In order to correctly determine the tax base for a single tax, all taxpayers using the simplified tax system must keep a book of income and expenses (KUDiR). The Ministry of Finance of Russia, by order of October 22, 2012 No. 135n, approved the KUDiR form and the procedure for filling it out. It doesn’t matter what object of taxation an entrepreneur or organization has, “income” or “income minus expenses” - keeping a book of income and expenses under the simplified tax system is mandatory for everyone. If the accounting book is missing or contains incorrect data, which led to an underestimation of the tax base, the tax authorities have the right to fine the entrepreneur.

Let's look at the procedure for maintaining and some features of filling out KUDiR on the simplified tax system, and also give an example of an accounting book for the object “income minus expenses”.

© photobank Lori

Application of KUDiR

KUDiR - stands for a book of income and expenses under a simplified taxation system. Everyone who uses the simplified procedure is required to keep a book of income and expenses. The form of the book was approved by order of the Ministry of Finance of Russia dated October 22. 2012 No. 135n. In the book of income and expenses, organizations and individual entrepreneurs using the simplified tax system must reflect business transactions completed in the reporting (tax) period.

For each new tax period (year), you need to create a new accounting book (clause 1.4 of the Procedure approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n). The book of income and expenses is compiled in a single copy. Starting from 2021, you need to open a new book using a new form.

Instructions for filling

The book is filled in chronological order throughout the year.

In this case, an entry is made for each document; merging is not allowed. At the end of the old year it is closed, and the next register is opened for the new year. You can fill it out in a magazine purchased from a printing house, or using specialized programs and Internet services. The latter is the most preferable, as it significantly reduces the time for its registration, because very often it is compiled on the basis of previously issued documents automatically.

When filling it out manually, you can make all the necessary corrections in the book, you just need to cross out the incorrect entry with one line so that it can be read. A correctional entry is made nearby, and it is certified by the signature of the responsible person.

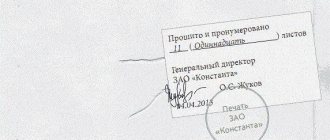

After the tax period closes, it is printed, laced, and each sheet is numbered. Next, the book is certified by the seal of the business entity and the signature of its director. Previously, it was still necessary to send it to the office of the Federal Tax Service for affixing a stamp. Currently, such a requirement no longer exists.

Please pay attention! Keeping a book is a must. It is provided to the tax office only upon request from the inspection inspector. In this case, you can use a special Internet service for electronic maintenance of KUDiR.

Composition of the new form: sections of the book

Starting from 2021, you need to use a new form of income and expense accounting book. Changes to KUDiR from 2021 were made by order of the Ministry of Finance dated December 7, 2016 No. 227n. See “New form of book for accounting income and expenses for the simplified tax system from 2021: what has changed.”

The book of income and expenses, used since 2021, consists of a title page and five sections:

- Section I “Income and Expenses”;

- Section II “Calculation of expenses for the acquisition (construction, production) of fixed assets and for the acquisition (creation by the taxpayer himself) of intangible assets taken into account when calculating the tax base for the tax for the reporting (tax) period”;

- Section III “Calculation of the amount of loss that reduces the tax base for the tax paid in connection with the application of the simplified taxation system for the tax period”;

- Section IV “Expenses provided for in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation, reducing the amount of tax paid in connection with the application of the simplified taxation system (advance tax payments) for the reporting (tax) period”;

- Section V “The amount of the trade fee that reduces the amount of tax paid in connection with the application of the simplified taxation system (advance tax payments) calculated for the object of taxation from the type of business activity in respect of which the trade fee is established for the 20__ reporting (tax) period” .

as amended by order of the Ministry of Finance dated December 7, 2016 No. 227n (including a new form of the income and expenses accounting book).

.

.

New book of income and expenses (KUDiR) according to the simplified tax system

The Ministry of Finance of Russia presented a new sample of the Book of accounting of income and expenses according to the simplified tax system. You can download the KUDiR template from the link.

The main reason for the changes is that the latest edition was used for 3.5 years and was not modified. The Ministry of Finance talks about the need to bring the Book into a more modern form.

What changes await us?

Companies were allowed to stop using the seal from 04/07/2015. From April 7, 2015, companies have the right to refuse printing. In the new edition, the seal is mandatory for those who use it in their work. The book will be supplemented with a new section V for trade collection. Entrepreneurs using the simplified system with the “income” object will have to fill out a new section.

The fee has been introduced only in Moscow...

Filling out the new section “threatens” only metropolitan traders who pay tax to the budget of the city of Moscow (clause 8 of article 346.21 of the Tax Code of the Russian Federation).

An example of filling out a new section of the Book of Income and Expenses (KUDiR) according to the simplified tax system

| V. The amount of the trade fee, which reduces the amount of tax paid in connection with the application of the simplified taxation system (advance tax payments), calculated for the object of taxation from the type of business activity in respect of which the trade fee is established for the first quarter and second quarter of 2021 | |||

| No. | Date and number of the primary document | The period for which the trade fee was paid | Amount of fee paid |

| 1 | 2 | 3 | 4 |

| 1 | Payment order dated January 24, 2017 No. 65 | IV quarter 2021 | 150,000 rub. |

| Total for the first quarter | 150,000 rub. | ||

| 2 | Payment order dated April 23, 2017 No. 107 | I quarter 2021 | 172,000 rub. |

| Total for the second quarter | 172,000 rub. | ||

| Total for the half year | RUB 322,000 | ||

Period for opening the Accounting Book using the new form?

After registration of the order by the Ministry of Justice (MoF Order dated 07.12.16 N 227n), an explanation will be published about the moment of application of the new form of the Book. Most likely this will not happen earlier than January 1, 2017.

Should all simplifiers change KUDiR to a new model from 2017? Can those who do not pay the sales tax use the old edition of the Book or is the transition obligatory for everyone?

According to the register, all firms and entrepreneurs using the simplified tax system must introduce a new edition of the Book, regardless of payment of trade tax. Those who do not pay this tax must put dashes in the appropriate column.

Opening a new Accounting Book: rules and features

All firms and private entrepreneurs using the simplified tax system must open a new Book of Income and Expenses every year, but is the old one subject to mandatory closure?

Every year, simplifiers must open the Accounting Book in a single copy based on clause 14 of the Procedure, which was approved by the Ministry of Finance of Russia in Appendix 2 of October 22, 2012 No. 135n (hereinafter referred to as the Procedure).

How and where can I get a new copy of the Income and Expense Book?

After approval of the new edition of the Book of Income and Expenses, it can be downloaded from any legal reference system or found in accounting programs.

Is it possible to maintain the register electronically or is a paper copy required? Can an entrepreneur choose the type of bookkeeping?

In 2021, entrepreneurs are given a choice of how to fill out the Book, so they can keep it both electronically and in standard paper form.

Is preparation required to fill out a paper register?

Preparation is mandatory and consists of filling out the title page of the Book, stitching and numbering the pages. The number of pages must be indicated on the last numbered and stapled sheet of KUDiR. After this, the Book is certified by the manager. If a company or entrepreneur uses a seal, then it must be affixed to the last sheet (clause 1.5 of the Procedure).

What is the most convenient way to fill out the Book?

It is believed that it is much easier to fill out the book in the electronic version, since it is easier to correct errors or make changes.

Closing the Book for last year: highlights

Should an entrepreneur keep books for previous years?

Storage of Books from previous years is mandatory. At the same time, such a book of income and expenses should only be in paper form. In case of maintaining an electronic register, the Book must be printed and kept at home.

Book closing process for 2021

- If the Book was kept in paper form, then it is enough to carry out all the final calculations for 2021.

- Make sure that the KUDiR is correctly laced, numbered and certified by the supervisor (clause 1.5 of the Procedure). There is no need to take any further action.

- If the register was maintained electronically, it is necessary to print the Book (clause 1.4 of the Procedure);

- Then lace it, number it and have it certified by your supervisor, indicating the stamp and number of pages.

- It is better to close the Book on the first days of the new calendar year.

- The Book must be stored in a safe or other safe place (clauses 6.2-6.4 of the Regulations approved by the Ministry of Finance dated July 29, 1983 No. 105).

- Storage of the Book has no statute of limitations and is permanent (clause 401 of the List, which was approved by Order of the Ministry of Culture dated August 25, 2010 No. 558). The Book must be kept until the business is closed and deregistered.

Where and when to use the Account Book

If the tax office discovered any problems with paying taxes or errors in filling out documents, can they require a Book of Income and Expenses?

The book must be provided to the tax office upon any request within 10 days from the date of delivery based on a letter from the Federal Tax Service for Moscow dated September 14, 2006 No. 18-11/3/ [email protected] ). After all, this is precisely why the Book for all past periods should be kept.

Should entrepreneurs register the Book with the tax office?

No, since since 2013 the mandatory registration of the Book of Income and Expenses has been abolished.

Do I need to bring the Account Book to the tax office for viewing?

There is no such need if you have not been sent the corresponding requirement. This requirement is valid for electronic and paper versions (based on letter of the Ministry of Finance of the Russian Federation dated February 11, 2013 No. 03-11-11/62).

Procedure for making changes

Is it possible to make changes to the paper version of the Accounting Book?

You must cross out the incorrect value and write the corrected one. The date of changes must be indicated and all entries are confirmed by the signature of the manager, as well as the seal 9p1.6 of the Procedure).

Is there a procedure for making corrections to the electronic version of the Book?

There is no prescribed order; as practice shows, the numbers are simply erased and new ones are added.

Responsibility for the absence of an Accounting Book

Is there liability for an entrepreneur using the simplified tax system who does not keep accounting books at all?

If an entrepreneur does not keep accounting books, then he must pay a fine in the amount of 10 to 30 thousand rubles (Article 120 of the Tax Code of Russia). If the tax office has discovered violations in the maintenance of the Book in the direction of reducing the tax base, then liability arises in the form of a fine, the amount of which becomes 20% of the amount of unpaid tax, but not less than 40 thousand rubles.

Is there a penalty for refusing to provide the Tax Book (Clause 1 of Article 93 of the Tax Code)?

Yes, the penalty is 200 rubles for each refusal to provide the Account Book (clause 1 of Article 126 of the Tax Code).

Is there a penalty in 2021 for providing an old-style Book?

The penalty is the same as that which would be imposed if the Book were missing altogether.

Author of the article: Burenin Viktor

Author of a series of articles devoted to optimization of taxation and submission of tax reports under the simplified tax system, administrator and consultant of the website usn-rf.ru on these issues.

Developer of an online service for automatic generation of tax returns under the simplified tax system. Read more…

When comes into force: controversial point

Changes to the form of the book according to the simplified tax system were made by order of the Ministry of Finance of Russia dated December 7, 2016 No. 227n. This Order comes into force after one month from the date of its official publication (published on December 30, 2016), but not earlier than the 1st day of the next tax period according to the simplified tax system. That is, from January 1, 2021. Some experts think so. However, we have a different opinion. Let me explain.

The calendar month after the publication of the said document is December 2021. This month ended December 31, 2021. The next day, January 2021 arrived. The changes come into force no earlier than the 1st day of the next tax period according to the simplified tax system. The tax period according to the simplified tax system is a calendar year. This means the new form of the book will be applied from January 1, 2021, and not from January 1, 2021.

Order of the Ministry of Finance of Russia dated December 7, 2016 No. 227n states that it comes into force precisely after the expiration of a month. And the month of publication is December 2021.

Read also

14.03.2018

Trade fee

Based on paragraph 8 of Article 346.21 of the Tax Code of the Russian Federation, “simplifiers”, even with the object “income”, have the opportunity to reduce their tax through deductions from the trade tax where it is valid (so far only in Moscow).

For these purposes, they keep a book of income and expenses. Since 2017, a separate 5th section has been introduced. It looks like this:

As you can see, all payments for the trade fee are given in chronological order.

Note that before the appearance of this section, the book form did not imply a reflection of the trading fee at all. Accountants had to keep in mind the imputed tax amounts and reduce the simplified tax by them even before entering it into the book. Now such a need has disappeared.

Seal

Since 2021, the Ministry of Finance has directly indicated that the book does not need to be certified with a seal if a company or individual entrepreneur on the simplified tax system prefers to abandon its own stamp.

Let us remind you that such an opportunity appeared for business companies on April 7, 2015 thanks to the Federal Law of April 6, 2015 No. 82-FZ.

Let us note that previously the accounting department had to print out the entire electronic book of income and expenses on the simplified tax system at the end of the year and affix the company’s stamp and signatures on it. For the period 2021 and 2017, this will also have to be done, but without the obligatory company stamp.

Profit of controlled foreign companies

From 2021, only the income of the simplifier himself should appear in the book in question. Let us recall that they are shown in the fourth column of the 1st section.

In the rules for filling out the book, the Ministry of Finance clarified that the profits of foreign companies controlled by the domestic simplifier in the book of income and expenses under the simplified tax system since 2017 .

The catch was that a completely different tax is paid on the profits of CFCs - on profits, and the register in question is kept only for the purposes of the simplified tax system. Meanwhile, the rule that CFC profits do not need to be included in the book has not been recorded anywhere.

IP "Revenue" without staff

The updated rules for filling out the book of income and expenses since 2017 have significantly simplified the corresponding obligation for businessmen without employees who use the “income” object and pay insurance premiums only for themselves.

From January 1, 2021, Article 430 of the Tax Code comes into force. And under the name “insurance premiums in a fixed amount” she combined:

- contributions based on minimum wage

- contributions in the amount of 1% of income over 300,000 rubles

This suggests that businessmen using the simplified tax system will be able to easily list in the book all their deductions for compulsory insurance: both from the minimum wage and 1 percent of income above the specified level.

Note that until 2021, controllers often took hostility to reducing the tax on the simplified tax system due to one-percent contributions. Hence, problems arose with filling out the book of income and expenses.

Filling out KUDiR

Basic rules for conducting KUDiR:

- For each tax period, a new book of income and expenses is opened.

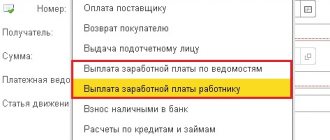

- Each operation is entered in chronological order on a separate line and confirmed by the appropriate document (agreement, check, invoice, payment order, etc.)

- Replenishment of the account, increase in the authorized capital are not recognized as income and, accordingly, are not entered into the KUDiR.

- KUDiR can be used in paper or electronic form. When maintaining a book in electronic form, at the end of the tax period, KUDiR must be transferred to paper media

- The book must be laced, numbered and confirmed by the manager’s signature and seal (if any)

- Unfilled sections of KUDiR are still printed and stapled in the general order

- In the absence of activity, profit or expenses, individual entrepreneurs and organizations must still have zero KUDiR