Taxes and fees

Current as of May 30, 2017

From July 1, 2021, a new invoice form will apply. A new invoice format for exchanging documents electronically is also becoming mandatory. What does the new invoice form look like as of July 1, 2021? Did the changes affect adjustment invoices? Here is a completed sample of a new invoice form that you can download.

Upper part of the Invoice (header)

- Number and Date . The number must correspond to the numbering of documents approved in the accounting policy of your organization. The date indicated is current at the time of creation of the Invoice.

- Correction and Date . The correction number must correspond to the document numbering approved in the accounting policies of your organization. The date indicated is current at the time the Invoice is corrected. When drawing up an Invoice, before making corrections to it, a dash is placed in this line.

- Column Seller , the full and abbreviated name of the legal entity or individual entrepreneur (seller) is indicated.

- Column Address , the full address (with index) of a legal or individual entrepreneur (seller) is indicated.

- The seller's TIN/KPP column indicates the TIN and KPP of the legal entity (seller). An individual entrepreneur indicates only the TIN.

- The column Shipper and his address indicates the full and abbreviated name of the legal entity or individual entrepreneur (shipper), as well as his full address (with index). If the Invoice is drawn up for services performed (rendered) or property rights, then a dash is placed in this line.

- Column Consignee and his address , the full and abbreviated name of the legal entity or individual entrepreneur (consignee), as well as his full address (with index) is indicated. If the Invoice is drawn up for services performed (rendered) or property rights, then a dash is placed in this line.

- Column For payment and settlement document No. , indicates the number and date of the payment and settlement document (payment order) or cash receipt.

- Column Buyer , the full and abbreviated name of the legal entity or individual entrepreneur (buyer) is indicated.

- Column Address , the full address (with index) of a legal or individual entrepreneur (buyer) is indicated.

- The TIN/KPP column indicates the TIN and KPP of the legal entity (buyer). An individual entrepreneur indicates only the TIN.

- Column Currency: name, code , indicates the name of the currency and its code in accordance with the OKV classifier. The specified currency must be the same for all listed goods (works, services), property rights.

- Column Identifier of government contract, agreement (agreement) , indicates the identifier of the government contract, agreement or agreement. If there is no government order in the invoice, then a dash is added.

Invoice for services If the Invoice is drawn up for services performed (rendered) or property rights, then the two columns “ Consignor and his address ” and “ Consignee and his address ” are not filled in, you can put a dash (“–”) or a triple dash (“- — -“).

If, when drawing up an invoice for services, you still fill in these two columns, then this will not be a mistake. In this case, this information will be additional information to the required details and cannot serve as a basis for refusing to deduct VAT.

Filling example

The invoice form must be completed by all VAT payers. Based on the document, the tax is deducted or reimbursed. When using the simplified tax system, you do not need to issue an invoice.

The document is prepared in two copies - for each of the parties to the transaction - and certified by the supplier. and it must be filled out by the seller who released the inventory items. You can use both paper and electronic media.

Instead of an invoice, you can use a universal transfer document (UDD). Be careful: the standard for formatting this document has also changed in 2021. If you are more accustomed to working with invoices, you don’t have to change your usual practice: using UPD does not limit or cancel it.

List of goods and services in the Invoice

The table with the list of goods and services is filled with data in accordance with the column headings.

- Column 1 - Product name , indicates the name of the product, work and service.

- Column 1a - Product type code , when exporting goods abroad, indicates the HS code, otherwise a dash is added.

- Column 2 and 2a - Unit of measurement , indicate the name and code of the unit of measurement of the product or service, in accordance with the OKEI classifier. If there are no indicators, a dash is added.

- Column 3 - Quantity (volume) , indicates the quantity of goods, works and services. If there are no indicators, a dash is added.

- Column 4 - Price (tariff) per unit of measurement , indicates the price per unit of goods without VAT. If there is no indicator, a dash is added.

- Column 5 - Cost of goods (work, services), property rights without tax - total , indicates the amount of goods without VAT.

- Column 6 - Including the amount of excise tax , indicates the amount of excise tax on excisable goods. If there is no indicator, “without excise tax” is indicated.

- Column 7 - Tax rate , indicates the tax rate (for example, 0%, 10%, 18%). For operations specified in clause 5 of Art. 168 of the Tax Code of the Russian Federation is indicated “without VAT”.

- Column 8 - Amount of tax presented to the buyer , indicates the amount of VAT. For operations specified in clause 5 of Art. 168 of the Tax Code of the Russian Federation is indicated “without VAT”.

- Column 9 - Cost of goods (work, services), property rights with tax - total , indicates the amount of goods, work, services including VAT.

- Column 10 and 10a - Country of origin of the goods , indicate the name and code of the country of origin of the goods in accordance with the OKSM classifier. For goods produced in the Russian Federation, a dash is added.

- Column 11 - Registration number of the customs declaration , indicates the number of the customs declaration. For goods produced in the Russian Federation, a dash is added.

Total payable - the sums of the numbers in columns No. 5, 8 and 9 are summed up.

The nuances of issuing an invoice, or why we often look for its form

An invoice is the main VAT document.

Filling it out correctly will allow you to carefully study Government Resolution No. 1137 dated December 26, 2011. This document is supplemented and changed quite often, so you have to constantly monitor that invoices comply with all legal requirements. At the same time, it is important that you have not only an up-to-date invoice form on hand, but also an up-to-date sample invoice, as this will help you quickly navigate all the changes. Let's list them.

Let's start with the fact that the increase in the basic VAT rate from 18 to 20% from 01/01/2019 did not affect the invoice form in any way. The fact is that the bet size is not included in the form, but is indicated when filling out the document. Therefore, the only thing that now needs to be done differently from then on is to enter the value 20 instead of 18 in column 7.

Also find out what has changed regarding invoices since 07/19/2019.

As for the direct changes in the rules for issuing invoices and the invoice form, the last time they changed was in October 2021 (Resolution of the Government of the Russian Federation dated August 19, 2017 No. 981).

Since then, the invoice form provides:

- that the government contract identifier must be provided when available;

- the presence of a new column “Product Type Code”, in which you need to indicate the code of goods exported to the EAEU;

- indication in column 11 is not the number of the customs declaration, but the registration number of the customs declaration;

- that it can also be signed by an authorized person of an individual entrepreneur.

Government Decree No. 981 dated August 19, 2017 also provides for changes in the procedure for filling out line 2a of the invoice, which indicates the address of the seller and additions in the procedure for filling out the invoice by forwarders, customers or developers who act on their own behalf.

In addition, officials periodically explain the nuances of filling out individual lines of the invoice in their letters. ConsultantPlus experts have prepared step-by-step instructions for preparing each line of an invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Read more about the features of filling out an invoice according to the current rules in this article.

FROM THE HISTORY OF THE ISSUE: Previous changes to the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, which affected the procedure for filling out invoices, were introduced by Decree of the Government of the Russian Federation dated May 5, 2017 No. 625. They supplemented the invoice form with new details, namely the line 8 “Identifier of government contract, agreement (agreement).”

Even earlier, changes to the invoice form were made by Government Decree No. 1279 on November 29, 2014. Then intermediaries were allowed to issue a consolidated invoice for the principal and indicate data from several invoices issued to buyers or received from sellers.

Bottom of the Invoice (footer)

The lower part contains the signatures of the responsible persons:

- Head of the organization or other authorized person - the full name is indicated and the signature of the head of the organization or other authorized person is affixed.

- Chief accountant or other authorized person - the full name and signature of the chief accountant or other authorized person is indicated.

- Individual entrepreneur - the full name and signature of the individual entrepreneur are indicated, and the details of the certificate of state registration of the individual entrepreneur are indicated.

In organizations, in addition to the manager and chief accountant, a “other” authorized person can sign, but only with a valid intra-organizational order with the right to sign accounting documents.

An individual entrepreneur signs only one column, Individual Entrepreneur .

How to download and fill out an invoice form in a few minutes?

Using the MyWarehouse service allows you to do this even without knowledge of accounting and special terminology. You can invoice in a few seconds and complete it in a couple of minutes. Each stage of working with the document is accompanied by appropriate comments and recommendations. Explanatory information is attached to the forms.

This allows:

- Save up to 70% of the time spent on registration;

- Eliminate errors when filling out;

- automatically create an archive of printed documents and maintain continuous numbering;

- export completed forms to Excel and PDF.

Invoice “Without VAT”

Goods and services not subject to VAT From January 1, 2014, when performing transactions that are not subject to VAT, in accordance with Art. 149 of the Tax Code of the Russian Federation, there is no need to issue Invoices, keep logs of received and issued Invoices, purchase books and sales books. Changes have been made to clause 5 of Art. 168 of the Tax Code of the Russian Federation and clause 3 of Art. 169 of the Tax Code of the Russian Federation.

Please note that 0% VAT and “No VAT” are not the same rate, and each is applied for its own purpose. When performing transactions with a zero rate, indicating 0% VAT in the Invoice is mandatory.

Thus, there is no need to issue invoices for goods from January 1, 2014. But at the request of the counterparty, you can issue an Invoice “Without VAT”; this is not a violation. The requirement to issue an Invoice “Without VAT” can be presented by budgetary and government institutions. According to the specifics of their work, the treasury cannot make a payment without presenting an invoice.

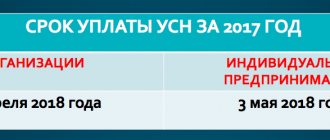

Storage of invoices new rules from October 1, 2021

- From October 1, 2021 p. f. and adjustment invoices must be kept for a minimum of 4 years.

- Stack them in chronological order as you post, receive, or correct them.

- Copies of paper invoices from intermediaries must be signed.

Let's sum it up

An invoice is not evidence of the process of transferring inventory items; this function is performed by waybills. Tax and accounting legislation does not even classify invoices as primary accounting documents. Meanwhile, it is undoubtedly important for buyers, as is the act of completed work. It is the invoice that provides the right to receive a tax deduction.

The issuance of new s/fs dated 10/01/2017 and their receipt are subject to mandatory recording in the journal. If they record taxable transactions issued, invoices received are recorded in the “purchase and sales ledgers.”

Invoice form in Word or Excel - what to choose

If the company does not have an automated accounting system, an invoice can be used to process VAT transactions, which can be found on any specialized Internet resource. In what format is it more convenient to download it?

If the invoice reflects one business transaction, then the format is not of fundamental importance. It’s another matter if you need to enter and process a large amount of information (for example, when selling a variety of products with dozens of items) - in this case it is more convenient to use an Excel form. It allows you to automatically make the necessary calculations (calculate the amount of goods for each item, the amount of VAT and calculate their total values).

Thus, the procedure is simple: the merchant first needs to decide which format will be more convenient for him to work with (Word or Excel), then find invoices on the Internet that correspond to the situation.

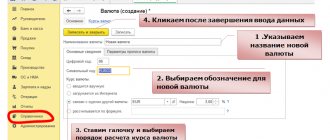

How to set up the reflection of the government contract ID in invoices in 1C

Step. 1. In order for invoices to reflect the identifier of a government contract, in the Main – Settings – Functionality on the Calculations , select the “Invoices for government orders” checkbox (Fig. 1):

Rice. 1

Step. 2 . Open the primary document “Sales (acts, invoices)”, issue an invoice and follow the link to the invoice form to indicate the identifier (Fig. 2):

Rice. 2

Step. 3 . Enter the necessary information in the “Government Contract ID” field in the invoice (Fig. 3):

Rice. 3

The identifier can contain 20 or 25 characters depending on the type of contract (Fig. 4):

Rice. 4

Contracts worth less than RUB 100,000. no identifier is assigned.

The Federal Tax Service has posted a reminder on its portal that the identifier must also be indicated in the advance invoice.

The new analytics “Government Contract Identifier” will now allow fiscal authorities to gain additional control over the use of federal budget funds.

The invoice form from July 1, 2017 has the following form (Fig. 5):

Rice. 5

UPD form recommended for use from July 1, 2017 (Fig. 6):

Rice. 6

Adjustment invoice form (Fig. 7):

Rice. 7

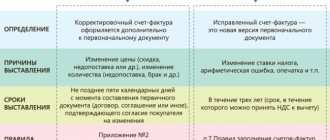

Types of Invoices

The concept and cases of using invoices are established by the Tax Code of the Russian Federation in Article 169. It follows from it that 3 types of payment and settlement documents are currently used:

- The main or shipping is provided by the supplier to the customer upon delivery of goods, performance of work or provision of services, as well as during the legal transfer of rights from one economic entity to another. The description, format and content of such documents are regulated by clause 5 of Art. 169 of the Tax Code of the Russian Federation.

- The prepayment is sent by the contractor to the customer if the latter has paid an advance for the goods, works or services supplied. The procedure for filling out is approved by clause 5.1 of Art. 169 of the Tax Code of the Russian Federation.

- An adjustment is formed when the price or quantitative characteristics of the supply change. Information on settlement and payment documents is updated in the event of a decrease in the price of goods, work, services or the volume of supplied products. This type of document has been used since 2011 (245-FZ dated July 19, 2011).

Shipping and advance payments differ in the moment of preparation. A shipping invoice is issued upon completion of delivery of products, performance of work or provision of services, while advance payment is subject to prepayment. There are significant differences in the content of such settlement documents, because prepayment invoices are drawn up even before the actual delivery. Some of the information to be included in the form is simply missing.

Where to find the registration rules and download a free sample of filling out an invoice for 2020-2021

A current invoice (2020-2021 model) is required for all VAT payers. The ability to download an invoice in Excel for free, as we have already said, is provided by many thematic sites, but choosing an option that meets legal requirements from numerous search results may take a while. Therefore, we offer you a simpler option - download invoice forms 2017 and invoices 2018-2021 in Excel for free on our website.

If you provide services, check whether you have issued an invoice correctly using the Ready-made solution from ConsultantPlus. If you are a tax agent, detailed material from ConsultantPlus will help you. You can get trial access to K+ for free by following the links.

So, for the period 2017-2021 there are three different invoice forms:

- An invoice that applies from 10/01/2017 (valid also in 2019-2021).

You can download a sample of filling out this form from the link below:

- An invoice that was used from 07/01/2017 to 09/30/2017. The form can be downloaded here:

- Invoice form valid until 06/30/2017. You can see the form and invoices for 2021 in this edition below:

IMPORTANT! The invoice must not contain errors that impede the ability to identify the seller, buyer, names of goods, as well as their cost, rate and VAT amount (clause 2 of Article 169 of the Tax Code). Which errors are not critical for deduction, see here.

Postings when receiving an advance from the seller

The seller, having received money from the client on account of future shipment, is obliged to perform the following actions:

- Select VAT from the received amount and make an entry to accrue it for payment;

- Prepare s/f within 5 days;

- Register the compiled s/f in your sales book in the quarter when the money is received;

- On the day of actual shipment, issue the s/f again against the advance received previously;

- The VAT accrued on the shipment should be sent for payment;

- VAT calculated upon receipt of the prepaid amount should be deducted;

- Register the shipping s/f in the sales book;

- Register the advance payment in the purchase book.

Settlements with customers are accounted for in account 62, advances are shown separately from other payments, for example, in subaccount 62av, while subaccount 62p will show other receipts from customers.

The seller's transactions look like this:

- Deb.51 Credit.62av – money was received from the client in the form of an advance;

- Deb.62av. Credit 68 – reflects the accrual of added tax allocated from the advance payment;

- Deb.62r. Credit 90.1 – shows the proceeds from the sale of inventory items against the advance payment;

- Deb.90.3 Credit.68 – VAT accrued on the sales transaction;

- Deb.68 Credit.62av. – Advance VAT is accepted for deduction;

- Deb.62av. Credit.62 rub. – The prepaid amount has been offset.

The first two postings are made on the day the advance money is received, the rest – on the day of the shipping operation. Such postings will eliminate double payment of added tax on advance and shipment.

Definition of the concept

An advance invoice is a document that confirms that the buyer has transferred part of the money to the seller of goods (or service provider) in the form of an advance payment. It contains all the basic information about the parties to the transaction, as well as financial information (in particular, the amount transferred, the time when the payment was made, the product or service for which these funds were transferred).

In addition, such an advance invoice also reflects tax information, due to which it also serves to obtain the necessary deductions (for this it must be submitted to the tax service during the reporting period).

Results

To draw up an invoice, you must have a current form and have up-to-date information on how to fill it out. When preparing this document, you can use any form format (Word or Excel). Free invoices in Excel are available on the Internet, including on our website. It would also be useful to familiarize yourself with a sample of filling out an invoice in 2020-2021 - this will help you avoid mistakes and not worry about tax deductions.

Sources:

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

- Decree of the Government of the Russian Federation of August 19, 2017 N 981

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.