You need to fill out an income tax return when paying dividends depending on who pays them and to whom. Be sure to include in the declaration sheet 01, subsection 1.1 section. 1, sheet 02, Appendices No. 1 and No. 2 to sheet 02. If you transferred dividends to Russian or foreign organizations, then include sheet 03 and subsection 1.3 in the declaration. section 1. If the JSC pays dividends to organizations and individuals or only to individuals, then include sheet 03 and subsection 1.3 in the declaration. section 1, as well as Appendix 2 for each individual shareholder. If the LLC pays dividends to organizations and individuals, then include sheet 03 and subsection 1.3 in the declaration. section 1. If the LLC pays dividends only to individuals, then do not fill out sheet 03.

Structure of Sheet 03

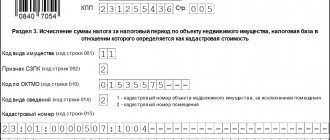

The current form of the company income tax declaration is established by order of the Federal Tax Service of Russia dated October 19, 2021 No. ММВ-7-3/572. According to it, Sheet 03 of the income tax return in 2021 is intended to calculate the income tax that the company must withhold as a tax agent and source of payment. The same order established the rules for filling out the income and profit declaration (hereinafter referred to as the Procedure). Who should fill out Sheet 03 of the income tax return becomes clear from the three sections it includes:

| Structural part of Sheet 03 | What to reflect | What norms of the Tax Code of the Russian Federation should we follow? |

| Section A | Calculation of tax on dividends/income from equity participation in other organizations established in Russia | By equity participation:

|

| Section B | Calculation of tax on interest income on state and municipal securities | Article 281 Clause 5 of Article 286 Paragraph 4 of Article 287 Articles 328 and 329 |

| Section B | Register-decoding of dividend amounts (percent) | – |

As you can see, dividends to individuals are also reflected in Sheet 03 of the income tax return (in lines 020, 021, 022, 023, 024, 030, 040, 050, 051, 052, 053, 054, 060). That is, it shows not only the income addressed to the legal entity as a whole, but also the dividends that this company accrued to individuals and legal entities, and submits this report as a tax agent.

Ilya Nazarov, partner

Taking into account the fact that the threshold value of CFC profit, which the controlling person has the right NOT to take into account when determining the base for its tax (personal income tax or non-income tax), starting from the 2021 financial year of the CFC, has been reduced to 10 million rubles. — the need to calculate CFC profits is becoming increasingly urgent. This article will analyze the most common cases related to the declaration of CFC profits and comment on frequently arising questions and controversial situations.

Determining the threshold value of CFC profit

The threshold value of a CFC's profit is determined based on its financial statements prepared either according to a local standard (if provided) or according to IFRS. If the standard is NOT established, the use of IFRS is mandatory (for example, for all offshore companies). General issues of legal regulation are described on the page Taxation of profits of CFCs of the MNE department.

CFC profit is reflected in the STATEMENT OF PROFIT AND LOSS (or STATEMENT OF COMPREHENSIVE INCOME) section, in the line “PROFIT BEFORE TAX”. The profit indicator in foreign currency must be multiplied by the average exchange rate of a particular currency to the Russian ruble for the reporting year - clause 12 Letter of the Ministry of Finance of the Russian Federation dated February 10, 2021 No. 03-12-11/2/7395 . At the same time, for the purposes of comparison with the threshold value, it is necessary to take into account the profit indicator of the entire company (and NOT in proportion to the share of participation of the controlling person in it).

Average rates and equivalents 10 million rubles. in currencies: 2017: 10 million rubles. /58.3086 (USD exchange rate) = USD 171.502 10 million rubles. /65.8714 (EUR exchange rate) = EUR 151.811 10 million rubles. /75.1115 (GBP rate) = GBP 133.135

2018: 10 million rubles. /62.6906 (USD exchange rate) = USD 159.514 10 million rubles. /73.9628 (EUR exchange rate) = EUR 135.203 10 million rubles. /83.6126 (GBP rate) = GBP 119.599

2019: 10 million rubles. /64.6625 (USD exchange rate) = USD 154.650 10 million rubles. /72.4101 (EUR exchange rate) = EUR 138.102 10 million rubles. /82.5539 (GBP rate) = GBP 121.133

IMPORTANT! When determining the profit of a CFC, the following income (expenses) are not taken into account - clause 3 of Article 309.1 of the Tax Code of the Russian Federation:

- in the form of amounts from the revaluation and (or) impairment of shares in the authorized (share) capital (fund) of organizations, shares in mutual funds of cooperatives and mutual investment funds, securities, derivative financial instruments at fair value, made in accordance with the applicable financial standards statements recognized as part of the profit (loss) of a controlled foreign company before tax;

The above paragraph is applied in practice if the CFC owns a portfolio of securities. In accordance with IFRS, profit from portfolio revaluation (“net fair value gain”) at the end of the year is included in the PnL indicator, BUT should not be taken into account when determining the profit indicator of a CFC. Those. for the purposes of comparison with the threshold value, the “net fair value gain” indicator can be subtracted from the PnL indicator. And the resulting number is recalculated at the exchange rate into rubles for the purpose of comparison with the threshold of 10 million rubles.

In addition, when determining the profit of a CFC, the following income (expenses) are also NOT taken into account:

- in the form of amounts of income from the sale or other disposal of shares in the authorized (share) capital (fund) of organizations, shares in mutual funds of cooperatives and mutual investment funds, securities, derivative financial instruments (excluded from 09.11.2020 Federal Law dated 09.11.2020 No. 368 -FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation”) and expenses recognized upon disposal of these assets as part of the profit (loss) of a controlled foreign company before tax (income from the sale of securities is subject to adjustment in accordance with clause 3.1 Article 309.1 of the Tax Code of the Russian Federation, namely, when calculating the income/expense indicator, the historical cost of the sold security is subtracted from the sales price, i.e. the cost of accepting it for accounting (if the security was accepted for accounting before 2015, its value at 01/01/2015), and not the value at the beginning of the financial period, taking into account revaluation as established by IFRS).

- in the form of amounts of profit (loss) of subsidiaries (associated) organizations (except for dividends) recognized in the financial statements of a controlled foreign company in accordance with its personal law (the accounting policies of this company for the purposes of preparing its financial statements);

- in the form of the amount of expenses for the formation of reserves and income from the restoration of reserves. In this case, the profit of the controlled foreign company is reduced by the amount of expenses that reduce the amount of the previously formed reserve;

- in the form of dividends, the source of payment of which are Russian organizations, if the controlling person of this CFC has the actual right to such income, taking into account the provisions of Art. 312 of the Tax Code of the Russian Federation.

IMPORTANT! For the purposes of comparing CFC profits with the threshold value, CFC losses from previous periods are NOT taken into account.

IMPORTANT! For the purposes of comparing CFC profits with the threshold value, the amount of distributed dividends based on the results of the financial year is NOT taken into account.

The above is established by clause 22 and clause 23 of the Letter of the Ministry of Finance of the Russian Federation dated February 10, 2021 No. 03-12-11/2/7395. In accordance with IFRS, these figures are not included in the “profit and loss” indicator in any case.

Benefits that exempt CFC profits from taxation

Let’s say that after the calculations were made, it became obvious that the company’s profit exceeds 10 million rubles. Next, it is necessary to evaluate the possibility of applying a benefit that exempts CFC profits from taxation. Some of the most popular benefits are the following:

- benefit according to the criterion of “active” activity, in accordance with the Tax Code of the Russian Federation, any activity is considered, with the exception of “passive”, which is expressly specified in clause 4 of Article 309.1 of the Tax Code of the Russian Federation. “Active” activities in particular, for example, include trade. At the same time, it does not matter whether your company has any agreements with the Russian Federation on tax issues (for example, tax treaty) - even a classic offshore company (Belize, Seychelles, BVI, etc.) can claim this benefit. The share of active income, in this case, must be at least 80% of the company’s total income - clause 3 of Article 25.13-1 of the Tax Code of the Russian Federation.

When applying for this benefit, documents confirming the claimed benefit must be attached to the CFC Notification. The Tax Code does NOT provide a specific list of such documents; in practice, such documents may be:

- financial statements of the CFC with an audit report that directly indicates the type of activity of the CFC

- an extract from the bank account of the CFC, from which it follows the nature of the transactions carried out by the CFC

- register of agreements concluded by the CFC for the required reporting period

- copies of contracts (if they are of the same type - a copy of one such contract and a covering letter)

- any other documents that together directly or indirectly confirm the “active” nature of the CFC’s activities

- benefit based on the criterion of the effective rate of local corporate tax - applies if such an effective rate is at least 75% of the weighted average tax rate for income tax in the Russian Federation (clause 3 of clause 1 of Article 25.13-1 of the Tax Code of the Russian Federation). For the purposes of applying this benefit, it is necessary that the jurisdiction of the CFC has an agreement with the Russian Federation on tax matters (for example, a tax treaty) and is NOT included in the list of countries that do not ensure the exchange of information for tax purposes with the Russian Federation - clause 7 of Article 25.13-1 of the Tax Code of the Russian Federation .

To understand more precisely whether the benefit based on the effective rate criterion is applicable in each specific case, it is necessary to make calculations using the formula given in clause 2 of Article 25.13-1 of the Tax Code of the Russian Federation. When declaring this type of benefit, a corresponding calculation must be attached to the CFC Notification. Additionally, the specifics of the application of this benefit are explained in paragraph 9 of the Letter of the Ministry of Finance of the Russian Federation dated February 10, 2021 No. 03-12-11/2/7395.

- other benefits that exempt CFC profits from taxation are also established - clause 1 of Article 25.13-1 of the Tax Code of the Russian Federation: for CFCs - non-profit organizations;

- for CFCs registered in Armenia, Belarus, Kazakhstan, Kyrgyzstan, Moldova;

- for CFCs that are banks or insurance organizations;

- for CFCs participating in mining projects (subject to certain additional conditions);

- for CFCs that are operators of a new offshore hydrocarbon field

What documents are submitted to the tax authority?

As I wrote above, if there is a benefit, documents confirming the claimed benefit must be attached to the CFC Notification.

CFC reporting to the Federal Tax Service is always submitted, starting with the CFC Notifications for 2021 (not submitted with CFC Notifications for previous years) (as amended by Federal Law dated November 9, 2020 No. 368-FZ “On Amendments to Parts One and Two of the Tax Code”) Code of the Russian Federation").

The 3-NDFL declaration is NOT submitted to the Federal Tax Service.

IMPORTANT! In accordance with the clarifications of the Ministry of Finance of the Russian Federation, the benefit can be applied ONLY when independently submitting Notifications about CFC. If the controlling person hid the fact that he had a CFC, and this fact was revealed in the future, it is IMPOSSIBLE to claim the benefits and exemption of CFC profits from taxation (if the threshold of 10 million rubles is exceeded).

Calculation of tax on CFC profits in the absence of benefits

If the profit threshold is exceeded and it is impossible to apply any benefit (for example, for companies receiving dividends or companies leasing/selling real estate, etc.), it is necessary to calculate the tax on the profit of the CFC to take into account the resulting value in the 3-NDFL declaration of the controlling person and pay personal income tax from him.

Let me remind you that the profit of a CFC is taken into account when determining the base of the controlling person in proportion to his share of participation in the CFC.

Formula for calculating tax (X) on CFC profits:

X (declared in 3-NDFL) = participation share of k.l. x (CFC profit before tax - Dividends distributed (total amount) - Previous period losses in the order in which they were received) x 13% - CFC foreign corporate tax x participation interest k.l.

Reduction of CFC profits by distributed dividends

As can be seen from the formula, the profit of a CFC can be reduced by the amount of dividends paid in the year following the financial year of the CFC based on the results of this financial year, as well as by the results of the accumulated profit of previous financial periods and by the amount of interim dividends paid during the financial year of the CFC. The amount of distributed dividends must be confirmed, and, as the Ministry of Finance of the Russian Federation explained in its letter, “confirmation of the amount of dividends paid, in addition to financial statements, is carried out through copies of payment orders or cash documents for the payment of dividends, accounting statements, transcripts of financial statements, copies of decisions on the payment of dividends , other documents provided for by the customs of business turnover of the state of permanent location of a controlled foreign company" - Letter of the Ministry of Finance dated April 28, 2017 N 03-12-12/2/26265a.

The reduction in retained earnings of a CFC by the amount of dividends is carried out IN CURRENCY.

Reduction of CFC profit by losses of previous periods

After reducing the profit of a CFC by the amount of distributed dividends, the amount of profit of the CFC can be further reduced by the amount of losses of previous financial periods without limitation.

At the same time, losses for the 2015-2017 financial years of the CFC are determined in RUBLES at the exchange rate of the Central Bank of the Russian Federation as of December 31, 2017. The loss, starting from the 2018 financial year of the CFC, is determined in RUBLES at the average exchange rate of the Central Bank of the Russian Federation for the period in which the loss was received - Letter of the Ministry of Finance of Russia dated November 21, 2019 N 03-12-11/2/90241.

Thus, after the CFC’s retained earnings in foreign currency have been reduced by the amount of dividends in foreign currency, it must be converted into rubles at the average exchange rate for the year and from the resulting amount subtract the amount of losses, also translated into rubles, taking into account what is described above.

IMPORTANT! Losses from previous periods can be carried forward to future periods when determining the profit of a CFC ONLY if the controlling person filed a Notification of the CFC based on the results of the financial periods in which such losses were incurred.

Foreign corporate tax credit

The resulting figure after reducing the CFC's profit for dividends and losses must be multiplied by 13%, and the resulting tax amount can also be reduced by the amount of corporate tax paid on the CFC's profit in a foreign country in proportion to the controlling person's share of participation in the CFC.

The amount of the foreign corporate tax of the CFC must be documented, and if Russia does not have a tax treaty with the state of registration of the CFC, the document confirming the payment of the corporate tax must be certified by the competent tax authority of the foreign state.

The foreign corporate tax of a CFC must be recalculated into rubles at the exchange rate on the date of its actual transfer to the budget of a foreign state.

What documents are submitted to the tax authority?

If, after reducing the profit of a CFC by the amount of distributed dividends and losses of previous periods, a negative value , a 3-NDFL declaration is NOT filed (income tax return for controlling persons of Russian organizations is submitted zero) and financial statements are submitted (starting from the Notification of CFC for 2021) .

If, after reducing the profit of the CFC by the amount of distributed dividends and losses of previous periods, a positive value , a 3-NDFL declaration is submitted to the tax authority with the declared amount of profit of the CFC and the personal income tax calculated on such profit.

Also, as I wrote above, in the 3-NDFL declaration it is also possible to deduct the amount of foreign corporate tax paid in a foreign country - in this case, it will be necessary to pay additional personal income tax to the budget up to a rate of 13%.

The following must be attached to the 3-NDFL declaration: - translation into Russian of a copy of the audited (if an audit is required) financial statements of the CFC - clause 5 of Article 25.15 of the Tax Code of the Russian Federation

If a foreign corporate tax is claimed as a deduction, the following must also be attached to the 3-NDFL declaration: - a document issued by a foreign state confirming the amount of corporate tax paid by the CFC in a foreign state. Such documents can be (any of): - a tax return certified by the tax authority of a foreign state or sent via electronic communication channels used to send such a document in a foreign state; — notification from the tax authority about the amount of calculated tax;

- payment documents

For taxes withheld by tax agents: - written confirmation of the tax (paying) agent; - payment document; — other similar information and documents confirming the calculation and (or) payment of taxes, including by other persons in relation to the profit of the CFC

Exemption from personal income tax of dividends in case of indicating income in the form of CFC profit in the 3-NDFL declaration

In accordance with paragraph 66 of Article 217 of the Tax Code of the Russian Federation, income of an individual received from a CFC in the form of dividends is not subject to taxation (exempt from taxation), if the income in the form of profit of this company was indicated by this taxpayer in the 3-NDFL declaration.

Tax optimization - options

As follows from the calculation methodology above, the ability to offset personal income tax against foreign corporate tax and the legislative exemption of future dividends subject to personal income tax at the level of CFC profit from repeated tax provides some opportunity to optimize personal income tax. For example, the profit of a CFC in Cyprus for the 2021 financial year amounted to 150 thousand EURO (RUB 10.86 million), then 2 scenarios are possible with the following tax consequences:

1st OPTION - Distribution of dividends in 2020 150 thousand EURO x (rate as of the date of distribution (value date on personal account) 88.86 rubles (rate as of 09/17/2020) x 13% = 1,732,770 rubles (personal income tax amount to payment to the budget of the Russian Federation)

2nd OPTION - Declaration of retained earnings of the CFC, distribution of dividends in 2021 150 thousand EURO x (average rate for 2021) 72.4101 rubles x 13% - 12.5% (corporate tax in Cyprus) = 54.307 rubles. (the amount of personal income tax payable to the budget of the Russian Federation). In fact, the additional payment after offset of the corporate tax remains 0.5% of the CFC profit instead of 13%.

Dividends paid starting from 2021 (from the retained earnings of the CFC, from which 0.5% was actually paid) are exempt from personal income tax in accordance with clause 66 of Article 217 of the Tax Code of the Russian Federation.

Disadvantages of the option: - it is necessary to postpone the payment of dividends for 1 year - it is beneficial if in the jurisdiction of incorporation of the company withholding tax on dividends = 0% (for example, Cyprus, Singapore)

3rd OPTION - Difference in exchange rates As you can also see, in the case of payment of dividends, the amount of dividends in foreign currency is recalculated into rubles at the rate on the value date of the personal account. Moreover, in the case of declaring retained earnings of a CFC without paying dividends, the amount of retained earnings is recalculated into rubles at the average exchange rate for the financial year of the CFC. Depending on the fluctuations in the exchange rate, it is possible to make an appropriate decision - whether to pay dividends or pay personal income tax on the retained earnings of the CFC.

Practical examples

Examples are based on the average exchange rate for 2021. We believe that the CFC does not need to make adjustments to the CFC’s profit by the amounts of the types of income/expenses mentioned above - clause 3 of Article 309.1 of the Tax Code of the Russian Federation. EXAMPLE 1 (typical for classic offshore companies) Controlling person - an individual, tax resident of the Russian Federation Participation share - 100% CFC profit before tax - 250,000 USD (approximately 15.67 million rubles) Distributed dividends (total) - 0 USD Loss of previous periods - 0 USD Foreign corporation tax -0 USD

CALCULATION OF TAX ON CFC PROFIT:

X = 100% x (250,000 USD - 0 USD - 0 USD) x 13% - 0 USD = 32,500 USD x dollar exchange rate

Declaration 3-NDFL: submitted What is declared: profit of the CFC What is attached to the declaration 3-NDFL: audited (if an audit is required) financial statements of the CFC (notarized translation into Russian).

EXAMPLE 2 (dividends and corporate tax were paid) Controlling person - individual, tax resident of the Russian Federation Participation share - 100% CFC profit before tax - 250,000 EUR (approximately 18.49 million rubles) Distributed dividends (total) - 100,000 EUR Past losses periods - 0 EUR Foreign corporation tax -31.250 EUR (12.5%)

CALCULATION OF TAX ON CFC PROFIT:

X = 100% x (250,000 EUR - 100,000 EUR - 0 EUR) x 13% - 31,250 EUR x 100% = 19,500 EUR x EURO exchange rate - 31,250 EUR x EURO exchange rate on the date of tax payment = negative value

Declaration 3-NDFL: submitted What is declared: CFC profit and foreign corporate tax deductible What is attached to the 3-NDFL declaration: 1) audited (if an audit is required) financial statements of the CFC (notarized translation into Russian); 2) documents confirming the amount of corporate tax paid in a foreign country

EXAMPLE 3 (accumulated loss from previous periods exceeds profit received)

Controlling person - an individual, tax resident of the Russian Federation Participation share - 100% CFC profit before tax - 250,000 EUR (approximately 18.49 million rubles) Distributed dividends (total) - 0 EUR Loss of previous periods - 300,000 EUR Foreign corporate tax - 0 EUR

CALCULATION OF TAX ON CFC PROFIT:

X = 100% x (250,000 EUR - 0 EUR - 300,000 EUR) x 13% - 0 EUR x100% = negative value

Declaration 3-NDFL: NOT submitted What is declared: — What is attached to the declaration 3-NDFL: —

The situation would look similar if the amount of distributed dividends (including interim ones, including from accumulated profits of previous periods) exceeded the amount of net profit - the 3-NDFL declaration in this case is also not submitted.

EXAMPLE 4 (participation share - 50%, dividends were paid, there is a loss and corporate tax) Controlling person - individual, tax resident of the Russian Federation Participation share - 50% CFC profit before tax - 250,000 EUR (approximately 18.49 million rubles) Distributed dividends (total) - 100,000 EUR Losses from previous periods - 50,000 EUR Foreign corporation tax -31,250 EUR (12.5%)

CALCULATION OF TAX ON CFC PROFIT:

X = 50% x (250,000 EUR - 100,000 EUR - 50,000 EUR) x 13% - 31,250 EUR x 50% = 13,000 EUR x EURO exchange rate - 15,625 EUR x EURO exchange rate on the date of tax payment = negative value

Declaration 3-NDFL: submitted What is declared: CFC profit and foreign corporate tax deductible What is attached to the 3-NDFL declaration: 1) audited (if an audit is required) financial statements of the CFC (notarized translation into Russian); 2) documents confirming the amount of corporate tax paid in a foreign country

EXAMPLE 5 (participation share - 100%, corporate tax was paid) Controlling person - individual, tax resident of the Russian Federation Participation share - 100% CFC profit before tax - 250,000 EUR (approximately 18.49 million rubles) Distributed dividends (total) - 0 EUR Previous period losses - 0 EUR Foreign corporation tax -31.250 EUR (12.5%)

CALCULATION OF TAX ON CFC PROFIT:

X = 100% x (250,000 EUR - 0 EUR - 0 EUR) x 13% - 31,250 EUR x 100% = 32,500 EUR x EURO rate - 31,250 EUR x EURO rate on the date of tax payment = 1,250 EURO (in rubles at the EURO exchange rate)

Declaration 3-NDFL: submitted What is declared: CFC profit and foreign corporate tax deductible What is attached to the 3-NDFL declaration: 1) audited (if an audit is required) financial statements of the CFC (notarized translation into Russian); 2) documents confirming the amount of corporate tax paid in a foreign country

Who is obliged to include Sheet 03 in the declaration

Now about who fills out Sheet 03 of the income tax return. In relation to Section A this is:

- companies - issuers of securities (i.e., distributing the remaining profit after payment of tax) and recognized in this regard as tax agents on the basis of clause 3 and sub. 1, 3 p. 7 art. 275 Tax Code of the Russian Federation;

- companies are not issuers of securities, but pay income on them (must indicate the issuer's TIN) and are recognized in this regard as tax agents on the basis of sub-clause. 2, 4, 5, 6 clauses 7 and 8 art. 275 Tax Code of the Russian Federation.

In turn, Section B is intended for those organizations that pay interest on state and municipal securities. The tax on them may be:

- 15% (subclause 1, clause 4, article 284 of the Tax Code of the Russian Federation);

- 9% (subclause 2, clause 4, article 284 of the Tax Code of the Russian Federation).

Also see “Income tax rate in 2021 for legal entities.”

How to fill out Appendix No. 2 to the income tax return

Appendix No. 2 was last used to reflect dividends paid to individuals from securities in the income tax return for 2021. In the 2021 declaration, Appendix No. 2 is intended for other purposes. Now it reflects information on income (expenses) received (incurred) during the execution of agreements on the protection and promotion of investments, as well as on the tax base and the amount of calculated corporate income tax.

Appendix No. 2 on dividends was also removed from joint stock companies. It was filled out only at the end of the year, separately for each individual recipient of dividends.

The header indicated the serial number and date of the certificate as part of this application, as well as its type:

- 00 - primary representation;

- 01-98 — correction number;

- 99 - cancellation of a previously submitted certificate.

The following were the personal data of the individual: TIN, full name, tax status, date of birth, citizenship, identification document details. Then information about the amount of dividends and tax on them (lines 010-034).

On the second page, in lines 040-052, a breakdown of the total amounts of income and tax deductions indicated in lines 020 and 021 was given.

Rules for filling out Sheet 03

One of the basic principles for filling out Sheet 03 of the income tax return is on an accrual basis. Since the profit from dividends and/or shares in other businesses, the company shows:

- for the reporting period – 1st quarter, half a year and 9 months;

- then for the entire tax period - a calendar year.

Sometimes the question arises: is it necessary to fill out Sheet 03 of the income tax return several times if there were several decisions on the payment of dividends during the year? Yes, this is necessary: one such decision is a separate Sheet 03 filled out for it (clause 11.2.1 of the Procedure).

In general, you need to show information about dividends:

1. In Section A and B of Sheet 03.

2. Subsection 1.3 of Section 1 of Sheet 01.

Section B of Sheet 03 is filled out for each organization to which the dividends shown in Section A of Sheet 03 were accrued. Including those taxed at a zero rate.

Also see “The most important things about the income tax return for the 1st quarter of 2021 and a sample for filling it out.”

What are dividends

Income received by participants (shareholders) of organizations from their ownership of shares or shares of these organizations is called dividends.

The concepts of such income in tax and civil law may differ:

- According to civil law, an organization has the right to pay dividends disproportionately to its shares (clause 2 of Article 28 of the Law on LLCs dated 02/08/1998 No. 14-FZ). For tax purposes, income issued to participants that does not correspond to their shares is not recognized as dividends. Income received in excess of the proportional distribution must be taxed at the basic rates of income tax, personal income tax.

- In civil law, it is allowed to pay dividends during the year (clause 1 of article 28 of the law on LLCs, clause 1 of article 42 of the law on joint-stock companies dated December 26, 1995 No. 208-FZ). If at the end of the year no profit was generated and dividends were paid, the amounts paid are not recognized as dividends for tax purposes. Payments must be taxed at basic tax rates.

- There are payments that are equated to dividends in tax law, but not in civil law.

| Type of payment | Rationale |

| Income paid upon closure of the company in an amount higher than the founding contribution | Clause 1, sub. 1 item 2 art. 43 Tax Code of the Russian Federation |

| Interest paid in excess of the norm on debt to a foreign company | Clause 6 Art. 269 Tax Code of the Russian Federation |

| Income received outside the territory of the Russian Federation, which is recognized as dividends within a foreign state. | Clause 1 Art. 43 Tax Code of the Russian Federation |

Sample filling

Now let's give an example of filling out Sheet 03 of the income tax return in 2021.

Let’s assume that Guru LLC submits income tax returns every quarter. In 2021, this company received dividends in the amount of 8 million rubles. Among them:

- taxed at a zero rate – 2 million rubles;

- taxed at a rate of 13% - 6 million rubles.

These dividends were not taken into account when calculating the tax on dividends paid by Guru LLC in 2021.

The participants decided to distribute profits for 2021 in the amount of 11 million rubles. Dividends were paid on March 22, 2018, and the tax withheld from them was transferred to the treasury on March 23, 2018.

From the total amount of dividends:

- 2 million rubles - accrued to its individual participant;

- 9 million rubles – to participants-legal entities.

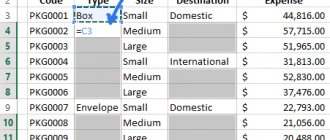

The table below shows the main indicators of income tax on dividends issued to organizations.

| Members of Guru LLC | Dividends accrued, rub. | Tax rate, % | Tax on dividends, rub. |

| LLC "Sila" | 3 900 000 | 0 | 0 |

| LLC "Trimmer" | 3 100 000 | 13 | 403 000 |

| LLC "Dar" | 2 000 000 | 13 | 260 000 |

| Total including Trimmer and Dar LLC | 9 000 000 | – | 663 000 |

| 5 100 000 | 13 | 663 000 |

Since the dividends were paid based on only one decision of the owners, Guru LLC will include one Sheet 03 in the declaration for the first quarter of 2018, in which it will fill out:

- one Section A;

- three Sections B (for each company receiving dividends).

In addition, Guru LLC will include subsection 1.3 of Section 1 of Sheet 01 in the report.

As a result, you need to fill out the declaration as follows:

In the report for half a year, 9 months and the whole of 2021, in lines 01 to 21, as well as in all lines 040 of subsection 1.3 of Section 1 of Sheet 01, dashes are placed for these dividends.

In the report for half a year, 9 months and the whole of 2021, Section A of sheet 03 for these dividends is drawn up in the same way as in the declaration for the 1st quarter. Except lines 110 and 120:

In the report for half a year, 9 months and the whole of 2021, dashes are placed on these dividends in lines 040, 050 and 060 of Section B of Sheet 03.

Read also

09.04.2018

Dividends issued in finished products

If dividends (income) are issued in finished products or goods, make the following entries:

DEBIT 75–2 (70) CREDIT 90–1

– dividends or income in finished products (goods) were issued;

DEBIT 90–2 CREDIT 43 (41)

– the cost of finished products (goods) is written off;

DEBIT 90–3 CREDIT 68 SUBACCOUNT “VAT CALCULATIONS”

– VAT is charged;

DEBIT 90–9 (99) CREDIT 99 (90–9)

– reflects the financial result from the sale of finished products (goods) (based on the results of the reporting month).