More and more older people want to lead active lives. An energetic lady or older gentleman driving a car no longer surprises anyone. Indeed, along with the growing desire to be a motorist, the opportunities for this are also growing. The banking system offers car loans, the program of which is adapted for pensioners. Car dealerships offer discounts and promotions that turn a personal car from an unattainable dream into commonplace. But the pleasure of owning a car comes with additional costs. This is the need for refueling, maintenance, and paying taxes. The subject of today's conversation is the transport tax for pensioners in Moscow and Moscow Region, the features of its registration and possible benefits.

photo from life.ru website

Transport tax - what is it?

Transport tax is a special payment made by citizens and organizations that own vehicles.

Among other things, these include:

- cars and trucks;

- motorcycles and scooters;

- self-propelled vehicles;

- water vehicles.

To charge this fiscal fee, you only need to have ownership of a vehicle without additional conditions.

When it comes to transport tax, the fee primarily applies to a car or truck. It should also be noted that its amount may be different for different categories of vehicles. This is due to the fact that the tax base for its calculation is the power of the car engine, which is traditionally measured in horsepower. Accordingly, the larger it is, the more significant the amount the owner will have to pay.

Important! The tax rate may vary depending on the specific region. As a rule, the further north the federal subject is, the higher it is.

Transport tax falls under the category of local taxes. This means that all funds collected are sent to the budget of the subject of the federation. Accordingly, regional authorities use this money to repair existing roads , build new ones, and also cover the costs of maintaining road infrastructure.

Car tax for pensioners in Moscow

photo from moscowchronology.ru

In paying this fee, age pensioners do not have advantages over other citizens, and are forced to pay it on an equal basis with other citizens. All TN standards in the capital are determined by the Moscow City Duma, and are reflected in Law No. 33 “On Transport Tax” dated 07/09/2008. This document is systematically revised, and as of today the last amendments were made to it on April 1, 2015.

Transport tax for pensioners in Moscow - table of current rates

| Type of vehicle | Engine power | Bid |

| Passenger vehicles | 100.00 or less hp | 12 r × l.s. |

| 100.01-125.00 hp | 25 r × hp | |

| 125.01-150.00 hp | 35 r × hp | |

| 150.01-175.00 hp | 45 r × hp | |

| 175.01-200.00 hp | 50 r × hp | |

| 200.01-225.00 hp | 65 r × hp | |

| 125.01-250.00 hp | 75 r × hp | |

| more than 250.01 hp | 150 r × hp | |

| Motransport | 20.00 or less hp | 7 r × l.s. |

| 20.01-35.00 hp | 15 r × l.s. | |

| more than 35.01 hp | 50 r × hp | |

| Freight transport | 100.00 or less hp | 15 r × l.s. |

| 100.01-150.00 hp | 26 r × hp | |

| 150.01-200.00 hp | 38 r × hp | |

| 200.01-250.00 hp | 55 r × hp | |

| more than 250.01 hp | 70 r × hp | |

| Other self-propelled vehicles, incl. pneumatic or crawler driven | 25 r × hp | |

| Snowmobiles, motor sleighs | 50 hp or less | 25 r × hp |

| 50.01 or more hp | 50 r × hp | |

| Motorized water vehicles | 100 hp or less | 100 r × hp |

| 100.01 or more hp | 200 r × hp | |

| Sail-motor water vehicles | 100 hp or less | 200 r × hp |

| 100.01 or more hp | 400 r × hp | |

| Jet skis | 100 hp or less | 250 r × hp |

| 100.01 or more hp | 500 r × hp | |

| Air vehicles | 250 r × hp | |

| Jets | 200 r × kGs | |

| Other water and air vehicles | 2,000 rubles for each vehicle |

When paying for TN, you should be aware that the payment is rounded to the nearest ruble. If a large amount was paid intentionally or accidentally, the excess is carried over to the next year or returned to the payer.

Discounts for pensioners on transport tax in Moscow

photo from the site https://nastroenie.tv

The policy of forming a list of beneficiaries in the capital does not provide for the provision of tax breaks to persons of retirement age. However, they can receive benefits on a general basis. The authorities that assess taxes for pensioners on transport tax in Moscow completely exempt from TN citizens who need social support and belong to one of the groups:

- Heroes of the Soviet Union and the Russian Federation;

- Disabled people of group I or II;

- Veterans and disabled people of the BD, WWII;

- Pensioners of special forces units

- Prisoners of fascist concentration camps during the Second World War;

- Knights of the Order of Glory, 3 degrees;

- Owners of cars with a power of less than 70 hp;

- Participants in nuclear and thermonuclear weapons tests or victims of radiation;

Moscow municipal authorities have exempted the listed categories of citizens from paying TN for one land vehicle (with the exception of snowmobiles and motor sleighs) if its engine power does not exceed 200 horsepower.

Does a pensioner pay transport tax?

Pensioners belong to one of the categories of citizens who, by virtue of their status, have the right to claim many types of benefits, including those related to taxation. However, current federal legislation does not provide for their exemption from payment of transport tax. In addition, existing regulations do not imply a reduction in the tax rate for this category of citizens.

In this regard , the pensioner will need to pay the appropriate tax for vehicles owned. However, among retired citizens, there are certain categories that have benefits.

In addition, a number of constituent entities of the federation have adopted their own regulations, where pensioners are exempt from paying transport tax or the conditions for calculating it are much softer. However, local regulations are valid only in the territory of a specific region, and are not generally binding for the entire country.

Who is exempt from paying

It has been established at the federal level that the following categories of citizens are exempt from paying transport tax or pay it in a smaller amount:

- disabled people and veterans of World War II and military operations;

- prisoners of Nazi concentration camps;

- persons affected by the radiation disaster at the Chernobyl nuclear power plant;

- disabled people of groups I and II;

- large families;

- parents of disabled children.

Reference! This benefit is provided on an application basis. This means that the Federal Tax Service will accrue payments until the person entitled to it submits a corresponding application to the tax service.

Do pensioners need to pay for vehicles they own?

So, you need to pay tax. However, this statement only applies to vehicles that are properly registered. Accordingly, equipment that belongs to a citizen, but has already been deregistered (for example, for disposal) is not subject to taxation.

There is no need to pay for the following types of vehicles:

- rowing boats;

- motor boats equipped with engines up to 5 hp;

- passenger cars equipped with equipment for use by disabled people;

- a car with an engine no more powerful than 100 hp. provided that they are acquired by receiving them from social security authorities.

Fees are not paid for vehicles that are on the wanted list. If the search activities are stopped, no payment will be made for the period during which the vehicle was stolen.

Depending on regional laws, other types of transport may be excluded from taxation. Note that these rules apply to all categories of taxpayers, not just those receiving a pension.

Are there any benefits for pensioners

In general, the status of “pensioner” itself is not a basis for providing the opportunity not to pay transport tax. However, this applies only to the general procedure for providing benefits for the payment of the transport tax in question, provided for at the federal level.

Regional

Transport tax belongs to the category of local tax; in this regard, the subjects of the federation have quite broad powers and opportunities in terms of its assessment. They are also responsible for issues related to the provision of benefits to socially vulnerable categories of the population.

For example, in many of them, labor veterans, as well as disabled people of group III, are exempt from the need to make this fiscal payment.

Some regions establish that this benefit is also available to pensioners who have no other grounds for receiving it. It can be expressed either in complete exemption from tax or in a significant reduction in its amount, which may be associated, among other things, with the engine power of the vehicle.

In this case, the example of the Kirov region is quite typical. Thus, pensioners here pay only 50% of the accrued tax, but on the condition that they own a car with an engine power of no more than 150 horsepower. And, for example, disabled pensioners of group III receive a “discount” of 70% of the accrued payment.

Federal

Federal legislation does not allocate pensioners to a separate category of beneficiaries for the payment of transport tax. However, if they have other reasons for receiving relief, then they have the right to use it on a general basis.

Interesting!

Discussions about the need to amend tax legislation to provide transport tax benefits for pensioners at the federal level regularly arise among experts. However, given the shortage of funds in regional budgets and the poor quality of roads owned by federal subjects and municipalities, this idea is unrealizable in the near future.

Car tax for pensioners in Moscow and Moscow Region - calculation and payment procedure

photo from the site podborauto.ru

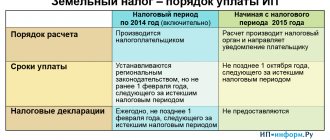

In order for the TN to be accrued, no active action is required from the payer. After the official procedure for registering a vehicle with the traffic police, all data is transferred to the regional tax service, which calculates the payment amount based on the following parameters:

- Type of vehicle that is registered to the payer;

- Engine power, measured in kilowatts or horsepower;

- Gross tonnage (if we are talking about non-propelled vessels);

- Duration of ownership - the actual number of months for the reporting year during which the vehicle is registered in the payer’s name is paid, including the month of registration and deregistration;

- The cost of transport - an increasing coefficient, according to which the rate can increase from 1.1 to 3 times, is applied to objects whose price is above 3,000,000 rubles.

If two or more vehicles are registered for the payer, then payment of transport tax by pensioners in the Moscow region and Moscow is made for each of them.

According to Art. 363 of the Tax Code, individual taxpayers are required to pay TN after receiving a notification by mail with a receipt from the relevant service. All-Russian legislation sets the deadline for making payments as December 1, but local authorities have the right to shift this date downward.

photo from the site www.nalog.ru

In the constituent entities of the Russian Federation, which are the subject of consideration of this material, the latest deadline for payment of tax payments for individuals coincides with the recommendations of the Tax Code. This means that before December 1 of the current year, the car owner is obliged to pay for the transport that was in his possession during the previous calendar year. For example, before December 1, 2021, it was necessary to pay for all vehicles owned during 2015.

You can make a payment through the official online services of the federal tax service or by visiting its nearest branch.

How to apply for a benefit

If a pensioner has grounds for receiving transport tax benefits, then he needs to submit a corresponding application to the Federal Tax Service. It should be noted that even if you have the right to a tax break, without an application from the citizen, the inspectorate will continue to accrue it.

Rules for filling out an application

The application for exemption from paying the fiscal fee has a strict and approved form.

The general rules for filling it out are:

- entering current, factual information;

- use of black ink (when handwritten);

- inadmissibility of corrections and blots;

The application is submitted with a set of documents identifying the citizen, as well as confirming the right to receive the corresponding benefit.

How to submit documents

The pensioner has the right to submit an application and related documents using one of several methods available to him.

- Personal appeal to the Federal Tax Service. A citizen can contact any tax office, even one located outside his place of residence.

- Through MFC. Multifunctional centers have convenient operating hours for citizens and are also located in almost every municipality. Please note that documents are not submitted to the tax office on the day they are submitted to the MFC.

- Electronic. You can submit an application through the State Services portal or your personal account on the Federal Tax Service website. To authenticate them, you will need an electronic digital signature.

- Through a representative. If a pensioner does not have the opportunity to submit documents personally, then a third party - a representative - can do this for him.

Attention! The authority of the representative must be confirmed by a properly executed power of attorney.

Federal legislation does not provide special benefits for pensioners in terms of exempting them from paying transport tax. However, such preferences are provided by regulations of some regions of the country. To apply for a benefit, a pensioner must contact the Federal Tax Service and provide documents confirming their right to it.

For what transport can a pensioner receive a benefit?

Are there any transport tax benefits for pensioners?

In order to understand transport tax benefits for pensioners in 2020-2021, let’s look at the Tax Code. In accordance with paragraph 1 of Art. 358 of the Tax Code of the Russian Federation, all individuals (including pensioners) are required to pay tax on the following types of vehicles:

In what cases can a pensioner receive a benefit for these types of transport? Only in one case - if the regional legal regulation provides for tax bonuses in the form of full or partial exemption from transport tax.

There is also a group of vehicles for which transport tax is not paid at all. Such tax exemption is not considered a benefit (clause 2 of Article 358 of the Tax Code of the Russian Federation).

You can find out more about the list of property not subject to transport tax here .

Rules for drawing up an application

The application is written in free form; there is no legally established form. However, when writing it, you must be guided by the following rules:

- In the right corner, at the top, is written the name of the tax office to which the application is being submitted.

- Then write the last name, first name and patronymic of the person to whom this application is addressed, as well as his position.

- The applicant's surname and initials are written, and the date of birth is also indicated.

- After this, the TIN is registered.

- The place of registration of the applicant, as well as the actual place of residence, must be indicated.

- In order for the tax officer to be able to contact the applicant, he must leave a telephone number and email address.

- The essence of the pensioner's request.

- The application must be accompanied by copies of documents such as a driver’s license, vehicle title, and purchase and sale agreement.

- The application must be signed.

The tax authorities review this application and then inform whether the pensioner must pay transport tax.

Let's sum it up

More than half of the regions of Russia provide pensioners and people of pre-retirement age with tax benefits, including for personal transport.

Benefits may vary in different regions. Therefore, before applying for tax breaks, we recommend that you study the current version of the local law on this. You can find it in the table at the link above.

Do not forget that the procedure for applying for benefits is by application. In order for the tax authorities to calculate the reduced tax, you must submit an application.

Read also

03.08.2020

How is transport tax calculated for pensioners?

The main criterion influencing the amount of transport tax is the amount of horsepower in a pensioner’s vehicle.

In 2021, as in the previous year, the collection amount is calculated using the following formula:

Fee amount = tax coefficient * horsepower * ownership period (months) / 12 months

The presence of a benefit significantly reduces the tax rate. In some regions it is purely symbolic and amounts to 1-10 rubles per horsepower.

What's required

“Zero” property tax

A great help to pensioners in our country is exemption from property taxes.

Who should

This benefit is provided to both non-working pensioners and those who continue to work.

“A pensioner receiving a pension assigned in the manner established by the pension legislation of the Russian Federation is exempt from paying property tax if he owns it,” says the Tax Code (Article 401, paragraph 10, paragraph 1, paragraph 4 of Art. 407 of the Tax Code of the Russian Federation).

Where to go and how to get it

You can apply for a property tax deduction at the tax office at your place of residence.

Terms of service

The tax is zeroed for the following types of real estate:

- apartment or room;

- House;

- garage or parking space in a shared garage;

- premises used as creative workshops, ateliers, studios, non-state museums, galleries, libraries;

- utility buildings whose area does not exceed 50 square meters. m and which are located on land plots provided for private farming, summer cottages, and individual housing construction.

The benefit is provided in respect of one taxable object of each type.

If, for example, a pensioner owns an apartment, a house and a garage, he is fully exempt from paying tax on all this property. And if a pensioner has two apartments and a house, then he has the right to a tax break for the house, as well as only for one of the apartments. You will have to pay tax for the second apartment.

Where to go and how to get it

An application for a tax benefit and a document giving the right to receive it must be submitted in person to the tax office at the location of the property (clause 6 of Article 407 of the Tax Code of the Russian Federation). The document confirming the right to the benefit is a pension certificate.

Note!

If, as of December 31, 2014, you were granted a property tax benefit in accordance with Law No. 2003-1 dated December 9, 1991, then you have the right not to re-submit to the tax authority an application and documents confirming the right to the benefit (Part 4 of Art. 3 of the Law of October 4, 2014 No. 284-FZ).

If a pensioner is the owner of several taxable objects of the same type (for example, three apartments), before November 1 of the calendar year in which he received the right to the benefit, he must submit an application to the tax office and indicate which apartment the tax should not be levied on. That is, the owner himself chooses the property to use his right to the benefit. It is clear that it is beneficial for him to “exempt” the most expensive apartment from tax, but there may be some other considerations.

Almost all benefits are of an “application” nature, which means that you need to apply for them and write an application

True, if the owner does not submit such an application to the tax authorities, they themselves are automatically obliged to “zero out” the tax on the object for which they had to pay the most (clause 7 of Article 407 of the Tax Code of the Russian Federation).

If real estate appears

This benefit is relevant, unfortunately, only for working pensioners who receive a salary and, therefore, pay income tax (such tax is not levied on pension payments in our country). But it can also be used by non-working pensioners who recently retired and had income (still worked) in previous years before purchasing real estate.

The benefit is that the pensioner has the right to carry over the balance of property deductions for personal income tax to previous tax periods.

Who should

For example, a pensioner bought or built a house or other real estate. After registering ownership, he can return part of the money spent through a property tax deduction. Simply put, you will be partially refunded the amount of income tax paid before you became the owner of the property.

Terms of service

A property deduction can be obtained if:

- a residential building, apartment, room was built or purchased;

- share(s) in any of these types of real estate;

- purchased a plot of land for individual housing construction;

- the land plot on which the purchased residential building is located (or a share in it) is purchased.

In addition, property deductions apply not only to expenses associated with the purchase or construction of real estate, but also to the payment of interest on relevant targeted loans (loans).

If the owner has a house, an apartment, and a garage, he is exempt from property tax on all real estate properties

It is allowed to receive a deduction for three tax periods (in other words, three years) preceding the period in which the carryover balance of property deductions was formed (clause 10 of Article 220 of the Tax Code of the Russian Federation).

How much money will be returned

The amount of property deduction depends on the amount of expenses for the purchase (construction) of housing and the amount of interest paid on the loan taken for the purchase or construction. In this case, the maximum deduction amount cannot exceed 2 million rubles. and 3 million rubles. (Clause 1, Clause 3, Clause 4, Article 220 of the Tax Code of the Russian Federation).

Important detail: limit of 3 million rubles. property tax deduction for the cost of paying interest on a loan taken for the purchase (construction) of housing is applied to loans received from 01/01/2014 (clause 4 of article 2 of Law dated 07/23/2013 No. 212-FZ).

Income Tax Exemption

Personal income tax is not charged on some pensioner income.

Not subject to taxation:

- the amount of pensions under state pension provision, insurance pensions, a fixed payment to the insurance pension (taking into account its increase) and funded pension;

- social supplements to pensions paid in accordance with the legislation of the Russian Federation and the legislation of the constituent entities of the Russian Federation (clause 2 of Article 217 of the Tax Code of the Russian Federation);

- the amount of payment at the expense of the organization’s own funds for the cost of sanatorium vouchers, as well as the cost of treatment and medical care for former employees who retired due to disability or old age (clauses 9, 10 of Article 217 of the Tax Code of the Russian Federation);

- gifts, amounts of financial assistance provided by employers to their former retired employees;

- the amount of payment (reimbursement) for the cost of medicines by employers to their former employees (age pensioners).

In some regions, pensioners are exempt from transport tax. Photo: Reuters

For each of these grounds, the amount of tax-free income is no more than 4,000 rubles. for the calendar year (clause 28 of article 217 of the Tax Code of the Russian Federation).

Additional leave

We are talking about unpaid leave provided to working pensioners.

Who should

The employer is obliged, at the request of the employee, to provide leave without pay (Article 128 of the Labor Code of the Russian Federation):

- participants of the Great Patriotic War - up to 35 calendar days per year;

- for working old-age pensioners (by age) - up to 14 calendar days per year;

- for working disabled pensioners - up to 60 calendar days per year.

If you need to go on vacation

Compensation for travel costs to and from your vacation spot

Who should

According to the federal law on guarantees for northerners, compensation is provided to non-working pensioners who receive an old-age or disability insurance pension and live in the Far North or equivalent territories (Article 34 of the Law of February 19, 1993 No. 4520-1).

Terms of service

Travel is paid once every two years and only within the territory of Russia.

Where to go and how to get it

The benefit is provided by the territorial body of the Pension Fund of the Russian Federation, so you need to contact your Pension Fund branch at the place of residence where your pension file is located.

There are two options for receiving compensation: directly receive tickets or first buy them yourself, and then return the money spent (clauses 2, 3, 6 of the Rules for compensation of expenses for paying the cost of travel to pensioners, approved by Decree of the Government of the Russian Federation of April 1, 2005 No. 176) .

You can also contact the Pension Fund through the MFC.

How to apply

1. If you want to receive travel tickets in advance, before departure, you will need to document your upcoming stay in a sanatorium, holiday home, camp site or other holiday destination. Such a document can be a voucher, course, accommodation agreement, etc.

2. You can also receive monetary compensation after your vacation. In this case, you will need to attach air or train tickets to your application for reimbursement of travel expenses.

There are no restrictions on carriers: these can be both state and private transport companies. But only tickets for travel within the territory of Russia, including Crimea, are paid (clauses 7, 9 of Rules No. 176; clauses 13, 19 of the Administrative Regulations, approved by Order of the Ministry of Labor of Russia dated October 22, 2012 No. 331n).

State social assistance

State social assistance is provided to pensioners whose average income does not exceed the subsistence level established in the region where they live. General rule: monthly social supplement to pension up to the level of the regional subsistence minimum if the pensioner does not work. In addition, the law specifies certain categories of citizens who have the right to receive such assistance (Article 7 of Law No. 178-FZ of July 17, 1999).

State social assistance is assigned on the basis of a pensioner’s application by a decision of the social protection authority at the place of residence or place of stay of the pensioner. Some types of social assistance are prescribed by the territorial bodies of the Pension Fund (Parts 1, 2, Article 8 of Law No. 178-FZ of July 17, 1999). We will tell you more about this in other issues of the “Useful Book”.

Regional benefits

There are other tax and “material” benefits for pensioners, which may be established by regional or local legislation. For example, benefits for paying transport tax (Article 356 of the Tax Code of the Russian Federation), benefits for paying land tax (clause 2 of Article 387 of the Tax Code of the Russian Federation), benefits for paying for public transport, paying for utilities and others. We will also talk about this in more detail in the “Useful book” section.

The material was prepared based on materials from the Pension Fund of the Russian Federation, the Ministry of Labor of the Russian Federation, the Federal Tax Service, using the ConsultantPlus information system

Specifically

Example of calculating property deduction

Let’s say that a pensioner, including a working person, purchased and registered ownership of a house worth 2 million rubles in 2021. The total amount of the property deduction due to him will be this amount - 2 million rubles.

This means that the tax service can return to him the amount of income tax paid on his income in the amount of 2 million rubles. Since the income tax rate is 13%, the refundable amount will be 260 thousand rubles. (RUB 2,000,000 x 0.13).

Let’s say the income (salary) of a property owner will be 300 thousand rubles in 2013, 320 thousand rubles in 2014, 410 thousand rubles in 2015, 508 thousand rubles in 2021. Consequently, a pensioner in 2021 will be able to receive a deduction for 2021, and transfer the balance to 2013, 2014 and 2015 in the full amount of available income.

He is entitled to a refund of 200 thousand rubles. or, respectively, for the indicated years: 39 thousand rubles. (RUB 300,000 x 0.13), RUB 41.6 thousand. (RUB 320,000 x 0.13), RUB 53.3 thousand. (RUB 410,000 x 0.13), RUB 66 thousand. (RUB 508,000 x 0.13).

The balance of the deduction in the amount of 462 thousand rubles. (2,000,000 rubles - 508,000 rubles - 410,000 rubles - 320,000 rubles - 300,000 rubles) the pensioner will be able to use in the future if he has income taxed with personal income tax at a rate of 13% (clause 3 of Art. 210, clause 9 of article 220 of the Tax Code of the Russian Federation).

Useful phone numbers:

Russian Pension Fund Consulting Center: 8-800-775-54-45

;

official website of the Pension Fund: www.pfrf.ru;

Contact center of the Federal Tax Service of the Russian Federation: 8-800-222-22-22

, it will redirect you to the help desk of the region where you live;

official website of the Federal Tax Service: www.nalog.ru

How will social benefits increase for disabled people, Afghans and other beneficiaries? How much will families with children receive? How to apply for a discount on transport and land taxes? The answers to these and other questions are in our upcoming issues of the “Useful Book”.

Discounts for pensioners

During the analysis of regional legislation, it was possible to identify general patterns in the provision of benefits for pensioners. When paying transport tax, discounts are provided:

- Elderly citizens receiving a labor pension due to reaching a certain age;

- Only for one vehicle registered for a citizen of retirement age;

- Pensioners have only one status. If a pensioner has several special statuses at once, he can receive only one discount; the discounts are not cumulative;

- In full, in part or by establishing a fixed amount;

- Reducing tariffs.

What is required from a pensioner to receive benefits?

If a pensioner is entitled to a transport tax benefit, he must inform the tax office about this. This message is issued in the form of a statement in the established form (order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/ [email protected] ).

A sample from ConsultantPlus will help you fill out the application. Get trial access to the system for free and proceed to the sample.

Using this document, you can declare your right to benefits for three property taxes at once:

- transport;

- land;

- on property.

You can download a sample application here .

If the pensioner does not send this application to the tax authorities, he will not receive benefits.

You can attach documents confirming your right to benefits to your application, although this is not necessary (clause 3 of Article 361.1 of the Tax Code of the Russian Federation). If documents are missing, the tax authorities themselves will request them from the relevant authorities that have the necessary information. And only if the controllers do not receive this information will they inform the pensioner about the need to submit documents.

Results

Pensioners can count on certain transport tax benefits if regional authorities have provided for such a possibility in regulations. This may be a full or partial tax exemption. Regions solve the issue differently: they allow pensioners to reduce the tax burden by 20%, 40%, 50% of the tax base for specific types of transport or set reduced rates per unit of capacity.

If a pensioner does not use his car due to theft, he does not have to pay transport tax. To do this, you need to bring a police certificate to the tax authorities or deregister the car with the traffic police.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Other tax features for pensioners

If the power of a vehicle registered to a pensioner is less than one hundred horses, he can independently choose one of the benefits:

- The pensioner does not pay transport tax at all;

- Payment of only ten percent of tax for each vehicle. This option is best chosen when you own two types of transport (for example, a car and a snowmobile).

If the vehicle's power is more than one hundred horses, a citizen of retirement age can pay tax only for the power that exceeds the limit.

What tax benefits do pensioners have when selling a car?

When selling a car, no special bonuses or transport tax benefits are provided for pensioners. In addition, in some cases, a pensioner needs to pay income tax (NDFL) to the budget and submit a 3-NDFL declaration.

The obligation to pay personal income tax on the proceeds from the sale arises for a pensioner if he has owned the vehicle for less than three years (subclause 5, clause 1, article 208, clause 17.1, article 271 of the Tax Code of the Russian Federation).

How you can reduce the amount of personal income tax in this case, find out from this material.

Despite the fact that there are no transport tax benefits for pensioners when selling a car, there is a way to reduce the tax by using a special coefficient. With its help, the period of ownership of the vehicle in the year of sale is taken into account. The closer the sale date is to the beginning of the year, the lower the amount of transport tax on the sold vehicle.

When calculating the months of ownership of a vehicle, the date of deregistration is important (clause 3 of Article 362 of the Tax Code of the Russian Federation): if this event occurred before the 15th day, then this month is not included in the tax calculation, if after the 15th day - the month accepted as complete.

Example

The Patrikeev family has two absolutely identical cars, registered separately in the name of husband and wife. Every year, each spouse pays a transport tax in the amount of 3,630 rubles for their car.

The head of the family decided to upgrade his car and sold his old car at the beginning of January 2021 (immediately after the New Year holidays). In the same month, his wife damaged her car as a result of unsuccessful parking. After the repairs, she decided to sell it, but only deregistered it with the traffic police on December 16, 2020.

As a result for 2021:

- the husband does not pay transport tax - including for January (the month of sale and deregistration), since the date of deregistration of the car falls before January 15;

- the wife is obliged to pay the transport tax in full for the year - the date of deregistration of the car falls in the period after December 15 and this month is fully taken into account when calculating the transport tax.

As a result, in 2021, both spouses did not use their cars, and the amount of transport tax turned out to be completely different for them.

It turns out that when selling a car there are no transport tax benefits for pensioners. But from the moment the sold car is deregistered, the pensioner ceases to be a payer of transport tax on it.