What is an advance payment under the simplified tax system?

We have told you about the simplified special regime (USN or simplified tax regime) more than once. We have also already written about filling out declarations on the simplified tax system “Income” and about how to fill out a declaration on the simplified tax system “Income minus expenses”.

We also wrote separate articles about KUDIR for individual entrepreneurs on the simplified tax system “Income” and about KUDIR for individual entrepreneurs on the simplified tax system “Income minus expenses”.

Let us note several important points regarding simplification for today’s topic:

- According to the simplified tax system, the tax period is considered to be a year. The declaration must be drawn up and submitted based on the results of the year;

- The simplified reporting periods are quarter, six months and 9 months. At the end of these periods, you do not need to prepare and submit a declaration, but you do need to calculate the advance tax payment and pay it.

The advance payment represents the amount of tax calculated and subject to transfer to the budget based on the results of the reporting period.

That is, based on the results of the 1st quarter, we first calculate what tax we currently have and pay it. Then we make a calculation based on the results of 6 months, subtract from it the amount already paid based on the results of the 1st quarter, and pay the rest to the budget. The same calculations are made based on the results of 9 months. Then we calculate the tax at the end of the year and make the final calculation, which should be reflected in the declaration you submit.

The situation may change during the year, so as a result, when drawing up an annual declaration, you may end up with both an amount that needs to be paid additionally to the budget, and an amount to be deducted from the budget - this is when you transferred more advances during the year than you ended up with tax came out.

Advance simplified tax system: to pay or not to pay

First, let’s define what an advance payment is under the simplified tax system. This is part of the tax liability credited to the Federal Tax Service as an advance payment. The listed advances are counted when calculating the final transfer according to the simplified tax system.

Advance payments must be paid to the budget no later than the 25th day of the month following the reporting period. Transfer amounts should be calculated on an accrual basis. Pay the annual payment to the Federal Tax Service no later than March 31 of the year following the reporting year.

Deadline for making advance payments under the simplified tax system for 2021:

| For 2021 | 31.03.2020 |

| For the 1st quarter of 2021 | 27.04.2020 |

| For the first half of 2021 | 27.07.2020 |

| For 9 months of 2021 | 26.10.2020 |

| For 2021 | 31.03.2021 |

IMPORTANT!

There are two exceptions in which the payment deadline for the simplified tax system for 2020 is shifted to a period earlier than the established deadlines.

- Termination of the activities of an individual entrepreneur or company: then you need to pay the Federal Tax Service no later than the 25th day of the month following the month of liquidation.

- If the taxpayer has lost the right to use the simplified tax system. Then transfer the payment by the 25th day of the month following the quarter in which the subject lost the right to apply the simplification.

If the last day of payment falls on a holiday, weekend or other non-working day, then the budget should be paid on the first working day. But representatives of the Federal Tax Service do not recommend postponing settlements until the last day. Make payments in advance to avoid interest and penalties.

Advance payments according to the simplified tax system “Income”: calculation and formula

So, what data do we need to calculate the advance:

- The amount of income for the period on an accrual basis;

- Applicable tax rate;

- The amount of insurance premiums paid during the period;

- Amounts of advances already transferred earlier in the current year.

Then the formula for calculating the advance looks like this:

Advance payment = Income for the period * Rate – Insurance premiums – Advance payments of previous periods

We’ll show you how to calculate using an example: let’s say you’re an individual entrepreneur without employees, and at the end of the 1st quarter you received 100 thousand rubles. income. Your simplified tax rate is standard 6%. In the 1st quarter, you transferred part of your contributions to the funds, for example, 5 thousand rubles.

Advance (after 1st quarter) = 100 thousand rubles. * 6% - 5 thousand rubles. = 1 thousand rub.

Then in the 2nd quarter you received another 150 thousand rubles. income and paid the next 5 thousand rubles for themselves. contributions.

Advance (after 6 months) = (100 + 150 thousand rubles) * 6% - (5 + 5 thousand rubles) – 1 thousand rubles. = 4 thousand rub.

Further calculations are done in a similar way.

Important! On the simplified tax system (with income base):

- LLCs can deduct contributions for their employees from tax, but the tax can only be reduced by 50% of the calculated amount.

- Individual entrepreneurs who do not have employees have the right to deduct all contributions for themselves .

- Individual entrepreneurs can deduct from the tax both contributions for themselves and contributions for employees, but they are allowed to reduce the calculated tax amount by no more than 50% of the calculated tax amount.

Calculation of the final tax payment for the 4th quarter of 2020

For the 4th quarter, it is not the advance tax payment that is paid, but the tax at the end of the year. The fact is that the tax is paid in installments at the end of each reporting period, and 4 quarters of the year are the tax period. When calculating the payment for the year, all advance payments made during the year are taken into account.

Calculation of single tax for simplified tax system 6%

Tax is calculated using the formula = Tax base × 6% – Advance payments for 1st, 2nd and 3rd quarters

Step 1. Calculate income for the tax period. To do this, sum up all the income received in the 1st, 2nd, 3rd and 4th quarters on an accrual basis. This amount is in the first section of KUDiR. Organizations and individual entrepreneurs using the simplified tax system take into account revenue from sales as income, as well as non-operating income, which are listed in Art. 249 and Art. 250 Tax Code of the Russian Federation.

Step 2. Determine the amount of insurance premiums for the period and reduce the tax by their amount

- LLCs and individual entrepreneurs with employees can reduce tax by no more than 50%;

- An individual entrepreneur without employees has the right to reduce tax without restrictions by the amount of insurance premiums that he pays for himself.

Step 3: Determine your tax base. From the amount of income received for the year, subtract the amount of insurance premiums paid for the year. If the amount of the tax deduction exceeds 50% of the tax (for organizations and individual entrepreneurs with employees), then reduce the tax only by half.

Step 4. Calculate the tax according to the simplified tax system. Multiply the resulting tax base by the tax rate and subtract all advance payments transferred to the budget during the year.

An example of calculating a single tax for Cactus LLC for 2021

LLC "Cactus" operates on a simplified basis with the object of taxation "income". The organization has two employees, the salary of each of them is 45,000 rubles. The company's income for the entire year amounted to 860,000 rubles.

1st quarter - 200,000 rubles;

2nd quarter - 160,000 rubles;

3rd quarter - 280,000 rubles;

4th quarter - 220,000 rubles.

During the year, advance payments were transferred for the 1st quarter - 6,000 rubles, for the 2nd quarter - 4,600 rubles, for the 3rd quarter - 7,500 rubles.

The tax amount for the year is: 860,000 × 6% = 51,600 rubles.

We may reduce this amount by the amount of fees paid. From the salary of two employees (90,000 rubles), insurance premiums are paid monthly in the amount of 30% - 90,000 × 30% = 27,000 rubles per month. Over the past year, the organization transferred insurance premiums in the amount of 27,000 × 12 = 324,000 rubles. Sick leave was not paid.

We see that the amount of contributions is greater than the amount of tax, but we can still reduce the tax only by half: 51,600 × 50% = 25,800 rubles.

Now from this amount we must subtract advance payments for three quarters:

25,800 – (6,000 + 4,600 + 7,500) = 7,700 rubles.

Thus, the organization must pay 7,700 rubles by March 31, 2021.

Calculation of single tax for simplified tax system 15%

Step 1: Determine your tax base. Take income and expenses from KUDiR. Income is recorded in the first section of KUDIR in column 4. “Simplified” must take into account income in the tax base in accordance with Art. 249 and art. 250 of the Tax Code of the Russian Federation. Expenses are indicated in column 5 of the first section of KUDiR. Economically justified and documented costs, which are listed in clause 1 of Art. 346.16 Tax Code of the Russian Federation.

Unlike the simplified taxation system “Income”, under the “Income minus expenses” system, insurance premiums cannot be deducted. They are immediately included in expenses and reduce the tax base and the tax itself.

Step 2. Determine the tax amount. The tax is calculated using the formula:

Tax = (Income - Expenses) × 15%.

Check the tax rate for your region and type of activity, it may be less than 15%.

Step 3. Calculate the amount of tax payable for the year. From the calculated tax amount, subtract the advance payments that were made in the 1st, 2nd and 3rd quarters.

Advance payments according to the simplified tax system “Income minus expenses”: calculation and formula

So, what is needed to calculate the advance payment according to the simplified tax system “Income minus expenses”:

- The amount of income for the period on an accrual basis;

- The amount of expenses for the period on an accrual basis;

- Applicable tax rate;

- Amounts of advances already transferred earlier in the current year.

Then the expression for calculating the advance is the following expression:

Advance payment = (Income for the period – Expenses for the period) * Rate – Advance payments of previous periods

Now let’s look at an example: you are an individual entrepreneur without employees, at the end of the 1st quarter you received income of 100 thousand rubles, expenses for this period amounted to 60 thousand rubles. Your simplified tax rate is standard 15%.

Advance (after 1st quarter) = (100 thousand rubles – 60 thousand rubles) * 15% = 6 thousand rubles.

Then in the 2nd quarter you received another 150 thousand rubles. income and incurred expenses of 70 thousand rubles.

Advance (after 6 months) = ((100 + 150 thousand rubles) – (60 + 70 thousand rubles)) * 15% - 6 thousand rubles. = 12 thousand rubles.

Further calculations are done in a similar way.

Important! In this formula, contributions to insurance funds for yourself and for employees are not taken into account, since they are already included in expenses - there is no need to count them separately, they have already taken part in reducing the tax base.

Reduction of advance payments by the amount of insurance premiums

The amount of insurance contributions paid by individual entrepreneurs, contributions for the workforce of companies and individual entrepreneurs, help reduce the estimated cost of the tax. The reduction algorithm depends on the object of taxation:

- Using the simplified tax system “income” the amount of the calculated payment is reduced.

- In the simplified tax system “income minus expenses,” the amount of contributions paid is taken into account in the amount of income received.

An important condition for individual entrepreneurs operating at the simplified tax rate = 6% is the fact that they have workers. The presence of employees working on the basis of an employment or civil contract allows reducing advance payments by up to fifty percent.

The absence of workers allows advance payments to be reduced to the amount of advances paid. Low-profit businesses with absent employees and revenue may reduce advances to the cost of contributions.

If initially the entrepreneur worked himself, and after a while hired workers, the amount of payments for the period when there were no hired workers is taken into account.

When hiring employees in June, the individual entrepreneur can reduce the amount of the advance by the amount that has already been paid for two quarters. In the future, by the end of the previous period and based on its results, the amount of the amount can be reduced to half, even if the workforce is dismissed already in the next so-called reporting period.

To calculate everything correctly, you need to take into account not only your own payments, but also the amounts that were paid for employees.

Deadlines for making advance payments under the simplified tax system in 2021

Advance payments under the simplified tax system must be transferred to the budget by the 25th day of the month following the completed period - that is, by April 25 / July / October.

You must pay them within a year! This is provided for by tax law, and if you violate it, you will be subject to late payment penalties.

To always pay advance payments under the simplified tax system and other taxes on time, use a special service that will simplify accounting.

Even if you already understand that the tax on your annual operating results will be lower than the amount of advances, you still need to pay them during the year. It’s just that at the end of the year you have an overpayment of taxes - you can offset it against payments from the next year or return it.

Common rules for simplifiers

The simplified encumbrance regime has the right to apply to merchants and organizations that meet three mandatory conditions:

- income does not exceed 150 million rubles (for the previous year);

- book value of property - no more than 150 million;

- the number of employees does not exceed 100 people.

If the conditions are met, then the economic entity has the right to switch to the simplified tax system. The Tax Code provides for two simplified taxation options:

| Criterion or characteristic of the regime | Income | Income minus expenses |

| Taxable object | All income receipts of an economic entity, both revenue from the main activity and non-operating and other income. Expenses of an economic entity are not taken into account when calculating the simplified tax system. | The difference between revenue and costs incurred. Moreover, all types of company income are included in the revenue part. The costs include only those expenses that are indicated in the Tax Code of the Russian Federation. |

| Bid | 6 %. | 15 %. |

| Benefits and relaxations | Regional authorities have the right to reduce the tax rate to 1%, in accordance with clauses 1, 3 of Art. 346.20 Tax Code of the Russian Federation. | The rate can be lowered by decision of the government authority of a constituent entity of the Russian Federation to 5%, in accordance with clause 2 of Art. 346.20 Tax Code of the Russian Federation. |

| The amount of insurance contributions, as well as temporary disability benefits (at the expense of the employer), is allowed to be offset against the transfer of the simplified tax system (Clause 3 of Article 346.21 of the Tax Code of the Russian Federation), but not more than 50% of the accrued payments for the single tax. | ||

| Minimum payment | Absent. | If the entity’s activities for the reporting year resulted in losses, then the minimum payment is applied. The amount is determined as 1% of the total income received during the reporting period. |

| Is it necessary to pay advance payments under the simplified tax system? | It is mandatory to pay an advance payment to the budget under the simplified tax system. Transfer the money no later than the 25th day of the month following the reporting period. | |

| What taxes does it replace? | VAT, income tax for organizations and personal income tax for individual entrepreneurs, property tax (but there are exceptions). | |

| What will you have to pay, besides the simplified tax system? | Land and transport taxes, if the taxpayer owns land or vehicles. Property tax, if the value of real estate is determined by the cadastre (clause 2 of article 346.11, clause 1 of article 346.19 of the Tax Code of the Russian Federation). Taxes and fees specific to a specific type of activity (MET, trade tax, gambling tax, water tax, etc.). Insurance premiums and personal income tax for employees, insurance coverage for individual entrepreneurs for themselves. | |

| How to report | How to fill out a tax return under the simplified tax system | |

| How to switch to simplified taxation system | Notification of transition to the simplified tax system, sample filling | |

| How to pay | Sample payment order when applying the simplified tax system | |

This might also be useful:

- Advance payment of Unified Agricultural Tax in 2021

- Changes to the simplified tax system in 2021

- Tax calendar for 2021

- How to calculate the simplified tax system?

- How to reduce the simplified tax system for insurance premiums?

- How to work on the simplified tax system income 6%

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Novation of an obligation to supply goods into a loan obligation

It happens that a “simplified” buyer, having received an advance payment for the upcoming delivery of goods, cannot fulfill the terms of the contract for its shipment. In this case, the parties often resort to concluding an agreement on novation of the obligation to supply goods into a loan obligation. As a result of the novation, the obligation under the supply contract is terminated, and the amount of the prepayment received is recognized as a loan.

Since borrowed funds received are not taken into account as income (clause 1, clause 1.1, article 346.15, clause 10, clause 1, article 251 of the Tax Code of the Russian Federation), the received amounts are not subject to “simplified” tax (resolution of the Federal Antimonopoly Service of the North Caucasus District dated 4 June 2013 in case No. A61-1274/2012).

General approach

Thus, in 2021, organizations and individual entrepreneurs will need to cover the final tax under the simplified taxation system for the previous year 2017. Along with the submission of the relevant declaration, payment must be made before the end of March.

Typically, simplified taxation system payers have on their agenda the question of the exact amount of money that must be indicated in the payment order at the time of transfer of this tax. However, the purpose and period for which the tax is paid are also of great importance. Let's look at these questions further.

Also see “Rules for calculating advance payments under the simplified tax system.”

Punishment for failure to pay advance payments on time

According to the Tax Code of the Russian Federation, if advance payments were not accrued on time and sent to the state budget, penalties are charged on them.

The amount of the penalty is equal to 1/3 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay.

However, with regard to individual entrepreneurs who neglect to pay advance payments, legislators limited themselves to only charging penalties - no other fines or punishments are provided here.

But if an individual entrepreneur does not submit a tax return according to the simplified tax system on time, then in this case he will be required to pay a fine. The amount of the fine is individual in each case, since it is equal to 5% of the unpaid amount for each month.

However, there are also restrictions on the amount of the fine - it should not be higher than 30% of the amount of unpaid tax, and at the same time it cannot be lower than 1 thousand rubles.

Payment mechanism

There is a special procedure for the relationship between the organization that conducts banking operations and the payer. In addition, the main points regarding the payment order - namely its form and related details - are given in the rules approved by the Central Bank in 2012 under No. 383-P.

Details play a key role in the payment security system. They are the ones that the credit institution needs to correctly and accurately identify the payment. In addition, the details themselves guarantee that the payer will fulfill his obligation to pay funds.

If there are shortcomings and/or inaccuracies in the payment document itself (for example, an error when indicating the purpose of payment under the simplified tax system), this may cause:

- erroneous transfer of funds;

- incorrect payment identification.

You can familiarize yourself with the list of payment details when transferring the simplified tax system for the year in Appendices 1, 2 and 3 of Rules No. 383-P.

The so-called purpose of payment and other important information must be reflected in a specially designated field of the payment document. It is worth paying attention that the number of characters in this field is equal to or less than 210 characters. This rule also applies to the purpose of payment under the simplified tax system in the current year.

In order for the payment to be correctly identified, you must indicate:

- exact type of tax payment (for example, advance/annual);

- the period for which tax is deducted.

If there is an overpayment of advance payments

Ideally, this shouldn't happen. However, in practice, situations quite often occur when an overpayment occurs. In this case, two scenarios are possible:

- the overpayment was discovered by the tax authorities - they are obliged to notify the taxpayer about this and conduct a reconciliation report on tax payments with him;

- the taxpayer himself discovered the overpayment - he must inform the tax authorities about this and also draw up a payment reconciliation report.

As a rule, if the fact of overpayment is established and documented, the transferred tax payments are counted against future advance payments. However, if the taxpayer does not want this, he has the right to write to the tax service an application for a refund of overpaid amounts.

All individual entrepreneurs using the simplified regime for calculating and paying taxes are required to pay advance payments. However, in cases where this does not work out for some reason, no large fines or punishments will follow; the maximum that can happen is the accrual of small penalties, which, of course, is also unpleasant, but quite tolerable. However, advance payments contribute to maintaining order in tax payments, internal financial discipline of the individual entrepreneur, and also almost completely eliminate the possibility of sudden audits from tax authorities.

KBK for payment documents of the simplified tax system advance payments

KBK is a budget classification code that is indicated on receipts or bank documents for tax payment, in addition to the details of the Federal Tax Service to which the payment should be sent.

The BCC of advance payments for the simplified taxation system does not differ from the BCC of the single tax itself. In 2021, the budget classification codes approved by Order of the Ministry of Finance of Russia dated July 1, 2013 N 65n (as amended on November 26, 2018) continue to apply. It is very important to indicate the BCC correctly. Payment using an incorrect classification code will result in an incorrect allocation of amounts paid. Such a mistake will lead to you being in arrears. In the future, you will have to write an application to clarify the details of the payment order for the advance payment of the simplified tax system.

KBK simplified tax system 6% (tax, arrears and debt) - 182 1 05 01011 01 1000 110;

KBK simplified tax system 15% (tax, arrears and debt, as well as minimum tax) - 182 1 0500 110.

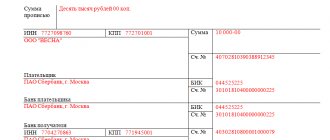

Filling out a payment order

The payment slip contains the details of the sender (the individual entrepreneur himself) and the recipient (the tax authority). How to fill in payer information:

- TIN – taken from the registration certificate, consists of 12 characters, the checkpoint field is not filled in (put “0”);

- last name, first name, patronymic are entered without abbreviations, followed by “(IP)” and the address of the entrepreneur, for example, “Sergey Ivanovich Nikolaev (IP) (Moscow, Parkovaya St., 66, apt. 166)”;

- payer status (field “101”, located at the top of the form) – “09”.

An individual entrepreneur's current account consists of 20 digits (the same as a bank's correspondent account), while the bank's BIC consists of 9 digits.

When transferring funds, you cannot make mistakes in the following fields (clause 4, clause 4, article 45 of the Tax Code of the Russian Federation):

- beneficiary's (treasury) account number;

- name of the recipient's bank.

Otherwise, the tax amount will be considered unpaid; It is impossible to clarify such a payment; you will have to apply for a refund and remit the tax.

Errors in other details are not considered critical, but because of them the amount may fall into the unknown. To correct this, it is enough to send an application to the Federal Tax Service to clarify the payment, attaching a copy of the payment order.

The recipient's details can be found at the territorial inspectorate at the place of residence of the individual entrepreneur or found on the official website of the Federal Tax Service using ]]>special service]]>. The funds are transferred to the account of the Federal Tax Inspectorate of the subject of the Russian Federation, with the name of the tax inspectorate written in brackets. The correspondent account field of the recipient's bank remains empty when paying taxes.