If you are not familiar with the first two parts, you can find and read them using the links.

- 1C Accounting 8. Part 1: Setting up accounting parameters.

- 1C Accounting 8. Part 2: Accounting policies.

Income tax payers who are engaged in the production of products, performance of work and provision of production services need to divide production costs in 1C Accounting 8 into direct costs and indirect costs.

Methods for determining direct and indirect production costs in tax accounting of the 1C Accounting 8 program are described in the information register of the same name. The user must independently indicate in it a list of direct production costs in tax accounting 1C. The 1C program interprets everything that is not indicated in this register as indirect production costs.

Using specific examples, we will learn how to determine direct production costs in tax accounting in the 1C Accounting 8.2 program. It is very important that the distribution of direct expenses in 1C is handled by a person who knows accounting and tax accounting.

Direct costs

Direct costs form the cost of only one type of product. In your accounting policy, you must independently determine the costs classified as direct.

Examples of direct costs:

- inventories, components and semi-finished products;

- wages of primary production workers and social benefits;

- depreciation of main production equipment.

The list of direct costs is presented in Art. 318 of the Tax Code of the Russian Federation, it is open and may include other expenses at your discretion. However, before including costs in the list of direct costs, please note: they must be directly related to the production and sale of goods, works and services.

For trade organizations there is a separate list of direct expenses, which is strictly regulated and cannot be changed. These include the cost of goods purchased and transportation costs.

1C Accounting 8 edition 2.0 - Setting up a list of direct expenses

Start accounting - filling out the necessary reference books and entering initial balances is done manually.

Download data from 1C Accounting 8 - directories, balances at the beginning of the year, documents (if accounting does not start from the beginning of the year) are automatically transferred from the 1C Accounting 8 edition 1.6 program.

Download data from 1C Enterprise 7.7 - directories, balances at the beginning of the year, turnover for the period (if accounting does not start from the beginning of the year) are automatically transferred from the 1C Accounting 7.7 program.

Picture 1.

Regardless of the method of starting accounting, for all organizations under the general taxation system, it is necessary to configure the distribution of expenses in income tax accounting into direct and indirect.

In accordance with Article 318 of the Tax Code of the Russian Federation (TC RF)

, if the taxpayer determines income and expenses using the accrual method, then for income tax purposes, production and sales expenses incurred during the reporting (tax) period are divided into

direct and indirect

.

At the same time, the amount of indirect

production and sales expenses incurred in the reporting (tax) period are fully included in the expenses of the current reporting (tax) period.

Direct expenses refer to the expenses of the current reporting (tax) period as products, works, and services are sold in the cost of which they are taken into account.

In the 1C Accounting 8 edition 1.6 program, a separate Chart of Accounts for tax accounting is used for income tax accounting. In this Chart of Accounts, additional subaccounts are opened for all cost accounts (20.01, 23, 25, 26, 28, 29): 1 - direct expenses, 2 - indirect expenses. By choosing a specific subaccount of a given account in accounting, the accountant classifies expenses as direct and indirect.

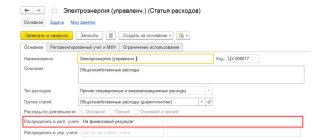

In the 1C Accounting 8 edition 2.0 , accounting and income tax accounting is carried out using a “single” Chart of Accounts for accounting and tax accounting. Therefore, there was a need for additional settings to separate tax accounting expenses into direct and indirect. For this purpose, a register of information is used. Methods for determining direct and indirect production costs in tax accounting

.

This register of information is configured in the processing of Accounting policies of organizations

.

To access this information register, on the Income Tax tab there is a button Specify a list of direct expenses

.

If the register is not filled in, then when you press the button, the program offers to fill it automatically with entries that comply with the recommendations of Art.

318 Tax Code of the Russian Federation , see fig. 2. You can agree or refuse this proposal. For example, we will refuse and fill out the information register ourselves.

Figure 2.

This information register is intended to store a list of direct costs associated with the production of goods (performance of work, provision of services). It contains information about the rules for determining direct expenses in tax accounting. Moreover, this register must be filled out separately for each tax period. Therefore, when the new year begins, the program will offer to copy the rules from the previous period to the current one. In Fig. 3 shows an empty register of information Methods for determining direct and indirect production costs in tax accounting

.

Figure 3.

Each entry in this information register represents an accounting entry template. The following parameters are required to be filled in: Organization, Start date of the tax period and Type of expenses for tax accounting for income tax

.

When closing the month, the program compares accounting entries for accounts 20.01 Main production and 23 Auxiliary production

with these templates. If a suitable template is found, then income tax expenses are recognized as direct and included in the cost of goods, works, services, and if not, then they are recognized as indirect and included in current expenses (account 90). If some parameters in the template are not filled in, then they are not included in the comparison.

It must be recalled that these rules have nothing to do with the accounts 25 Manufacturing overhead, 26 General business expenses and 44 Selling expenses

, since expenses on these accounts in this program always relate to indirect expenses.

Let's turn to the Tax Code of the Russian Federation and create a list of direct expenses. In accordance with paragraph 1 of Art. 318 Tax Code of the Russian Federation

, direct costs may include, in particular:

- material costs determined in accordance with paragraphs. 1 and 4 paragraphs 1 art. 254 Tax Code of the Russian Federation

; - expenses for remuneration of personnel involved in the process of production of goods, performance of work, provision of services

, - the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

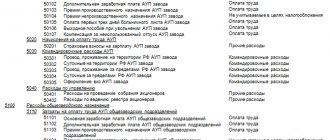

- material costs: raw materials and materials - 50,000 rubles

- production equipment – 2000 rubles

- production services - 10,000 rubles

- total - 62,000 rubles

- wages – 10,000 rubles

- insurance premiums - 2600 rubles other expenses (FSS NS and PZ) - 20 rubles

- depreciation – 1000 rubles TOTAL – 75620 rubles

In paragraph 1, paragraph 1 of Art. 254 (Material expenses)

The Tax Code of the Russian Federation talks about the costs of purchasing raw materials and (or) materials used in the production of goods (performance of work, provision of services).

In paragraph 4 of paragraph 1 of Art. 254 Tax Code of the Russian Federation

refers to the costs of purchasing components that undergo installation and (or) semi-finished products that undergo additional processing.

Consequently, not all material expenses are classified as direct expenses, but only those that go to account 20.01 from the credit of account 10.01 Raw materials and materials

and 10.02

Purchased semi-finished products and components

.

Let's formulate the rules, see Fig. 4.

Figure 4.

Consequently, wages accrued in the debit of account 20.01 relate entirely to direct costs. Let's create one more rule. See Figure 5.

Figure 5.

as well as expenses for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases, accrued on the specified amounts of labor costs;

Thus, all insurance premiums accrued on the debit of account 20.01 can also be classified as direct costs.

To account for FSS NS and PP, the program must use cost items with the type of expense in NU - Other expenses. Other expenses vary. Therefore, let us clarify the rule with credit account 69.11 Calculations for compulsory social insurance against industrial accidents and occupational diseases

.

Figure 6.

Consequently, only depreciation of fixed assets accrued in the debit of account 20.01 relates to direct expenses. Therefore, we will select the loan account 02.01 Depreciation of fixed assets accounted for in account 01

.

Figure 7.

As a result of our actions, we have compiled a list of direct costs recommended by Art. 318 Tax Code of the Russian Federation. See rice. 8.

Figure 8.

Auxiliary production in its accounting

, you need to create records for this account as well.

For example, consider the economic activities of our organization

in January 2010.

For the production of garments in the Sewing Shop

according to the document

Request-invoice,

the material was transferred -

of woolen material

in the amount of 50,000 rubles in accounting and tax accounting. In accordance with our income tax accounting policy, the cost of raw materials and materials is classified as direct expenses.

Figure 9.

The wages of seamstress-motorist Maria Petrovna Petrova

in the amount of 10,000 rubles. In accordance with our accounting policy, remuneration of production personnel is classified as direct expenses.

Figure 10.

To pay production workers, insurance premiums and Social Insurance Fund for National Insurance and Labor Protection were assessed in the amount of only 2,620 rubles. In accordance with our accounting policy, insurance premiums accrued for wages of production personnel are classified as direct expenses.

Figure 11.

Depreciation of 1000 rubles was accrued on fixed assets used for the production of garments. In accordance with our accounting policy, depreciation of production fixed assets is classified as direct expenses.

Figure 12.

Production equipment worth 2,000 rubles was transferred to the workshop. The cost of inventory is not a direct expense.

Figure 13.

Production services from a third party organization in the amount of 10,000 rubles were credited to account 20.01. Costs of production services are not considered direct costs.

Figure 14.

And finally, the workshop produced finished products, which were received at the Main warehouse

at a planned cost of 40,000 rubles. The planned cost is reflected in the credit of account 20.01.

Figure 15.

Thus, we took into account on account 20.01 the actual costs in accounting and tax accounting in the amount of 75,620 rubles, of which:

The planned cost of manufactured products is 40,000 rubles, therefore in January our organization experienced an overexpenditure of 35,620 rubles (75,620 actual minus 40,000 plan). Closing the month should bring the cost of our products to the actual cost, that is, add additional charges to the account 43 Finished products

overexpenditure (close account on 20.01).

We will perform the processing Closing the month

for January.

The closing of account 20.01 is carried out by the regulatory operation Closing accounts

20, 23, 25, 26. See fig. 16.

Figure 16.

The postings of this regulatory operation regarding the closure of the account on January 20 for accounting and tax accounting are presented in Fig. 17.

Figure 17.

In accounting, the amount of overexpenditure of 35,620 rubles was written off from the credit of account 20.01 to the debit of account 43 and thereby formed the actual cost of finished products in accounting.

In tax accounting, the closure of the account on January 20 was divided into two parts. Direct expenses in terms of overexpenditure of 23,620 rubles (63,620 - 40,000) were written off to account 43 and formed the actual cost of finished products in tax accounting. Simultaneously on the debit of account 43 and the credit of account 20.01 for accounting in accordance with PBU 18/02 Calculation of corporate income tax

a temporary difference in the amount of 12,000 rubles is taken into account (BU (35620) – NU (23620)).

Indirect expenses in the amount of 12,000 rubles were written off from the credit of account 20.01 to the debit of account 90.08.1 Administrative expenses for activities with the main taxation system

, and also on the debit of account 90.08.1 and the credit of account 20.01, a temporary difference of -12,000 rubles is taken into account (BU (0) - NU (12000)).

As a result, we received different costs of finished products in accounting and tax accounting. Let's look at the balance sheet for account 43 for the month of January. Using the Settings

For clarity, we will select three indicators: BU, NU and VR. See fig. 18.

Figure 18.

The report shows the actual cost of finished products in accounting, tax accounting, as well as the amount of temporary differences of 12,000 rubles.

Let's return to PBU 18/02. Temporary differences in the account credit on January 20 in the amounts of 12,000 and -12,000 compensated for each other.

When calculating deferred tax assets and liabilities, temporary differences in accounts 25, 26, 90, 91 and 99 are not taken into account.

But the temporary difference of 12,000 in the debit of account 43 will lead to the recognition of a deferred tax liability

in the amount of 2400 rubles (BP (12000) * STnp (20%)).

In Fig. Figure 19 shows the posting of a regulatory operation Calculation of income tax

processing

Closing the month

for January.

Figure 19.

Since we have different product costs in accounting and tax accounting, the costs of selling these products will be different. Figure 20 shows the postings of the document Sales of goods and services

in February 2010.

As we can see, expenses in the debit of account 90.02.1 Cost of sales for activities with the main tax system

in accounting are 75,620 rubles, and in tax accounting are 63,620 rubles.

Figure 20.

Along with the write-off of finished products, temporary differences are also written off from the credit of account 43. If we sell all our products in February, then the temporary differences will be written off completely and the deferred tax liability will be paid off at the end of the month. See fig. 21.

Figure 21.

If an accountant does not want to distinguish between accounting and tax accounting, then he needs to improve his accounting policies for tax accounting.

In accordance with Art. 318 Tax Code of the Russian Federation

, the taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services).

Required in the information register Methods for determining direct production costs

in tax accounting, add rules for production inventory and production services.

Figure 22.

If such rules are added, then closing the account on January 20 in accounting and tax accounting will be identical, and temporary differences will not arise. See fig. 23.

Figure 23.

The generated actual cost of finished products for accounting and tax accounting can be seen in the balance sheet for account 43 for January 2010. See fig. 24.

Figure 24.

To control income tax accounting, it is convenient to use the report Register of Production Expenses.

.

It is located in the Reports

in the submenu

Tax accounting registers for income tax

.

The register is intended to determine the amount of direct costs for the production of products (works, services) and indirect costs of the current period.

When generating the report, direct or indirect expenses are selected; by clicking the Settings button, you can select the types of expenses of interest. See fig. 25.

Figure 25.

Indirect costs

Using the cloud service Kontur.Accounting will help you correctly divide expenses into direct and indirect, as well as reflect them in a timely manner and in full. Get free access to the service for 14 days

Indirect costs form the cost of several types of products simultaneously. There is no way to directly determine which products they should be attributed to. These expenses support production processes and the operation of the organization as a whole. Examples of indirect costs:

- communal payments;

- salaries of support staff, administrative workers and managers;

- depreciation of auxiliary equipment;

- marketing campaigns for company advertising.

The Tax Code states that all costs that you did not classify as direct in your accounting policies are classified as indirect. Non-operating expenses should not be classified as indirect expenses, since they do not have a direct connection with the production and sale of goods, works and services. Distribute indirect costs proportionally across all types of products. Select a base for distribution. The base can be variable costs, for example, wages or the cost of materials.

Combinations of different cost types

Using the cloud service Kontur.Accounting will help you correctly divide expenses into direct and indirect, as well as reflect them in a timely manner and in full. Get free access to the service for 14 days

Cost classification is based on different criteria, so combinations of them are possible. There are variable and fixed direct and indirect costs.

Direct costs are closely related to production, so most of them are variable. But there are exceptions: for example, the salary of a supervisor who controls the production process of a certain type of product. His salary does not depend on production volumes, which indicates the constant nature of the costs, and the relationship to a specific type of product makes them direct.

Indirect costs are also divided into fixed and variable costs. Fixed expenses include office rent, and variable expenses include the cost of tools, auxiliary materials, etc.

Direct and indirect costs in accounting

Of all the costs of manufacturing a product, its cost is added up. Account 20 contains almost all production costs that can be classified as direct. The main production account on debit corresponds with accounts 02, 10, 23, 25, 26, 60, 69, 70 on credit. To determine the cost of a product of a certain type, open analytical accounts for individual types of products and costs for account 20. This will simplify the procedure for generating cost by type.

Indirect costs are contained in accounts 25 and 26. To prepare loan entries, the same correspondence is used as for direct costs. Do not forget that indirect costs cannot be attributed directly to the cost of one product. Select a reasonable allocation basis and note your choice in the accounting policy.

Key nuance

In all the examples we gave, we meant cases where a company receives objective financial benefits from the sale of manufactured products or services provided. We should not forget that the economic crisis in our country is still taking place, and therefore there are often cases when companies operate not even at zero, but at minus. This often happens because its management found the funds to open a company, but they don’t really know how to work. In these cases, they are faced with many additional costs not only for the production of finished products, but also for objectively indirect needs. If there is no revenue, then how to correctly determine the tax base for income tax purposes? From the point of view of our legislation, it turns out that even the costs of producing the product in this case will be taken into account as indirect, because there is no profit from its sale. An expense that does not even bring profit in a given period can also be justified, for example, aimed at future income. Thus, there are no contradictions for recognizing expenses during a non-income period as indirect (letters of the Ministry of Finance of the Russian Federation dated August 25, 2010 No. 03-03-06/1/565, dated May 21, 2010 No. 03-03-06/1/341, dated 08.12.2006 No. 03-03-04/1/821). At the same time, it is important to pay attention to the fact that if the company’s management fails to prove the economic justification (focus on future profits) of the expense in a period when there is no financial income, then it cannot be recognized as either direct or indirect (letters from the Federal Tax Service of Russia in Moscow dated 12.11.07 No. 20-12/107022, dated 26.12.06 No. 20-12/115144).

We wish you good luck and see you again!

Direct and indirect expenses in tax accounting

Using the cloud service Kontur.Accounting will help you correctly divide expenses into direct and indirect, as well as reflect them in a timely manner and in full. Get free access to the service for 14 days

In tax accounting, expenses are also divided into direct and indirect, but for different purposes. The task of accounting is to formulate the cost per unit of production, and for tax accounting it is important at what point the costs are charged to the cost of production. The size of the tax base will vary depending on the amount of direct and indirect costs.

Direct expenses are charged to the current tax period only after the products to which they are charged have been sold.

Indirect expenses are in no way related to sales; they reduce the tax base in the same reporting period in which they arise.

If in your organization the volume of indirect costs exceeds direct ones, then the costs will be taken into account earlier and the amount of taxable profit will decrease. You need to carefully monitor the rationale behind your decisions to classify expenses as indirect. If you underestimate the amount of direct expenses or incorrectly account for them, the tax authorities may consider this a violation and hold you accountable.

Why do disagreements arise with the Federal Tax Service?

Obviously, it is much easier and more convenient for a company to attribute most of the possible costs to indirect costs, because this reduces the tax base, therefore, the income tax paid by the organization will be less than that which will be calculated on direct expenses. Federal Tax Service inspectors understand this very well, and are very willing to look for discrepancies in the documentation of those they inspect. In this matter, it may turn out to be “more expensive for themselves,” because Particularly zealous Tax Service employees may regard your actions as tax evasion. This is a rather controversial accusation, because... We are talking about paying income tax only in different reporting periods. And yet inexperienced managers and accountants can be “intimidated” by this. A few tips from our previous article will help you defend your rights.