Organizations are no longer required to have round seals: let's look into the details

Several years ago, legislation required organizations to have round seals indicating their name and location. But in April 2015, Federal Law No. 82-FZ dated 04/06/15 came into force, which removed such an obligation and made the use of seals the right of JSCs and LLCs. The laws on LLCs and JSCs now use the following wording:

The Company has the right to have a seal, stamps and forms with its name, its own emblem, as well as a trademark registered in the prescribed manner and other means of individualization. Federal law may provide for the obligation of a company to use a seal. Information about the presence of a seal must be contained in the company’s charter (clause 7, article 2 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”, clause 5 of Article 2 of the Federal Law of 02/08/98 No. 14-FZ “On limited liability companies").

LLC seal requirements

Are you thinking about what kind of seal is needed for an LLC and what documents are needed to order an LLC seal? We answer: there are no legislative restrictions, you only need a state registration certificate.

There is no official record of seals of commercial structures, so there is no need to register the seal of an LLC with the tax office.

The seal usually contains:

- full name of the company in Russian indicating the organizational and legal form;

- location;

- state registration number.

The corner stamp must also include a business address and telephone number. If desired, you can add the company name in a foreign language and a registered trademark.

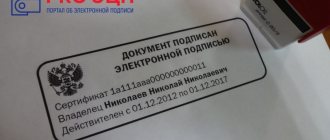

Manufacturers offer many methods of protection against counterfeiting, but so far none of them guarantee 100% security, so it is safer to use an electronic digital signature. This is what we do at Finguru, so that the accountant does not have to distract the client for each signature.

Find out how much smartphone accounting costs for your business!

Let's highlight a few key points.

1) Now organizations have the right, but are not required, to have a seal. In other words, management can decide for itself whether the society needs a seal. 2) Information about the presence of a seal must be contained in the charter. The charter must state that the organization has a seal. 3) A seal is equated to a means of individualization. A seal is only a means of individualizing an organization (the same as an emblem or a trademark). And it can be anything (not necessarily round). 4) Certain laws may provide for cases where an organization is required to use a seal. At the level of federal legislation, there may still be cases where a seal cannot be avoided.

What about IP seals?

The legislation of the Russian Federation does not oblige individual entrepreneurs to have a seal. Entrepreneurs still decide on their own how to make and use a seal.

Can an individual entrepreneur work without a seal?

Yes. When signing documents, just sign and add the note B.p. - No stamp.

Some contractors insist on having a seal, because... if it goes to court, it will be easier to prove that the signature on the document was not forged. If there is no seal, you may be asked for a letter stating that it is not used. It can be compiled in free form, for example: “I inform you that I, IP Sidorov Konstantin Petrovich, do not use a seal in my activities, since the corresponding obligation is not established by law. From the moment of registration, I certify all documents related to my business activities with my personal signature.”

Important! If you have a seal, you should always have it on hand and put it on all documents you sign.

When can a stamp be affixed (if available)

Many laws directly indicated that when making certain transactions, affixing a seal is mandatory. But since having a seal is not necessary, these laws have been adjusted. And they provided for in which cases the seal impression should be affixed only if it is available. We have summarized the list of such laws in the table.

| Name of the law | Stamping |

| Labor Code of the Russian Federation (Article 230). | The seal (if any) must be used to certify the report of an industrial accident. |

| Arbitration Procedural Code of the Russian Federation (Part 5, Article 61). | A power of attorney on behalf of the organization must be signed by its head or other authorized person and affixed with the organization’s seal (if any). |

| Civil Procedure Code (Part 3 of Article 53 of the Code of Civil Procedure of the Russian Federation). | A power of attorney on behalf of an organization is issued signed by its head or other authorized person, sealed by the seal of this organization (if any). |

| Civil Code (paragraph 9, clause 1, article 913 of the Civil Code of the Russian Federation). | To issue a double warehouse receipt, you must use a seal (if available). |

| Federal Law of December 26, 2008 No. 294-FZ “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control” (Part 10, Article 16). | The audit log must be stitched, numbered and certified by the seal of a legal entity or individual entrepreneur (if any). |

| Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” (Part 2, Article 54). | A power of attorney issued on behalf of an organization to another person must be signed by the head or another authorized person and affixed with the seal of the organization (if any). |

| Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate” (Part 9, Article 18). | When submitting copies of constituent documents to the registration authority, they must be certified by the seal of the legal entity (if any). |

| Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products” (subclause 5, clause 1, article 10.2). | The release (sale) of ethyl alcohol is carried out if the purchasing organization has a copy of the notice of advance payment of excise duty certified by the signature of the head and seal (if any) with a mark from the tax authority at the place of registration of the buyer of alcohol. |

| Federal Law of July 16, 1998 No. 102-FZ “On Mortgage (Pledge of Real Estate)” (paragraph 6, paragraph 1, article 17, paragraph 2, article 25). | The seal (if any) must be certified by:

|

| Federal Law of April 22, 1996 No. 39-FZ “On the Securities Market” (clause 1 of article 17, paragraph 11 of part 4 of article 18, clause 10 of article 27.5-3). | The seal (if any) must be certified by:

|

| Federal Law of December 21, 2001 No. 178-FZ “On the privatization of state and municipal property” (paragraph 4, paragraph 1, paragraph 1, paragraph 2, article 16). | The seal (if any) must be certified by:

|

| Federal Law of November 27, 2010 No. 311-FZ “On customs regulation in the Russian Federation” (clause 6, part 3, article 90) | The seal (if any) must be affixed: to a copy of the auditor's report on the reliability of the financial statements attached to the application for inclusion in the register of authorized economic operators |

| Federal Law of 04/05/13 No. 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” (Art. Art., ). | The stamp (if any) must be affixed:

|

Mandatory information in the employment contract

The contract must contain a reference to the place and date of its conclusion, as well as information that accurately identifies the parties. When applying for a job, a citizen represents:

- FULL NAME;

- passport details;

- TIN;

- pension insurance certificate number.

The hiring company provides the following details:

- exact name;

- TIN;

- number of the signatory’s power of attorney or a link to the relevant clause of the organization’s charter.

Attention! All of the above data is written at the beginning of the contract or on the last page, next to the signatures. If the employer is an individual, then his details are filled out in the same way as those required from the employee.

Article 57 of the Code also contains a number of mandatory and additional clauses that are included in the employment contract:

| Essential conditions | Additional terms |

| Description of the place of performance of official duties, its location | Specification of data about the structural unit |

| List of labor functions, operating mode | Availability of probationary period and its duration |

| Start and end date (for urgent work) of the contract | Obligations of non-disclosure of information received in the service |

| Salary calculation procedure | Opportunity for training, advanced training at the expense of the employer, obligations associated with such training |

| Guarantees for specialists involved in hazardous and hazardous industries | Additional social benefits, compensation and incentives |

| Conditions and nature of work | Non-state pension provision |

| Clauses on compulsory social insurance indicating the amount of contributions | Information about additional insurance programs implemented at the expense of the employer |

The parties have the right to stipulate other conditions not prohibited by law. At the same time, mandatory clauses must be fulfilled, even if they are not specified in the contract.

If there is a seal, you need to use it

It follows from the law that if there is a seal, it must be affixed. After all, legislators did not provide that the seal is affixed “at discretion” or “at will.” This means that if an organization has a seal, then it needs to be used. And even if the company was created before the seal became optional, it is better not to rush to destroy it. It is possible that government agencies may require a seal on documents, citing the fact that such an organization must have a seal.

Clerk's cheat sheet

| Stamp on a document: which one to put? |

According to the methodological recommendations for the implementation of GOST R 6.30–3003, a seal is a mechanical device, a device containing a printing block for subsequent imprinting on paper.

The seal on the document gives it legal force and certifies the authenticity of the official’s signature.

In GOST R 6.30–2003, the name of the attribute has changed compared to GOST R 6.30–97 (the attribute was called “seal”), the new name is “seal imprint”. The essence of the props remains the same.

Technical requirements for official seals - their shape, size, text and symbols placed on them - are set out in the state standard GOST R 51511–2001. Technical requirements for seals without a coat of arms are not specified in state standards.

See below for the list of documents on which the organization’s seal is affixed.

What types of seals are there?

- Stamp. According to the federal constitutional law “On the State Emblem of the Russian Federation” dated December 25, 2000 (as amended on March 12, 2014), the state emblem of the Russian Federation is placed on the seals of federal government bodies, other government bodies, organizations and institutions, on the seals of bodies, organizations and institutions regardless of the form of ownership, vested with certain state powers, as well as bodies carrying out state registration of acts of civil status.

The right to use the official seal is granted to the first managers, officials from among the employees of the preschool education service or the financial service.

- Round seal with the name of the organization (without reproducing the coat of arms). Every organization must have it to certify the authenticity of the signatures of officials.

- Stamp of structural units, as well as round and triangular seals that have a narrow functional purpose (for packages, passes, etc.).

Both the stamp and the round seal usually indicate the TIN of the organization, the number of the state registration certificate, as well as its location.

What document is used to secure seals in an organization?

Each organization develops instructions for using seals.

The instructions are approved by the manager and have the following sections: - list of seals used in the organization;

— storage locations and positions of persons entitled to use seals;

- procedure for using seals.

The instructions must also contain lists of documents certified by all types of seals. Lists of documents are compiled on the basis of regulatory legal acts and our own experience in the organization. The lists establish who personally and in what cases has the right to certify the authenticity of a document’s signature. The right to have and use a seal should be recorded in the regulations on the structural unit

The instructions also determine the storage location of the seals and the persons authorized to organize the storage and use of the seal and monitor its correct use.

The instructions should also contain a list of seals , which includes:

— the name and number of copies of each seal authorized for use (the permitted number of copies of each seal is not specified in regulations);

- positions of persons authorized to store and use seal impressions and control the correctness of their use.

The procedure for using seals is established by the organization in accordance with current regulations and taking into account the specifics of the organization’s activities.

Changes and additions to the list are allowed only on the instructions of the head of the organization.

The use of seals in the organization is permitted only to employees specially appointed by order of the manager.

The seal impression is affixed only to correctly executed and signed documents.

Stamps are subject to registration in the preschool educational institution service and are issued to structural units to users against receipt in the registration and accounting form. In departments, prints are stored in securely locked cabinets.

The destruction of seals occurs in cases of liquidation of an organization, termination of activities as a result of a merger, annexation, transformation, renaming of an organization or a separate structural unit, as well as mechanical wear of the clichés.

Destruction is carried out according to an act with a mark in the registration and accounting forms. Registration and accounting forms of seals, as well as sheets with their imprints certified by the preschool educational institution service are included in the list of affairs of the organization.

Where is the stamp placed?

The location of the official seal imprint in relation to the signature is not established in current legal acts. It is recommended to place the seal imprint so that the signature and all information on the seal imprint are clearly visible.

An approximate list of documents on which the official seal (seal of the organization) is affixed:

Acts (acceptance of completed construction facilities, equipment, work performed; write-offs; examination, etc.).

Powers of attorney (for receiving inventory, conducting business in arbitration, etc.).

Agreements (on financial liability, supplies, contracts, scientific and technical cooperation, rental of premises; on the execution of work, etc.).

Tasks (for the design of facilities, technical structures, capital construction; technical, etc.).

Conclusions and Reviews of abstracts.

Applications for tickets for travel on public transport.

Applications (for a letter of credit; refusal of acceptance, etc.).

Writs of execution.

Consumption rates.

Samples of seal impressions and signatures of employees who have the right to carry out financial and business transactions.

Correspondence with foreign missions.

Submissions and petitions (for awarding orders and medals, prizes, etc.).

Letters of guarantee (for work, services, etc.).

Orders (budgetary; banking; pension; payment (consolidated, to the bank, to receive foreign currency from accounts; currency transfer; for imports, etc.).

Regulations on organizations.

Registers (checks; budget orders) submitted to the bank.

Cost estimates (for the maintenance of the management staff; for the costing of the contract).

Agreements.

Certificates (limit; on payment of insurance amounts; on the use of budget allocations for salaries; on accrued and due wages, etc.).

Specifications (products, products, etc.).

Title lists.

Certificates.

Charters of organizations.

The indicative list is not exhaustive and may be changed in accordance with a written order (instruction) of the head of the organization.

Find out how to properly approve documents>>

Find out how to work with documents “For official use”>>

Is a stamp required on the contract?

Even before the seal ceased to be mandatory, judges came to the conclusion that the legislation does not contain the mandatory presence of a seal of the parties to the agreement (Resolution of the Federal Antimonopoly Service of the Moscow District dated March 22, 2012 No. A40-62363/11-71-291).

It turns out that affixing a seal to contracts was not mandatory before (unless, of course, the contract itself required it).

Without a seal, it is also possible to conclude employment contracts, since the article of the Labor Code of the Russian Federation does not provide for a seal as a mandatory requisite. Thus, for the purpose of concluding contracts, the abolition of the seal, in principle, did not change anything.

Basic Concepts

An employment contract is a type of agreement provided for by the Labor Code (hereinafter also referred to as the Code) between an employee and an employer on key points of the work process. The document establishes the rights and obligations of the parties, determines the result obtained by the organization, and the payment due to the specialist hired.

It is important to know! Citizens acquire legal capacity to enter into contractual relations with employers from the age of 16 years. The contract is in a free form, which specifies mandatory and additional conditions.

The agreements of the parties are sealed with the signatures of the general director (other authorized employee) and the employee. The seal on the employment contract is used to certify the signature of the official. As a rule, this is the stamp of the organization, but a number of companies have a separate stamp for personnel documents.

The basis of legislation on the conclusion of written employment agreements is laid down in Chapter III of the Code. Explanations on certain issues relating to the relationship between employees and employers are contained in letters from federal executive authorities authorized in the relevant area (Ministry of Labor and Rostrud of Russia).

When labor disputes arise, judges are guided by previously adopted decisions of colleagues in similar cases, in order to maintain uniformity of law enforcement practice.

Tax and other reporting of the organization

Many organizations that submit reports electronically have long forgotten about stamps on declarations (after all, they only need an electronic digital signature).

But those who continue to report “on paper” must affix a stamp, since the forms of some reporting documents require its presence, for example:

- form 4-FSS;

- sales book;

- book of accounting of income and expenses (when using a simplified taxation system).

What does the 2-NDFL certificate contain?

Certificate 2-NDFL is considered an official document confirming the income received and the payment of taxes on it. It is used in various areas (for lending, refund of tax payments when purchasing real estate, etc.) and has several sections.

The latter includes the following data:

- Tax agent details;

- Information about the recipient of the earnings;

- Income for a certain period;

- Applicable deductions;

- The combination of income and tax amounts.

In addition to the above information, the document must include the date of preparation, the number in the organization’s reporting and the signature of the responsible person. Without this data, the certificate will not be considered valid and you will not be able to use it.

Reporting in Form 2-NDFL includes information about the recipient of income, which is compiled exclusively according to his passport. Even a minor mistake can make it impossible to use the document for its intended purpose. Initial care when entering data into the computer will help you avoid difficulties in the future.

Is it necessary to change the charter in connection with the decision to use the seal?

As we have already said, legislators provided that information about the presence of a seal should be contained in the charter. But what if the company was created in those days when the presence of a seal was mandatory, and mention in the charter was not required? We come to the following conclusions:

- if the charter does not say anything about the seal, then you can leave it as is. But then it turns out that the organization does not have a seal and, accordingly, cannot use it;

- If an organization wants to officially consolidate the presence of a seal, then changes must be made to the charter. But then it turns out that the seal will have to be used even in cases where affixing a seal is not necessary.

Is it possible not to make changes to the charter and at the same time continue to use the seal? There is no clear answer to this question. After all, on the one hand, if the charter says nothing about a seal, then there shouldn’t be a seal. On the other hand, there are a number of documents that still need to be stamped by all organizations (regardless of the content of the charter).

Sources: Here

Requirements for IP printing

If you decide to purchase a seal, you can choose any one - its format is not regulated by law. As a rule, it contains:

- the phrase “Individual entrepreneur” or the abbreviation “IP”;

- FULL NAME;

- OGRNIP;

- TIN.

You can add a logo, trademark or some kind of design, but you do not have the right to use the Russian coat of arms, regional or municipal symbols, or images for which you do not own the copyright.

What documents are needed for IP printing? Most likely, you will be asked to present the originals of the constituent documents, from which employees of the manufacturing company can make copies.

There is no need to register the IP seal with the tax office.

Reporting for the Pension Fund of Russia

According to the law on insurance contributions, certification of reports submitted to the Pension Fund of the Russian Federation is not required. This provision also applies to filling out forms such as RSV-1 Pension Fund. But, despite this, in the form itself there is a field that requires a stamp. In this regard, the lack of certification on the RSV-1 Pension Fund leads to a refusal by the receiving authority. Also, making corrections during the process of filling out the calculation requires mandatory certification of the corrections with a seal.