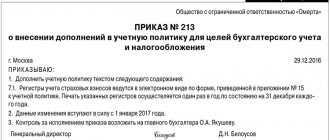

A situation often arises that, for various reasons, you did not have time to make changes to the Accounting Policies before the beginning of the year. Or they deliberately didn’t. I wanted to think about it better, remember all the changes - and modify it later. But it is important to take into account that with continuous numbering of orders for conducting financial and economic activities, the order approving changes to the accounting policy for 2021 must be dated exactly 2021.

Each company has its own accounting policy

There are many innovations in legislation, but not all of them should be included in the accounting policy. It makes sense to describe in the accounting policy only those provisions that relate specifically to your company and take into account the specifics of accounting and the characteristics of a particular business.

The accounting policy sets out accounting methods that you must establish yourself or choose for yourself the best option from acceptable alternatives. Duplicating the direct provisions of the Tax Code - mandatory and not providing for a choice from possible options - is pointless. You should not burden the document with them. Let it be small, but meaningful and useful.

There is no point in “inflating” the rules and developing accounting policies for the future just in case. Take into account only the real subtleties of accounting work. When new accounting objects appear, the accounting policy can be supplemented.

Changes to accounting policies in 2021

There is no direct obligation to review accounting policies annually. This is the right of the organization. But due to the fact that many legislative changes have been adopted that come into force on January 1, 2021, the accounting policy for 2021 should be reviewed and updated.

Innovations from 2021

A new restriction has been introduced when switching from a linear to a non-linear method of depreciation of fixed assets - no more than once every 5 years. Until January 1, 2021, the five-year moratorium was valid only for the transition from non-linear to linear. From 2021 - any change in the depreciation method - no more often than after 5 years.

From January 1, 2021, the following changes have been made to the depreciation procedure:

- Depreciation on fixed assets transferred for free use cannot be recognized as expenses that reduce the tax base for income tax.

- The useful life of the object will not be extended for a period of conservation of more than 3 months. For a conservation period of more than 3 months, fixed assets are excluded from depreciable property.

These are direct provisions of the Tax Code - mandatory rules. They need to be taken into account in the work, but there is no need to include them in the accounting policy.

The horizon for applying the investment income tax deduction has been expanded:

- deductions are allowed for fixed assets of 8-10 depreciation groups (except for buildings, structures, transmission devices). Currently it only applies to 3-7 groups;

- The list of expenses that can be covered by deductions has been expanded: up to 100% of the amount of expenses for the creation of transport and utility infrastructure facilities and no more than 80% of the amount of expenses for the creation of social infrastructure objects. Provided that the creation of these objects is provided for in an agreement on the comprehensive development of the territory for the construction of standard housing.

The 50% limitation on the carry forward of losses from previous years has been extended until December 31, 2021.

If for 2021 you decide to change the procedure for making advance payments for income tax - based on actual profits, monthly or quarterly advance payments for income tax - this should be reflected in your accounting policies. If the procedure does not change from January 1, 2020, no changes need to be made.

Rules for accounting and payment of taxes for separate divisions

If a company has created several separate divisions located in one region, then the accounting policy establishes the procedure for paying taxes to the regional budget from two possible options:

- Each department independently.

- Centrally - through the parent company or through a responsible division.

The accounting policy lists the separate divisions to which the right of representation is delegated, indicating the taxes in respect of which the specified division will perform duties - submit tax returns and pay taxes.

If, from January 1, 2021, such a procedure was prescribed in the accounting policy and you do not plan to change it, there is no need to make changes. But with regard to the centralized payment of personal income tax and insurance premiums, there are innovations that need to be included in the accounting policy for 2020.

Innovations from 2021:

- From January 1, 2021, it is officially allowed to submit 2-NDFL and 6-NDFL reports and transfer personal income tax in a single payment for all separate divisions located within the same municipality (within one OKTMO).

- From January 1, 2021, the company has the right to grant the authority to transfer insurance premiums only to those separate divisions that have a bank account.

Don’t forget to notify the tax authority about the centralized procedure for paying taxes, submitting reports and choosing a responsible department. Please note that regarding the centralization of personal income tax, only the selected inspectorate should be notified - the rest of the Federal Tax Service will receive information automatically. Each Federal Tax Service is notified regarding insurance premiums, in which the “separate” ones are registered. Messages are sent either about the vesting or deprivation of powers of the corresponding separate unit.

If you switch to a different tax regime from the beginning of the year, you need to draw up a new accounting policy

When changing the object of taxation according to the "simplified" tax system - from "Income" to "Income minus expenses" and vice versa - the change must be made to the accounting policy for 2021.

In the event of a transition from UTII to “simplified” taxation, the accounting policy must specify the accepted methods and accounting procedures for the new taxation procedure - the simplified taxation system.

Innovation from 2021:

From January 1, 2021, sellers of three groups of goods subject to mandatory labeling will lose the right to use UTII and PSN: medicines, shoes, clothing and other products made from natural fur.

In return for UTII, small companies and individual entrepreneurs will consider the option of switching to the simplified tax system.

To switch to the simplified tax system, the current accounting policy will have to be revised. And it’s important: no later than December 31, 2021, do not forget to notify the tax authority by sending an application to switch to the simplified tax system using form No. 26-1. Otherwise, in 2021 you will have to pay taxes according to the general taxation system.

If part of the business is transferred to UTII or the opportunity to receive targeted financing opens up, the accounting policy needs to detail the procedure for maintaining separate accounting.

There are still many tax innovations that will come into effect on January 1, 2021. Eg:

- the obligation to restore VAT during reorganization if the successor applies a special regime or begins to use the received property, goods, work, services in non-VAT taxable activities;

- the obligation to use electronic forms of salary reporting 6-NDFL, 2-NDFL, calculation of insurance premiums for companies with a staff of 10 people or more;

- new deadlines and formats for submitting tax reports;

- deadlines for payment of advance payments for transport and land taxes established at the federal level, and others.

All these innovations are unambiguous norms for execution that do not allow for choice of actions or alternative judgments. Therefore, it is necessary to take them into account in the work, but it is not necessary to include them in the accounting policy.

Please note other provisions of existing accounting policies. It is possible that some of the elements have lost their relevance, while others do not take into account the changes that have occurred in the structure of the company or the peculiarities of doing business. Some accounting methods require simplification, while others require replacement to achieve optimal results.

This may concern:

- working chart of accounts;

- inventory procedure;

- methods for valuing assets and liabilities;

- list of direct expenses;

- methods of maintaining separate accounting, if such an obligation is provided;

- benefits for which you have the right to apply and other solutions for organizing accounting.

If you create reserves in accounting and tax accounting, do not forget to take inventory of them as of December 31, 2021. From January 1, 2021, you can refuse to form reserves for tax purposes by reflecting the decision made in your accounting policies.

How is it formed?

The organization is engaged in the formation of accounting policies based on the following factors:

- continuity of work;

- separation of the accounting of the company's liabilities and property from other entities;

- temporary determination of economic activity facts;

- the sequence of its implementation.

It is created at the enterprise by the chief accountant for accounting needs in accordance with the Regulations, and approved by the manager (clause 5 of PBU 1/98, agreed upon by order of the Ministry of Finance of the Russian Federation No. 60n dated December 9, 1998).

The policy applies to the work of all structural divisions of the company and employees, who must comply with all conditions. Therefore, its approval is carried out by issuing a separate order, and all interested structural departments and officials take part in it. If necessary, development can be additionally carried out by third-party consultants invited under a contract.

This documentation is developed at all enterprises and does not depend on the means of investment and forms of ownership. The accounting methods that the company has chosen have been used since the beginning of the year after the release of organizational and administrative documentation. They should be used by all structural units.

In accordance with the approved plan, the organization independently develops a working chart of accounts; from all the accounts it can select the necessary ones and enter other synthetic accounts with free codes.

The company independently selects the form of accounting (simplified, journal-order, etc.), a list of accounting registers, their phasing, construction and methods of recording in them. A system of internal production reporting, accounting and control is independently developed in accordance with the peculiarities of functioning and production management standards.

The form of the policy is not regulated by regulations, so it can be stated in an order. May have a text format with highlighted items in a table or other form. The most suitable document is in the form of a table . The accounting policy agreed upon in the order is an independent completed documentation with a unique form and structure that corresponds to the purposes of its creation.

Thanks to the tabular form, the document becomes more structured with references to standards that justify the chosen method of accounting. In this case, certain sections of the paper corresponding to certain directions or objects are graphically highlighted. This makes it easier for specialists to use it in their daily work.

It should include applications, including document flow, external accounting forms, and a working account plan.

There may also be applications in the form of additionally created primary accounting documents, detailed technologies of developed accounting methods, etc. But at the same time, the policy remains official documentation and can be requested during inspections and court proceedings.

And more useful for an accountant

How not to be responsible for someone else's mistake

On July 26, 2021, an addition was made to the accounting law that all employees of the organization are required to comply with the requirements of the chief accountant (or the person responsible for accounting) regarding the execution and submission of primary accounting documents.

The accountant must submit a request to eliminate the identified violation or the need to submit certain information to the accounting department in writing to the employee.

In the accounting policy for 2021, the accountant should use this opportunity: fix this condition, approve the form (form) of the chief accountant’s written request to the employee, prescribe the procedure for issuing such requirements, the deadlines for their implementation, responsibility and other conditions.

All documents and information go to the accounting department!

In 2021, to be honest, I was surprised by the negative judicial practice, which confirmed the legality of holding an accountant liable for failure to record primary documents on new objects and operations that he did not even know about. True, the decision of the Krasnoyarsk Regional Court No. 7Р-116/2019 dated March 14, 2019 concerns a budgetary organization, but every accountant should take precautions.

To do this, it is worthwhile to prescribe in the accounting policy - in addition to the company's existing document flow regulations - the procedure for the company's employees to notify the chief accountant of all transactions with new accounting objects: forms of accounting documents, deadlines for their submission and responsibility.

About the closed list of accounting registers

In the accounting policy, it is advisable to approve a closed list of accounting registers for accounting. Which can be - at your discretion - concise and short. And consist, for example, of the general ledger, sales ledger, purchase ledger and balance sheets for accounting accounts (list them).

This can be a great help in not having to submit a ton of documents for the unlimited demands of the tax authorities.

Taking into account the provisions of the accounting policy, tax authorities can request only those accounting and tax registers that are maintained in the prescribed manner. This is what the state tax policy regulator, the Ministry of Finance, thinks so (letter dated May 11, 2010 No. 03-02-07/1-228).

You should not indicate in your accounting policy a link only to the accounting program: 1C or other software packages. You understand that a great variety of accounting forms and transcripts can be generated and downloaded from the database according to any requests of the inspectors. Save your time.

Innovations in PBU

Please note the updated versions of PBU 13/2000, PBU 16/02 and PBU 18/02 and the FSBU standard 25/2018 “Lease Accounting”.

FAS 25/2018 comes into force in 2022, but if the company decides to apply it ahead of schedule from 2021, this should be stated in the accounting policy for accounting.

About the annual report

Pay attention to the new accounting forms. And according to the order of the Ministry of Finance dated April 19, 2021 No. 61n.

Lines about the audit of the annual reports have been added to the balance sheet - if the audit of the annual report is mandatory for the company, a check mark is placed and information about the auditor is indicated.

In the balance sheet and financial results report, you cannot indicate data in millions of rubles, but only in thousands of rubles.

Updated financial reporting forms are applied starting with reporting for 2021. But the company has the right to decide to use them earlier, consolidating changes in accounting policies.

Starting from 2021, annual reports do not need to be submitted to Rosstat. If this condition was specified in the accounting policy, it should be excluded in the new edition.

What it is?

An optimally selected accounting policy affects the size of the cost of goods, profits, taxes and the company’s budget criteria. That is, it is considered the most important tool for creating a certain volume of main indicators of the work process, planning taxes and prices .

Without studying it, a comparative analysis of the organization’s performance criteria for different periods or with other companies is not allowed. Accounting policy is a set of fundamental accounting methods that a company chooses in accordance with business conditions.

Its main goal is the maximum reflection of the enterprise’s activities, the formation of reliable, complete and objective information for effective regulation.

The correct choice of policy will allow the organization to regulate work processes, increase the efficiency of using its own resources, reduce the risk of errors, protect itself from claims from regulatory authorities, make transparent reports and make business attractive.

Here you can find this documentation

For it to be effective, a systematic approach and detailed analysis of accounting and tax legislation are required. Taking into account the amount of materials, the specifics of Russian tax laws and the practice of their use, developing documentation requires a lot of effort and time.

You can watch the basic principles and methodology for drawing up the document in the following video:

About changes in accounting policies in the middle of the year

The accounting policies developed when the company was founded are applied consistently from year to year. During the year, changes and additions can be made to the accounting policy for tax purposes only in two cases:

- if new operations have appeared or you have mastered a new type of activity;

- if amendments to the legislation are made during the year.

There are no other opportunities to change previously established accounting methods in the middle of the year by tax law.

Rules revised at will can be applied only from the new year. And approve them before it starts - before December 31.

For accounting purposes, the reasons for changes in accounting policies during the year are similar. There are three of them:

- when the legislation of the Russian Federation on accounting, federal or industry accounting standards changes;

- when developing or choosing a new method of accounting, the use of which leads to improved quality of information;

- when there is a significant change in the operating conditions of an economic entity (for example, reorganization, change in types of activities, etc.).

Accounting info

In Russia, a four-level system of regulatory regulation of accounting has developed:• first level – the Law “On Accounting”, other federal laws, decrees of the President of the Russian Federation and resolutions of the Government of the Russian Federation on accounting issues;

• second level – Accounting Regulations;

• third level – guidelines, instructions, recommendations and other similar documents of the Ministry of Finance of Russia;

• fourth level – internal documents of a specific organization.

The first three levels of the system are the prerogative of the state.

The fourth level is formed by the organization based on the specifics of its business.

The inclusion of internal documents of an organization in the regulatory system does not mean complete freedom of the organization in developing the content of these documents and the procedure for their adoption. The state controls this process through its reflection and disclosure in regulations governing accounting and financial reporting issues in the Russian Federation.

As the main document of the fourth level, regulatory documents consider the accounting policy of the organization.

According to paragraph 3 of Art. 5 “Regulation of Accounting” of the Law “On Accounting”: “...organizations, guided by the legislation of the Russian Federation on accounting, regulations of bodies regulating accounting, independently form their accounting policies based on their structure, industry affiliation and other features of their activities "

Provision PBU 1/98 “Accounting policy of an organization” (approved by Order of the Ministry of Finance of Russia dated December 9, 1998 No. 60n) is a fundamental regulatory document that should guide an organization when forming and disclosing its accounting policy.

The regulation includes four sections:

I. General provisions;

II. Formation of accounting policies;

III. Disclosure of accounting policies;

IV. Change in accounting policy.

In accordance with PBU 1/98, the accounting policy of an organization is understood as the set of accounting methods adopted by it - primary observation, cost measurement, current grouping and final generalization of the facts of economic activity.

Accounting methods include:

• techniques for organizing document flow,

• methods of using the accounting register system,

• methods of information processing,

• techniques for organizing inventory,

• methods of using accounting accounts,

• methods of grouping and assessing facts of economic activity,

• methods of repaying the value of assets,

• other methods and techniques.

When forming an accounting policy on a specific issue of maintaining and organizing accounting, one chooses one of the methods allowed by the legislation and regulations governing accounting in the Russian Federation.

The organization's accounting policies must meet the requirements of completeness, prudence, priority of content over form, consistency and rationality.

Organizations are independent in forming accounting policies. However, this independence must be deliberately limited in order to develop accounting methods that allow for the effective exchange of reporting information, for example, within a group of organizations.

The composition of participants in the process of developing accounting policies (chief accountant, company management, methodologists and employees of functional services, internal and external consultants) depends on the size of the organization.

When involving consultants in the development of accounting policies, it is necessary to carefully approach the formulation of the terms of the contract and determine the scope of the consultant's services and responsibilities.

Establishing the responsibility of the manager for organizing accounting and compliance with the law when performing business transactions (clause 1, article 6), the Law “On Accounting” names the chief accountant of the organization as the person responsible for the formation of accounting policies (clause 2, article 7 ). At the same time, the Law “On Accounting” defines the organization itself as the subject of the process of forming accounting policies without specifying any specific officials (clause 3 of article 5). In accordance with paragraph 3 of Art. 6 the adopted accounting policy is approved by order or order of the person responsible for the organization and state of accounting (i.e., based on the norm of paragraph 1 of Article 6 - the head of the organization).

Thus, in accordance with the Law “On Accounting”:

• the organization forms accounting policies;

• the chief accountant is responsible for the formation process;

• the manager approves the adopted accounting policy and is responsible for its content (since he is generally responsible for the organization of accounting and compliance with legislation when carrying out business transactions).

The norm of legislation on accounting policies imposes great responsibility on the head of the organization and the chief accountant and requires good knowledge of the methodology and organization of accounting, taxation, finance and other issues.

If the organization does not have an accounting department or a full-time accountant, such a person may be the head of the organization, since the Law “On Accounting” entrusts him with full responsibility for organizing accounting.

The text of PBU 1/98 includes the norm of the Law “On Accounting” and the Regulations on Accounting and Financial Reporting in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n) regarding the list of issues approved during the formation of accounting policies. These include:

• working chart of accounts, containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

• forms of primary accounting documents used to document facts of economic activity, for which standard forms of primary accounting documents are not provided

• forms of documents for internal accounting reporting;

• the procedure for conducting an inventory of the organization's assets and liabilities;

• methods for assessing assets and liabilities;

• document flow rules and technology for processing accounting information;

• the procedure for monitoring business operations;

• other issues whose solution is necessary to organize accounting.

Thus, conditionally, the entire set of issues resolved with the help of accounting policies can be divided into methodological and organizational-technical.

Methodological issues of an organization's accounting policy affect the procedure for generating the financial results of the organization's activities and the assessment of its financial condition.

Organizational and technical issues of an organization's accounting policy include techniques and methods for organizing the technological process of the accounting and financial service of an enterprise, aimed at successfully completing the tasks facing the information system that ensures the process of making economic decisions.

The most difficult, perhaps, is the problem of resolving disputes when making decisions on choosing one or another method of accounting. The choice of a specific option can significantly affect the volume of accounting work and the division of responsibility for certain accounting processes.

We can talk about the timing of the formation of accounting policies only in relation to newly created organizations.

All other organizations, that is, organizations that exist for more than one reporting period, were required to formulate an accounting policy in the reporting period for which the first financial statements were presented. The accounting policy adopted by the organization must be applied consistently from year to year, undergoing changes only in cases established by law (clause 4 of article 6 of the Law “On Accounting”).

Thus, “old” organizations can only talk about changes or additions to previously formed accounting policies, even if its content is changed by 100%.

The deadlines for the formation and execution of accounting policies are established in paragraph 10 of PBU 1/98: “A newly created organization draws up its chosen accounting policies in accordance with this paragraph before the first publication of financial statements, but no later than 90 days from the date of acquisition of the rights of a legal entity (state registration) . The accounting policy adopted by the newly created organization is considered to be applied from the date of acquisition of the rights of a legal entity (state registration).”

All decisions made by the organization are necessarily enshrined in the order on accounting policies (clause 3 of article 6 of the Law “On Accounting”).

Order on the accounting policies of organizations for 2007. must be dated no later than December 31, 2006, that is, no later than the accounting period from which the accounting policy is put into effect.

Taxpayers must have at least two provisions on accounting policies: “Accounting policies for accounting”, “Accounting policies for taxation”.

Accounting policies for accounting.

Accounting policies are developed as a whole as a strategy for the accounting process for an organization with the need to maintain consistency in its application. Through the accounting policy, it is necessary to prescribe, for example, how to calculate depreciation: using the straight-line method or the reducing balance method, this is a set of issues that determines the system for maintaining the accounting process in the organization, which is formed and developed throughout the year.

The corresponding organizational and administrative documentation that formalizes the accounting policy in the organization for accounting may contain the following sections.

1. Organization of the accounting department. Organization of document flow. Accounting register system. The organization independently establishes the organizational form of accounting work, based on the type of organization and specific business conditions. The organization of the accounting service includes the rights and responsibilities of the chief accountant (or the accountant performing his functions), the procedure for interaction of the accounting service with other services, the organizational structure of the accounting department, etc.

2. Accounting system and methods of processing accounting information. Today, the most common accounting system is using software using a journal of business transactions with continuous numbering of the latter.

3. Organizing an inventory of property and monetary obligations. Inventory is a physical count of the company’s assets and reconciliation of its liabilities.

The number of inventories in the reporting year, the dates of their conduct, the list of property and liabilities checked during each of them are established by the head of the organization, except in cases where an inventory is required.

4. Methods of using accounting accounts. When maintaining accounting records, organizations are guided by the Chart of Accounts for accounting the financial and economic activities of organizations (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

This Chart of Accounts is typical. The head of the organization approves the Working Chart of Accounts, which contains the accounts used in the organization and necessary for maintaining synthetic and analytical accounting. At the same time, the content of individual subaccounts (second-order accounts) is clarified, subaccount data is excluded or combined, and additional subaccounts are introduced.

5. Method of calculating depreciation of fixed assets. Depreciation of fixed assets can be carried out in one of the following ways: linear; write-off of cost in proportion to the volume of insurance services provided; reducing balance; write-off of cost based on the sum of the numbers of years of useful life.

Moreover, the last three methods are applied to fixed assets put into operation since 01/01/1998.

6. Method of paying off the cost of MBPs in operation.

7. List of intangible assets and depreciation rates for them. Depreciation on intangible assets is accrued monthly at rates determined by the organization based on the established useful life established by the organization independently.

8. List of deferred expenses and deadlines for their write-off. Expenses incurred in the reporting period, but related to the following reporting periods, are reflected in the statements as deferred expenses and are subject to write-off to the cost of insurance services (or to the appropriate sources of funds of the organization) during the period to which they relate.

9. Other sections of accounting policies. Any organization may provide for other sections of accounting policies predetermined by the Regulations on Accounting and Financial Reporting in the Russian Federation, the Accounting Regulations “Accounting Policy of an Enterprise” (PBU 1/98) and other regulatory documents.

So, for example, if an organization has branches, then the accounting policy must provide for a system for organizing work with branches (deadlines for submitting accounting/financial reports to the parent company, a system for monitoring the activities of branches, their accounting work, etc.).

The organization must disclose the accounting methods adopted when forming its accounting policies, which significantly influence the assessment and decision-making of interested users of the financial statements.

Accounting methods are considered essential, without knowledge of the application of which by interested users of financial statements it is impossible to reliably assess the financial position, cash flow or financial results of the organization.

Issues of changing accounting policies require special attention. The fact that in PBU 1/98 a separate section is devoted to them is evidenced by how significant these issues are at the present time.

PBU 1/98 (clause 16) specifies the norm of clause 4 of Art. 6 of the Law “On Accounting” and provides for the following cases in which the accounting policy of an organization may be changed:

• changes in the legislation of the Russian Federation or regulatory acts on accounting;

• development by the organization of new methods of accounting. The use of a new method of accounting requires a more reliable representation of the facts of economic activity in the accounting and reporting of the organization or less labor intensity of the accounting process without reducing the degree of reliability of the information;

• significant change in operating conditions. A significant change in the operating conditions of an organization may be associated with reorganization, change of owners, change in types of activities, etc.

As you can see, the list of possible options for changing the operating conditions provided for by PBU 1/98 is not closed.

PBU 1/98 (clause 16) defines: “It is not considered a change in accounting policy to approve the method of accounting for facts of economic activity that are essentially different from facts that occurred previously, or that arose for the first time in the organization’s activities.”

This means that an organization can make additions to its accounting policies as new facts of economic activity that have not taken place before arise, rather than trying to “guess” all possible operations that the organization will carry out in the future when forming an accounting policy.

Changes in accounting policies are documented in the relevant organizational and administrative documentation in the same manner as the accounting policies are drawn up when adopted (clause 17 of PBU 1/98).

Accounting policy for tax purposes.

Just a few years ago, many organizations did not formulate accounting policies for tax purposes at all as a separate document. Some elements of such a policy were part of the company's unified accounting policy. There, at the same time, there were both applicable accounting rules and rules regarding the procedure for calculating and paying certain types of taxes.

Everything changed dramatically after Ch. 21 “Value added tax” and 25 “Tax on corporate profits” of part two of the Tax Code of the Russian Federation.

The text of these chapters directly contains a requirement to formulate a special accounting policy for tax purposes.

However, this does not mean that the organization should limit itself only to drawing up an accounting policy for value added tax (VAT) and corporate income tax. The Tax Code of the Russian Federation contains quite a lot of other issues that require the company to choose one or another course of action.

Consequently, an accounting policy for tax purposes is a document in which the taxpayer is obliged to prescribe all the rules and methods that he intends to follow when calculating and paying taxes and fees.

In this case, an organization can choose one of two options for drawing up tax accounting policies:

1) reflect individual issues for each tax in the relevant sections of the single order on tax accounting policy;

2) draw up separate accounting policies for each tax and approve them as appendices to the order on accounting policies for tax purposes.

Accounting policies for tax purposes should reflect three main points.

Firstly, this is the organizational and technical part:

• organization of tax accounting: by accounting employees, by creating a separate specialized unit, outsourcing (involving a specialized third-party organization to perform certain types of work), etc.;

• development of a tax register system for calculating corporate income tax;

• development of a document flow system for filling out tax registers, etc.

Secondly, and this is the most important part of the tax accounting policy, it must record the organization’s choice of tax legislation, the right to choose which belongs to the taxpayer. For a number of issues regarding taxation procedures, legislation provides the right to choose an accounting method from several possible options.

Thirdly, on some important issues of tax calculation, tax legislation is either absent altogether or is explained so vaguely that it requires additional clarification in the company’s tax accounting policy.

The latter is very important for relations with the tax office. A correctly drawn up accounting policy for tax purposes will help avoid many controversial situations. If suddenly a dispute with the tax authority goes into court, then in court the tax accounting policy of the organization will serve as a serious argument in its favor.

However, when developing an accounting policy, the taxpayer does not need to provide rules for all possible cases.

When developing an accounting policy, it is necessary to proceed from the situation in which the organization actually finds itself, to determine the immediate prospects for its activities and, on this basis, to highlight those issues that should really be reflected in the document being drawn up.

The obligation to draw up and adopt tax accounting policies is enshrined in several chapters of part two of the Tax Code of the Russian Federation:

• art. 167 ch. 21 “Value added tax”;

• art. 313 ch. 25 “Organizational profit tax”;

• clause 2 of Art. 339 ch. 26 “Mineral extraction tax”;

• clause 16 art. 346.38 ch. 26.4 “Taxation system for the implementation of production sharing agreements.”

There is no uniform procedure for drawing up accounting policies for tax purposes in our legislation. Therefore, in ch. 21 “Value added tax” and in chap. 25 “Corporate Income Tax” contains various instructions for approving accounting policies. Other chapters of the Tax Code of the Russian Federation do not contain anything specific about tax accounting policy in their text.

Theoretically, for tax purposes, it is not necessary to draw up a new accounting policy every year. Indeed, in tax accounting, as in accounting, the principle of consistency of accounting policies is applied. Once adopted, an accounting policy is applied until changes are made to it, that is, it must be applied for a long time. However, in practice this is almost impossible. The fact is that our tax legislation changes with such alarming frequency that sometimes it is easier to approve a new tax accounting policy than to make changes to the old one.

By the way, it is very important to take into account that the tax accounting policy is uniform for the entire organization and is mandatory for all its divisions - both existing ones and those that will be created in the future. With regard to VAT, this rule is directly enshrined in clause 12 of Art. 167 Tax Code of the Russian Federation.

In most cases, the structure of a company's tax accounting policy consists of two sections.

The first section describes general issues related to taxation.

1. The procedure for organizing tax accounting is indicated. To begin with, indicate which department will deal with this issue: accounting or a specialized service. Often, it is a separate department that has to deal with tax accounting problems, since now accounting and tax accounting have been divided into two systems that are no longer very similar to each other.

2. Issues of interaction with separate divisions of the organization are reflected. In particular, as stated in Art. 26 of the Tax Code of the Russian Federation, a taxpayer can participate in relations regulated by legislation on taxes and fees through his legal or authorized representative. Such a representative for an organization may be its separate division. On this basis, a number of taxes can be calculated directly in a separate division. At the same time, the tax base necessary for the calculation is formed there. But with such an organization of tax accounting, it is necessary to prescribe the procedure for transferring all necessary information from a separate division to the parent organization and back. Thus, the tax accounting policy should fix the deadline for submitting information to the head office for the preparation of consolidated accounting for the company as a whole.

The second section should reflect those options for forming the tax base for specific taxes that allow you to choose the current legislation:

• for VAT;

• for corporate income tax;

• for mineral extraction tax;

• for excise taxes;

• for taxation during the implementation of production sharing agreements.

The majority of this section of accounting policy will be occupied by corporate income tax. Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation contains a lot of different opportunities for the taxpayer to independently select elements of tax policy.

Order on accounting policyOrder No. _________ dated ________________On the accounting policy of the organization for 2006 I order to establish the following procedure.1. Accounting is maintained in accordance with Federal Law No. 129-FZ dated February 23, 1996 “On Accounting”, Regulations on Accounting and Financial Reporting in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n), Regulations on Accounting accounting, the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.2. The initial cost of intangible assets is repaid in a straight-line manner based on the norms calculated by the organization based on their useful life (clause 15 of PBU 14/2000 “Accounting for intangible assets”).3. Depreciation charges for intangible assets are reflected in accounting by accumulating the corresponding amounts on account 05 “Depreciation of intangible assets” (clause 21 of PBU 14/2000).4. Fixed assets used by the organization for a period exceeding 12 months, with a cost of no more than 10,000 rubles. per unit, are written off as production costs as they are released into production or operation (clause 18 of PBU 6/01 “Accounting for fixed assets”).5. Depreciation of fixed assets is calculated using the straight-line method (clause 18 of PBU 6/01). Considering that fixed assets are operated in a normal environment, in a normal shift mode, and the organization is created for an indefinite period, the useful life is established when the objects are accepted for accounting within the time limits established for these fixed assets in the Classification of fixed assets included in depreciation groups ( Decree of the Government of the Russian Federation dated January 1, 2002 No. 1).6. Accounting for the process of purchasing and procuring materials is carried out in the assessment at actual cost using account 10 “Materials” (according to the Chart of Accounts and Instructions for its use).7. When releasing inventories into production and otherwise disposing of them, they are assessed at the average cost (clause 16 of PBU 5/01 “Accounting for inventories”).8. Work in progress is valued at the actual production cost (clause 64 of the Regulations on accounting and financial reporting in the Russian Federation).9. Accounting for production costs is carried out by dividing them into direct (collected in the debit of accounts 20 “Main production” and 23 “Auxiliary production”) and indirect (reflected in the debit of accounts 25 “General production expenses” and 26 “General expenses”). At the end of the reporting period, indirect costs are included in the cost of products (works, services) as a result of the distribution: debit of accounts 20 or 23 – credit of accounts 25 or 26 according to ownership. The full actual production cost of products (works, services) is calculated (clause 9 of PBU 10/99 “Organization expenses”).10. Indirect expenses collected in the debit of accounts 25 “General production expenses” and 26 “General operating expenses” are distributed between types of products (works, services) - objects of calculation in proportion to direct wages (wages of main production workers). 11. Costs for the repair of fixed assets are included in the cost of the reporting period in which the repair work was carried out (clause 27 PBU 6/01 “Accounting for fixed assets”, clauses 5, 7 PBU 10/99 “Organization expenses”).12. Selling expenses are recognized in full in the reporting year of their recognition as expenses for ordinary activities (clause 9 of PBU 10/99 “Expenses of the organization”).13. Finished products are valued in the balance sheet at the actual production cost (clause 59 of the Regulations on accounting and financial reporting in the Russian Federation).14. Accounting for the output of finished products is organized without using account 40 “Output of products (works, services)” (Chart of Accounts and Instructions for its use). 15. Goods are reflected in accounting at actual cost, which includes the costs of procuring and delivering goods to central warehouses (bases) until they are put on sale (clause 13 of PBU 5/01 “Accounting for inventories”).16. Long-term debt on received loans and (or) credits is transferred to short-term debt at the moment when, according to the terms of the loan and (or) credit agreement, 365 days remain until the repayment of the principal amount of the debt (PBU 15/01 “Accounting for loans and credits and the costs of servicing them” ).17. A reserve is created for the upcoming payment of vacations to employees (clause 72 of the Regulations on accounting and financial reporting in the Russian Federation).18. A reserve for doubtful debts is created (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation). Director of the enterprise _____________________________________ (signature)

Comments:

- In contact with

Download SocComments v1.3

| Next > |