Tax accounting of bills of exchange, unlike accounting for other securities, has its own characteristics. This is due to the fact that a bill, like a bond [1], is also a debt obligation. When using bills of exchange in business activities, it is important to correctly calculate the income tax base and fill out a tax return. How to do this is explained in the article.

Murzin V.E. Advisor to the Tax Service of the Russian Federation, 2nd rank, Department of Profit Taxation of the Ministry of Taxes and Taxes of Russia

magazine "Russian Tax Courier" No. 19 - 2004

A bill of exchange is a security that certifies the owner’s right to receive the amount specified in it. The bill can be either discounted or interest-bearing. A discount bill is one that is sold at a price lower than its face value. The difference between the face value of a bill and its selling price is called a discount. If predetermined interest accrues on the amount specified in the bill of exchange, such a bill is called an interest-bearing bill. Interest-bearing bills can be sold at par. There are also interest-bearing bills that are sold at a price below par.

The person issuing the bill is called the drawer, and the person who currently holds the bill is the holder of the bill.

Use of bill transactions by enterprises

Recently, modern enterprises are increasingly using bill transactions.

A bill of exchange can act both as a promissory note and as a means of payment. Also, enterprises can use a bill of exchange as an object of sale, in which case the bill of exchange will be one of the types of movable property. Also, increasingly, lenders, when issuing a loan, require the debtor to provide his own bill of exchange as confirmation of the borrowing relationship.

The bill, in turn, can be of two types - interest-bearing or discount:

- An interest-bearing note has a fixed interest rate. It is issued for the purpose of accumulating income.

- A discount bill is interest-free; the discount will be formed in the form of the difference between the amount received by the borrower and the face value of the bill, that is, the amount that he is obliged to return.

Legal regulation and circulation of bills

Article 142 of the Civil Code of the Russian Federation classifies a bill of exchange as one of the types of documentary securities - a document that meets the requirements established by law and certifies obligations and other rights, the exercise or transfer of which is possible only upon presentation of such documents. Chapter 42 of the Civil Code of the Russian Federation “Loan and Credit” contains Art. 815 of the Civil Code of the Russian Federation, from which it follows that in cases where, in accordance with the agreement of the parties, the borrower issued a bill of exchange certifying the unconditional obligation of the drawer (promissory note) or another payer specified in it (bill of exchange) to pay upon the arrival of the term stipulated by him the loan received monetary amounts, the relations of the parties to the bill are regulated by the law on bills of exchange and promissory notes, and the rules on loans will apply to these relations only to the extent that they do not contradict this law.

It should be borne in mind that a bill of exchange is a promissory note certifying the obligations of the parties (lender and borrower) arising under a loan agreement.

Currently, the Federal Law of March 11, 1997 N 48-FZ “On bills of exchange and promissory notes” is in force, which establishes that on the territory of the Russian Federation the Resolution of the Central Executive Committee and the Council of People's Commissars of the USSR “On the implementation of the Regulations on bills of exchange and promissory notes” is applied "Dated August 7, 1937 N 104/1341.

Bill of exchange legislation provides for the possibility of transferring rights under a bill of exchange to another person by delivering it with an endorsement on it - an endorsement. The person transferring the bill by endorsement is called the endorser, the person in whose favor the endorsement is made is called the endorsee.

The endorsement is made on the reverse side of the bill or on an additional sheet (allonge).

A blank endorsement may not contain an indication of the person in whose favor it is made, or it may consist of a single signature of the endorser. In this case, the bill holder has the right:

1) fill out the form either with your own name or the name of some other person;

2) endorse a bill in blank or in the name of some other person;

3) transfer the bill to a third party without filling out the form and without making an endorsement.

A personal or order endorsement contains an indication of the person to whom or whose order the execution is to be made (the endorser), the signature and seal (if any) of the endorser.

Like the obligation under the bill itself, the endorsement must be simple and unconditional. Any condition limiting it is considered unwritten. Partial endorsement is invalid. If the drawer has placed in the bill of exchange the words “not to order” or any equivalent expression, then the document can be transferred only in compliance with the form and with the consequences of an ordinary assignment.

Features of accounting for your own bill

Accounting for transactions related to a bill of exchange is one of the most complex and controversial from a tax point of view. For the purpose of correct accounting, it is necessary to correctly use a fairly large volume of articles of the Tax Code.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Note 1

Regardless of the type of bill, the participants in the relationship will have income and expenses in the form of interest, which must be reflected in tax accounting. The discount on the own bill will be considered non-operating income or expense and will be distributed evenly. The amount of income or expense in the form of interest on debts is taken into account based on the profitability of the obligation and its duration in the reporting period as of the date of recognition of income/expenses. The discount will be recognized as received and included in expenses/income at the end of the relevant reporting periods, regardless of the date from which interest is accrued.

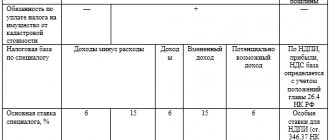

simplified tax system

For tax purposes, there is no difference between the treatment of interest and discount. This is explained by the fact that, according to tax law, any previously declared (previously known) income, including a discount, is recognized as interest. This follows from paragraph 3 of Article 43 of the Tax Code of the Russian Federation and is confirmed by arbitration practice (see, for example, decisions of the FAS of the North-Western District dated February 8, 2008 No. A05-8613/2007 and the West Siberian District dated July 25, 2006 No. F04-4649/2006(24854-A46-37)). It also does not matter the type of bill of exchange (a bill of exchange of a third party or the counterparty’s own bill of exchange) and the method of receiving it (as security for payment, under a purchase and sale agreement, etc.).

When the bill of exchange is presented for redemption, the loan obligation is terminated. Funds received to repay a loan obligation do not count as income taken into account for tax purposes (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation). Therefore, not the entire amount received must be recognized as income, but only interest (discount) (Clause 6, Article 250 of the Tax Code of the Russian Federation). This procedure does not depend on what object of taxation the organization applies - income or income minus expenses.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated November 25, 2008 No. 03-11-04/2/177 and dated October 10, 2006 No. 03-11-04/2/202.

For information on how a simplified organization can account for income from a bill of exchange that was purchased for resale, see How to record the sale and other disposal of a bill of exchange of a third party.

Accounting for early repayment of bills

In case of early repayment of the promissory note, income will be recognized as received and included in income on the date of repayment of the debt obligation. The remaining difference will be taken into account by the holder of the bill at a time between the entire amount of the discount and that already accrued as income in tax accounting. The borrower who paid for the security ahead of schedule similarly accrues additional expenses in the form of the difference between the actually paid discount amount for early repayment and the already calculated amount in tax accounting.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Note 2

If the bill is repaid before the end of its validity period, then income is accrued in the same way, since the discount is distributed evenly over periods and will not be fully taken into account by the time the bill expires.

When calculating expenses, it is important to remember that they are standardized. There are two ways to normalize interest expenses. The first method is rationing based on the refinancing rate of the Central Bank. The procedure is established by Article 269 of the Tax Code of the Russian Federation.

A comparison of data with other loans can also be used - used in the case where the company has other debt obligations on similar terms. The maximum amount of interest by which taxable profit can be reduced will be determined based on the average level of interest on similar obligations. When choosing this method, it is necessary to have a clear procedure for determining comparable loans in the accounting policies of the organization. Loans are considered comparable if the following conditions are met: the same currency and term, comparable amounts and similar collateral.

The Supreme Court clarified the legal status of the bill for tax purposes

On September 30, the Supreme Court of the Russian Federation issued Ruling No. 305-ES19-996 in the case of a Russian brewery challenging the results of an on-site tax audit, during which it was fined for failure to pay income tax in connection with settlements for the acquisition of trademarks using promissory notes of foreign companies.

A Russian company paid for trademarks with promissory notes from foreign companies

In 2003–2006 a foreign company, being the owner of a share of over 50% of the capital of Ivan Taranov Brewery LLC, issued its bill of exchange to the latter free of charge, and also transferred the bill of exchange to another foreign company.

Further, the above-mentioned Russian company, being the only participant in PIT Investments LLC, transferred one of these bills to the latter free of charge. As a result of the reorganizations of foreign companies, the obligations of the drawer for the above securities transferred to (Republic of Cyprus). Subsequently, the bills went to United Heineken Breweries LLC by way of succession from the Russian companies Ivan Taranov Breweries and PIT Investments, which were annexed to it.

In August 2012, a Russian brewery bought the rights to trademarks from a foreign brewery on the basis of an agreement on the alienation of exclusive rights. The company paid with the above bills and the parties entered into an agreement on the offset of claims.

The tax inspectorate assessed additional income tax, penalties and a fine to the company

In 2021, the interregional inspectorate of the Federal Tax Service of Russia No. 3 for the largest taxpayers conducted an on-site tax audit of Heineken for the period from January 1, 2012 to December 31, 2013. Based on its results, the inspection concluded that when offsetting counterclaims in 2012, the company did not record income from the sale of promissory notes received free of charge. As a result, the tax base for corporate income tax for the above year was underestimated by 729 million rubles, and the Russian budget did not receive additional tax in the amount of 145 million rubles. Thus, the tax authorities decided to hold the organization accountable, assessing additional income tax, penalties and a fine for a total amount of over 237 million rubles.

Subsequently, the Federal Tax Service of Russia only slightly reduced the accrued tax and penalties, leaving the decision of the lower body in force. In this regard, United Heineken Breweries LLC challenged the results of the on-site inspection in court.

Two instances decided that the controversial transaction was equivalent to the repayment of a loan, but the cassation did not agree

The courts of the first and second instances satisfied the applicant's demands and invalidated the tax inspectorate's decision. They proceeded from the fact that the disputed bills of exchange were used by the company as a means of payment when acquiring trademarks and the company did not receive any economic benefit subject to taxation. According to the courts, repayment of disputed bills in the current situation should be considered as repayment of the loan, which, according to sub. 10 p. 1 art. 251 of the Tax Code of the Russian Federation is not income for tax purposes.

In addition, both courts considered that the inspectorate, when accruing arrears, unlawfully ignored the taxpayer’s accumulated losses from previous tax periods. As the courts indicated, during the on-site audit, the tax authority requested, and the company presented, documents confirming the period of formation and the legality of the formation of the corresponding loss, starting from 2008. In this regard, the courts came to the conclusion that, within the framework of the application of Art. 283 of the Tax Code of the Russian Federation, when assessing additional taxes, the inspection was obliged to adjust additional assessments to the amount of the generated loss.

Subsequently, the district court did not agree with the conclusions of the lower authorities and partially overturned their judicial decisions. The cassation noted that in 2012 the company disposed of bills of exchange as securities as a result of their presentation for payment and repayment of the nominal value of bills. This operation, in accordance with paragraph 2 of Art. 280 of the Tax Code of the Russian Federation is subject to income tax taxation. The district court also pointed out that the case materials do not confirm the existence of borrowed relations with the participation of the company; on the contrary, the bills were received by it free of charge as securities.

The cassation instance added that the inspectorate did not have the obligation to take into account the losses of previous tax periods accumulated by the company when determining the amount of tax arrears for the periods covered by the inspection, since in response to the requirement to submit primary documents confirming the amount of the generated loss, the taxpayer provided only tax accounting registers and balance sheets without submitting primary documents. Thus, the company did not confirm its right to account for losses.

The Supreme Court of the Russian Federation only partially agreed with the conclusions of the district court

With reference to significant violations of substantive and procedural law, United Heineken Breweries LLC filed a cassation appeal to the Supreme Court of the Russian Federation.

Having studied the circumstances of case No. A40-24375/2017, the highest court supported the conclusion of the district court that the inspectorate had legal grounds for including the value of redeemed bills of exchange in the taxable income of the company. “When considering the case, the company did not provide evidence confirming the entry of its legal predecessors - Ivan Taranov Breweries LLC and PIT Investments - into borrowing relations with the foreign companies Ivan Taranov Breweries (Cyprus) Limited and D&D Brewing Ltd, which issued the disputed bills. On the contrary, as the courts have established, these bills of exchange were transferred to the company free of charge on the basis of separate agreements. Consequently, as the district court correctly pointed out, the courts of the first and appellate instances had no basis for concluding that sub-clause. 10 p. 1 art. 251 of the Tax Code of the Russian Federation and on the exemption from taxation of income received by the company when presenting bills of exchange for redemption,” noted in the ruling of the Court, which indicated that in this part the cassation appeal is not subject to satisfaction.

At the same time, the Supreme Court did not agree with the conclusion of the district court that when determining the final amount of the arrears, the inspectorate did not have the obligation to adjust this income by the amount of losses accumulated by the company in previous years. Thus, the Court explained that when calculating income tax, taxpayers are given the right to take into account the loss when calculating the specified tax, but subject to compliance with the requirements established by law, including when fulfilling the obligation provided for in paragraph 4 of Art. 283 Tax Code of the Russian Federation. Consequently, in order to refuse to apply the provisions of the above article, it must be established that the corresponding expenses of the taxpayer, included in the amount of the transferred loss, are not documented (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 24, 2012 No. 3546/12). This circumstance is established during a tax audit, i.e. based on the results of interaction between the tax authority and the taxpayer, taking into account the behavior of the parties within the framework of such interaction.

“This means that if a question arises about the transfer of accumulated losses from previous years, the tax authority, during a tax audit and consideration of its results, is obliged to provide the taxpayer with a real opportunity to confirm compliance with the requirements of clause 4 of Art. 283 Tax Code of the Russian Federation. In this case, as established by the courts, during the tax audit the inspectorate sent the company a request to provide primary documents confirming the amount of the loss generated, in response to which the taxpayer submitted tax registers and balance sheets. Thus, the taxpayer did not ignore the request received from the inspectorate. Tax accounting registers in accordance with the provisions of Art. 313–314 of the Tax Code of the Russian Federation are intended for systematization and accumulation of information contained in primary documents accepted for accounting, analytical data of tax accounting for reflection in the calculation of the tax base, and, therefore, are evidence allowing to determine the amount of transferred losses,” the Court’s ruling noted. .

The case was sent for a new trial to the court of first instance

The Supreme Court noted that in the current situation, taking into account the volume of documents confirming the taxpayer’s expenses, the objective complexity of their one-time submission in a short time, in order to ensure his right to transfer losses, the inspectorate had the right to use the powers provided for in paragraph 1 of Art. 93 Tax Code of the Russian Federation. Namely, to request from the taxpayer documents that the inspectorate does not have (not presented during previous inspections) and that are necessary to verify the validity of specific expenses indicated in the tax and accounting registers. However, the tax authority did not take advantage of this right.

Under such circumstances, the conclusion of the district court that the tax authorities do not have an obligation to take into account the amount of losses accumulated by the company when determining the amount of arrears for income tax for 2012 cannot be considered legal. At the same time, the courts of the first and appellate instances did not establish in which specific cost items the company announced the transfer of losses and to what extent the loss declared for transfer was actually confirmed by primary accounting documents. Thus, the Supreme Court of the Russian Federation found that the courts of three instances did not properly assess the behavior of the inspectorate and the company at the stage of the tax audit when confirming the amount of the transferred loss and did not establish the amount of the transferred loss that meets the requirements of paragraph 4 of Art. 283 Tax Code of the Russian Federation.

In this regard, the Supreme Court overturned the judicial acts of the lower courts regarding the conclusion regarding the episode related to income tax, and sent the case for a new trial to the court of first instance. When considering the case again, the court should check the arguments of the company and the objections of the tax authority regarding the admissibility of transferring losses, taking into account the behavior of the company and the inspectorate at the stage of conducting a tax audit and considering its results, and, if necessary, invite the parties to provide evidence confirming the amount of losses from previous tax periods, which may be postponed to 2012 due to a decrease in income from repayment of bills.

AG experts had mixed assessments of the Supreme Court’s findings

Lawyer, partner and head of the “Arbitration, Tax and Bankruptcy Law” practice of the Moscow Bar Association No. 5 Vyacheslav Golenev noted that the commented definition of the RF Armed Forces concerns two issues: the ratio of a bill and a loan for tax purposes, as well as the transfer of losses.

“With regard to the legal status of a promissory note for tax purposes, the Court's main point is that a promissory note can be considered a loan only to the first holder of the promissory note who paid the promissory note (i.e., in fact, issued the loan financing). However, in the above case, the bills were received free of charge precisely as securities, and not as debt financing on the conditions usually existing in practice. Bills of exchange began to be transferred from company to company as an object of property, and their nature for tax purposes is the transfer of securities, which means that the form of the transaction was initially different (not a loan, but an assignment of claims on a security). The taxpayer was not a participant in the original debt financing. For any subsequent holder of the bill, the transfer of the bill will be considered as a transaction for the purchase and sale of the bill, and the repayment of debt on it will be considered as a profitable transaction with the taxation of such income with income tax,” the expert explained.

According to the lawyer, the Supreme Court correctly noted that the tax base in this case is determined taking into account the features established by Art. 280 Tax Code of the Russian Federation. Thus, the taxpayer’s income is taken into account, including from the redemption or partial redemption of their nominal value and expenses incurred, determined based on the purchase price of the securities. Since the reorganization does not change the taxation procedure, to determine the tax base, the taxpayer can also use the price of acquisition of securities by his legal predecessor (clause 1 of Article 277 of the Tax Code of the Russian Federation). “In the case under consideration, it was established that the bills of exchange were received by the legal predecessors free of charge, which means that there were no expenses that could be used to reduce the income from the controversial operation to repay the bill of exchange within the framework of Art. 280 Tax Code of the Russian Federation. The taxpayer did not personally issue the loan (did not buy the bill), and therefore he could not be a participant in the original loan legal relationship for the purpose of tax exemption under subsection. 10 p. 1 art. 251 of the Tax Code of the Russian Federation,” explained Vyacheslav Golenev.

Regarding the issue of transferring losses, the expert noted that the Supreme Court supported the well-known approach of the need for documentary evidence of losses. “At the same time, the Supreme Court pointed to an additional procedural criterion necessary for correctly establishing the taxpayer’s actual tax liability in terms of losses - the request for documents from the taxpayer must be correlated with his real opportunity to confirm compliance with the requirements of paragraph 4 of Art. 283 Tax Code of the Russian Federation. In this case, the tax authority requested documents confirming the amount of the loss, but not its basis. The tax authority did not request any other documents, thereby refusing to exercise its rights to a more in-depth audit of the taxpayer’s behavior in terms of reflected losses. Therefore, the controversial legal issue of the case during a new consideration will be precisely the amount of the loss, and not the legality of its accounting,” the lawyer explained.

Lawyer, head of tax disputes practice at MEF Audit Dmitry Kirillov did not agree with the Supreme Court’s conclusion on the taxation of bills. “The Supreme Court concluded that the presentation of a bill of exchange for payment not by the original holder of the bill, but by the person who received it in the course of subsequent transactions, is a different disposal and sale for tax purposes. This position seems controversial; I am inclined to agree with the approach of the lower courts (alas, refuted in the definition), which considered in this case the legal nature of the bill of exchange and the loan agreement to be similar. In this situation, the drawer issued an obligation to pay money to the holder of the bill or another person, subsequent transactions for the transfer of this bill could be considered assignments, and the last holder of the bill, Heineken United Breweries LLC, presented the bill for payment, and the drawer fulfilled his obligation by offset,” noted He.

According to the expert, the Supreme Court indirectly confirmed this logic, pointing out that sub. 10 p. 1 art. 251 of the Tax Code of the Russian Federation is applicable to situations where the taxpayer (his legal predecessor) acted as a participant in a borrowing relationship formalized by issuing a bill of exchange. “From this we can conclude that the Court would be ready to recognize the borrowed nature of these bill of exchange legal relations if United Heineken Breweries LLC were their direct participant. Unfortunately, further the Supreme Court of the Russian Federation made a negative conclusion for the taxpayer regarding the taxation of the disposal of the bill of exchange with income tax in accordance with clause 2 of Art. 280 of the Tax Code of the Russian Federation,” the lawyer believes.

At the same time, Dmitry Kirillov positively assessed the Court’s conclusion that the tax authority’s inaction was inadmissible when the taxpayer submitted to it documents that the tax authority considered insufficient to confirm the loss carried forward to future periods. “The Supreme Court correctly indicated that the tax authority had the right to use its powers to demand documents and establish with their help the grounds for transferring losses, but did not do this, on this basis the case was sent for a new consideration,” the expert concluded.