Payment

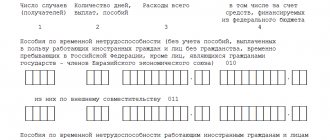

Home — Consultations In order to reimburse the costs of benefits for periods starting from 2021, companies

When calculating taxes, not only the amount of financial assistance is taken into account, but also its purpose. By

The tax period for value added tax (VAT) is a quarter. In the general case (with

Why is the basic yield for UTII established and how to find out its Basic yield -

* One of the most important indicators when calculating UTII (single tax for individual entrepreneurs and

All articles Advance payment for goods on the simplified tax system: the moment of recognition (commentary to the Letter of the Ministry of Finance of Russia

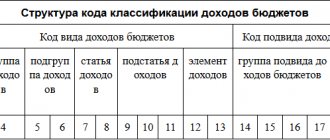

The basis of the fiscal structure of the Russian Federation is made up of payment deductions that have different purposes, characteristics and types:

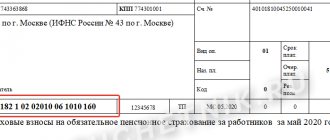

Details for paying taxes Let's consider the main fields of the payment slip when paying taxes: Field 101 is intended

What is a time sheet and why do you need to record time worked? According to the standards, it is mandatory to keep

The accounting department of any organization knows that, regardless of the tax system applied, at some point, in addition to