Often individual entrepreneurs and commercial organizations have to resolve the issue of filing a zero declaration for property they do not have. They cannot understand what will happen if they do not file such a declaration. After all, if they do not own property, then there is no need to report to the tax office. The question of whether it is necessary to submit a zero tax return on missing property requires careful analysis, otherwise you may earn fines for late submission of tax reports. Experienced lawyers specializing in tax law and well versed in all reporting procedures when communicating between economic entities and the tax authorities will help with this.

Do I need to submit

The law approves the mandatory filing of property declarations for private entrepreneurs. This paper contains information about both purchased objects and those that have been owned for a long time.

If there is no property as such, then there cannot be a planned filing of the declaration. This document is submitted to the tax service only when acquiring ownership of any movable or immovable object. After purchasing it, you should fill out a declaration and submit it to the Federal Tax Service. However, there are no specific deadlines.

When purchasing a vehicle, you must register with the traffic police. Only after this the entrepreneur will have the necessary notes in his hands, which will be included in the declaration for the tax office.

The acquired land plot is also subject to registration. First, a package of documents is submitted to the state registration service. There the owner receives a receipt indicating that the organization has received the necessary documentation. Next, you should enter all the information about the land in the declaration and submit the document to the tax office.

Accounting for property in the form of fixed assets.

According to the accounting rules, fixed assets are recognized as assets that meet the criteria given in paragraph 4 of PBU 6/01 “Accounting for fixed assets”[1]. However, if the value of such assets is no more than 40,000 rubles, they can be included in the inventory (if this is provided for by the accounting policy - clause 5 of PBU 6/01).

For tax purposes, depreciable property is property with a useful life of more than 12 months and an original cost of more than 100,000 rubles. (Clause 1 of Article 256 of the Tax Code of the Russian Federation). An organization cannot change this rule by its accounting policy and set a lower cost threshold for recognizing property as depreciable. “Low value” objects are written off for tax purposes as material expenses (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

In order to bring tax and accounting data closer together, write-offs can occur evenly, and it is this decision that is fixed in the accounting policy for tax purposes.

In paragraph 4 of Art. 374 of the Tax Code of the Russian Federation lists property that is not recognized as an object of taxation. This list includes land plots, nuclear installations, icebreakers, space installations, as well as fixed assets included in the first or second depreciation group in accordance with the Classification of fixed assets included in depreciation groups[2].

Consequently, if an organization’s balance sheet contains fixed assets (movable and (or) immovable), named as part of the objects of taxation, it is recognized as a payer of property tax and is obliged to submit a declaration (tax calculation for advance payments) for this tax.

The fact that, according to paragraph 25 of Art. 381 of the Tax Code of the Russian Federation in 2021, a preferential tax regime applies to movable fixed assets (regardless of their depreciation group) accepted on the balance sheet from January 1, 2013, does not mean that such objects are automatically excluded from the list of taxable objects.

Exclusion from the list of taxable objects and provision of benefits are not the same thing. These are different mechanisms for regulating the tax burden, provided for by various articles of the Tax Code. So, by virtue of Art. 381.1 of the Tax Code of the Russian Federation from January 1, 2021, the tax benefit established by clause 25 of Art. 381 of the Tax Code of the Russian Federation, will be applied by taxpayers at the discretion of the constituent entities of the Russian Federation.

What is important to consider

Role and data requirements

Due to changes to the Tax Code in 2015, everyone must submit a zero return. In this case, the lack of income does not matter. They submit a declaration in cases where the entrepreneur did not work and did not receive income, or worked, but the level of income was low - without making a profit.

A zero declaration for individuals should be considered one that indicates the sale of property, but its price was the same as when purchased. In this case, you need to fill out the document, but the income will be listed as zero.

For individual entrepreneurs, a zero property tax return for 2021 will indicate that although the businessman did not receive a profit for the specified period, he continues to carry out his activities.

There are several categories of business in which such a declaration can be submitted:

- activities tied to the season - based on climatic and weather conditions;

- during the reporting period, the entrepreneur was employed in another institution;

- no payroll was processed. This case is possible at the start of activity;

- if the operation of the enterprise was stopped.

Among the data required to be provided, the following should be highlighted:

- Full name of the person paying the tax;

- You will need individual identification codes responsible for the tax period, OKATO.

- passport and registration information;

- type of adjustment.

It is worth noting that most of the document and its column will be empty.

Main provisions

The declaration should indicate those assets that are subject to average annual property tax and real estate with cadastral value.

When filling out the document, you should use the following tips:

| Preferential objects should be separated from others | Movable depreciation objects are classified as preferential, so you cannot simply add the value of the property without taking into account the preferential one. This indicator should be entered in column 3 of the second section. And in line 130 you will need to indicate the required benefit code. |

| The assets of the two groups are reflected in the document | According to the Federal Tax Service letter No. BS-4-11/13906 dated August 7, 2015, line 270 should contain data on the cost of funds from the first and second depreciation groups. However, these figures are not included in the tax calculation. |

| The third section is filled in for each of the objects | This section provides information on objects of cadastral value. Even if there is no property, you should fill out the TIN, KPP and put down the serial number of the page. The remaining columns are filled with dashes. Moreover, if the institution has property on its balance sheet, a separate sheet should be filled out for each of the objects. |

Conditions, terms and responsibilities

When filling out the declaration, you should take into account the conditions prescribed by law:

- All prices in the document should be indicated in rubles. Non-integer values should be rounded to the nearest ruble.

- The numbering should be continuous and should be placed on all pages, starting with the title page. There are special fields for numbers in the declaration. Numbering should begin with the value 001.

- Blots and errors cannot be corrected; the sheet must be filled out again.

- Duplex printing is not permitted.

- Fill out the declaration using ink of three colors - blue, black and purple.

- All data is entered exclusively in the fields provided for them.

- Text data is indicated in capital block letters.

- If there is no data in the field, you must put a dash there.

All taxpayers in the country provide the necessary information to tax authorities in accordance with the deadlines established by the Federal Tax Service and for the specified periods.

The following terms are considered standard:

- until the 28th - should be counted from the moment the reporting period ends;

- for the past period, data must be provided by March 28;

- If the deadline coincides with a weekend or holiday, you can submit documents both in advance and on the day following the weekend.

If the deadline for submitting a tax return to the Federal Tax Service is missed, fines and penalties should be expected.

The Tax Code of the Russian Federation in Article 119, paragraph 1 states that an administrative fine is provided for failure to submit tax reports. Its size depends on the amount of tax that should have been paid. Typically this figure is 5 percent of the amount.

It is worth considering that there is a maximum and minimum fine. Today, the fine cannot be less than 100 rubles and more than 1000. The maximum fee will not exceed 30% for the reporting period.

Objects of activity

According to Federal Law No. 242-FZ of October 30, 2009, only those organizations that have objects subject to taxation must pay property tax. These are indicated in the Tax Code in paragraph 1 of Article 373. This change came into force on January 1, 2010.

Such property may include objects that are on the balance sheet of the institution as fixed assets of the company:

- movable and immovable;

- received for rent or for permanent use;

- transferred on the basis of a power of attorney;

- added to joint business activities.

As for benefits, they can apply to all objects owned by the enterprise. But they are not exempt from filling out a tax return and must submit all calculations. Since this property has a place and must obey general orders.

How to fill out a report

Here are step-by-step instructions for completing your 2021 property tax return:

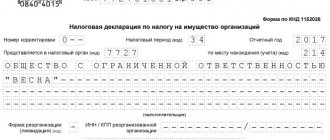

Step 1. Fill out the Title Page.

The TIN and KPP are filled out in accordance with the registration documents. The tax period code for the 2021 report is “34”. If a liquidated or reorganized enterprise reports to the Federal Tax Service, the value “50” is entered. The location code is “214”. Then fill in the name of the taxpayer in accordance with the charter, contact phone number and full name. the responsible person - the manager and the date of submission of the form to the inspection. The title page is certified by the signature of the head and the seal of the institution.

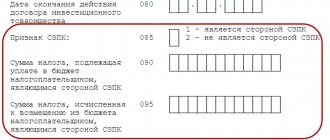

Step 2. Fill out Section 1.

Here the taxpayer's OKTMO, the calculated contribution amount and the budget classification code to which the payment is sent are indicated.

Step 3. Fill out Section 2.

This block is used to reflect calculated information - the average annual value of all property assets for the reporting period. Data is listed for each month of the calendar year.

Line 150 shows the total result for the average annual cost.

Line 160 indicates the tax benefit code, if any.

Line 190 is intended to reflect the general tax base, and line 210 illustrates the current rate for property contributions in the region.

In field 220 the total calculated amount is entered, and in 230 - previously paid advance payments.

An updated example of filling out a property tax return for organizations involves entering in cell 270 the value of the residual value of fixed assets as of December 31, 2019 (as of the last date of a specific reporting period).

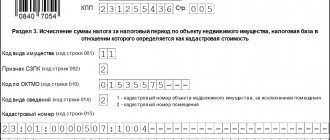

Step 4. Fill out Section 2.1.

This is a new section that is filled out carefully and in strict accordance with the explanations of the Federal Tax Service (Letter No. BS-4-21 / [email protected] dated March 14, 2018). Here you enter information about each property subject to taxation at the average annual value.

The cadastral number is entered in field 010, and the conditional number in 020, if the fund has one.

Line 030 reflects the inventory number of the asset if there is no cadastral or conditional nomenclature.

In line 040, write down the 9- or 12-digit OKOF code for a specific property.

Field 050 reflects the residual value of the asset as of December 31 of the reporting year. Information is entered for each fund separately, therefore, if an organization has several assets with cadastral or conditional numbers, then lines 010 to 050 of section 2.1 are filled in for each such property. The residual value at the end of the period is determined for each position separately by calculating the share in the total value of each asset in the inventory card. The calculated share of the fund is multiplied by the total residual value of all funds taken into account.

Step 5. Fill out Section 3.

The block is intended for calculating property contributions based on cadastral value.

In line 001 the code of the type of property is entered (Appendix 5 of the Procedure). Then OKTMO and the cadastral number of the property are registered.

Line 020 reflects the cadastral value of the real estate, which is also the tax base from line 060.

In field 080 the tax rate is entered, and in field 100 the calculated value of the contribution to be paid to the budget.

To submit the report you will need:

- print and sign with the manager if the form is submitted to the Federal Tax Service on paper;

- sign with an electronic digital signature and transfer to the Federal Tax Service via telecommunication channels for electronic reporting;

- receive confirmation (notice) that the register has been accepted by the inspector.

Completing and submitting a zero property tax return for 2021

Individual entrepreneur and legal entity persons who use the simplified taxation system must fill out only three sheets of the document.

First, you should provide the following information:

- , tax office code;

- Full name of the entrepreneur or name of the organization;

- , information about the director of the company;

- date and signature.

The second sheet contains information about the property, OKATO and information on income and expenses.

The last page should reflect the tax rate. The remaining cells are not filled in - dashes are placed in them.

If the enterprise operates according to the OSNO scheme, then a zero declaration should be submitted via the Internet. To do this, you will need to install special software and acquire.

Detailed algorithm

The first thing you need to do is enter the data on the title page. There they indicate information about the institution and declaration. After this, filling is carried out in reverse order. First you should complete the third section, then the second and finally the first.

The third section should be completed for each property. In this case, the tax on it is calculated based on the cadastral value. If such real estate is not owned by the company, then dashes should be placed in all columns except the TIN and KPP.

If the object was owned by the organization for part of the reporting period, then line 090 should be filled in. It should indicate the figure obtained as a result of the ratio of the period of ownership of the object to the full number of months in the year.

It is worth considering that the month in which the property was acquired or sold will be considered complete - regardless of the date of the transaction. For example, the purchase of property took place on September 30. Then the value 4/12 is indicated in the corresponding column.

There may also be several second sections in a document. It all depends on what code the property is located under. It happens that on the same territory, two buildings will have different codes. In the event that one of the objects enjoys a tax benefit, another sheet of the second section is filled out.

The residual price for the main objects is entered in line 270 of the section.

The exception is land plots and some groups of property:

- which is included in the first and second depreciation groups;

- buildings that are subject to taxation according to cadastral value;

- objects that are on the balance sheet of a separate enterprise.

If documentation is submitted to one tax organization, lines 270 for the OP and the enterprise will be identical.

The first section includes six groups with columns from 010 to 040. They are intended to indicate tax amounts that should be paid or reduced. In this case, the OKTMO classification is used.

The decoding of the line codes is as follows:

To fill out line 030, you will need the amount of tax received from the book value and the amount of tax based on the cadastral value. In this case, the OKTMO codes must be the same.

What property is taxed?

Objects of taxation for Russian enterprises include real estate in ownership, possession, use, disposal and received under concession, which are recorded on the balance sheet of the taxpayer (Articles 378, 378.1, 378.2 of the Tax Code of the Russian Federation).

For foreign companies, taxable objects will be:

- For foreign organizations with a permanent establishment in the Russian Federation - real estate as fixed assets and real estate received under a concession agreement.

- For foreign companies that do not have a permanent representative office in Russia - real estate that is owned by such companies and real estate assets received under a concession agreement.

IMPORTANT!

Since 2021, the procedure for tax accounting and reporting for property funds has changed significantly. Now movable property fixed assets, land, natural resources and other assets are not taxable.

Difficult situations

There are situations in which filling out a declaration becomes more difficult.

Most often, difficulties arise in three cases:

| No objects | If there is no property subject to taxation, then the organization is not automatically a tax payer. Based on this, this enterprise should not submit documentation to the tax office. |

| All property is subject to exemption | Property tax benefits provided by the state can apply to the entire range of activities of the enterprise. In such situations, the organization does not pay tax, but does not cease to be a taxpayer. Therefore, such an enterprise is required to fill out a declaration in accordance with the general procedure. |

| Residual value is zero | If all property that is subject to tax is depreciation and its residual value is zero, then there will be no tax payable. In this regard, the tax will be zero, but the very fact of taxation remains. Based on this, the company must provide a tax return even for objects with zero residual value. |

It is worth remembering that the absence of an amount to pay tax does not relieve the taxpayer of the obligation to submit a report to the tax office. After all, obligations both for the object and for the taxpayer remain.

Filing a property tax return is a simple process. It is important to determine the situation when it is possible not to submit it and the one when reporting is required even with zero indicators.

We indicated the deadline for submitting the property tax return for 2021 in the article.

The company is required to file a property tax return

Even if the residual value of fixed assets is zero, the company must file a property tax return, says Art. 386 of the Tax Code, according to which all taxpayers are required to file tax returns for property tax (letter of the Federal Tax Service dated 02/08/2010 No. 3-3-05/128), reports the newspaper “Accounting. Taxes. Right".

If the residual value of fixed assets that are recognized as an object of taxation is zero, the tax base and the amount of tax indicated in the declaration will be equal to zero.

Source Russian Tax Portal

FEDERAL TAX SERVICE OF THE RUSSIAN FEDERATION LETTER dated February 8, 2010 No. 3-3-05/128

About corporate property tax

Sent to the Interregional Inspectorate of the Federal Tax Service of Russia for the largest taxpayers No. 6

The Federal Tax Service has considered the appeal regarding the application of tax legislation on corporate property tax and reports the following.

In accordance with paragraph 1 of Article 373 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) (as amended in force before the entry into force of the Federal Law of October 30, 2009 No. 242-FZ “On Amendments to Article 373 of Part Two of the Tax Code of the Russian Federation” ( hereinafter referred to as Law No. 242-FZ)) Russian organizations were recognized as tax payers.

By virtue of paragraph 1 of Article 386 of the Code, taxpayers of corporate property tax are required to submit to the tax authorities the relevant tax returns and tax calculations for advance payments for this tax. Taxpayers of the property tax of organizations were the organizations specified in paragraph 1 of Article 373 of the Code, with the exception of the organizations specified in paragraph 1.1 of the said article. At the same time, the recognition of organizations as taxpayers of corporate property tax was not made dependent on the presence or absence of the corresponding object of taxation.

Thus, organizations that are taxpayers of the corporate property tax were required to submit tax returns (tax calculations for advance payments) for this tax to the tax authorities in accordance with Article 386 of the Code, regardless of the fact that the property of these organizations was not recognized as an object of taxation on the basis Article 374 of the Code or was completely exempt from paying tax in connection with the provision of tax benefits. A similar position was contained in the letter of the Ministry of Finance of Russia dated 03/04/2008 No. 03-05-04-02/14, communicated to the tax authorities by the letter of the Federal Tax Service of Russia dated 04/03/2008 No. ШС-6-3/

In connection with the entry into force of Law No. 242-FZ on January 1, 2010, the wording of Article 373 of the Code has changed. From 01.01.2010, taxpayers are recognized as organizations that have property recognized as an object of taxation in accordance with Article 374 of the Code.

Objects of taxation for Russian organizations are movable and immovable property (including property transferred for temporary possession, use, disposal, trust management, contributed to joint activities or received under a concession agreement), accounted for on the balance sheet as fixed assets in accordance with the procedure established for accounting, unless otherwise provided by Articles 378 and 378.1 of the Code.

Taking into account the above, from 01.01.2010 organizations that do not have property recognized as an object of taxation on their balance sheet are not taxpayers of the corporate property tax, therefore, they do not have the obligation to submit declarations (tax calculations for advance payments) for this tax to the tax authorities.

The tax base for the property tax of organizations, when determining which, in accordance with Article 375 of the Code, takes into account the residual value of fixed assets, is formed for tax purposes in accordance with the established accounting rules approved in the accounting policy of the organization.

According to paragraph 29 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, disposal of an item of fixed assets occurs in the event of: sale; termination of use due to moral or physical wear and tear; liquidation in case of an accident, natural disaster and other emergency situation; transfers in the form of a contribution to the authorized (share) capital of another organization, a mutual fund; transfers under an agreement of exchange, gift; making contributions under a joint venture agreement; identifying shortages or damage to assets during their inventory; partial liquidation during reconstruction work; in other cases.

Thus, until the moment of disposal (write-off from the balance sheet), fixed assets are recorded on the organization’s balance sheet as fixed assets, including fully depreciated fixed assets that have zero value. Consequently, the organization retains the obligation to submit declarations (tax calculations for advance payments) on corporate property tax to the tax authorities.

Acting State Advisor of the Russian Federation, 2nd class S.N. Shulgin

A paper that indicates that the payment tax is equal to the zero mark is called a zero declaration. Quite often, entrepreneurs do not know whether they need to submit a zero tax return on their own property to the control authority. Self-filling also causes difficulties. Therefore, it would be a good idea to find these answers, as well as understand what the payer can expect if he fails to submit property tax documentation for verification on time.

New reporting form for 2021

You will have to report your organization’s property tax for 2021 using a new form. Not only the declaration form was adjusted, but also the rules for filling out and submitting. The changes were approved by Order of the Federal Tax Service No. KCh-7-21/ [email protected] dated 12/09/2020. The document was published on January 14, 2021 and will come into force two months later - from March 15, 2021. This is the second change to the reporting form since it was last submitted in March 2021.

The amendments were first introduced by order of the Federal Tax Service of Russia No. ED-7-21 / [email protected] dated July 28, 2020; they came into force on November 3, 2020 and are absolutely applicable to reporting for 2021. Key autumn changes compared to the previous property tax declaration are collected in the table.

| Declaration section | What changed | How to fill out |

| Section 1 | Added the field “Taxpayer Attribute” | Enter:

|

| Sections 1, 2 and 3 | Added the field “SZPK Attribute” | To be completed by taxpayers who have entered into an investment protection and promotion agreement |

| Tax benefits field | Added new benefit codes. This is necessary for organizations that have had their property taxes written off for the 2nd quarter. |

Amendments to Article 386 of the Tax Code of the Russian Federation, which required the inclusion in the declaration of information on the average annual cost of movable property items recorded on the organization’s balance sheet as fixed assets, were introduced by Federal Law No. 374-FZ of November 23, 2020. In connection with them, a new section 4 was added to the form, in which legal entities will indicate the average annual value of movable property items recorded on the balance sheet.

Additionally, the procedure for using codes “2010501” and “2010505”, intended to identify SMEs from affected sectors of the economy, for which special deadlines and rules for making advance payments on corporate property tax for the reporting periods of 2021 have been established, has been clarified. All new changes are mandatory for reporting for 2021.

When do you need to submit a declaration?

According to the amendment, which is provided for in the current legislation of the country, all payers without exception must submit a zero property tax return. You need to send a reporting document, regardless of whether the profit came in the reporting period or was zero. That is, if an entrepreneur works under the OSN system, he in any case needs to submit a property tax return, even if the working period brought zero profit. It can also be obtained in the following situations:

- if business activity is not carried out during a certain period, therefore the individual cannot receive income;

- if the work process is carried out, but not at the proper level, in the end the income does not come, which means it turns out to be zero.

Filling procedure

The declaration includes:

- title page;

- Section 1 “The amount of tax payable to the budget, according to the taxpayer”;

- Section 2 “Determination of the tax base and calculation of the amount of tax in relation to the taxable property of Russian organizations and foreign organizations operating in the Russian Federation through permanent representative offices”;

- Section 3 “Calculation of the amount of tax for the tax period on an object of real estate, the tax base in respect of which is recognized as the cadastral (inventory) value.”

An important detail: in the declaration that the organization submits at its location, there is no need to duplicate the data reflected in the declarations that the organization submits:

- by location of separate divisions that are allocated to a separate balance sheet;

- by location of geographically remote real estate objects.

Situation: what sections need to be filled out in property tax returns if an organization submits two declarations: for its location and for the location of geographically remote property, the tax base for which is the cadastral value?

Fill out two separate declarations: one for the organization, the other for remote property. In each report, indicate only the amount of tax that needs to be paid at the location of one or the other.

Let me explain. The organization is obliged to pay the tax on a geographically remote property to the budget of the region where this property is registered (Article 385 of the Tax Code of the Russian Federation). For the remaining property that is listed on the balance sheet, the tax must be transferred to the budget at the location of the organization itself (clause 2 of Article 383 of the Tax Code of the Russian Federation).

OKTMO in each declaration will be different. In one, put the code of the municipality subordinate to the inspectorate in which the organization is registered at its location. And in the other - according to the location of geographically distant property. This follows from the provisions of paragraphs 1.3, 1.6 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

How to fill out a declaration at the location of the organization

In such a declaration, reflect data on all property that is listed on the organization’s balance sheet, but without taking into account geographically remote real estate. Submit to the tax office as follows:

- title page;

- section 1;

- section 2. On line 270, reflect the residual value of all fixed assets as of December 31 (taking into account the geographically remote property);

- section 3. Since there is no data to fill out this section, put dashes in all cells (clause 2.3 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895).

How to fill out a declaration on the location of geographically remote property

In this report, reflect data about the deleted object. That is, without taking into account the rest of the property that is listed on the organization’s balance sheet. Submit a declaration to the tax office containing:

- title page;

- section 1;

- section 2. In all cells except line 270, put dashes. And only on line 270 reflect the residual value of all fixed assets as of December 31 (clause 2.3 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895);

- section 3.

How to file a zero property tax return

If no business activity was carried out during the reporting period, then the property tax declaration is prepared using a different system. The document should contain the following sections:

- the first title page, which is drawn up according to the general rules; a sample of the filling can be seen at the tax authorities;

- the first part of the document displays KBK and OKATO. Since no numerical profit was received, dashes must be placed in these sections;

- the second part of the document also indicates income figures. Due to the fact that no profit was made, dashes are placed in these places.

It may happen that in the process of activity there were both income and expenses, but the profit still turned out to be zero. In this case, you need to submit a declaration drawn up according to a standard template and enter into the document all the indicators of the work process. A zero declaration can be called a very simple document, because only two subparagraphs will be left unfilled, which reflect the amount of the tax payment and the main base for payment; the provision of the remaining information should be fully reflected in the property tax documentation.

General filling requirements

In each line in the corresponding column of the declaration, indicate only one indicator. If there is no data to fill out the indicator, then put dashes in all cells. For example, like this:

All values of the declaration’s cost indicators are indicated in full rubles. Indicator values are less than 50 kopecks. throw it away, and 50 kopecks. or more, round up to the full ruble.

Fill text indicators in cells from left to right in capital letters. Also fill in whole numeric indicators from left to right, with a dash in the last unfilled cells:

The return may not correct errors by corrective or other similar means.

This is all stated in paragraphs 1.1, 2.3–2.8 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

When do you need to submit your property tax return?

According to the legislation of the country, all taxpayers must submit a property tax declaration to the control authority by the end of the reporting period indicated by the tax authority. The general rules for submitting documentation are as follows:

- Documentation must be submitted to the control body by the 28th calendar day; the report is made from the date on which the reporting period ends.

- If a declaration is submitted for the past tax period, submission must be made no later than the 28th day of the first spring month.

- If the reporting day falls on a weekend or holiday, the documentation must be submitted the next day or the day before the weekend.

Responsibility

If a company fails to submit a property tax return on time, it faces a fine of 5% of the tax amount for each partial or full month that elapses from the due date for submitting the return until the day it is submitted.

At the same time, the following restrictions are imposed on the amount of the fine: The maximum limit is no more than 30% of the tax amount; Minimum - no less than 1000 rubles.

A fine of 300 to 500 rubles may also be imposed on the head of the organization.

Who must submit the quarterly report?

Taxpayers whose reporting periods are quarters, that is, the first quarter, six months and nine months, must submit documents for reporting quarterly, as well as based on the results of the entire year:

- no later than April 28, documentation for the first working quarter is submitted;

- the report for the entire half-year must be submitted by July 28;

- before October 28, a zero declaration for a period of 9 months is submitted;

- The property tax declaration for the entire reporting year is submitted to the control authority by the 28th day of the first spring month.

Section 1

In section 1 please indicate:

- on line 010 – OKTMO code according to the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st. If the OKTMO code value is less than the number of cells allocated for it, put dashes in the empty cells;

- on line 020 – BCC for property tax;

- on line 030 - the amount of tax payable to the budget according to the codes KBK and OKTMO, indicated on lines 010–020 of the corresponding block. The procedure for calculating this indicator is given in subclause 3 of clause 4.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895. If the resulting value is negative, put a dash on line 030;

- on line 040 – the amount of tax to be reduced based on the results of the tax period. This figure represents the difference between the tax for the year and the accrued advance payments. From these amounts, subtract the tax that was paid abroad on the property of a Russian organization located on the territory of another state. If the resulting value is negative, enter it without the minus sign. And when it is positive, then enter zero.

Fill out separate sections 1 for all cases when you pay tax by location:

- a Russian organization or a place where a foreign organization operates through a permanent representative office;

- a separate division with property allocated to a separate balance sheet;

- real estate taking into account the peculiarities of the budget structure of the regions.

Each Section 1 must be signed by the head of the organization or other authorized representative. Don’t forget to include the date you made the declaration:

This procedure is provided for in clause 2.4 and section IV of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Situation: which OKTMO code – 8-digit or 11-digit – should I indicate in my property tax return?

It all depends on how the tax is distributed between budgets of different levels in a particular region.

The explanation is simple. Despite the fact that the declaration itself has 11 cells for filling out OKTMO, you must indicate the code that corresponds to the final recipient of the tax. That is, OKTMO budgets of municipalities (8 characters) or smaller territorial associations (11 characters). Therefore, there are two options.

Option 1. The property tax can be sent entirely to the regional budget or distributed in whole or in part between municipalities of a constituent entity of the Russian Federation. In this case, indicate OKTMO of eight characters in the declaration.

Option 2. As a result, property taxes can also be redistributed to the budgets of smaller territorial associations that are part of municipalities. For example, various settlements, towns, districts, villages, uluses, etc. Then the 11-digit OKTMO must be entered in the declaration.

This procedure follows from paragraph 1.6 of Appendix 3 to the order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895 and the order of Rosstandart dated June 14, 2013 No. 159-ST.

How is the tax distributed?

The decision on how to distribute property taxes between budgets of different levels is made by regional authorities. Therefore, you can find out this procedure in a particular region from local regulatory documents. Or check with your tax office. Typically, such information can be found on inspection information boards.

How to fill out OKTMO in the declaration

Regardless of how many characters must be indicated in section 1 of the declaration, fill out the line “OKTMO Code” from left to right. If you enter an 8-digit code, put dashes in the cells left empty.

For example, in Moscow property taxes are distributed at the level of municipal districts. In most cases, they correspond to 8-digit OKTMO. And this is what the code entry will look like in the property tax return in Novogireevo:

Situation: how to correctly indicate the amount of tax in section 1 of the property tax return. Is the tax calculated at the end of the year less than the advance payments? The organization does not have property in other countries.

Indicate the tax on line 040 of section 1 of the declaration. There is no need to put a minus sign or fill out line 030.

This is exactly the procedure established by subclause 4 of clause 4.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

An example of filling out section 1 of a property tax return. The tax calculated at the end of the year is less than the amount of accrued advance payments. The organization does not have any property located in other states

The amount of the organization's property tax for 2021 is 166 rubles. The amount of advance payments for property tax accrued to the budget for the nine months of 2021 is 175 rubles.

The amount of tax to be reduced is: 166 rubles. – 175 rub. = 9 rub.

The organization's accountant reflected this amount on line 040 of section 1 of the property tax return. In line 030 of the declaration, the accountant added dashes.

Monthly report 2016-2017

A monthly report must be submitted to the control body if payment is calculated on actual profits. In this case, the declaration is submitted by month and after a year:

- the first report must be submitted before February 28 of the current year;

- the second report is submitted by March 28;

- For activities of the third month, documentation must be submitted by April 28.

The remaining monthly reports are carried out in the same way, and the declaration for the entire year must be submitted before the 28th day of the first spring month of the next reporting year. It should be noted that the final report for the year has not yet been submitted, and a new period of activity has already begun, so current declarations are submitted earlier than annual ones.

Sample declaration of real estate: filling algorithm

In this article

- Provision of the Tax Code on taxpayer status

- When must Nil Returns be filed for taxable property?

- Rules for filling out a reporting document for the tax office in the absence of profit or loss of property in 2021

- Penalties for late submission of a zero declaration

Provision of the Tax Code on the status of a taxpayer According to Art. 374 of the Tax Code, taxpayer status is assigned to legal entities and individuals who own taxable property. Taxpayers of property tax are organizations that own property recognized as an object of taxation in accordance with Article 374 of the Tax Code. The law obliges owners to pay tax on such property and determines when and where to file a property tax return.

That is, if an entrepreneur works under the OSN system, he in any case needs to submit a property tax return, even if the working period brought zero profit. It can also be obtained in the following situations:

- if business activity is not carried out during a certain period, therefore the individual cannot receive income;

- if the work process is carried out, but not at the proper level, in the end the income does not come, which means it turns out to be zero.

How to file a zero property tax return If no business activity was carried out during the reporting period, then the property tax return is prepared using a different system.

All legal entities persons and individual entrepreneurs who are payers of property tax are required to periodically report to regulatory authorities. The form of such reporting is a property tax declaration, which based on the results of 2021 will be submitted on a modified form approved by Order No. ММВ-7-21/271 of the Federal Tax Service of the Russian Federation.

The document is submitted once per tax period (year) based on the final results, but at the discretion of regional authorities, payers must submit a quarterly calculation of the tax liability for advance payments, and based on the results of the year, a tax return for property tax is submitted. The advance payment form can be found in Appendix No. 4 of the Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/895.

In accordance with tax legislation, the tax base is formed in relation to each individual group of property, as well as for those types of fixed assets that have different taxes on the property of legal entities; the declaration reflects their calculations in separate columns. Submission deadline According to the general rules of tax legislation, the declaration must be submitted no later than the established deadlines - this is the last day of the month that follows the reporting period.

about the author

And we also have

Attention

A zero declaration can be called a very simple document, because only two subparagraphs will be left unfilled, which reflect the amount of the tax payment and the main base for payment; the provision of the remaining information should be fully reflected in the property tax documentation.

When should a property tax return be submitted? According to the country's legislation, all taxpayers must submit a property tax return to the control authority by the end of the reporting period indicated by the tax authority.

Russian Federation act as tax agents if they make payments on:

- interest rate regarding payment of the cost of securities of state or municipal importance for both Russian and foreign companies that have a representative office in Russia;

- a certain amount of money is paid for foreign companies that have representative offices on the territory of the Russian Federation, but do not operate with representative offices;

- Dividends are paid to both domestic and foreign companies with a representative office in Russian territory.

In this case, the declaration is submitted by month and after a year:

- the first report must be submitted before February 28 of the current year;

- the second report is submitted by March 28;

- For activities of the third month, documentation must be submitted by April 28.

The remaining monthly reports are carried out in the same way, and the declaration for the entire year must be submitted before the 28th day of the first spring month of the next reporting year. It should be noted that the final report for the year has not yet been submitted, and a new period of activity has already begun, so current declarations are submitted earlier than annual ones.

For Russian legal entities this is, in particular:

- Movable objects accepted for balance sheet accounting.

- Immovable objects accepted for balance sheet accounting.

- Objects transferred to the trust, temporary possession, disposal, use, etc.

based on contracts.

Note! Land, water resources and other objects under clause 1 are not taken into account for tax purposes.

4 stat. 374 NK. If an enterprise does not have the appropriate facilities, there is no obligation to file a property tax return. But in cases where there is no need to pay tax due to complete depreciation of fixed assets or the presence of preferential objects on the balance sheet, it is necessary to submit a zero property tax return for 2021.

Tax Code of the Russian Federation (Tax Code of the Russian Federation) Where exactly to submit a property tax declaration To submit a declaration correctly, you should be guided by the norms of stat.

If no business activity was carried out during the reporting period, then the property tax declaration is prepared using a different system. The document should contain the following sections:

- the first title page, which is drawn up according to the general rules; a sample of the filling can be seen at the tax authorities;

- the first part of the document displays KBK and OKATO. Since no numerical profit was received, dashes must be placed in these sections;

- the second part of the document also indicates income figures. Due to the fact that no profit was made, dashes are placed in these places.

It may happen that in the process of activity there were both income and expenses, but the profit still turned out to be zero. In this case, you need to submit a declaration drawn up according to a standard template and enter into the document all the indicators of the work process. A zero declaration can be called a very simple document, because only two subparagraphs will be left unfilled, which reflect the amount of the tax payment and the main base for payment; the provision of the remaining information should be fully reflected in the property tax documentation.

Taxpayers whose reporting periods are quarters, that is, the first quarter, six months and nine months, must submit documents for reporting quarterly, as well as based on the results of the entire year:

- no later than April 28, documentation for the first working quarter is submitted;

- the report for the entire half-year must be submitted by July 28;

- before October 28, a zero declaration for a period of 9 months is submitted;

- The property tax declaration for the entire reporting year is submitted to the control authority by the 28th day of the first spring month.

The remaining monthly reports are carried out in the same way, and the declaration for the entire year must be submitted before the 28th day of the first spring month of the next reporting year. It should be noted that the final report for the year has not yet been submitted, and a new period of activity has already begun, so current declarations are submitted earlier than annual ones.

Non-profit companies do not pay property tax because they do not have one. This means that they do not have to prepare and submit a zero declaration; they must submit only a report for the year to the control body. This provision applies to the following organizations:

- state theaters and museums;

- public concert venues;

- non-profit organization.

The deadline for submitting the annual report for these companies is the same, that is, March 28 of the next reporting period.

If a taxpayer fails to file a return in a timely manner, he or she will be subject to a penalty. Such a resolution is provided for in the Tax Code of the Russian Federation. The size of the sanction will be 5 percent of the amount that was not paid to the state treasury on time. However, the fine should not exceed 30% for each full reporting period, and also be higher than the amount of 1000 rubles.

A fine of 1,000 rubles is imposed on the taxpayer only if the amount required for payment is missing and the declaration is not submitted on time. State control and statistics bodies collect a fine and monitor the entire process. In the future, the withdrawn amount will be transferred to the state treasury. Control authorities must indicate to fines the date by which the fine must be paid.

It is worth noting that only the declaration that indicates the entire reporting period, that is, the annual one, is subject to a fine. It is its untimely submission that can cause problems for the taxpayer. If the “profitable” documentation is submitted untimely, the inspection authorities have the right by law to impose a fine on the taxpayer not exceeding 200 rubles. After analyzing the situation and seeing that the fine was imposed undeservedly, the taxpayer can appeal to the panel of judges.

Failure to submit the declaration on time will result in administrative liability. As a result, the taxpayer may be held administratively liable or given a fine, the amount of which varies from 250 to 550 rubles. The application must be submitted to the Russian judicial board by the inspectorate that controlled the company's activities.

Attention! There is a special offer for visitors to our website: get advice from a professional lawyer completely free of charge by simply leaving your question in the form below.

Do I need to prepare and submit an income tax report for non-profit companies?

Non-profit companies do not pay property tax because they do not have one. This means that they do not have to prepare and submit a zero declaration; they must submit only a report for the year to the control body. This provision applies to the following organizations:

- state theaters and museums;

- public concert venues;

- non-profit organization.

The deadline for submitting the annual report for these companies is the same, that is, March 28 of the next reporting period.

The procedure for filling out the declaration and calculations in “1C: Accounting of a government institution 8”

In the program “1C: Accounting of a State Institution 8”, edition 2, for drawing up a declaration and tax calculation for an advance payment for the property tax of organizations, regulated tax reports are provided: Property Tax Declaration and Advances for Property Tax (section Accounting and Reporting, 1C-service Reporting).

In order to generate and submit a “zero” declaration to the tax office, you should create a report, Property Tax Declaration (Property Tax Advances) (hereinafter referred to as the Report), by selecting the reporting period for which the institution is reporting. As a result of creating the report, the Cover Sheet will be filled in automatically.

Then you should go to Section 2 of the Report and manually indicate the property type code, OKTMO code, budget classification code (Fig. 1).

The declaration (advance payment calculation) for property tax may include several Sections 2. For example, several Sections 2 should be completed in relation to:

- property, the tax on which is paid at the location of the organization;

- property of each separate division with a separate balance sheet;

- real estate that is located outside the location of the organization (a separate division with a separate balance sheet);

- property, the taxation of which is subject to different tax rates.

A complete list of categories of property for which Section 2 must be drawn up separately is given in paragraph 5.2 of the Procedure. If there is property with different property type codes, several Sections 2 of the Report should be completed according to OKTMO.

Next, go to Section 1 of the Report and click the Fill in Section 1 button according to the data in Sections 2 and 3, and lines 010 “OK code” will be filled in automatically (Fig. 2).

After filling out and recording the report, the institution will only have to send it to the tax office via telecommunication channels directly from the program.

Which companies are tax agents?

Companies operating in the Russian Federation act as tax agents if they make payments for:

- interest rate regarding payment of the cost of securities of state or municipal importance for both Russian and foreign companies that have a representative office in Russia;

- a certain amount of money is paid for foreign companies that have representative offices on the territory of the Russian Federation, but do not operate with representative offices;

- Dividends are paid to both domestic and foreign companies with a representative office in Russian territory.

A zero property tax return is a paper that states that the tax payment is zero. Often, even entrepreneurs, not to mention ordinary citizens, do not know whether they need to submit such a property tax return. It is important to understand that even if there is no property, you need to submit these reports to the regulatory authority.

Results

The property tax return for 2021 must be submitted by those companies that have real estate assets subject to taxation on their balance sheets. The report for 2021 is presented in a new form. Starting with reporting for 2021, advance payments are not submitted to the tax office; taxpayers remain obligated to pay advances and the final amount of the obligation, as well as to submit reports for the tax period.

In the article we talked about the rules for filing a declaration, and also gave an example of how it can be filled out.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why is a zero declaration needed?

The changes that were made to the tax code in 2015 also affected zero property declarations in 2021. Now absolutely everyone is required to submit this paper to the fiscal authority for real and movable property.

Those who had no profit in the reporting period or it was zero are subject to zero taxation. This applies more to entrepreneurs, and you will have to submit a zero declaration in this case:

- If at a certain time there was no business activity, then there was no profit.

- If the activity was carried out, but not at the proper level, as a result, there was no profit from it.

If the case concerns individuals, then it is also important to know who submits such a declaration for real estate or movable property.

For example, the declaration will be zero if an apartment has been sold that has been owned for less than 5 years and the purchase and sale prices are the same. In this case, it is necessary to submit a declaration, although there will be no profit in it. Otherwise, a fine will be issued, or worse, a notification will be sent to pay tax on this amount of the sale.

Title page

On the title page please indicate:

- adjustment number (for the primary declaration “0—”, for the updated declaration “1—”, “2—”, etc.);

- the reporting year for which the declaration is being submitted;

- tax office code;

- code of the place of reporting (in accordance with Appendix 3 to the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895);

- full name of the organization;

- code of the type of economic activity according to OKVED 2 or OKVED (Order of Rosstandart dated September 30, 2014 No. 1261-st);

- code of the reorganization form (in accordance with Appendix 2 to the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895) and TIN/KPP of the reorganized organization (in accordance with clause 2.8 and subclause 1 clause 3.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895), if a reorganization took place;

- contact phone number of the organization;

- the number of pages on which the declaration is drawn up;

- the number of sheets of supporting documents (copies thereof) attached to the declaration, including documents (copies thereof) certifying the authority of the representative of the organization who submits the declaration.

On the title page, indicate the date the report was completed. It is also mandatory that the person who certifies the declaration and the completeness of the information in it affixes his signature. A stamp can be affixed if the organization has one.

If this is the head of the organization, indicate his last name, first name and patronymic. In this case, in the section of the title page “I confirm the accuracy and completeness of the information specified in this Declaration”, put “1”.

In the section of the title page “I confirm the accuracy and completeness of the information specified in this Declaration,” put “2” if the report is certified by a representative of the organization:

- employee or outsider. Then indicate his last name, first name and patronymic, as well as a document that confirms his authority, for example, a power of attorney. In this case, the declaration is signed by a representative;

- outside organization. In this case, indicate the name of such a representative organization, as well as the last name, first name and patronymic of the employee who is authorized to certify the report on its behalf. He also certifies the declaration with his personal signature. The seal is affixed by the representative organization. In addition, documents confirming the authority of the representative organization are indicated. It could be a contract.

Here, for example, is how to fill out information about a representative - an employee of an organization:

This procedure is provided for in Section III of the Procedure for filling out the declaration, approved by Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Necessity for individual entrepreneurs

Filing a zero return for last year is not a whim of the NSF, but a necessity. Because with such documents the individual entrepreneur confirms that he continues his activities, but his work is simply temporarily suspended. The categories of entrepreneurs who submit such reports include:

- Seasonal business, which depends on the climate and weather.

- If during the past period the entrepreneur worked as an employee.

- If a businessman has not paid the salary, this happens if he is only at the beginning of his entrepreneurial activity and has not yet had time to receive income.

- In case of termination of activity.

Nuances

A zero declaration is a standard form for individuals. It is not its appearance that differs, but its filling. It is necessary to indicate information about the payer. In this case, all calculations and amounts of income are missing. That is, the form does not contain data on the movement of funds, which means there is no tax base for calculating the payment.

Important! It is necessary to submit a declaration for any type of property, including movable property, once a year until April 30, following the reporting period. That is, in 2021 it is necessary to submit a zero declaration before April 1, 2021 for 2021.

Online magazine for accountants

Important

Calculation of advance payment The formula for calculating the advance payment, if provided in the region, will be the same, regardless of the tax rate and calculation of the taxable base. Advance payment amount = tax base * ¼ * tax rate; When calculating the tax base, those who submit a property tax return and calculate the advance payment should decide what the size of the base will be.

There can be two options:

- Average property value. It is calculated as the total value of the remaining value of the property on the 1st day of the month of the reporting period and the 1st day of the month that follows this period, divided by the number of months of the reporting period with the added value of 1 (Article 376 of the Tax Code of the Russian Federation).

- Cadastral value.

Legal entities can find out the cadastral value by requesting it from the Roseestra in their region.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. Call ext. 664 It's fast and free!

Important

However, the issue of taxation of property is not limited to its presence or absence.

In legal practice, the market includes organizations that have tax benefits, as well as individuals who completely lost their property in 2021.

Mandatory data

There are no difficulties with filling it out, since you don’t need to make any mistakes, you just have to have an idea of the codes. The first 2 sheets must be filled out; they contain information about the tax payer, more specifically:

- Full name of the payer.

- Codes:

- Categories of individuals.

- Identity cards.

- Tax period.

- OKATO.

- Passport and registration details.

- Type of adjustment.

Most fields are left blank.

The most common mistakes:

- Blots and corrections.

- Incorrect codes.

- Use of correctors.

- Lack of payer's signature on all sheets.

Declarations with such errors will not be accepted.

What and how to fill out

For a businessman who has just started his journey, there will certainly be difficulties with maintaining records, but it is not always necessary to involve an accountant, because you can fill out the form yourself.

The zero property tax declaration has the same form as the standard declaration form. You only need to fill out the first sheets. 4-NDFL is submitted along with this form; it must indicate how much profit it is planned to receive in the coming year. There are categories of persons for whom the question of whether it is necessary to submit a zero declaration is not worthwhile, these include:

- Individual entrepreneurs who work on the general taxation system.

- Individual.

- Lawyers, notaries and anyone involved in private practice.

- Farm owners.

- An individual who sold real estate or movable property in the past period.

- Those who have won the lottery.

- If the income was received from a source located outside the country.

- If the profit is received in the form of salary, but the employer has not paid the tax.

What to give your wife when she is discharged from the maternity hospital?

27.01.2021

How to teach a child to hold a pen correctly consultation on the topic Correct holding of a pen when writing

27.01.2021

Responsibilities of parents in raising children What responsibilities do children have towards their parents?

27.01.2021

How to submit a report

Reporting is submitted to the NSF branch at the place of residence (individual entrepreneur registration). Moreover, businessmen submit it regardless of how long they worked in the reporting period.

There is no need to worry that the tax service will begin checking the lack of income; legislators understand that the business sector is not stable and it is quite possible that during the year expenses and income are equal, that is, there is no profit.

It’s worse if the declaration is not filed on time, in which case the individual or businessman will face a fine of 1,000 rubles. If it is ignored, a criminal case may well be opened.

In some regions, a practice is used in which a zero declaration is submitted to the inspector who deals with such reporting. Before submitting the completed form, you must review it to ensure it is complete and accurate.

When sending by mail, it is necessary to make an inventory of the contents - this will be a guarantee for the payer that he handed over the documents.

You can also fill out the declaration in electronic format, but to do this you need to register on the State Services portal. There, select the section called “Taxes and Fees”, subsection “Filing a Declaration”. A previously prepared and completed reporting form must be attached to the submission form.