The accounting department of any organization knows that, regardless of the tax system applied, at a certain point, in addition to paying income tax, they are required to pay tax on property that does not belong to the Unified Gas Supply System. It is for this procedure that among the budget classification codes there is KBK 18210602010021000110.

The 20-digit combination is a kind of sign indicating a certain type of monetary transaction being carried out, which allows a given amount received by the budget to be moved to the group of expenses or income. The Budget Code of the Russian Federation was used as a basis during the creation of each BCC code. It is thanks to this code that the department subsequently has the opportunity to obtain the required information about the payment made by the organization.

A correctly entered KBK code allows each organization to avoid “stuck” payments. If necessary, track its transfer to the budget and even find out whether there is a tax debt. For the tax service, a correctly entered BCC also has a beneficial effect on their performance. Indeed, in this case, they quickly redirect incoming tax funds to the desired group, thereby improving the performance of the entire financial flow. The correct KBK code for each taxpayer is a guarantee that the transferred tax funds will quickly reach the budget account.

In which legal acts are the BCC approved?

KBK is a code for the budget classification of income or expenses of the budget of the Russian Federation.

In practice, business owners use only the “income version” of the KBK in their legal relations - indicating them in payment orders and thus identifying the payment that is transferred to the budget. This could be a tax, fee, contribution, duty, penalty or fine. Budget classification codes are approved in the regulations of the main federal department that is responsible for taxes and fees - the Ministry of Finance of the Russian Federation. For 2021, the procedure for the formation and application of BCCs, their structure and principles of appointment were approved by order of the Ministry of Finance of the Russian Federation dated 06.06.2019 No. 85n. And the lists of codes related to the federal budget and extra-budgetary funds are by order of the Ministry of Finance dated November 29, 2019 No. 207n. That is, if you need to find out which tax KBK 18210301000012100110 (or any other) corresponds to in 2021, then order No. 207n dated November 29, 2019 will be the primary source.

Let's consider the main BCCs used by businessmen in 2021.

What do the numbers in KBK mean?

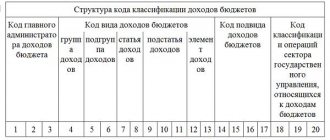

The general procedure for coding types of budget revenues is given in Section 1 of Order 65n:

The first three digits (chapter code for budget classification 2020) for payments to the Federal Tax Service will always have a value of 182, and for the Pension Fund - 392. The fourth digit for tax payments always has a value of 1.

In characters 4 to 11 a specific tax is encoded. And at 12 and 13 - the budget level:

- 01 - federal;

- 02 - regional.

14–17 characters determine what exactly is being paid: the current tax payment or penalties:

- 1000 - tax;

- 2100 - fines;

- 3000 - fine.

The last three digits for tax income will always have a value of 110.

Coding of government expenditures is carried out using a similar method, but is aimed at specifying the target code for the 2021 budget classification.

Main BCCs for taxes and contributions in 2021: list, explanation

The most used in 2021 are KBK, necessary for modern Russian individual entrepreneurs and business entities dealing with payment:

- Personal income tax for hired employees (KBK 18210102010011000110);

- income tax (regional KBK - 18210101012021000110, federal - 18210101011011000110);

- simplified tax system (KBK under the “income” scheme - 18210501011011000110, under the “income minus expenses” scheme - 18210501021011000110);

- UTII (KBK 18210502010021000110);

- VAT (KBK for tax 18210301000011000110, penalties - 18210301000012100110, fines - 18210301000013000110);

- fixed contributions to mandatory pension insurance (KBK18210202140061110160);

- contributions to mandatory pension insurance for employees (KBK 18210202010061010160);

- fixed contributions for compulsory medical insurance (KBK 18210202103081013160);

- contributions to compulsory medical insurance for employees (KBK 18210202101081013160);

- contributions for compulsory insurance in case of temporary disability and in connection with maternity (KBK 18210202090071010160);

- contributions to the Social Insurance Fund for occupational injuries (KBK 39310202050071000160);

- voluntary fixed contributions to the Social Insurance Fund (KBK 39311706020076000180).

KBK for payment of corporate property tax for legal entities

| Decoding the code | Budget classification code |

| Property tax of organizations on property not included in the Unified Gas Supply System (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) | 182 1 0600 110 (original code) 18210602010021000110 (short code) |

| Property tax of organizations on property not included in the Unified Gas Supply System (penalties on the corresponding payment) | 182 1 0600 110 (original code) 18210602010022100110 (short code) |

| Organizational property tax on property not included in the Unified Gas Supply System (interest on the corresponding payment) | 182 1 0600 110 (original code) 18210602010022200110 (short code) |

| Property tax of organizations on property not included in the Unified Gas Supply System (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) | 182 1 0600 110 (original code) 18210602010023000110 (short code) |

| Property tax of organizations on property included in the Unified Gas Supply System (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) | 182 1 0600 110 (original code) 18210602020021000110 (short code) |

| Organizational property tax on property included in the Unified Gas Supply System (penalties on the corresponding payment) | 182 1 0600 110 (original code) 18210602020022100110 (short code) |

| Organizational property tax on property included in the Unified Gas Supply System (interest on the corresponding payment) | 182 1 0600 110 (original code) 18210602020022200110 (short code) |

| Property tax of organizations on property included in the Unified Gas Supply System (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) | 182 1 0600 110 (original code) 18210602020023000110 (short code) |

What is the code 18210602010022100110 for?

KBK 18210602010022100110, transcript 2021 is a 20-digit code used to pay penalties assessed to an organization by the tax authority in case of late payment of property tax not included in the Unified Gas Supply System. Payment of penalties occurs by filling out a payment document using the same form 0401060, which is also used for paying taxes. But it is worth considering that in both cases, filling out a payment form in 2021 is somewhat different in nature compared to previous years.

In total, 6 lines were changed in the payment document. Now line 16 is used to enter information about the recipient. On line 22, the organization’s accountant must enter the UIN. To enter information about the reason for carrying out a financial transaction, that is, payment of penalties, line 106 is used. Line 107 reflects the tax period, and in line 108 the accountant must reflect the document number for which the funds are transferred. In line 109 the date of the document for which the amount is deducted is entered.

In addition to such changes in filling out the lines, there are also some features that must be taken into account by the accountant when filling out the payment document for the payment of penalties. So line 16 should now reflect the territorial body of the Federal Tax Service. In line 106 you should enter the KBK code 18210602010022100110 .

Decoding KBK 18210502010021000110

Companies and individual enterprises use different taxation systems (STS): basic and special regimes. Special regimes facilitate accounting and exempt the resident from a number of fees. Thus, a single tax on imputed income replaces: personal income tax, VAT, on profit, on property and others. A tax on profits is paid on UTII. The peculiarity of imputation is that the fee is not calculated on earned income, but on an approximate fixed amount of 15%. The approximate amount is established by the Tax Code of the Russian Federation.

The imputation has the right to be used by enterprises whose activities are limited by law. Thus, KBK 18210502010021000110 is indicated in the payment slip when transferring the standard amount of UTII collection for comprehensive income for certain types of work. In addition to the standard payment, payers contribute tax funds for fines, penalties and interest. KBK UTII 2021 for individual entrepreneurs are valid in 2019.

The classification code for paying UTII according to the standard payment consists of 20 digits and is divided into seven blocks:

- 182 - department that controls revenues: Federal Tax Service Inspectorate.

- 1 - category of budget revenues: tax payments.

- 05 — collection subcategory: complex profit tax.

- 02010 - type of budget and source of tax calculation: UTII for certain types of work to the regional budget.

- 02 - a specific type of treasury: the budget of the constituent entities of Russia.

- 1000 — purpose of payment: standard.

- 110 - generalized category of tax payment: tax revenues to the budget.

Decoding KBK 18210602010021000110

The legislation provides for taxes for entrepreneurs, individuals and legal entities. Companies pay fees under individual BCCs. Thus, KBK 18210602010021000110 is used to deposit the tax amount on property not included in the Unified Gas Supply System (UGSS). The UGSS is a technological complex that includes gas production, processing and storage facilities. For organizations participating in the Unified State Gas System, a separate tax base for payment is provided. Their budget classification code is different from others. An organization must calculate tax only on depreciated property, which is listed as fixed assets.

The code for paying the property tax consists of 20 digits, divided into combinations. Each combination corresponds to the value:

- 182 - department that controls the receipt of payments: Federal Tax Service Inspectorate.

- 1 - type of income: tax.

- 06 — revenue subtype: property taxes.

- 02010 - specifies the fee, indicates the budget: property tax of organizations on property that does not belong to the Unified State System, which is transferred to the regional budget.

- 02 - treasury category: budget of a subject of the Russian Federation.

- 1000 — purpose of payment: standard payment.

- 110 - specifies the income group: tax receipts.

KBC for payment of penalties and fines

In addition to codes for standard contribution amounts, KBC have been developed for the payment of fines and penalties. Some payers violate tax laws and pay monetary penalties for violating the Tax Code of the Russian Federation.

KBK for payment of penalties

Penalties for UTII are charged to tax residents if the deadlines for payment of the fee are violated. The amount of the penalty is calculated based on the number of days of late payment, the refinancing rate of the Central Bank of the Russian Federation and the amount of the fee payable. The month of delay is calculated at the refinancing rate of 1/300, and from the 31st day at the rate of 1/150. Taxpayers do not have the right to exceed the amount of the penalty over the amount of the fee payable.

To pay the collection along with the overdue tax, indicate KBK 18210502010022100110 in the payment slip.

The fee must be paid and the declaration submitted in the month following the reporting quarter. The tax payment deadline is the 25th, and reporting must be submitted by the 20th.

Fines

If the payer refuses to pay the penalty, the amount of the fee or the amount of the penalty already exceeds the amount of the tax, then the tax office charges the offender a fine. A fine is a monetary penalty in a fixed amount, which is calculated as a percentage or a specific amount in ruble equivalent. In addition to refusal to pay the fee, sanctions may be imposed for other reasons, for example, late submission of reports. Also, the payer will not be charged a penalty, but will be immediately assigned a fine if the resident committed the crime intentionally, or not for the first time.

To pay the fine, you must indicate KBK 18210602010023000110 on your payment slip.

What happens if you indicate incorrect budget classification codes for 2021 on your payment

The details are indicated in field 14 of the payment order.

If you make a mistake in it, the tax authorities will not be able to correctly attribute the payment. Therefore, the tax revenue will not be reflected and the fee will be considered unpaid. Penalties will be charged on the arrears until the payment is confirmed by the payer. To correct the error, it is necessary to submit an application to the Federal Tax Service to clarify the BCC, indicating the correct value of the erroneous details (Letter of the Ministry of Finance dated January 19, 2017 No. 03-02-07/1/2145).

All codes can be viewed in a special section of our portal.

Other KBK from this category:

| 18210502010022100110 | Single tax on imputed income for certain types of activities (penalties on the corresponding payment) |

| 18210502010022200110 | Single tax on imputed income for certain types of activities (interest on the corresponding payment) |

| 18210502010023000110 | Single tax on imputed income for certain types of activities (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| 18210502020021000110 | Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) |

| 18210502020022100110 | Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) (penalties on the corresponding payment) |

| 18210502020022200110 | Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) (interest on the corresponding payment) |

| 18210502020023000110 | Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

Changes to the BCC for corporate property tax in 2021

The property tax code for 2021 has not changed. But there have been changes in the corporate property tax. From January 1, 2021, for the previous year, payers have the right to calculate and pay the fee only for real estate. Movable property is not subject to tax, regardless of the type of enterprise. These changes also apply to individuals.

Sources

- https://nalog-nalog.ru/uplata_nalogov/rekvizity_dlya_uplaty_nalogov_vznosov/rasshifrovka_kbk_-_18210102010011000110_i_dr/

- https://www.taxinspections.ru/codes/kbk/kbk-urlica/kbk-urlica-imushchestvenye/kbk-urlica-imushchestvo.html

- https://saldovka.com/nalogi-yur-lits/kodi-kbk/18210602010022100110.html

- https://NalogObzor.info/publ/rassifrovka-kbk-18210502010021000110-v-2019-godu-peni-i-strafy

- https://NalogObzor.info/publ/kbk-18210602010021000110-v-2019-godu

- https://kbk1.ru/ip/18210502010021000110.php