When calculating taxes, not only the amount of financial assistance is taken into account, but also its purpose. By law, an employer has the right to financially support its employee at any time at its discretion, but not as a reward for work. Most often, financial support is provided in a difficult life situation or before a joyful event.

Financial assistance as a type of income

Such support, unlike other types of income, does not depend on:

- from the employee’s activities;

- from the results of the organization’s activities;

- from the cyclical nature of work periods.

The grounds for receiving financial assistance can be divided into two: general and targeted. It is provided when any circumstances arise in the employee’s life:

- anniversary, special event;

- difficult financial situation;

- illness of an employee or close family member;

- death of an employee or close family member;

- birth of a child;

- emergencies;

- vacation.

A complete list of grounds for calculating financial assistance, as well as their amounts, are established by the regulatory (local) document of the organization. In some cases, for example, due to illness, the amount of financial assistance will be determined by the decision of the manager.

Registration of financial assistance

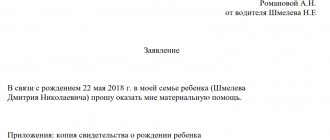

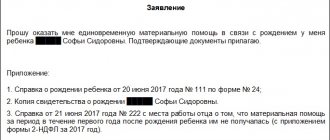

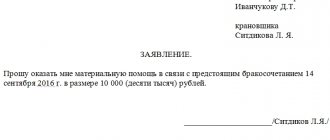

To receive payment to an employee or former employee, you must write an application in any form. In the text part of the application, describe the circumstances in as much detail as possible. Attach documents confirming your life situation (certificate from the Ministry of Emergency Situations about a natural disaster, death certificate of a relative, birth or adoption certificate of a child, extract from the medical history, doctor’s report).

The manager, having considered the employee’s appeal, makes a decision on the amount of financial assistance based on the financial situation and complexity of the employee’s life situation.

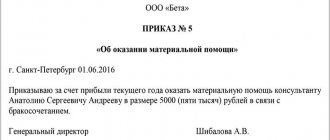

Payment of financial assistance is made on the basis of an order (instruction) of the manager. The material may be divided into several parts and paid in several payments, for example, due to financial difficulties in the organization. But there should be only one order; it should indicate the frequency of transfers. If several orders are created for one reason, then the tax authorities will recognize only the payment under the first order as financial assistance, and the rest will be recognized as remuneration for work.

Taxation of financial assistance

The main question that an accountant asks is whether financial assistance is subject to personal income tax?

Each type has its own distinctive characteristics and accounting features for determining the personal income tax base, as well as insurance premiums. The personal income tax and contribution base depends on the basis for which financial assistance was provided. It is indicated in the employee’s application. Taxation of financial aid follows the same principles. At the same time, monetary support from the employer is either completely tax-free or not taxed up to an amount limit, which depends on the basis.

Procedure for accounting for assistance up to 4,000 rubles

In the case when financial assistance does not exceed 4,000 rubles, the reason for its appointment does not play a special role. Such a payment can be issued in the form of a holiday gift or as a simple incentive payment. The only important thing is that it does not exceed the established cash limit, calculated from the beginning of the year.

If an employee changes his place of work during the year, he is obliged to provide the new employer with a certificate in Form 2-NDFL in order to eliminate taxation errors. It is possible that he has already received checkmate. assistance at the beginning of the year, therefore, repeated payments in excess of the limit will be taxed according to the general rules.

Not taxed

The list of such income is specified in Art. 217 Tax Code of the Russian Federation. In particular, financial assistance, tax-free for 2021, is provided in the following cases:

- death of an employee or a close member of his family;

- natural disaster;

- purchasing sanatorium and resort vouchers on the territory of the Russian Federation (compensation depending on the type of support, for example, for accompanying parents of children with disabilities to a place of recreation and recovery);

- emergency situation (terrorist attack and others).

Who is the employee's family member?

Who are the employee's family members?

According to the Family Code, family members include spouses, parents and children, adoptive parents and adopted children. Close relatives include parents, children, grandparents, grandchildren, as well as brothers and sisters.

But to exempt from personal income tax the amount of financial assistance paid in connection with the death of a family member, the definitions from the Family Code are not enough.

These must be persons related by kinship and living together, that is, leading a joint household.

Therefore, to receive financial assistance in connection with death, in addition to the death certificate, you need a document confirming joint residence (see letter of the Ministry of Finance dated December 2, 2021 No. 03-04-05/71785).

Taxed over the limit

This applies to support that is of a general nature by providing:

- birth, adoption, establishment of guardianship rights - in the amount of no more than 50,000 rubles for each child when paid within 1 year after birth;

- the amount of partial compensation for sanatorium and resort vouchers in the Russian Federation in the amount of up to 4,000 rubles (taking into account the type of assistance, for example, to support the health of children due to severe environmental and climatic conditions, etc.);

- anniversary, special event (wedding) - up to 4,000 rubles;

- support for an employee in a difficult life situation, vacation - up to 4,000 rubles.

Let us remind you that the limit of financial assistance for the birth of a child is 50,000 rubles per parent. Such clarifications were given by the Ministry of Finance of the Russian Federation in letter dated 08/07/2017 No. 03-04-06/50382. Previously, officials considered the set amount to be the limit for both parents or guardians.

IMPORTANT!

When calculating personal income tax, a deduction for financial assistance on a general basis up to 4,000 rubles is provided once, regardless of how many times the support is provided.

How to get help

To receive financial assistance, the employee must notify the company management about the current circumstances. To do this, an application written in any form is submitted to the accounting department. The text should most accurately describe the need to receive a financial payment. For each individual case, the application is accompanied by relevant official documents that confirm the event.

In some cases, an employee's spouse or a corporate retiree of the company may receive assistance. This will also require a package of supporting documents.

znaybiz.ru

Financial communication between employer and employee is not limited only to wages and material incentives; financial assistance is also provided. The legislative framework does not have a clearly formulated interpretation of the concept of “material assistance”. At the same time, it is mentioned in various documents quite often. Let's figure out what it is and, most importantly, whether financial assistance is subject to personal income tax.

Cash payments, medicines and food, clothing and basic necessities - all this can be classified as material assistance that one person can provide to another. The relationship between a manager and a subordinate limits this list, in most cases, only to monetary payments, which are made in accordance with the procedure established by law. Financial assistance is not mandatory.

Financial assistance can be defined as the payment of funds to an employee in a difficult life situation or under special circumstances.

There is no strict guidance in the legislation regarding this type of payment. It follows from this that the manager himself has the right to decide on the need to provide financial assistance to his employees. The amount of payments, terms and grounds that will serve as a reason for paying assistance should be recorded in the employment contract or order. In this case, pay special attention to the wording of the concept of “material assistance”, as well as the list of cases in which payments will be made. Beware of vague definitions (“in cases like this”, “situations like this”). Everything must be extremely precise in order to avoid suspicions of an attempt to reduce the tax base on the part of the tax inspectorate. Financial assistance must be paid in accordance with drawn up orders or contracts.

Income codes and material support deduction codes

The personal income tax tax base codes are fixed in the Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/ [email protected] Depending on the basis of financial assistance, the following are determined:

- material assistance income code (Appendix 1 of the Order of the Federal Tax Service);

- deduction code that provides financial assistance (Appendix 2 of the Federal Tax Service Order).

Let's look at an example. As a result of the fire, the employee lost her husband, long-term treatment did not produce results, the employee took leave due to life circumstances. By decision of the head of the organization, the employee was provided with financial support:

- in connection with a natural disaster - 100,000 rubles;

- in connection with the death of a spouse - 80,000 rubles;

- compensation for the cost of treatment - 60,000 rubles;

- in accordance with the collective agreement, when taking annual leave, an employee is entitled to support in the amount of two salaries (salary for the position held is 20,000 rubles), thus, financial assistance for leave amounted to 40,000 rubles.

Below we discuss the taxation of financial assistance to an employee in 2021, as well as financial assistance up to 4000 (2021 taxation).

Examples of calculating financial aid to be issued to an employee

Example 1

An employee's house, which he owned, burned down. This fact is confirmed by a certificate from the Ministry of Emergency Situations, which states that the fire was the result of a natural disaster. The employee submitted a written application to the employer for payment of financial assistance. The director of the company issued an order to assign a financial payment to the employee. The amount of assistance is 25,000 rubles. The employee will be paid the entire accrued amount, no income tax will be withheld from it.

Example 2

The employee applied to the employer for financial assistance in connection with the adoption of a child. The head of the company granted the request and appointed a payment of 55,000 rubles. The accountant performed the following operations:

- financial assistance was accrued in the amount of 55,000 rubles;

- The tax base for personal income tax has been determined - 5,000 rubles. (55,000 – 50,000);

- personal income tax is calculated - 650 rubles. (5000 x 13%);

- Personal income tax was withheld and the amount to be issued was withdrawn - 54,350 rubles. (55,000 – 650).

Example 3

In connection with the upcoming wedding, the employee turned to the employer for financial support. The director of the enterprise appointed by his order financial assistance in the amount of 5,000 rubles. Accounting, when checking the accruals on the personal card, revealed that this year this employee had already received financial assistance in the amount of 2,000 rubles. due to the difficult financial situation. Calculations:

- financial assistance was awarded in the amount of 5,000 rubles;

- The balance of the tax benefit for the current year for personal income tax for financial assistance has been determined - 2000 rubles. (4000 – 2000);

- The tax base for current financial assistance has been calculated - 3,000 rubles. (5000 – 2000);

- income tax withheld 390 rubles. (3000 x 13%);

- issued in person - 4610 rubles. (5000 – 390).

Calculation of the base for insurance premiums

IMPORTANT!

If payments are reflected in one of the reporting forms, then, based on clause 3 of the inter-document control relationships, prepare explanations for discrepancies in the forms. For example, non-taxable income not indicated in the 2-NDFL certificate and reflection of the dates of transfers for the specified payments in the 6-NDFL form.

Finally, let’s figure out whether financial assistance is subject to insurance contributions or not.

When determining the base of insurance premiums, support amounts are legally excluded on the same grounds as the base for calculating personal income tax.

Tax payment deadline

According to current legislation, tax agents are required to calculate income tax on all employee income on an accrual basis from the beginning of the year. The moment of its accrual is the date of actual receipt of funds.

When calculating tax, an important parameter is the date of actual receipt of assistance. For income in cash, this date is the day of cash payment or transfer of the amount to the employee’s account. Personal income tax on the income received must be transferred no later than the day following the payment . This norm is regulated by the Tax Code of the Russian Federation, Art. 226 clause 6.