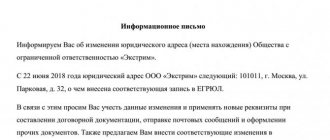

Legal address is an indispensable attribute of a legal entity. The Civil Code of the Russian Federation defines it as the place where the permanent executive body of the enterprise is located - office, owner, director. If a company has moved, information about its new “registration” must be immediately entered into the Unified State Register of Legal Entities, otherwise the tax office will do it for you, and not in the most pleasant way (photo below).

We tell you how to correctly change your legal address without missing anything.

If the tax authority detects a discrepancy between the actual and legal address of a legal entity, it will indicate in the Unified State Register of Legal Entities that the information about it is unreliable

How is the location different from the legal address?

In accordance with Law 99-FZ dated 05/05/2014, location is a broader concept. It indicates the locality in which the legal entity is registered, for example, Krasnodar. It is enough to write only this in the Charter.

In the Unified State Register of Legal Entities, in addition to the location, the postal details of the legal entity are indicated with a detailed breakdown of the street, house, and office number. This is the legal address. The legislator emphasizes that the legal address in the Unified State Register of Legal Entities must be located within the region where the company is registered. If this is Krasnodar, then the address should be Krasnodar.

There are 4 options for changing your legal address, and each of them has its own nuances regarding the procedure.

If the inspection decision is not completed correctly

If an organization is sure that the inspectorate issued a decision on a tax audit retroactively after the company was deregistered, then it can try to prove this. To do this, you should write a complaint to a higher authority, on the basis of which the date of the decision will be checked. Mandatory details of the decision are, in particular, the date and number. The number is assigned by the office on the day of application.

Let’s say an organization was deregistered on September 26th. If an inspector comes to the office on September 27 and asks for a number from the 23rd, he will be refused, since the operating day for September 23 is closed and all numbers have been assigned. The inspector is left with two options: either he refuses the on-site inspection, since from the 27th the organization is registered with another tax office, or he takes the number from the 27th, but indicates an earlier date in the decision. In this case, a higher tax authority can help if it detects this violation. It should be noted that this happens extremely rarely. Experienced inspectors from the Federal Tax Service reserve several empty numbers for each day in the office, which they use if necessary.

Option 3. Change of location (region) of a legal entity

If a company changes region, for example, moves from Odintsovo to Moscow, use the third option of changing the legal address. The corresponding adjustments are made to the Unified State Register of Legal Entities and constituent documents, and the procedure itself takes place in 2 stages.

1. Notification of the tax authority about the planned move within 3 days from the date of the decision

To do this, submit to the Federal Tax Service at the old place of registration (Odintsovo):

- notarized application in form P14001;

- decision to change the legal address.

After 5 days, a record of the upcoming change of the company’s legal address will appear in the Unified State Register of Legal Entities. From this date, according to Law No. 67-FZ of March 30, 2015, you need to count 20 calendar days and you can proceed to the second stage of the procedure.

2. Registration of a legal address in a new location

It is necessary to generate and submit to the Federal Tax Service at the upcoming place of registration (territorial office in Moscow) the same package of documents as in option 2.

Be prepared that a tax inspector will visit the specified address to verify its accuracy. If everything is in order, after 5 working days you will receive a statement with your new address. If the address is fictitious or mass (several companies are registered), changes to the Unified State Register of Legal Entities will be refused.

Before you register with the Federal Tax Service in your new location, make sure you have paid your taxes in your old location.

What are the risks of changing the tax office?

A change of legal address does not always mean a change of tax office is the same thing.

You can change the address of the company's location without changing the Federal Tax Service. This will happen if the new address is within the competence of the same Federal Tax Service. Remember that the authority to make these changes is vested by law in the tax authorities. For your part, all you have to do is make changes to the constituent documents and register them with the authorized body.

Where to start moving?

- First you need to change your legal address

. To do this, you need to contact the registration authority by providing it with a package of documents specified by law. - The registering authority, in turn, will have to make changes to the constituent documents of the legal entity and the Unified State Register of Legal Entities.

Please note that the company’s TIN will remain unchanged throughout the entire activity of the legal entity, but the KPP - the code for the reason for tax registration will change. - No later than one business day following the date of making an entry in the Unified State Register of Legal Entities, the registering authority will send information about the changes that have occurred to two tax inspectorates

(both at the previous and at the new location of the company). The inspectorates will also receive extracts from the register containing a record of a change in the location of the taxpayer. - The previous inspection will also deregister the taxpayer

and issue him (send by mail to his legal address) a corresponding notification in the form approved by order of the Federal Tax Service. The date of deregistration of a legal entity will be the date of making an entry about a change in location in the Unified State Register of Legal Entities. - The inspector of the former tax office will reconcile all the taxpayer’s calculations.

The period for carrying out this reconciliation, as well as the formation and execution of the act, provided that there are no discrepancies in the data of the taxpayer and the tax authority, should not exceed 10 working days. days, if discrepancies are identified - 15 working days. days. The established deadlines do not include the days spent on delivering reconciliation reports of all taxpayer accounts by mail. In addition, according to the law, the period for reconciliation for the largest taxpayers can be extended if necessary. - Within 3 working days days from the date of deregistration, the previous inspection sends the registration and accounting file of the legal entity to the new tax authority

at the new location of the taxpayer. - The new tax office registers the organization at its new location

no later than one business day following the date of receipt of the extract from the Unified State Register of Legal Entities.

Option 4. Change of location with registration to the home address of the manager

Registration in two stages and a 20-day waiting period does not apply if, when changing the region, the legal entity is registered at the address of the director or founder who has a share of more than 50% in the authorized capital.

In this case, immediately contact the tax authority at the place of registration of this person. The package of documents is almost the same as in option 2. The only difference is that to confirm the accuracy of the new address, it is enough to attach documents for the property that match the registration in the passport of the manager (founder), and the consent of other owners, if any.

Who conducts an on-site tax audit?

Regardless of the fact that the organization is already registered with another Federal Tax Service, the old tax inspectorate carries out the audit to the very end. The new one assumes the responsibility for collecting additional taxes, penalties and fines, as well as legal red tape in case of disputes. The period for conducting an on-site audit is limited to a two-month period, which can be extended to four or six months, and also suspended for up to six or nine months (Article 89 of the Tax Code).

How should an on-site audit of an organization end?

On the last day of the audit, the tax authorities draw up a certificate indicating the subject of the on-site audit and the timing of its conduct. The next document that the organization will receive will be a tax audit report, which must be generated within two months from the date of the on-site audit certificate. This document, like the certificate, is drawn up by the inspectorate that conducted the on-site tax audit, and objections to the report must be considered by the head of the inspectorate that compiled the audit report. The period for filing objections in case of disagreement with the received act is 15 days from the date of its receipt.

After this period has expired, within 10 days (this period can be increased to one month), the tax office that conducted the audit must make a decision to hold or refuse to hold the organization accountable. If the decision states that ]has not paid part of the taxes[/anchor] and, as a result, will be fined, then the next document that will be sent to the company will be a demand for payment of arrears. However, this requirement can only be made by the tax inspectorate at the new place of registration of the organization (clause 5 of Article 69 of the Tax Code of the Russian Federation).

Who needs to be notified about a change of legal address?

There are several organizations that should be aware of a legal entity's address change:

- Pension Fund and Social Insurance Fund. The IRS will notify them, so you don't need to file anything. After receiving information about the change of legal address, the Pension Fund and the Social Insurance Fund themselves will send documents to the territorial offices of the funds at the future place of registration, and the company will be registered.

- Statistics. There is no need to report, but if you moved to another region, the statistics codes will most likely change. They can be printed from the Rosstat website.

- Bank. Notifying him of a change of legal address is the direct responsibility of the legal entity. The manager writes a letter to the bank and asks to make changes to the company’s bank card. As justification, attaches a sheet of entry from the Unified State Register of Legal Entities with new details.

- Counterparties. It will be enough for them to send a registered letter and inform them about the changes that have occurred.

In order not to get confused in the procedures for changing your legal address, we recommend using the legal support service. This way, you will not only save time, but are also guaranteed to avoid errors in registration documents, thereby preventing possible conflicts with tax authorities.

Conducting tax audits of the old Federal Tax Service

Often, controllers from the Federal Tax Service at the company’s old address, upon learning that it is changing its address, schedule an on-site tax audit right before moving to another inspectorate. These actions of the inspectors, unfortunately, cannot be considered unlawful, therefore, it is pointless to demand that the decision to conduct a tax audit be canceled on the basis that it was made two days before the transfer to another inspectorate. However, if the organization can prove that the decision to conduct an on-site inspection of the former tax office was made retroactively, that is, after the transition to the new inspectorate, such a decision can be canceled. After all, an inspection can only be carried out by an inspection at the location of the company at the time the decision is made. It is quite difficult to prove that it was untimely, but there is a chance.

The term of the on-site inspection is counted from the date of the decision to conduct it (clause 8 of Article 89 of the Tax Code of the Russian Federation). The Tax Code does not regulate the procedure for serving a decision, which is why it will be difficult to prove that the decision was made after the organization transferred to another tax office. However, tax authorities are interested in quickly handing over to the company a decision to conduct an on-site audit, since its deadline, as mentioned above, is counted from the date of its issuance. The longer the tax inspectorate delays in handing over the decision to a representative of the organization, the less time it will have to carry out this procedure, since the tax inspectorate has no right to begin an on-site audit without notifying the company’s representatives. If the enterprise avoids receiving the decision, the inspection will send it by registered mail and after six days the decision will be considered served.

An example of a decision to conduct an on-site tax audit

The controllers made a decision to conduct an on-site tax audit of the company on August 18, but actually presented the decision and began the audit on August 25. Therefore, the last day of the two-month tax audit period will be October 18. That is, in this situation, the tax lost one week of inspection (from August 18 to August 25).

+ 2 days

The Taxpayer Registration and Accounting Department establishes that the taxpayer's new address belongs to the tax authority. If the taxpayer is subject to deregistration, officials will refer to the relevant departments (department for working with taxpayers, department of desk audits, department of on-site tax audits, department of counter audits, debt settlement department, department for ensuring bankruptcy procedures, department of accounting and reporting, department of operational control , legal department, data entry department, information technology department, other departments) a memo about the receipt of the information letter.

Geographic terror

Just a few years ago, enterprises took the concept of “legal address” lightly. It was considered as a kind of mandatory registration requisite, which can then be forgotten. Now the situation has changed. The tax authorities are seriously concerned about the problems associated with the legal address. The concept of “mass registration address” appeared. By the way, if your company is registered in such a place, it already has signs.

In addition, tax inspectorates closely monitor compliance with current legislation. If during their inspection it is discovered that there is no such company at the company’s location address, punitive sanctions will be applied to the “unscrupulous” organization - a fine of 5 thousand rubles. (Article 14.25 of the Code of the Russian Federation on Administrative Offenses), refusal to deduct VAT to someone who is not at the legal address, as well as blocking the company’s current account and other administrative measures.

All this has led to the fact that companies are increasingly changing their old legal address to a new one, which is the actual address of the company. In this case, a transition to a new inspection almost necessarily occurs.

Everything about changing your legal address: procedure, risks, documents

In order to form a unified approach to the issue of the location of a legal entity, the current legislation does not provide for the existence of a legal and actual address for an organization. The legislation provides for the term “location of a legal entity”.

Terminology

A legal address in everyday life is the address at which a legal entity is registered; accordingly, such an address is listed in the Unified State Register of Legal Entities. However, the company may actually be located at a different address.

In connection with this, two different definitions have been formed, which are not officially established anywhere, but are widely used.

- “legal address” is the address indicated in all constituent documents of the company. Based on the provisions of paragraph 2 of Art. 54 Civil Code of the Russian Federation, clause 1, art. 5 of the Federal Law of 08.08.2001 N 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” the location of a legal entity is recognized as the location of its permanent executive body, and in its absence - the location of another body or person who is authorized to act on behalf of the name of a legal entity by virtue of a law, other legal act or constituent document. It is the legal address that is indicated in the company details in the course of its activities (when concluding transactions and contracts).

- “actual address” is the address of the actual location of the legal entity where the company directly carries out its activities and also stores all the company’s documentation. If there is a legal address, the actual one does not appear in any of the company’s constituent documents.

If at the same time the company did not make sure that government agencies and contractors could contact it at its legal address, then such a discrepancy is fraught with unpleasant consequences: from failure to receive important letters to various fines, as well as forced liquidation of the company.

Risks

Let's consider the consequences of a discrepancy between legal and actual addresses.

1. The risk of consequences of non-reception of legally significant messages received at the company address indicated in the Unified State Register of Legal Entities; such a legal entity does not have the right, in relations with persons who in good faith relied on data from the Unified State Register of Legal Entities about the address of the legal entity, to refer to data not included in the specified register, as well as on the unreliability of the data contained in it (including improper notification during the consideration of the case by the court, in the framework of proceedings on an administrative offense, etc.), except for cases when the relevant data was entered into the Unified State Register of Legal Entities as a result of unlawful actions of third parties persons or in any other way against the will of the legal entity.

2. Forced liquidation of the organization. Tax authorities have the right to forcibly liquidate companies that do not correct inaccurate information about themselves contained in the register within six months.

The exclusion of a company from the Unified State Register of Legal Entities is considered as a refusal by the main debtor to fulfill obligations (Part 3.1, Article 3 of Federal Law No. 14-FZ of 02/08/1998). In this case, if the excluded company has debts resulting from the dishonest or unreasonable actions of the controlling persons, such persons may be held vicariously liable. Accordingly, after the company is excluded from the Unified State Register of Legal Entities, creditors (including the tax inspectorate) will have the right to demand the fulfillment of the company’s obligations to them from the persons controlling this company.

3. Fine for conducting activities without registering with the tax authority. The fact that an organization operates at a different address than that indicated in the Unified State Register of Legal Entities may be regarded by tax authorities as the creation of a separate division. And at the location of the separate division it is necessary to register with the Federal Tax Service.

4. Reluctance of counterparties to cooperate. Starting this year, inspections can verify the accuracy of a number of information contained in the Unified State Register of Legal Entities, including the address of a legal entity. And if it raises doubts among the tax authorities, they will send a notice of unreliability to the director of the company, as well as to all its participants. If confirmation of reliable data is not provided within 30 days from the receipt of the relevant notification, tax authorities enter information into the Unified State Register of Legal Entities about the unreliability of the company’s information.

5. Problems with the bank. As a rule, the bank account agreement stipulates the client’s obligation to provide reliable information, in particular, about his location. And if the bank finds out that in fact the company is located at a different address than that indicated in the Unified State Register of Legal Entities, it can terminate the contract through the court, since the client has violated an essential term of the contract.

Also, a bank can easily refuse to open an account for a company whose legal and actual addresses do not match. But if they do take it on for service, then the bank will ensure close attention to its operations. In addition, information about the flow of its funds can be sent to the Federal Service for Financial Monitoring.

6. Fine for using a cash register in violation of the procedure, conditions and terms of its re-registration. If, when registering a cash register, a legal address is indicated as the place of its installation, and a cash register is used at the actual address, the cash register must be re-registered.

7. Sanctions for the director for submitting false information about a legal entity to the registration authority.

If such a violation is committed repeatedly or information about the organization’s address submitted during its state registration was knowingly false, then tax authorities may disqualify the manager.

Definition of unreliability

The following may be considered an invalid address:

- address of mass registration of a legal entity. That is, the tax authorities know for sure that communication at this address is impossible (in particular, all correspondence is returned with the marks “the organization has left”, “after the expiration of the storage period”, etc.);

- non-existent address or address of a destroyed building;

- conditional postal address assigned to an unfinished facility;

- an address that obviously cannot be used to contact the company (for example, the address of a government agency).

Also, the information provided about the address is considered unreliable if the Federal Tax Service Inspectorate has a statement from the owner of the relevant building that he does not allow organizations to be registered at this address.

Inaccurate information about the legal address will serve as a basis for changing it; in addition, changing the legal address of the company may be necessary for the following reasons:

- upon expiration of the contract under which the premises are provided for rent;

- in case of change of the actual location of the company;

- if there is a reason for the impossibility of confirming the previous location of the company;

- if circumstances exist, to change the tax authorities with which the company is registered.

Thus, absolutely any of the above situations forces one to resort to such a procedure as changing the legal address, which involuntarily entails the preparation of various documents.

Procedure for changing address

Law dated 05.05.2014 N 99-FZ separated the concepts of “location of a legal entity” and “address of a legal entity”: location is the name of the locality; The address of a legal entity is the full address of the company indicated in the Unified State Register of Legal Entities.

The unified state register of legal entities must indicate the address of the legal entity within the location of the legal entity (clause 3 of article 54 of the Civil Code of the Russian Federation).

It is necessary to know the difference between these concepts, because a change of address within the same locality and a change of location are formalized differently.

Let's consider how to register a change of legal address within one locality.

If the charter specifies only a locality, without a detailed address, then a one-stage change of registration address takes place using form P14001.

Within three working days after changing the address, the following documents must be submitted to the registering Federal Tax Service at the previous legal address:

- notarized form P14001;

- documents confirming the right to stay at the new address (letter of guarantee, certificate of ownership, lease agreement);

- minutes of the general meeting of participants or the decision of the sole participant to change the address.

The procedure for changing the legal address within one locality, if the full address was indicated in the charter. In this case, changes will have to be made to the charter, so you must fill out form P13001.

Documents on change of legal address:

- notarized form P13001;

- document confirming payment of the state duty for changing the legal address;

- documents confirming the new address of the company (letter of guarantee, certificate of ownership, lease agreement);

- protocol of the general public management or the decision of the sole participant to change the address;

- Charter as amended or annex to it (2 copies).

Documents are submitted to the tax office at the previous address. After 5 working days, not counting the day of filing, the tax office issues a Unified State Register of Legal Entities entry sheet, which will indicate the new address of the company.

Updated order

Until 2021, the change of legal address took place according to the above scenario, regardless of whether the organization remained in the same locality or moved to another. Nowadays, changing the location of a legal entity when moving to another locality takes more than a month and occurs in two stages:

- notification of the tax office about a change of legal address;

- registration of change of legal address.

The procedure for changing the address in 2021 when changing a locality occurs in accordance with the law of March 30, 2015 No. 67-FZ, which significantly changed the provisions of Article 17 of the Law “On State Registration” No. 129-FZ.

At the first stage, within three working days after making a decision to change the legal address, you must inform the tax office about this. To do this, you must submit the following to the registering Federal Tax Service at your previous address:

- form P14001 certified by a notary;

- protocol or decision of a single participant to change the address.

Based on these documents, the tax inspectorate, after 5 working days, makes an entry in the Unified State Register of Legal Entities indicating that the company has made a decision to change its location. No earlier than 20 calendar days after making an entry in the state register, the director again contacts the registering Federal Tax Service, but at a new address.

At the second stage, almost the same documents are submitted as when changing the address with a change in the charter:

- notarized form P13001;

- confirmation of payment of the state duty (to the details of the registering Federal Tax Service at the new address);

- documents confirming the new address;

- minutes of the meeting or the decision of the sole participant to change the address and amend the charter;

- Charter as amended or annex to it (2 copies).

If during the process of changing the address no information was revealed about its unreliability, then after five working days the Federal Tax Service will issue a Unified State Register of Legal Entities entry sheet with the new address.

If the new legal address of the company is the home address of the director or participant with a share of more than 50%, then such a two-stage procedure for changing the location does not apply.

Urgent change of address

If you urgently need to change the location of the company, you can register a new address according to the registration of the director or participant who has a share of at least 50% in the company. In this case, the change of address occurs in one stage and within 5 working days after submitting the following documents to the registering Federal Tax Service at the new address:

- form P13001, certified by a notary;

- document confirming payment of state duty (to the details of the tax office at the new address);

- protocol or decision of the sole participant on amending the charter of information about the location;

- charter as amended or annex to it (2 copies).

No documents are required to confirm the new address, but the registration of the manager or participant in the passport must match the data in the application.

After registration

After registering a new legal address, you must keep in mind the following: if in the process of changing the address there is a change of the Federal Tax Service or territorial divisions of the Pension Fund and the Social Insurance Fund, then there is no need to deregister yourself and register it in another district or locality. Removal and registration by the Federal Tax Service and funds are carried out without the participation of the company through a system of interdepartmental interaction. (Resolution of the Government of the Russian Federation dated December 22, 2011 N 1092 obliges tax inspectorates to transfer the necessary information to the Pension Fund of the Russian Federation, the Social Insurance Fund and Rosstat within 5 working days).

The pension fund must deregister the company within 5 days from the date of receipt of information from the tax office about the change in legal address. Next, the company’s file is sent to the new territorial division of the Pension Fund, and the organization is assigned a new policyholder registration number.

Changing the Social Insurance Fund when changing the legal address is carried out in the same way as changing the Pension Fund, but the registration number of the company does not change.

There is also no need to report a change of address to Rosstat, but statistics codes may change when moving. In this regard, you can personally contact Rosstat at a new address to receive a document on assigning codes with a stamp, but almost everywhere they accept a notification printed from the Rosstat website.

But the tax office is not obliged to inform the bank about a change of legal address. If the company decides to continue servicing at the same bank, then it is necessary to replace the bank card and indicate in it the new legal address of the organization.

Although, according to the law, government agencies must register at a new address independently and in a short time, the human factor cannot be ignored. If there is an interest in ensuring that re-registration due to a change in the legal address of the company occurs without problems, it is necessary to keep the process under control. We recommend that you find out on your own whether the documents arrived on time and in full; due to failures in interdepartmental cooperation, you sometimes have to register yourself.

Standards for transition

The procedure for actions of tax authorities when an enterprise changes its address is prescribed by Order of the Federal Tax Service of Russia dated December 20, 2004 N SAE-3-09 / [email protected] True, a truly detective story happened with this document. It lost force due to the publication of Order of the Federal Tax Service of Russia dated November 6, 2007 No. MM-4-09/30dsp. Pay attention to the letters “DSP”: the abbreviation is familiar to everyone - “for official use”. You may be unlikely to find a document in the public domain. Although, it would seem, why keep it secret? Perhaps it would be better for the taxpayer to know the procedure? But the tax authorities have their own logic.

Order of the Federal Tax Service of Russia for the city of Moscow dated February 29, 2008 N 106 “On organizing the work of structural divisions of the tax authorities of Moscow on the transfer of a package of documents of Russian organizations, individual entrepreneurs, individuals not related to individual entrepreneurs, to tax authority at the new location (place of residence), as well as upon termination of the organization’s activities through a separate division.” Since the latter was issued three months later than the Order of the Federal Tax Service, it must be assumed that its provisions do not contradict the original source.

Using this document, we will try to describe the sequence of actions of all participants in the process of transferring an organization from one tax office to another. The starting point will be the day the move begins. Having considered all stages of the move, we will focus on the end of this procedure. So, instructions.