The birth of children is a joyful event for a family, but it affects not only the parents, but also the organization in which the young mother works. By law, a woman has the right to receive maternity benefits, and can also receive payments while on maternity leave after childbirth. Considering the fact that employee income is generally subject to taxation, the question arises whether these payments are included in their number - are benefits up to 1.5 years subject to personal income tax? It is important to know exactly in what form such payments need to be displayed and whether this needs to be done in order to avoid mistakes in preparing the relevant documentation.

Features of taxation

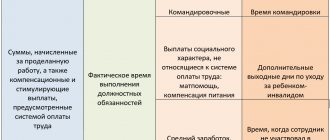

All income is shown in the 2-NDFL certificate. Child care benefits are a kind of exception in this case. They are subject to other rules, which also affect the preparation of reporting documentation.

Thus, sick leave for temporary disability is usually taxed, but this rule does not apply to maternity benefits. This is prescribed by law, so you can be sure that such payments are not required to be indicated in the 2-NDFL certificate.

If a woman is on maternity leave to care for a child who is not yet 1.5 years old, she also receives a corresponding benefit, which is not taxed and is not reflected in 2-NDFL.

If an employee simultaneously works part-time, she will receive a salary, which, in turn, is already subject to taxation.

Also see “Benefits from May 1, 2021 after increasing the minimum wage: new sizes.”

It is worth noting that parental leave is not reflected in 2-NDFL. But if this is sick leave, then the same rules apply to it as sick leave for temporary disability. Therefore, if the child gets sick and the mother receives sick leave due to this, then tax payments must be deducted.

In some cases, maternity leave may be less than average earnings. Then the employer can pay some additional amount, giving out even more than is required for established benefits. Since this money will no longer be considered part of the benefit, it is taxable and classified as “other income.”

Also see “What are the minimum maternity payments in 2021.”

Taxation of personal income tax on additional payments up to average earnings

The amount of maternity benefit is determined based on the employee’s average salary for the last 2 years of work. This procedure is determined by part 1 of article 14 of Federal Law No. 255. The total annual income of an employee cannot exceed the maximum base for insurance payments in the Social Insurance Fund. The rule is contained in Part 3.2 of Article 14 of Federal Law No. 255. If the employee’s actual earnings are greater than the limit amount, the benefit is paid in a smaller amount.

It is also important to consider the following points: not every employee receives payments of 100% of the average salary. Sometimes benefits are determined according to the minimum wage. In all these cases, the employer can pay the employee a certain amount in order to ensure that the benefit is equal to her real average salary. This is an additional payment up to average earnings.

The entrepreneur makes payments from his own pocket, and not from the Social Insurance Fund. For this reason, the additional payment is subject to personal income tax, since it does not apply to state benefits. This rule is stipulated by Articles 209 and 217 of the Tax Code of the Russian Federation. Moreover, the additional payment must be paid to insurance contributions to various funds (for example, to the Social Insurance Fund).

ATTENTION! There are exceptions to this rule. The law allows entrepreneurs to provide financial support to employees and not pay tax on it. The “loophole” can be found in Article 217 of the Tax Code of the Russian Federation. According to the law, personal income tax will not be assessed on additional payments of up to 50 thousand rubles paid within a year from the birth of the baby. That is, the manager can make a one-time payment within the prescribed limits.

IMPORTANT! When preparing accounting documents, the additional payment must be indicated as labor costs.

Eligibility for benefits

The legislation specifies the circle of those who can receive maternity benefits:

- Women who work officially and under an employment contract, as well as those who work as civilian personnel in military formations in other countries, can count on it;

- if a woman does not work, but was fired due to the liquidation of the enterprise, then she can also apply for benefits; the same applies to women who have ceased activities as individual entrepreneurs;

- full-time students in any educational institution.

It is important that only the woman herself is entitled to maternity benefits. It cannot be issued by other relatives, as is possible in the situation with some other child benefits.

A woman can also receive benefits when adopting a child under 3 months old, which will be accrued only to the mother. If in the family that adopted the baby, the father works and the mother does not, then the benefit will not be transferred.

If a woman officially works in two places at once and has worked in these organizations for the last 2 years, then she can count on accruing two benefits at once - from each employer.

Income tax on maternity leave in 2019–2020

There were no changes in the rules for calculating maternity benefits or in the issue of their taxation with personal income tax in 2019–2020. This means that in 2019-2020, income tax is still not taken from maternity workers. However, traditional changes have been made to the amounts depending on the size of the minimum wage and the value of the employee’s income, within the limits of which this income is subject to contributions for disability and maternity insurance.

Based on these values, from 01/01/2020 for maternity leave:

- the minimum value in connection with the next increase in the minimum wage (up to 12,130 rubles) will be 55,830.60 rubles. in case of normal birth (within 140 days);

- the minimum amount for complicated childbirth (for 156 days) will be 62,211.24 rubles;

- the minimum amount for multiple pregnancy (for 194 days) will be 77,365.26 rubles;

- the maximum for normal childbirth (for 140 days) is at the level of 322,191.80 rubles;

- the maximum for complicated childbirth (for 156 days) will be 359,013.72 rubles;

- the maximum amount of benefits for multiple pregnancies (for 194 days) will be 446,465.78 rubles.

For information on how the minimum and maximum amounts are calculated, read the article “When is sick leave given for pregnancy and childbirth?”

Does a maternity leaver have taxable personal income tax income if the Social Insurance Fund refuses to reimburse the benefit? The answer to this question was given by 3rd Class Advisor to the State Civil Service of the Russian Federation L.M. Bobkova. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

Direct payments

In some regions, the Social Insurance Fund project “Direct Payments” operates. It provides that the woman will receive benefits directly through the Social Insurance Fund. In this case, the documents are submitted to the appropriate department by the employer himself, or in some situations the woman can do this herself.

The presence of such a project makes life easier for accountants of organizations and the employees of the Social Insurance Fund themselves, and a woman receives a guaranteed opportunity to receive payments in the required quantity and on time - regardless of how the financial affairs are in the organization where she works. This procedure protects against unscrupulous employers who use crisis conditions as an excuse not to pay employees or delay due payments.

Also see “FSS Pilot Project in 2021.”

Reflection in the 2-NDFL certificate

Since maternity benefits and child care benefits up to 1.5 years are not subject to personal income tax, maternity benefits and child care benefits are not reflected in the 2-NDFL certificate (Appendix No. 1 to the Order of the Federal Tax Service dated November 17. 2010 No. ММВ-7-3/ [email protected] ). And the additional payment up to the average earnings is reflected in the certificate with code 4800 “Other income” (Appendix No. 3 to the Order of the Federal Tax Service dated November 17, 2010 No. MMV-7-3 / [email protected] ). The same code will need to be indicated in the 2-NDFL certificates for 2015 in accordance with the new codes approved by the Federal Tax Service (Appendix No. 1 to the Order of the Federal Tax Service dated September 10, 2015 No. MMV-7-11 / [email protected] ).

In general, there is no need to submit 2-NDFL for an employee on maternity leave who does not receive any income other than child care benefits.

Certificates on form 2-NDFL, submitted in 2015, can be found here.

certificates submitted in 2021 based on the results of 2015 can be found here.

Receiving benefits

Payments are made for the time that the woman remains on maternity leave. You can go into it at the 30th week of pregnancy - 7 months after its onset. If a mother is expecting not one baby, but several, then she can go on vacation earlier.

To receive payments, you need an appropriate basis, which will be attached to the documentation. This may be a certificate from the antenatal clinic, as well as a birth certificate when the child is born. These documents are attached to the application, and are also included in the order for the calculation of benefits, which the employer draws up after receiving the application.

Also see “Order for payment of benefits for registration in the early stages of pregnancy.”

Read also

19.05.2018

Monthly payments for children under one and a half years old

On January 1, 2021, Federal Law No. 418-FZ of December 28, 2017 came into force, which guaranteed families with low income the right to receive an additional monthly payment for their first or second child.

Payments are established for children born (adopted) starting from 01/01/2018. And we are talking specifically about the first and second child. Payments are not provided for the third child and subsequent children.

Employers are not responsible for making these payments. Payments for the first child are made at the expense of the federal budget, and for the second - at the expense of maternity capital if the applicant has a certificate for maternity capital (clause 4 of article 1 of Federal Law dated December 28, 2017 No. 418-FZ). Payments for the first child are made by social protection authorities, and for the second - by the Pension Fund of Russia branches. However, you can declare to the Pension Fund about the appointment of a monthly payment for the second child simultaneously with submitting an application for the issuance of this certificate (Clause 7, Article 2 of the Federal Law of December 28, 2017 No. 418-FZ). The amount of maternity capital will be reduced monthly by the amount of payment in connection with the birth of a second child (Clause 11, Article 3 of Federal Law No. 418-FZ of December 28, 2017).

Families whose average per capita income does not exceed 1.5 times the regional subsistence level of the working-age population for the second quarter of the year preceding the year of application for payment have the right to receive monthly payments. The amount of payments is the regional subsistence minimum for children for the second quarter of the previous year (clause 5 of Article 1 of Federal Law No. 418-FZ of December 28, 2017).

You can apply for a payment for your first child to the social protection authority at your place of residence (Clause 4, Article 2 of Federal Law No. 418-FZ of December 28, 2017). To do this, you need to submit an application, a child’s birth certificate, certificates from the work of each family member about the amount of income, as well as documents confirming the account details for transferring payments.

An application for assignment of payments for the second child is submitted to the territorial branch of the Pension Fund. Since payments for the second child are made at the expense of maternity capital, only parents who have received the appropriate certificate/sent an application for a certificate can apply for payments (Clause 4 of Article 1 of Federal Law No. 418-FZ dated December 28, 2017).

An application for a monthly payment may be submitted at any time within one and a half years from the date of birth of the child. But it’s better not to delay submitting your application. The fact is that if you apply for payment no later than 6 months from the date of birth of the child, then it will be paid from the date of birth of the child until he reaches one and a half years old. If you miss the 6-month period, monthly payments will be made only from the day you apply for their appointment (Clause 2, Article 2 of Federal Law No. 418-FZ of December 28, 2017).

Payment in connection with the birth (adoption) of the first or second child is assigned for a period of one year. After this period, the citizen submits a new application for payment until the child reaches the age of one and a half years. When the child reaches the age of one and a half years, payments stop (clause 1, clause 1, article 6 of the Federal Law of December 28, 2017 No. 418-FZ).

How long does maternity leave last?

After receiving a certificate of incapacity for work, the woman writes an application for maternity leave. Depending on how the pregnancy proceeds, the law (Article 10 of the Federal Law-255) provides for the duration of leave:

- 140 calendar days - for normal pregnancy (70 days before and 70 days after the baby is born)

- 156 days – if there is a difficult birth or pregnancy with complications (70 and 86 days)

- 194 days – for multiple pregnancies (84 and 110 days)

If pregnancy comes with complications, two certificates are issued for temporary disability. One for 140 days - by a doctor observing the pregnancy, the second for 16 days - upon discharge from the hospital with a newborn (clause 48 of Order of the Ministry of Health and Social Development No. 624n).

Who is paid for maternity leave?

After issuing sick leave in connection with maternity, a woman can apply for maternity benefits. The hospital form is filled out by an obstetrician-gynecologist at the 30th week of pregnancy (clause 46 of Order of the Ministry of Health and Social Development No. 624n).

Recipient categories include:

- Officially employed

- Unemployed, if 12 months have not passed since the date of dismissal due to liquidation of the company

- Full-time students

- Military personnel under contract, and civilians in the military, outside the Russian Federation

- Adoptive mothers

Payment of benefits is made: at the place of work, service or study. Dismissed persons apply to the social protection authorities (SZN).

Certificate of incapacity for work when caring for a patient

The amount of the benefit depends on the insurance period of the person receiving sick leave and his average earnings . Only persons who have had insurance coverage for more than 8 years can apply for full compensation of average earnings. With an insurance period of 5 to 8 years, the benefit is calculated based on 80% of average earnings, less than 5 - 60%.

However, some employers provide the possibility of paying additional benefits from their own funds.

Are taxes withheld?

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

In accordance with the Tax Code of the Russian Federation, the income of an individual is subject to taxation, unless otherwise provided by law. Payments of sick leave benefits are not exempt from personal income tax .

Are there any insurance premiums?

The Tax Code of the Russian Federation provides that state benefits are not subject to insurance contributions . Since, as a general rule, incapacity for work to care for a sick child is compensated from the Social Insurance Fund from the first day of his illness, the benefit received by the employee may not be subject to insurance contributions (you can find out who pays for sick leave for child care - the Social Insurance Fund or the employer here ).

In this case, additional payments, the amount of which is established by the employer, are subject to insurance contributions in full.