In practice, the dismissal of an employee is accompanied by a number of payments, the taxation procedures of which vary. All payments that an employer pays to an employee on its own initiative are subject to personal income tax in full. But for most payments that the employer makes upon dismissal in connection with the requirements of the law, including regional and local, an exemption is provided within three (for employees of the Far North and equivalent areas - six) average monthly earnings (clause 3 of Article 217 of the Tax Code of the Russian Federation) . We are talking, for example, about such payments as severance pay, retained average earnings, compensation to the manager (Articles 178, 181 of the Labor Code of the Russian Federation).

Therefore, when paying certain amounts to a resigning employee, it is important to understand whether the payment is provided for by law, and if so, whether its amount does not exceed the established limit, above which tax must be paid. An exception is compensation for unused vacation, which, although provided for by law, is subject to personal income tax in full, regardless of the amount (clause 3 of Article 217 of the Tax Code of the Russian Federation). Please note that the procedure for withholding and transferring personal income tax for all payments upon dismissal is standard: tax is withheld upon actual payment and transferred to the budget no later than the day following the day of payment to the employee.

Amount of benefit at the labor exchange

In each individual case, temporarily unemployed citizens may receive a different amount of compensation payments.

The amount of the benefit depends on:

- Average income at previous place of employment;

- The duration of the period between dismissal and registration;

- Duration of registration for unemployment.

When calculating benefits, the average earnings of the unemployed for the last quarter of official work are taken into account. Data on past wages must be provided to the labor exchange in a special certificate, which will indicate not only the amount of the salary, but also the dates of hiring and dismissal.

If you are dismissed due to a disciplinary offense, the amount of benefits will be reduced. The percentage by which payments will be reduced is set individually, taking into account the severity of the violation and the scale of the damage.

If the unemployed person has not previously been employed or the time interval between dismissal and registration exceeds a year, he will be assigned the minimum benefit rate, without taking into account past wages.

The longer a citizen maintains his unemployed status, the lower his payments. In the first three months, an unemployed person can receive up to 75% of their previous salary.

Expert opinion

Korolev Konstantin Georgievich

Practicing lawyer with 7 years of experience. Specialization: criminal law. More than 3 years of experience in document examination.

In the future, the amount will be reduced to 60% from the fourth to seventh months of being on the labor exchange. For ordinary citizens, the period for receiving benefits is 6 months.

Pre-retirees from the eighth month to a year can receive an amount not exceeding 40% of their previous salary.

If the temporarily unemployed period lasts more than a year, the citizen will receive the minimum rate of employment center benefits.

Important. As of 2021, the minimum unemployment benefit is 1,500 rubles.

Preferential conditions for being registered and increased benefits are provided for:

- Pregnant women fired due to the closure of the enterprise. They are provided with compensation payments of 100% of their previous salary until they go on maternity leave.

You can find out how much benefit you will receive before registering. To do this, you can use an online calculator:

To accurately calculate unemployment benefits, use the online calculator

Maintained earnings during employment in case of layoff

A dismissed employee is entitled to all redundancy payments. Maintained earnings during employment during layoffs is a special payment that is established for all employees who were laid off and lost their jobs at the initiative of the employer. There is a difference between retained earnings and severance pay, even regardless of the total amount of funds.

Payment procedure

According to Article 178 of the Labor Code of the Russian Federation, the employer must pay the employee, after reduction, severance pay and average monthly earnings for the period of job search. The paid search period is two or three months. For a number of categories of citizens, the deadlines will be individual. There are preferential conditions in the area, for example, the Far North, which allows you to have a maximum monthly salary of six times rather than three times.

Based on the wording of the legislative acts, it becomes clear that the payment of severance pay is included in the offset of the required maximum three times the amount. In the usual version, severance pay is initially paid in conjunction with the calculation upon dismissal.

It is included in the first month of job search. A month after contacting the manager, a second payment can be paid, which is considered retained earnings. The third payment is also a salary that is saved for the period of new employment.

There are two options for issuing saved earnings. This can be either a one-time payment of severance pay and a second payment of earnings, which is retained without fail, or in a monthly form. It is worth considering that in order to receive financial compensation during the period of employment, you will need to contact the employer in the form of an application. You will also need to provide your work record book and a photocopy of it.

Sample entry in the work book about dismissal due to reduction

There should be no new employment.

If a third payment is required, all conditions must be met:

- go to the labor exchange immediately after being laid off and not be employed;

- have in hand documents that regulate the absence of work;

- obtain permission from an employment center employee;

- write an application for a third average monthly salary addressed to the former manager and provide all the necessary documents;

Sample application for payment of unemployment benefits for the third month

- after this, payment is made in accordance with the salary day.

Payment terms are not strictly required, but the form of payment is monthly. For example, if a former employee brought an application at the beginning of the month, then the manager can either issue the funds immediately or make the payment in accordance with the salary schedule. But this payment must be made within this period, since otherwise the employee may hold the former manager liable and receive additional compensation.

If necessary, payment terms can be discussed with the manager individually. But the best option would be to formalize the agreements in writing.

Features of saved earnings

The salary retained by the employee during the period of job search has a limited period of two or three months. In some cases, the duration can reach six months. Also, earnings have several features that will have to be taken into account when making reductions, as well as payments:

- payments cease upon employment. For example, if a former employee received a payment and got a new job, then there will be no further accrual;

- Mandatory payments must be made either immediately or as applications from laid-off workers are received. More often, employers make one-time payments, since after this there is less possibility of being held liable in the future for missing a due payment or similar actions;

- if the required average retained earnings are not paid, the employee may demand payment through the court. He also has the right to moral compensation. In addition to additional costs for the employee, the employer may receive sanctions from both the court and the labor inspectorate;

- retained earnings are calculated based on the average monthly salary option. If there is a collective agreement, the amount of compensation may be significantly greater, since it is already established in accordance with the agreement;

- retained earnings are paid in all cases of reduction, but for this it is necessary to record in the employment record that the employee was actually laid off and not dismissed for another reason.

The number of payments may also depend on the category of employees, for example, pensioners after a layoff are paid only double the amount of compensation based on average earnings, and not triple. Some categories of retained earnings are not paid at all. For example, after being laid off, seasonal workers are paid two weeks' wages and all payments stop there.

.

Calculation of severance pay and further payments is made immediately before dismissal. This is due to the fact that the severance pay paid is the same amount as the retained earnings. The difference only appears if there are additional days off in the paid month.

Those being laid off are given severance pay to find a new job. Also, for the period of new employment (two or three months), retained earnings are paid, which is the second part of the redundancy compensation. The amount of monthly earnings is individual for each employee and is calculated separately if there is no amount established by the collective agreement.

Source: https://u-volnenie.ru/posts/sokrashhenie/sohranyaemyj-zarabotok-na-vremya-trudoustrojstva-pri-sokrashhenii

Are taxes withheld from unemployment benefits?

I am an orphan. How much income tax is withheld from my unemployment benefits? I'm currently being charged 20%. Is this legal?

According to the general rule (clause 1 of Art.

210 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation)), when determining the tax base for personal income tax (hereinafter referred to as personal income tax), all income of the taxpayer received by him both in cash and in kind, or the right to dispose of which he has, is taken into account. it arose, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation.

However, in Art. 217 of the Tax Code of the Russian Federation contains a list of income that is not taxed. These include, in particular, unemployment benefits.

- failure to appear without good reason for employment negotiations with the employer within three days from the date of referral by the employment service;

- refusal without good reason to appear at the employment service to receive a referral to work (training).

The above may cause your benefits to be reduced.

Unemployment benefits are paid subject to strict conditions, which are verified by the Employment Centre. The size of the benefit is small, and the Russian Government justifies its size by encouraging citizens to find a job faster, rather than live on state benefits. Is it really necessary to pay income tax on this small amount?

Average monthly earnings for the period of employment, personal income tax

For the site to work correctly, you must enable JavaScript support in your web browser settings. If your question concerns the activities of legal entities, you can ask it in the new PPT project for solving accounting and legal business issues. Nastya June 2, 2015 09:00

print closed question Hello, is retained earnings during employment subject to personal income tax if the second month is laid off? The question relates to the city of the Republic of Bashkortostan Subject: Answers: June 2 11:22 The amounts of severance pay and average earnings for the second and third months after dismissal are not subject to personal income tax.

If the amount of payments upon dismissal exceeds three times the average monthly earnings, then these payments are subject to personal income tax in the amount that generally exceeds three times the average monthly earnings (). |

- 19:56 23/12 Hosta

replies: - 17:56 5/12 Olga

replies: - 18:21 17/05 Galya

replies: - 11:19 17/05 Svetlana

answers: - 20:36 23/03 Tatyana

answers: - 00:58 22/06 Svetlana

answers:

Email Password is someone else's computer

PPT.RU - Power.

Right. Taxes. Business

- Made in St. Petersburg

© 1997 - 2021 PPT.RU Full or partial copying of materials is prohibited; with agreed copying, a link to the resource is required. Your personal data is processed on the site for the purpose of its functioning.

Class

Legal advice Help from experienced lawyers and attorneys Expert advice Solving accounting and legal issues in the professional community Best specialists More than one answer You can ask a question for free here and now Personal question from a private person (labor disputes, social services)

persons

Personal income tax from severance pay in case of staff reduction

In addition, by agreement between the parties, the employer has the right to make any compensation payment to the dismissed person, the maximum amount of which is not limited by labor legislation.

The collective agreement establishes that upon termination of employment relations under clause.

2 tbsp. 81 of the Labor Code of the Russian Federation, the dismissed person is paid severance pay in the amount of three average monthly earnings, which in this case is 75,000 rubles.

Payment of average earnings for the period of employment to employees upon dismissal

On line 030, reflect the amounts of accrued payments and rewards in favor of individuals (p.

1 and 2 tbsp. 420 of the Tax Code of the Russian Federation). Be careful: do not reflect payments that are not subject to insurance premiums under paragraphs 4–7 of Article 420 of the Tax Code of the Russian Federation in line 030. For example, there is no need to show payments under sales or lease agreements in the calculation (letter of the Federal Tax Service of Russia dated August 8, 2021 No. GD-4-11/15569).

The same applies to an agreement on the alienation of the exclusive right to works of science, literature, art, a publishing license agreement, a license agreement on granting the right to use a work of science, literature, art (clause 8 of Article 421 of the Tax Code of the Russian Federation)

Is severance pay subject to personal income tax?

severance pay in the amount of 80,000 rubles was paid. The average monthly salary of a worker is 20,000 rubles. The threefold amount was 20,000*3=60,000 rubles.

- The amount of payments subject to personal income tax is 80,000-60,000 = 20,000 rubles.

- It is from 20,000 rubles that the accountant needs to calculate, withhold, and pay personal income tax.

It should be noted that if the taxpayer is not a tax resident of the Russian Federation, then upon dismissal and receipt of severance pay, his income is not subject to personal income tax. The legislation of the Russian Federation contains information and the risks of unlawful non-withholding or non-transfer of tax to the budget entail penalties :Violation of legislationPenaltiesRegulatory actFailure to withhold or transfer tax to the budget20% of the amount payable.

How to reflect in accounting and taxation the payment of severance pay, average earnings for the period of employment and compensation upon dismissal

No. 17-4/B-422. The organization is obliged to pay compensation to the head of the organization, his deputies and the chief accountant if the employment contract with such employees is terminated due to a change of owner (Art.

181 Labor Code of the Russian Federation). Also, the manager is entitled to compensation if the decision to dismiss him was made by the owner of the organization’s property (the authorized body of the legal entity).

Compensation is paid in the absence of guilty actions (inaction) of the manager.

This procedure is established by paragraph 2 of Article 278, Article 279 of the Labor Code of the Russian Federation. At the same time, the Labor Code of the Russian Federation does not provide for the payment of severance pay and average earnings for the period of employment upon dismissal of managers (their deputies, chief accountants) on these grounds. For more information about this, see In what cases is an organization obliged to pay a dismissed employee severance pay, average earnings for the period of employment and compensation upon dismissal.

For the purposes of calculating personal income tax and insurance premiums, such compensation is standardized.

Are unemployment benefits subject to personal income tax?

Article 208 of the Tax Code of Russia specifies the income of individuals from sources in the country and abroad. According to the general meaning of paragraph 11 of the article, it is clear that benefits are also income of an individual. And Article 209 of the Tax Code of the Russian Federation states that the object of personal income tax is the income of citizens in the country and abroad.

Therefore, personal income tax must be paid on unemployment benefits. However, clause 1 of Article 217 of the Tax Code of the Russian Federation states that all types of state benefits are exempt from income taxation, except leave for temporary disability, and unemployment and maternity benefits are included in the exemption.

There is no income tax on unemployment benefits.

But if you have any other income, for example, you sold a car, garage, rented out an apartment or transport, then you need to report this income to the Federal Tax Service by filing a 3-NDFL declaration, and then pay the tax itself, if the amount thereof is deduced from the calculation.

Vacation compensation and taxation

If an employer has a need to pay a resigning employee compensation for unused vacation, he must withhold personal income tax from this amount.

Despite the presence of a list of compensations not subject to income tax, this type of payment is not included in it (paragraph 7 of paragraph 3 of Article 217 of the Tax Code of the Russian Federation). Personal income tax is withheld at the time the employer actually pays the amount for unused vacation, since he, in this case, acts as a tax agent.

According to subparagraph 1 of paragraph 1 of Art. 223 of the Tax Code of Russia, the moment of receipt of taxable income is considered to be the day the money is issued through the company’s cash desk or transferred to the employee’s bank account.

Expert opinion

Irina Vasilyeva

Civil law expert

If an employee plans to first go on vacation and then resign, tax must be withheld on the calculation date - the last day of work before the vacation. At this moment, the citizen receives an amount from which income tax has already been deducted.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Results

- Unemployment benefits are an individual’s income and subject to personal income tax.

- However, according to Article 217 of the Tax Code of the Russian Federation, unemployment benefits are exempt from income tax.

- You can find out about the size and history of benefit payment at the employment center that assigned you the benefit.

I tried very hard when writing this article, please appreciate my efforts, it is very important to me, thank you!

Unemployment benefits and personal income tax are connected only by the need to confirm your income in the form of a 2-NDFL certificate from your last place of work to establish the status of unemployed and receive subsidies at the time of lack of employment. 2-NDFL is issued at the previous place of work in accordance with paragraph 3 of Article 230 of the Tax Code of the Russian Federation.

Also, according to the tax code, or more precisely according to paragraph 1 of Article 217, personal income tax is not included in the calculation of unemployment benefits. This allows you to accurately say whether the personal income tax benefit is subject to tax or not - it is not, since this point is enshrined in the law.

Benefits during employment are subject to personal income tax

Severance pay is a sum of money paid at a time to an employee upon dismissal for certain reasons. Article 178 of the Labor Code establishes the employer's obligation to pay this benefit if the employment contract is terminated in the following cases: an employee is called up for military service; refusal to transfer to work in another area; liquidation of the organization; reductions; inadequacy of the position held or work performed due to insufficient qualifications or health status; reinstatement of the employee who previously performed this work; refusal of an employee to continue working due to a change in the terms of the employment contract.

What salary should be taken for the equivalent of an average monthly salary in this situation? In accordance with the norms of the Labor Code of the Russian Federation, when an employee is dismissed on the basis of staff reduction, the employer is obliged to pay (in addition to wages and compensation for unused vacation)

basic information

Personal income tax is assessed only on a number of incomes from places of employment. All other payments, including unemployment benefits, do not have such deductions.

Unemployment benefits can only be received by certain categories of citizens who meet all the requirements and have fulfilled all the conditions.

Also, benefits are not provided to the following categories:

- having an age of less than 16 years, that is, at the age of 16 you can already join the stock exchange if there is no permanent or temporary income;

- all full-time students;

- pensioners;

- IP;

- disabled people with non-working groups (most often they do not include group 3, which allows full work, but with a number of restrictions);

- to all persons who apply at the place of temporary registration, since registration and obtaining status is regulated only at the place of permanent registration and residence;

- convicted and sent by the court to correctional or community service;

- any person who provided false information when contacting.

This benefit is a one-time cash payment to a dismissed employee. Benefit accrual is possible in the following situations:

Benefits during employment are subject to personal income tax

In the case when a “physicist”, not registered as an individual entrepreneur, purchases goods using a foreign Internet service (for example, eBay), the duties of a tax agent for VAT are not assigned to him. For the first time, a new unified calculation of contributions must be submitted to the Federal Tax Service no later than May 2.

- reductions;

- refusal of an employee to continue working due to a change in the terms of the employment contract.

- refusal to transfer to work in another area;

- reinstatement of the employee who previously performed this work;

- inadequacy of the position held or work performed due to insufficient qualifications or health status;

- liquidation of the organization;

- conscription of an employee for military service;

Amount of payments in different situations

The amount of the benefit may vary, its size depends on the circumstances of termination of the employment contract and the employee’s average salary for the last year before dismissal:

- in case of liquidation of an enterprise or reduction of its staff, the benefit is equal to a monthly salary . If a citizen was unable to find a job within 2 months, then he is entitled to another payment - in the amount of 2 monthly salaries. When terminating a contract with a seasonal worker, he is entitled to benefits in the amount of 2 weeks' earnings. Severance pay is provided if an employment contract was concluded between a citizen and an organization. If the contract was concluded with an individual entrepreneur, then the employee is entitled only to those payments that are specified in the employment contract. In their absence, severance pay upon dismissal due to liquidation of the organization is not paid;

- upon termination of an employment contract due to the employee’s inability to perform his job duties for health reasons , the employer is obliged to pay severance pay in the amount of the employee’s earnings for 2 weeks;

- upon dismissal due to conscription for compulsory military service , due to the impossibility of moving to another locality for work reasons, the citizen is paid an allowance in the amount of 2 weeks’ salary.

How to calculate personal income tax upon dismissal

To correctly calculate tax you need to:

- determine whether a specific payment is subject to personal income tax (if the payment is not taxed, then in full or in part, taking into account the established limits).

More information about how specific payments are taxed with personal income tax can be found above;

- determine the tax base, apply deductions;

- calculate the tax amount by multiplying the payment amount by the tax rate applied to the employee (13% or 30%).

Example. Calculation of personal income tax on payments upon dismissal

The chief accountant of the organization, Petrov, is resigning due to a change of owner, with payment of compensation upon dismissal in the amount of five average monthly earnings (RUB 250,000).

Personal income tax is subject to only part of the compensation as the chief accountant in the amount of 100,000 rubles. (RUB 250,000 – (RUB 50,000 x 3)). The personal income tax amount will be 13,000 rubles. (RUB 100,000 x 13%).

Deductions for payments upon dismissal

The legislation does not contain any restrictions on the provision of personal income tax deductions for payments upon dismissal. Therefore, the tax agent can apply deductions to these payments in the usual manner (for example, a tax deduction for children), thereby reducing the amount of personal income tax to be withheld from the employee (clause 3 of Article 210 of the Tax Code of the Russian Federation).

| See also: Deductions for personal income tax |

Personal income tax on severance pay

Severance pay is income received by a citizen. Therefore, according to the law, severance pay is subject to personal income tax (personal income tax). The state considers this type of benefit as a compensation payment and therefore provides preferential taxation.

The personal income tax rate is currently 13% for residents of the Russian Federation and 35% for citizens of other countries working in Russia.

- Fine for late filing of personal income tax declaration 3

- Property tax formula: holding period coefficient

- Accounting policies for tax purposes: how to apply, sample order for 2021

- Fine for non-payment of taxes by individual entrepreneurs

- Accounting for calculations of taxes and fees in the balance sheet

- Find out tax debt using TIN: how to find and pay for individuals

- Simplified taxation system: transition for individual entrepreneurs, types of activities, forms, necessary documents

Average earnings for the period of employment for the second month taxation

Termination of an employment contract with an employee is formalized by order. The order specifies the date and reason for the completion of the work. On its basis, an entry must be made in the work book about the end of work in this organization.

In case of layoffs, leaving work for health reasons and other cases specified in the article of the Labor Code of the Russian Federation, severance pay is also paid.

This accrual upon termination of an employment contract may also be provided for by the employment contract, for example, upon completion of work by agreement of the parties.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

- Severance pay and compensation upon dismissal

- Article 178. Severance pay

- Is severance pay subject to personal income tax?

- Taxation of payments upon staff reduction with personal income tax and insurance premiums

- Saved earnings during employment

Severance pay and compensation upon dismissal

Platform 8. Prompt the person who was fired due to redundancy. Two weeks later he brings confirmation that he has not yet gotten a job. We must charge the subject. How to change an old document or what? And if he continues to bring confirmation in a month, how will this be reflected and with what? What did you accrue on the day of dismissal due to layoff?

Usually, upon dismissal due to reduction, severance pay is paid. It is “preservation of average earnings for the period of employment” for the first month of job search. You will need to pay for the second month only when the second month has expired from the date of dismissal and there are documents confirming this.

In the document “Calculation upon dismissal of an employee of an organization,” you indicated the number of days of severance pay. By also creating another document with the same reason “Dismissal from the organization”, you can enter the number of days of retained earnings. Kovyazina Deputy I wonder what is stopping you from creating a document and seeing how and what will be calculated in this case. In our hours, a person at a tariff rate is calculated as the average hourly rate. You answered your own question. We are preparing for the transition to electronic personnel document management.

Support in 1C. We invite everyone to practice automation with benefits for business. We use cookies to analyze traffic, tailor content and advertising to you and enable you to share on social media. If you continue to use the site we will assume that you are happy with it. Pyatov Articles by Professor Ya.

Sokolova Balance in the profession and in life Notes of an inadequate chief accountant Advice from Vera Khomichevskaya Customs payments Changes - Protection of personal data Taxation Self-employed professional income tax Tax administration Federal taxes and fees Regional taxes and fees Local taxes Special tax regimes Canceled taxes Agreements and settlements with employees Agreements Personnel registration Employment of foreign citizens Settlements with employees Reference information Insurance premiums Base for calculating insurance premiums Reporting on insurance premiums Checks and liability Insurance premium rates Payment of insurance premiums Environmental payments, reporting to Rosprirodnadzor Legal regulation of activities Free use.

Donation State registration Contractual liability, obligations Agreements with intermediaries Documentary execution Loans, credits Protection of consumer rights Purchase and sale, supply Licensing, certification, SRO Provision of services Relations with government agencies.

Responsibility Relations with founders, corporate issues Contract work Dispute settlement, going to court, arbitration practice Rent. Forum Accounting, taxation, automation Saved earnings for the duration of employment. Site Rules Community Members. Search in topic:. Sales of services from davalch. Letter to 1C technical support.

Cancel Submit. Registration date: Well, severance pay was accrued for the first month, but what about for the second month? Sergey Golubev. Which question? The number of days varies. The amount will vary. Reading the topic: 1 guests. We are preparing for the transition to electronic personnel document management on September 19 - Labeling.

Unemployment benefit

Briefly about who can be recognized as unemployed:

- able-bodied citizens from 18 to 55 years (women), up to 60 years (men);

- persons who do not have an official place of employment at the time of contacting the employment service;

- citizens registered at the employment center.

These requirements must be present together.

Calculation of unemployment benefits is carried out by specialists from the employment center. The size of the payment depends on the average salary and the availability of employment during the year before contacting the employment service. You can read more about this on the pages of our Internet portal.

Unemployment benefits are not interpreted by law as income, therefore they are not subject to taxation (clause 1, article 217 of the Tax Code of the Russian Federation).

Benefits during employment are subject to personal income tax

For the first time, a new unified calculation of contributions must be submitted to the Federal Tax Service no later than May 2. However, it has already become known what mistakes policyholders make especially often when filling out reports. The Government of the Russian Federation has approved a list of non-food products, for the sale of which at retail markets, fairs, exhibition complexes and other trading areas, organizations and individual entrepreneurs are required to use cash register equipment.

The beginning of the employee’s employment period, during which he retains his average earnings, is the day following the date of dismissal. End – the day preceding the date of new employment, or the day of expiration of a two-month period from the date of dismissal.

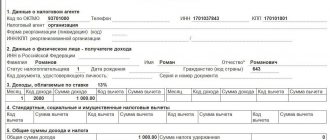

Documents for applying for unemployment benefits

Next, we list what documents are needed for unemployment benefits (clause 7 of the Procedure for registering the unemployed):

- passport;

- work book (if available);

- salary certificate from last place of work. It is worth noting that such a document is needed if a citizen has been officially employed for 1 year before applying to the employment service. This certificate is necessary for calculating unemployment benefits, therefore there are special requirements for its execution:

- the document must be drawn up on the organization’s letterhead indicating its details, in particular – TIN and legal address,

- the document must bear an imprint of a corner stamp,

- It is mandatory to indicate the number of weeks worked during the last year of work;

- certificate of assignment of TIN;

- pension insurance certificate;

- all documents indicating the education received . It is worth considering that in addition to the document on basic education, you can submit certificates, diplomas, certificates of all additional acquired skills and knowledge. If such a document was received outside the Russian Federation, then a notarized translation into Russian must be attached.

Expert opinion

Korolev Konstantin Georgievich

Practicing lawyer with 7 years of experience. Specialization: criminal law. More than 3 years of experience in document examination.

Citizens who have not worked during the year before contacting the employment center or have not worked at all must present only a passport and a certificate of education. All other documents - only if they are available.

What is severance pay and who is entitled to it?

Severance pay is the amount due to a dismissed employee in a number of cases provided for by law. These funds are paid in addition to his salary for the last period worked and compensation for unused vacation. Depending on the reason for dismissal, its size varies with the average earnings of such an employee for a period of two weeks to three months.

The difficulty with calculating this payment is that there are no clear recommendations in the legislation on how to calculate it. This means that the employer is often forced to act at his own peril and risk, not being completely sure that he will have to pay anything extra to former employees by a court decision or bear responsibility, for example, for understating the tax base if inspectors find errors in calculating benefits.

Severance pay is covered in Art. 178 Labor Code of the Russian Federation

The Labor Code of the Russian Federation provides for the payment of severance pay upon dismissal for the following reasons:

- Liquidation of company;

- staff reduction;

- complete loss of ability to work (disability);

- refusal to transfer to another job due to health problems;

- refusal to continue working if significant working conditions change;

- refusal to move to another location with the employer;

- conscription into the army or entry into alternative service;

- reinstatement of the employee who previously occupied it to the position in which the dismissed person worked (by a court decision or labor inspectorate, return from the army, maternity leave, after long-term treatment, etc.);

- the impossibility of further performance by the employee of duties within the framework of his position is not his fault. Such cases include: a court ban on holding certain positions;

- medical contraindications for specific work;

- lack of mandatory documented qualifications for work requiring special knowledge;

- disqualification, deprivation of special rights or deportation from the Russian Federation;

- dismissal according to legal requirements from state or municipal service;

- restrictions on engaging in specific activities, for example, a ban on the employment of minors in hazardous industries, etc.

Video: dismissal and payment of severance pay

https://youtube.com/watch?v=bkdS4wogt6M

Payments to an employee by court decision: personal income tax taxation procedure

Often, workers go to court to protect their labor rights. If the court finds that the employee was fired illegally, then the employing organization will be obliged to compensate the employee for all inconveniences caused as a result of such dismissal, in particular to pay an amount that includes wages for the period of forced absence, an indexed amount of wages not received on time, compensation for expenses, related to the employee's appeal to the court, the amount of compensation for moral damage. The organization's accountant has a question: what is the taxation procedure for these amounts - are these payments subject to personal income tax?

Labor Code on the regulation of labor disputes

The main goals and objectives of labor legislation are defined in Art. 1 Labor Code of the Russian Federation. One of these tasks is the legal regulation of labor relations and other relations directly related to them, in particular, the resolution of labor disputes. Methods for protecting labor rights and freedoms are listed in Art. 352 Labor Code of the Russian Federation. These include: