Payment

You need to fill out an income tax return when paying dividends depending on

Last modified: January 2021 The generally accepted mode of using working time is not possible when drilling oil and

Enterprises with the status of a legal entity, in accordance with the legislation of the Russian Federation, are required to maintain reports. One

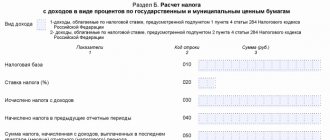

How to calculate income tax The tax period for income tax is one year. Therefore the tax

The company systematically conducts an inventory of its own assets. The purpose is to check the consistency between documentary information and

Domestic legislation connects the amount of net assets with, for example, the amount of the authorized capital of the organization and

Travel expenses include employee travel expenses, housing rental expenses, daily allowances and

Law for the benefit of the employer Denis Pokshan Expert in taxes, accounting and personnel records Relevant

The procedure for the head of the tax authority to make a decision based on the results of consideration of tax audit materials is established by article

What is KBK and why is it needed? KBK is a budget classification code.