Last modified: January 2021

The generally accepted mode of using working time is impossible when drilling oil and gas wells, activities in hard-to-reach areas, or construction of new complexes in a metropolis, since it is impossible to organize the systematic delivery of specialists to the beginning of the work shift. For mining, logging, and fishing activities, a rotational work method is used, what is it and what is the difference from a long business trip?

Basic theses about shifts according to the Labor Code of the Russian Federation

The list of structures that have the right to use rotational work is established by Resolution of the State Committee for Labor of December 31, 1987 No. 794/33-82:

- Subjects of the oil and gas industry.

- Construction education.

- Public catering places.

- Transport companies.

- Subjects of health protection.

Question: Is a shift bonus accrued while an employee is in a rotational housing complex during rest between shifts? View answer

The concept of the considered method of work is disclosed in Article 297 of the Labor Code of the Russian Federation. This is a type of work organization in which an employee works far from his place of residence and cannot return home. The shift is used to reduce the delivery time of the project, if it is necessary to work in uninhabited areas and in areas with special natural conditions. The decision to use a given method of work is made if it will be most effective in this situation. To determine the effectiveness of the method, technical and economic calculations are used. The rotation method can be established both for the entire company and for certain teams and locations.

ATTENTION! The employer is obliged to provide employees with all conditions for comfortable work during shift conditions.

In particular, he must build workers' towns or villages in which workers will live. A dormitory can be used for workers' accommodation. It is paid by the employer. This rule is stipulated by part 3 of article 297 of the Labor Code of the Russian Federation. In any case, the accommodation of employees is the responsibility of the employer.

Payment for inter-shift rest days

Since each day of the shift is associated with overtime within the limits established by the Labor Code for the duration of working hours, it must be compensated by the fact that days of inter-shift rest are paid using the daily tariff rate or part of the salary for calculations. This calculation is used if the collective agreement or local act on the organization of rotational work does not provide for higher pay. To do this, you need to calculate the number of days of inter-shift rest using the following algorithm:

1. The normal number of working hours for the accounting period is calculated.

2. The number of working hours is calculated according to the schedule.

3. The number of hours of overtime or underproduction is determined in relation to the standard established by law.

4. The number of hours and whole days that relate to days of inter-shift rest is established.

Overtime working hours, presented in whole days, are added to the days of inter-shift rest and paid based on the tariff rate or salary, and non-whole days (that is, hours) are transferred to another rest period and summed up. After the summed parts reach entire working days, they can be added to the inter-shift rest in the form of additional days.

You can learn about recording working time using the rotation method of organizing work activities from the article “Total recording of working time - examples of calculation” .

Duration of watch

A shift period is a time period that includes the shifts themselves, as well as rest periods between them (according to Article 299 of the Labor Code of the Russian Federation). The maximum duration of a shift is a month. However, the period can be extended to 3 months if there is permission from the trade union, the procedure for obtaining which is established in Article 372 of the Labor Code of the Russian Federation. The maximum duration of a shift is 12 hours, the minimum duration of rest between shifts is 12 hours.

Is it possible to arrange a business trip for a rotation worker sent by the employer to another city and pay daily allowance?

An employee may underuse rest hours between shifts. They can be summed up and then provided in the form of days off. The number of daily days off should not be less than the number of weeks in a month.

Question: What type of income code should I indicate in a payment order when transferring to an employee an allowance for shift work, which is paid in exchange for daily allowance? View answer

Differences between a shift and a business trip

To solve production problems and carry out management tasks in other territories, the law provides for business trips - business trips compensated by the employer.

Shift work, what is it if not a business trip? The differences between the trips are presented in the table:

| Indicators | Business trip | Watch |

| Purpose of the trip | Fulfillment of a specific task by management | Performing direct official duties in accordance with the employment contract |

| Character | One-time upon the direction of the employer or invitation of the host party | Systematic for the entire period of implementation of the rotational work method |

| Relation to the scene | The employee is sent on a business trip from the territory of performance of official duties | The employee is sent to the place of performance of direct official duties |

| Definitions of time between trips | Work on a regular schedule established by management | Inter-shift rest |

| Payment | Reimbursement of travel-related expenses and daily allowances provided for by the organization in the amount | Compensation payments in amounts not lower than those established by law for a particular region |

| Labor guarantees | Maintaining and paying the average salary for the entire period of the trip | Calculation of wages according to the volume of work performed, payment in accordance with the tariff rate for round trip travel time |

| Reporting provided | Advance report with attached documents confirming expenses (travel, rental of premises), paid in full upon approval by the manager | Not provided, payment for travel and housing does not require documentary confirmation from the employee |

In terms of the performance of a labor function when working on a rotational basis, a shift is equated to a workplace, in addition to which the employee’s duties are not performed in accordance with the concluded employment contract. A business trip involves resolving production issues that cannot be resolved by an alternative method without a business trip to another territorial region.

Who can't work on a shift basis?

According to Article 298 of the Labor Code of the Russian Federation, the following persons cannot be involved in the watch:

- Minors.

- Pregnant women.

- Mothers of children under three years of age or fathers raising children under 3 years of age alone.

- People with relevant contraindications.

The list of contraindications, in the presence of which an employee cannot be involved in the work in question, is determined by Order of the Ministry of Health and Social Development No. 302.

Question: Is it possible to take into account for income tax purposes the costs of delivery of employees working on a rotational basis if they pay for the travel themselves, and then the employer compensates (reimburses) the corresponding amount (Article 255, paragraph 12.1, paragraph 1, Article 264 of the Tax Code of the Russian Federation )? View answer

Specifics of the organization

The Labor Code describes the peculiarities of work on a rotational basis in the form of restrictions, special regimes of work and rest, as well as their duration.

In accordance with Article 298, it is prohibited to involve the following categories of citizens in labor in this form:

- children and adolescents;

- pregnant women and young mothers (until the child is three years old);

- adult men and women with medical contraindications.

Based on the results of a medical examination, a ban can be obtained by people with diseases of the heart, nervous and hematopoietic systems, hypertension, as well as patients suffering from disorders of consciousness.

How is shift work paid?

Payments and guarantees provided to workers are determined by Article 302 of the Labor Code of the Russian Federation. The first and eighth parts establish the following rules:

- Daily tariff rate and allowance for the time spent in the rotation work area, as well as for days on the road.

- Tariff for delays in transit. In this case, there must be a valid reason for the delay: weather conditions, transport problems.

The amount of the shift allowance is regulated by law if it is a budget company. If this is not a budget organization, the amount of the bonus is determined by internal regulations. If this is a company whose activities are financed from the federal budget, the premium is established by Government Decree No. 51 of February 3, 2005.

IMPORTANT! If a worker travels to the Far North or regions equivalent to it, in addition to the allowance, it is necessary to list the coefficients and additional allowances regulated by part 5 of Article 302 of the Labor Code of the Russian Federation. The coefficient will be calculated not on the basic allowance, but on the tariff rate. This is due to the fact that the bonus is compensation, not salary (according to Articles 129 and 164 of the Labor Code of the Russian Federation).

Compensation for difficult working conditions

In addition to the bonus, employees have the right to a regional coefficient and special percentage bonuses if they are sent for rotational work in the Far North or equivalent territories. It should be noted that the regional coefficient and special percentage bonuses are not charged on the bonus in connection with the rotational form of labor relations, since the bonus itself is a compensation payment, and not part of the salary on which these bonuses and the coefficient are calculated.

Providing leave

The employee is given annual paid leave of 28 days. Graduation graduations are calculated in the standard manner. It is performed based on the average salary.

Let's look at an example of a calculation. The employee was on shift for a month. Of these, he rested for 15 days and worked for 15 days. As a rule, rest days are taken into account when calculating. The average daily earnings is 1,000 rubles. We multiply the daily salary by the number of vacation days:

1,000*28 = 28,000 rubles.

This is the amount that the worker receives as vacation pay.

Additional leave

The employee is given additional leave. This right is established by part 5 of Article 302 of the Labor Code of the Russian Federation. Duration of this holiday:

- 24 days for persons working in the Far North.

- 16 days for workers working in conditions similar to those of the Far North.

Vacation is paid in the standard manner.

Employment contract when working on a shift: document structure

The employment contract between the company organizing the work on the shift and the employee will consist of the following sections:

1. Preamble.

The wording in it will be standard - the same as in an employment contract at a regular enterprise.

2. Section with general provisions.

There should be wording here that the work is carried out on a rotational basis, indicating the location of the shift (region, municipality, facility).

The “General Provisions” of the contract also reflects the duration of the shift.

3. Section on wages.

The wages of workers on shift may be calculated (and this will be reflected in the contract):

- according to a piecework scheme;

- according to a time-based scheme;

- according to salary.

A bonus may also be awarded on earnings.

4. Section on working time and rest.

During the shift, a summarized accounting of working time should be used - including the periods when the employee is on the way from the gathering place (the location of the employing organization) to the facility where the person directly works. However, the duration of the shift cannot exceed 12 hours (clause 4.2 of the Shift Regulations).

5. Section on guarantees and compensation.

Here it makes sense to consider the wording given in Art. 302 of the Labor Code of the Russian Federation, as well as in the corresponding norms of the Regulations on Shifts.

The standard wording, which does not fundamentally distinguish a rotational employment contract from a regular one, will be the wording in the sections:

- on compulsory insurance;

- on the rights and obligations of an employee and employer;

- on the responsibility of the parties to the contract;

- on amendment and termination of the contract.

As is the case with any other agreement, the agreement in question indicates the personal data of the employee, the details of the employer, the signatures of the parties, and the seal of the employer.

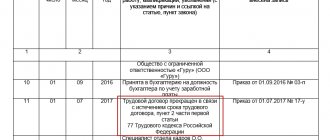

When filling out an employee’s work book, a specialist from the enterprise’s personnel service must indicate in column 3 of the “Work Information” section that the employee is hired to work on a shift basis (clause 2.4 of the Shift Regulations).

The greatest number of nuances when drawing up an employment contract for a rotational shift arise, as a rule, when drawing up the section of the agreement regulating how working time and rest are organized.

Responsibilities of the employer to the employee and tax accounting

The entrepreneur must pay all transportation costs associated with moving the employee to the shift site. Expenses are provided for by internal regulations. The company's own vehicle can be used for transportation. In this case, according to Article 264 of the Tax Code of the Russian Federation, the corresponding expenses must be taken into account as part of the costs of maintaining official vehicles. Shipping costs are subject to tax.

The employer is obliged to create a rotational camp for employees to live. Related expenses will be classified as other expenses. Payment for accommodation will not be subject to taxes and insurance premiums.

What it is?

Work at rotational sites means the formation of working relationships when workers are physically unable to get home after working a shift due to the significant distance between home and the work site .

The employer guarantees the provision of housing for workers during shift shifts, provides satisfactory living conditions, and organizes transportation of shift workers to the workplace.

You can earn money at shift sites an order of magnitude higher than similar activities carried out without the involvement of shift workers.

In addition to geographically remote places, Moscow and St. Petersburg are increasingly used as rotation sites . This is directly related to much higher pay for work in the capitals, constantly available open vacancies and the lack of current vacancies in the provinces.

It is customary to distinguish several types of organizations working using this method:

- Intraregional type - the work site is not far from the workers’ permanent habitat, the shift period is usually no more than 2 weeks.

- Interregional (shift-expeditionary) type - characterized by a significant distance between the work site and the employees’ place of residence; such work lasts longer than 2 weeks.

- Research expedition. Field research also takes the form of rotational work.

The very concept of a shift includes not only the work manipulations directly performed, but also the duration of rest between shifts.

Documentation of the watch

The use of the rotation method is approved by the employer. In this case, the opinion of the trade union must be taken into account. Approval of a watch is made by issuing a regulation or order. Employees must be familiarized with the document. The following information must be included in the documents:

- Approval of shift work schedule and internal work schedule (in accordance with Article 190 of the Labor Code of the Russian Federation).

- Approval of labor time recording.

- Conditions for issuing wages and compensation.

- Duration of the watch.

- Trade union approval.

ATTENTION! Foreign citizens can also be involved in the shift. However, the registration procedure must comply with the requirements for attracting foreigners to work. Within a week from the date of arrival of the foreign specialist, the migration registration authorities must be notified of this fact.

The employer must establish a work schedule. It is needed to track time (according to Article 300 of the Labor Code of the Russian Federation). The schedule must be agreed upon with the union. Employees must be familiarized with the document 2 days before the schedule goes into effect. This rule is established by Article 301 of the Labor Code of the Russian Federation. The schedule should establish:

- Working hours, including overtime.

- The time required to transport employees to their shift.

- Rest period.

Overtime should not exceed 120 hours per year in accordance with Part 6 of Article 99 of the Labor Code of the Russian Federation. Otherwise, the relevant services may identify violations.

FOR YOUR INFORMATION! Shift work can only be established if the place of work is located far from the head office. Otherwise, questions may arise. However, sometimes this rule is broken.

Using summarized accounting when calculating wages

A work schedule is necessary in order to calculate employee wages, since summarized working hours are used for this. The period of such accounting cannot exceed one year. The accounting period includes the entire period of shift work, that is, not only working days, but also the time required to travel from the gathering place to the shift site, as well as the rest period between shifts. Working hours are recorded for each employee with a monthly breakdown for the entire annual accounting period.

2. Work and rest regime.

- The duration of working hours, the beginning and end of the working day, breaks for rest and meals are determined by the internal labor regulations and other local regulations of the employer.

- The duration of the shift is 30 (thirty) days.

- The duration of the annual basic paid leave is 28 calendar days.

- Additional paid leave is provided for work in areas equated to the regions of the Far North, in the amount of 16 calendar days, for work with harmful and (or) dangerous working conditions - in accordance with the collective agreement;

FOR EXAMPLE

If pre-holiday days are included in the calculation (according to the general norm, work on a pre-holiday day is reduced by 1 hour). The fractional part of the number of days “does not disappear”, but accumulates during the calendar year and can subsequently be summed up to whole working days with the subsequent provision of additional days of inter-shift rest to the employee (Part 4 of Article 301 of the Labor Code of the Russian Federation). And in the event of an employee’s dismissal or the expiration of the calendar year, the specified hours are paid based on the tariff rate (part 3, clause 5.4 of the Shift Regulations).

But sometimes an employee needs money more than days off between shifts.

Is it possible to compensate an employee for overtime days with money, by analogy with the rules of Article 152 of the Labor Code of the Russian Federation, because if an employee is hired to work overtime, he is either provided with rest days or must be paid?

With a shift method, this is not possible, since in this case we are not talking about overtime work, but about overtime. Therefore, shift workers must be provided with rest between shifts.

HR SERVICES