Home — Articles

Commentary to the Ruling of the Supreme Arbitration Court of the Russian Federation dated December 26, 2013 N VAS-18613/13 “On refusal to transfer the case to the Presidium of the Supreme Arbitration Court of the Russian Federation”

The commented Determination of the Supreme Arbitration Court of the Russian Federation dated December 26, 2013 N VAS-18613/13 is another example of how attempts to recover input VAT on the cost of fuels and lubricants (fuels and lubricants) can be unsuccessful if you only have a gas station cash receipt without allocated tax amount. Strictly speaking, the task for taxpayers was initially difficult to solve, and they did not receive help from the Supreme Arbitration Court of the Russian Federation.

Excise taxes on fuel will increase by one and a half times

Contrary to the fears of experts, the conclusion of the Accounts Chamber, the forecasts of the Central Bank, and simply the current situation on the fuel market that is far from stable , the Government is still going to increase excise taxes.

From January 1, 2019, the excise tax on fifth-class gasoline will increase from 8,213 to 12,314 rubles per ton , on diesel fuel - from 5,665 to 8,541 rubles per ton .

At the same time, ministries involved in economic and fuel issues, Prime Minister Dmitry Medvedev, Deputy Prime Minister Dmitry Kozak and President Vladimir Putin assure that the increase in excise taxes will not affect the price of fuel , and if it does, it will be very insignificant - at most, an increase of 1-1. 1.5%.

And this despite the fact that excise taxes account for at least 30% . That from January 1, 2019, VAT will increase to 20% and, as part of the continuation of the “tax maneuver,” the mineral extraction tax (MET) will increase. That together these three taxes form 70 percent of the final price of fuel . relentlessly artificially restrained for several months now .

However, it is quite likely that in the first month or two a significant rise in fuel prices will actually be prevented by some tricks. Moreover, the situation with world oil prices is favorable for this : they are falling and thereby discourage our oil workers from increasing the export of produced oil.

That is, at least those spring circumstances, when, against the backdrop of the long-awaited rise in price of “black gold” and a reduction in the export duty on it, oil companies significantly increased export supplies, creating a shortage of petroleum products on the domestic market , we are not threatened in the near future.

But anyway, economic laws are not “accustomed” to obeying administrative commands for a long time , especially if their effect should cease on March 31, 2019.

On March 31, the agreement on small-scale wholesale oil prices at the level of June 2018 expires. It is possible that at the same time the retail prices fixed at the end of May will “unfreeze”.

And will anyone (well, except the Government) be able to give a guarantee that they will not begin to catch up?.. At least, the laws of economics and common sense will definitely refrain from such a guarantee.

Deputy Prime Minister Dmitry Kozak, in charge of the fuel and energy complex/Photo: website of the President of the Russian Federation

Let us remind you: on June 1 of this year, against the backdrop of a sharp rise in fuel prices, the Government decided to reduce excise taxes and abandoned their planned increase from July 1.

Taking into account this refusal, the total reduction was 3,700 rubles for gasoline and 2,700 rubles for diesel fuel.

The government also agreed with oil retail prices. It came into effect on May 31st. At the same time, small-scale wholesale prices were fixed later - from November 1, which is why independent gas stations operated on the verge of profitability for several months.

The “freeze” of wholesale prices should last until March 31, 2019 , after which the Government promises to return economic (and not the currently existing administrative!) principles of pricing to the market.

Among the options for the economic approach is a proposal to replace the fixed rate of fuel excise tax with a floating one , depending on world oil prices. The relevant departments must present the possibility of switching to a “flexible” excise tax before March 1st.

True, it is very doubtful that it will still be introduced. Although the Ministries of Energy and Economic Development, as well as the Federal Antimonopoly Service, support such a mechanism, the Ministry of Finance is against its implementation. At a minimum, because the floating rate can “float” in the direction of decrease , and this, in turn, threatens to reduce revenues to the state treasury.

The final increase in prices for diesel fuel as of the beginning of December was 13.5% , for gasoline - 9.5% .

Transport companies, whose cost of services accounts for 30% of fuel prices , are already saying that their costs have increased by a third, and are warning about a possible 10% increase in tariffs .

Taxation and VAT: gasoline at gas stations

To understand whether gasoline is subject to VAT, just look at this section of the article, which already provides calculations for payment.

One tax was replaced by another. An ordinary consumer still needs to pay for them. Only the calculations and some numbers have changed. Now 1 liter of gasoline is equal to 285 soums.

The fee is paid based on the invoice. It contains all the information that can be used to calculate a specific amount.

So, to find out the usual cost of gasoline for a buyer, just multiply the established price by the quantity. Everything is simple here.

The amount of excise tax is calculated as the rate already known to us * quantity. Accordingly, to determine the amount of delivery including VAT, it is necessary to subtract the second from the first: the price of gasoline - the amount of excise tax. Divide the resulting figure by 120% and multiply by 20%. This is how we find out the VAT itself.

If you need the amount of net delivery, then you need to subtract this same percentage from the amount of supply including VAT.

Based on these calculations, a payment is formed to be added to the state capital.

The tax on movable property is abolished

The tax, which only “returned” from January 1, 2018, completely canceled .

For five years, from 2013 to 2018, the zero rate introduced by federal decision was in effect for movable property tax. On January 1, 2018, the zero rate was abolished, giving regions the right to independently decide at what level to fix it. The only thing: the increase limit was limited to 1.1% .

It was assumed that from 2019 the tax rate could be increased to 2.2%, but in the middle of this year everyone changed their game : either to celebrate the long-awaited surplus budget ( for the first time in the last four years ), or in anticipation of revenues from increased VAT The government completely abandoned the tax on movable property.

One could say that now cargo carriers will begin to intensively update and expand their fleet (its average age in the country is approximately 19 years). But will they have enough funds for this against the backdrop of a possible even higher rise in fuel prices?..

Table with main VAT rates for 2021

The table below contains the new VAT rates that will apply from 01/01/2021:

| Bid | Application area |

| 0% | · Sale of goods intended for export, passing through customs clearance. |

| · International shipping. | |

| · Operations carried out by organizations for the transportation of oil and its products. | |

| 10% | · Sales of food products. |

| · Sales of children's goods. | |

| · Sales of medicines and medical products. | |

| · Sales of printed and periodicals related to the field of education and culture. | |

| 20% | All other transactions that do not fall into the previous two categories |

Transport tax deductions are canceled for Platon users

At least so far, no one has spoken in favor of extending the benefit at the legislative level . While the benefit itself, which makes it possible to deduct from the transport tax the amount of road tolls paid for the year according to the Platon system, was introduced for a limited period - until January 1, 2019.

Some regions, such as the Kaliningrad region, have already taken into account increased revenues from transport taxes in their budgets, while others are in no hurry to make their decision public (maybe they are waiting for a clear message “from above”?..).

In principle, the abolition of the transport tax benefit looks very logical . At one time, it was introduced against the backdrop of dissatisfaction among carriers and solely in order to make registration in the Platon system at least minimally attractive . Now, after control over defaulters has passed to Rostransnadzor, a much better “incentive” for registration has appeared - fines, which now come even to those who were never listed in Plato at all.

Protest against the introduction of the Platon system, Omsk, 2015/Photo: om1.ru

And why, one might ask, in a situation where sooner or later all owners of heavy trucks will start paying road tolls, deliberately limit revenues to the treasury ?..

VAT deduction on a cash receipt - conclusions

When an item is purchased at a retail store for cash, taxpayers are entitled to a VAT deduction based on the sales receipt, even if there is no invoice. The main thing is that the VAT amount is highlighted as a separate line in the goods and the cash receipt.

If a conflict arises with the tax service, you can refer to arbitration practice. The judges are of the opinion that it is impossible to refuse a VAT deduction only because of the absence of an invoice if there is a cash receipt or other document of the established form.

To avoid problems with the Federal Tax Service, whose inspectors refuse to deduct VAT in the absence of an invoice at the time of the on-site inspection, it is better to carry out the purchase and sale operation in special contract departments of retail stores

– specialists will issue an invoice, cash receipt order or invoice to the buyer who paid in cash. When the VAT amount is highlighted as a separate line in the listed documents, VAT can be deducted.

Plato's tariff will be indexed

It was going to be indexed on July 1 of this year, but then the idea was abandoned, moving the indexation date to July 1, 2019 .

Instead of indexation this year, we repeat, they “came up with” another move : they gave the function of collecting fines in the system to Rostransnadzor, after which registration in “Plato” was “full of records and only recently, finally, slowed down.

To what exact level the Platon tariff will be indexed from July 1, 2019 has not yet been specified . It is only known that the level of accumulated inflation and that this year the tariff was going to be raised from the current 1.9 to 2.15 rubles per kilometer .

At the same time, inflation for 2019 alone is predicted by the Central Bank to be in the range of 5-5.5% .

Increase in VAT rates from 2021

The last VAT increase took place in 2021. Then the basic VAT rate was raised from 18 to 20 percent. This entailed many consequences (in particular, an increase in the cost of some goods).

However, from 2021 the main VAT rates have been retained. Yes, there are quite a lot of VAT changes from 2021. But they did not affect the main rates. For more information about this, see “ How VAT has changed since 2021. ”

By the end of the year they will launch a “pilot project” for automated weight and dimensional control

One such pilot project has already been carried out - in 2016 in the Vologda region. And at the moment there are 27 automated “frameworks” operating .

True, according to Rosavtodor’s plans, there should have been 125 .

Apparently, the state does not have enough funds to distribute the system , and therefore it is not at all surprising that these functions will be transferred under concession to the Platon operator - the RT-Invest Transport Systems company (the corresponding application is now under intensive consideration by the Ministry of Transport).

Due to the fact that the system will have a new operator , and a new pilot project will be launched.

During the October Public Hearings on Weight and Dimensions Control, it was reported that the “pilot” could involve shippers and transport companies along with their measuring systems (there is an idea to use such measurements to challenge the results of automatic weighing on roads). It was also stated that each new automated point would work in test mode for three months - notify about overload, but not issue fines for it .

The head of the Novosibirsk region Andrei Travnikov is presented with an automated weight and dimensional control system, VII International Siberian Transport Forum, May 2018 / Photo: Government of the Novosibirsk region

According to the updated plans of the Ministry of Transport, by the end of 2021 there should be 400 automated control points (previously they hoped to install 387 points by the end of 2020).

In addition, it is possible that the functions of the administrator of fines in the system will be transferred to Rostransnadzor , and therefore, by analogy with Plato, we can expect a real tightening of control in this area of cargo transportation activities.

The cross-border nature of transportation between Russia and China is canceled

At the moment, the Russian carrier can only go 30 km deep into China . The same applies to a Chinese carrier delivering cargo or passengers to Russia.

They have been talking about abolishing such an absurd procedure for more than one year, but only this year finally signed , which the states managed to ratify almost instantly (the agreement was signed on June 8, and it was finally legalized already by August 22nd).

Russian and Chinese delegations exchanged permits for 2019/Photo: Road Transport Agency

In accordance with this agreement, which will come into force on January 1, 2019 , Russian carriers will be able to move freely within the territory of China , and Chinese carriers will be able to move freely within the territory of Russia. The only thing: you can only get permission for those vehicles that are equipped with GLONASS and BeiDou satellite navigation systems .

Russia and China, by the way, have already managed to exchange the number of permits increased by a third . Thus, Russia has received 41 thousand permits for bilateral cargo transportation, another 42,700 forms must be transferred to it by January 25, 2019.

We also note that from October 7 of this year, two checkpoints on the Russian-Chinese border (Zabaikalsk international checkpoint and Prigranichny international checkpoint) began working with TIR carnets . to increase the number of such checkpoints in 2019 .

From November 1, 2019, electronic passports will begin to be issued for new vehicles.

They are, however, already being issued. And on October 7 of this year, new rules came into force that allowed cars to be registered using an electronic passport .

However, from November 1, 2019, the issuance of such documents for new cars in electronic form should become ubiquitous throughout the EAEU and should not be carried out as an experiment.

At the same time, paper passports will reportedly not lose their validity : they will continue to be valid and will even be issued at the request of the car owner when replacing a lost document.

Let us remind you: the transition to electronic vehicle passports was planned to be carried out from July 1 of this year , however, due to the unavailability of the information systems of the allied states, the deadline was postponed to November 1, 2019.

Features of accounting and tax accounting at gas stations: postings

Despite the amendments made to the law, accountants still have to do their job and take into account the rate and value added tax. These accounts are based on the following entries:

- Revenue. The record D4010-K9010 corresponds to it.

- 20% is attached to D4010-K6410, and the excise surcharge is also fixed here.

- Gasoline is written off according to the D9110-K2920 model. The basis for all of the above actions is the SF for a certain period. This could be a day, a week, a month.

- The loss process is recorded as D9410-K2920. The proof is the write-off act.

- Debiting money from a terminal card using a bank statement and posting D5110-K5530.

- Cash collection – D5710-K5010. The supporting document is the RKO and the receipt of the collector himself.

- Receipt of money from collection to the settlement account. Registered by circuit D5110-K710.

If the main documentation is missing and is replaced by a certificate or other forms, the presence of primary details is necessary.

MTPL reform starts in January

the tariff corridor will be expanded by 20% up and down , the coefficient of experience and age of drivers will be detailed (instead of the current four, 58 levels will be introduced), and for the accident rate indicator - the bonus-malus coefficient (BMC) - a single annual value will be established (for transport companies - a single annual value for all machines in the fleet).

It is noted that as a result of the reform, the cost of the policy will increase by an average of 1.5-5% .

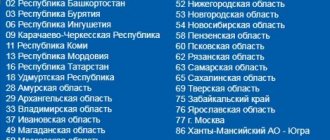

True, according to experts, the policy will rise in price (and probably by more than the average 5%) for residents of the so-called. “red” (unprofitable for insurers) zone . Such regions, for example, include North Ossetia-Alania, the Karachay-Cherkess Republic, Adygea, Volgograd and Lipetsk regions, Ingushetia...

But for residents of “green” (profitable for insurers) regions, including the Pskov, Ryazan, Oryol, Bryansk, Novgorod (...) regions, the policy, on the contrary, should become cheaper .

From what date of the new year the tariff setting in compulsory motor liability insurance will change has not yet been specified . However, it is known that the corresponding instruction from the Central Bank has already been sent for registration to the Ministry of Justice and, in theory, should take effect sometime in the first month of 2019.

Let us remember that the reform consists of two stages . The second, presumably, will start on September 1, 2019 , when the vehicle power factor will be removed . A year later, from September 1, 2020, they also want to “get rid” of the coefficient of the territory of primary use of a vehicle.

At the same time, the stated goal of the reform is to make MTPL tariffs more fair, individual and dependent not on the characteristics of the car, but on the qualities of the driver .

Self-driving cars will hit the roads in the spring

The experiment itself on the use of unmanned vehicles on public roads has already begun - on December 1 of this year . It takes place in Moscow and Tatarstan and will last until March 1, 2022.

Currently we are accepting applications for participation in testing “smart” cars. Presumably, it will take 3-4 months to review them. So, only right by spring will drones be able to start “cruising” along the roads (they, by the way, will be marked with the letter “A” ).

Both cars and trucks should take part in the experiment .

Testing of an unmanned KamAZ truck at a closed testing ground/Photo: KamAZ

we wanted to test the latter earlier this year . There was even a corresponding order from Prime Minister Dmitry Medvedev (to begin testing by the end of November), within the framework of which a section of the M-11 Moscow-St. Petersburg highway, bypassing Vyshny Volochok, and potential participants had been identified (KamAZ, GAZ, Skania, Volvo...). However, apparently, something on the technological side delayed the start of the “pilot”.

In general, over three years, the experiment should show the level of development of technologies, their safety for humans, the readiness of the road infrastructure, as well as what exactly needs to be changed in the legislation for the non-experimental use of drones.

According to experts, the mass introduction of smart cars will begin only by 2025-2030 . But according to Dmitry Medvedev, even later - about thirty years ...

A special tax regime is being introduced for self-employed citizens who do not pay taxes.

Let us remind you: this is also another experiment , which will take place so far only in four regions of the country (Moscow, Moscow and Kaluga regions and Tatarstan) from January 1, 2019 to December 31, 2028 .

The experiment is voluntary “self-employed” in any field of activity will be able to take part in it . The only thing: they will be able to switch to the new tax regime only if they do not use hired workers less than 2.4 million rubles per year .

The new tax regime provides for a monthly payment of 4% of income received if it was received in the provision of services to individuals, or 6% if to legal entities. Of the funds paid, 1.5% will go to the Compulsory Health Insurance Fund , but contributions to the Pension Fund are voluntary .

For the interaction of “self-employed” with the Federal Tax Service, a special mobile application “My Tax” : through it a fiscal receipt will be generated and it will also calculate the amount of monthly tax.

The experiment, naturally, was launched in order to “help” individuals come out of the shadows and thereby replenish the state treasury. It is possible that in a few years it will spread to the entire territory of Russia .

However, what is important: the law clearly states that the conditions of the tax experiment cannot be worsened , which means that for 10 years it still promises to remain voluntary.

True, experts doubt that the trial tax regime will be in demand among self-employed citizens, because it does not promise them any benefits . Unless in the future, when the tax for the “self-employed” becomes mandatory, they will somehow be credited for voluntary pioneering...

Accounting for VAT in expenses

Of course, you don’t have to rack your brains, but simply take into account the amount of VAT from receipts in which it is not highlighted as part of the cost of purchasing fuel and lubricants when calculating income tax.

However, even here you can fall into a trap. Let’s assume that the cash register receipt will indicate something like “including VAT”, but without indicating the amount. Then the tax authorities will independently allocate this amount by calculation and not only will not allow it to be deducted (we have already discussed the reason earlier), but will not even allow VAT to be taken into account in tax expenses (Letter of the Ministry of Finance of Russia dated April 24, 2007 N 03-07-11/126 ).

Pension reform is being launched

In the coming year, it will manifest itself mainly in the fact that men born in 1959 and women born in 1964 , who were supposed to retire in 2019, will not be able to access it . They will go on a well-deserved rest only in a year.

Protest against pension reform, July 2018/Photo: official website of the Communist Party of the Russian Federation

The pension reform, we recall, provides for an increase in the retirement age for men from 60 to 65 years , for women - from 55 to 60 years (initially, by the way, women were planned to retire at 63 years). It should be completed in 2028.

As part of the reform, among other things, the amount of unemployment benefits for people of pre-retirement age is increased from 4,900 to 11,280 rubles “ stretched” from 2 to 5 years . Criminal liability is also being introduced for employers for the unjustified dismissal of workers of pre-retirement age.

By the way, those who were supposed to retire in 2019 or 2020 can apply for it six months earlier .