The Russian government did not ignore the issue of sick leave and maternity leave, increasing sick leave, maternity leave, childcare benefits for children under 1.5 years old and other payments for 2021.

Sick leave and maternity benefits for the period of pregnancy, childbirth and child care in the first year and a half of life have been increased according to inflation for 2021, namely by 4-5%.

Maternity leave - new law

In 2021, no significant changes were made to the texts of the legislation on maternity leave. However, current circumstances must be taken into account when calculating benefits.

When calculating maternity benefits, variable indicators such as:

- Minimum wage, i.e. legally established minimum wages that every employer is required to pay;

- salary limits taken into account for calculating benefits;

- a list of years for which earnings are taken into account.

The listed data changes annually and even more often.

- So the minimum wage changed twice - as of January 1 and July 1, 7600 and 7800 rubles, respectively. In 2021, it is planned to increase the minimum wage to 9,489 rubles . Starting with, it is envisaged that the minimum size will come into line with the subsistence level, and this equality will be maintained in the future.

- Similarly, the maximum (limit amount of remuneration) that is taken into account when determining maternity benefits has increased. If in 2021 it was 718 thousand rubles, then – 755 thousand rubles. In plans, this amount will increase to 991 thousand rubles.

- In 2021, to calculate the salary fund, salaries for 2021 and 2021 are taken into account, i.e. two full calendar years preceding pregnancy.

How does indexation and regional coefficients affect?

When calculating the amount of benefits, the indexation coefficient for the current year is always taken into account. This indicator is determined based on Rosstat data on the size of actual inflation for the previous period. Thus, by Government Decree No. 74 of January 26, 2018, the indicator was set at 1.025. Benefits increased by this coefficient will be paid only if the right to them arises from February 1, 2018. With regard to the B&R benefit, when calculating for employed insured women, the indexation of the minimum wage (for the minimum indicator) will be important; for women laid off from work, the amount of the benefit is established by Federal Law No. 81. Before indexation in 2021, it was equal to 613.14 rubles for 1 month of sick leave, after which it became equal to 628.47 rubles.

Regional coefficients play a significant role in calculations. If it is taken into account when calculating the salary (this point can be clarified in the accounting department or looked at in salary slips), then a separate multiplication by the indicator is not required. If the calculation is carried out on the basis of the minimum wage (when the insurance period is less than six months), then the regional coefficient will act as a separate multiplier, which will significantly increase the final amount of payment. The Labor Code of the Russian Federation (Article 316) states that the size of the coefficients should be determined by the Government of the Russian Federation, but as of 2021, the Decree of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions No. 527/13 dated July 27, 1959 is still in force, according to which the coefficient, for example, in Khabarovsk region is 1.40, in the Irkutsk region - 1.20, in the Kurgan region - 1.15, and so on. At the same time, regional authorities can independently set this indicator for their subject. For example, according to the Decree of the USSR State Committee for Labor, the coefficient in the Novosibirsk region is 1.15, but in reality it is 1.20.

At what stage of pregnancy does maternity leave begin?

The period of pregnancy from which a pregnant woman can go on maternity leave is calculated by a gynecologist. He also writes out sick leave as the main document giving grounds for starting vacation.

This event occurs:

- for most expectant mothers upon reaching 30 weeks from conception;

- for mothers with multiple pregnancies (twins, triplets, etc.) at 28 weeks;

- in accordance with the list of benefits for victims of Chernobyl, leave is provided for 27 weeks.

The exception is early birth, which occurs between 22 and 30 weeks, i.e. before the official date of maternity leave. In this case, sick leave is provided from the day of birth for the entire vacation period.

Calculation of maternity benefits in 2021, taking into account the minimum wage - examples of calculating maternity benefits

When calculating maternity benefits, the minimum wage can be taken into account if...

- Mom’s income for the required period was equal to “0” or the average monthly salary could not jump over the minimum wage.

Example:

- Petrova goes on maternity leave in May 2018, having earned 220,000 rubles during the required period.

- The average monthly salary will be: 220,000: 24 months = 9166.66 rubles. Which does not exceed the minimum wage for 2018 (9489 rubles).

- When calculating the average salary taking into account the minimum wage, the daily earnings will be equal to 311.54 rubles. We multiply it by the number of days of maternity leave and get the amount of the PBIR benefit.

- Mom worked in her company for less than 6 months

- When calculating the amount of benefits, the minimum wage is also taken into account. Daily earnings will be 311.54 rubles.

- The benefit for a month, including 31 days, cannot exceed the minimum wage.

- Calculations may differ for different regions, as well as in accordance with other coefficients.

How long is maternity leave?

The total duration of maternity leave for pregnancy and childbirth consists of two parts (before and after childbirth), which are added up and determined as the total number of days.

The duration may vary due to living conditions or the complexity of childbirth, so these nuances must be taken into account.

Duration of OBiR

| Payment terms | Total | Before giving birth | After childbirth |

| For most | 140 | 70 | 70 |

| In case of complicated labor | 156 | 70 | 86 |

| When more than one child is born | 194 | 84 | 110 |

| If a multiple pregnancy is detected during childbirth | 194 | 70 | 124 |

| For women living in the zone of eviction due to the Chernobyl disaster | 160 | 90 | 70 |

| For women living in the area of eviction due to the Chernobyl disaster with complicated childbirth | 176 | 90 | 86 |

| For women living in the zone of eviction due to the Chernobyl disaster upon the birth of twins | 200 | 90 | 110 |

All listed periods of maternity leave are indicated on the sick leave certificate. A pregnant woman can voluntarily shorten her vacation, i.e. leave later than indicated in the documents, but due to this, the vacation dates do not move forward. In addition, social benefits are not paid for those days for which wages are accrued.

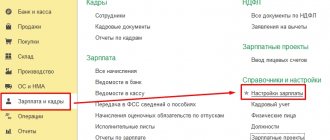

Step-by-step registration instructions

Registration of maternity leave is a two-way process in which the pregnant employee and administration employees (HR managers, accounting, management) take part.

The expectant mother is obliged:

- at the beginning of pregnancy, register with a gynecologist;

- upon arrival of 30 (28 or 27) weeks, obtain sick leave and certificates from your doctor;

- obtain a certificate from the bank about the current account number for transferring benefits;

- make copies of your passport;

- submit to the personnel, accounting department or secretary the collected documents in the original and a copy of the passport;

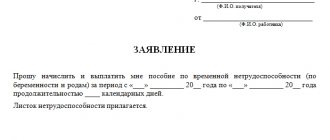

- write an application for leave indicating its start and duration;

- indicate in the application your desire to receive maternity benefits;

- list the attached documents;

- read the text of the order for granting leave;

- Do not go to work from the specified date.

Employees of the enterprise responsible for processing maternity leave are obliged to:

- receive documents and a statement from an employee going on maternity leave;

- draw up and sign a vacation order;

- familiarize the applicant with it;

- calculate benefits;

- draw up a calculation note in form T-60, on the basis of which special payments are made;

- transfer it to the card or bank account specified in the application from the company’s funds;

- draw up documents in the prescribed form to reduce transfers to the social insurance fund by the amount of funds paid;

- prepare a report on the expenditure of the allocated amount in a timely manner.

After giving birth, the mother in labor submits a copy of the baby’s birth certificate to the enterprise. If circumstances arise to extend the leave, for example, complicated childbirth, then an additional sick leave sheet is submitted and the entire procedure with writing an application, calculating and paying benefits is repeated for additional days.

After the expiration of the leave period, mommy has the right:

- write an application for leave to care for a newborn child;

- give up vacation and go to work, and all documents for vacation and benefits will be completed by another family member, for example, the child’s father or grandmother.

Don't miss: What is the size of benefits for old-age pensioners in Russia?

It is not allowed to interrupt vacation at the initiative of the employer and call a pregnant or postpartum employee to work for production reasons.

Additional benefits that an expectant mother may qualify for at the birth of a child

We considered only 2 options for cash payments that financially support the family due to a woman’s temporary disability associated with maternity. After birth, the right to receive other benefits arises:

- One-time payment for early registration of pregnancy. You must make your first appointment at the antenatal clinic before the start of the first trimester, namely 12 weeks. The size is indexed annually and is now equal to 628.47 rubles. To receive it, you need to bring a specially issued certificate from where you are registered; it must have a clearly readable signature and seal.

- It is given to the place of work or training, or, in case of unemployment, to the social security authorities.

- A lump sum benefit at birth is based on a birth certificate and an application from one of the parents. The amount is 16,759.09 for each baby born in 2018.

- Monthly assistance in the amount of the child's subsistence level in the region of residence is an innovation for 2021. The payment conditions are simple: you need to give birth to a child after January 1 of the current year and receive a salary below the official minimum, multiplied by 1.5. For example, if you live in the Chelyabinsk region, where the cost of living is set at 10,608 rubles, it turns out that your official income should not exceed 15,912 rubles. Then, until the age of one and a half years, you will be paid 10,221 rubles. additionally. Please note that when you replenish your family, this assistance is withdrawn from your maternity capital.

- Monthly payment to a child whose father is undergoing military service . Started before the child’s third birthday and ends upon the expiration of the father’s conscription period. The amount of 11,374.18 rubles per person is paid in addition to all benefits.

- Maternal capital. Issued upon the birth of a second or adopted second child. The denomination of the certificate is 453,026 rubles, which allows improving living conditions, mother’s pension, and educational services for children. Until a child turns 3 years old, you cannot manage maternity capital funds unless it concerns improving living conditions. The program has been extended until December 31, 2021. You can order a certificate from the Pension Fund or MFC.

- A birth certificate is required for every expectant mother who has a compulsory medical insurance policy. It consists of 3 parts, because it pays for medical care services at the antenatal clinic, maternity hospital and clinic, where the baby will be observed until 1 year. Its face value is 11,000 rubles, 3,000 of which go to consultations, 6,000 go to the maternity hospital and 2,000 to the children's clinic. Funds are allocated from the federal budget to improve the quality of care provided during pregnancy, childbirth and pediatric monitoring of the baby.

- A child tax deduction is applied annually , in the amount of 1,400 per month for each, if the family consists of one parent, then the amount doubles. At the birth of a third child, a deduction of 3,000 is due for him. The tax benefit is valid until adulthood and up to 24 years of age for a full-time student.

- State support - intended for low-income families. Low-income is one where everyone's earnings do not reach the subsistence level. Help can be:

- additional payment for food with the products themselves or their cash equivalent. Products that can be washed include: dairy and fermented milk products, juices, meat and fruit purees, cereals and milk mixture. Implemented in the Moscow, Belgorod, Murmansk, Saratov and Astrakhan regions, as well as in Kabardino-Balkaria and Kamchatka. Cash payments are due in the Leningrad, Tyumen, Penza and Voronezh regions.

- The Housing Code provides for social rental housing for low-income people. To do this, you need to receive benefits one by one. You can use the apartment for free.

- subsidy for housing and communal services, if it is proven that more than 22% of the family budget is spent on receipts. It is valid for six months; in the absence of an increase in income, the right to a subsidy remains.

- cash benefit for a low-income family with 3 or more children. Due in the equivalent of the child's subsistence level. The amount is determined by the region of residence. For example, for residents of Mordovia it is equal to 6,646 rubles, for Nenets it is 17,817 rubles. It is paid every month until the age of 3 years, you must confirm your status annually.

- New mortgage program for families with 2 children, the state is obliged to co-finance the interest rate up to 6% during the first 3 years. If there was an addition to the family by 3 children after the beginning of the current year and until the end of 2021, then co-financing lasts 5 years. Housing properties under construction purchased from a legal entity are suitable for this.

- Special benefits have been developed for families with 3 children. Let us immediately make a reservation that in each region the concept of a large family is different, and accordingly the assistance provided is different. All details are in Presidential Decree No. 431, dated 05/05/1992. We have already indicated the cash benefit in paragraph 8, and it is also stipulated:

- a plot of land for building personal housing or maintaining a vegetable garden. The benefit has been allowed since 2011. Keep in mind that the spouses should not have other land plots; they must live in this region for more than 5 years. The size ranges from 6 to 15 acres and is allocated based on an application to the City Administration.

- full exemption or payment of part of the transport tax. A personal application to the tax office is required.

- “regional” maternity capital, a cash payment from 25,000 to more than one hundred thousand rubles, which can be used for a new car, land or treatment of offspring.

- The governor's allowance is legally enshrined in those regions of the country where there are poor demographic indicators. These are over 50 constituent entities of the Russian Federation, not counting the southern territories. The size of the payment is determined by the specific region independently, depending on the level of the subsistence minimum. For example, in the Chelyabinsk region 2,000 rubles are paid for the fact of birth. St. Petersburg residents will receive 21,500 upon the birth of their first child, while the second will receive 28,600. For Muscovites, a large financial payment is provided if you fall into the category of a young family; no one is yet 30 years old. There is a connection between the subsistence level (LS) and this benefit. Now in Moscow it is a multiple of 16,160 rubles. The amounts are:

- 5 times the amount (80,800) for 1 child;

- 7 times the size (113,200) for the second;

- for the third and subsequent – 10 PM payments – (161,600)

- Compensation for long-term admission to kindergarten. Until now, a complete list or amount of compensation for each region of Russia has not been adopted at the federal level. But there are separate decisions on the payment of this type of assistance in some regions of our homeland. For example, in Perm, from one and a half to three years old, the amount is 5,295 rubles, from three to 6 years old - 4,490 rubles. It is better to independently contact the social security authority in your area and find out about the compensation due.

Thus, maternity leave not only gives you the opportunity to become parents, but also to feel significant support from the state.

How to take sick leave during pregnancy

If a pregnant woman experiences symptoms that are not related to her situation, such as a runny nose, she should see a GP. He, of course, should be notified of your pregnancy if the due date is not yet very noticeable outwardly.

Any doctor, for example, a therapist, an ophthalmologist, a neurologist, can give a sick leave to a pregnant woman according to his indications, depending on the complaints that the woman came with.

Pregnant women turn to a gynecologist due to symptoms characteristic specifically of pregnancy:

- dizziness;

- fatigue;

- drowsiness or insomnia;

- leg cramps;

- swelling;

- nausea and vomiting;

- nagging pain in the abdomen;

- vaginal discharge.

The gynecologist will determine how strongly these symptoms affect the woman’s health and the risk of miscarriage. Previously, a gynecologist had the right to issue a certificate of incapacity for work for a long period with such a diagnosis as “toxicosis of pregnancy” and “threat of miscarriage”. Now the rules have changed. With such diagnoses, the gynecologist refers to the hospital, where they issue a certificate of incapacity for work, which, if necessary, can last for the entire period of gestation.

Procedure for paying maternity leave

Payment for maternity leave depends on the woman’s type of employment:

- working women with more than six months of experience - 100% of average earnings;

- contract servicemen - in the amount of monetary allowance;

- female students - in an amount equal to the scholarship, regardless of the basis on which the training is provided - paid or free (Letter of the Federal Social Insurance Fund of the Russian Federation dated 08/09/2010 N 02–02–01/08–3930);

- dismissed due to the liquidation of the organization - in the amount of 628.47 rubles. (after indexing 02/01/2018);

- pregnant women with less than six months of total experience - from the minimum wage, from May 1 it is 11,163 rubles.

Let us briefly describe the scheme for calculating benefits for women employed:

- Let's sum up all payments to a woman for 2021 and 2021.

- We determine the total number of calendar days in the accounting years (2016 - 366, 2021 - 365).

- We determine the calendar days of excluded periods for a woman (sick leave, labor and employment leave, etc.).

- We subtract the days of the excluded periods from the calculated total number of calendar days.

- To determine the average daily earnings, we divide the amount of all payments for two years by calendar days minus the excluded periods.

- To calculate the amount of vacation benefits, we multiply the average daily earnings by the number of vacation days according to the BiR.

Vacation days at your own expense are not included in the excluded periods.

When calculating benefits, a pregnant woman has the right to replace any of the calculation years with any previous one. For example, in 2021 she was on maternity leave and this year, at the request of the woman, can be replaced by 2015, if the result of such a replacement is an increase in the calculated amount.

The legislation determines the minimum and maximum amount of the B&R benefit. The maximum amount of daily benefit is determined from the maximum value of the base for contributions to the Social Insurance Fund for the calendar years that are used to calculate the benefit:

- The maximum base for 2021 is 718,000 rubles, for - 755,00 rubles, for a total of two years - 1,473,000 rubles.

- Calendar days in the billing period are 731 days.

- Maximum daily benefit: RUB 1,473,000. / 731 = 2021.81 rub.

- We calculate the minimum daily benefit from the minimum wage, which is equal to 11,163 rubles as of May 1, 2019.

A pregnant woman with an insurance period of up to six months will receive this amount per month. We will show the minimum and maximum payments for holidays under the BiR of different durations.

Minimum benefit amount

The amount of payment directly depends on the size of the salary. The higher it is, the higher the maternity funding will be. In addition to the benefits provided by the organization, a woman can also count on additional regional supplements. However, this will only happen if this clause is provided in the region in which she lives.

You can also count on the minimum benefit:

- If you have an insurance period of at least 6 months;

- If there is no constant income over the last two years;

- If the benefit amount determined by the formula is below the standard minimum.

Table: maximum amounts of payments for vacation according to BiR

| Duration of vacation according to the BiR in calendar days | Minimum payments for vacation according to the BiR, rub. | Maximum payments for vacation according to BiR, rub. | |

| until 05/01/2018 | from 05/01/2018 | ||

| 140 | 311.97 x 140 = 43675.80 | 366.5 x 140 = 51380.10 | 2017.81 x 140 = 282493.40 |

| 156 | 311.97 x 156 = 48667.32 | 366.5 x 156 = 57174.11 | 2017.81 x 156 = 214778.36 |

| 194 | 311.97 x 194 = 60522.18 | 366.5 x 194 = 71101.13 | 2017.81 x 194 = 391455.14 |

If a woman works for more than one employer, then she can receive B&R benefits for each place of employment (Part 2 of Article 13 No. 255-FZ) where she worked for the previous two years. The calculation will be carried out without taking into account the income received by the woman from other employers.

If a woman is fired due to the liquidation of a legal entity or termination of the business of an individual entrepreneur and less than a year has passed from the date of her recognition as unemployed, the employment and employment allowance paid to her by the social security authorities will be 628.47 rubles. Any close relative of a child on parental leave for up to one and a half years is paid a benefit in the amount of 40% of the average monthly earnings. To calculate average monthly earnings, the amount of accruals to a relative for two years before the year of birth of the baby is used. Unemployed parents can also take advantage of this leave, but the amount of benefits from the Social Insurance Fund will be minimal.

Table: allowance for leave to care for a child up to one and a half years old

| Conditions of receipt | Monthly amount, rub. |

| First child | |

| Parent or other relative working under an employment contract | 40% of average earnings |

| Unemployed parents | 4465,2 |

| Second, third, and subsequent children | |

| Parent or relative working under an employment contract | 8930,4 |

| Unemployed parents | 15 849,00 |

For relatives using parental leave to care for a child up to one and a half years old, lower and upper limits of benefits have been established. If a relative’s earnings are below the minimum wage, then the benefit will be calculated from the minimum wage. The maximum benefit amount is limited by the limit on payment of insurance premiums for 2016–2017. The maximum care allowance for up to one and a half years will be 24,536.55 rubles.

Don't miss: How to get housing for employees of the Ministry of Internal Affairs?

Maternity leave for 2 and 3 children

The rules for calculating payments when going on maternity leave are the same, regardless of how many children there are in the family, i.e.

- sick leave is paid based on the salary for the previous two years;

- one-time benefit for early registration.

After a mother takes leave to care for a child up to 3 years old, she is paid a one-time allowance in connection with the birth of a child, and then until the date when the child turns 1.5 years old, a monthly allowance in the amount of 40% of the average salary is accrued .

The difference in the accrued amounts arises if her salary is less than the officially approved minimum wage. In this case, the benefit is calculated in a fixed amount and is (after July 1, 2017):

- for the first child – 3120 rubles;

- for each subsequent baby – 6131.37 rubles.

If a mother has older children and is on leave to care for both children, then the benefit amounts are added up.

A similar situation arises when twins are born, i.e. for the first child, 40% of the salary is accrued, for two - 80%, for triplets and more children - no more than 100% of the accrued salary for the 2 full years preceding maternity leave.

Payment terms

After all the documents have been submitted to the personnel department or accounting department, the organization prepares an order for vacation and transfer of required funds. The calculation must be completed within 10 days

, and payment can be made on the nearest date of salary transfer. The entire amount is issued immediately for the entire period.

Approximately the same scheme applies to the issuance of additional one-time benefits when registering in the early stages of pregnancy and at birth.

Having received the application and documents, the employer or other body transferring funds must pay the woman within ten days. This can be done on the day you receive your salary or on any other day no later than the 26th day of the month following the one on which the documents were submitted.

Maternity leave for father

The definition of maternity leave usually refers to two different types of leave - maternity leave and child care leave.

There are certain differences between the rules for granting these leaves. The main one is the circle of people who are granted vacation days.

Only a mother who has independently given birth or adopted a child under 3 months can receive sick leave for pregnancy and childbirth.

At the same time, a wider range of people are entitled to care leave. This could be a father, grandmother or other relative. The family independently determines the person who will care for the baby.

Traditionally, these functions are assigned to the mother, but there are often cases when a woman receives the largest salary, or has significant prospects in a career, scientific or creative activity. In this case, a more economically advantageous option is chosen, and the father, or less often the grandmother, goes on vacation.

To apply for such leave, it is necessary to provide a certificate from the mother’s place of work stating that she did not take advantage of her right to leave.

There are options when, at the birth of twins, parental leave for each child is taken out separately by the father and mother.

Calculation principle

The formula for calculating payments implies that a woman in labor who has worked in a certain organization for two years without vacation, sick leave or other time off has the right to count on a larger amount. It will be equal to what she would have earned at the enterprise for all this time. That is, no deductions will be made.

The essence of the formula is that a woman’s income in an organization twenty-four months before maternity leave is added up and divided by the number of working days in the mentioned two years. Thanks to this, it becomes possible to calculate a woman’s income for one working day; after this calculation, the amount is multiplied by the days that constitute maternity leave. Again, you need to take into account the fact how much the woman in labor received at work - the lower the salary, the smaller the benefit will be.

Maternity leave for men if the wife does not work

In cases where a woman does not work, the father can receive part of the benefits due in connection with the birth of a child.

First of all, this concerns a one-time payment. If the mother does not have a place of work, the father must collect a package of documents confirming the birth of the child and the mother’s lack of income, including:

- birth certificate;

- wife's work record;

- a certificate from the employment fund confirming that she is not registered;

- a certificate from the Social Insurance Fund confirming that the mother has not applied for benefits;

- a certificate confirming that the father lives in the same place as the child.

All of the above documents are attached to the application for benefits, which is submitted at the father’s place of work. Application deadlines are limited, i.e. it must be submitted before six months have passed since the birth of the child.

Also, the father can similarly take out parental leave in his name or take advantage of other benefits due to the mother of a small child (for example, working part-time).

Maternity leave is not issued to fathers who are military personnel, except for those who have entered into a contract. A military father can receive leave in the event that the mother has died, abandoned the child, or for other reasons the father is raising the child on his own. However, this leave is provided only for 3 months.

Legislative regulation

Article 8 of Federal Law No. 81 of May 19, 1995 establishes a list of persons who can receive BiR benefits, as well as the amount of such payment. So, for all insured employed women, this is the amount of average earnings, on which insurance premiums are calculated in the Social Insurance Fund in case of temporary disability, including in connection with maternity. In addition, the following are eligible for payment:

- Women dismissed from the enterprise due to its liquidation, cessation of activity (including individual entrepreneurs, notaries, and so on);

- Female students of professional educational organizations and universities studying full-time;

- Employees of the Department of Internal Affairs, customs, GUFSIN, State Border Service, as well as those who have entered into a military contract.

Regulates the procedure for payment, as well as its size and Federal Law No. 255 of December 29, 2006. Thus, Article 11 of the legal act states that all insured women must receive payments in the amount of 100% of the average earnings. Moreover, if the insurance period of such a citizen is less than six months, then she can receive a payment not exceeding 1 minimum wage for a full month.