A newly created LLC quite often does not have its own or rented office and is listed only at its legal address. This may be the home address of the manager (founder) or an address with postal and secretarial services. While no real activity is being carried out yet, and correspondence intended for the LLC, especially from official bodies, arrives in a timely manner, this situation is normal. But, sooner or later, the LLC begins to work, which means it must “materialize” somewhere in space.

You can get answers to any questions about registering LLCs and individual entrepreneurs using the free business registration consultation :

Free consultation on business registration

Sometimes the nature of the activity allows you to conduct business from home or with the help of remote workers, but if an LLC opens a store, warehouse, office, production facility, or in some other way begins to operate at an address other than its legal address, then it is necessary to create and register a separate division .

There is an important condition here - the criterion for creating a separate unit is the presence of at least one stationary workplace , and it is recognized as such if it is created for a period of more than one month. The concept of a workplace is in the Labor Code (Article 209), from which we can conclude that:

- an employment contract must be concluded with the employee;

- the workplace is under the control of the employer;

- the employee is constantly in this place in accordance with his job duties.

Based on this, a storage warehouse that does not have a permanent employee will not be considered a separate unit. Vending machines, payment terminals, ATMs, etc. are not considered as such. Remote (remote) workers also do not fall under the concept of a “stationary workplace”, therefore concluding employment contracts with them does not require the creation of a separate unit.

Please note that individual entrepreneurs should not create and register separate divisions . Individual entrepreneurs can operate throughout the Russian Federation, regardless of the place of state registration. If they work under the UTII regime or have purchased a patent, they only have to additionally register for taxation at the place of business.

General information about separate divisions

The Tax Code designates a separate subdivision (SU) as a structural unit of an organization with stationary workplaces, which operates in a territory different from the location of the main office (Article 11 of the Tax Code of the Russian Federation).

In this case, the term “workplace” is defined by Art. 209 Labor Code of the Russian Federation. This is a place prepared for the conduct of company activities for a period of more than 1 month, where an employee regularly comes in connection with his work. The concept is explained in detail in the letter of the Ministry of Taxes and Duties No. 09–3-02/1912 dated April 29, 2004.

Without knowing the law, an entrepreneur can open a separate division by accident, without even knowing it, and thereby incur sanctions from the tax service.

Features of a separate unit:

- activities outside the location of the legal entity - in this case, “location” is usually understood as the registration address of the main company and its permanent executive body (clause 2 of Article 54 of the Civil Code of the Russian Federation), which coincides with the actual address;

- the presence of an employee constantly working on the territory of the unit; an employment contract must be signed with him.

Location of a separate division - the territory in which the organization operates through the division

If an employee works under a GPC (civil law) agreement, the tax office has no reason to recognize that the organization has an OP. But the labor inspectorate may reveal that the clauses of the contract correspond to the labor contract and impose a fine on the company and management.

A division can be opened:

- in the same city as the main organization - is not registered for taxation if it operates in the territory under the jurisdiction of the same inspectorate as the main office;

- in another subject of the Russian Federation - registration with the tax office is required under clause 1 of Art. 83 Tax Code of the Russian Federation;

- outside the Russian Federation - in accordance with the legislation of the Russian Federation and the country where the unit is opened; no need to register with the Russian tax office.

Separate divisions of not only Russian but also foreign organizations can be created on the territory of Russia (Article 2 of the Civil Code of the Russian Federation).

Examples for understanding:

- Alman LLC is registered in Volgograd and acquires an office in Pskov. The office is equipped with workspaces, but all of them are rented to employees of a third-party organization. In this case, the Pskov office is not a separate division.

- Nika LLC is registered at the address: Ekaterinburg, st. Kuibysheva, 44 and opens a warehouse in the same city at a different address. At the warehouse, company representatives set up a workplace and hire a worker for security under an employment contract for a period of more than 1 month. The warehouse becomes a separate division of the company.

- Lest LLC from Krasnodar acquires an office to open a branch in Moscow and hires a team of finishers under a service agreement. The office is not yet considered a separate division. But later, to guard the premises, the company hires a permanent employee under an employment contract. From this moment on, she has a division that requires registration.

A company division can be opened even on the street adjacent to the head office, and the number of OPs is not limited

A separate division can be recognized by the tax inspectorate regardless of whether appropriate changes have been made to the company’s constituent and organizational documents regarding its existence.

Do not confuse a separate division with a subsidiary or dependent company - the latter are independent legal entities that were established by the “parent” company and operate according to their own charters. A subsidiary company is recognized if the parent organization has the opportunity to make key decisions in its activities due to the presence of a large share in the authorized capital of the subsidiary or the corresponding agreement. A dependent company is one in which 20% of the voting shares of a joint-stock company or 20% of the authorized capital of an LLC belongs to another company.

How to place an order

There are no rules for the execution of the order or its content, so it can be written on a simple blank sheet of A4 or even A5 format or company letterhead, either by hand or in printed form. At the same time, a printed version on letterhead will be much more advantageous, since it initially contains the details of the organization, legible text, and looks more solid.

The order is issued in a single copy , but if necessary, an unlimited number of copies can be made.

Types of separate divisions

The legislation clearly distinguishes two types of separate divisions - a representative office and a branch, but does not limit them only to these types (Article 55 of the Civil Code of the Russian Federation, Article 11 of the Tax Code of the Russian Federation). Accordingly, you can open a division that is neither a branch nor a representative office.

It is necessary to separate these concepts when choosing a taxation system. Legislation (clause 3 of Article 346.13 of the Tax Code of the Russian Federation) prohibits organizations with branches and representative offices from using a simplified tax system. But the law does not apply to everyone who has an openly separate unit.

Representation

A representative office of an organization is a separate division located outside the location of a legal entity and organized to protect and represent its interests (Article 55 of the Civil Code of the Russian Federation).

The representative office can use the company brand in its work, but cannot conduct commercial activities on behalf of the legal entity

From the definition it becomes clear that the representative office only protects the interests of the organization, but does not perform its functions.

Factors that distinguish a representative office from an independent legal entity:

- concludes transactions on behalf of the parent company;

- delegates powers to the manager by virtue of a power of attorney drawn up by the general director of the company, but he himself has the right to transfer powers to another person on the basis and according to the rules of Art. 187 Civil Code of the Russian Federation;

- needs to be registered as part of a legal entity with the tax office at its location;

- is not liable for the company’s obligations;

- has the right to have a current account and property allocated by the company on a separate balance sheet;

- does not have the right of ownership to the property and finances of the legal entity, but only the right to dispose of them;

- has a record of the function of representation in the constituent documents of the organization (Article 5 of the Federal Law “On LLC”, Article 5 of the Federal Law “On JSC”).

Branch

A branch is a separate division of a company, located outside its location and conducting activities on its behalf, including performing the functions of a representative office (Article 55 of the Civil Code of the Russian Federation).

The branch carries out activities similar to those of the parent company, but in a different territory

Criteria that distinguish a branch from an independent legal entity:

- information about the division is included in the company’s charter and the unified register of legal entities;

- The head of the branch works by proxy;

- the parent company bears judicial and financial responsibility for its activities;

- a branch can accept funds and property of the parent organization on its balance sheet and have its own current account.

The main difference between a branch and a representative office is that it not only protects the interests of the company, but also conducts activities on its behalf. Judicial practice shows that in order to recognize a separate division as a branch or representative office, it must have not just one, but all of their characteristics prescribed in Art. 55 Civil Code of the Russian Federation.

Table: comparison of branch with representative office and division

| Criterion | Representation | Branch | Subdivision |

| Functions | Protects the interests of the company | Performs company functions | Employees work at stationary locations |

| Can he carry out commercial transactions on behalf of the company? | No | Yes | It can’t, only labor relations are maintained with the unit |

| Do I need to notify the tax office about the creation of an OP? | Yes, within a month from the creation of the OP - form P13002; at the place of registration of the parent company | Yes, within a month from the creation of the OP - form P13002; at the place of registration of the parent company | Within a month from the date of creation - draw up a message of form C 09–3-1; at the place of registration of the parent company |

| Is it necessary to make changes to the charter and the Unified State Register of Legal Entities when registering an OP? | Yes | Yes | No |

| Can I do my own accounting? | Yes | Yes | No |

| Can I open a bank account? | Yes, in the name of the main company | Yes, in the name of the main company | No |

Signs of a branch and representative office

Considering what unpleasant consequences recognition of a separate division as a branch can lead to for the simplified tax system payer, you need to know what its signs may be:

- The fact of the creation and commencement of activities of a branch or representative office is reflected in the charter of the LLC (from 2021 this is not necessary).

- The parent organization approved the regulations on the branch or representative office.

- A head of a separate division has been appointed, who acts by proxy.

- Internal regulatory documents have been developed to regulate the activities of a separate division, as a branch or representative office.

- A branch or representative office represents the interests of the parent organization before third parties and protects its interests, for example, in court.

Thus, in order to retain the right to the simplified tax system, it is necessary to ensure that the created separate division does not have the indicated characteristics of a branch. In addition, it is necessary to indicate in the Regulations on a separate division that it does not have the status of a branch or representative office and does not conduct the business activities of the organization in full (for example, a store is engaged only in the storage, sale and delivery of goods). The creation of a separate division is within the competence of the head of the LLC; it is not necessary to include information about this in the charter.

Sequence of actions for opening a subdivision

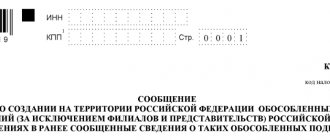

To register a division that does not have the characteristics of a branch or representative office, it is enough to submit a report to the tax office at the place of registration of the parent company. The message is drawn up in form No. S-09–3-1. The inspectorate itself transmits data about the unit to the territorial authority at its location.

On the first page of the message about the creation of a unit, you must indicate information about the main organization and its founder

The form for reporting the creation of an OP is unified. It is filled out on two sheets and contains data about the parent organization and the new division.

On the second sheet of the message about the creation of a subdivision, you must indicate information about the subdivision - name, address and date of creation

To register a branch, you need to collect a set of documents and fill out an application for the tax office. The algorithm of actions is given using the example of opening a branch of an LLC:

- develop regulations on the branch;

- organize a meeting of LLC founders;

- at the meeting, approve the developed regulations and formalize the decision to create a unit;

- collect a package of documents for making changes to the Unified State Register of Legal Entities;

- fill out application form P13002;

- appoint a branch director;

- provide the unit with finances and property.

Approval of the regulations on the branch

Before gathering the founders to decide on creating a new division of the company, develop regulations on the branch. Include in the document information about:

- name and address of the branch;

- tasks and functions of the unit;

- territories where it is planned to operate;

- types of activities of the branch;

- composition and powers of management;

- the procedure for document management and reporting;

- list of transferred property.

Other information may be included in the branch regulations at the discretion of management.

The regulations on the branch must be approved by the general director of the company and certified with a seal

Decision of the meeting of LLC participants on the creation of a branch

The decision to create an LLC division is approved by voting at a meeting of founders, just like the regulations on the branch. At the end of the event, draw up a protocol that all participants must sign. Be sure to include:

- date and time of the meeting;

- composition of the founders with a listing of full names and passport data;

- information about the chairman and secretary of the meeting;

- agenda, list of issues discussed;

- voting results for each issue and a list of decisions made.

If the LLC has one founder, instead of a protocol, it is enough to formalize and sign the decision of the sole founder to create a branch.

At the meeting, agree on the format of the branch’s work and make appropriate adjustments to the charter and constituent documents of the company (for now in draft format, without fundamental changes). In the charter, indicate information about the location of the future unit .

Since September 2014, meeting minutes require notarization. The following situations are exceptions:

- technical means were used at the meeting to confirm the accuracy of the decision (for example, video recording);

- in the charter of the LLC there is an entry that “the adoption of decisions by the general meeting of the founders of the company and the composition of the participants in the meeting are confirmed by the signatures of the chairman and secretary of the meeting”;

- An entry was made into the minutes of the meeting about how the method of authenticating the document was determined, and a vote was also taken on this item.

Based on the results of the meeting of the founders of the LLC, a protocol is drawn up, which must be officially certified

Methods for submitting documents and deadlines for registering an EP

After completing the internal documents of the company, prepare everything necessary for registration with the tax office. You will need:

- decision of the meeting of founders to open a branch;

- updated charter - two copies;

- application P13002, signed by a notary;

- receipt of payment of state duty.

To certify form P13002 with a notary you will need:

- regulations on the branch;

- OGRN and TIN of the company;

- minutes of the meeting on the creation of the LLC;

- amended charter - two copies;

- power of attorney for the head of the department;

- an extract from the Unified State Register of Legal Entities, issued maximum one month before applying to the tax office.

The state duty is charged not for opening a branch, but for making changes to the constituent documents of an LLC and amounts to 800 rubles. The receipt can be generated online and printed on the Federal Tax Service website. For this:

- Go to the tax portal

- Click "Generate Receipt".

On the tax inspection portal you can generate a receipt for payment of any state duties related to the activities of a legal entity

- Select the type of state duty - “For registration of changes made to the constituent documents of a legal entity.”

- Enter the TIN, full name and address of the payer, as well as the legal address of the company.

- Check the details and click "Pay".

- Oh and click “Generate payment document”.

- Save and print your receipt.

Since 2010, according to Federal Law No. 229, an application and accompanying documents can be submitted to the tax office at the place of registration of the parent company. The inspectorate will transmit information about changes in the Unified State Register of Legal Entities to employees of the territorial body at the location of the branch (clause 3 of Article 83 of the Tax Code of the Russian Federation). The deadline for applying to the inspectorate is one month from the date of creation of the unit. Registration is carried out within 5 days from the date of filing the application, after which the representative of the LLC only needs to receive the corresponding notification.

You will also need to notify the Pension Fund and the Social Insurance Fund about the creation of a branch. A month is given for this from the moment the unit opens.

Filling out application P13002

Form P13002 is an application for the inclusion of changes in the constituent documents of a legal entity. There are 6 sheets in total:

- title page with information about the legal entity;

- sheet A, pages 1,2 - sheets with information about the branch/representative office;

- sheet B, pp. 1,2 - information about the applicant;

- sheet B, page 3 - with the signatures of an authorized representative and a notary.

To make changes, you need to fill out all sheets of the application, except page 2 of sheet A, and have it notarized. You can enter data manually in black ink, electronically, or using a document preparation program. The latter option is preferable, as it reduces the risk of making a mistake in design.

Photo gallery: form P13002

Enter the INN, OGRN and name of the organization

Provide all information about the branch, including address and name

Skip the page if you do not make changes about existing branches

Provide information about the applicant and management organization

Fill in additional information about the applicant

Enter your full name, indicate how you will receive a response and sign

Allotment of property to a branch

The LLC branch receives property from the parent organization. The transfer is not formalized by an agreement, since it remains the property of one legal entity - it is reflected only in the balance sheets.

To formalize the transfer of property, open a subaccount 79–1 with the name “Calculations for allocated property” at the parent organization and branch. The head office accountant will need to record the transfer as follows: "Debit 79-1 - Credit 01 - Written off the original cost of the property transferred." The branch's accounting department capitalizes what was received: “Debit 01 - Credit 79–1 - Property from the head office was capitalized.”

Do the same with any property and funds transferred between departments.

Appointment of a branch director

To appoint a manager, there is no need to gather the founders - it is enough to issue an order from the general director of the LLC. Include:

- Full name and position of the manager;

- passport details;

- information about the manager provided for by the company’s internal documents;

- salary information.

Develop a job description for the manager and give it to him for signature. Form a power of attorney giving the right to work on behalf of your company.

Video: how to register a unit

Receiving a response from the tax authority

The tax office has 5 working days from the date of filing the application to make a decision on registering the unit.

Organizations are given the right to choose the tax office to which they can apply. That is, regardless of whether the company reports the opening to the Federal Tax Service at the place of registration of the head office or branch, the division must be registered (Letter of the Ministry of Finance No. 03–02–07/1 68 dated 02/18/2010).

The tax office can reject an application only on formal grounds: it is filled out incorrectly, there is no notary signature, an incomplete package of documents has been submitted, etc. To register, it is enough to make adjustments to the documents and submit them again to the Federal Tax Service.

Registration with funds

Previously, registration with the Pension Fund when opening a separate division was carried out on the basis of an application from the LLC; now this data is automatically transmitted by the tax office. However, the obligation to independently register with the Social Insurance Fund remains.

To register with the FSS, notarized copies are submitted:

- tax registration certificates;

- certificate of state registration of a legal entity or Unified State Register of Legal Entities;

- notice of registration as an insurer of the parent organization, issued by the regional branch of the Social Insurance Fund;

- information letter from the State Statistics Service (Rosstat);

- notifications about tax registration of a separate division;

- opening order, Regulations on a separate division, documents confirming that the separate division has a separate balance sheet and current account;

- original registration application.

A single simplified tax and insurance premiums for employees employed in a separate division must be paid at the place of registration of the parent organization, and personal income tax from these employees must be withheld at the location of the separate division.

Economic activities of a separate division

Information about branches and representative offices is in the extract from the Unified State Register of Legal Entities and in the charter, but divisions that are neither one nor the other may not be there. In this case, an outsider can only find out information about the existence of divisions in an unofficial way - for example, by asking management.

TIN is not assigned to any type of unit, but KPP and OKTMO are assigned to all, regardless of the availability of an application for assignment of a number. OKTMO is the territorial code of the municipality where the unit operates, and KPP is the code for the reason for registration. Also, a branch or representative office may have separate details of a current account registered in the name of the main company.

A separate division pays taxes for its activities independently and at its location, but on behalf of a legal entity (Article 19 of the Tax Code of the Russian Federation). So it fulfills the duties of a legal entity to pay taxes in the area where it operates. Divisions do not pay income taxes, since the amounts are formed based on the results of reporting periods for the company as a whole. Reporting 2-NDFL and 6-NDFL can be submitted to the tax office where the branch is registered, or to the same inspectorate as the reporting of the main company.

Responsibility for non-payment of taxes by a division lies with a legal entity, unless deliberate concealment of income by the head of the division is proven.

Video: accounting of departments in the 1C program

Responsibility for violation of the procedure for registering a separate subdivision

Violation of the deadlines for submitting messages and applications for registration of a separate division entails the following fines:

- violation of the deadline for filing an application for registration - 10 thousand rubles (Article 116 of the Tax Code of the Russian Federation);

- Conducting activities as a separate division without registration - a fine of 10 percent of the income received as a result of such activities, but not less than 40 thousand rubles (Article 116 of the Tax Code of the Russian Federation);

- violation of the deadline for registration with the Social Insurance Fund - 5 thousand rubles or 10 thousand rubles if the violation lasts more than 90 calendar days (Article 19 No. 125-FZ of July 24, 1998).

Closing a separate division

The procedure for closing a unit is as simple as possible. Algorithm of actions:

- Approve the decision to liquidate the division (for branches and representative offices).

- Deregister the division with the tax office by submitting a message in Form No. S-09–3-2. The period for deregistration with the Federal Tax Service is no more than 10 days.

- Make changes to the Unified State Register of Legal Entities (similar to the opening procedure).

- Deregister the division from the funds by receiving a notice of liquidation from the tax office.

- Fire employees.

- Terminate the rental agreement for the premises (if necessary).

Before dismissal, branch employees must be notified of the upcoming layoff and paid the due amounts. Additionally, an inventory of the property should be carried out and transferred back to the balance sheet of the parent company.