When insurance premiums were transferred under the control of tax authorities in 2021, a new chapter 34 was added to the Tax Code of the Russian Federation, regulating their calculation and payment procedure. It reveals the concepts that define both reporting periods and billing periods in relation to insurance premiums. In this article we will tell you about the billing period for insurance premiums in 2021, and consider the payment deadlines.

Wherein:

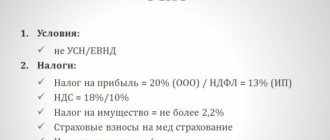

- The reporting period is a quarter, half a year, etc.;

- and the calculated year is the calendar year.

During the billing period, accounting forms the basis for future accruals for insurance premiums. Each billing period is represented by four reporting periods, based on the results of which interim results can be summed up, as well as reporting can be submitted to the tax authority.

Reporting and settlement period in the Tax Code of the Russian Federation

In 2021, Chapter 34 “Insurance Premiums” continues to be in effect in the Tax Code. This chapter includes articles 419–432, which regulate the rules for calculating and paying insurance premiums. This chapter of the Tax Code of the Russian Federation, in particular, defines the concepts of reporting and settlement periods for insurance premiums in 2021. These concepts are disclosed in Article 423 of the Tax Code of the Russian Federation, namely:

- reporting periods are the first quarter, half a year, nine months of the calendar year;

- The billing period is the calendar year.

For insurance premium payers, these periods are needed to summarize the payment of premiums.

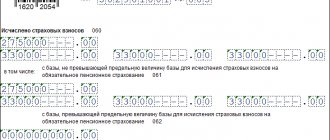

During the billing period of 2021, the accountant must form the basis for calculating insurance premiums (clause 1 of Article 421 of the Tax Code of the Russian Federation). The billing period consists of four reporting periods. At the end of each reporting period, interim results on the payment of insurance premiums are summed up, and reports are drawn up and submitted to the tax office.

How to fill out the RSV

Fill out the fields in the calculation from left to right, starting with the first acquaintance. Indicate monetary amounts in rubles and kopecks. If you fill out the calculation manually, use blue, black or purple ink. If you fill out the calculation on a computer, use capital block letters, Courier New font size 16-18; if there are no indicators, there is no need to put dashes and zeros. If there are no indicators, put zeros (for amounts) or dashes (for text) in the cells. When filling out, you don’t have to put anything on your computer.

Those dismissed in the DAM report are indicated in section 3 of the calculation: it lists all persons in whose favor payments were made in the reporting period and employees dismissed in the previous reporting period. The attribute of the insured person for dismissed employees “1” must also be indicated.

After filling out the calculation, number the pages consecutively, regardless of the absence of sections to be filled in or their number. At the end of the article we provide a sample of a completed calculation for an organization with two employees.

Reporting period in 2021

The reporting periods for insurance premiums are the first quarter, six months, 9 months of the calendar year and the calendar year (clause 2 of article 423 of the Tax Code of the Russian Federation). For those policyholders who do not pay benefits to individuals and transfer insurance premiums only “for themselves,” there are no reporting periods. We are talking about individual entrepreneurs, lawyers, notaries and other persons engaged in private practice (subclause 2, clause 1, article 419 of the Tax Code of the Russian Federation).

They can pay insurance premiums either monthly or in a lump sum for the year. Moreover, the deadlines for the monthly payment of contributions have not been established, however, in general, the entire payment must be transferred no later than December 31 of the current year (clause 2 of Article 432 of the Tax Code of the Russian Federation).

However, if individual entrepreneurs attract employees, then they additionally calculate and pay insurance premiums from employee benefits. For such contributions, the billing period will consist of reporting periods. Based on their results, it is necessary to submit a calculation of insurance premiums, which was approved by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551 (clause 7 of Article 431 of the Tax Code of the Russian Federation).

Do I have to take zero marks?

The calculation must be submitted even if no activity was carried out during the reporting period. The absence of activity and payments to individuals, the absence of movements on accounts does not cancel the obligation to submit settlements. It’s just that in such a situation a zero calculation is submitted to the tax office.

It is filled in:

- Title page;

- Section 1 (no appendices). In line 001 the code “2” is indicated. In the lines “including for the last three months” zeros are entered. All other lines are filled in in the standard order;

- Section 3. Subsection 3.1 indicates the data of each individual. Field 010 remains empty. In the lines of subsection 3.2 of section 3, dashes are inserted.

Payment of contributions in the billing period

Payment of insurance premiums from payments to individuals assumes that during the billing period (year) you calculate and pay contributions in the form of monthly mandatory payments (clause 3 of Article 431 of the Tax Code of the Russian Federation).

We will give you the deadlines for paying insurance premiums in the 2021 billing period:

The deadlines for insurance premiums for OPS, VNiM, compulsory medical insurance and injuries are the same (clause 3 of Article 431 of the Tax Code of the Russian Federation, Article 22 of Law No. 125-FZ).

- 01/15/2021 – for December 2021;

- 02/15/2021 – for January;

- 03/15/2021 – for February;

- 04/15/2021 – for March;

- 05/17/2021 – for April;

- 06/15/2021 – for May;

- 07/15/2021 – for June;

- 08/16/2021 – for July;

- 09/15/2021 – for August;

- 10/15/2021 – for September;

- 11/15/2021 – for October;

- 12/15/2021 – for November;

- 01/17/2022 – for December.

Read also

31.01.2020

Fines for violations when submitting payments

For violation of the delivery format, when an organization with more than 10 employees submits calculations on paper, the tax office imposes a fine of 200 rubles.

If errors are made in the calculation (incorrect personal data or discrepancies in indicators), the tax office will send a notification of errors with a request to correct the calculation. The policyholder has 5 business days from the date the electronic notice is sent or 10 business days from the date the paper notice is sent to send an adjusted estimate. If these deadlines are violated, the calculation will be considered unsubmitted, which will result in a fine of 5% of the amount of contributions due.

For failure to submit a payment within 10 working days after the deadline for its submission, account transactions may be suspended.

If the payment is late, the tax office will fine the policyholder for each full or partial month of delay in the amount of 5% of the premiums payable. The total amount of the fine cannot be less than 1,000 rubles and more than 30% of the amount of contributions payable. For failure to submit a zero report, the fine will be 1,000 rubles.

Fines are distributed to the budgets of state non-budgetary funds in the same proportions as the insurance premium rates of 30%. For example, from 1,000 rubles, 733.33 rubles (22 / 30 × 1,000) will be sent to the Pension Fund budget.

Information about the status of settlements

Using the certificate of payment status, you will check whether there is any debt or overpayment at all.

The first column shows the name of the tax you are reconciling against. Information on debts and overpayments is contained in columns 4 - for taxes, 6 - for penalties, 8 - for fines:

- 0 - no one owes anyone, you can breathe easy.

- A positive amount means you have overpaid.

- The amount with a minus - you owe the tax authorities.

Why does the certificate include an overpayment?

- You really overpaid and now you can return this money from the tax office or count it as future payments.

- You ordered a certificate before submitting your annual report under the simplified tax system. At this moment, the tax office does not yet know how much you have to pay. She will understand this from the annual declaration. Before submitting the declaration, quarterly advances under the simplified tax system are listed as an overpayment, and then the tax office charges tax and the overpayment disappears. Therefore, overpayment in the amount of advances under the simplified tax system during the year is not yet a reason to run to the tax office for a refund.

If you see incomprehensible debts or overpayments in the certificate, you will need an extract of transactions with the budget to find out the reason for their occurrence.

Code of type of reorganization or liquidation

EXAMPLE

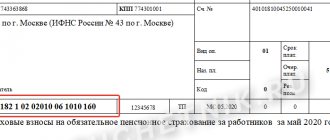

Depending on the territorial location, tax inspectorates are assigned an individual number. You can find it out on the official website of the Federal Tax Service of Russia, from accounting reference books, or take the first four digits of the TIN.

| Region of Russia | IFTS/MIFNS code |

| Moscow | 77— |

| Moscow region | 50— |

| Saint Petersburg | 78— |

| Tyumen region | 72— |

| Novosibirsk region | 54— |

| Amur region | 28— |

Where: “–” is the serial number of the tax authority in the region.

If there are no actions related to reorganization or liquidation, a dash is placed in the appropriate field.

The calculation of insurance premiums consists of a title page and three sections:

- Section 1 “Summary of the obligations of the payer of insurance premiums.” It is worth noting that the first section is the most capacious. It includes calculations for all contributions: for compulsory pension, medical and social insurance (except for contributions “for injuries”);

- Section 2 “Summary data on the obligations of insurance premium payers - heads of peasant (farm) farms”;

- Section 3 “Personalized information about insured persons” (this section must be completed for each insured person).

| Who represents | Composition of calculations for insurance premiums |

| All employers without exception | - title page; - section 1; — subsections 1.1 and 1.2 of Appendix No. 1 to Section 1; — Appendix No. 2 to Section 1; — section 3 |

| Employers paying contributions at additional rates and/or applying reduced rates | - title page; - section 1; — subsections 1.1, 1.2, 1.3.1, 1.3.2, 1.3.3, 1.4 of appendix No. 1 to section 1; — Appendix No. 2 to Section 1; — appendices No. 5-10 to section 1; — section 3 |

| Employers who incurred expenses in connection with the payment of compulsory social insurance in case of temporary disability and in connection with maternity | - title page; - section 1; — subsections 1.1 and 1.2 of Appendix No. 1 to Section 1; — Appendix No. 2 to Section 1; — Appendix No. 3 to Section 1; — Appendix No. 4 to Section 1; — section 3 |

Deadlines for submitting reports on insurance premiums

At the end of each reporting period, organizations are required to submit reports on insurance premiums to the tax authority. It is submitted no later than the 30th day of the month following the reporting period. That is, the report for the 1st quarter must be submitted no later than April 30. In the event that the last day of delivery falls on a weekend, the deadline is moved to the first next working day. So, in 2021, April 30 is a day off, and May 1 is a holiday, then the deadline for delivery is postponed to May 2.

The report is provided electronically or in paper form, it depends on the average headcount of the organization for the previous year. For example, if in 2021 it was more than 25 people, then the report will need to be submitted only in electronic form. Otherwise, the company will face penalties of 200 rubles. If the average headcount is less than 25 people, the company itself chooses the method of reporting. There will be no penalty for providing the report in non-electronic form.

Insured person category codes

The category codes of the insured person also help to simplify the processing of the information contained in the calculation. They are assigned to groups of people when they meet certain conditions. These could be employees who work in particularly difficult conditions, are engaged in intellectual activities, etc.

The meaning of the code usually depends on the nationality and tariffs at which contributions are calculated. A complete list of these codes can be seen in Appendix No. 8 to the procedure for filling out a single calculation.

EXAMPLE

When using the basic tariff, the organization making payments for a foreigner temporarily residing in the Russian Federation indicates the code “VZHNR”. For holders of Russian passports, its value will be “NR”.

For more information about this, see “Category codes of the insured person for 2019: table with decoding.”

Shelf life of RSV

Art. 23 of the Tax Code of the Russian Federation establishes the taxpayer’s obligation to store accounting and tax documentation for four years. At the same time, the list approved by Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 establishes that declarations and calculations must be stored for at least 5 years, and if the organization does not have personal accounts or payroll records for employees, it is necessary to ensure the safety of the reporting in for at least 75 years. You can store reports not only on paper, but also in electronic form. The storage procedure and responsible persons must be defined in the accounting policy.

What other information is reflected by codes in the income tax return?

In the income tax return (approved by Order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/), the following information is subject to coding:

- name of the inspectorate to which the declaration is submitted. For example, if you submit reports to the Federal Tax Service of Russia No. 14 in Moscow, then the code “7714” is entered in the declaration;

- information about your affiliation with a specific inspection. Let's say your company, not being the largest taxpayer, submits an income tax return at the place of registration of the organization itself. In this case, you need to enter code “214” (“At the location of the Russian organization that is not the largest taxpayer”). And if, for example, you submit a declaration at the place of registration of your separate division, then the code “220” (“At the location of the separate division of the Russian organization”);

- data on reorganization/liquidation. For example, if the declaration is submitted by a company that is completing its activities, then “0” (“Liquidation”) is entered in the corresponding cell of the title page of the declaration;

- information about who signs the declaration: the payer himself (code “1”) or his representative (code “2”).

Select category 1. Business law (235) 1.1.

Instructions for starting a business (26) 1.2. Opening an individual entrepreneur (27) 1.3. Changes in the Unified State Register of Individual Entrepreneurs (4) 1.4. Closing an individual entrepreneur (5) 1.5. LLC (39) 1.5.1. Opening an LLC (27) 1.5.2. Changes in LLC (6) 1.5.3. Liquidation of LLC (5) 1.6. OKVED (31) 1.7. Licensing of business activities (13) 1.8. Cash discipline and accounting (69) 1.8.1. Payroll calculation (3) 1.8.2. Maternity payments (7) 1.8.3. Temporary disability benefit (11) 1.8.4. General accounting issues (8) 1.8.5. Inventory (13) 1.8.6. Cash discipline (13) 1.9. Business checks (17) 10. Online cash registers (14) 2. Entrepreneurship and taxes (413) 2.1. General tax issues (27) 2.10. Tax on professional income (7) 2.2. USN (44) 2.3. UTII (46) 2.3.1. Coefficient K2 (2) 2.4. BASIC (36) 2.4.1. VAT (17) 2.4.2. Personal income tax (8) 2.5. Patent system (24) 2.6. Trading fees (8) 2.7. Insurance premiums (64) 2.7.1. Extra-budgetary funds (9) 2.8. Reporting (86) 2.9. Tax benefits (71) 3. Useful programs and services (40) 3.1. Taxpayer legal entity (9) 3.2. Services Tax Ru (12) 3.3. Pension reporting services (4) 3.4. Business Pack (1) 3.5. Online calculators (3) 3.6. Online inspection (1) 4. State support for small businesses (6) 5. PERSONNEL (103) 5.1. Vacation (7) 5.10 Salary (6) 5.2. Maternity benefits (1) 5.3. Sick leave (7) 5.4. Dismissal (11) 5.5. General (22) 5.6. Local acts and personnel documents (8) 5.7. Occupational safety (9) 5.8. Hiring (3) 5.9. Foreign personnel (1) 6. Contractual relations (34) 6.1. Bank of contracts (15) 6.2. Conclusion of an agreement (9) 6.3. Additional agreements to the contract (2) 6.4. Termination of the contract (5) 6.5. Claims (3) 7. Legislative framework (37) 7.1. Explanations of the Ministry of Finance of Russia and the Federal Tax Service of Russia (15) 7.1.1. Types of activities on UTII (1) 7.2. Laws and regulations (12) 7.3. GOSTs and technical regulations (10) 8. Forms of documents (82) 8.1. Primary documents (35) 8.2. Declarations (25) 8.3. Powers of attorney (5) 8.4. Application forms (12) 8.5. Decisions and protocols (2) 8.6. LLC charters (3) 9. Miscellaneous (25) 9.1. NEWS (5) 9.2. CRIMEA (5) 9.3. Lending (2) 9.4. Legal disputes (4) Which payer tariff code should I indicate when calculating insurance premiums in 2021? Where to put the tariff code in RSV? What codes for general, reduced, additional tariffs of insurance premiums should be included in the reporting? Detailed answers and a table of codes for 2021 are in the article.

Tax officials have approved the form of a new calculation for insurance premiums or, as it is also called, RSV (Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551). The calculation form contains columns in which insurance premium rate codes must be entered.