RSV-2 - “Calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund by the heads of peasant (farm) farms.”

The form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated September 17, 2015 No. 347p “On approval of the form of calculation for accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and insurance contributions for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund by the heads of peasants ( farms) and the Procedure for filling it out" (Registered with the Ministry of Justice of Russia on 10/08/2015 No. 39241).

This resolution applies starting with the submission of calculations of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and insurance contributions for compulsory medical insurance to the Federal Compulsory Health Insurance Fund by the heads of peasant (farm) farms for 2015.

Main innovations in the form of DAM

The updated form appeared for several reasons. The main one is the amendments made to the Tax Code.

Firstly, starting from 2021, the DAM includes data on the average number of employees. They are reflected on the title page. This is due to the fact that the self-report with this information has been cancelled.

Secondly, in 2021 a number of insurance premium rates were changed. For small and medium-sized businesses, the aggregate rate was reduced by half. For those areas that suffered the most from the coronavirus crisis, zero insurance premium rates were in effect in the first half of 2020.

In this regard, the tax service previously recommended indicating new payer tariff codes in the DAM form: 20 – for SMEs; 21 – for those that belong to the most affected industries; 22 – for electronics / radio electronics developers.

In addition, to reflect in section 3 of the KND form 1151111, new codes for insured persons were introduced, corresponding to payer tariff codes 20-22:

- MS. Serves to indicate the portion of the payment exceeding the minimum wage to an employee of a small or medium-sized enterprise;

- KV. Used to reflect payments from which insurance premiums were calculated at a zero rate;

- ECB. Used to reflect employer payments related to IT/electronics development.

The above changes must be taken into account when filling out the DAM for the 4th quarter of 2021.

Another innovation: from 14% to 7.6%, tariffs for calculating contributions for employee insurance for organizations in the field of high technology and electronics development were reduced. For this category of payers, the new DAM form contains a separate section - Appendix 5.1.

DAM for the 4th quarter of 2021 for affected industries

Due to the coronavirus, from April 2021, the procedure for calculating insurance premiums for small and medium-sized businesses listed in the SME Register has changed. When calculating contributions, three tariffs are applied simultaneously:

- basic - 30% (including 22% PFR, 5.1% FFOMS and 2.9% FSS) for amounts of payments to insured persons within the minimum wage (RUB 12,130);

- reduced - 15% (10% PFR, 5% FFOMS, 0% FSS) for that part of payments that exceed the minimum wage;

- zero - for policyholders from affected industries.

The calculation is carried out for each insured person. Income is compared with the minimum wage at the end of each calendar month.

When filling out the Calculation for the Ⅳ quarter of 2021. Such companies and individual entrepreneurs will need to use the new codes listed in the Federal Tax Service Letter No. BS-4-11/ [email protected] :

Base:

1) payer tariff code “01” (when filling out line 001 of Appendices 1 and 2 to Section 1); 2) category code of the insured person “NR” (when filling out line 130 of Subsection 3.2.1 of Section 3) for individuals - citizens of the Russian Federation:

Reduced:

1) payer tariff code “20” (when filling out line 001 of Appendices 1 and 2 to Section 1); 2) category code of the insured person (line 130 Subsection 3.2.1 of Section 3):

- MS - for individuals-Russian citizens;

- VZHMS - for foreigners or stateless persons temporarily residing in the territory of the Russian Federation or temporarily staying to receive temporary asylum;

- VPMS – temporarily staying foreign citizens.

First, fill out the application with the basic tariff, then with the reduced one.

Let's consider a sample of filling out a calculation of insurance premiums for the Ⅳ quarter of 2021 for a SME company applying a reduced tariff of 15%.

Filling out the RSV in 2021

So, the DAM for the 4th quarter of 2021 must be filled out using a new form. It contains several sheets, but only those with indicators are included in the calculation. Most organizations and individual entrepreneurs must fill out the following form sheets: Title, Section 1 with Appendix 1 (subsections 1.1 and 1.2) and Appendix 2, Section 3. If a zero calculation for insurance premiums is submitted (there was no activity), then only the title page and section are submitted 1.

First of all, fill out the title page. Next, you should reflect the information in the reverse order of sections: start with Section 3, then fill out the appendices, and lastly, Section 1.

Title page

Let's look at filling out the first sheet of the new DAM form, which is valid from 2021. Here you need to indicate:

- adjustment number – “001” (primary calculation);

- settlement period code - taken from Appendix No. 3 to the Procedure for filling out the DAM form for 2021, which is contained in Order No. MMV-7-11 / [email protected] (hereinafter referred to as the Procedure). In the calculation for the year, code “34” is indicated;

- calendar year – 2020;

- tax authority number;

- code for the place of submission of the form from Appendix No. 4 to the Procedure. For an organization – usually “214”, for an individual entrepreneur – “120”;

- name of the organization or full name of the entrepreneur;

- average number of employees. This is a new field that has been added to the form in 2021 in place of the headcount report. It must be filled out in the DAM for 2021 and further in all forms for the following periods;

- main OKVED;

- phone number;

- number of pages of the DAM report and copies of documents, if attached.

In the lower part on the left, the accuracy of the information is confirmed.

Who is required to submit it?

The new RSV-2 report is submitted exclusively by the heads of peasant (farm) households .

The document is submitted to the Pension Fund even if there is no income or activity at all. Previously, the legislation established that these reports must be submitted by persons who do not make payments or remuneration. These include individual entrepreneurs who do not have employees, that is, making contributions to the Pension Fund only for themselves. Currently, all tax, accounting and other reporting for entrepreneurs has been significantly simplified, the list of required documents, their structure, content, and deadlines for submission have been reduced. In particular, now individual entrepreneurs do not submit the RSV-2 form.

Section 3

Section 3 must be completed for each insured person. Subsection 3.1 indicates personal data: TIN, SNILS, last name, first name and patronymic, date of birth, country of citizenship code (RF - 643), gender, document code (Appendix No. 6 to the Procedure), its series and number.

Column 010 is not filled in - code “1” is entered in it only when information is corrected or canceled.

Subsection 3.2.1 should indicate the amounts paid to this person for the last three months of the period. The following data is entered in the columns:

- 130 – category code of the insured (Appendix No. 7 to the Procedure). Here new MS, HF and EKB codes appeared, which were mentioned above;

- 140 – amount of remuneration paid;

- 150 – amount subject to pension contributions;

- 160 – amounts under civil contracts (included in line 150);

- 170 – calculated amount of OPF contributions. It is calculated as the contribution base (column 150) multiplied by the tariff.

If the policyholder is a SME and pays the employee a salary above the minimum wage (12,130 rubles), two subsections 3.2.1 should be completed:

- first in relation to payments within the minimum wage. The code “NR” is indicated, the amount is 12130 and the amount of contributions is 2668.6;

- then in relation to payments exceeding the minimum wage. For example, if an employee’s salary is 55,000 rubles, then you should indicate: code “MS”, payment amount - 42870 and the amount of pension contributions at the 10% rate - 4287.

If the payment does not exceed the minimum wage, then subsection 3.2.1 is filled out as when calculating contributions at the basic tariff in the singular.

Subsection 3.2.2 is completed only by those employers who pay pension contributions at the additional rate.

Connect online accounting from 1C First month - free

Annex 1

The application is intended for calculating pension contributions and contributions to compulsory medical insurance.

Column 001 is intended to indicate the tariff code - it must be taken from Appendix No. 5 to the Procedure. SMEs with payments above the minimum wage fill out this application 2 times: with code “01” for the part of the payment within 12,130 rubles and with code “20” for the part exceeding this amount.

In subsection 1.1, you must indicate the number of insured persons, including those from whose payments contributions are calculated. The following indicates the amount of payments from the beginning of the billing period and for each of the last three months.

✐ Example ▼

For example, the company has 1 employee (director) with a salary of 55,000 rubles per month, there were no other payments. The total amount since the beginning of the billing period (2020) is 660,000 rubles. At the same time, at the basic tariff of 22% payments are subject to contributions:

- entire salary for January-March – 55,000 * 3 = 165,000 rubles;

- Salary within the minimum wage for April-December – 12130 * 9 = 109170 rubles.

Payments for April-December above the minimum wage are taxed at a reduced rate of 10%:

(55000 – 12130) * 9 = 385830 rubles.

Further in this subsection, in the same order (total from the beginning of the year and for the last 3 months) are reflected:

- amounts not subject to contribution;

- amounts to be deducted;

- calculated base (including those exceeding the limit value);

- the amount of contributions (including separately from the base within the limit and above it).

In subsection 1.2 of Appendix 1, medical contributions are calculated in a similar way. The difference is in the size of the tariff, and also in the fact that in this subsection there are no fields relating to amounts exceeding the maximum base value, since it is not established for medical contributions.

Appendix 2

Appendix 2 to Section 1 calculates contributions for illness and maternity. It is filled out similarly to Appendix 1 with a slight difference. Column 002 indicates the payment attribute depending on which scheme is used. These can be direct payments or an offset system.

In addition, the second page of Appendix 2 indicates the costs of paying insurance coverage and the amounts reimbursed from the Social Insurance Fund (under the credit system).

Submission options and deadlines

The completed calculation is submitted every 12 months to the territorial office of the Pension Fund of the Russian Federation until March 1 of the following reporting year . That is, a form with information for 2015 must be submitted to the government agency to which the farm is assigned before March 1, 2021.

The document can be completed on paper by printing the form. You must enter information using a black or blue ballpoint pen. You must write in block letters. This is necessary to ensure that there are no errors when transferring data by employees of the pension authority due to the handwriting characteristics of the person responsible for the submission. The completed form is signed personally by the head of the household and stamped.

The report may also be provided in digital form using electronic document management tools. In this case, the authenticity of the information is confirmed by the use of an electronic digital signature certificate.

Section 1

Section 1 is final. In field 001, code “1” is entered if payments were made to individuals in the last 3 months. If there were none, code “2” is set. In line 010 OKTMO is written.

Next, in the lines of the section for each type of contribution you need to indicate:

- KBK;

- the amount of contributions for the reporting period;

- monthly contribution amounts.

This completes filling out the RSV form for 2021. Please note that the new section 5.1, intended for the IT sector, must be completed starting in 2021 when reporting for the 1st quarter. Those who send the DAM electronically should remember that the format for its presentation has also been changed.

The deadline for submitting calculations remains the same - no later than the 30th day of the month following the end of the quarter. You must submit the DAM for 2021 by February 1: the deadline is being moved, since January 30 is a Saturday.

What it is?

One of such documents is the calculation of accrued and paid contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund , compiled according to the RSV-2 form.

The report is a form filled out in the prescribed manner, containing information about the enterprise, calculation of contributions to the Pension Fund of the Russian Federation and transfers to the Federal Compulsory Medical Insurance Fund. Certified by the signature of the head and the seal of the organization. The new document was determined on September 17, 2015 by Resolution No. 347p.

With the establishment of a new standard form, the deadlines for submission, the procedure for filling out and the list of persons obliged to use this document have changed. All of these adjustments apply to reporting for 2015 and beyond.

The previously valid form was canceled by order No. 294n dated 05/07/2015. Information on this form is no longer required to be provided.

Sample filling

Filling out the title page begins by indicating at the top of it the number received upon registration with the Pension Fund. The same number must appear on all other completed pages.

Documents for download (free)

- Form RSV-2

Further on the title page the following data is indicated:

- In the field intended for the clarification number, three “0s” are written if the report is primary. If it is clarifying and contains some edits and corrections, then two “0s” are put with a number indicating the time at which the report is submitted for the same period.

- The calendar year to which the reporting corresponds is specified.

- In the field that corresponds to the termination of the activity, an “L” is placed if it was actually terminated before the reporting period ended.

- Last name of the head of the household with full name and patronymic without any abbreviations.

- Personal taxpayer number issued along with a tax registration certificate.

- The OKVED code corresponding to the main type of activity of the peasant farm according to the classifier is entered.

- The telephone number is indicated in digital format without brackets and dashes.

- The number of members included in the peasant farm is noted, taking into account the person acting as the head.

- The number of pages of the form is written at the very end after the report has been completed and all pages, including the title page, have been numbered. If additional supporting documents are submitted along with the report, the number of sheets they contain must also be indicated.

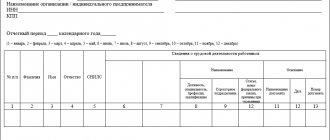

It is advisable to start entering data directly into the RSV-2 form from the 2nd section. It should display all accruals for insurance premiums that took place in the reporting year. For each member of the peasant farm and its head, data is entered in separate lines. Only indicators for participants during the time when they were actually members are taken into account.

Significant nuances:

- when entering the surname with first name and patronymic in the 2nd column, you must be guided by their spelling in the passport and not make any abbreviations;

- for column 3, SNILS should be taken from the insurance certificate issued when applying for compulsory insurance at the Pension Fund of the Russian Federation;

- The 4th column is intended for entering the date of birth;

- filling out the 5th and 6th columns is carried out on the basis of applications for joining peasant farms, if there were any in the reporting year (if there were no entries or exits from their peasant farms, then the start and end dates of the period are simply written down);

- The 7th and 8th columns reflect fixed accrued contributions (pension and health insurance).

For 2021, the amount of contributions for health insurance for each individual is 8,426 rubles, and 32,448 rubles must be paid to the Pension Fund. However, if the annual income crosses the mark of 300,000 rubles, you will have to add 1% of income above this threshold to the fixed amount payable to the Pension Fund.

Insurance premiums are payable before the end of the year, regardless of whether the activity took place. Contributions can be made in stages quarterly/monthly or in a lump sum in full. Contributions from amounts over the limit must be made no later than April 1 of the following reporting year.

Section 3 reflects the recalculation of contributions, if any. The reasons for filling it out may be:

- additionally accrued contributions to the Pension Fund for previous years based on reports of desk audits;

- self-identified errors by peasant farms or incompletely reflected information, which resulted in an underestimation of the amounts of contributions for previous years;

- data adjusted by the head of the peasant farm, used for accrual for previous periods.

The 6th and 7th columns must indicate the period for which the recalculation was made.

Next comes filling out the 1st section, and for this you need to have a report for the previous year. The algorithm and features of the actions are as follows:

- The 100th line contains data on debts existing at the beginning of the year, which are taken from the DAM report for the previous year. If there is an overpayment in the 4th column of the 150th line of last year's document, the 3rd column of the 100th line for the current period will correspond to the amount of the 3rd and 4th columns of the 150th line for the earlier period.

- A negative value is not allowed in the 4th column of the 150th line.

- In the 110th line, the 3rd column corresponds to the 7th column of the final line of the 2nd section, and the 6th column corresponds to the 8th column in the same place.

- The 120th line reflects the amounts corresponding to the recalculations from the 3rd section. In accordance with this, columns 3-6 of the 120th section of the 1st section should be correlated with columns 8-10 of the 3rd section.

- In the 120th line, the indicators contained in the 100th, 110th and 120th lines are summed up and the contributions payable are reflected.

- Line 140 contains data regarding the amounts of contributions paid during the year.

- Line 150 indicates the amount of arrears in payment of contributions generated at the end of the year. It is the difference between the 130th and 140th lines. If there is an overpayment, the amount will have a negative sign.

We fill out Appendix No. 3 to Section 1

This application is optional and must be completed only if benefits were paid during the reporting period:

- for temporary disability;

- for pregnancy and childbirth;

- for child care;

- for early pregnancy registration;

- at the birth of a child;

- for caring for a disabled child (payment for additional days off);

- for burial.

For each payment indicate:

- the number of cases that are the basis for the payment or their recipients;

- number of paid days of incapacity (number of payments or benefits);

- the amount of expenses incurred (including from the federal budget).

On page 100 indicate the total amount of expenses (sum of lines 010-090).

On page 110, for reference, they reflect the amount of accrued but unpaid benefits (except for benefits accrued for March, for which the payment deadline has not been missed).

The insurer attributes the amounts received from the Social Insurance Fund in the report for the period when the fund reimbursed the costs of paying sick leave benefits. The period in which the days of incapacity for work are paid to the employee does not matter (Letter of the Federal Tax Service dated November 19, 2019 No. BS-4-11 / [email protected] ).

We fill out subsection 1.1 of Appendix No. 1

Rules for filling out subsection 1.1 of Appendix No. 1 of the RSV

| Line | What do they indicate? |

| 001 | Contribution payer tariff code. You can find it in Appendix No. 5 to the Filling Out Procedure. The codes used when filling out the DAM for the first half of 2021 are given below |

| 010 | From left to right - the total number of insured employees, regardless of whether they received income in the reporting period:

|

| 020 | From left to right - the number of employees who were paid income subject to compulsory pension contributions:

|

| 021 | If during the reporting quarter the employee's income exceeded the maximum base for contributions, show their number in the columns of this line. In 2021, the maximum base for contributions to compulsory pension insurance is RUB 1,292,000. |

| 030 | The amount of payments to employees subject to contributions to compulsory pension insurance:

This line does not include payments that are not subject to insurance premiums: dividends, material benefits, payments under lease agreements or upon the sale of property (Letter of the Federal Tax Service of Russia dated 08.08.2017 No. GD-4-11 / [email protected] , Letter of the Ministry of Health and Social Development dated 05/19/2010 No. 1239-19). Example of filling out page 030: |

| 040 | If any payments during the year were not subject to contributions to compulsory pension insurance, they are reflected in the columns of this line in the same order as we reflected contributions on page 030 |

| 045 | This line shows the amounts:

|

| 050 | Contribution base for half a year and April-June 2021. It is calculated using the formula: page 030 - page 040 - page 045 |

| 051 | Contribution base exceeding the maximum limit |

| 060 | The amount of calculated insurance premiums, calculated according to the formula: line 050 x tariff. Page 060 = page 061 + page 062 |

| 061 | The amount of insurance premiums calculated for the first half of 2021 from a base not exceeding the limit of RUB 1,292,000. Calculated using the formula: (050 - 051) x tariff |

| 062 | The amount of contributions calculated from a base exceeding the limit. Calculated using the formula: line 051 x per tariff |

Codes for filling out subsection 1.1 of Appendix No. 1

INSURANCE PAYER TARIFF CODES

| 01 | Payers of insurance premiums applying the basic tariff of insurance premiums |

| 06 | Payers of insurance premiums operating in the field of information technology |

| 07 | Payers of insurance premiums who make payments and other remuneration to crew members of ships registered in the Russian International Register of Ships for the performance of labor duties of a ship crew member |

| 10 | Payers of insurance premiums are non-profit organizations (with the exception of state (municipal) institutions), registered in the manner established by the legislation of the Russian Federation, applying the simplified tax system and carrying out activities in accordance with the constituent documents in the field of social services for the population, scientific research and development, education, healthcare, culture and art (the activities of theaters, libraries, museums and archives) and mass sports (except professional) |

| 11 | Payers of insurance premiums are charitable organizations registered in accordance with the procedure established by the legislation of the Russian Federation and applying the simplified tax system |

| 13 | Payers of insurance premiums who have received the status of project participants for the implementation of research, development and commercialization of their results in accordance with the Law of September 28, 2010 No. 244-FZ or project participants in accordance with the Law of July 29, 2017 No. 216-FZ |

| 14 | Payers of insurance premiums who received the status of participant in the free economic zone in accordance with Law dated November 29, 2014 No. 377-FZ |

| 15 | Payers of insurance premiums who have received the status of resident of the territory of rapid socio-economic development in accordance with Law dated December 29, 2014 No. 473-FZ |

| 16 | Payers of insurance premiums who have received the status of resident of the free port of Vladivostok in accordance with Law No. 212-FZ dated July 13, 2015 |

| 17 | Payers of insurance premiums are organizations included in the unified register of residents of the Special Economic Zone in the Kaliningrad Region in accordance with Law No. 16-FZ dated January 10, 2006 |

| 18 | Payers of insurance premiums are Russian organizations engaged in the production and sale of animated audiovisual products produced by them, regardless of the type of contract and (or) provision of services (performance of work) for the creation of animated audiovisual products |

| 19 | Payers of insurance premiums who received the status of a participant in a special administrative region in accordance with Law dated 03.08.2018 No. 291-FZ |

General requirements

The form can be filled out either manually (but in block letters) with a blue or black pen, or using a computer.

One indicator must be entered in each line and corresponding columns. If any data is missing, then a dash is placed in the place intended for it.

In case of errors, it is prohibited to use corrective means: the incorrect data should be crossed out and the correct data should be entered, confirming the changes with the signature of the head of the peasant farm.

Display of monetary indicators should be exclusively in rubles and kopecks. After the calculation is completely filled out, all pages are numbered in the appropriate field.

Completing the title page, as well as sections 1 and 2, is mandatory in all cases. As for the 3rd section, intended for the recalculation of insurance premiums, it is aimed only at those who filled out line 120 in the 1st section.

The top part of each page that has been filled out must contain the registration number of the peasant farm issued by the territorial body of the Pension Fund upon registration.

Each page ends with the signature of either the head of the peasant farm or the one who is his representative, indicating the date of completion.

Who rents and when?

Submission of this document is the responsibility of all heads of peasant farms recognized by members, and if only one person took part in the creation of the farm, he will automatically be the head.

This person maintains the accounting and reporting of the peasant farm; in addition, he makes contributions to the funds, paying the funds due in accordance with the relevant legislation. In this case, the amount of contributions is strictly fixed.

Until 2015, reporting had to be done by persons who did not make any payments. Now this is the exclusive responsibility of the heads of peasant farms. Another important point is that RSV-2 must be provided even if the farm has no actual activity and no income.