding subaccount) | 135,55 | Requirement of the Federal Tax Service |

| Penalty payment reflected | 69 (according to the corresponding subaccount) | 51 | 135,55 | Payment order |

| Arrears accrued | 20 - if the arrears were accrued for the current year; 91.2 - if the arrears were billed for previous reporting periods | 69 (according to the corresponding subaccount) | 5000,00 | Requirement of the Federal Tax Service |

| Payment of arrears | 69 (sub-account) | 51 | 5000,00 | Payment order |

IMPORTANT!

Fix the method of reflecting penalties in accounting in your accounting policy. It is permissible to assign penalties to 91 or 99 accounts. We talked about which account to choose in the article “Tax Penalties: Postings”.

Penalties for late insurance payments, fines

All insurance payments must be made on time and in full, since penalties and fines are assessed for violation of the order. The collected amounts must be repaid along with the unpaid amounts. The amount of the penalty is determined as a percentage of the amount of insurance contributions that need to be paid: CxDxSRx1/300, where C is the amount of overdue contributions, D is days of delay, SR is 11% (refinancing rate). In case of violations, amounts that were not received due to the seizure of property or the suspension of banking operations as a result of a court decision are not taken into account.

The penalty cannot relate to the past billing period. Usually it is paid by debtors voluntarily. In individual cases, regulatory services may issue demands for debt repayment or take an extreme measure - to collect the arrears through a collection order, bailiffs or the court. Fines are provided for late registration in funds, submission of reports not in the form or not on time.

The amount of the fine can be reduced if there are valid reasons provided for by Federal Law No. 212, Art. 44, paragraph 1. These include difficult personal circumstances and a difficult financial situation. The possibility of reducing the fine is considered by the court or the territorial body of the fund.

Example #1. Calculation of penalties and preparation of transactions

Strela LLC paid insurance premiums for May 2021 on June 17 of this year. Since deductions had to be made no later than June 15, 2016, in this case the delay is only 1 day, and the amount of debt is 3 thousand rubles. The late fee is calculated according to the formula CxDxSRx1/300. The refinancing rate at this time is 11%. Thus, it turns out: 3000*1*11*1/300=110. The total amount (fine) is 110 rubles. The calculations take into account all changes in the refinancing rate. From here the corresponding account assignments are compiled:

- Contributions in the amount of 3 thousand rubles were assessed: D20, K 69.

- A late fee of 110 rubles was charged: D 91, K 69.

- The debt on insurance premiums is listed: D 69, K 51.

- Penalty paid: D 69, K 51.

Example #2. Calculation of contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund, preparation of transactions

For May, employees were paid salaries, the total amount of which is 281,555 rubles. The calculation of insurance contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund is made taking into account the tariffs as follows. For the Pension Fund: 281555x22%=61942.1. For FFOMS: 281555x5.1%=14359.3. Here's a description of the wiring:

| Description | Calculation of deductions | Debit | Credit |

| Contributions to the Pension Fund have been accrued. | 61942.1 | 20.01 | 69.2 |

| Contributions to the FFOMS have been accrued. | 14359.3 | 20.01 | 69.3 |

| Contributions paid (PFR) | 61942.1 | 69.2 | 51 |

| Contributions have been paid (FFOMS). | 14359.3 | 69.3 | 51 |

Insurance for individual entrepreneurs

Insurance coverage for individual entrepreneurs (in relation to themselves) differs significantly from the norms provided for employers. So, for 2021, a businessman is obliged to transfer fixed payments to the budget:

- 32,448 rubles - for OPS;

- 8426 rubles - for compulsory medical insurance.

However, if his income exceeds 300,000 rubles per year, then from the excess amount he will have to additionally transfer 1% to the Federal Tax Service for compulsory pension insurance. More information about mandatory payments of individual entrepreneurs for themselves: Individual entrepreneurs: insurance premiums in 2021.

How to make postings? If the individual entrepreneur does not resort to hiring employees, then there is no need to reflect the accrual of insurance premiums. Small businesses are exempt from the obligation to maintain accounting records according to general rules. SMEs have the right to keep simplified, complete, or completely abandon accounting. Therefore, it is not necessary to reflect the SV with postings.

However, if the individual entrepreneur decided to conduct accounting according to generally accepted standards and consolidated such a decision in his accounting policy, then the accrual of fixed payments to the individual entrepreneur is reflected in the accounting using account 69 and the corresponding subaccount to it.

Results

Attribute insurance premiums to cost accounting accounts 20,23,25,26,44, etc. To break down insurance premiums by type, use account 69 and various subaccounts. When transferring contributions to the budget, record the posting Dt 69 (for subaccounts) Kt 51. If during the reporting period there was sick leave paid for from the Social Insurance Fund, reflect it with the posting Dt 69 Kt 70.

Sources:

- tax code

- Law “On the Fund’s Budget...” dated December 2, 2019 No. 384-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.