Details for paying taxes

Let's look at the main fields of a payment slip when paying taxes:

- Field 101 is intended for selecting the payer status. For example, if the payment is made by a tax agent, then code 02 is entered.

More information about what code should be indicated for payments in other cases is described in the article “Filling out field 101 in the payment order in 2021 - 2019” .

- In field 104 enter the BCC of a specific tax. At the same time, there are codes for penalties and fines. Tax codes are approved every year, so it is important to keep track of any possible changes.

“KBK in a payment order in 2017 - 2021” will explain what an incorrect indication of the KBK can lead to . And for the BCC values relevant for 2017-2018, see the article “Changes in the BCC for 2021 - 2018 - table with explanation”

- Field 105 - OKTMO. This is a code that determines the territorial affiliation (either of the payer or the object of taxation).

You will learn whether the error in this detail is significant from this publication .

- Field 106 - basis of payment. Here they most often indicate “TP” - current payment; “ZD” - payment of debt and “TR” - repayment at the request of the Federal Tax Service are also often used.

Other possible options for filling out this field are discussed in this publication .

- Field 107 is necessary to reflect the reporting or tax period for which tax is paid. For example, if payment is made for January 2021, “MS.01.2018” is indicated, if for 2021, “GD.00.2017” is indicated.

Other values that can be used to specify in this field can be found here .

- Field 108 is intended for payments made on the basis of any executive or administrative documents - the numbers of such documents are indicated here.

Please note cases when this field is entered with 0; details are here .

- In field 109 indicate the date of the document. For example, if payment of a tax, fine, or penalty is made at the request of the tax office, then the date of the request is indicated; If the tax amount is paid at the end of the tax period, then the date of submission of the declaration must be indicated.

The format for filling out this detail, as well as examples of possible values, are presented in this publication .

- Field 110 records the order to transfer funds, but due to the abolition of this detail in 2015, until recently it indicated 0 or a dash. This field should remain empty for now.

Find out more in the article “Filling out field 110 in a payment order in 2017” .

- Field 22 (UIN) is intended for the payment identification number for payment of penalties and arrears of fines. In other cases, it is set to 0.

Read more about this here .

- Field 24 is the purpose of the payment, which reflects what exactly the payment is for, for example, “Payment of VAT for the 4th quarter of 2017.”

Little tricks and big difficulties of paying from a treasury account.

You have received a government order with treasury support or a subsidy. Everything is fine! You are interested in only one thing: “How to quickly open a personal account with the treasury?” But it should be: “How to withdraw money from a personal account in the treasury?” Because in order to safely transfer funds from the treasury account in the future, you need to think through a payment scheme for suppliers and include certain language in the contract with your customer at the stage of its approval. Let's talk about everything in order.

How to open a personal account in the treasury

What expenses can be paid from a treasury account?

How TOFK authorizes the spending of funds in 2021. Sample of filling out information on transactions with target funds (form code according to OKUD 0501213)

How to withdraw funds from a personal account in the treasury

Closing a personal account in the treasury

Treasury checks

List of main regulatory documents for treasury support

But first, congratulations! You have new responsibilities: maintain special separate records, indicate the IGK in documents, notify counterparties of their responsibilities, promptly respond to requests from regulatory services, etc.

So, how to open a personal account with the treasury in 2021

To open a personal account, you must contact the territorial body of the Federal Treasury - TOFK. As a rule, each TOFK publishes on its website the procedure for opening personal accounts, forms of documents, who to contact and on what issue. Legal entities, peasant farms, and individual entrepreneurs open a single personal account with the code “71” (the first two digits out of 11). The opening procedure is in the Order of the Federal Treasury dated December 29, 2021 No. 44n. A single personal account is opened once on the first state. contract, but for each budget of the budget system of the Russian Federation separately. For the second and subsequent contracts, sections of the personal account are opened. Each section is assigned a unique code - analytical section code .

If a personal account with code “41” is opened for the main contractor (subsidy recipient), then a personal account (not a single one) with code “41” is also opened for co-executors (the opening procedure is in Order No. 21n dated October 17, 2016). From January 1, 2021, personal accounts with code “41” are being transferred to the GIIS “Electronic Budget” with the code replaced by “71” (Letter of the Ministry of Finance of Russia N 09-01-09/65721, Letter of the Treasury of Russia N 07-04-05/22 -14713 from 07/28/2020).

Formation of documents for reserving, opening, changing details, closing a single personal account “71” is carried out using two information systems: - state integrated information system for public finance management “Electronic Budget” (hereinafter referred to as GIIS “Electronic Budget”); — a unified information system in the field of procurement (hereinafter referred to as the UIS) in the case of a state (municipal) contract, information about which is subject to inclusion in the register determined by the legislation on the contract system of the Russian Federation in the field of procurement.

In the absence of technical capabilities, information and documents are generated on paper and submitted to the TOFK at the client’s location.

It is possible to connect to the components of the GIIS “Electronic Budget” system if there is a legal entity in the Register of Participants and Non-Participants of the Budget Process (Consolidated Register), indicating the appropriate organization code (8 characters) in the connection application. Access (connection) of treasury support participants to personal accounts of GIIS “Electronic Budget” and UIS is carried out: in GIIS “Electronic Budget” - by the Specialization Center (connection materials: https://www.roskazna.ru/gis/ehlektronnyj-byudzhet/podklyuchenie- k-system); in the UIS - upon registration in the unified register of procurement participants in the UIS (ERUZ EIS): https://www.zakupki.gov.ru/epz/main/public/document/view.html?searchString=§ionId=949). You can check the presence of a legal entity in the Consolidated Register and determine the code on the Unified Portal of the Budget System of the Russian Federation (https://www.budget.gov.ru) in the “Budget” / “Expenditures” / “Register of Participants and Non-Participants in the Budget Process” section. Order of the Ministry of Finance of Russia dated July 19, 2019 N 113n specifies information entered into the register of contracts and the corresponding codes.

Package of documents: 1. Card of sample signatures for personal accounts (form in Order No. 21n dated October 17, 2021). The card can be notarized or executed in the presence of an authorized official of the TOFK (in this case, the original or a notarized copy of the constituent document and a document confirming the authority of the person who is granted the right to sign is presented). 2. Application for reservation/opening (closing) of a personal account. 3. State contract (contract, agreement, agreement), subject to treasury support, or an extract from the contract containing the state. secret ( foundation document ). If the basis document is subject to placement in the GIIS “Electronic Budget” or the Unified Information System, information is sent to the TOFK using information systems. If not, a copy certified by the customer or notarized. 4. Documents for issuing an enhanced qualified electronic signature (ES). 5. Power of attorney to receive settlement, cash and other documents on paper (if received by a person not included in the sample signature card).

An account with TOFK can be reserved. Moreover, both the contractor and the customer can reserve a personal account. The Contractor provides an Application for reserving/opening (closing) a personal account, and the customer provides a List of legal entities for reserving personal accounts. You can agree on a contract with the customer before opening a personal account with TOFK, and after opening it, sign an additional agreement to change the details.

To open subsequent sections of the single personal account “71” in TOFK, only the basis document is provided.

TOFK has the right to suspend the opening of a personal account or refuse to open it after checking information about the client. Resources used: 1. “Business risks: check yourself and your counterparty,” address: https://www.nalog.ru.

- • Checking the Application and Card, data from the Unified State Register of Legal Entities for compliance with the full and abbreviated (if any) name, INN, KPP, address, position of the manager, his Last Name, First Name, Patronymic. • Availability in relation to the client of information about the relationship of connection (affiliation) with the state customer, legal entities and individual entrepreneurs who are executors under contracts concluded as part of the execution of the contract.

2. Information about the client’s bankruptcy in the information resource “Card Index of Arbitration Cases”, address: https://www.arbitr.ru.

The money in the personal treasury account is budgetary. They do not belong to the supplier (performer) of the government contract, he only manages them. Budget funds can be spent strictly for the purposes specified in the agreement.

| Violation | Sanctions |

| Action (inaction) that leads or may lead to an unreasonable increase in the price of products under the state defense order. | Fine from 300 thousand to 1 million rubles (Article 14.55.2 of the Code of Administrative Offenses of the Russian Federation). |

| Inclusion in the cost of production (sales) of products under the state defense order of costs not related to their production (sales). | A fine of double the amount of costs unreasonably included in the cost of production (sales) of products under the State Defense Order (Article 14.55.2 of the Code of Administrative Offenses of the Russian Federation). |

| Gross violation of the requirement to maintain separate records (distortion of expense amounts by at least 10%) | Fine from 500 thousand to 1 million rubles (Article 15.37.2 of the Code of Administrative Offenses of the Russian Federation). |

| Abuse of authority during the implementation of the State Defense Order, resulting in grave consequences. | Imprisonment for a term of five to ten years (Article 201.1 of the Criminal Code of the Russian Federation). |

The intended use of funds is confirmed by primary documents and separate accounting performed in accordance with legal requirements.

Read more about separate accounting of state defense orders and state defense orders here.

State Defense Algorithm

Wording 2021, which is better to be included in the contract with the customer at the signing stage, in order to work with the treasury without problems in the future.

STC APB.

C Support of State Standards and State Defense Orders: answers to complex questions, contractual documents, forms, reports and calculations, actions during verification, recommendations for separate accounting in 1C: Accounting, etc.

What expenses can be paid from the treasury account.

Funds from a personal account for accounting for transactions of a non-participant in the budget process are allowed to be spent in accordance with the requirements of Article 5 of Federal Law No. 385-FZ of December 8, 2020 “On the Federal Budget for 2021 and for the planning period of 2022 and 2023.”

But first, you need to know exactly what funds you actually manage, is it a state defense order or just a state order. Contracts usually contain a reference to the decree:

| State order (GOS), sole supplier, subsidy | State Defense Order (GOZ) |

| 2021 | |

| Resolution of December 15, 2021 N 2106 | Resolution of December 18, 2021 N 2153 |

| 2020 | |

| Resolution of December 23, 2021 N 1765 | Resolution of December 25, 2021 N 1819 |

| 2019 | |

| Resolution of December 30, 2021 N 1765 | Resolution of December 28, 2021 N 1702 |

| 2018 | |

| Resolution No. 1722 of December 30, 2021 | Resolution No. 1680 of December 28, 2021 |

The rules for working in the field of state defense procurement are much stricter, more details here

Budget funds cannot be used as a contribution to the authorized capital, placed in deposits or other financial instruments (if this is not the purpose of the contract).

In 2021, under contracts concluded for an amount of more than 600 thousand rubles , funds can be credited and debited only to the same personal accounts in the Treasury, with the exception of : - payment for goods actually delivered (work performed, services rendered); — reimbursement of expenses incurred (part of expenses); — payment of obligations for overhead costs; — payments in accordance with the currency legislation of the Russian Federation; — calculations for wages; — calculations for social benefits; — purchase of communication services for receiving, processing, storing, transmitting, delivering telecommunication messages or postal items, utilities, electricity, hotel services, services for organizing and carrying out the transportation of goods and passengers by public rail transport, air and railway tickets, travel tickets urban and suburban transport, subscription to periodicals, rent, carrying out work on the transfer (reconstruction, connection) of engineering networks, communications, structures belonging to legal entities, as well as conducting state examination of design documentation and engineering survey results in accordance with the legislation of the Russian Federation on urban planning activities , providing insurance in accordance with the insurance legislation of the Russian Federation, purchasing services for accepting payments from individuals carried out by payment agents; - transfer of profits.

How TOFK authorizes spending of funds in 2021

The procedure for authorization in 2021 is prescribed in Order No. 301n dated December 10, 2021. To authorize current payments to TOFK, the following is provided: 1. A contract or an extract from the contract (state secret). The contract may not be provided if it was presented when opening a personal account. 2. Information on transactions with target funds, form code according to OKUD 0501213 (hereinafter referred to as Information).

The information is approved by the customer (performer of the previous level) or the performer himself, if this is permitted by the customer of the previous level.

3. Copies of primary (consolidated) accounting documents (supporting documents). 4. Payment order. 5. Other documents. Additionally, you may need: - a certificate of distribution of overhead costs (form in the accounting policy); — extract from the analytical accounting registers (Appendix N1 to Order No. 334n dated 12/30/20).

Sample of filling out Information on transactions with target funds for 2021 and for the planning period 2021 and 2022 (form code according to OKUD 0501213)

Information on transactions with target funds for 2021 and for the planning period 2021 and 2022 (form code according to OKUD 0501213). Download the form in Word

Information on transactions with target funds for 2021 and for the planning period 2021 and 2022 (form code according to OKUD 0501213)Download the form in EXCEL

The Information indicates the sources of income and directions for spending targeted funds.

| Directions for spending targeted funds | Enlarged code |

| Payments to staff | 0100 |

| Procurement of works and services (except for payments for capital investments), including on the basis of a civil law agreement, the contractor under which is an individual or individual entrepreneur | 0200 |

| Purchase of non-produced assets, intangible assets, inventories and fixed assets and other assets (except for payments for capital investments), including on the basis of a civil law agreement, the executor of which is an individual or individual entrepreneur | 0300 |

| Capital investments | 0410 |

| Payments by transfer of funds as a contribution to the authorized (share) capital, contributions to the property of another organization | 0420 |

| Disposal from accounts of advance payments under contracts (agreements) | 0610 |

| Disposal of funds from accounts to separate (structural) divisions | 0620 |

| Payments for the transfer of funds for the purpose of placing them on deposits, in other financial instruments (under loan agreements) | 0630 |

| Payments from interest | 0631 |

| Payment of taxes, fees and other payments to the budgets of the budget system of the Russian Federation | 0810 |

| Value added tax | 0811 |

| Personal income tax | 0812 |

| Insurance contributions for compulsory social insurance | 0813 |

| Insurance contributions for compulsory pension insurance | 0814 |

| Insurance premiums for compulsory health insurance | 0815 |

| Other payments | 0820 |

| Overheads | 0888 |

| Payment of profit | 0999 |

| Payments based on final settlements | 0991 |

| Payments for transferring balances of target funds to budget revenues | 1000 |

| Payments for transferring receivables to budget revenue | 2000 |

The first digit of the code “0” can be changed to: “6” - for settlements under government contracts with a single supplier (contractor), determined in accordance with paragraph 2 of part 1 of Article 93 of Federal Law 44 Federal Law; “8” - for payments for goods (work) actually delivered, - for reimbursement of previously incurred actual expenses.

The payment order must contain an analytical code for the personal account section and a detailed code and name of payments (Appendix No. 3 to Order No. 301n dated December 10, 2020). ATTENTION! On January 1, 2021, the law of December 27, 2019 No. 479-FZ “On amendments to the Budget Code of the Russian Federation in terms of treasury services and the treasury payment system” came into force; the format of the payment order and the details of the TOFK (in contracts concluded in 2021) year, you need to enter new details of treasury accounts).

The list of areas for spending targeted funds can be downloaded here.

To make the final settlement in TOFK, sometimes (with extended treasury support) it is necessary to provide an expense declaration (Appendix No. 2 to Order No. 334n dated December 30, 2020), filled out on the basis of data from separate accounting of the results of financial and economic activities. To determine whether the declaration corresponds to reality, TOFK will evaluate not only the correctness of separate accounting, but also the actual volume of goods (work) supplied. On-site inspection is also possible.

State Defense Algorithm

Recommendations for compiling Information on transactions with target funds and payment orders.

STC APB.

Support for State Standards and State Defense Orders: answers to complex questions, contractual documents, forms, reports and calculations, actions during verification, recommendations for separate accounting in 1C: Accounting, etc.

How to withdraw funds from a personal account in the treasury

For payments upon completion of a government contract by the parties, the following codes are used: - 0999 “Payment of profit” - 0991 “Payments on final settlements ...”, but only if a Notification of full execution of the contract by the lead contractor has been received. In this case, the cost of goods actually delivered (work performed, services rendered) is not included in the amount of payments under code 0991.

How to receive funds? What to do? You can list the remaining funds in three ways of spending funds: 1. As profit.

For state defense contracts in an amount not exceeding the amount of profit to be applied by the state customer as part of the price of products in the manner established by Federal Law No. 275-FZ of December 29, 2012.

2. As compensation for expenses incurred. 3. As payment for goods actually delivered (work performed, services).

BUT! For the first two items of expenses, payment can be made from a personal account in the Treasury only if there are certain wordings in the contract. And here you will want to turn back time and redo the contract with the customer. But alas, it will be too late.

The possibility of using the third expense item is also limited.

Check the contract for any problem areas regarding treasury support.

STC APB.

The Ministry of Finance is gradually transferring procurement powers under Federal Law 44 to the Federal Treasury. In turn, the Treasury is tightening the requirements for maintaining a register of contracts and switching to electronic actuation of documents.

Closing a personal account in the treasury.

Closing a personal account in the treasury is carried out in the event of: a) reorganization (liquidation) of a legal entity, termination of the activities of an individual entrepreneur, peasant farm; b) upon execution (termination) of a government contract, agreement, agreement and (or) absence of transactions on the personal account for three years; c) in other cases provided for by the legislation of the Russian Federation.

If there is a balance of funds on the account being closed, an application is submitted to TOFK, as well as a settlement document for the transfer of the balance of funds for the intended purpose.

Treasury checks.

Transactions on your personal account may be suspended. And in some cases, in addition to supporting documents, TOFK will check: - the timing and volume of work performed, services, delivery of goods; — data on separate cost accounting; — information about the contract price structure; — availability of supporting documents in the UIS; — actual volume of goods (works and services) supplied. During the inspection, specialists have the right to use photo, video and audio equipment , and measuring instruments.

State Defense Terms and Definitions. General provisions here.

State Defense Terms and Definitions. Pricing here.

State Defense Terms and Definitions. Separate accounting here.

It is clear that some options for implementing a government contract promise an inevitable inspection and problems with payment. It is important to know the intricacies of working with government orders: Firstly , there are key phrases that must be included in the contract with the customer. Secondly , there are nuances that should be discussed with suppliers before processing documents. Thirdly , there is an algorithm for working with state defense orders and state standards, including calculating prices, profits, maintaining separate records, preparing primary and reporting documentation, etc. This is a lot of work. And it’s better to immediately know exactly where and how to put your efforts, so as not to redo this work in the future. List of questions here

STC APB :& [email protected] , +7 911 006 72 37 Contacts

Support of State Defense Orders and State Defense Orders: explanations, diagrams, forms, templates, separate accounting in 1C: Accounting, measures to reduce risks, etc. Cost of work.

Regulatory documents for treasury support.

| Regulatory document | Document text fragment | A comment |

| Resolution No. 2153 dated December 18, 2020 | On approval of the Rules for treasury support of state defense order funds in the currency of the Russian Federation in cases provided for by the Federal Law “On the Federal Budget for 2021 and for the planning period of 2022 and 2023” | Rules for treasury support of the State Defense Order. 2021 |

| Resolution No. 2106 dated December 15, 2020 | On approval of the Rules for treasury support of funds in cases provided for by the Federal Law “On the Federal Budget for 2021 and for the planning period of 2022 and 2023” | Rules for supporting government orders (not state orders). 2021 |

| Federal Law of December 8, 2020 No. 385-FZ | On the federal budget for 2021 and for the planning period of 2022 and 2023. Article 5. Features of the use of funds provided to individual legal entities and individual entrepreneurs in 2021. | Mandatory conditions that must be specified in the 2021 contract. |

| Order of the Ministry of Finance of the Russian Federation dated December 10, 2020 No. 301n | On approval of the Procedure for the territorial bodies of the Federal Treasury to authorize expenses, the source of financial support of which are target funds, with treasury support of target funds in cases provided for by the Federal Law “On the Federal Budget for 2021 and for the planning period of 2022 and 2023” | Including the procedure for filling out information (form code according to OKUD 0501213). |

| Order of the Ministry of Finance of the Russian Federation dated December 24, 2020 No. 323n | On approval of criteria for suspending operations on personal accounts opened in territorial bodies of the Federal Treasury during treasury support of funds of the state defense order | Criteria for suspending operations: payment of taxes and fees of more than 50%, payment of labor for individuals. persons more than 50%, profit more than 20% of the amount of the Civil Code payable in the current financial year from the personal account . |

| Order of the Treasury of Russia dated January 11, 2021 No. 1n | On approval of the forms of documents used when suspending the opening (refusal to open) of personal accounts, suspending (cancelling the suspension) of transactions on personal accounts and refusal to carry out a suspended operation by territorial bodies of the Federal Treasury during treasury support of funds of the state defense order | Notification forms. |

| Order of the Treasury of Russia dated January 11, 2021 No. 4n | On approval of the Procedure for the formation of an agreement identifier, a government contract, an agreement on capital investments, an institution contract and an agreement on major repairs with treasury support of funds in the currency of the Russian Federation in cases provided for by the Federal Law “On the Federal Budget for 2021 and for the planning period 2022 and 2023" | Formation of IGK for government contracts (not state defense orders). |

| Order of the Ministry of Defense and Treasury of Russia dated August 11, 2015 No. 475/13n | On approval of the procedure for generating a state contract identifier for a state defense order | Formation of IGK for state defense contracts. |

| Order of the Ministry of Finance of the Russian Federation dated December 30, 2020 No. 334n | On approval of the Procedure for maintaining separate records of the results of financial and economic activities under an agreement, a state contract, an agreement on capital investments, an institution contract, an agreement on major repairs, a state contract for a state defense order, an agreement (contract, agreement), distribution of overhead costs for them , disclosure of information about the structure of the price of a government contract, a capital investment agreement, an institution contract, a capital repair agreement, a government contract for a state defense order, an agreement (contract), the amount of funds provided for by the agreement, when implementing treasury support for targeted funds in accordance with Federal Law of December 8, 2021 No. 385-FZ “On the federal budget for 2021 and for the planning period of 2022 and 2023” | Rules for separate accounting for treasury support of funds. |

| Order of the Ministry of Finance of the Russian Federation dated December 30, 2020 No. 333n | On approval of the Procedure for the submission by the head executor (performer) to the territorial body of the Federal Treasury of an extract from the state contract for the supply of goods (performance of work, provision of services), concluded for the purpose of implementing the state defense order, contract (agreement) concluded as part of the execution of the specified state contract, and extracts from the document confirming the occurrence of a monetary obligation of the head executor (performer), containing information constituting a state secret, as well as forms of these extracts | Extract from the contract containing state secrets. |

| Order of the Federal Treasury dated December 22, 2020 No. 43n | On approval of criteria for suspending the opening (refusal to open) personal accounts by territorial bodies of the Federal Treasury during treasury support of funds received during settlements for the purpose of executing government contracts, contracts (agreements) for state defense orders | |

| Order of the Federal Treasury dated October 17, 2016 No. 21n | On the procedure for opening and maintaining personal accounts by territorial bodies of the Federal Treasury | Procedure for opening personal accounts (41 accounts) |

| Order of the Federal Treasury dated December 29, 2020 No. 44n | On approval of the Procedure for opening personal accounts by territorial bodies of the Federal Treasury for legal entities and individual entrepreneurs with treasury support for targeted funds in cases provided for by the Federal Law “On the Federal Budget for 2021 and for the planning period of 2022 and 2023” | The procedure for opening personal accounts (71 accounts) in 2021 |

| Order of the Ministry of Finance and Treasury dated 04/01/2020 No. 15n | About the Procedure for opening treasury accounts | Procedure for opening accounts in 2021 |

| Resolution of November 28, 2013 N 1084 | On the procedure for maintaining a register of contracts concluded by customers and a register of contracts containing information constituting state secrets | Rules for maintaining a register of contracts |

| Order of the Ministry of Finance of Russia dated July 19, 2019 N 113n | On the Procedure for generating information, as well as exchanging information and documents between the customer and the Federal Treasury for the purpose of maintaining a register of contracts concluded by customers | The information entered into the register of contracts and the corresponding codes are indicated |

| Order of the Ministry of Finance of the Russian Federation dated December 22, 2020 No. 316n | On approval of the Procedure for implementing treasury security of obligations during treasury support of target funds | Treasury letter of credit |

| Order of the Treasury of Russia dated 01/09/2020 N 6n | On approval of document forms used for treasury provision of obligations during treasury support of target funds, the procedure for filling them out | Application for issuance (transfer, change, revocation) of Treasury security for obligations (f.0506108) |

| Order of the Ministry of Finance of the Russian Federation dated January 11, 2021 No. 5n | On approval of the Regulations for inspection by territorial bodies of the Federal Treasury, in cases established by the Government of the Russian Federation, of actually delivered goods (work performed, services rendered), including using photo and video equipment, for compliance with the information specified in the state contract, capital investment agreement , institutional contract, agreement on major repairs, agreement (contract), documents confirming the occurrence of monetary obligations of legal entities when carrying out treasury support of funds in accordance with the Federal Law “On the Federal Budget for 2021 and for the planning period of 2022 and 2023” | If the item cannot be inspected without violating its structural integrity, without traveling to its location. |

| Order of the Federal Treasury dated January 11, 2021 No. 3n | On approval of the Procedure for reflecting transactions for crediting and writing off targeted funds of legal entities and individual entrepreneurs with treasury support in cases provided for by the Federal Law “On the Federal Budget for 2021 and for the planning period of 2022 and 2023” | Reflection of transactions |

| Order of the Federal Treasury dated January 11, 2021 No. 6n | On approval of the Procedure for carrying out operations for the transfer by territorial bodies of the Federal Treasury on behalf of the recipient of federal budget funds of subsidies to legal entities (with the exception of subsidies provided using treasury security for obligations in the cases provided for in Part 8 of Article 5 of the Federal Law “On the Federal Budget for 2021 and planning period 2022 and 2023") with treasury support of funds from these subsidies | Treasury support of subsidies |

| Order of the Treasury of the Russian Federation dated May 28, 2019 No. 17n | On approval of forms and requirements for the content of documents drawn up by officials of the Federal Treasury when exercising powers of control in the financial and budgetary sphere | Forms of requests, orders, etc. |

| Order of the Treasury of the Russian Federation dated March 16, 2020 No. 11n | On approval of the Procedure for the implementation by the Federal Treasury of the functions of an accredited certification center and the performance of its duties | Certificate of keys for verifying electronic signatures |

| Resolution dated February 27, 2020 N 208 | On approval of the federal standard for internal state (municipal) financial control “Planning of inspections, audits and surveys” | Risk-based approach. Criteria of “materiality” and “probability”. |

| Letter from the Ministry of Finance and the Treasury of the Russian Federation dated January 10, 2020. No. 09-01-09/299, No. 07-04-05/22-77 | On the application of the provisions of regulatory legal acts governing issues of treasury support in 2021 in relation to targeted funds provided on the basis of the state. contracts, contracts concluded before 01/01/2020. | Authorization of budget funds 2018-2019 in 2021. |

| Letter from the Treasury of the Russian Federation dated July 17, 2019. No. 07-04-05/05-15149 | On determining the tax base for VAT when carrying out operations on treasury security of obligations | VAT on advances under treasury letter of credit. |

In 2021, a completely non-trivial situation with separate accounting will arise. Firstly , separate accounting in the state defense order (GOZ) differs from accounting for state orders (non-GOZ). Secondly , there are differences in the separate accounting of funds received on the basis of government contracts with banking and treasury support. Thirdly , separate accounting in government orders and state defense orders differs significantly from accounting and tax accounting (different composition of costs, procedure for distributing overhead costs, financial results). More details here

The costs of state defense products must be justified. Find out how to justify costs here.

Everyone somehow forgets that there are many benefits for small and medium-sized enterprises (SMB), including those in the state defense order. And this is the vast majority of companies. Who belongs to this category of business, where you can get financial support, as well as answers to questions regarding procurement: - who and in what volume should purchase from SMP; — benefits in securing the application; — benefits in ensuring the execution of the contract; — dumping benefits; — benefits when paying; - the maximum amount of fines, etc., can be read here.

Details for paying insurance premiums

From 2021, insurance premiums that were previously calculated in accordance with the Law “On Insurance Contributions...” dated July 24, 2009 No. 212-FZ and paid to extra-budgetary funds are now subject to the rules of Chapter. 34 of the Tax Code of the Russian Federation and are paid to the budget. Accordingly, payment documents for them should be prepared in the same way as for tax payments.

There have been no changes regarding “unfortunate” contributions to the Social Insurance Fund since 2021, and they must still be paid to the Social Insurance Fund according to the same details and rules. For a sample of such a payment, see this article.

Entering details into the payment slip for budget payments is a very responsible undertaking, since mistakes made can lead to fines and penalties for taxes and contributions.

“Details for paying taxes and contributions” will help you avoid problems in filling out payment slips .

What's happened?

The Federal Tax Service published a letter dated December 28, 2018 No. KCh-4-8/ [email protected] , in which it reminded its territorial authorities and all taxpayers about changes in the details of bank accounts opened by the territorial body of the Federal Treasury in the divisions of the Bank of Russia on balance sheet account N 40101 “Revenues distributed by the bodies of the Federal Treasury between the budgets of the budget system of the Russian Federation.” The letter, as stated in it, was sent with the aim of “ensuring the completeness of revenues administered by the tax authorities.”

Timing of changes

Bank account details in all listed regions will change from February 4, 2021 .

However, for the convenience of payers, from the specified date to April 29, 2021 inclusive, the Central Bank is introducing a transition period. That is, during it, when filling out the payment, both options of bank accounts are relevant:

- Accounts planned for closure No. 40101.

- Newly opened accounts No. 40101.

And from April 30, 2021, there will be a transition to independent operation of new account details No. 4010. That is, from this date only they will be relevant for filling out payments.

ADVICE

In order not to get confused, we advise you not to abuse the transition period, but immediately from February 4, 2021, indicate the new UFK bank account number in all payments.

Table of old and new accounts

The table below provides complete information on the details of closed and opened bank accounts No. 40101.

| № | Name of the Federal Treasury Department | 20-digit bank account number that is being closed | The 20-digit number of the new bank account that is being opened |

| 1 | UFK for the Republic of Adygea | 40101810100000010003 | 40101810803490010004 |

| 2 | UFK for the Republic of Kalmykia | 40101810300000010003 | 40101810303490010005 |

| 3 | UFK for the Karachay-Cherkess Republic | 40101810900000010001 | 40101810803490010006 |

| 4 | UFK for the Republic of Mari El | 40101810100000010001 | 40101810922020016001 |

| 5 | UFK for the Republic of Mordovia | 40101810900000010002 | 40101810022020017002 |

| 6 | UFK for the Republic of Tyva | 40101810900000010001 | 40101810050049510001 |

| 7 | UFK for the Udmurt Republic | 40101810200000010001 | 40101810922020019001 |

| 8 | UFK for the Republic of Khakassia | 40101810200000010001 | 40101810150045510001 |

| 9 | UFC in the Altai Territory | 40101810100000010001 | 40101810350041010001 |

| 10 | UFC in the Trans-Baikal Territory | 40101810200000010001 | 40101810750042010001 |

| 11 | UFC in Kamchatka Territory | 40101810100000010001 | 40101810905070010003 |

| 12 | UFK for the Irkutsk region | 40101810900000010001 | 40101810250048010001 |

| 13 | UFK in the Kirov region | 40101810900000010001 | 40101810222020011001 |

| 14 | UFK for the Kurgan region | 40101810000000010002 | 40101810065770110002 |

| 15 | UFC in the Kursk region | 40101810600000010001 | 40101810445250010003 |

| 16 | UFC in the Magadan region | 40101810300000010001 | 40101810505070010001 |

| 17 | UFK for the Murmansk region | 40101810000000010005 | 40101810040300017001 |

| 18 | UFK for the Novgorod region | 40101810900000010001 | 40101810440300018001 |

| 19 | UFC in the Oryol region | 40101810100000010001 | 40101810845250010006 |

| 20 | UFK for the Penza region | 40101810300000010001 | 40101810222020013001 |

| 21 | UFC in the Rostov region | 40101810400000010002 | 40101810303490010007 |

| 22 | UFK for the Samara region | 40101810200000010001 | 40101810822020012001 |

| 23 | UFK for the Smolensk region | 40101810200000010001 | 40101810545250000005 |

| 24 | UFC in the Tyumen region | 40101810300000010005 | 40101810965770510005 |

| 25 | UFK for the Khanty-Mansiysk Autonomous Okrug - Ugra | 40101810900000010001 | 40101810565770510001 |

| 26 | UFK for the Yamalo-Nenets Autonomous Okrug | 40101810500000010001 | 40101810465770510002 |

As you can see, the number of digits in the new bank account number remains the same - there are again 20 units.

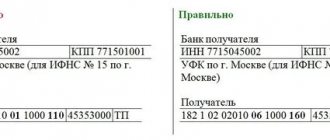

Filling example

The Federal Tax Service for the Novgorod Region has provided new details of the Federal Tax Service for the Novgorod Region:

| Name of OFK: · Full – Department of the Federal Treasury for the Novgorod Region; · Brief – UFK for the Novgorod region. |

| Payee account number (No. 40101): · from 02/04/2019 – 40101810440300018001; · until 02/04/2019 – to the recipient’s account number: 40101810900000010001. |

| Name of the payee's bank: · full – Novgorod Region Branch of the North-Western Main Directorate of the Central Bank of the Russian Federation; · short – Novgorod Branch. |

| BIC of the recipient's bank - 044959001. |

The following shows an example of filling out a payment order from Novgorod, which contributes insurance contributions to the budget for compulsory pension insurance (OPI) for January 2021. According to the law, this must be done before February 15, 2021 (clause 3 of Article 431 of the Tax Code of the Russian Federation). That is, when the new UFC account number is already in effect.

.

Read also

09.08.2018

What to follow

To pay personal income tax for an employee, it is almost impossible to get the details somewhere in one place (source). After all, each employer-tax agent has its own status and its own tax office.

In addition, the accountant needs to constantly monitor whether new personal income tax details have appeared.

In any case, when entering details for personal income tax payment, you must first of all strictly follow the Rules for indicating information in the details of orders for transferring money to pay payments to the budget. They were approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Officials update them almost every year.

A special service on the website of the Federal Tax Service of Russia will also help you fill out the personal income tax payment form correctly (common link for all regions):

What regions are these?

The change in the UFC bank account details for the payment of taxes, fees, and insurance premiums in 2021 affects the following regions of Russia:

- Adygea;

- Kalmykia;

- Karachay-Cherkessia;

- Mari El Republic;

- Mordovia;

- Tyva;

- Udmurtia;

- Khakassia;

- Altai region;

- Transbaikal region;

- Kamchatka Krai;

- Irkutsk region;

- Kirov region;

- Kurgan region;

- Kursk region;

- Magadan region;

- Murmansk region

- Novgorod region;

- Oryol region;

- Penza region;

- Rostov region;

- Samara region;

- Smolensk region;

- Tyumen region;

- Khanty-Mansiysk Autonomous Okrug - Ugra;

- Yamalo-Nenets Autonomous Okrug.

Basic Rules

The following table shows the key details for paying personal income tax.

| Field no. |

payments

If an individual entrepreneur pays income tax for himself, then – 09

- arrears, penalties, personal income tax fine at the request of the Federal Tax Service, which does not indicate the UIN - 0;

- current tax payments UIN – 0;

- arrears, penalties, personal income tax fines at the request of the Federal Tax Service, which indicates the unique accrual identifier (UIN) - UIN specified in the request.