What is KBC and why is it needed?

KBK is a budget classification code. In other words, this is a special series of 20 numbers by which you can determine what kind of payment it is, who the recipient and sender of the payment are, the type of income, the origin of the payment, etc. This code was first established in 1999. Since then, the codes have changed many times. There is no point in memorizing the KBK. There are special KBK directories for payers, which are changed annually by the Ministry of Finance depending on changes in legislation. The codes were developed based on the Budget Code of the Russian Federation. A complete current list of all BCCs can be found in the order of the Ministry of Finance of the Russian Federation dated 06.06.2019 No. 85n. The KBK directory is also posted on the official portal of the Federal Tax Service. The BCC is needed in the financial system of the state so that every ruble of tax, fee, duty, fine, and penalty received is taken into account and analyzed in the financial flow.

"Assortment" KBK

Let us remind you that the new BCCs were approved by Order of the Ministry of Finance dated December 7, 2016 N 230n. And by this Order for insurance premiums, the “tax” BCCs differ depending on the period for which contributions are paid - before or after January 1, 2021. So, if we are talking about the payment of contributions (penalties, fines) for periods before January 1, 2021, then they must be transferred according to the following BCC:

Pension contributions

| Pension contributions | 182 1 0200 160 |

| Penalties on pension contributions | 182 1 0200 160 |

| Penalty penalties | 182 1 0200 160 |

Contributions for hospital insurance

| Contributions to compulsory social insurance in case of temporary disability and in connection with maternity | 182 1 0200 160 |

| Penalties for sick pay | 182 1 0200 160 |

| Fines for sick pay | 182 1 0200 160 |

"Medical" contributions

| Contributions for compulsory health insurance of the working population, credited to the FFOMS budget | 182 1 0211 160 |

| Penalties for medical fees | 182 1 0211 160 |

| Fines for “medical” contributions | 182 1 0211 160 |

For periods from January 1, 2021, that is, starting with contributions for January 2021, they must be paid according to other BCCs:

Pension contributions

| Pension contributions | 182 1 0210 160 |

| Penalties on pension contributions | 182 1 0210 160 |

| Penalty penalties | 182 1 0210 160 |

Contributions for hospital insurance

| Contributions to compulsory social insurance in case of temporary disability and in connection with maternity | 182 1 0210 160 |

| Penalties for sick pay | 182 1 0210 160 |

| Fines for sick pay | 182 1 0210 160 |

"Medical" contributions

| Contributions for compulsory health insurance of the working population, credited to the FFOMS budget | 182 1 0213 160 |

| Penalties for medical fees | 182 1 0213 160 |

| Fines for “medical” contributions | 182 1 0213 160 |

The most common mistake that companies made was that when paying contributions, for example for January 2021, the “tax” BCC was indicated, but... the wrong one. Moreover, these CBCs differ by only one number. And the result: a demand was received from the tax office for the payment of arrears in contributions.

Why is an error in the KBK dangerous?

When filling out a payment slip or receipt for payment of taxes, duties and other non-tax fees, you need to be very careful when specifying the BCC. If an error is made in the KBK, then your payment will end up in unidentified receipts and will “hang” there until you sort it out. But the worst thing is that for the tax or fee that you paid with an erroneous payment or receipt, arrears will appear and penalties will be charged. And if it was a state duty for performing legally significant actions or issuing documents, then you will simply be denied this action. For example, they will not accept a statement of claim in court, or issue a driver’s license or a duplicate of the required document.

Unpaid taxes, fees and contributions may also be recovered through legal action. However, if the payment order correctly indicates the account number (settlement and correspondent account) and the details of the recipient's bank, the obligation to pay tax is considered fulfilled from the moment the payment order is presented to the bank for the transfer of funds (subclause 1, clause 3, article 45 of the NKRF) when provided that there are sufficient funds in the business entity’s current account. The tax service also agrees with this opinion, having issued a corresponding letter dated October 10, 2016 No. SA-4-7/ [email protected] The Ministry of Finance also has a similar letter dated January 19, 2017 No. 03-02-07/1/2145.

We wrote about the fine for failure to pay personal income tax on time in the article.

How to write a letter to clarify the KBK

A correctly drafted letter to clarify the BCC will help quickly resolve the misunderstanding that has arisen. The document does not have a form established by law; taxpayers draw it up independently, taking into account the general requirements of document flow. The letter must be accompanied by a payment slip with the bank's note on execution (a copy).

The document must contain the following information:

- address of the territorial body of the Federal Tax Service to which the letter is addressed;

- information about the taxpayer;

- a detailed description of the error made;

- the correct details to apply;

- details of an erroneously executed payment order, according to which the tax was initially transferred.

The responsibility for drawing up the letter, as a rule, is assigned to the chief accountant or the employee who incorrectly completed the payment. The document must be signed by the head of the organization.

What to do if the BCC is indicated incorrectly

The legislation does not directly stipulate what a business entity should do if it made a mistake in indicating the tax payment to the KBK. However, organizations and individuals can be guided by paragraph. 2 clause 7 art. 45 of the Tax Code of the Russian Federation, which establishes the procedure in case of detection of an error in a payment order that does not lead to the payment of tax. So, if you incorrectly indicated the KBK when transferring the tax payment, then you need to write an application as quickly as possible to the Federal Tax Service at the place of registration to clarify the payment. After all, due to an incorrect KBK, your payment will not be received as intended and the payment will be incorrectly reflected in your personal card. This means that you will have an arrears and penalties will be charged.

If the business entity made a mistake in the State Duty Code, then the application is also written to the Federal Tax Service, but this document must also be accompanied by confirmation from the Federal Treasury about the receipt of money into the budget. Applications for clarification of payment are always submitted to the tax office, if it is necessary to clarify the BCC of a tax, fee and other obligatory payments administered by the tax authorities, to the budget system of the Russian Federation. In this case, it does not matter whether, as a result of the error, the tax or fee was credited to the same budget or not. There is no official form for this application, so you can compose it arbitrarily. The application must indicate:

- name of the organization, individual entrepreneur or full name of the taxpayer - an individual;

- TIN, OGRN or OGRNIP;

- legal and actual address;

- contact phone number for communication.

Further in the text of the application it is necessary to explain in detail what exactly needs to be clarified and what the error is. A copy of the payment slip for which the “erroneous” payment was transferred must be attached to the application.

The completed application must be sent to the tax office in one of the following ways:

- submit an application to the Federal Tax Service in person or by proxy;

- send by registered mail or courier service;

- send via telecommunication channels or through the taxpayer’s personal account.

In our article you can apply for clarification of tax payment.

If you forgot to indicate the KBK in the payment order, then in this case an application is submitted to search and return the erroneously transferred funds.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Despite the fact that the recipient of the funds is the Federal Treasury, it does not work directly with payers, therefore applications for clarification or refund of payments are submitted to the administrator of the Federal Treasury, indicated in the payment as the recipient.

What to do if, when transferring a tax payment, you made a mistake in other details of the payment order, read the ready-made solution “ConsultantPlus”. If you don’t have K+ yet, take advantage of a free trial access to the system.

Blog

What to do if the payment went to the wrong KBK?

It happens to everyone? They accidentally copied the payment slips and did not correct the KBK. In general, the 1C program changes it automatically when you select one or another tax, but something did not work.

According to paragraph 7 of Art. 45 of the Tax Code of the Russian Federation, if a taxpayer discovers an error in a payment order, he has the right to write a letter to the Federal Tax Service Inspectorate, with the help of which he can clarify the payment.

Unfortunately, such a letter cannot correct an error in a payment slip if it is associated with an incorrect indication of the Federal Treasury number or an incorrect indication of the name of the recipient's bank.

If the above two errors are made, according to current legislation, the obligation to pay tax (or contribution) will be considered not fulfilled. Therefore, you will have to re-pay taxes (or contributions) to the budget and pay penalties. This norm is contained in Article 75 of the Tax Code of the Russian Federation.

Related course

Accounting and tax accounting for beginners + 1C: Accounting 8.3

Find out more

All other errors in the payment order are considered not critical. Non-critical errors also include incorrect indication of the BCC. This was stated in the letter of the Ministry of Finance dated January 19, 2017 No. 03-02-07/1/2145.

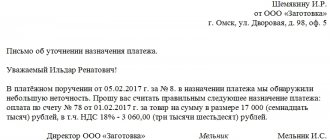

There is no clearly regulated form for submitting a letter clarifying details incorrectly specified in the payment slip and it can be drawn up in any form.

We advise you to indicate the following details in such a letter:

- amount, date and number of the payment order, as well as the name of the budget payment.

- information about the details being specified indicating the correct data.

A copy of the payment slip must be attached to the letter, which needs clarification.

Employees of regulatory authorities, after receiving such a letter, may offer the company to reconcile mutual settlements, but this does not always happen.

Within 5 working days after receiving the letter, the Federal Tax Service must make a decision to clarify the payment and inform the taxpayer of its decision. If clarification is made, but at that moment penalties have already been accrued, then they will be reversed, this is stated in clause 7 of Article 45 of the Tax Code of the Russian Federation.

We present to your attention a sample of such a letter:

To the Head of the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 22 for the Krasnoyarsk Territory 660079, Krasnoyarsk, 60 Let Oktyabrya St., 83a.

from LLC "Meteor" INN 2464002233 KPP 246401001 660079 Krasnoyarsk, st. 60 Let Oktyabrya d.200, office 200

Contact person: accountant Olga Ivanovna Minaeva 8 902 222 66 77

Application for clarification of payments due to errors made

Meteor LLC, in connection with errors made in payment orders for the transfer of insurance premiums for compulsory insurance on the basis of clause 7 of Article 45 of the Tax Code of the Russian Federation, requests that the following details be clarified:

| Payment order | Details to be specified | Correct value of the attribute | Amount, rub. | Purpose of payment | |

| № | date | ||||

| 45 | 13.02.2020 | KBK (field 104) | 18210202010061010160 | 2182,40 | Insurance contributions for compulsory pension insurance in the Pension Fund of the Russian Federation for the payment of insurance pensions for January 2020 |

| 46 | 13.02.2020 | KBK (field 104) | 18210202090071010160 | 287,68 | Insurance contributions for compulsory social insurance for temporary disability and maternity for January 2020 |

| 47 | 13.02.2020 | KBK (field 104) | 18210202101081013160 | 505,92 | Insurance premiums for compulsory health insurance to the federal compulsory medical insurance fund for January 2020 |

In addition, we ask you to recalculate the penalties accrued for the period from the date of actual payment of contributions to the budget system of the Russian Federation until the day the decision was made to clarify payments.

Copies of payment orders dated February 13, 2020 No. 45, No. 46 and No. 47 on three sheets are attached.

Director of Meteor LLC _____________________ Evseev I.N.

/ “Accounting encyclopedia “Profirosta” 05/14/2020

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Accounting organization

Decision to clarify payment

The tax office will review your application within 5 working days. Before a decision is made, penalties are accrued, and until a decision is made, the tax authority may require their payment. The Federal Tax Service can also reconcile settlements with the payer or request a payment order from the bank to transfer the tax.

If the outcome is favorable, the Federal Tax Service will decide to clarify the payment. The form of the decision was approved by the order of the Federal Tax Service of Russia “On approval of the form of the decision to clarify the payment and the procedure for filling it out” dated December 29, 2016 No. ММВ-7-1/ [email protected] In addition, the tax authority will have to recalculate accrued penalties from the date of actual payment of the tax or collection (i.e. this is the date of your “erroneous” payment) until the day the decision is made to clarify the payment. It would be useful to subsequently request from the tax office a certificate of absence of debt or a statement of reconciliation of calculations, in which you will see that your erroneous payment has been corrected, there are no arrears and penalties have been recalculated.

We wrote about the reconciliation act in the article.

What happens if the taxpayer does not send a letter requesting correction of the mistakes made?

Any inaccuracies related to tax payments must be corrected as soon as possible. If the taxpayer shows negligence in this matter and does not promptly send a letter about clarification of the BCC to the tax service, he will not be able to avoid the consequences.

A tax or contribution paid under an incorrect code will result in an overpayment for one tax and an underpayment for another. After the expiration of the period established for payment of the tax, sanctions in the form of penalties accrued on the amount of arrears are inevitable.

How to fill out a request?

Having a problem with a code mismatch in your payment? Do not despair. Go to the tax office at your place of registration. Submit a free form application for clarification of payment. Use company letterhead with the obligatory stamp and signature of the manager (owner).

What to include in the application? Fill in the fields:

- in the header the legal address, other information about the company;

- information about the error made;

- request for clarification of payment details;

- date, signature.

Next, explain exactly what error you made during payment. Indicate the payment document number, from what date the payment is due, and for what amount. What contribution was made to pay?

Write what code was specified (incorrect). Sign the correct option next to it.

Informally ask for the exact code. To support this, please attach a copy of the payment receipt and your account statement.

The application is sent to the tax service at the place of registration of the payer.

The tax service is obliged to respond to the application within 3-5 business days. During this period, a decision is made and a notification is sent. In a positive scenario, the service will issue a decision document. As well as a reconciliation report from the tax authority with a list of all transactions. The document is issued on the date of initial transfer. Therefore, no fines or penalties are assessed.

KBK structure

Based on the current requirements of the legislation of the Russian Federation, the corresponding codes in payment orders must be 20-digit. The KBK 2018-2019 is represented by 8 blocks of numbers.

The 1st block contains 3 numbers. They designate the administrator of the budget revenue of the Russian Federation. For example, the Federal Tax Service is designated by the numbers 182, the Social Insurance Fund - 393, the Federal Customs Service - 153.

In the 2nd block there is 1 digit. It denotes a group of receipts.

The 3rd block contains 2 numbers. With their help, a specific type of budget revenue is recorded. These may be, in particular:

- taxes;

- government fees;

- payments against debts on canceled taxes and fees;

- payments for the use of natural resources;

- fines, sanctions, compensation for damages;

- revenue from the provision of paid services.

The 4th and 5th blocks (sometimes they are considered as one) have 2 and 3 digits, respectively. They mean items as well as subitems of income.

The 6th block contains 2 numbers. With their help, the budget level to which the tax is transferred is indicated.

The 7th block contains 4 numbers. They determine the current status of the payment obligation (tax, penalty, collection, etc.).

The 8th block contains 3 numbers. They determine which economic category a particular budget revenue belongs to. So, if we are talking about taxes, then the main economic categories will be:

- tax income - with code 110;

- income from property transactions - with code 120;

- income from the provision of paid services - with code 130;

- cash receipts in the form of forced seizure - with code 140;

- contributions for social needs - 160.

Blocks 2–6 of the BCC can also be considered within the single category “type of income”.

BCC according to the simplified tax system “income” in 2018-2019: 182 1 0500 110.

BCC according to the simplified tax system “income minus expenses” in 2018-2019: 182 1 05 01021 01 1000 110.

BCC for personal income tax in 2018-2019 for the tax agent: 182 1 01 02010 01 1000 110.

IMPORTANT! As of 2021, there is no separate BCC for the simplified tax system for the minimum tax. It has become the same as for a regular payment under the simplified tax system “income minus expenses”.

See more about this here.

Documents required for correcting miscalculations when paying insurance fees

The key document that appears in correcting such errors is the statement of the obligated person. This may be an application for clarification of payment or offset of the excess amount that was paid.

Sample application for offset of excess amount of fines collected

Sample free form application for clarification of payment

What to do if the tax office refused to reconcile the KBK?

Often the tax authority refuses to accept an application to clarify payment. What to do in this case? It will be necessary to prove in court that this decision does not comply with the law.

It happens that pennies are charged on tax paid under the wrong code. The organization files an application, but tax officials refuse to recalculate the amount of the fine. A dispute arises. In this case, the best solution would be litigation. By decision of the judge, the pennies are recalculated or completely cancelled.

It should be explained to the court that the incorrect indication of the KBK does not constitute concealment of contributions. Please indicate that the wrong code on the payment slip does not result in a debt to the state budget. But it is only a means of distributing funds between budgets.

The court usually sides with the taxpayer. If there was only one error in the payment document, there is no need to re-deposit funds. According to the court's decision, the money will be transferred to the required account.

How to forward an application to the tax office

There are several ways to submit your application to the tax service:

- the most reliable and accessible way is to get to the territorial inspection and give the application to the inspector in person;

- you can submit the application with a representative who will have a duly certified power of attorney;

- send an application via Russian Post with a list of the contents by registered mail with acknowledgment of receipt;

- through electronic means of communication, but only if the organization has an official electronic digital signature.

Position of the tax authority

The taxpayer is considered to have lost the right to use the patent taxation system and switched to the general taxation regime from the beginning of the tax period for which he was issued the patent if he did not pay the tax on time (clause 6 of Article 346.45 of the Tax Code of the Russian Federation).

Due to the direct interpretation of tax legislation, violation of the payment deadline is an unconditional basis for the loss of the right to use the patent tax system and the transition to a general regime for calculating taxes.

Thus, if the right to use a patent is lost, the taxpayer is obliged to pay taxes under the general taxation regime for the entire period of application of the patent taxation system.

KBC 2018-2019: what's new?

What fundamental legislative innovations regarding the regulation of BCC came into force in 2021?

As we said above, the regulatory codes of legal acts have changed. Instead of the Ministry of Finance order No. 65n dated 01.07.2013, the Ministry of Finance order No. 132n dated 06.08.2018 is now in effect.

At the same time, an important change in 2021 was the change in codes for pension insurance contributions, which are paid at additional rates. They stopped depending on the results of the special assessment.

See here for details.

Let us also remind you about the changes for 2021:

- a new BCC was introduced for the payment of income tax on income received in the form of interest on bonds of Russian organizations, which, at the corresponding dates of recognition of interest income on them, are recognized as being traded on the organized securities market, denominated in rubles and issued during the period from 01/01/2017 to 12/31/2021 inclusive, as well as for mortgage-backed bonds issued after 01/01/2017 (Order of the Ministry of Finance of Russia dated 06/09/2017 No. 87n.);

- KBK appeared to pay excise tax on electronic nicotine delivery systems produced in Russia, nicotine-containing liquids, tobacco (tobacco products), which are intended for consumption by heating (Order of the Ministry of Finance of Russia dated 06.06.2017 No. 84n).

What could be the criteria for classifying certain payments as unclear? Let's study this aspect in more detail.

Basis of dispute

The entrepreneur received the right to use the patent taxation system with a patent validity period from March 1, 2015 to December 31, 2015. The taxpayer paid the patent tax on April 20. During the audit, the tax inspectorate assessed additional taxes to the entrepreneur according to the general taxation system. The basis for this was the conclusion that the deadlines for paying the “patent” tax were violated. The inspection indicated that the entrepreneur incorrectly indicated the BCC and the purpose of the payment, and sent an application to clarify the payment later than the established payment deadline. The entrepreneur presented a payment order dated April 20, 2015 as proof of timely payment, and, considering his rights violated, went to court.

In what cases does the KBK predetermine the classification of a payment as unclear?

One of the criteria for classifying a payment as unclear is the absence of a KBK in the payment order, or an indication of an incorrect or ineffective KBK (clause 2.5.5 of the order of the Federal Treasury dated October 10, 2008 No. 8n). It is assumed that the responsibility for indicating the correct BCC rests entirely with the taxpayer, since the BCC data is published in regulations.

For information on how to fill out such an application, read the article “Sample application for clarification of tax payment (error in the KBK).”

It will be useful to consider what legal consequences, in principle, could result from an incorrect indication by the taxpayer in the KBK payment order in 2018-2019.