The term “advance”, known to every accountant, is referred to in law as the salary of the first half of the month. Previously, the current Resolution of the USSR Council of Ministers No. 566 provided the opportunity for the administration and representatives of the work collective to agree on the amount of advance payments to employees. Today, there are orders of the Ministry of Labor that establish certain strict rules for the calculation and payment of the first part of the monthly salary, based on the norms of the Labor Code of the Russian Federation, and their violation can result in a large fine according to the Code of Administrative Offenses of the Russian Federation.

When is the advance payment and the second part of the salary paid?

Is the employer obligated to pay salary advances?

The procedure for paying remuneration to employees of the enterprise is regulated by the provisions of legislative acts, as well as internal documents of the enterprise itself.

It is stipulated that salary payments to employees must be made at least twice a month. However, it is necessary to take into account whether these people had working days during the period under review. If the employee worked, then he has the right to receive the first part of the salary.

However, the management of the organization does not have the right to cancel the transfer. For this, appropriate measures may be applied to him, including payment of compensation to the employee for days of delay in the employee’s remuneration.

In addition, concluded agreements with people working at the enterprise may provide for more frequent payment terms. If they are specified in the employment contract or internal local regulations of the organization, the company administration is obliged to comply with them.

Attention! The company's management will not be saved by an employee's voluntary refusal to receive his salary in installments in several stages. The only option not to pay the first part to the employee is his absence from work during this period of time.

Conclusion: terms, amounts, laws, responsibility

In conclusion, I would like to remind you that ignorance of the laws does not exempt you from responsibility. This applies to all unscrupulous employers who, for one reason or another, delay payments or even refuse to pay an advance or salary to an employee. For employees, knowledge of the legal framework and their rights is also extremely necessary.

When concluding an employment contract, you must count on cash payments at least twice a month within a clearly defined time frame. The maximum period of salary delay is 7 calendar days. The maximum period between payments is 16 calendar days. If the employer fails to comply with the terms of the employment contract, you can contact the labor inspectorate of your city or the prosecutor's office, and the employer will bear financial responsibility.

Changes in terms, amounts and order of payments occur only by concluding a joint bilateral agreement.

When applying for a job, do not hesitate to clarify all financial issues in advance, as you have every right to do so.

In this case, you, as an employee, are protected by the Labor Code of the Russian Federation (it would be a good idea to read it) and the Labor Inspectorate service.

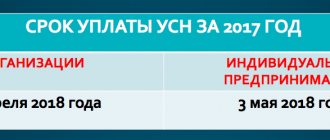

Deadlines for payment of advance payments and wages in 2018

The days on which it is necessary to issue an advance and salary must be clearly stated in the employment contract with the employee, as well as in the local acts of the organization (for example, in the regulations on wages).

The law clearly states that no more than 15 days should pass between the issuance of these two parts. In addition, it is established that earnings for the first part of the month must be issued between the 15th and 30th days of the current month, and the final payment must be made between the 1st and 15th days of the month following it.

The administration does not have the right to establish in the documents a period of days during which the payment is expected to be made. However, it can be stipulated that the payment must be made before the specified date. Also, inaccurate dates should not be recorded. The document must clearly indicate the days on which the payment is made, and exactly what part of the salary is paid at that moment.

The law does not prohibit payments at more frequent intervals, for example every 10 days. But in any case, these dates must be indicated in the documents.

Attention! If the day on which the payment of one of the earnings falls falls on a non-working day, then the employer is obliged to make the payment on the previous working day.

It is not recommended to indicate the 15th and 30th as days of issue. This is due to the fact that in many months of the year the 30th day is the last, and therefore on this day the accountant will have to calculate and withhold personal income tax from the advance payment.

You might be interested in:

Who can receive maternity capital, the amount, what it can be used for in 2021

Salary advance in 2021: new calculation

The rules for determining salary advances in 2021 have changed. Back in August 2021, the Ministry of Finance issued a letter in which it clarified the rules for calculating the advance payment. Now it has been precisely determined which payments must be taken into account when calculating this part of the salary, and which are applied only when determining earnings for the entire month.

The recommendations can be divided into three steps.

Step 1. Determine the number of days worked for the period

According to the explanations, the advance must be determined in proportion to the number of days worked in the first part of the month. This means that how much the employee actually worked during this period of days is how much he needs to be paid.

It follows that if on some of these days the employee did not perform his duties due to vacation or illness, then there is no need to pay an advance for them.

Step 2. Determine the charges that need to be included in the advance payment

The Ministry of Finance believes that to calculate the advance, the following types of accruals must be taken into account:

- The amount of the employee’s salary or tariff rate for the period;

- Allowances and additional payments, the receipt of which does not depend on the employee’s performance during the pay period, fulfillment of the monthly work schedule, or compliance with work schedules. This includes, for example, additional payment for going to work at night, for combining several positions, for length of service, etc.

If you calculate the advance only taking into account the salary or tariff rate, then the regulatory authorities will consider such a step to be an infringement of the employee, which will lead to the imposition of a fine of up to 50 thousand rubles.

Step 3. Determine accruals that do not need to be used

So, if an advance is determined, then the following accruals do not need to be taken into account:

- Bonuses that are paid based on monthly work results;

- Additional payments, the determination of which depends on the monthly work and are made only at the end of the billing month. For example, extra pay for overtime work.

The size of these payments will be known only after the end of the month at the time of the general salary calculation.

As you know, advance payments do not need to be subject to personal income tax. However, there is always a risk that the company, having given the employee the full salary for the first half of the month, will not be able to withhold tax for the second half. This could happen, for example, if an employee becomes ill.

Therefore, experts recommend applying a coefficient of 0.87 to the calculated advance amount. As a result, even if there are no charges in the second half of the month, the amount for withholding and transferring tax will still remain. To “legalize” this calculation procedure, it is necessary to describe it in the company’s local documents and familiarize employees with them.

It is recommended to calculate the advance payment as follows.

The portion of the salary advance is equal to:

| Advance from salary | = | Salary | : | Total number of working days in a month | X | Number of working days worked |

Part of the advance from other additional payments is equal to:

| Advance from additional payments | = | Amount of surcharge | : | Total number of working days in a month | X | Number of working days worked |

The total advance amount is:

| Advance for the first half of the month | = | Advance from salary | + | Advance from additional payments |

Minimum size

In practice, most companies pay amounts in the form of half the monthly salary, taking into account salaries (tariff scale), monthly benefits.

When calculating the advance payment, bonuses, sickness benefits, allowances and other amounts are not taken into account. When calculating the minimum value, the monthly amounts are initially reduced by the number of tax payments withheld, and forty percent is taken from the remaining amount.

Example of calculating the advance payment

Fillipova A. N. Works as a cashier at Rassvet LLC. Her salary is set at 18,000 rubles. She also receives an additional payment for combining the position of an accountant - 8,000 rubles. If the sales department fulfills the plan for selling products, all employees are also awarded a bonus in the amount of 30% of the salary.

You might be interested in:

Payroll taxes: what the employee pays and what the employer pays in 2021, the timing of their payment to the budget

There are 21 working days in a billing month, the advance is paid for 11 days worked.

We will calculate the advance payment. It will include the salary and the amount of additional payment. Since the bonus is calculated only based on monthly sales results, it is not included in the calculation of the advance payment.

The salary for the first half of the month will be: 18,000 / 21 x 11 = 9,429 rubles.

The additional payment for the same period will be: 8000 / 21 x 11 = 4191 rubles.

Total total advance amount: 9429 + 4191 = 13620 rubles.

bukhproffi

Important! Income tax is not deducted from the advance payment, therefore the entire calculated amount must be issued to the employee on the day established in local regulations.

Taxes

The Labor Code establishes that an employee receives his salary in two parts - an advance and the rest of his earnings. In this case, the advance must be paid in the second half of the month.

By law, the day on which the employee received his income is considered the final day of the month. Since the advance is usually paid before this point, there is no need to calculate and withhold income tax on it. The amount of personal income tax is supposed to be determined when the final part of earnings is issued and transferred to the budget the next day.

However, there is an exception to this rule. If the advance is issued on the last day of the month, then, according to legislative acts, this day is considered the day the employee receives income. This means that tax must be determined and withheld on the advance amount. This position is voiced by judges in proceedings between companies and the Federal Tax Service.

Attention! The amount of contributions is determined when calculating the total amount of salary, and is transferred before the 15th day of the period following the billing month. Therefore, they do not in any way affect the advance payment, no matter what day of the month it is made.

See more about payroll taxes.

What about vacation?

How to correctly calculate an advance payment in case of vacation? Let's consider this issue in more detail.

There are rules for calculating an advance payment in cases where an employee works for an incomplete reporting period. The most important prerequisite for absence is leave, regardless of its type (paid or at your own expense).

You may be interested in: Why SMS are not sent to number 900: description of problems, possible solutions

An example of how an advance payment is calculated after a vacation. So, if the weekend ended on the 12th, and the employee started work on the 13th, the administration must pay him wages within 3 working days (13, 14 and 15).

If the vacation ends on the 15th, and the employee comes to work on the 16th, then the accounting department has the right not to give him an advance, since there was practically no time in the first half of the month. In this case, the employee cannot appeal the administration’s decision.

Responsibility of the employer for failure to pay the advance

The Labor Code does not establish the concept of advance payment. What we call this word is one of the parts of the salary. Therefore, failure to pay an advance is subject to the same liability as failure to pay all earnings.

The law determines that the culprit may be subject to three types of liability:

- Material - occurs immediately the next day after the fixed date of issue. The amount of the fine is calculated based on the amount not paid and the total period of delay as 1/150 of the debt for each day of delay. This compensation must be accrued and paid to each employee, regardless of the reason for which he was not paid on time.

- Administrative - imposed by inspection bodies when they detect a delay in payment of wages. Can be awarded to a responsible person, company or individual entrepreneur. The maximum amount of punishment is 50 thousand rubles, which can be increased if a similar violation is repeated.

- Criminal - imposed by a court decision in case of deliberate non-payment for more than 2 months. Applies to the director of the company or entrepreneur. The maximum penalty is a fine of 500 thousand rubles, or imprisonment for up to 3 years.