Control ratios 6-NDFL and 2-NDFL for 2021 are a separate way to check tax reporting. Officials have provided a special algorithm for reconciling income tax reporting forms. If the Federal Tax Service inspector finds discrepancies, the company is obliged to correct the error or provide explanations.

All tax agents are required to provide two key reporting forms to the Federal Tax Service:

- 2-NDFL “Certificate of income of an individual” - annual report;

- 6-NDFL “Calculation of the amounts of personal income tax calculated and withheld by the tax agent” - quarterly form.

Individual indicators of the reporting forms must match. Back in 2021, the Federal Inspectorate approved four types of inspections: intraform reconciliations and inter-documentary controls, that is, carried out between different reporting forms. The control ratio of 6-NDFL and 2-NDFL for 2021 has been updated. Let's take a closer look at the new reconciliation rules.

How the tax office checks the report

When a completed report is received from an enterprise, the tax office checks it for compliance with the control indicators. The legislation provides for a procedure for checking reports, identifying inconsistencies and an algorithm for issuing requirements and applying penalties. Taxpayers have access to all information on the taxpayer, all reports are consolidated in the taxpayer’s card. Therefore, an organization should take care of such a procedure as checking 2-NDFL before submitting a tax and income tax return, since then it will not be possible to “adjust” the information. Inspectors check received reports for two types of deficiencies:

- Errors inside the report are errors associated with incorrectly specified values in the columns of the report, that is, the relationship between the lines is not satisfied (such errors are found by special accounting programs).

- Lack of necessary relationships between values in three documents: 2-NDFL, 6-NDFL and income tax return (such errors can only be detected manually).

If errors are identified, the inspector requests an explanation of the information from the accountant. If a response to the request is not sent, the tax office may order an audit. During the audit, the organization will be required to provide originals of all documentation used to complete the report to confirm the accuracy of the information. To relieve all accounting personnel from such worries, it is recommended to independently take actions such as checking 6-NDFL, and if an error is discovered by the organization, immediately provide clarification. When filling out, you need to focus on typical errors, including typos, since a typo is considered as unreliable information, even when it is obvious as a technical error.

Detailed analysis of personal income tax for an employee

The report allows you to view all information on the selected employee:

- Accrued and paid income;

- Deductions applied;

- Tax base;

- Accrued, withheld, transferred personal income tax and tax debt.

The report is generated indicating the primary documents, broken down by accrual months.

Source:

Accounting Without Worries

Heading:

6-NDFL

- Olga Kruglova

Sign up 7800

9750 ₽

–20%

How to check form 6-NDFL before submitting it to the tax office

Before sending 6-NDFL to the inspector, you should check it for compliance with the form of the report form and the electronic format, as well as for the correctness of completion and accuracy of the indicated indicators in the sections of the report. The control ratios developed and established by law, which were developed by the tax authorities themselves, will help to verify the correctness of the calculations. These indicators will help you detect inconsistencies in the form of simple typos and analyze whether the report has been compiled correctly. The first section of 6-NDFL contains all the information on the enterprise on a cumulative basis for all previous quarters from the beginning of the year, including the current one, and the second section contains information only for the current quarter. The sections perform different functions, so they do not correspond with each other. Therefore, to the assumption: should the amount of accrued income from section 1 of the 6-NDFL report go with the total amount from section 2, the answer is negative. No control relationships between sections can be established.

Results

Knowledge of the control ratios used by the Federal Tax Service when checking 6-NDFL reports will allow the compiler of this form, already at the stage of its preparation, to check the parameters that the tax authorities will focus on during control.

This will reduce the risks of identifying inconsistencies in reporting, the need to provide explanations for them and submit updated reports. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

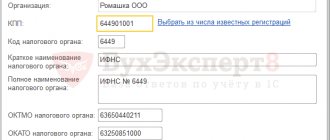

Checking the title page

To begin with, it is recommended to perform such a simple operation as checking that 6-NDFL is filled out correctly on the title page, then we check both parts of the report. The first sheet contains basic information about the company (name with explanation, codes, address, telephone, etc.); information about the inspection where the enterprise is registered. A separate report is generated and submitted for each branch of the enterprise, where the codes of the corresponding enterprise are indicated; a personal report is provided for the parent company. In accordance with the new changes made to the rules for filling out the title page of personal income tax-6, two lines have been allocated specifically for assignees and three codes have been added for the place of submission of the report. For the initial version of the report, the adjustment code is indicated as 000, and for adjustments - from 1 and successively further, for example, 003. Some employers mistakenly assign code 001 to the initial report.

What will the tax office do?

If control ratio No. 1.1 is not met - when it is established that the calculation was not submitted within the prescribed period - an act is drawn up in accordance with Art. 101.4 of the Tax Code of the Russian Federation for making a decision on bringing to responsibility in accordance with clause 1.2 of Art. 126 Tax Code of the Russian Federation

In case of failure to comply with the remaining KS, inspection in accordance with clause 3 of Art. 88 of the Tax Code of the Russian Federation will send a written notification of identified errors, contradictions, and inconsistencies with the requirement to provide the necessary explanations within 5 days or make appropriate corrections within the prescribed period.

If, after considering the provided explanations and documents, or in the absence of explanations, a violation is established, an inspection report will be drawn up in accordance with Art. 100 Tax Code of the Russian Federation.

Checking the first section

The first section should indicate the totals for all previous tax periods for all individuals to whom the company paid money. If an enterprise paid income taxed at different rates for the past reporting period, it will be required to provide the completed first part of the report for each rate on a separate sheet. If personal income tax was calculated at the rates: 13, 15, 30, 35%, then in lines 10 to 50 the manager or accountant of the enterprise enters information in each section number 1, and lines from 60 to 90 - only on page 1 of this first section. If all payments were made based on the tax rate, for example, 13%, then the organization draws up one first section, filling out all lines from 10 to 90.

Personal income tax analysis by month

The group of reports “Personal Income Tax Analysis by Month” allows you to compare calculated, withheld and transferred personal income tax, analyze the tax base and applied deductions. The report is presented in a complete and simplified version, as well as with details of the months of the tax period and the months of mutual settlements with employees.

The simplified version contains summary information on the indicators.

To detail records by employee, check the “Detail by employee” checkbox. A section of the same name will be added to the report.

The second version of the “Analysis by Month” report displays the same information, but in a slightly different interface.

The report “Analysis of personal income tax by months of the tax period and months of mutual settlements with employees” has added additional settings and selections. The user can specify:

- period of income;

- settlement period;

- organization and branch;

- Inspectorate of the Federal Tax Service.

Amounts in this report, as in all other reports, can be drilled down by right-clicking and selecting an option to drill down. For example, by the “Registrar” field, i.e. according to the document.

Checking the second section

The design of the second section is more difficult than the first. It is very important not to make mistakes with dates and amounts. The second section consists of identical blocks for placing information on dates and amounts with lines from 100 to 140. To reliably fill out the second section, you must indicate the dates correctly. To accurately enter information, you need to prepare documentation, from which you can highlight:

- Date of actual receipt of income. This date is not the date when money is issued to an individual. This refers to the date of accrual of income (for salary, for example, this is the last day of the month).

- The date of personal income tax withholding from this income. This is the number of tax withholding from income, and not the number of the payment order for the transfer of tax.

- The last day of the period when the organization was obliged to transfer the personal income tax withheld from this income to the budget.

If these three numbers are the same, then the accountant groups the information and indicates it in one block of lines from 100 to 140. If the dates differ, the blocks are filled out individually for each date, and the number of blocks corresponds to the number of date options.

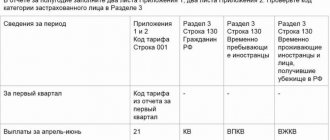

Interdocumentary KS

When comparing the values indicated in the calculation with the indicators reflected in the NA KRSB, attention will be paid to the compliance of the following ratios:

- line 070 – line 090 >= KRSB data (personal income tax paid since the beginning of the tax period);

- date on line 120 >= date of transfer according to KRSB NA data (date of payment of the personal income tax amount).

If the difference between the total amount of personal income tax withheld at all rates (page 070 of the calculation) and the total amount of tax returned by the tax agent to taxpayers in accordance with Art. 231 of the Tax Code of the Russian Federation (p. 090 of the calculation), it turns out to be less than the data of the CRSB NA (personal income tax paid from the beginning of the tax period), then it is possible that not the entire amount of personal income tax was transferred to the budget .

If the date on line 120 is less than the date of payment of the personal income tax amount on line 140 (information on transfers according to KRSB NA), then the deadline for transferring the withheld personal income tax amount may be violated . This control ratio was discussed in detail earlier.

In Sect. 3 shows the relationship between the calculation, information on Form 2-NDFL and the income tax return. They apply to the annual form 6-NDFL. There is still a whole year before such a report is submitted. In addition, the developers’ promises to simplify the calculation and its verification may come true, so let’s not get ahead of ourselves and leave this section for analysis at a later date.

Regarding Sect. 4 (last), then it shows the control ratio of the calculation indicators and the document related to external sources. As already noted, we are talking about the journal “Patent for Foreign Citizens” (in the Letter under comment the abbreviated name of this document is “IR Patent”). This journal is maintained in order to implement the provisions of paragraph 6 of Art. 227.1, which establishes the specifics of calculating personal income tax and filing a tax return for certain categories of foreign citizens engaged in paid labor activities in the Russian Federation.

The journal is maintained on the basis of:

- information from applications confirming the right to reduce the calculated amount of personal income tax by the amount of fixed advance payments paid by the taxpayer;

- information received from the territorial bodies of the Federal Migration Service of Russia about the fact that a tax agent has concluded an employment contract with a taxpayer or a civil contract for the performance of work (rendering services) and the issuance of a patent to the taxpayer.

The responsibility for maintaining such a journal is assigned to employees of territorial tax inspectorates.

The journal reflects the information contained in the statements submitted by tax agents (on paper and in electronic form).

As the journal is filled out, the tax authorities form a database of applications from tax agents who applied to the tax inspectorates for confirmation of the right to reduce the calculated amount of personal income tax by the amount of fixed advance payments paid by the taxpayer, and taxpayers in respect of whom notifications were issued to tax agents.

The sum of fixed advance payments generalized for all individuals, accepted to reduce the amount of calculated tax from the beginning of the tax period on the basis of notifications, is indicated on line 050 of the calculation.

If the tax agent has a notification, the value of the indicator on line 050 of the calculation must be greater than zero . If the tax inspectorate in the journal (IR Patent) does not have information about issued notifications, and in the calculation the value of the indicator on line 050 is greater than zero (line 050 > 0), the tax inspectorate, when checking the calculation, will regard such a discrepancy as an unlawful reduction in the amount of calculated tax by the amount of fixed advance payments.

In order to eliminate the contradiction, the tax inspectorate will send a written notification to the tax agent about errors (inconsistencies) identified during the desk audit and will require the necessary explanations or correction of the calculation. If the fact of violation of tax legislation is confirmed, a report will be drawn up within 10 days.

The tax audit report, as well as written objections submitted by the person being inspected must be considered by the head (deputy head) of the tax inspectorate that conducted the tax audit, and a decision on them must be made within 10 days from the date of expiration of the period specified in clause 6 of Art. . 100 Tax Code of the Russian Federation.

Connecting control ratios

You can carry out such work as checking whether the calculation of 6-NDFL is correct using control ratios. Control ratios are a sequence of mathematical calculations between certain lines that must coincide with other report indicators, that is, all calculations encrypted in the report lines must, when crossed, give the corresponding results. The organization is not obliged to check the control ratios of 6-NDFL (for the 3rd quarter of 2021, by the way, they will probably differ compared to the 1st quarter of the same year). This procedure is advisory in nature to eliminate elementary errors in the report made by the accountant. Some new accounting programs already include an option such as “check form 6-NDFL”, that is, automatic verification of information entered in the lines of the report for compliance with control ratios. As a result of the analysis, the program offers options for adjusting the data. However, it is recommended to take such a step as checking 6-NDFL yourself, recalculating several or all control ratios manually on a calculator - this will protect the accountant from making adjustments. The letter from the tax service contains twelve points of those indicators, the discrepancy of which will cause additional clarifications from the tax authorities. Here are some of them:

- the actual date of filing 6-NDFL coincides with the date indicated on the title page of the report;

- the calculated value of total income indicated in line 20 must be no less than the value of total deductions on line 30;

- the value of line 40 must correspond to the result of the following operations: the difference between lines 20 and 30 *line 10/100;

- the value from line 40 must be no less than the value from line 50;

- the total amount contributed to the budget must be no less than the delta between the amount of personal income tax actually withheld (line 70) and the value of line 90 (refund to the payer) of the tax.

Returning to the question of how to check 6-NDFL, we will give an example of changes in control ratios. In previous editions of the letters, it was recommended to use 6-NDFL as a control ratio for checking: line 070 should be equal to the sum of lines 140. Let us recall that in line 70 the enterprise informs how much it withheld personal income tax, in line 140 - the same tax with distribution by dates of payment of all types of remuneration. Then the tax authorities changed their minds and admit that this control ratio is not always valid. An exception to the previously proposed ratio was the transfer of actual payments in the quarter following the accrual, for example, of wages. Therefore, some amounts do not fall into line 140 in the second part of the report. There is no violation of the law in this case: one quarter ends, the report is closed, and salaries are paid in the next quarter. Hence the discrepancy in the results according to the verification formula previously proposed by the tax authorities. Based on the assumption that some organizations calculate and pay salaries according to this scheme, the Federal Tax Service excluded this control ratio from the list of mandatory ones. The department confirmed on its official website that this ratio is not mandatory. Therefore, in order to perform such an operation as checking 6-NDFL for 2021 (for any reporting period of this year), there is no need to apply this control ratio. If the accountant nevertheless decides to conduct a more pedantic study of the report being prepared for submission, we remind you that the difference in the values of the highlighted lines is the amount of the actual payment of remuneration on which tax was accrued in the current reporting period, and the payment will be made in the next quarter.

Deadlines for transferring personal income tax

Responding to the tax agent’s request, the drafters of the Letter indicated that according to line 120 of section. 2 “Tax payment deadline” should indicate the date in accordance with the provisions of clause 6 of Art. 226 and paragraph 9 of Art. 226.1 of the Tax Code of the Russian Federation, no later than which the amount of personal income tax must be transferred. Well, as they say, “brevity is the sister of talent.” But the Russian writer who wrote this phrase drew the attention of the brother to whom this recommendation was addressed to the fact that this rule should be used to argue the content where there is freethinking (when writing a play, for example). And there should be no freethinking in the interpretation of the Tax Code of the Russian Federation. The meaning of the answer lies in its content. And in order to be understood, I would like the officials who make up the answers to be more verbose.

Well, since there are no specifics in the answer, let’s turn to the specified norms of the Code.

As follows from paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to transfer the amounts of calculated and withheld personal income tax no later than the day following the day the income is paid to the taxpayer .

For many taxpayers, the main type of income is wages. The date of actual receipt by the taxpayer of income in the form of wages in accordance with clause 2 of Art. 223 of the Tax Code of the Russian Federation recognizes the last day of the month for which income was accrued for fulfilled labor duties in accordance with the employment agreement (contract).

In accordance with paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, the tax agent is obliged to withhold the accrued amount of personal income tax directly from the taxpayer’s income upon their actual payment, taking into account the features established by clause 4 of Art. 226 of the Code.

Thus, the tax agent is obliged to transfer personal income tax to the budget no later than the day following the day the income is paid to the taxpayer. This day should be reflected in line 120 of section. 2 as the tax payment deadline . When paying wages for the first half of the month (advance), personal income tax does not need to be withheld. The tax agent calculates the amount of personal income tax on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income for which a tax rate of 13% is applied (clause 1 of Article 224 of the Tax Code of the Russian Federation). In this case, the amount of tax withheld in previous months of the current tax period is offset. And before the end of the month, income in the form of wages cannot be considered received by the taxpayer. Therefore, personal income tax cannot be calculated before the end of the month (Letters of the Ministry of Finance of Russia dated April 10, 2015 N 03-04-06/20406, Federal Tax Service of Russia dated January 15, 2016 N BS-4-11/320).

Example. The terms of the collective agreement provide for the payment of wages on the 3rd and 18th. For the first half of the month, the advance payment is paid on the 18th, and the final payment for the past month is paid on the 3rd of the next month. It is this date, the 3rd date, that should be reflected on line 120 of section. 2 as the tax payment deadline.

If the employment relationship is terminated before the end of the calendar month, the date of actual receipt by the taxpayer of income in the form of wages is considered to be the last day of work for which the income was accrued to him (clause 2 of Article 223 of the Tax Code of the Russian Federation). This means that personal income tax in this case must be transferred no later than the day following the last day of work .

Tax inspectorates distribute information about received amounts of taxes and fees to the “Settlements with the Budget” (CRSB) cards in accordance with the dates and details specified by the taxpayer in the payment order for the payment of taxes (fees). And discrepancies in the dates indicated in the calculation in Form 6-NDFL and in the tax agent’s KRSB (KRSB NA) may indicate a violation of the tax payment deadline. We’ll tell you a little later how tax inspectors will check the relationship between this and other information between documents and within the calculation form itself.

In the meantime, let's return to the deadlines for transferring personal income tax.

As can be seen from the previous explanations, the rules on the timing of personal income tax transfers are applied in conjunction with the rules for determining the date of actual receipt of income established by Art. 223 Tax Code of the Russian Federation.

In addition to income from employment, which was mentioned earlier, individuals can receive other types of income. For example, this may be income in the form of material benefits generated from savings on interest on borrowed funds (Article 212 of the Tax Code of the Russian Federation). In this case, the date of actual receipt of income is considered to be the last day of each month during the period for which the borrowed (credit) funds were provided. This means that the deadline for paying personal income tax on such income must be no later than the first day of the month following the month in which the income was received .

If income in the form of material benefits is received from the acquisition of goods (work, services) in accordance with a civil contract from individuals, organizations and individual entrepreneurs who are interdependent in relation to the taxpayer, then the date of receipt of the income is considered to be the date of acquisition of goods (work, services) ) (Clause 3, Clause 1, Article 223 of the Tax Code of the Russian Federation). No later than the day following this date, the deadline for paying personal income tax should be determined.

The same can be said about the deadline for transferring personal income tax on material benefits received from the acquisition of securities. But if the acquired securities are paid for after the transfer of ownership of them to the taxpayer, then the date of actual receipt of income is determined as the day the corresponding payment is made to pay for the cost of the acquired securities (clause 3, clause 1, article 223 of the Tax Code of the Russian Federation).

As for business trips, the date of receipt of income when calculating personal income tax is considered to be the last day of the month in which the advance report is approved after the employee returns from a business trip (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Income subject to personal income tax may arise when paying daily allowances in excess of the established norms (700 rubles per day on a business trip in Russia and 2,500 rubles per day on a business trip abroad). Personal income tax must be withheld from compensation for undocumented expenses for accommodation on a business trip in excess of the same norms. In this case, income is also determined on the last day of the month in which the advance report is approved. The next day will be the deadline for tax payment.

From January 1, 2021, new rules apply to amounts of vacation pay and amounts of temporary disability benefits (including benefits for caring for a sick child). withheld from these incomes must be transferred to the budget no later than the last day of the month in which they were paid . For example, if the vacation was paid on February 26, 2021, personal income tax on vacation pay must be transferred to the budget no later than February 29.

The day of personal income tax transfer may fall on a weekend or non-working holiday. In this case, the payment deadline is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

If we return to the conditions of the previously considered example, we will see that the deadline for payment of wages (3rd day) for April 2016 falls on a non-working day - May 3rd. In this case, the payment deadline is postponed to May 4.

If for different types of income that have the same date of their actual receipt, there are different deadlines for tax remittance, then lines 100–140 of the calculation are filled in for each tax remittance deadline separately .

We compare 6-NDFL for the year with 2-NDFL and profit declaration

We looked at how to check 6-personal income tax for 9 months, 3 and 6 months using the example of using control ratios along the lines of two parts inside the report. Here's how to check the 6-NDFL report for the year - it is recommended to use additional tools. As a result of checking, the values of some lines of the 6-NDFL annual report must definitely correlate with the information provided by the organization in the 2-NDFL certificate and profit declaration for the same period. Tax inspectors use the following control ratios to check the submitted report:

- the value of line 20 (total accrued income) is equal to the amount according to the declared 2-NDFL certificates and the amount in line 20 of the second appendix in the profit declaration;

- the value of line 25 (total dividends accrued) must be equal to the amount according to the declared 2-NDFL certificates and according to code 1010 correspond to Appendix 2 of the declaration;

- line 40 (calculated tax) coincides in value with line 30 of the second appendix of the declaration and with the amount of calculated tax according to the declared 2-NDFL certificates;

- the withheld tax in line 80 corresponds to line 34 of the declaration in Appendix 2 of the declaration and the amount of unwithheld tax according to the declared 2-NDFL certificates;

- the number of individuals who received payments from the enterprise is equal to the number of 2-NDFL certificates and the number of annexes No. 2 prepared for the declaration.

Comparing a report with other data

This group (4) includes KS 4.1, according to which the amount of a fixed advance payment (p. 050) cannot remain unspecified if there is a document (patent) issued to the reporting person obliging him to pay such a payment (clause 6 of Article 227.1 of the Tax Code of the Russian Federation ). Tax agents to whom taxpayers working under a patent have submitted a notification confirming the right to reduce the calculated amount of personal income tax by the amount of fixed advance payments paid by the taxpayer must enter data in this line in Form 6-NDFL.

If page 050 is completed, but there is no information about the issuance of a patent in the Federal Tax Service, then the amount of tax accrued for payment turns out to be illegally underestimated.

In addition, tax authorities compare the amounts in lines 020 and 025 with line 050 “Base for calculating insurance premiums” of Section 1 of Subsection 1.1 based on contributions. This is provided for by the control ratios to the ERSV (letter of the Federal Tax Service dated December 29, 2017 No. GD-4-11 / [email protected] )/. If the income under 6-NDFL is less than the contribution base, the taxpayer will be obliged to explain this.

Fines

The deadlines for submitting the 6-NDFL report are established by law, and it is not recommended to violate them, otherwise, penalties will be imposed on the company. For failure to submit reports, in addition to a fine of 1,000 rubles for each month of delay, the organization faces the possibility that the company's current account will be completely blocked and unblocked only after the report is submitted. It seems possible to avoid penalties if the organization independently corrects errors and submits clarifications before the inspector identifies the inaccuracies. For submitting a report containing errors, the organization will be fined, and the tax office will require clarification.

How to fill out 6‑NDFL: answers to popular questions

Close Every year the SKB Kontur company holds a competition for entrepreneurs, hundreds of businessmen from different cities of Russia take part in it - from Kaliningrad to Vladivostok. To start, you need some prerequisites: an idea, some money and, most importantly, the desire to start Fred DeLuca Founder of Subway

Issue No. 30 Alexey Krainev July 14 Despite the fact that form 6-NDFL is quite simple - it has only two sections, many questions arise about the order of filling it out and submitting it in various life situations, for example, when reflecting the payments of a resigning employee.

Through the competition, we have created an inspiring collection of business stories told by people who are turning small start-ups into successful companies. Their experience and advice will be useful to anyone who is thinking about starting their own business.

Filling out the RSV

The calculation of insurance premiums looks much more voluminous due to the many appendices to the sections, of which, in fact, there are only three. Everyone fills out the title, section 1 (summary data on accrued contributions), appendix 1 to the first section (in terms of subsections 1.1 - pension insurance and 1.2 - health insurance), appendix 2 (FSS in terms of disability and maternity benefits), section 3.

Important! When submitting a clarifying (corrective) DAM, where Section 3 is not affected, the latter is not included in the calculation. Check programs may indicate a possible error, but in this case there will not be one.

The remaining applications are included in the reporting provided that there are appropriate indicators: additional or preferential rates, sick leave, etc. Let's go through the main sections.

Section 1

For each type of contribution there is a separate block of information containing the following information:

- KBK.

- The amount payable (i.e. accrued!) cumulatively from the beginning of the year (cumulative total).

- Amounts for the last three months of the period (monthly).

A common error is a discrepancy between the data in the first section and those calculated in the third for individual employees (in aggregate for all). This is the result of rounding and the peculiarities of accounting programs. Paragraph 1 of Article 431 of the Tax Code of the Russian Federation states that the calculation is carried out on an accrual basis from the beginning of the year.

Example: when calculating contributions to compulsory pension insurance for May 2020, we take the base for the period January-May inclusive, multiply by the tariff, from the resulting result we subtract the contributions calculated for January, February, March and April, and get the amount for May.

When filling out the DAM both automatically and manually, sometimes a situation arises when the control ratios will not be met. For example, you calculated contributions by simply multiplying the current month’s accruals by the tariff, without using the cumulative method, a difference of one kopeck will formally become a reason for refusing to accept the report (paragraph 2 of paragraph 7 of Article 431 of the Tax Code).

Subsections 1.1 and 1.2

Calculation of contributions to compulsory pension insurance from the beginning of the year and for the last three months. Here it is indicated:

- number of insured persons (note that the actual number of employees is not taken as the average value);

- accrued income;

- income that is not subject to taxation and deductions (they concern few people - these are expenses for rights to the results of intellectual activity, licenses, etc.);

- taxable base.

The breakdown is also made in terms of the maximum value of the annual base (and contributions) and excess. Limit values in 2020 according to Decree No. 1407 of November 6, 2019:

- According to the Social Insurance Fund – 912000.

- According to OPS – 1292000.

By the way! There are no limits set for contributions to the Compulsory Health Insurance Fund.

Subsection 1.2 is filled out similarly, but without breakdown by maximum base and excess.

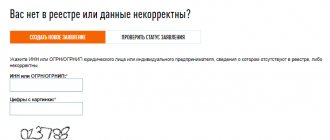

Section 3

Filled out according to the data of employees or workers under the GPC agreement. Personal data of an individual will be required:

- TIN

- SNILS.

- Passport data (number, series).

- FULL NAME.

- Date of Birth.

- Floor.

- Citizenship.

Very often, when concluding a contract or provision of services, they forget to receive information to fill out the calculation. If you have any doubts or there is not enough data, check them using the Federal Tax Service website and your personal account.

You can find out the TIN by following this link, and send a request to check the TIN, full name, SNILS of working persons in electronic form from the personal account of a legal entity or individual entrepreneur (see screenshot).

Next, section 3 calculates the taxable base and the payments themselves for the last three months. In the line “category code of the insured person” there will most often be an NR - these are ordinary workers (including those under GPC contracts) or VZHNR - foreign workers (without special features). The remaining codes are indicated in Appendix 7 to the instructions for filling out the form.