Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 08/09/2017

Reading time: 6 min

0

155

In accordance with the Federal Tax Service Law of June 28, 2013 No. 134-FZ, taxpayers in the general taxation system who pay VAT, as well as those who are tax agents and submit a VAT declaration to the regulatory authority, are required to submit such a declaration to the territorial authority from the 1st quarter of 2014 tax office only in electronic form. This list also includes taxpayers who are exempt from the obligation to pay tax, but who issue invoices with the indicated amount of VAT - so that the inspectorate can control the accepted deductions of their counterparties.

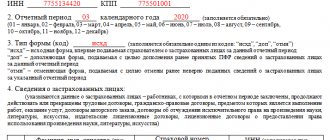

From the 1st quarter of 2021, the declaration must be submitted in the form according to the latest edition of the above law dated December 20, 2016, quarterly until the 25th day of the month following the reporting quarter.

- Federal Tax Service website service

- Operator services for electronic document management

- Procedure for electronic delivery Select a telecom operator and enter into an agreement with it

- Get an electronic signature

- Buy the software

Submitting electronic VAT reporting: is there an alternative?

VAT reporting must be submitted by all payers of this tax - individual entrepreneurs and legal entities - electronically through a specialized operator. This procedure presupposes that the taxpayer has:

- electronic digital signature with a valid certificate;

- access to the software through which declarations are sent to the Federal Tax Service;

- Internet access.

If at least one of the above conditions is not met, VAT reporting will not be sent electronically. But the occurrence of such a situation is quite likely: the digital signature certificate may expire or be canceled for one reason or another, the program for sending documents will freeze or become infected with a virus, and failures in access to Internet resources are not uncommon even in the largest cities.

If you have access to ConsultantPlus, find out who, where, when and in what way should submit a VAT return. If you don't have access, get a free trial online access.

What should a taxpayer do in this case?

There is only one option - to submit reports through a proxy. For some time, taxpayers took advantage of the opportunity to submit a declaration in paper form, while paying a fine for reporting not in the form in the amount of 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation). However, since 2015, in paragraph 5 of Art. 174 of the Tax Code of the Russian Federation clearly states that a declaration on paper is considered not submitted. And these are completely different fines.

IMPORTANT! If no activity was carried out, then instead of a zero VAT declaration, you can submit a single simplified declaration. It is not subject to the requirement to submit reports electronically under the TKS.

Operator services for electronic document management

In order not to waste time studying instructions and send reports in a couple of clicks, you can resort to the services of EDF operators. They will help with connecting the online reporting system and provide recommendations if errors are detected when sending a VAT return.

To connect to the system, you need to pay a certain amount for installing software at the operator's rate, as well as pay a monthly fee for subscription services. Reports will be sent with a qualified electronic signature, but in order to receive it, you need to fill out an application, bring copies of documentation for the general director, the original application and other requested documents to the operator’s office.

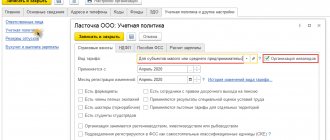

In addition to obtaining the EPC key, you need to stock up on certain knowledge to send an electronic declaration file in a unified format, the formation of which will be helped by the 1C program, version 8.2 “Enterprise Accounting”.

In the EDI operator center, the taxpayer can receive an electronic signature and a system for sending electronic declarations and records.

Advantages of this method:

- saving time costs;

- fewer technical errors, since reporting is automatically generated in the required format, output control means are used, which is then used to check the declaration for the relationship between internal data and supplier declaration data;

- promptness of current updates of reporting formats (if changes are made to the approved tax and accounting reporting forms, or new forms are introduced before the deadline for submitting the declaration, the taxpayer is given the opportunity to update old versions of the formats);

- guarantee of confirmation of sending documentation (the ability to receive confirmation within 24 hours, as well as quickly view your personal card. This frees you from the need to wait for a reconciliation report);

- protection from viewing and correction by third parties;

- the possibility of sending an information request to the tax service;

- the opportunity to receive: a certificate of payment to the budget;

- a statement of all settlement transactions;

- a list of accounting and tax documentation required by the inspection;

- reconciliation report on taxes, penalties, fees, fines;

- current innovations in tax legislation.

To clarify the boundaries of a land plot, you need to order the services of a cadastral engineer. How to properly privatize a garden plot and what documents need to be prepared? Find out about this by reading our article. How can you find out if an organization is a VAT payer? The answer is here.

How to submit a VAT return through a representative: nuances

The main condition for using the considered option of sending a VAT return to the tax office is the execution of a power of attorney for the representative. For an individual entrepreneur, it must be notarized; legal entities draw up a power of attorney without the participation of a notary.

The power of attorney must be in the tax office before submitting the declaration (clause 1.11 of the Methodological Recommendations approved by Order of the Federal Tax Service of the Russian Federation dated July 31, 2014 No. ММВ-7-6/398). Otherwise, there is a risk that the declaration will be refused. This was indicated by the Federal Tax Service in a letter dated November 9, 2015 No. ED-4-15/ [email protected]

Read more here.

Note! From the report for the 4th quarter of 2021, it is necessary to use the updated form, as amended by the Federal Tax Service order No. ED-7-3 dated August 19, 2020 / [email protected]

You can find out what has changed in the report in the Review material from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Technically, this can be done in 2 ways:

- Take or mail a paper copy of the executed power of attorney to the Federal Tax Service in advance.

- Also send a copy of the power of attorney via TKS in advance. The scanned image must be signed by the principal's UKEP. The representative cannot do this. There is no need to provide an additional paper copy of the power of attorney to the tax authorities.

VAT changes in 2021

Despite the fact that the Federal Tax Service does not plan to make changes to the VAT return form for the periods of 2021, from January 1, 2021, some nuances for paying VAT will still be added:

- a mandatory condition for VAT offset will be the registration of legal entities and individual entrepreneurs switching to paying VAT as a payer of this tax with the tax authorities;

- notification of the transition to VAT payment is provided no later than 10 working days before the beginning of the month of transition to VAT payment;

- when switching to VAT payment, the VAT amount is accepted for offset on the confirmed balances of inventories acquired over the last 12 months preceding the date of transition in the part corresponding to the sales volume;

- Changes and additions will be made to the list of transaction codes related to the fact that the following will be exempt from VAT:

- importation into Russia of civil aircraft subject to registration in the State Register of Civil Aircraft of the Russian Federation;

- import of aircraft engines, spare parts and components used for the construction, repair and modernization of civil aircraft in Russia.

Due to changes in VAT legislation that occurred in 2019 and 2021, the VAT tax return in 2021 will take into account:

- appearance in paragraph 2 of Art. 146 of the Tax Code of the Russian Federation, new sub-clause. 16, which includes in the list of transactions not subject to VAT, the gratuitous transfer to authorities of property from 100% state-owned joint-stock companies that were established to conduct activities in special economic zones.

- regulation of VAT in terms of tax refunds to foreign citizens exporting goods purchased in Russia abroad under the Tax Free scheme.

- simplification of the procedure for submitting documents to the Federal Tax Service certifying the right to apply the zero rate when exporting goods and services.

- transfer for payment of VAT by payers of the Unified Agricultural Tax.

- increase in the VAT tax rate.

- exclusion from the list of transactions not subject to VAT of banking transactions with precious stones.

The State Duma is considering bill No. 19842-7, which proposes to expand the list of goods subject to a VAT rate of 10%. To date, the list of preferential goods is established by paragraphs. 1 item 2 art. 164 Tax Code of the Russian Federation. The bill is aimed at adding fruit and berry crops and grapes to the list of goods on the sale of which VAT is calculated at a rate of 10% instead of 20%.

Other VAT reporting

In addition to the VAT return, VAT payers must provide the following reporting:

- journals for accounting of invoices (VAT payers do not keep a log);

- declaration on indirect taxes when importing from the territory of the Customs Union.

The deadline for filing a Tax Declaration for indirect taxes (value added tax and excise taxes) when importing goods into the territory of the Russian Federation from the territory of member states of the Customs Union is quarterly until the 20th day of the month following the reporting quarter. The form and procedure for filling out this declaration were approved by order of the Ministry of Finance of the Russian Federation No. 69 n dated July 7, 2010.

The deadline for submitting the Invoice Log is quarterly by the 20th day of the month following:

- the month of registration of imported goods;

- after the month of the lease payment due under the leasing agreement.

The form and Rules for filling out the invoice journal were approved by Decree of the Government of the Russian Federation No. 1137 of December 26, 2011. Invoice registers are handed over to intermediaries who are neither payers nor tax agents for VAT if they issue or receive invoices in the course of intermediary activities.

The material has been edited in accordance with changes in the legislation of the Russian Federation 10/26/2019

Results

VAT reporting can only be submitted to its payers in electronic form. If the company cannot do this on its own, you can send the tax return through a representative. To do this, you need to issue a power of attorney and give it to the tax authorities.

Sources:

- Tax Code of the Russian Federation

- Methodological recommendations approved by order of the Federal Tax Service of the Russian Federation dated July 31, 2014 No. ММВ-7-6/398

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

About the benefits of EP

Submitting electronic reporting requires the taxpayer to have not only access to the Internet, but also the installation of special software through which document forms are sent. The declaration is signed with a special electronic signature.

Let us remind you that, based on various purposes, electronic signatures can be simple and enhanced. The latter, in turn, are divided into unqualified and qualified EPs. To submit reports to regulatory authorities, firms and individual entrepreneurs require an enhanced qualified electronic signature created using cryptographic means certified by the FSB of Russia. They are issued only by certain accredited organizations, which certify the issued certificate and act as a guarantor of its authenticity.

Of course, maintaining a valid electronic signature requires additional costs. A license for the right to use a signature and the software necessary for transmitting reports is purchased for a certain period, usually at least a year. The cost will depend primarily on the taxation system used by the taxpayer, in other words, on the number of reports that he needs to submit. OSN is always a more “expensive” tariff, both for companies and individual entrepreneurs.

Of course, now most merchants still have a formalized electronic signature. However, it is not strictly mandatory, and in some situations you can successfully do without it. The exception is the above-mentioned case of the need to submit VAT reports electronically. What to do in a situation where there is no electronic signature, but you need to report on value added tax? The obvious answer is to issue an electronic signature certificate. However, there is an additional solution.

Programs and prices

Programs and prices

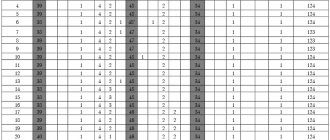

The leader in terms of price-quality-convenience ratio in the electronic reporting market is 1C-Reporting. Comparison with other special operators is presented in table form. As an example, we took the service of a legal entity during the year.

Obviously, when choosing the optimal program, you need to consider how it will work:

- offline — the system is installed on the computer (copy on an external hard drive or flash drive);

- online - cloud technologies, work from any computer on the Internet.

From the table above it can be seen that the first group includes such software products as: VLSI++, 1C-Reporting and Astral Report. The second group is a little more difficult. Not all online programs allow access from any device. For example, Kontur.Extern allows you to generate and send a VAT return directly on its portal in cloud mode, but you can only access the information from the computer on which the cryptographic information protection tool (CIPF) is installed. Therefore, Contour can be considered an online program only conditionally. Completely “cloud” programs are Bukhsoft, Moe Delo, Otchet.ru and Nebo.

To select a special operator, it is important to evaluate the ratio of the functions and options offered to their price among similar operators. More expensive options usually include additional services, such as checking the declaration before sending. In addition, users can even receive a regulatory framework for accounting and reporting, as well as advice from experienced accountants. Ease of connection and configuration, as well as feedback from the Federal Tax Service of Russia, play an important role. After all, in addition to sending the VAT return itself, you must receive from the Federal Tax Service a receipt of its receipt, as well as other requirements and notifications.

Information about the reorganization

In the field “Form of reorganization (liquidation)” the reorganization (liquidation) code is indicated in accordance with Appendix 3 to the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. For example, when reorganizing in the form of affiliation, you need to indicate code “5”.

In the “TIN/KPP of the reorganized organization” field, please enter the TIN/KPP that was assigned before the reorganization.

This is stated in paragraphs 26, 27 and 16.5 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Situation: how to fill out and submit a VAT return during reorganization in the form of transformation?

The answer to this question depends on who submits the declaration - the successor or predecessor.

After all, the predecessor can submit a declaration only for the period of his activity. That is, from the beginning of the quarter to the date when the reorganization was completed. If for some reason the predecessor did not submit a declaration for the last period of his activity, this responsibility passes to the successor. He must prepare a declaration for the entire quarter as a whole. It must reflect both the transactions performed by the predecessor and its own transactions performed from the date of reorganization until the end of the tax period.

The deadline for filing a declaration is general: no later than the 25th day of the next month after the end of the quarter.

This follows from paragraph 3 of Article 80, Article 163, paragraphs 1 and 5 of Article 173, paragraph 5 of Article 174 of the Tax Code of the Russian Federation and is confirmed in the letter of the Federal Tax Service of Russia for Moscow dated May 13, 2015 No. 24-15/046265.

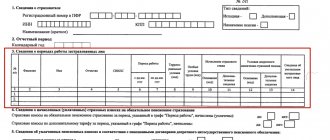

The predecessor and his successor draw up the declaration differently.

Option 1. The organization that is being transformed independently submits a declaration for the last tax period

The tax period, the last for the predecessor, is indicated in the declaration with the following values:

- 51 – I quarter;

- 54 – II quarter;

- 55 – III quarter;

- 56 – IV quarter.

This procedure is prescribed in paragraph 21 of the Procedure for filling out a VAT return and Appendix 3 to it, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In the “Form of reorganization” indicator, enter the code “1”. This follows from the provisions of paragraph 26 of the Procedure for filling out a VAT return and Appendix 3 to it, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Fill in the “TIN/KPP” indicators as follows. At the top of the title page and on the remaining sheets, indicate the details of the organization being converted. In the “TIN/KPP of the reorganized organization” field, put dashes - until the moment of registration, the taxpayer does not have this information. This conclusion follows from paragraphs 16.5 and 18 and the Procedure for filling out a VAT return, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In the remaining details (name, type of activity code, etc.), provide information about the organization before the transformation.

Option 2. The declaration for the entire quarter is submitted by the legal successor - the transformed organization

In this case, the declaration must indicate:

- on the title page “at the location (registration)” - code “215”, and if the assignee is the largest taxpayer, then code “216”;

- TIN and KPP (in the entire declaration) – data of the legal successor;

- Taxpayer – name of predecessor;

- TIN/KPP of the reorganized organization - codes that were assigned to the organization before the transformation;

- The form of reorganization is code “1”.

In Section 1 of the declaration, in the “OKTMO Code” field, indicate the code of the municipality in which the reorganized organization (predecessor) was located.

Remember, fill out the specified information only in the declaration, which reflects the indicators for the predecessor and successor. In subsequent declarations, follow the general procedure. This procedure is directly provided for in clause 16.5 of section II of appendix 2 to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Submitting reports electronically through a representative

| VAT and tax reporting by proxy in electronic form to any regulatory authorities in St. Petersburg and Moscow for a company with an inaccurate legal address the ability to prepare reports by our accountants requirements and reconciliations are already included in the service package |

Personal Area

| Reporting | Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat Confirmation immediately Protocols in real time Upload with a mark of delivery |

| Requirements | Simple and under your control No hidden inboxes Replies are marked automatically |

| Reconciliations | No limits |

| Security Guarantee | Only you have access Login confirmation via SMS |

| Unlimited number of organizations | You can submit reports for an unlimited number of companies and individual entrepreneurs. Information on all shipments will be in one personal account. |

Payment only for the submitted report

| No monthly fee | Reconciliation with the budget for taxes, contributions, penalties, fines, list of submitted reports Receiving requirements and incoming documents Sending explanations of requirements and letters |

| For actually sending the report | Federal Tax Service = 500 rubles, Pension Fund, Social Insurance Fund, Rosstat = 300 rubles. |

By proxy

| VAT with quarterly turnover (tax base) of no more than 2.5 million rubles. per quarter VAT zero Income tax, calculation of insurance premiums, all forms of personal income tax, declarations of the simplified tax system, UTII and others |

Original powers of attorney

| St. Petersburg and Leningrad region Moscow | All tax offices |

| Regions of the Russian Federation | check the location before sending the report |

Dear Clients! To guarantee the provision of the service, it is necessary to provide a power of attorney to the operating room directly to the inspector to register in the database and receive a mark of acceptance on the power of attorney form. If your Federal Tax Service currently has restrictions on accepting taxpayers in person, you will be offered the option of issuing an electronic signature. For information about the operating hours of the operating room of your Federal Tax Service Inspectorate, check at your location.

With the issuance of the ES certificate

| VAT on turnover of more than 2.5 million rubles. VAT adjustments Reporting for companies with an inaccurate legal address Reporting for individual entrepreneurs Reporting to the Pension Fund and the Social Insurance Fund |

Attention. The issued electronic signature cannot be exported or copied, is not transmitted over open channels, and is stored on a secure server.

Obligation to submit an electronic declaration

Article 174 of the Tax Code of the Russian Federation states that the VAT return is submitted by payers and tax agents to the Federal Tax Service at the place of their registration no later than the 25th day of the month following the expired tax period. The VAT return can be sent to the Federal Tax Service only in electronic form. In 2019, only tax agents who are not VAT payers or who are exempt from the obligation to pay this tax, with the exception of those listed in paragraph 5 of Article 174 of the Tax Code of the Russian Federation, retained the right to file VAT returns on paper:

- persons who carry out business activities in the interests of another person on the basis of commission agreements, agency agreements providing for the sale and (or) acquisition of goods (work, services), property rights on behalf of the commission agent (agent),

- persons who carry out activities on the basis of transport expedition contracts,

- persons performing the functions of the developer.

For organizations and individual entrepreneurs with a small staff or no employees at all, and regardless of the tax system used by the taxpayer, no exceptions are provided. By virtue of the same Article 174 of the Tax Code of the Russian Federation, when submitting a VAT return on paper, it is not considered submitted with all the ensuing consequences. Therefore, all VAT payers are certainly interested in the rules for submitting reports online.

Electronic reporting tools

Any accountant understands that it is most convenient to submit VAT via the Internet using the exact program in which it was created. Transferring reporting from an accounting program to another resource is not immune to additional errors. Therefore, a program is needed that will allow you to pass the NSD via the Internet and, if possible, for free. First of all, the thought comes to mind about the website of the Federal Tax Service of Russia. There really is a “Taxpayer” program, which is absolutely free. In addition, there are many offers on the market for accounting and reporting programs. Some of them can be considered shareware, but most will still require certain financial investments. After all, as you know, you have to pay for convenience.

Program from the Federal Tax Service: submitting VAT electronically for free

The Federal Tax Service is conducting a pilot project to operate software that ensures the submission of tax and accounting reports in electronic form through its website on the Internet. Taxpayers are given the opportunity to submit reports electronically completely free of charge. Although the “help” button in each section provides instructions for filling out the corresponding section of the VAT return, this program does not provide support. You will have to track all software updates yourself. The user must deal with all errors and malfunctions independently. It will also not be possible to test the declaration before sending it.

In addition, in accordance with paragraph 3 of Article 80 of the Tax Code of the Russian Federation and paragraph 5 of Article 174 of the Tax Code of the Russian Federation, tax returns for value added tax can be submitted using the Federal Tax Service service only if you have an electronic digital signature (EDS). You will have to buy it from any accredited certification center. That is, there will still be certain costs for sending reports in this way. In this regard, today it is not possible to submit a VAT return absolutely free of charge. Therefore, it is still worth getting to know paid services better.

Electronic reporting market

There are two ways to generate a VAT return and explanations in electronic form (2018), as well as send them to the tax office:

- straight;

- representative.

In the first case, the taxpayer organization must independently enter into an agreement with an electronic document management (EDF) operator. In addition, there are intermediary companies, in other words, special operators, with whom you can also negotiate. The taxpayer becomes a subscriber under the agreement, he is provided with a program for sending reports, and an electronic digital signature is issued for the manager or other authorized person. In this case, the organization must have a special programmer who can configure the program, integrate it into the accounting program and update it regularly. For services, you will have to transfer money annually to the EDF operator.

In addition, there are so-called cloud services. In this case, the software is provided by the operator directly on the Internet and the user does not have to install anything on their computers, but can access such a program from any computer or laptop. In this case, the user receives full control over the submission of his reports, as well as the ability to directly receive notifications and requests from the tax service.

The representative method is much simpler, but it does not guarantee control over the delivery of reports. In this case, the VAT return is sent through an organization that already has a software package installed that allows you to send reports to other organizations or entrepreneurs. Typically, such services are much cheaper than working directly with an operator. However, the tax authorities themselves do not welcome them, because in this case there is no feedback for them from the VAT payer.

Operator and program selection

In total, today there are 119 electronic document management operators registered and operating in Russia (the full list can be viewed on the Federal Tax Service website). Such an operator must be a Russian organization and comply with the requirements approved by the Federal Tax Service of Russia (clause 3 of Article 80 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated No. PA-4-6/17542). You can only work with those operators that are registered with the Federal Tax Service of Russia. Although the leaders in the EDI market are constantly changing, today the leaders in terms of the number of clients are:

- Tensor (product - Sbis);

- Kaluga Astral (product - Astral Report and many other projects where Kaluga Astral appears only as a special communications operator: 1C reporting, Bukhsoft Online, My Business, Sky and others);

- SKB Kontur (products: Kontur.Extern, Elba and Accounting.Kontur);

- Taxcom (products: Dockliner and 1C-Sprinter).

Products for sending reports include:

- Accounting.Outline();

- Astral Report();

- Contour.Extern();

- MyBusiness ();

- Sky ();

All of these companies do not provide the opportunity to submit VAT for free via the Internet, but they all hold promotions during which they offer temporarily free reporting preparation. In addition, when establishing long-term cooperation, you can almost always get good discounts and submit VAT returns for a very reasonable fee.

Sanctions for violators

For violation of the procedure for submitting a VAT return, including failure to comply with the electronic form, an organization or individual entrepreneur may be brought to tax liability:

- For failure to submit a declaration within the prescribed period, liability is provided for in Article 119 of the Tax Code of the Russian Federation. Its provisions introduce a fine of 5% of the amount of tax not paid within the period established by law, which was indicated for payment in this declaration. The fine is charged for each full or partial month from the day on which the legally established deadline for submitting the declaration falls. The maximum fine in this case cannot exceed 30% of the specified amount, and the minimum must be no less than 1000 rubles.

- For violation of the rule on submitting a VAT return in electronic form, sanctions of Article 119 of the Tax Code of the Russian Federation are also applied, since such a report is considered not submitted.

In addition, for violation of the established deadlines for submitting VAT reports, officials of the organization may be brought to administrative liability under Article 15.5 of the Code of Administrative Offenses of the Russian Federation. In this case, they may be given a warning or a fine of 300 to 500 rubles. For a delay in filing a VAT return (including if it is sent in paper form) for more than 10 working days, tax authorities may suspend transactions on the taxpayer’s bank accounts and electronic money transfers. This possibility is provided for in Article 76 of the Tax Code of the Russian Federation. From all this we can conclude that submitting a report on paper, violating legal requirements, is not at all profitable. Therefore, you need to carefully study how to submit VAT electronically via the Internet.

Preparation of reports

Qualified accountants of our company will help you prepare any reports for the tax inspectorate, Pension Fund, Social Insurance Fund, Rosstat. We will take into account all your wishes for tax optimization.

| Preparation of zero reporting in 15 minutes Preparation of reporting with accruals within 2 hours Preparation of VAT with turnover during the working day |

If you require accounting, use the Accounting support service.