In August 2021, the Russian Tax Service presented statistics on the payment of transport tax. The largest payment for 2016 was 540,000 thousand rubles, which was awarded to a resident of the capital who owns a Bugatti Veyron 16.4 Super Sport with a power of 1200 hp. But if the car was registered in Dagestan, the payment amount would be 378,000 rubles. Legal instructions 9111.ru will tell you how transport tax is calculated and what can affect its amount.

Independent determination of the tax amount

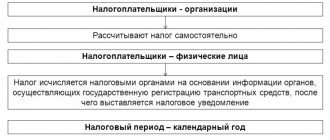

Only legal entities independently calculate the amount of transport tax for themselves. If the owner of the car is an ordinary person, then the amount of transport tax payable for him is calculated by the tax authority. That is, individuals pay transport tax after receiving the relevant document from the Federal Tax Service inspection.

Also see “Transport tax for legal entities: KBK in 2021”.

Next, we will discuss in detail the methodology for determining the amount of tax by enterprises.

If an organization had an expensive vehicle registered in 2021, the accountant, when calculating the transport tax, is obliged to apply an increasing coefficient for the transport tax in 2017 - Kp. As a result, the total amount of tax according to the calculation method is determined for all machines separately.

There is a clear rule according to which the amount of the tax payment is the product of:

- tax base (taking into account the engine power of the car, usually in horsepower);

- tax rates;

- shared ownership of a car;

- coefficient Kv (the ratio of the number of months of owning a car in the reporting year to the number of calendar months in the taxation period (always 12 months))

- increasing coefficient Kp.

Also see “Rules, procedure and formulas for calculating transport tax in 2017”.

Changes in regional legislation.

The basic provisions on accrual rules are reflected in Chapter 28 of the Tax Code of the Russian Federation. But since transport tax is a regional fee, the taxpayer must familiarize himself not only with the Tax Code, but also with the legislation of the subject in which he lives. Regional laws have the right to change rates, the system of benefits, and payment rules for legal entities. Organizations must independently calculate the amount based on available data; individuals pay the amount specified in the notification of the Federal Tax Service.

Each subject of the Russian Federation has adopted a law regulating the amount and procedure of payment.

St. Petersburg can be called one of the regions with the highest rates - from 24 rubles. for a car with power up to 100 hp. up to 150 rub. for powerful models from 250 hp. Almost the same indicators were established in Moscow. The owner of a low-power car pays a tax with a coefficient of 12 rubles, and for power over 250 hp. you will have to pay at a rate of 150 rubles. The lowest numbers were found in the Magadan region and the Nenets Autonomous Okrug.

Residents of the Astrakhan region, Kamchatka Territory, Nenets Autonomous Okrug, and the Komi and Tyva republics faced an increase in rates in 2021. In 2017, an increase occurred in the Pskov and Smolensk regions, as well as in Karelia, Karachay-Cherkessia, Khakassia and Mari El.

Regional laws provide for a number of benefits that exempt the most vulnerable categories of citizens from paying taxes. An approximate list of citizens eligible for benefits:

- Heroes of the USSR and Veterans of the Great Patriotic War;

- persons who participated in hostilities;

- concentration camp victims;

- disabled people of groups 1 and 2;

- persons raising a disabled child;

- one of the parents in a large family;

- victims of nuclear disasters;

- other categories of citizens.

In a number of regions, benefits are provided to citizens who have reached retirement age. Cars up to 100 hp fall under the preferential category. Similar measures have been introduced in the Astrakhan, Belgorod, and Novosibirsk regions. In the Kursk region, the benefit applies only to domestically produced cars. Half of the tax is paid by residents of the Krasnodar Territory, the Republic of Adygea, and the Kostroma Region.

Increase in tax on luxury cars

Since 2014, to determine the amount of tax payment for transport, it is necessary to take into account the Kp coefficient. Using this instrument, the state applies increased taxation on luxury items.

But KP is not calculated for every vehicle registered with a company, but only in situations where the company owns a so-called luxury car.

What do you mean by luxury car? Legislatively, since 2016, cars with the appropriate engine capacity and price exceeding 3,000,000 rubles have been classified as luxury vehicles. At the same time, in addition to the original price at which the car was purchased, it is necessary to take into account the time that has elapsed since the car was manufactured.

According to information from reliable sources, a bill has already been prepared, according to which a vehicle costing over 5,000,000 rubles will be considered luxury.

An increasing transport tax coefficient is used in 2017 if the car meets the following conditions:

- price – not less than 3,000,000 rubles;

- the brand and model are mentioned in the list of the Ministry of Industry and Trade;

- no more years have passed since the date of manufacture of the car than indicated in the list of the Ministry of Industry and Trade.

How to calculate the cost of a car? Before other actions, you need to establish whether your vehicle is on the List of passenger cars with an average cost of 3,000,000 rubles for the tax period for 2021.

This List is prepared and posted on the website of the Ministry of Industry and Trade of Russia. The full list of cars subject to luxury tax in 2021 is published on our website at the following link.

Also, the current list of cars of the Ministry of Industry and Trade, prepared by it for the period 2021, can be viewed and downloaded on our website using the following link.

Please note that for the purposes of calculating transport tax, the list of cars with an increasing coefficient is regularly supplemented. Thus, in 2016, the list of the model range consisted of more than 700 types of cars, and for 2021 there are already more than 900 positions.

Also see “List of the Ministry of Industry and Trade of expensive cars in 2021.”

How to calculate the ownership coefficient for transport tax

Organizations calculate the increased tax on their own, and Federal Tax Service employees do this for private citizens, sending vehicle owners notifications with the accrued amount. But, in order to avoid erroneous taxation, private owners of expensive cars can independently double-check this amount. To do this, you can use the calculator available on the Federal Tax Service website to calculate the amount of the fee, taking into account the transport tax coefficient .

The car owner can also make calculations himself using the following formula:

Tn = Tp x Kp , where Tn is the amount of the transport tax “for luxury”, Tp is the general base rate, Kp is the value of the increasing coefficient applied to this model.

Determining the operating time of a vehicle

In the List you can find references to the number of years from the date of manufacture of the machine (column No. 6). After the end of such a period, the vehicle, as it were, acquires the status of a “budget” car. That is, the Kp coefficient is no longer used when determining the amount of transport tax.

How to determine the period of operation of a vehicle? Thus, for the purposes of the Kp coefficient, which increases the amount of payment, the time from the moment of manufacture of the car is calculated taking into account the registered date of manufacture of the car (including it).

If it is necessary to apply a differentiated rate (clause 3 of Article 361 of the Tax Code of the Russian Federation), the lifetime of the machine is counted from the year following the date of manufacture of the vehicle. This rule does not apply to the application of the Kp coefficient.

EXAMPLE

When calculating transport tax using the increasing coefficient Kp for 2021 for a car priced from 3 to 5 million rubles, manufactured in 2014, the period that has passed since the production of this vehicle is 4 years. Taking into account the calculation methodology, from 2017 the Kp coefficient does not need to be applied to this vehicle.

Taking into account the above, when determining the time from the date of manufacture of the car, you need to end with the year for which the tax is applied. It is this approach that is confirmed by the explanations of the tax authorities, based on the Tax Code (letter of the Federal Tax Service dated March 2, 2015 No. BS-4-11/3274).

Also see “Kv coefficient in the declaration of legal entities for transport tax in 2017”.

If the car is not in the List

What should you do if the car on which you need to pay transport tax is not included in the document regulating the application of the increasing coefficient Kp? In this situation, you need to calculate the average cost of the vehicle yourself.

For correct calculation, the Russian Ministry of Industry and Trade has approved the Methodology for calculating the average cost of passenger cars. The option for determining it depends on the territorial location of the dealer or car manufacturer. That is, they take into account the stationary location of the point of sale of the car - on domestic territory or abroad:

- If the point of sale of the vehicle is located in Russia, the dealer/manufacturer provides information on the recommended retail selling prices of the vehicle.

- In the second case, data is taken from automobile catalogs - “Audatex”, “DAT”, “Kelley Blue Book”, “Mitchel”, “Motor”, “Canadien Black Book”, “Schwacke”.

Tax × 3

What should be done if the car is included in the List of transport tax vehicles with an increasing coefficient, costs more than 3,000,000 rubles and its operating time is longer than those established by the Tax Code of the Russian Federation and the List of the Ministry of Industry and Trade of standards for applying the increasing coefficient Kp?

In such a situation, the payment amount must be adjusted to a coefficient. There are 5 types in total. Each depends on the year the car was made and its price.

The minimum percentage increase in payment is 10. In the case of a maximum increase, the tax will triple (see table below).

| Year of manufacture of the car and transport tax | ||||||

| Car price (million rubles) | Coefficient based on the number of years from the year of manufacture of the passenger car | |||||

| Up to 1 year | From 1 to 2 years | From 2 to 3 years | Up to 5 years | Up to 10 years | Up to 20 years | |

| From 3 to 5 | 1.5 | 1.3 | 1.1 | |||

| From 5 to 10 | 2 | |||||

| From 10 to 15 | 3 | |||||

| From 15 | 3 | |||||

Results

An increasing factor for transport tax is applied if the car is indicated in the list of the Ministry of Industry and Trade and the period of use of the car does not exceed the period established in the Tax Code of the Russian Federation for the purposes of applying the increasing factor.

List of expensive cars with an average cost of over 3 million rubles. updated annually on the website of the Ministry of Industry and Trade no later than March 1. If the vehicle is not on this list, the increasing coefficient does not participate in the calculation of transport tax.

The deadlines for payment of transport tax for legal entities and advance payments for it are determined in relation to organizations by the laws of the constituent entities of the Russian Federation that have established this tax on their territory (clause 1 of Article 363 of the Tax Code of the Russian Federation).

So, for example, in Moscow, organizations do not pay advance payments for transport tax. And the total amount of the annual transport tax 2021 for legal entities in Moscow must be transferred no later than February 5 of the following year (Clause 1, Article 3 of Moscow Law No. 33 dated 07/09/2008).

But in the Moscow region, organizations must pay advance payments for transport tax no later than the last day of the month following the end of the quarter, and the tax at the end of the year - no later than March 28 of the next year (clause 1 of article 2 of the Law of the Moscow region of November 16, 2002 No. 129/2002-OZ).

Quarterly tax calculation

As a rule, enterprises are required to determine the transport tax every quarter, also applying the adjustment coefficient Kp.

For example, in 2014, the KP was applied exclusively to the annual amount of transport tax. All quarterly payments were calculated without applying a corrective increasing factor. But starting from 2015, it must also be used when calculating tax advances.

In the process of filling out the main transport tax report, the coefficient Kp is indicated in line 180 of Section 2. Its value is taken from the table we provided above.

Also see "Transport Tax: Advance Payments in 2021."

Read also

19.06.2017