What taxes are paid on wages?

A number of taxes must be paid from wages to the budget, one part is paid at the expense of the employee himself, and the other part at the expense of the employer.

At the expense of the employee

Current legislation determines that during this period, taxes on employee salaries are represented by one single payment to the budget - personal income tax or it is also called salary income tax.

The obligation to tax wages is assigned to the employer because he is the source of the employee’s income. According to the existing procedure, the organization first withholds taxes from salaries, and then, excluding them, pays the amounts due to its employees.

At a certain time after this, the employer, acting as a tax agent, must send these funds to the budget. Despite the fact that they are transferred by the enterprise, they are made at the expense of the employee’s accruals. The company is prohibited from transferring personal income tax from personal funds.

When calculating this tax, it must be taken into account that at the moment several tax rates are used:

- 13% - this personal income tax is calculated on the income of residents, that is, persons who are in the territory of the state for more than 183 days. This category includes almost all employees of business entities.

- 30% - this amount of tax must be withheld from the income of persons who were in Russia for less than 183 days. They are called non-residents. This group mainly includes workers who are foreign citizens.

- 35% - this mandatory payment rate applies to the organization in relation to employee income in the form of material benefits, winnings, etc.

Attention! In this case, taxes must be calculated even if the employee has the minimum wage. In this situation, he actually receives amounts less than the minimum wage. But this is not prohibited by law, because the minimum wage requirement applies to its calculation.

At the expense of the employer

The company must, in accordance with the law, provide compulsory insurance for its employees from its own funds. First of all, these are pension, medical, and social insurance types. Currently, the tax authorities are in charge of administering the calculation and payment of these insurance amounts.

In addition, there is another type of insurance - against accidents, which is under the jurisdiction of the Social Insurance Fund.

A business entity must remember that contributions for injuries should be calculated only from wages. When civil contracts are drawn up with performers, these deductions are made by the company if such an obligation exists in the contract.

Almost all employers calculate insurance contributions to the budget in the amount of 30%. This percentage is provided for by the general rules and applies to most employers.

Under certain taxation regimes and for certain types of activities, it can be significantly reduced. For example, under the simplified procedure, entities carrying out preferential activities have the right to apply a rate of 0% for Social Insurance Fund and Compulsory Medical Insurance Fund, and for contributions to the Pension Fund - 20%.

Attention! In addition to these payments, there are additional contributions to the Pension Fund for the presence of harmful health impact factors on site based on the results of the assessment. Their size ranges from 2 – 8% of the salary of the relevant employees. These mandatory payments are not subject to base limits.

Transport tax rate for 2018

The transport tax is calculated at a rate in rubles. You can calculate it yourself using an online calculator. To do this, enter:

- region;

- type of vehicle;

- engine power in l/s.

The calculator will immediately display the amount required to be paid.

Attention! Changes in tax rates for cars of expensive models are already in effect. The tax office does the calculations. Therefore, you don’t have to count it yourself. If the vehicle owner has not received a notification from the Federal Tax Service, he must make the payment himself. But before that, you need to notify the Federal Tax Service that you did not receive the letter.

Tax deductions for personal income tax - how to reduce taxes for an individual?

The Tax Code of the Russian Federation provides for employees whose income is subject to a personal income tax rate of 13% to use benefits in the form of standard, property, investment and social deductions.

You might be interested in:

Payroll form T-53: in what case is it used, who fills it out, sample filling

The first group of benefits includes the standard tax deduction for children, as well as a deduction for yourself for certain categories. These benefits are provided upon presentation of forms confirming the employee’s right to the benefit, as well as a written request for this. For example, in order to receive a deduction for children, you need to file an application for a tax deduction for children.

There are the following deductions for children:

- 1400 rub. on the first;

- 1400 rub. - on the second;

- 3000 rub. - on the third and all subsequent ones;

- 12000 rub. – for each disabled child until he reaches the age of 18 or 24 years when studying.

The amount for all children after the second remains the same even when the older ones have already reached the established age and the benefit for them is closed.

Attention! However, when using this benefit, there is a maximum amount of income that entitles you to such a deduction - the amount of personal income up to 350,000 rubles. If it is exceeded, deductions do not apply to children.

The following individuals are entitled to receive the standard benefit:

- In the amount of 500 rubles - to participants in combat operations, heroes of Russia and the USSR, liquidators of the consequences at the Chernobyl Nuclear Power Plant, PA Mayak, evacuated people from exclusion zones, etc.

- In the amount of 3,000 rubles - those who were diagnosed with radiation sickness as a result of the emergency, disabled people from the Second World War, etc.

When using a social deduction, operating enterprises can reduce the personal income tax tax base by the amount of their social expenses (treatment, training, etc.).

An employee has the right to a property deduction when purchasing or selling housing. He can apply to his employer for this type of benefit if he has purchased real estate (house, apartment, etc.).

The investment deduction applies to transactions with securities.

Types of tax and insurance deductions

The tax withheld from wages is the personal income tax (NDFL), or income tax. This is the main type of fee, which is reflected in the salary amount. It is believed that the employee pays it himself, and the employer acts only as a tax agent who transfers the money to the tax service. However, the role of the employee is nominal, because the deduction of personal income tax does not depend on his will.

The amount of personal income tax depends on the status of the taxpayer (Article 224 of the Tax Code of the Russian Federation):

- Residents of the Russian Federation are citizens who have been in the country for at least 183 days over the past year. They deduct 13% from their income.

- Non-residents of the Russian Federation are citizens who stayed in Russia for less than the specified number of days. The personal income tax amount for non-residents is 30%.

The above amounts are basic (standard) tariffs applied on a general basis. They may change for certain categories of persons.

The following types of income are not subject to income tax (Article 217 of the Tax Code of the Russian Federation):

- maternity and unemployment benefits;

- severance pay for the period of employment upon dismissal of an employee;

- compensation payments (for unused vacation, compensation for material damage and harm to health, etc.).

Insurance premiums

This type of deduction is paid by the employer independently and is not reflected in the employee’s payroll. These contributions are used for pension, social and health insurance. They are calculated based on the salary amount (which includes personal income tax). Basic rates for insurance premiums are shown in the table.

Limit on insurance premiums

The provisions of the Tax Code of the Russian Federation also provide for the existence of a maximum base for pension and social insurance, upon reaching which the payment rate is reduced. At the same time, organizations must annually submit confirmation of their main type of activity by providing the appropriate statements.

The maximum value of the base for calculating insurance premiums is adjusted every year taking into account the accepted coefficients. Let's take a closer look at the company's taxes on its employees in the table.

Salary taxes in 2021 as a percentage table:

| Obligatory payments | Basic contribution percentage | Limit limit in 2021 | Rate over the maximum base |

| Pension Fund | 22,0% | RUB 1,150,000 | 10% |

| Social Insurance Fund | 2,9% | 865,000 rub. | 0% |

| Health Insurance Fund | 5,1% | Indefined | 5,1% |

| Injuries | 0.2% – 8.5% (depending on activity) | Indefined | 0.2% – 8.5% (depending on activity) |

There is a rule according to which the calculation of the maximum bases is carried out in relation to each employee working at the enterprise. Accounting for accruals therefore needs to be done in special registers, which include most accounting programs.

What payments are employers required to pay?

The obligation to pay such contributions with taxes rests with each manager:

- Income tax.

- Mandatory contributions for social insurance against accidents, social insurance, medical and pension insurance (see Life and health safety: what insurance is the most necessary today?).

- Savings parts of pension contributions. Required only for employees who have submitted special applications.

- Contributions for pension payments for hazardous working conditions. Listed if there are retired workers and harmful working conditions.

- Social insurance for those who are members of flight crews. The rule also applies to some representatives of the coal industry.

If a manager has certain types of benefits, he is exempt from certain types of compensation. This will help you more accurately calculate how much taxes an employer pays for an employee in 2018.

Advance and salary – on what part are taxes levied?

Advance and salary are two parts of the employee’s income, which he receives for his activities at the end of the month. The advance must be issued based on the results of the first 15 days of work, and the rest is payment for the second half of the month, and it is issued before the 15th day of the month following it. When issuing the final part, the organization settles with the employee, and at the same time the tax is withheld.

The law states that the date of receipt of income for employees is considered to be the final day of the month. Since the advance is usually paid before this date, there is no need to withhold taxes on it. The amount of personal income tax subject to withholding is determined when calculating wages and is withheld from the employee at the time the second part of the salary is issued. The next day after this, the tax must be sent to the budget.

There is an exception to this rule. If the decision to issue an advance is made on the last day of the month, and according to the law, the employee receives income on the same day, then tax must be withheld and transferred from the amount paid. This position is also taken by the court in disputes between companies and the Federal Tax Service.

You might be interested in:

Payroll form T-49: when used, sample filling, main errors, postings

Attention! The amounts of contributions to the funds are calculated at the time the salary is calculated for its entire amount, and are transferred until the 15th day of the next month. Therefore, the date of payment of the advance does not affect them in any way.

KBC for transferring contributions

If we are talking about pension insurance, then the number 182 1 0210 160 is used as the BCC. For health insurance, the indicator changes slightly:

182 1 0213 160.

Social insurance has two types of codes:

- 393 1 0200 160 – this is for accidents.

- 182 1 02010 160. This number is for temporary disability.

Inspection at the place of residence, territorial branch of the FSS - institutions where you can get acquainted with other details. They will also tell you how much the company pays in taxes for the employee.

Deadlines for paying taxes on payroll

From 2021, there is a single date on which income taxes must be paid. Thus, the employer is obliged to withhold it at the time of payment of wages, and it must be transferred to the budget the very next day. It does not matter exactly how the funds were issued - in cash from the cash register, to a current account or salary card, or in any other way.

There is an exception to this rule. If tax is withheld from vacation or sick pay, it can be transferred on the last day of the month. Moreover, such a transfer can be made in a single amount for all deductions from this type during this month.

Social contributions that were accrued on employee salaries must be paid before the 15th day of the month that follows the month of accrual. If this date falls on a weekend or holiday, then the payment deadline can be moved forward to the next working day.

Example of calculations and transfers - calculation of payroll and all mandatory payments

Let's look at how the volume of taxes and mandatory payments from the payroll fund is calculated in 2021 using the example of the fictitious organization LLC "Flowers". Let’s assume that the organization employs 18 employees, 16 of whom are tax residents of Russia (that is, they pay 13% personal income tax), and the other 2 are non-residents (that is, 30% personal income tax for them).

The salary of 5 employees is 15,000 rubles (including two foreign citizens), 5 others - 18,000 rubles, 3 - 25,000 rubles, 4 - 30,000 rubles and 1 - 40,000 rubles. No other accruals other than employee wages were made this month. First, we calculate the size of the wage fund for this month:

(5 * 15,000) + (5 * 18,000) + (3 * 25,000) + (4* 30,000) + 40,000 = 400,000 rubles.

At the same time, the total salary of tax residents is 370,000 rubles, and non-residents - 30,000 rubles. Now let’s calculate what and in what amount the employer will pay to the budget and insurance funds:

- Personal income tax of tax residents. 370,000 * 13% = 48,100 rubles.

- Personal income tax of non-residents. 30,000 * 30% = 9,000 rubles.

- Pension contributions. 400,000 * 22% = 88,000 rubles.

- Health insurance premiums. 400,000 * 5.1% = 20,400 rubles.

- Social insurance contributions. 400,000 * 2.9% = 11,600 rubles.

Thus, the total value of all mandatory payments to the budget and insurance premiums for an organization whose monthly payroll amounted to 400,000 rubles will be 177,100 rubles. That is, the cost of paying employees and accompanying accruals will be equal to 577,100 rubles.

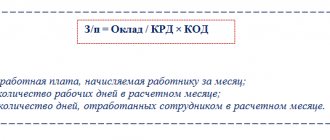

Salary calculation example

Zhdanov A.G. works as a sales manager. This is the main place of work, deductions are provided here. His salary is set at 25,000 rubles. At the end of the month, if he fulfills the sales plan, he is awarded a bonus in the amount of 25% of his salary. The employee has two children.

There are 20 working days in a billing month, 9 of which are for the advance part, 11 days for the main part.

We will calculate the advance payment. Since the bonus is paid based on the results of the month, it does not take part in determining it.

The advance amount will be: 25,000 / 20 x 9 = 11,250 rubles.

Taxes are not withheld from the advance payment, so this amount must be issued in person.

The sales plan was fulfilled. The monthly salary was: 25,000 x 1.25 = 31,250 rubles.

Amount of tax to be withheld (tax deduction for children is taken into account): (31250 - 1400 - 1400) x 13% = 3699 rubles.

The remaining part of the salary for payment (adjusted to the previously issued advance): 31250 - 3699 - 11250 = 16301 rubles.

Employer reporting

The employer’s responsibility is to compile and submit to government agencies a whole package of reports, the data for which is the amount of accrued wages.

- 2-NDFL - at the end of the year, a separate form is issued for each employee, which includes data on accrued wages, deductions, withheld and transferred tax.

- 6-NDFL - issued every quarter. Includes two sections - the first indicates the amounts of wages and taxes from the beginning of the year, the second - in the context of the reporting quarter;

- A unified calculation of insurance premiums is a form that was introduced in 2021 instead of RSV-1. Rented every quarter for all company employees;

- 4-FSS - sent to social insurance every quarter, contains information on the calculation and payment of employer contributions for injuries;

- SZV-M - compiled for all employees of the company every month. Its main goal is to control pensioners who continue to work and at the same time receive a labor pension.

- SZV-STAZH is a new report, which began to be submitted for the first time in 2021. Contains data on the length of service of all employees over the past year, including contract agreements.

Certain categories of taxpayers

Taxation of income of some categories of citizens is calculated according to different tariffs. These include individual entrepreneurs (IP), foreigners, stateless persons, and refugees.

entrepreneurs who do not make payments to other individuals (clause 2, clause 1, Article 419 of the Tax Code) began to pay mandatory government fees according to a new principle. If previously the rate was calculated based on the minimum wage, now this category of citizens is obliged to pay fixed amounts, which must be paid at the end of the calendar year. They are defined in Article 430 of the Tax Code of the Russian Federation, clause 1. and make up:

- for pension insurance - 26,545 rubles, if the annual income does not exceed 300 thousand rubles;

- for compulsory medical insurance 5,840 rubles.

Workers who do not have Russian citizenship are divided into several categories of taxpayers who pay personal income tax depending on their status. These include:

- Highly qualified foreign workers. They pay an income tax of 13%.

- Foreign citizens working on a patent. They pay the tax themselves in a fixed amount.

- Employees are citizens of the EAEU. Specialists who come from the countries of the Eurasian Economic Union pay an income tax at a rate of 13%.

- Citizens with official refugee status pay personal income tax of 13%.

In all other cases, foreign citizens, as non-residents of the Russian Federation, pay a tax of 30%.

Preferential rates on insurance premiums

Employers in some organizations can count on reduced amounts of insurance premiums, a full list of which is given in Article 427 of the Tax Code of the Russian Federation. These include:

Don't miss: Repeated medical commission for conscripts in Russia

- Individual entrepreneurs using the patent taxation system, non-profit and charitable organizations using the simplified taxation system, pharmaceutical companies using UTII do not make insurance contributions at all.

- Business companies using the simplified tax system, whose activities fall into the categories set forth in Article 427 of the Tax Code, paragraph 1, paragraph 5, deduct 20% for pension insurance and are exempt from other payments.

- Residents of special economic zones (Article 427 of the Tax Code, clause 1, clause 2) contribute 13% to the pension fund, 2.9% to the Social Insurance Fund, and 5.1% to compulsory medical insurance.

- Preferential tariffs apply to residents of certain economic zones (Republic of Crimea, Vladivostok, Kaliningrad region).

Accounting entries

Postings for payroll taxes are divided into two types - for personal income tax and for insurance contributions:

| Debit | Credit | Description |

| 68 | Tax withheld | |

| 68 | 51 | Personal income tax is transferred to the budget |

| 69 | Contributions to the salaries of key employees have been accrued | |

| 23 | 69 | Contributions to the salaries of support workers have been accrued |

| 25 | 69 | Contributions to the salaries of general production workers have been accrued |

| 26 | 69 | Contributions to the salaries of administrative staff have been accrued |

| 29 | 69 | Contributions to the salaries of support staff have been accrued |

| 44 | 69 | Contributions to the salaries of sales staff and catering workers have been accrued |

| 91 | 69 | Contributions are accrued to the salaries of employees who are not directly involved in production activities |

| 69 | 51 | Contributions to the budget have been transferred |

Personal income tax in other countries

If we add up the income tax and insurance contributions in the Russian Federation (at standard rates), it turns out that the employer pays 43% above the employee’s salary. What is the situation in other states?

The leader in the amount of personal income tax levied on citizens is Sweden - where this contribution can be up to 60% of earnings. Finland, Belgium, France and the Netherlands are not far behind - income taxes exceed 50%. But we must take into account that these countries have progressive taxation (when the amount of tax increases in proportion to income growth). A similar system is used in the USA, where income tax ranges from 10% to 40%. Russia is in the top ten countries with the lowest personal income tax.

As for insurance premiums, in Europe, for example, it is customary to “share” this burden between the employer and the employee. In Germany, half of the insurance premiums are paid by the company, and half by the employee. High medical and social security premiums are also paid by US citizens. Social support in European countries and the USA is at a high level: you can live on unemployment benefits abroad, while in Russia it is almost half the subsistence level.