Calculating vacation pay in a new way in 2021: examples of calculation. Vacation pay in 2021 is calculated taking into account the Regulations on the procedure for calculating average earnings, approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. A new law changing this procedure has not been adopted.

When calculating vacation pay in 2021, the following factors are affected:

- calculation period;

- coefficient of the average number of days worked in 2018;

- average employee salary;

- duration of vacation;

- work experience.

Procedure for providing annual paid leave

The provision of annual paid leave is guaranteed to each employee by the Labor Code in Article 114. Its duration is established by law and is 28 calendar days.

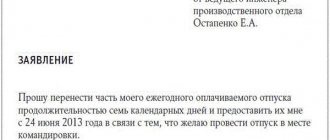

It can be provided at a time, or maybe in parts. The duration of each part is agreed upon between the employee and the employer. But one of the parts must be at least 14 calendar days. The employee has the right to paid rest after six months of work. But by agreement with the employer, it can be provided earlier. In subsequent years of work, the order of providing rest days to employees is established by the company in the vacation schedule.

It is prohibited to pay compensation instead of providing annual paid annual leave. Thus, the legislator protects the employee’s right to rest.

Employee's rights to leave

Every employee has the right to rest. It must be provided by the employer every year and paid in accordance with the law. This right does not depend on where a person works, how his place of work is organized, and so on. Moreover, both an ordinary employee and a part-time employee, a seasonal worker and any other can take advantage of the leave. Except for those who have entered into a civil contract with the employer (for example, a contractor).

The right to maintain a position and average earnings

One of the main responsibilities of an employer to an employee going on vacation is to maintain his level of earnings and position. The boss does not have the right to send an employee on a walk without paying him vacation money (based on average earnings), or to fire him while he is on vacation.

It is worth remembering that vacation at your own expense is not paid for by the employer. If the period exceeds 14 days, all subsequent days away from the workplace will not be included in the length of service required to take a well-deserved annual rest.

Right to use vacation

An employee has the opportunity to rest for 28 days after working for at least 6 months for one organization. He can take it at any time after six months of accrual of experience, without violating the approved vacation schedule. But you can take time off “in advance” (before reaching six months), if the employer agrees to this.

In the case when a person works part-time, he has the right to receive leave from both jobs at once in accordance with Art. 286 Labor Code of the Russian Federation. Even if he has not been on one of them for 6 months yet, in this case the boss must provide the rest “in advance.”

An employee cannot be recalled from vacation if he does not agree to it. If agreed, the “non-time off” days still remain with the employee, and in the event of dismissal, the employer must compensate for them. In addition, even if the employee wishes, the following categories of citizens cannot return from vacation earlier:

- minors;

- pregnant women;

- working in dangerous or harmful conditions.

It is worth remembering that according to Art. 114 of the Labor Code of the Russian Federation, annual paid leave is not only an employee’s right. This is his direct responsibility. You can't refuse a vacation. It can be transferred to the next calendar year at your own request (in some cases regulated by the Labor Code of the Russian Federation and internal regulations of the organization). But only once - you can’t not go on vacation twice in a row. The employer has the right to consider a voluntary refusal to take leave a disciplinary violation and apply appropriate sanctions to the employee.

In this case, annual leave can be divided into two parts (or more, if the number of days allows) so that one of them is at least 14 days.

Right to extend leave

In some cases, the employee has the opportunity to slightly increase the rest period. Such situations include:

- Illness during vacation (if confirmed by a sick leave certificate, does not apply to the illness of an employee’s child).

- Performing government duties while on vacation.

You can also obtain permission for additional days of rest in other situations provided for by law and internal agreements/regulations of the organization. The list of such situations still remains open, so it is worth checking with the employer about a specific precedent.

Calculation of average earnings for vacation pay in 2021

A special procedure for calculating average daily earnings for calculating vacation payments is established by paragraph 10 of the Regulations approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. Average daily earnings should be calculated using the formula:

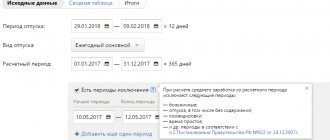

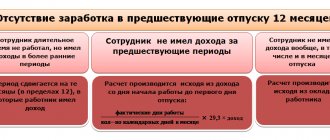

Vacation payment is made based on the employee’s average earnings for the 12 months preceding the month it began. If there is no earnings in the billing period (this happens when an employee is granted leave immediately after maternity leave and absence to care for a child), then it should be replaced. In this case, it is necessary to take as the calculation period the annual period preceding the start of the maternity leave.

Method 1: according to plan

When calculating vacation pay, the salary for the last month of the billing period is taken into account in the planned amount. If it changes at the end of the month, a recalculation is made. This method is suitable for salaried employees whose salary amount is stable and known in advance. If the employee works in full for the month before the vacation and this month he does not have payments for average earnings, sick leave, etc., then you will calculate the vacation pay accurately and no recalculations will be required.

For example, an employee goes on vacation from 08/01/2020. The accountant calculates and issues vacation pay on July 26, 2020. Billing period: August 2021 - July 2021. When calculating average earnings, the accountant takes the July salary in full. If the employee works as usual on July 29, 30 and 31, then there will be no need to recalculate vacation pay. But if he, for example, gets sick, a recalculation will be required.

If you doubt the correctness of your calculation for an employee whose vacation begins on the 1st, use the recommendations from ConsultantPlus experts. They will tell you how to correctly calculate your average daily earnings and not make mistakes with the dates. Get trial access to the system and proceed to consultation for free.

How to pay correctly

According to Part 9 of Article 136 of the Labor Code of the Russian Federation, vacation pay must be paid at least three days before the start of the vacation. How to calculate these days? There must be three full calendar days between the day of payment and the day the rest begins. That is, if an employee goes on vacation on Monday, he must pay the accrued amounts no later than Thursday.

If the payment day calculated in this way falls on a weekend or non-working holiday, the transfer to the employee must be made on the eve of this day or at an earlier date. This explanation is given by Rostrud in Letter No. 1693-6-1 dated July 30, 2014. However, judges argue with Rostrud, be careful, read about possible violations in the article “Paying vacation pay 3 working days before vacation will lead to a fine.”

Personal income tax is withheld from the amount paid on the day of transfer. The employer is obliged to pay the withheld tax to the budget no later than the last day of the month in which vacation amounts were paid.

Compensation for unused vacation

In some cases, an employee has the right to receive money instead of vacation directly (or part thereof). But not all of them. It is impossible not to go on vacation, receiving instead a certain amount in addition to your salary.

An employee may request money in lieu of vacation if he:

- He quit without taking the required time off (Article 127 of the Labor Code of the Russian Federation).

- He does not want to rest for more than 28 days and is ready to write a statement so that the remaining vacation days are replaced with money (Article 126 of the Labor Code of the Russian Federation). But only on the condition that the annual leave is more than 28 days, and the employee is an adult and not a pregnant woman.

Employees who have worked for at least 11 months without a 28-day vacation can count on full compensation upon dismissal. Moreover, if the vacation was postponed, you must work 23 months to receive compensation for 56 days. But, if an employee is discharged as a result of entering active military service or due to a reduction, liquidation or suspension of the enterprise, its reorganization, then the minimum threshold for receiving full compensation for 28 days is reduced to 5.5 months. To receive money for 56 days, such an employee must work 18 months with the transfer of vacation from the first year.

If the employee worked for less than 11 months and quit for any other reason, then he has the right to proportional compensation according to the months worked. To do this, you need to divide the number of vacation days by 12 months.

When calculating length of service, just as in the case of obtaining the right to leave, working months/years are taken into account, not calendar ones. That is, to obtain the right to 100% compensation, 28 days in case of dismissal must be worked, for example, from March 1, 2021 to February 1, 2019 (11 months).

The second option covers almost all citizens with extended or additional leaves - be they for disability, seasonal (teachers) or for other reasons. Only “Chernobyl victims” and those working in harmful/dangerous conditions are not subject to this rule (additional leave).

In addition, two annual holidays cannot be combined to obtain compensation for anything greater than 28 days. Because each of them is taken into account separately. But if both exceed 28 days (let’s say 32 days each), then you can request to pay an additional 4 days from each period. But this right of the employee is not the obligation of the employer. Therefore, the latter has the right to refuse payment of money and send the applicant to “walk” for the prescribed number of days.

Attention! You cannot receive compensation for a vacation of no more than 28 days (even if it was not taken last year) in money! This is a serious violation that will lead to a fine for the employer under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Let's look at a few examples

Example 1. No bonus payments to the employee

Citizen Frolov worked for the Century organization from August 2021 to August 2021. At first, he held the position of engineer and received 16 thousand rubles, then, after 8 months, he was promoted to the position of foreman with a salary of 20 thousand rubles. It is known that Frolov was supposed to go on vacation for 28 days, since he worked for the entire period (a year).

228,000 / 12 / 29.3 = 648.46 rubles. And then the total amount of compensation: 28 days x 648.46 rubles = 18,156.88 rubles. It turns out that Frolov’s vacation pay will be 18,156.88 rubles. |

Example 2. With bonus payments

The calculation is carried out in the same way as in the previous situation. But only the bonus paid to the employee in a certain period is added to the salary.

Determination of estimated time

If the OO falls on holidays that are officially recognized as days off, then it is extended by the number of days of rest. There are no additional charges or payments made. But for the next OO, holiday weekends will be considered as actually worked and will affect accruals.

Often situations arise when the period is completely excluded. Then the time actually worked preceding the interval is taken as it. When it is also excluded, then the current month and charges for it are taken.

The period under consideration does not include those days when the enterprise was downtime due to the fault of the employer, that is, the organization’s activities were suspended for some reason beyond the control of the staff. Payment for downtime is carried out in the amount of at least 2/3 of the average salary (LC Article 157). This amount, as well as downtime, is not taken into account.

Which days are taken into account?

To determine the amount of vacation pay, you need to take the previous 12 calendar months, as well as the length of time actually worked by the employee during this period. But the organization retains the right to change this period (for example, 3 or 6 months), which is confirmed by the contract concluded during employment.

Regardless of what period is adopted for calculation, the interests of employees should not be infringed, nor should the amount of vacation pay be affected in a smaller direction.

If an employee is employed in the middle of the calendar year and has not fully worked the time used for accrual, then when determining the amount of payment, the period that he actually worked at this enterprise is taken. In this case, the following are excluded from it:

- sick leave;

- decree;

- time of maternity leave;

- other cases of actual absence of a person when he was not at work, and wages were not accrued.