Every business has assets. These are material assets and investments, money that allows the company to engage in core and auxiliary activities. Account 58. Financial investments is an item that is needed to reflect in the accounting records the enterprise’s financial investments in securities of various types, make contributions to the company’s capital, issue interest-bearing loans and carry out other operations.

More details about transactions using account 58 will be discussed in the article. A real example will be given for novice accountants.

Scope of application

To display information about which funds should be regarded as financial investments, account 58 is used in the chart of accounts.

Structure of Article 58

Through this PBU article you can display:

- government securities;

- municipal central banks;

- bills, bonds of other companies;

- investments in the authorized capital of other companies;

- interest-bearing loans provided to other companies;

- deposit investments;

- receivables received on the basis of assignment of claims.

Financial investments account 58, subaccounts and other items corresponding to the specified item are used.

Important! Investments in a company's own securities cannot be considered financial investments. This does not include bills issued for manufactured products, purchased “jewelry,” or objects of art.

Analytics

The construction of accounting should provide the ability to obtain information about long-term and short-term assets. Analytics is carried out for the item under consideration in accordance with the types of financial investments and the objects in which they are made:

- For companies that sell shares.

- For other enterprises in which the company is a participant.

- By borrowing organizations, etc.

Accounting for investments within a group of interrelated companies, the activities of which are compiled as consolidated reports, is carried out on the account. 58 apart.

What are the subaccounts?

Account 58 is not used in accounting in its “pure” form. This article acts as the main one, which takes into account data from all existing sub-accounts.

Picture 4. Subaccounts

To separately account for amounts received in different currency units, an enterprise accountant can open sub-accounts:

- 58 1 - statutory contributions, contributions to joint-stock companies;

- 58 2 — investing in securities;

- account 58 3 - loans provided to citizens to companies in any form. It is 58 subaccount 03 that is often used in accounting;

- 58 4 - contributions to common property under a simple partnership agreement.

On a note! The number of subaccounts is not limited to those indicated, since it is necessary to maintain analytical accounting for each group of objects. An accountant can open additional sub-accounts if this is specified in the company's accounting policies. The most commonly used count is 58 03.

Legislative basis for the balance sheet line “Financial investments”

All financial actions carried out by the organization are regulated by the relevant legislative acts of the state on accounting. The balance sheet line “Financial investments” is regulated by the following regulatory documents:

- Regulations on accounting audit PBU 19/02 based on order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126 (amended in 2010);

- Law “On Accounting” dated December 6, 2011 No. 402-FZ;

- Civil Code of the Russian Federation;

- Tax Code of the Russian Federation.

In order to make financial investments fully and legally, an enterprise must comply with all standard requirements established at the legislative level. The legal regulation of this topic includes several stages. The decrees of the President of Russia are considered the highest, and the documents of the organization itself are considered the lowest, according to the industry direction and the amount of economic benefit received.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

How does Article 58 correspond to other accounts?

In addition to the main characteristics of the article, it is worth having an idea of which accounting accounts it corresponds with.

There are several accounts that enter into a “relationship” with the 58th account in debit and credit. We are talking about the following articles.

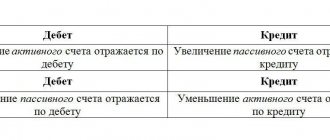

| Debit | Credit |

| 50, 51, 52, 75, 76, 80, 91, 98 | 51, 52, 76, 80, 90, 91,99 |

The main purpose of account 58 is to collect and summarize data on invested funds and other assets of the company in profitable activities.

Reflection methods

Thus, you can choose one of the following options:

- Regardless of the type, deposits are shown in the subaccount. 55.3. At the same time, experts recommend creating separate articles by type of deposit - on demand, fixed-term, certified by a certificate, and so on.

- Depending on the type, deposits are reflected in the account. 58.

Many experts are of the opinion that the second option is more appropriate. This is explained by the fact that the deposit is opened to extract additional profit from the provision of the company’s assets on a reimbursable basis.

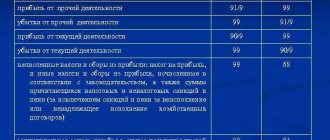

Posting account 58 in accounting

The PUB also shows the transactions used to display all operations using account 58. Let's look at the transactions for account 58 in more detail in the table:

| Operation description | Debit | Credit |

| The securities were purchased for foreign currency. | 58-1 | 52 |

| The bonds were paid from a current ruble account. | 58-2 | 51 |

| The loan was issued to another company with materials. | 58-3 | 10 |

| Under a simple partnership agreement, the fixed asset was transferred as a contribution to the management company. | 58-4 | 1 |

| The difference between the initial cost of the bond and the current market price was included in the financial results. | 58-2 | 91 |

| Revaluation of shares at market value as of the current date. | 91 | 58-1 |

| Payment on a bill. | 51 | 58-2 |

| The previously issued loan was returned by bank transfer. | 51 | 58-3 |

| The intangible asset transferred under a simple partnership agreement was returned. | 4 | 58-4 |

The presented entries were compiled using not the main financial investment account, but sub-accounts opened in the accounting of the enterprise. In the table presented, the debit of account 58 shows that the assets of the enterprise were transferred to another organization, and the passive position of the sub-accounts reflects the assets received by the company.

On a note! Every accountant must know that account 58 in the balance sheet is indicated on lines 1170 and 1240.

Compromise solution

In classical terminology, the excess of the exchange rate value over the nominal value is called agio, the decrease is called disaggio. There is a lot of debate in the literature about whether these processes affect the amount of capital of an enterprise. A realistic answer is positive. This is due to the fact that in this case the value of securities and the total price of assets are more accurately reflected. A negative answer will be no less realistic. In this case, the amounts actually invested in securities and, accordingly, in assets will remain. In practice, a compromise solution has been developed. In accounting, agios are not reflected, but disaggios are shown using an account. 59, fixing reserves for impairment of investments in shares and other securities.

Posting examples

The final paragraph provides a specific example of using postings with subaccounts 58 accounts for beginners. The Cactus company sells exotic plants.

Example of a balance sheet for account 58

During the first quarter of this year, the company bought shares for 10 thousand dollars and issued a loan to another company that supplies them with turf for infrastructure development in the amount of 200 thousand rubles. At the end of the reporting period, the loan was returned to the current account. The accountant revalued the shares, with an increase of 10% at the market rate. Let's create the entries that the accountant of the Cactus company must make.

- Dt. 58-1 - Kt.52 - $10,000 - shares purchased for foreign currency.

- Dt. 58-3 - Kt.51 - 200,000 rubles - loan to another company engaged in the supply of turf.

- Dt. 91—Kt. 58-1 - $1000 - revaluation of shares with an increase of 10%.

- Dt. 51—Kt. 58-3 - 220,000 rubles - loan repayment with interest.

In conclusion, Article 58 is used mainly by companies that work closely with third parties and often make various financial investments. The accounting department keeps records of open sub-accounts, and the final indicators are formed on the main account - 58.

https://www.youtube.com/watch?v=eRVeCaNt6hs

Current rate

When accounting for this indicator, the balance will show the liquidation value of the securities, that is, the price at which they can be sold at the current moment. However, you need to remember that stock prices are very volatile. This encourages the accountant to constantly re-evaluate them. Accordingly, their inventory becomes more complicated. At the same time, the value of the capital that was actually invested essentially disappears, and the size of the nominal value is quite problematic to calculate. Following the principle of prudence, it is preferable to choose the second and third options. Shares should be accounted for at cost of actual acquisition. However, if the current exchange rate falls below the purchase price, the difference is written off as a loss.

Typical correspondence for debit and credit

An analytical analysis is carried out based on the standard plan of the organization. To provide a complete picture of the financial position of the enterprise, the analysis reflects short-term and long-term cash deposits. Financial investments correspond with the following accounts of the enterprise's balance sheet.

In relation to debit:

- 50 – Treasury;

- 51 – Nominal accounts;

- 52 – Monetary account standards;

- 75 – Settlement with the founders of the enterprise;

- 76 – Payments to debtors and creditors;

- 80 – Property fund of the enterprise;

- 91 – Other income and expenses;

- 98 – Deferred income.

In relation to the loan:

- 51 – Current accounts;

- 52 – Monetary account standards;

- 76 – Payments to debtors and creditors;

- 80 – Property fund of the enterprise;

- 90 – Profit from sales;

- 91 – Other income and expenses;

- 99 – Profit and loss.

For the company to operate effectively, it is necessary to combine all corresponding accounts efficiently and correctly. This will help control and analyze the receipt of profit or loss from financial investments, and, accordingly, will show the feasibility and return on investment of such investments.

Conditions for issuing money in debt, affecting the accounting of transactions on this debt

Borrowing operations between legal entities other than credit institutions are not uncommon. In a simpler way than in a bank (without collecting a large number of documents), they allow you to obtain the necessary funds for the required period, and the interest rate may be lower than that set by the bank for the loan (up to its absence). Another positive aspect is that the recipient of the loan does not have to regularly report to his lender about his current financial situation, as is the case when receiving a loan.

Transactions for the provision of a loan to a legal entity and transactions for calculating interest on it, if they are provided for in the borrowing agreement, from the transferring party are directly dependent on two conditions:

- Will interest be accrued for the use of borrowed funds, or have the parties agreed that there will be no interest?

- Is the issuance of loans included in the list of its usual types of activities or such operations take place occasionally.

The first of the conditions determines the very essence of the debt arising from the receiving party to the lender: whether it turns out to be income-generating or not. That is, it should be considered a financial investment (placement of funds with the aim of extracting financial benefits from this process) or regarded simply as a receivable.

The second condition determines in which transactions the organization’s loan from the organization will be reflected when calculating interest (i.e., income on it).