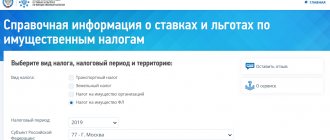

Every year in the second half of the year, the Federal Tax Service (FTS) informs each real estate owner how much taxes he needs to pay for the previous year. The Federal Tax Service receives all the necessary information about property and its owners from Rosreestr. The property tax rate ranges from 0.1% to 2%, depending on the region and the cadastral value of the property. The amount is indicated in tax notices that are sent by mail or via the Internet. Sending begins in the summer and continues for several months - the letter must arrive before the beginning of November, and the tax must be paid before December 1 .

Sometimes tax notices may not reach the addressee; this can happen for several reasons. However, if there is no receipt, this does not mean that taxes can not be paid. If there is a delay, the tax office will charge a penalty and a fine and forcefully collect the debt. If you don’t want to go to the tax office and find out whether there is a tax debt for the past period or not, then you can get the necessary information and pay for everything without a receipt - via the Internet. Usually, all you need to do is know your individual taxpayer number (TIN).

Property tax is a payment to the government for the ownership of real estate. If a citizen bought an apartment and registered it in his name, he becomes the owner of the property, for the right of ownership of which he is obliged to pay taxes annually . In this case, the amount payable does not need to be calculated independently . This is done by the tax service.

Why might I not receive a tax notice?

“Paper” tax notices are not sent to Russians who use the “Personal Taxpayer Account”. In this case, the document will appear in your account and will not be duplicated by mail. The exception is when the user has requested in advance to receive paper documents.

The notice is also not sent to those who have tax benefits, deductions or other legal grounds that completely exempt them from paying tax. These are certain categories of pensioners and disabled people, military personnel, etc.

Also, you should not wait for the document if the total amount of taxes is less than 100 rubles. Then the notification will be sent only in the calendar year, after which the possibility of sending the notification is lost.

In addition, Russians who have not notified the Federal Tax Service that they are the owners of real estate or vehicles will not be able to receive a notification. Finally, a document sent by mail may, for some reason, simply not reach the addressee.

How to pay personal property tax if there is no receipt

The absence of a tax notice is not a reason (or an excuse) for tax evasion. To pay accrued debt without a receipt, you can use one of the following methods:

- In the taxpayer’s personal account using the “Payment of taxes for individuals” service - on the website or in the mobile application of the Federal Tax Service, you can generate a receipt for payment at the bank or immediately pay by card online without commission. You can pay not only for yourself, but also for third parties. For example, a husband may pay taxes for his wife.

In 2021, it became possible to pay taxes in advance: a citizen can transfer any amount to his balance in his personal account. When the time comes to pay property taxes, the tax office will independently write off the required amount from the balance sheet.

- After December 1, unpaid property tax turns into a debt that can be repaid directly through State Services (the option is available to all citizens registered on the portal who have indicated their TIN). If there is a tax debt, a corresponding message will be displayed in your personal account. To pay, you need to click on the appropriate item, after which an invoice will be issued. On State Services you can also make payments for third parties. Once the payment is completed, the debt notification will automatically disappear from the main screen.

- You can check your debt and pay your apartment tax using the Yandex.Money service. To do this, go to the “Payment for services” section and select “Taxes”. Then you need to enter your Taxpayer Identification Number. It can be found out by passport data through a special service on the Federal Tax Service website - “Find out TIN”. After clicking the “Check” button, information will appear about the presence of debt on property taxes or their absence. You can pay the debt using funds available on your electronic wallet or from a bank card linked to it. There is no transfer fee.

It is impossible to pay taxes on time in this way; the service allows you to find out and pay only the debt that has already accumulated (that is, this method can only be useful after December 1).

- Citizens can pay taxes without a receipt through a bank. Using a mobile application or on the website of a credit institution, you can find out your debt by TIN number and pay it immediately. This option is available to clients of Sberbank, Tinkoff Bank, VTB, B&N Bank.

Read answers to other popular questions

Where to go if you haven't received a tax notice?

If the tax notice has not been received, you must contact the tax office in person, by mail, through the MFC or “Personal Account” on the website of the Federal Tax Service of the Russian Federation. You can also contact the inspection through the service’s online service in the section “Contact the Federal Tax Service of Russia”

In his appeal, the taxpayer must inform that he owns a piece of real estate or a vehicle, but has not received a tax payment notice. Those who have never previously received notifications or have not claimed tax benefits in relation to taxable property will also need to contact the tax office and report ownership of property or a vehicle.

Question answer

What to do if you transferred “extra” taxes?

Answered by lawyer, K. Yu. n. Yulia Verbitskaya:

You should definitely contact the tax office. By presenting your passport and TIN, you will be able to obtain the necessary information. The tax officer will also print out a duplicate payment receipt for you, which you can present at any bank and make payment. It is important to understand that the obligation to notify the tax service about the absence of receipts for payment of real estate taxes is the responsibility of the citizen who owns the property. If you do not do this and do not pay the tax, then in the future you will have to pay not only taxes for all missed periods, but also fines (penalties).

However, you can also clarify the amount of the property contribution due for payment remotely, via the Internet. There are several convenient resources for this: the official website of the tax service, the State Services portal, Sberbank’s personal account, etc.

Should a pensioner pay taxes on a share in 2 apartments?

Why are they collecting for major repairs already 3 years after the completion of the new building?

What property is subject to tax?

Owners of houses, apartments, rooms, cottages, garages, parking spaces and other capital construction projects must pay the tax. Land plots are also taxed, including those used as gardens, vegetable gardens, summer cottages, household plots and for individual housing construction.

Transport tax will need to be paid by owners of cars, motorcycles, yachts, boats and other vehicles.

Certain categories of Russians can count on federal benefits for property, land and transport taxes. These are Heroes of the Soviet Union and the Russian Federation, disabled people from childhood, groups I and II, disabled children, certain categories of pensioners, military personnel, etc. Regions can also introduce their own additional benefits. You can find out about the possibility of receiving benefits on the Federal Tax Service website.

From January 1: it is possible to submit an application for a personal income tax refund (tax deduction)

A tax deduction is provided to a citizen once in his life.

If you have never used it, but purchased real estate in 2021, then, starting from January 1, 2021, you have the right to apply for a personal income tax refund. The maximum amount for which a tax deduction is provided is 2 million rubles, therefore, you will be returned 260 thousand rubles. – 13% of it. If you used a mortgage loan when purchasing real estate, you will additionally receive 13% of the amount of interest paid by the time you received the deduction. An essential condition for exercising the right to a tax deduction is the regular receipt of income subject to personal income tax. Simply put, to receive a deduction in the specified amount, the amount of taxes you paid must exceed it.

Answers about commercial property taxes

Taxes when buying and selling housing: 23 useful articles

How do tax authorities find out about your bank accounts?

Elementary Watson. Through the federal resource “Bank-inform”. This is where banks provide information about all open accounts of individuals. This database contains complete records - starting from 2014 - of all banks and all accounts.

Everything – from the word absolutely: credit cards, salary cards and savings cards too. And information about blocked accounts and cards, by the way.

If the debtor has different accounts in different banks, the tax office sees them all. And he will send the court order for execution to one of the banks at his discretion. The court order exists in one copy, is not replicated and is not sent to all banks.

If there is no money in the debtor’s account, the order will remain in the bank for two months and will be returned to the tax office. Next, the tax office will send it to the second bank. If there is no money there, the document is returned again. And so on.

This is not convenient for the tax office. Therefore, if it turns out that the debtor has several accounts, bailiffs help the tax office to collect the debts. Based on a court order, bailiffs can seize all accounts at once.

What has changed in 2021

A new form has been approved for the property tax return for 2021 (Order of the Federal Tax Service of Russia dated July 28, 2020 No. ED-7-21/ [email protected] ). By the same order, the Federal Tax Service updated the procedure for filling out and the electronic format of the declaration.

Section 1 - two new lines appeared

Line 005 “Taxpayer Attribute”. You need to enter a code from 1 to 3:

- “1” - if the organization pays advance payments later on the basis of Government Decree No. 409 dated 04/02/2020;

- “2” - if the organization pays advance payments later on the basis of regional laws;

- “3” - if the organization pays advances on time.

Line 007 “SZPK sign”. This line is only for organizations that have entered into an Investment Protection and Promotion Agreement (IPPA). Enter one of the codes:

- “1” if the tax (advance payments) is calculated on real estate related to the implementation of the SZPK;

- “2” if the real estate is not associated with the SZPK.

Sections 2 and 3 - new line, benefit and property codes

New line 002 “SZPK Attribute” is needed only for organizations with an investment agreement. Enter “1” in line if the property is related to the execution of the SZPK, “2” if it is not. Each feature requires a separate section 2 and section 3.

New codes for federal and regional benefits related to coronavirus have been approved:

- 2010501 and 2010505 - for small and medium-sized enterprises;

- 2010502 and 2010506 - for socially oriented non-profit organizations;

- 2010503 and 2010507 - for non-profit organizations most affected by the coronavirus;

- 2010504 and 2010508 - for centralized religious organizations.

A special code was introduced for the property of FEZ participants - “14”. It is used for real estate in Crimea and Sevastopol. Indicate the code in line 001, and for each code create its own section 2.

Section 4 - new section with information about movable property

On January 1, 2021, amendments to the Tax Code of the Russian Federation came into force, according to which information about movable property must be included in the property tax declaration. Especially for this, the Federal Tax Service added a new section 4 to the declaration form, “Information on the average annual cost of movable property items recorded on the organization’s balance sheet as fixed assets.” It must be filled out in the declaration for 2021 if the company has such fixed assets on its balance sheet.

The average annual value of property must be indicated for each region. The value of such property, which is listed as a separate division, which has a separate balance sheet, is also reflected here.

At the moment, the fourth section is for reference only, since movable property is still not subject to taxation. But there is a possibility that in the future they will begin to be taxed again, although the Ministry of Finance promises to reduce rates.

Liability for non-payment

If a personal property tax receipt is not paid on time, the debtor may face a special tax liability in the form of a penalty.

It is 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay.

For incorrectly calculated tax, a fine of 20% of the amount of arrears is imposed.

The fine is collected administratively, but can be challenged in court. When you receive a tax receipt, you should pay it as quickly as possible. If the receipt contains incorrect calculations, they should be appealed administratively. In some situations, litigation may be necessary. Then it is advisable for the taxpayer to enlist the support of a competent lawyer.