Payment

In this article we will look at the property tax of an unfinished construction project. Let's learn about tax

The taxpayer is obligated to submit a “clarification” only if an error has been discovered in the declaration,

In order to correctly determine the tax base for a single tax, all taxpayers using the simplified tax system must maintain

Employers want employees to perform their duties well. But the needs of the enterprise change, and it is necessary

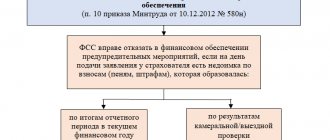

From 01.08.2017, employers can purchase workwear made from fabrics against contributions to the Social Insurance Fund,

The single tax on imputed income refers to special tax regimes, which are voluntary.

It is difficult to find this type of business where a car is required. These include various transportations,

Arrears in 4-FSS: how not to get confused in the terms of the Official explanation of the concept of “arrears in 4-FSS”

In August 2021, the Russian Tax Service presented statistics on the payment of transport tax. Most

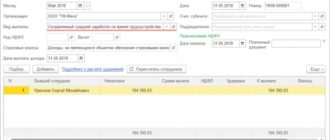

In practice, the dismissal of an employee is accompanied by a number of payments, the taxation procedures of which vary. All payments that